- Main Differences Between Bill.com vs Melio

- Melio vs Bill.com Key Tradeoffs at a Glance

- Bill.com Key Features

- Pricing and fees

- Business User Pricing Plans

- Pricing Plan for Accountants

- Pros and Cons of Bill.com

- Melio Key Features

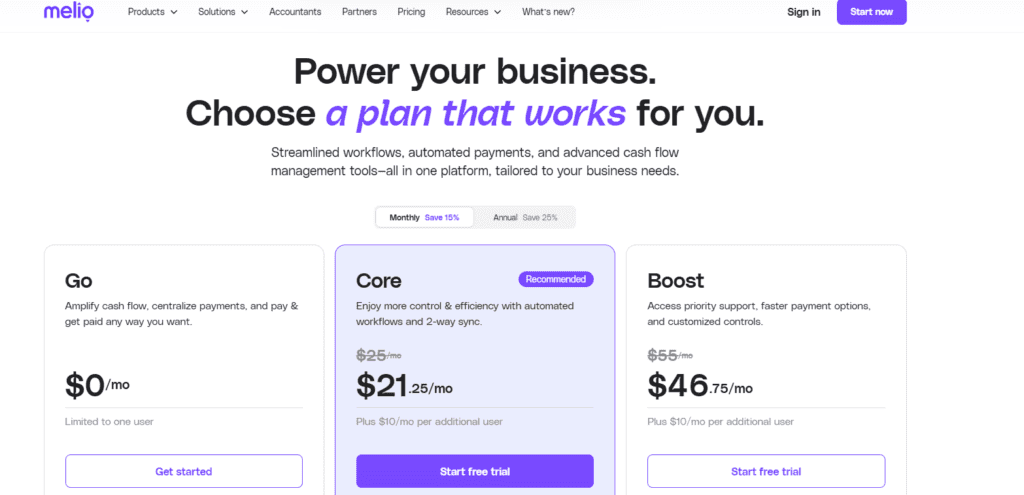

- Pricing

- Melio Affiliate Program

- Pros and Cons of Melio

- Price Comparison: Bill.com vs Melio

- Recommended Alternatives

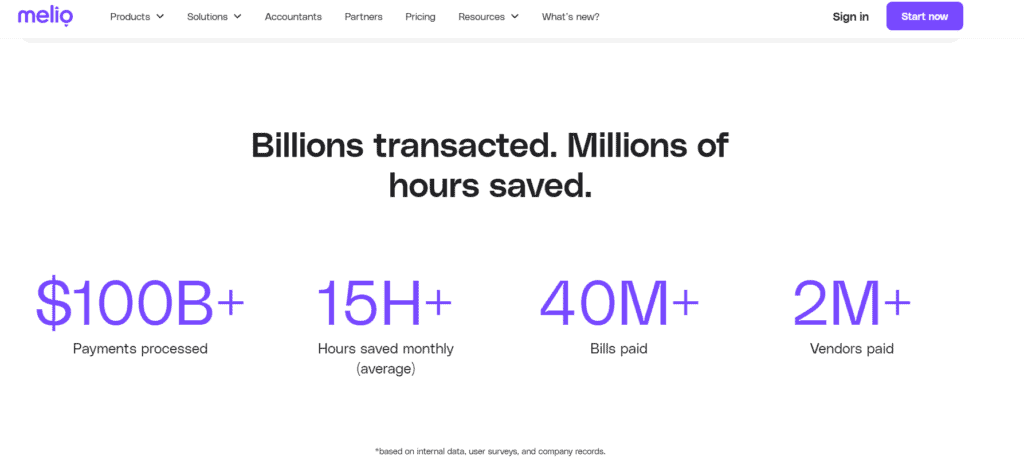

- Bill.com vs Melio: The Bottom Line

- Other Bill.com Alternatives Compared:

- Other Melio Alternatives & Competitors Compared:

Last Updated on April 3, 2025 by Ewen Finser

It’s important to know what to look for when choosing the right payments platform for your organization.

Ease of use is imperative, as well as standout features that make sense for how you choose to use the system. I’ve reviewed the differences between Melio and Bill.com to help you decide which platform is right for you.

TL;DR: If you need a simple, easy, and low-fee way to pay US-based contractors, clients, or vendors, go with Melio. Alternatively, if you’re a mid-sized business that needs more advanced features like bulk payments, financial reporting, and international support, go with Bill.com.

Main Differences Between Bill.com vs Melio

- Bill.com has deep automation features, whereas Melio has only basic automation.

- Bill.com has more features but a more complex user interface as opposed to Melio’s easy-to-use platform.

- Melio is generally faster when I’ve used it, whereas Bill.com takes 2-3X longer.

- Bill.com has an invoice system, whereas Melio has a page where you can get paid directly.

- Melio has the option to pay your partners with a credit card even if they do not accept it, whereas Bill.com does not (but there are many more payment options).

- Bill.com has integrations with most accounting software, whereas Melio integrates with a limited number of platforms.

- Bill.com supports international payments, whereas Melio only has US support.

Melio vs Bill.com Key Tradeoffs at a Glance

Here’s how I’d summarize the key distinctions between Bill.com and Melio:

Key features | Bill.com | Melio |

Cost | Bill.com has different pricing tiers starting from $45/user per month*. *as of 2025 | Melio now offers various pricing tiers depending on your business needs. They have a free plan, and the paid plans start at $25/user per month. Melio is free for bank transfers and debit cards. A 2.9% fee is charged for credit card payments |

Accounts Payable | Bill.com offers a comprehensive accounts payable solution. | Melio focuses on simplifying payments but offers fewer features for accounts payable. |

Accounts Receivable | Provides full-featured accounts receivable services. | Melio’s primary focus is on payments, so accounts receivable features are limited. |

Integration | Integrates with many accounting software like QuickBooks, Xero, Sage Intacct, and more. | Integrates with QuickBooks Online and Desktop, Xero, and Amazon Business. |

Platform | Available on web and mobile (iOS and Android). | Available on the web app, with a mobile app for both Android and iOS as of 2025. |

Payment Methods | ACH, ACH ePayments, Debit Card, Credit Card, Virtual Card, Paper Checks, International Wire Transfers. | ACH, Debit Card, Credit Card, Virtual Card, Paper Checks, Instant Payments, and International Wire Transfers. |

International Payments | Yes, in multiple currencies. | Yes, international payments in USD and 16 foreign currencies. |

Customer Support | Phone, Email, and Chat Support. Bill.com offers premium phone support for all accountant partners. | Email and Chat Support. Melio offers premium phone support for businesses and accounting firms who subscribe to the Boost plan. |

Bill.com Key Features

Aptly named, Bill.com is one of the most well-known pre-accounting software brands. It shines with its ability to let you deal with your accounts payables and receivables. It is a comprehensive service, although maybe a bit more expensive than other alternatives.

Data entry

You can easily add bills by snapping a picture through the phone app. When you do, most data will be automatically imported into Bill.com’s dashboard. You can also import digital bills and allow the AI to autofill most of the data, saving you a lot of time.

Receivables Features

Your Bill.com dashboard provides an instant overview of everything coming in and out. You can easily create digital invoices and share them with your partners. You can also add personal notes and set up billing automation.

This is a great way to conveniently send bills and stay on top of what is owed to you. Your customers and partners can directly pay online through bank transfer from your bank account or credit card for a totally streamlined process.

Payables Features

Similarly, Bill.com lets you keep track of all that you are supposed to pay in real time through its dashboard. You can send payments based on the previously scanned bills that your partners send you. On top of that, you even have the option to set up recurring and automated payments in a few clicks.

Integrations:

Bill.com integrates with most of the well-known accounting and fintech stack tools. Furthermore, if you’re using a service that does not integrate well with Bill.com, you can easily export highly compatible templates that will be a breeze to use with other software.

For most of Bill.com’s accounting integration, there is an active two-way cloud sync so that any data modified on one side will be updated on the other for maximum saved time and convenience.

QuickBooks, Xero, Oracle, Sage, and Microsoft services are among the many integrations native to Bill.com. It also integrates with other pre-accounting software such as Expensify, Hubdoc, Tallie, Earth Class Mail, and Tax1099.com.

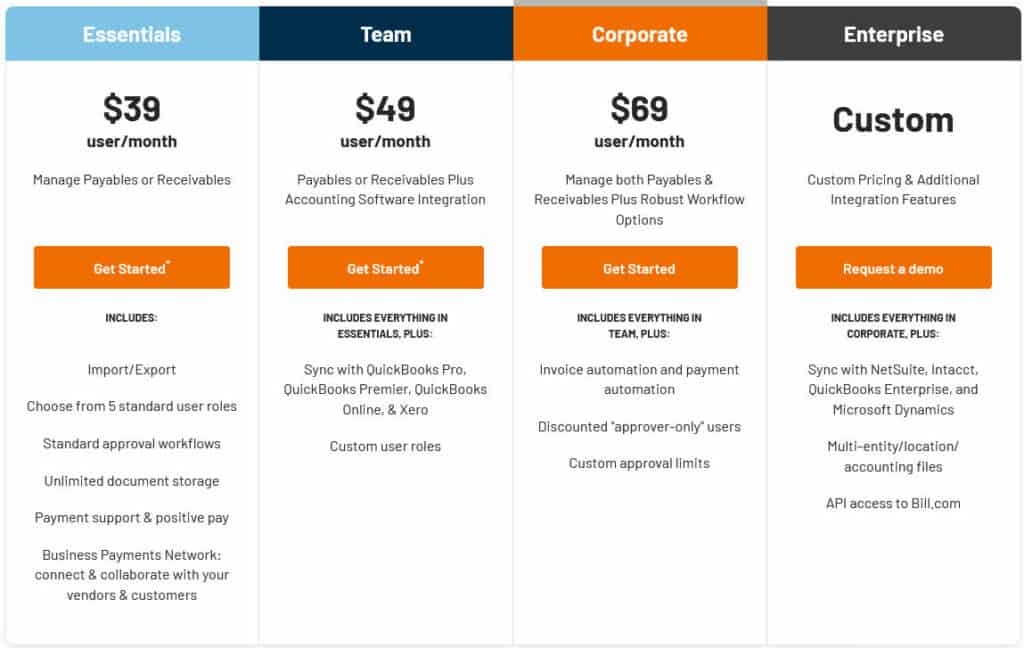

Pricing and fees

Bill.com offers a tiered system of paid plans but also has a free demo on request. They have structured pricing for both Business Users and Accountants.

Their Spend & Expense features are free for users across all tiers and include the following features:

- Business Credit

- Spend Management

- Expense Management

Business User Pricing Plans

1. The Essentials Plan:

- This basic plan starts at $45 per month per user. Limited to 6 standard user roles.

- Among the payables features, you will find a centralized inbox, invoicing scanning features, a complete overview through your dashboard, unlimited document storage, ACH, check & international wire transfer, standard approval policies, and more.

- Among the receivables features, expect customized invoice templates, automatic invoicing, payment status tracking, automated email reminders, ACH and credit card payments, and auto-charge/auto-pay features.

- You can also manually export and import your data (via CSV) to the accounting software of your choice with the premade templates.

2. The Team Plan:

- The Team plan starts at $55 per month per user and lets you access custom user roles.

- This plan offers everything that the Basic Plan provides, along with additional accounting integrations.

- Instead of the manual process to integrate on the basic plan, you can make use of the automatic 2-way sync with QuickBooks Pro/Premiere and Xero (this applies to both accounts payable and receivables)

3. The Corporate Plan:

- The most comprehensive plan is the Corporate Plan, with pricing starting at $69 per month per user.

- It includes all features, payables, and receivables perks from the Team plan.

- It also offers additional customization for approval policies and custom user roles.

- You will also have access to unlimited document storage and discounts for approver-only users.

4. The Enterprise Plan:

Bill.com offers an Enterprise Plan, which has customized pricing. The Enterprise Plan includes dual control as well as premium telephone support. The additional perks include their advanced integrations, which offer an automatic 2-way sync* with the following services:

- QuickBooks Online, Pro, Premiere

- Xero

- QuickBooks Enterprise

- Oracle NetSuite

- Sage Intacct

- Microsoft Dynamic

Pricing Plan for Accountants

BILL AP & AR Partner:

This plan costs $49/user per month. As an accountant on this plan, you can access both BILL Accounts Payable and BILL Accounts Receivable.

They have a generous service offering for Accountants, which includes the following:

- Robust 2-way sync with QBO, Xero, Oracle NetSuite, and Sage Intacct.

- Bulk payment functionality.

- Variety of payment options, including same-day international wire, same-day ACH, card, and check.

- Easier tax season with a comprehensive audit trail and 1099 Filing.

- Comprehensive audit trail.

- Customizable roles and approval policies.

- Dedicated bill inbox for each client.

- You can also use the wholesale client subscription pricing, which you can resell to clients at substantial margins or pass the savings on to them.

- Accountant users can access an additional 10-20% client subscription discount based on the number of clients onboarded.

They also let you process payments, but “hidden fees” come on top of the original subscription price.

Here is a rundown of those fees :

- ePayment/ACH processing fees:

Payor fee: $0.59

Receiver fee: $0.59 (or free if sent from a BILL subscriber) - Physical mailing of checks or invoices: $1.99 (Bill.com mails your check) and $1.99 (Bill.com mails your invoice)

- Getting paid via credit or debit card payment: 2.9% (you may pass the fee to your customer)

- International wire transfer fees:

International FX Wire: Free (currency conversion rate applies)$0/payment for local currencies

International USD wire: $19.99 - Instant Payments: 1.0% ($9.99 min fee, $100 max fee)

- Pay Faster ACH: Same day or next day: $11.99 (This excludes weekends and bank holidays)

- Pay by Card (Credit or Debit): Including ACH/ePayment, Check, Virtual Card, International FX Wire, International USD Wire: 2.9%.

- Faster pay by Check: 2.9% plus the below fees, which will apply.

Overnight: $24.99

Two-day: $19.99

Three-day: $14.99

(This excludes weekends and bank holidays)

Pros and Cons of Bill.com

Pros

- Scan receipts and directly import digital bills

- Widely compatible with other accounting tools

- Centralizes all that is bill-related

- Same-day transfers

- AI-powered OCR (Optical Character Recognition) is a huge plus. Bill.com allows you to scan and extract invoice data automatically, which lowers the risk of errors when capturing data manually)

Cons

- Not the best design (I really dislike the UI / UX, which is unfortunate and a big reason I didn’t stick with Bill.com in the long run)

- A bit pricey

- It is probably too complicated for small businesses and requires time to onboard the system.

Melio Key Features

Melio is an excellent alternative to the often tedious (and expensive) payment methods that many small and new businesses use. It makes it easy for companies to set up a simple payment page, which is where Melio shines. The main appeal is that the base service is totally free and takes minutes to set up.

Data Entry

Melio lets you scan bills with your phone or manually enter data. Compared to Bill.com, it seems bare-bones, but it gets the job done.

Receivables Features

Melio lets you set up a web page to receive payments. You can send your Melio.me profile to your partners to request payments. Although this feature is basic and lacks automation, it’s a no-fuss way to get paid quickly and easily.

Payables Features

As stated on its website, Melio is a great way to pay vendors and contractors while limiting fees or getting paid by clients. The most interesting feature here is the ability to pay with credit or debit cards, even with services and partners that do not accept card payments.

In that case, you’d use your card to pay Melio (the sum of the transfer, no extra fees for non-delayed payments from clients, etc.), and the service would then ensure that your recipient receives either a physical check or a bank transfer.

Through the Melio dashboard, you will easily access all of your account’s payables.

Integrations

Melio currently integrates with QuickBooks, Xero, and Amazon Business. In addition to this, the Melio API can easily be embedded with other SaaS, marketplaces, B2B, and financial institution partners.

Pricing

Melio’s pricing structure is competitive, and they have a generous free plan. There are three plans to choose from, with the option to pay monthly or annually, with the annual subscriptions offering a 25% discount.

Note, for all plans: Credit and debit card payments are subject to a 2.9% transaction fee.

1. Go

Free for up to one user and includes the following:

- Send 5 free ACH transfers/month (A $0.50 fee applies to each transfer after the monthly free ACH transfers are used.)

- 10 syncs with QuickBooks Online & Xero

- Multiple payment methods: Pay by card or bank—send check, ACH, or instant transfer

- Easy bill adding: Upload, scan, or import bills

- Dedicated email for auto bill capture

- Global payments in USD or local currencies

- Recurring & partial payments

- Instant payments

- Free mobile app (iOS & Android)

- Get paid: Accept payments via custom links

2. Core

$25/month for one user (plus $10 per month per additional user).

They also offer a free trial.

- Send 20 free ACH transfers/month(the same $0.50 fee applies to each transfer after the monthly free ACH transfers are used.)

- Unlimited 2-way auto-sync with QuickBooks Online & Xero

- Batch-pay multiple bills at once

- Combine payments into one transaction

- Roles, permissions, and user management

- Automated approval workflows

- W-9 collection & auto 1099 sync

- Automatic capturing of bill line items

- Priority support

3. Boost

$55/month for one user (plus $10 per month per additional user).

They also offer a free trial. The Boost plan includes everything in Core, as well as:

- 50 free ACH transfers/month (once consumed, the same $0.50 fee as above applies)

- 2-day ACH transfer eligibility

- Advanced multi-user approval workflows

- 2-way auto-sync with QuickBooks Desktop

- Advanced bill attributes (classes & locations)

- Premium phone support

Melio also offers a Platinum Plan for power users. You will be required to fill in your business information so that Melio can create a tailored plan that suits your needs, depending on your requirements. This is dependent on eligibility.

Melio Affiliate Program

Melio also has a lucrative affiliate program that is as easy as sharing your unique link. It uses cookies to track your referrals. Cookies last 90 days each time the potential customer clicks on your unique URL.

Pros and Cons of Melio

Pros

- Mostly free

- User-friendly

- Scan receipts

- Can pay with credit/debit card even if the recipient does not accept card payments

Cons

- Basic accounts payables & receivables features

- U.S only

- Not many native integrations

Price Comparison: Bill.com vs Melio

Overall, Melio is much more cost-effective than Bill.com. However, the depth of your desired features will likely influence your choice. If you do not need to manage many incoming payments and budget is your main concern, Melio is the best option.

Recommended Alternatives

PayPal:

Melio is similar to PayPal in many ways. With PayPal, you can send payments and set up a page where your partners can pay you. PayPal does include more fees, but it allows you to handle B2C and international payments.

Keap:

Keap combines CRM, marketing and sales automation, and payments in one platform. If you’d like to send and receive money online while also maintaining an online presence for your marketing needs, Keap can combine all and give you a more streamlined experience. It comes with a 14-day trial, too.

Tradeshift:

If most of your bills are associated with couriers and logistics (which might be the case if you’re running an eCommerce store), check out Tradeshift. It specializes in erasing physical bills and will help you overhaul and completely digitize your B2B billing process.

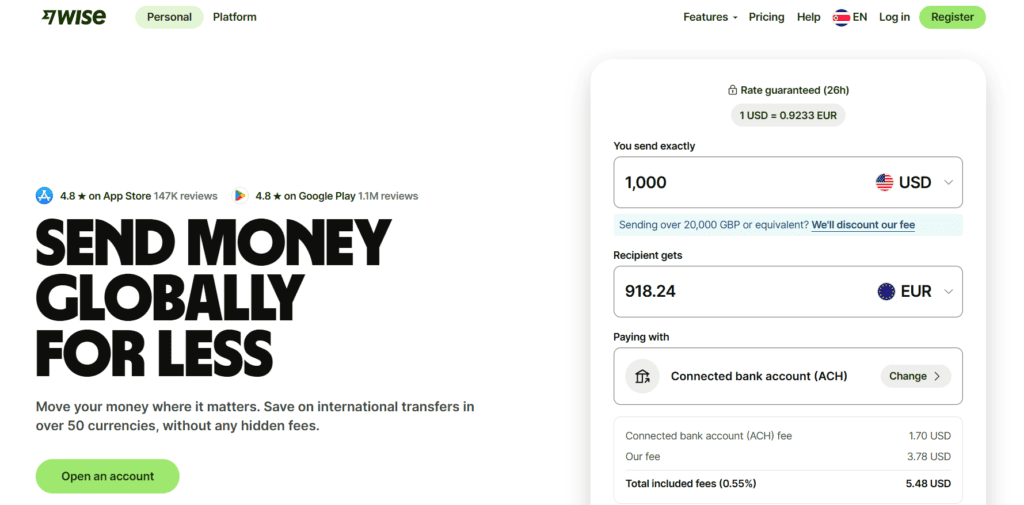

Wise:

If you find yourself dealing with an international workforce of contractors, Wise can be a cheaper way to send money and supports 100s of currencies (a clear limitation of Melio and, to a lesser extent Bill.com).

Veem:

Veem is another globally friendly payments network with 70+ currencies but a similar user interface like Melio. Also like Melio, Veem features free domestic bank transfers.

Bill.com vs Melio: The Bottom Line

While both services can help you keep track of your accounts, payables, and receivables, they do things differently and to varying degrees of intensity.

Bill.com is a robust and complete professional pre-accounting and bill payment system. Melio tries to fulfill the same objectives but is more of a light, primarily free alternative.

The main selling points of Bill.com are its complex features, an extensive array of integrations, and various automations. The main appeal of Melio is it’s mostly free. It does the basics well enough, though.

To summarize:

- If you’re a small business on a budget or a medium business with minimal accounting going on, you probably won’t need the heavy features of Bill.com. Go with Melio here.

- If you’re swarmed by incoming and outgoing bills (or invoices) and spend too much time on them, you will find Bill.com very convenient for simplifying your pre-accounting.