Let’s talk about money- After all, it’s the reason why you’re even doing business in the first place. Although it’s undoubtedly the most critical component of e-commerce, the concept of digital payments is often misunderstood.

For starters, we all know that money somehow finds its way out of a customer’s card to end up in the corresponding seller’s bank account. But, as it turns out, that’s pretty much all that most people in the e-commerce space understand about online transactions so far.

Perhaps unsurprisingly, they are unfamiliar with all the systems and checks that money goes through as it travels from a consumer to a seller’s account. That’s why, in fact, quite a number of e-commerce merchants do not even take time to comprehensively analyze their payment processing options. They simply go for any solutions that seem to be popular, without necessarily reviewing their individual business transaction needs.

Now, to be honest, that approach might have worked well for some merchants. We could say they were lucky enough secure favorable payment processors right off the bat. But, let’s face it- in such a game of chances, luck is only reserved for a select few.

And what happens to the rest?

Well, going by a 2017 Experian report, businesses are seemingly not doing as well you might have presumed. Payment fraud is still a major challenge, considering the number of attacks has been rising exponentially- with 2017 alone recording a bump of 30%. As a result, the primary victims have always been online stores and consumers, who continue to lose substantial amounts of money to fraudsters.

Then guess what? While some of the information used by the attackers is obtained directly from consumer victims, it turns out the bulk of it is stolen from businesses. According to an IBM Security Intelligence Report, more than 1.4 billion records were exposed from 686 data breach cases documented within the first three months of 2018. So, you can imagine how that had expanded by the end of the year.

Ok, let’s take a step back and look at this critically. What am I driving at?

Well, all things considered, there are many factors that might have contributed to such incidences. But, let’s not bury our heads in the sand here. A lot of it has to do with vulnerabilities arising from online transactions on various payment processing systems.

Quite simply, if there’s one thing you cannot afford to compromise in your online store, it certainly has to be the payment management framework. How it’s structured ultimately determines your transaction handling capabilities, the customer satisfaction rate, plus the security of your funds.

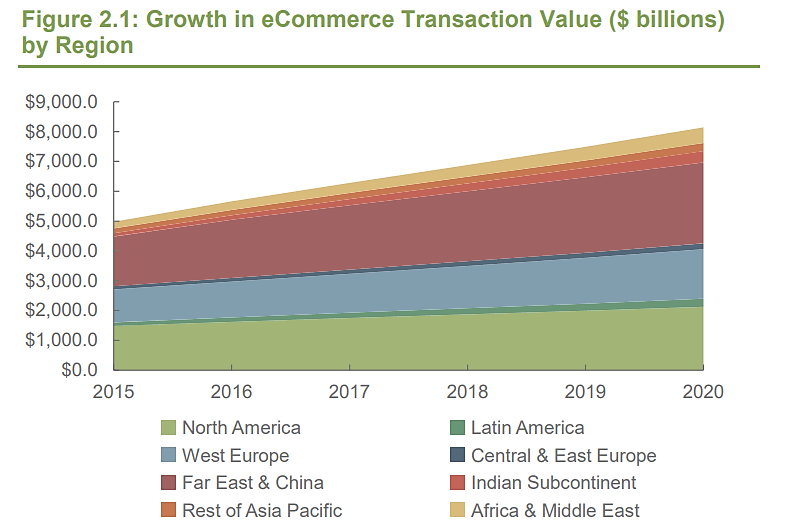

That said, here’s another interesting fact. It has been reported that the average value of online transactions is rising steadily worldwide. The growth of payments is seemingly proportional to the progressive expansion of e-commerce. So, of course, managing such a fluid environment requires a futuristic payment system.

Combined, all these factors point to one thing- that you cannot settle for anything but the best payment processor for your online business.

Therefore, all me to do you a huge favor. I’m going to explain exactly how you’ll be able to find the perfect one, by breaking down all the digital payment jargon into simple, digestible facts. And to start us off, what should you think of when you hear the phrase “payment processor”?

What Is a Payment Processor?

By now, I bet you’ve heard the term “payment processor” a couple of times in the ecommerce space. And come to think of it, you might have also come across something they call a “payment gateway”. As a matter of fact, quite a number of people, including some industry gurus, use the two terms interchangeably.

So, could it be one and the same thing?

Well, the truth of the matter is that it’s not. It sounds confusing at first, I know. Hence, to demystify everything accordingly, let’s define all the principal elements of online-based payments.

Now, at the center of it all, we have two main parties- you, the merchant, plus the customer. The merchant essentially opens a merchant account in a merchant bank to receive the money after payment is processed. The customer, on the other hand, needs a debit or credit card to pay for their purchase.

While the merchant bank plays the role of an acquirer to hold the funds for the merchant, the customer is served by an issuing bank. It basically provides a card then goes ahead to deduct funds from the customer’s account as transactions occur.

In between these two- the merchant and the customer- is where all the drama unfolds. A single payment instance goes through several systems in one transaction, for funds to be deducted from a customer’s account and subsequently deposited into the merchant’s account.

How?

Payment Gateway vs. Payment Processor

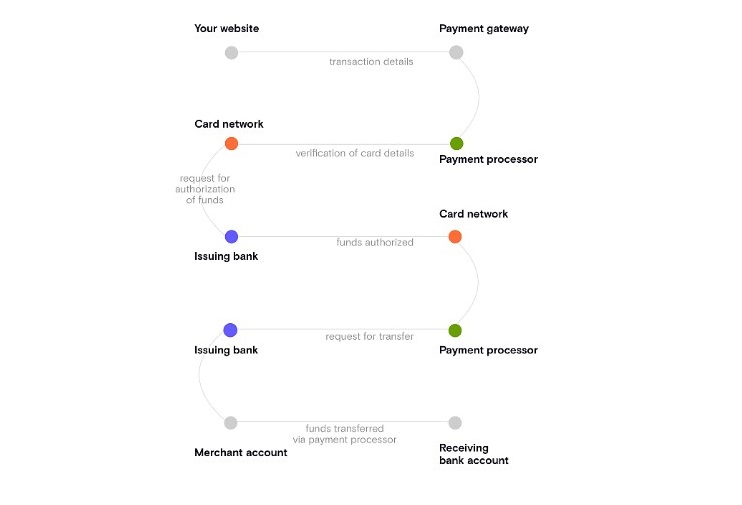

When a customer purchases something from your site, chances are that they might choose to pay via their credit or debit card at the checkout stage. And that is usually handled by a payment gateway, which serves as the primary link between your store’s shopping cart and the corresponding payment processing system.

Quite simply, the payment gateway picks up your customer’s card data, encrypts the information accordingly, and then passes all the necessary details to the payment processor.

The payment processor, on the other hand, does all the hard work. Apart from managing the actual processing of funds, it connects to your merchant account to effectively facilitate all-round communication, and then it supplements that by documenting the resultant transaction details.

Fair enough. And now, to address the elephant in the room, how is the processing of payments carried out?

How Online Payments Are Processed

In a nutshell, the payment processor picks up the details from the payment gateway, then pings a prompt query to the bank that manages the customer’s card. The goal here is to request the bank to release the funds as payment for the customer’s purchase.

At this stage, the bank reviews the transaction information before responding to the request. And you know what? In as much as an immediate approval is predictably the expected response, a bank can alternatively choose to decline- consequently canceling the transaction altogether. This usually happens when inconsistencies are picked up by the bank’s payment verification system.

However, in the event the bank issues a positive approval response, the payment processor is expected to notify you accordingly, then proceed to instruct the merchant bank to credit your account with the relevant funds- as shown by the illustration.

Now, here’s where it gets a bit interesting. So far, we’ve seen that payments typically go through multiple processes before the processor communicates with the merchant bank- not what you’d expect from a quick online transaction.

But, guess what? The whole thing, up until this stage, typically takes about one or two seconds. That means each system request relayed by the payment processor is subsequently attended to in a matter of microseconds.

Sadly, that’s pretty much it when it comes to prompt completion. The next set of settlement processes might contrastingly take much longer than two seconds. In fact, some transactions are left pending at this stage for a few days before the money is finally remitted to the merchant’s account.

Why you ask?

As a measure against potential chargebacks, some merchant banks might withhold a fraction of the funds for a certain period of time. And then we also have a select few that choose to do the opposite. They go ahead to credit your account way before they receive money from the customer’s bank.

But, don’t be quick to assume what you might be thinking already. A system of consistent prompt deposits doesn’t necessarily mean that you won’t be penalized for chargebacks. In case one develops, you can bet that the reversal will be automatically charged from your account even when the balance is zero.

That said, we can now look at everything holistically. And one predominant question that often arises after evaluating this entire structure is- should you acquire a payment gateway along with a payment processor?

Now, the fact is- your online store needs a payment gateway as much as it requires a payment processor. But then again, does that translate to two different solutions?

Here’s the thing. In the past, it was common for online businesses to get payment gateways, payment processors, and merchant accounts from different providers. But, as digital payment technology advanced, some providers found a way to merge all the three parallel components.

Consequently, eCommerce sites have since been running on full-stack payment processors that not only handle transaction processing but also act as gateways for accepting cards- as well as merchant banks that swiftly deposit funds to the corresponding seller accounts. PayPal is a particularly outstanding example, along with Braintree, Stripe, and many others.

Come to think of it, such a wide variety of options is perfect for increased competitiveness between payment providers. But then again, it complicates the whole selection process. Many of them might seem might like they offer the same range of functionalities at first, then turn out to be completely different down the road.

So, let’s separate facts from fiction by outlining all the critical steps to finding the best payment processor for your online business.

Choosing The Best Payment Processor

Convenience

The convenience of a payment processing solution should be the main concern above everything else. And this entails much more than just a solution’s overall availability. Convenience rather deals with a combination of factors that collectively determine a solution’s payment processing capabilities.

In other words, you should analyze various options by their individual functionalities and performance levels. Plus, of course, how effective they are at serving the business and its customers simultaneously.

For example, which payment methods does each processor support?

Payment Methods

It seems like debit plus credits cards are all we’ve mentioned so far when it comes to online payment methods. And it makes sense because the first payment option on the bulk of e-commerce sites happens to be either of the several card types- Visa, Mastercard, you name it.

But, is that all there is to it?

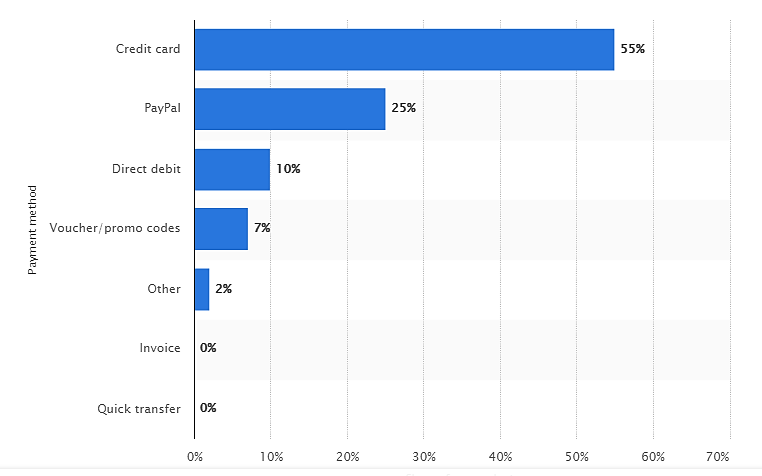

Well, if your online store deals with US-based buyers only, then you won’t have much of a problem with a payment processor that exclusively facilitates card transactions.

55% of the country’s online shoppers prefer using credit cards while 10% typically proceed with their debit cards. That adds up to a solid 65%, which is not bad at all for a standard online store.

However, the fact is, that’s only a fraction of the market. You can’t afford to ignore the rest if you intend to maximize your sales potential. And that basically means expanding beyond the card-only comfort zone to accommodate other popular digital payment methods.

Going with a payment processor that additionally accommodates PayPal, for instance, could potentially increase your market size by 25%.

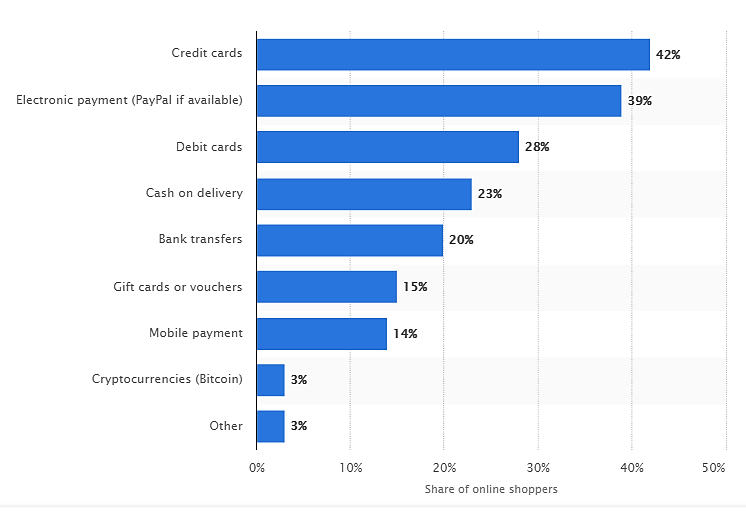

But, it turns out that these circumstances are bound to change when you start expanding to other countries. If you’ve sampled the global ecommerce market already, you might have noticed that it’s not entirely enthusiastic about cards.

While only 42% prefer paying through credit cards, 39% are comfortable with processing platforms like PayPal, 28% are for debit cards, and 20% rely on direct bank transfers.

The best way to sustain such a dynamic market is by adopting an equally versatile payment processor. And that requires you to look beyond card-based solutions by assessing customer preferences. Use the findings to subsequently narrow down the options to processors that provide all the relevant payment methods.

Location

Speaking of countries, here’s something I find to be rather ironic…

There are now about 180 unique currencies being used in 195 nations around the world. Despite each one of them having its own economic value and governing legislation, financial institutions found a way of harmonizing all of them to streamline the flow of cash globally. You can now travel with your dollars pretty much anywhere, and get to spend comfortably after converting them into local denominations.

Then the internet came with its payment processors. On paper, you’d expect them to capitalize on that to easily streamlining their cash flow internationally, especially considering the added benefit of swift data exchange on the web. But, surprisingly, that has never panned out.

Although many payment processors market themselves as “global payment providers”, they are not as universal you may have presumed. The actual reality is far from that.

Well, at least one side of that claim might be true- that you can pay from anywhere as long as you have a valid card. Then things get a little bit complicated when we shift to the receiving end- the merchant’s side.

So far, we are yet to see a payment processor with merchant account capabilities worldwide. Each provider has a limited set of countries where businesses are allowed to set up merchant accounts. While some support only US-based merchant accounts, the likes of PayPal have managed to expand to tens of countries.

As a result, wouldn’t it make sense to quickly get this headache over and done with by going straight for the most established provider?

That might seem feasible at first. However, it doesn’t guarantee you uninterrupted merchant services as your store grows. Instead, the best approach would be reviewing each payment processor’s supported countries by the list of international locations your business plans to expand to in the future.

Integrations

Although the fluid nature of the e-commerce ecosystem is exceedingly beneficial, it also has its fair share of drawbacks. Chief among which is the burden of persistently reviewing and adjusting supplementary apps on your online store, as you try to keep up with changing market trends. Apart from upscaling and downscaling some of your services repeatedly, you’ll be forced to acquire other solutions as your business morphs progressively.

One particularly outstanding challenge you might face here is the process of linking new apps your existing store framework. A well-streamlined network of systems can only be achieved by applications that integrate accordingly to form complementary cohesions.

A payment processor is one of the few elements whose performance largely depends on how it’s embedded into such a network. It should bond with multiple services on your store to achieve uninterrupted data exchange all around.

Therefore, it’s advisable to pay close attention to all the integrations each payment processor has built for third-party applications. Start with the respective e-commerce platforms they can embed with, then you work your way to other less critical resources like analytics and marketing solutions.

The most effective payment processors have been developed to embed holistically with not only a range of e-commerce platforms but also the whole spectrum of applications that are commonly utilized in e-commerce. In addition to that, they are updated frequently to keep up with the ever-changing web tech.

Payment Processing Interface

There are two primary types of payment processing interfaces your shoppers might encounter when they finally get to the checkout stage.

If you leverage an onsite payment solution, the corresponding transaction process follows a continuous straightforward path. The shoppers will be able to conduct transactions and eventually pay right from your website.

Offsite processors, on the other hand, come with a multifaceted structure. Instead of handling everything within the principal shopping site, the overlying payment interface is designed to run on a separate surfing window. In other words, your shoppers will be temporarily redirected from your website to complete their payments on the provider’s platform.

Now, more often than not, the latter would cost less than the former. Plus, of course, there’s the added benefit of a less cumbersome integration process. You just need to set up a button on your site and the payment service takes it from there. Basically, a system that many people consider to be simple and stress-free.

Or is it?

At first, pushing your payment transactions to a separate tab or window might sound harmless. I’ve been there at one point. And I admit that everything seemed to be proceeding fine for some time- until I simple test with an onsite payment system proved otherwise.

You see, online consumers are not that complicated after all. If you take time to carefully track their patterns, you’ll notice that they have similar shopping tendencies and preferences. For instance, they all want to be done with the whole shopping thing as fast as possible.

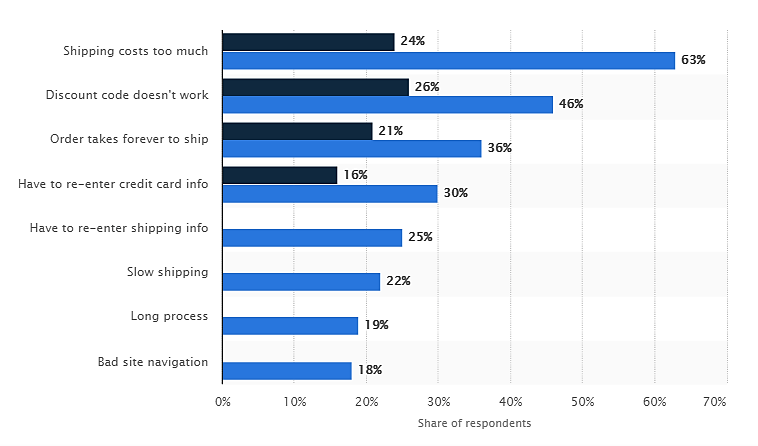

That’s why, in fact, 19% of cart abandonment cases are blamed on long shopping processes, and bad site navigation takes 18%.

What does this mean for you?

Well, all things considered, your site visitors would certainly appreciate a brief and continuous shopping pipeline- from product selection all the way to the payment process. Directing them to an offsite payment window would essentially break the flow, resulting in a long process and increased cart abandonment.

Therefore, the most suitable option for a well-optimized shopping process is an onsite payment processor. Although it might cost more and possibly take longer to embed, this approach alone could save you quite a number of conversions over the long haul.

Security

By making it possible to conveniently remit and process funds without your physical presence, online payment systems have given rise to a new wave of cybercrimes.

Gone are the days they were forced to break into banks. Today’s criminals just need a PC and decent IT skills to loot money from a vulnerable payment system. If truth be told, they are capable of stealing from your store in a matter of seconds without raising suspicion.

Well, there are many approaches they might possibly use. And CNP fraud is a popular preference due to its relative ease, plus the high level of susceptibility payment processors are exposed to.

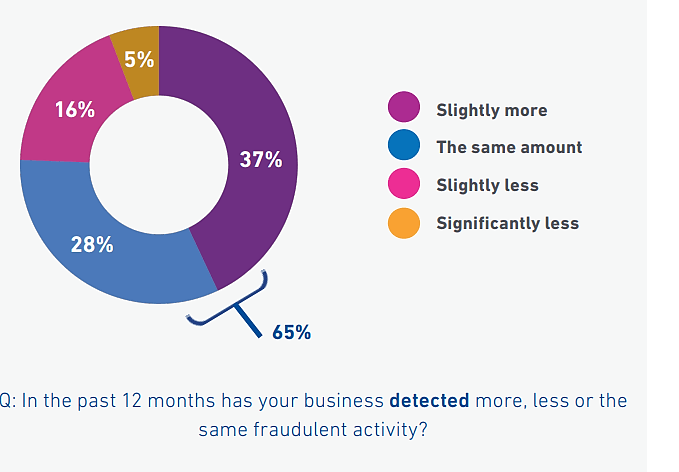

Sadly, the situation is getting worse by the day. According to Experian’s Global Fraud and Identity Report, only 21% of businesses experienced fewer fraud attempts in 2018. 37% noticed that the attacks had increased, while 28% recorded pretty much the same level of fraudulent activities as they had seen in previous years.

This alone should confirm your fears. That if they haven’t tried it already, you can bet that the fraudsters are going to come for your business pretty soon.

Therefore, to avoid a potentially disastrous outcome, you should be particularly keen about your payment processor’s security features.

Since data encryption is seemingly standard by now, focus on options that supplement that with advanced attack prevention features. They should be able to not only detect potentially fraudulent activity but also mitigate the attacks in case of any system infiltration.

You can start off by eliminating services that lack PCI compliance. This, in fact, would be a thoughtful way to save yourself from going through some of the complex digital security jargon. The Payment Card Industry’s Data Security Standard provides a set of firm protection regulations that processors should strictly conform to.

However, that should be the bare minimum. A comprehensively secured payment processor should also come with strong SSL protocol, tokenization, and CVV verification. In other words, an all-round fraud prevention framework.

Usually, the more the features, the corresponding level of protection. But, don’t get it wrong. Going overboard with the protocols might not necessarily translate to more business for you.

Why, you ask?

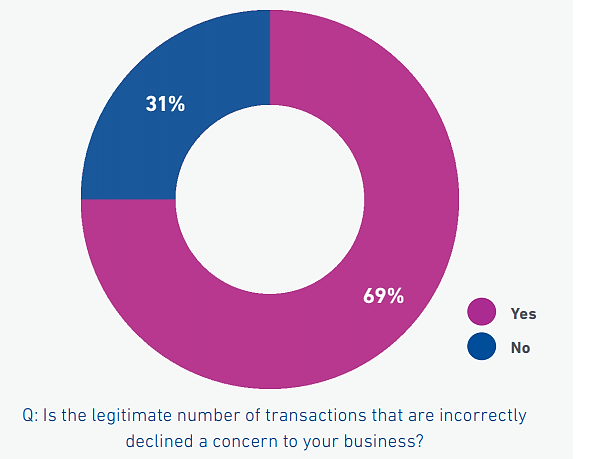

Strangely, CNP security systems are exceedingly flagging up even genuine transactions as potential fraud attempts. This alone is getting a whopping 69% of businesses worried.

And rather unbelievably, the resultant loss surpasses what businesses are actually losing to true fraud. The rate at which processors are declining false positives is worryingly 3 times higher than the corresponding true card fraud rate.

That said, look out for payment processors that combine card verification with robust machine learning to effectively discern real fraud attempts from potential false positives. But then again, ensure that it’s all subtle enough to avoid interfering with the standard shopping process. 72% of businesses are already seeking superior security authentication that doesn’t compromise customer experience.

Cost

You’re probably aware that digital payments are not free at all. And the saddest bit is that the bulk of the processing fees are paid directly by businesses.

On the bright side, however, you have a wide range of competitive pricing options to choose from. The only problem here is that it’s not as straightforward as you may assume. Comparing various costs requires a bit of analytical math since payment processors use varying charging modes.

Quite a number of them, for example, will hit you with a bill as soon as you try to register. And it doesn’t end there. The signup fees are usually the first of many that subsequently follow when you begin selling.

Speaking of which, there are two forms of continuous charges- monthly subscription costs and transaction fees. If a payment processor doesn’t bill you for the service on a periodic basis, you’ll probably end up paying a fixed or a percentage rate for each transaction. It’s also possible to incur both types of charges concurrently, considering some providers happen to methodically combine them.

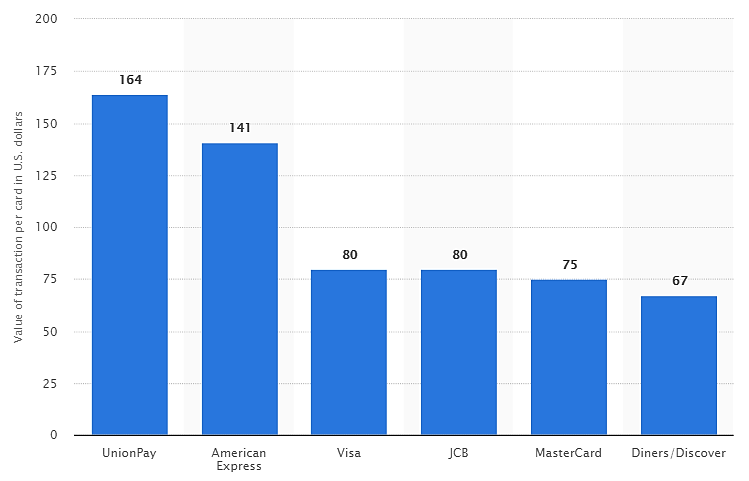

Here is the average transaction value of each card to help you estimate the consequently applicable fee range.

Then get this. We also have special fees that are not often revealed openly on the pricing schedule. They mostly apply to selected situations like chargebacks or service cancellation.

Now, as you compare the cumulative costs of the respective services based on your business setup, you should also consider what’s known as cost-plus, pass through or interchange-plus pricing. This mode is thought to be cost-effective because payment processors go apply a standard markup for all card types. And that comes along with direct interchange rates from the card providers.

Summary

| State of Online Payments |

|

| What is a Payment Processor? |

|

| Choosing The Best Payment Processor |

|

Now that we’re done with the first part, which payment processors would you vote as the best in the industry?

Well, guess what? We have all the critical information you need to know about all of them- their features, benefits, drawbacks, you name it. So, feel free to proceed if you want to discover and compare how various payment processors can impact your online store.

Here are some related articles you may be interested in:

Top Payment Processors

These are the top payment processors with corresponding reviews and comparisons by our team:

- PayPal: One of the most popular and widely accepted payment processors globally. It offers a secure platform for online transactions, making it the go-to for many businesses and consumers. Key selling proposition: widespread acceptance and robust fraud protection.

- Stripe: A developer-friendly, customizable payment solution that supports over 135 currencies and various payment methods. Key selling proposition: high-level customization and global payment support.

- Stripe vs Authorize.net

- Stripe vs Chargebee

- Stripe vs WooCommerce Payments

- Stripe vs Stax

- Stripe vs Recurly

- Stripe vs PayPal

- Stripe vs WePay

- Stripe vs Bill.com

- Stripe vs Adyen

- Stripe vs Moolah

- Stripe vs Shopify Payments

- Stripe vs Melio

- Stripe vs Marqeta

- Stripe vs Plaid

- Stripe vs Braintree

- Stripe vs Square

- Stripe Salesforce Integration Guide

- Top Stripe Alternatives

- Square: Ideal for small businesses, Square offers an all-in-one payment solution with features like point of sale (POS) system, online payments, and mobile payments. Key selling proposition: comprehensive payment solutions for small businesses.

- Braintree: A division of PayPal, Braintree offers global payment processing services including credit/debit cards, wallets, and bank transfers. Key selling proposition: seamless integration with PayPal and robust security measures.

- Authorize.net: A payment gateway service provider that allows businesses to accept credit card and electronic check payments through their website. Key selling proposition: advanced fraud detection and secure customer data management.

- Adyen: Known for its single-platform approach, Adyen enables businesses to accept payments almost everywhere in the world. Key selling proposition: unified, cross-channel payment solution.

- 2Checkout: A global payment processor that supports multiple payment methods, including credit cards, debit cards, and PayPal. Key selling proposition: global reach with support for 200+ countries and 100+ currencies.

- Amazon Pay: A trusted, familiar brand that offers a seamless payment experience for Amazon customers on third-party websites. Key selling proposition: leveraging the reputation and user base of Amazon.

- Google Pay: A digital wallet platform and online payment system developed by Google to power in-app, online, and in-person contactless purchases. Key selling proposition: integration with other Google services and Android devices.

- Apple Pay: A mobile payment and digital wallet service by Apple that lets users make payments using an iPhone, Apple Watch, or on the web. Key selling proposition: seamless payments for Apple device users.

- Chargebee: An efficient and flexible subscription management platform, Chargebee provides automated recurring billing, subscription management, and analytics. It is highly customizable and integrates with multiple payment gateways.

- Recurly: A subscription billing platform designed to recover maximum revenue. Recurly’s rich feature set, including flexible billing capabilities and analytics, makes it a favorite among businesses of all sizes.

- WePay: Owned by JPMorgan Chase, WePay is an integrated payment processor designed for platforms. It offers advanced fraud protection, supports multiple currencies, and provides a seamless customer experience.

- Moolah: Moolah is a straightforward payment processor that offers a simple setup with no monthly fees. It’s a great option for small businesses with its robust features and excellent customer service.

- Wise: Wise is a rapidly growing payments platform, with 100s of support currencies and transfer methods. Great for international payments and flexible pay option

- Melio: A B2B payment processing platform, Melio simplifies the payment process, allowing businesses to pay their bills via bank transfer or credit card. It’s known for its user-friendly interface and zero transaction fees for bank transfers.

- Veem: Veem is a global payment platform that uses blockchain technology to send and receive payments in local currency. It is valued for its simplicity, security, and transparency.

- Bill.com: A comprehensive business payment platform, Bill.com automates the process of paying and getting paid, reducing the time spent on back-office operations. It offers features like ACH payments, invoicing, and payment tracking.

- Payoneer: Payoneer is a robust payment platform that enables businesses and professionals from more than 200 countries to grow globally by facilitating seamless, cross-border payments.

- Shopify Payments: Mostly useful for Shopify store owners (although now expanding to all manner of merchants), Shopify payments is making a name for itself thanks to it’s burgeoning network effects.

- WooCommerce Payments: Similarly, WooCommerce Payments is emerging as a player thanks to the popular WooCommerce selling platform (built on WordPress).

Top Payroll Processors

If you are running payroll for a team, these “processors” take it up a notch whether you are paying a large enterprise workforce or a small international contracting team. See below for the full list with our editorial coverage:

- ADP: As a global leader in payroll services, ADP offers a wide array of features including direct deposit, tax filing, new hire reporting, and employee self-service. They offer solutions for businesses of all sizes.

- Paychex: Paychex offers customizable payroll services, HR solutions, 401(k) and benefits administration, and insurance services. They cater to businesses of all sizes and offer a 24/7 customer service.

- QuickBooks Payroll: Integrated with the popular QuickBooks accounting software, this platform offers automatic payroll, tax calculations, and direct deposit. It’s perfect for small businesses already using QuickBooks for their accounting needs.

- Gusto: Known for its easy-to-use interface, Gusto offers full-service payroll, benefits management, and HR tools. It’s particularly popular among small businesses.

- Paycom: Paycom offers an all-in-one solution, bringing payroll, time and labor management, HR, talent acquisition, and talent management into a single application.

- SurePayroll: A subsidiary of Paychex, SurePayroll is designed specifically for small businesses and offers an easy online payroll system, including guaranteed tax compliance and unlimited payroll runs.

- OnPay: This platform offers a simple, straightforward payroll service, with transparent pricing and no hidden fees. OnPay also handles your tax filings and provides an accuracy guarantee.

- Zenefits: While Zenefits is primarily an HR platform, it also offers robust payroll capabilities. It excels in integrating payroll with other HR functions, such as benefits and time tracking.

- Square Payroll: As part of the Square product suite, this platform is great for businesses already using Square for point-of-sale or payment processing. It offers features like automatic tax filing and easy timecard integrations.

- Wave Payroll: Wave Payroll is part of a free suite of accounting and invoicing tools, making it an economical choice for small businesses. It offers features like direct deposit, tax calculations, and online pay stubs.

- Justworks: Justworks is a comprehensive HR solution that offers automated payroll, access to big-company benefits, compliance support, and HR tools in an easy-to-use platform. It streamlines back-office work and helps to ensure that your business operations run smoothly.

- Namely: Namely is an all-in-one HR, payroll, and benefits platform that is designed to be as intuitive as social media. It offers modern, easy-to-use software that streamlines payroll processing, provides insightful reporting, and ensures compliance.

- Paylocity: Paylocity is a cloud-based payroll and human capital management (HCM) solution that provides businesses with tools to manage their workforce more efficiently. This includes features like payroll processing, talent management, benefits administration, and time & labor tracking.