- My Bottom Line Upfront

- What Square Is

- Square Payroll Features and Prices

- Pay Employees and Contractors

- Pay Just Contractors

- Tax

- Paid Time Off and Sick Leave

- Team Management

- Reporting

- HR and Onboarding

- Tips

- Additional Costs When Using Square

- Square Payroll’s Pros and Cons

- What Do The Reviews Say?

- Square Customer Support

- Square Payroll Alternatives

- FAQs

- Square Payroll Review: My Final Thoughts

Last Updated on June 1, 2023 by Ewen Finser

Running a small business isn’t without its challenges. I should know – I run one. On the one hand, you want your business to grow, but you need to balance that with running your day-to-day operations. This includes ensuring effective, secure, and accurate payment systems that enable you to pay your employees on time, every time.

Finding the right payroll solution, however, can be tricky. There are tons of options out there, many of them aimed at small businesses and larger enterprises alike, so how do you choose between them? With that said, I hope to help you with your research by taking a microscope to one such provider: Square Payroll. There’s lots to get through, so let’s make a start.

My Bottom Line Upfront

All in all, Square is a cloud-based solution that works on iOS and Android, offering its customers a full-service suite of payroll tools. These include direct deposits, tax support, paid time off, and a mobile app.

I like that Square point-of-sale users can easily integrate Square’s Payroll system, empowering them to streamline their in-person sales and payroll management systems. Similarly, Square Payroll is designed to work with other Square applications, such as Square Team. Here, employees can clock in/out, view their hours worked, view their weekly pay, edit their team profile, and more.

Pricing is simple to understand and primarily aimed at smaller and medium-sized businesses looking for an all-in-one, transparently priced solution.

What Square Is

Since its inception in 2015, Square Payroll has grown to offer payment solutions to businesses across the US, Australia, the UK, and Europe. As I’ve already mentioned, small and enterprise-level sellers can use Square to benefit from a pretty comprehensive payroll processing software. I.e., whether you’re a store, restaurant, bar,

professional service, or larger enterprise, you can:

- Set up payroll runs

- Generate reports

- Tailor your payroll

…for both hourly and salaried employees.

Square Payroll includes a range of mix-and-match services so that you can supplement your payroll plan with other features for an additional fee. This includes point-of-sale integrations, Square hardware, tax support, check printing, and more.

Now that you understand what Square Payroll is, let’s dive deeper into some of its core features.

Square Payroll Features and Prices

Square Payroll’s features offer customers everything they need to run:

- Payroll

- Handle employee benefits

- Automate tax filings for contractors and employees

…all from one place.

The simplest way to explain what Square Payroll offers is to provide an overview of the features and how much they cost.

At this point, I want to reiterate that Square Payroll integrates with several other Square products. This includes Square POS and Square Timecards. That’s as well as different third-party integrations like Xero, QuickBooks, QuickBooks Time, and ZipRecruiter. Of course, these may incur additional costs.

So, without further ado, let’s take a look at Square Payroll’s features and pricing:

Pay Employees and Contractors

If you want to pay employees and contractors, prices for this service start at $35 per month, plus $5 per person you’re paying. You can cancel at any time.

For this, you receive the following features:

- Unlimited pay runs each month.

- Automatic payroll tax calculations

- All tax filings and payments

- Multistate payroll

- Live support for account setup.

- Access to the timecards and employee app

- You can track, import, and calculate tips and commissions.

- Square mails W-2s and 1099-NEC forms to the IRS for you

- You can pay employees by check, direct deposit, or Cash App.

- Access to customer support Monday to Friday, 6 am to 6 pm Pacific time.

- Free seasonal inactivity – There are no hidden fees for account inactivity if your business only operates during specific seasons. There’s no need to disable your account during that time!

Pay Just Contractors

If you only want to pay contractors, prices start at $5 per month, per person paid. Again, you can cancel at any time. For this, you receive the following:

- Unlimited monthly pay runs

- Square mails all 1099-NEC forms to the IRS

- Customer support is available from Monday to Friday from 6 am to 6 pm Pacific time

- You can pay contractors by check, direct deposit, or Cash App

- Free seasonal inactivity

Whether you’re paying employees and contractors or just contractors, once you sign up, you have access to a Square Dashboard from which you can begin to run a payroll from the Payroll section. Alternatively, you can run payroll from the Square Payroll app.

I think it’s worth noting that you’ll need to run payroll by 8 pm PT to ensure your direct deposit recipients receive their pay on payday the next day. Now, let’s take a more detailed look at some of the features listed above, as well as other features that aren’t listed in Square Payroll’s pricing structure:

Payroll

As I’ve already alluded, Square Payroll aims to simplify your business’s payroll system. You can automate payroll, set reminders to run payroll, and terminate employees/contractors no longer on your books.

Other payroll processing features include unlimited payroll runs, paying contractors, tax support, direct deposits, access to the Square Payroll mobile app, manual paychecks, and allowing employees and contractors to be paid with the Cash App.

Tax

Fulfilling your employer obligations with the IRS is essential, which is why Square Payroll aims to simplify this. More specifically, Square Payroll’s tax support offers the following:

- Automatic state tax calculations, filings, and payments (for anyone on the Pay Employees and Contractors Plan)

- Automatic federal tax calculations, filings, and payments (again for anyone only on the Pay Employees and Contractors Plan)

- Square mails I-9 and W-9 tax forms to the IRS for you

- Create, file, and mail out 1099s and W-2s (the latter is only available on the Pay Employees and Contractors plan)

- Employees can eSign tax forms -(again, only on the Pay Employees and Contractors plan).

Paid Time Off and Sick Leave

You can set up a paid time off (PTO) policy for employees either from your Payroll settings inside Square’s Dashboard or from the profile section of Payroll Team.

You can calculate time off accruals and track the PTO balance for time off and sick leave. You can either monitor this based on the number of hours worked or a fixed amount. With the former, your employee will accrue a certain amount of time off based on the number of hours they’ve worked. Whereas, with a fixed amount, your employees are just entitled to a set amount of PTO determined by you.

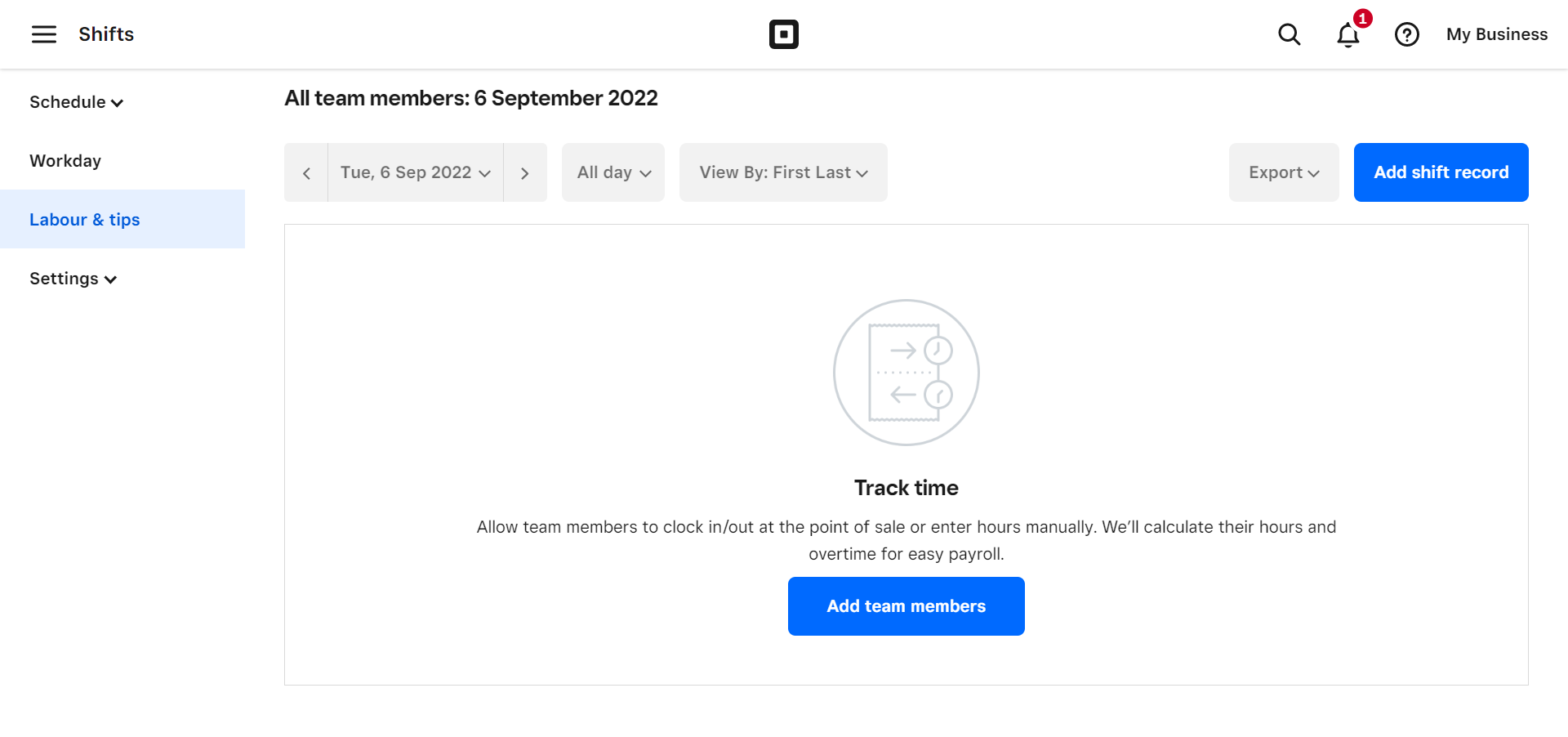

Team Management

Although Square Payroll doesn’t have time tracking built into its software, you can sign up for the Square Team (management) app. This will cost you an additional $35 a month per location to access its complete list of features. However, there’s a free version with limited features available.

Features include employees’ ability to calculate overtime, clock in and out, shifts scheduling, PTO, and sick leave tracking. (Please note this is only available with the Pay Employees and Contractors plan only).

Reporting

You can generate reports on employee payroll totals, paycheck totals, numbers of pay stubs generated, company tax totals, employee details, and more. Unfortunately, at the time of writing, the reporting function is only available via desktop and not via the Square Payroll app.

HR and Onboarding

Square Payroll integrates with HR consulting company Bambee. As a result, Square Payroll customers receive a discount on its features. This empowers employees to self-onboard with you, add e-signatures to documents, and access their pay stub information.

You’ll receive alerts once new hires are onboard. You can also track where they are in the onboarding process.

Prices vary depending on how many people you employ:

- 1-4 employees = $99 a month + $0 one-time Bambee in-depth HR audit

- 5-19 employees = $199 a month + $250 one-time Bambee in-depth HR audit

- 20-49 employees = $299 a month + $500 one-time Bambee in-depth HR audit

- 50-99 employees = $449 a month + $750 one-time Bambee in-depth HR audit

You receive a 50% discount on the one-time Bambee HR Audit fee. If your business falls into the 1-4 employee range, the audit fee is $0.

Tips

Suppose you’re an employer that allocates tips to employees. In that case, you can automate this process using the ‘Enable Tip’ option on your dashboard. You can then import tips daily/per shift/ pay period. You can also pay tips directly to employees using the Square Payroll app.

Alternatively, there’s a manual entry option within Square Payroll. Tips can either be paid via your payroll or in cash. You’ll also see a record of the number of tips employees have already allocated.

Additional Costs When Using Square

While it’s generally the case that Square Payroll’s costs are transparent, it’s worth digging a bit deeper into this. Why? Because if you want to provide employees with a full suite of benefits, this will cost you more.

Let’s look at some of the benefits you can introduce to your Payroll:

- 401(k) Retirement Plan: from $49 a month and $8 per employee (Square partners with Guideline to deliver this)

- Health benefits: from $190 a month per employee

- Worker’s compensation: from $50 a month per employee

- HR support: From $99 a month

From the’ Benefits’ tab, you can set up employee benefits like health insurance, 401(k) retirement plans, and worker’s compensation within your Square Payroll dashboard.

If you already offer employee benefits, Square Payroll enables you to add taxable benefit deductions and contributions on each Payroll employee’s individual profile. Supported benefits include Health Savings Account (HSA), Roth 403 B Retirement Plan, 457(b), and the Deferred Compensation Plan.

Square Payroll’s Pros and Cons

We’ve covered a lot of ground, so I’ll try and condense some of what we’ve discussed into a quick pro-cons list below:

Pros:

- Affordable pricing

- There’s a contractor-only plan

- Square offers a good set of online resources

- Square Payroll seamlessly integrates with other Square features

- It can be used across all 50 US states, plus Australia, and Europe

- Fulsome tax support

- There are no contracts, so you can cancel anytime

Cons:

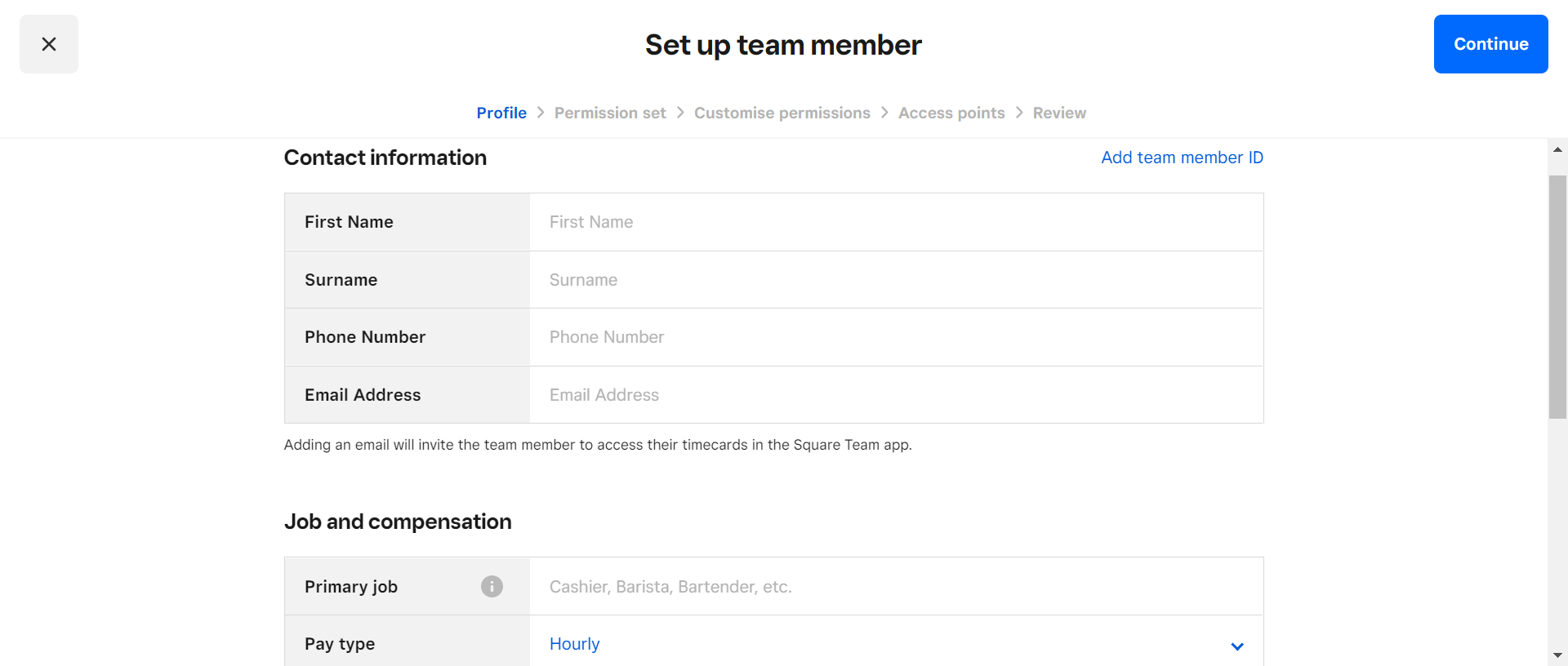

- The user experience isn’t as intuitive or sleek as other payroll services. The interface is somewhat outdated, and all employee data is displayed on one long screen, which makes it challenging to identify the information you need.

- Reporting features are relatively basic. Square doesn’t offer many preformatted reports, and you can’t review reports on the platform. Instead, you have to download them. Customization is also limited; you can only filter by pay date range and team members.

- You can’t pay employees the same day you sign-up, as Square takes a few days to authenticate your bank accounts.

- The $5 per person paid charges can mount up if you have to generate lots of payments.

- Users still must manually enter all employee data when setting up their employees. This can be a very long, tedious process. There’s no easy way to import employees’ data.

What Do The Reviews Say?

I checked several review sites to see what Square Payroll customers think of its software. Software Advice users give it an overall 4.7 out of 5 stars, with praise for its functionality, value for money, customer support, and ease of use. However, some users think the dashboard is somewhat basic, and others aren’t happy with the lack of reporting options.

Capterra users also rate the software highly, with 4.7 stars out of 5 stars. They are optimistic about its ease of use, help with tax filing and preparation, and that you can run unlimited monthly payrolls. Less popular were customer service response times and further references to basic reporting functions.

Square Customer Support

You can contact a Square Payroll Expert by completing an online form outlining the nature of your query. You can speak to a human between Monday and Friday, 6 am to 6 pm Pacific Time, via email and phone. In addition, live-chat support from US-based specialists is available Monday to Friday from 6 am to 4 pm PST.

Alternatively, you can reach out to the Square Seller Community via the Square community forum. The forum includes business resources, questions of the week, seller groups with common interests you can join, and much more.

The Square Support Center is where you can type in payroll-related questions and find answers to common queries. For example, how to suspend a payroll when you have no employees, download the Square Payroll app, and more. In addition, the website features articles and posts on payroll, including how to run a payroll.

Square Payroll Alternatives

When looking at payroll solutions for your business, it’s always wise to do your research first before making any final decisions. Part of this includes checking out the competition. So below, I’ve listed a few Square Payroll alternatives you might like to explore before deciding which to go for:

Gusto

Like Square Payroll, Gusto is aimed at small to medium-sized businesses looking for an all-in-one payment solution. However, Gusto’s prices are a bit higher, costing from $40 a month and $6 per person paid, rising to $80 a month and $12 per person paid if you want to utilize Gusto’s HR features too. Billing is monthly, and you can cancel anytime.

Standout features include unlimited monthly payroll runs, integrated HR functions, employee onboarding, and employee benefits.

In addition, Gusto integrates with various third-party apps, including QuickBooks, FreshBooks, and Xero. However, of the two, only Square Payroll offers a mobile app for employers to manage their payroll.

ADP

ADP is one of the better-known payroll administration software platforms. It offers solutions for small businesses with 25-199 employees and large companies with more than 999 employees and enterprises in global locations.

It bills itself as an HR and payroll solution offering features such as onboarding, employee and manager self-service via a mobile app, access to payroll experts 24/7, integration with HR and time-tracking systems, tax administration, and more.

There are different payroll solutions available based on your business size. However, the ADP website isn’t easy to navigate, and no prices were available at the time of writing.

Paychex Flex

Here’s a payroll software solution for small and larger businesses. It’s billed as an all-in-one solution for payroll, HR, employee time tracking and attendance, and employee benefits. Customer support is also 24/7.

Paychex automates the payroll process, and you can manage everything from the Paychex Flex mobile app. However, like Square Payroll, costs are higher if you want to offer employees additional benefits such as retirement planning and healthcare.

There are three pricing levels, with the lowest starting from $39 a month and $5 per person paid, rising to two other plans with custom pricing. You’ll have to contact the sales department for a quote.

FAQs

Question: Can my employees access Square Payroll?

Answer: Yes, via a Square integration called Team. This app allows employees to:

• Clock in and out

• Track their hours

• Look at timecards

• Track historical earnings

• Update their personal information

• Complete onboarding tasks such as filling out necessary forms, including W-4s.

Question: How do I run payroll for contractors using Square Payroll?

Answer: Log into your Square dashboard and head to the Payroll section on the left-hand side of the screen, then:

• Click ‘Pay Contractors’

• Choose your pay period dates and payment method.

• Select the contractor(s) you want to pay

• Input the hours they’ve worked and their pay rate. You can import this information from integrations like Square Timecards. If you aren’t using any integrations, you’ll have to input this information manually into the Amount column.

• Click ‘Continue’ and review the payment details.

• Click ‘Submit Payment’

• Contractors paid by direct deposit into their bank will be paid four business days after you’ve sent the payment.

Question: If I cancel my account, can I reinstate my payroll at a later date?

Answer: Once a Square Payroll account has been deactivated, there’s currently no way of reactivating it once it’s canceled. Instead, you’ll have to set up a new account with a different email address.

Question: Is Square Payroll secure?

Answer: It’s essential your employee and contractor data is safe and secure and that financial payments made aren’t susceptible to fraud. Square customer data is protected via:

• Secure transaction encryption

• Compliance with Level 1 PCI security standards

• Two-factor authentication processes

• Strong password controls for administrative access

Question: I’m confused about what payroll tax filing forms I have to submit?

Answer: At no additional charge, Square Payroll will tax care of your state and federal tax filings for you. Once the relevant forms are filed, you can download them, save, and print them from your Square dashboard.

Team members also receive copies of their tax forms (W-2 and 1900-NEC) through the Square Team app, or you can mail them instead. In addition, the Square Payroll website has an extensive article on payroll tax filings. Within that, you can see state-by-state, which state’s payroll forms the platform handles.

Square Payroll Review: My Final Thoughts

Having read my review, you’ll hopefully now have a better view of what Square Payroll can do and whether it’s suitable for your business. For example, suppose you’re looking for a simple and easy-to-use software solution that integrates with Square POS and offers payroll and tax support at affordable prices. In that case, Square Payroll could be a contender for you.

There are no hidden fees, although you’ll incur extra costs if you’re planning on adding employee benefits. Square Payroll pretty much does what it says on the tin. It’s a no-frills payroll solution that’s especially attractive to anyone already using other Square tools, such as POS and Team, to run their business.

Ultimately, it’s your decision to make. For example, you may feel that as your business grows, you might want a payroll processing platform that can scale with you. Unfortunately, Square Payroll is more suited to smaller companies, so you might outgrow this platform in time.

That’s all, folks; let us know what you decide in the comments below!