Last Updated on December 8, 2023 by Ewen Finser

Payment gateways allow anyone with a website and a dream to sell online by providing a secure way to process credit cards and accept credit cards payments.

When you pick the right gateway for your business, your customers find it easy and convenient to buy from your e-commerce store. If your gateway makes it difficult to complete a transaction, your customers will abandon their cart and check out your competitor’s site instead.

Today I’ll tell you the best features to look for when shopping for a payment gateway, and then I’ll compare two of the best available: Stripe and Authorize.Net.

If you are looking for a comparison full of technical jargon about Raspberry Pi, then you have come to the wrong place. I am a writer with a M.B.A. that has trouble hooking up my DVR. I do, however, own a business that requires a payment gateway, so I have spent hours conducting research to inform my choice, which I’ll share with you now.

Main Differences Between Stripe vs Authorize.net

The main differences between Stripe and Authorize.net are:

- Authorize.net requires a merchant account, whereas Stripe does not

- Authorize.net offers advanced fraud detection, whereas stripe does not

- Authorize.net charges a set-up fee, whereas Stripe does not

- Stripe generally has more third party integrations compared to Authorize.net

What is a Payment Gateway?

E-commerce solutions and e-commerce platforms rely on payment gateways to give their customers a secure, convenient way to pay online.

If you have every purchased anything using the internet, you have used a payment gateway. Some examples helping all types of e-commerce business include Stripe, Square, PayPal, Braintree, and Authorize.net.

Gateways have the authority and the secure network in place to “talk” to the financial networks to verify debit card and credit card processing payment information.

Once the credit card transaction is verified, there is usually (but not always) a merchant account set up associated with the payment gateway accepting payments from the customers’ credit card issuing bank. A merchant account is a virtual checking account (or virtual terminal), associated with your actual checking account, and is how you receive your money.

Are you with me so far? Good. Now let’s discuss the best features to look for when shopping for a payment gateway.

Payment Gateway Must-Haves

Before you immerse yourself with shiny marketing materials and sophisticated e-commerce sites to find that perfect gateway for your business (spoiler alert: they will all say they are the best), take some time to answer these three questions to help define your priorities and create a “must-have” list.

- Will this gateway integrate into my current platform?

In other words, do plugins and applications exist? If the answer is no, there are alternatives that won’t require a custom integration. Customizing a solution can be expensive and sometimes frustrating to implement and manage, so it’s better to find one that easily fits.

- How will this gateway improve my customers’ experience?

Your customers want a fast, secure, and easy transaction experience when they make an online purchase. Ideally you want a one-click checkout or close to it, an auto-populating feature, and access to customer data and credit information via a secure database.

- Will this gateway help me make millions?

When investing in a gateway, think big! Will it handle your online sales in 20 years as efficiently as it does now? Revenue aside, find out what features the gateway offers that will help your business grow. For example, some offer one-click buying via social media posts.

Now that you have your must-have list let’s compare two of the most popular payment gateways: Stripe and Authorize.Net.

Stripe vs. Authorize.Net: Which is Better?

First, consider your payment platform.

Platforms Supported |

Stripe |

|

Web-based |

Yes |

Yes |

iPhone app |

Yes |

Yes |

Android app |

Yes |

Yes |

Windows phone app |

No |

No |

If you need a payment processor that works on a Windows phone, it’s time to look elsewhere.

Next, find out who uses it.

According to my research, Authorize.Net is the popular choice for small businesses and the enterprise market while Stripe has a broader appeal that includes freelancers, small and mid-sized businesses, and the enterprise market.

Now it’s time to start comparing. Here’s a brief side-by-side comparison with a full cheat sheet to follow at the end of the article.

Features |

Stripe |

|

Merchant Account Required |

No |

Yes |

Cost per transaction |

2.9% + .30 |

2.9%+.30 |

Subscription Cost Per Month |

$0 |

$25/month |

Settlement Period |

2-7 days |

1-7 days |

Meet, Stripe

About Stripe

Stripe is a digital payment processor that is considered the most developer-friendly payment gateway available today. Based in San Francisco, CA with nine global offices, Stripe claims to offer the best software platform for running an internet business and has over 100,000 customers in more than 20 countries worldwide.

How Stripe Works

Since it is primarily built for developers, it requires that users have a basic to intermediate knowledge of coding to configure it properly. For those lacking in coding edification, there are plug-ins available.

Stripe provides friendly Application Programming Interfaces, or APIs, that allow businesses or individuals to accept and manage payments and payment methods using mobile devices.

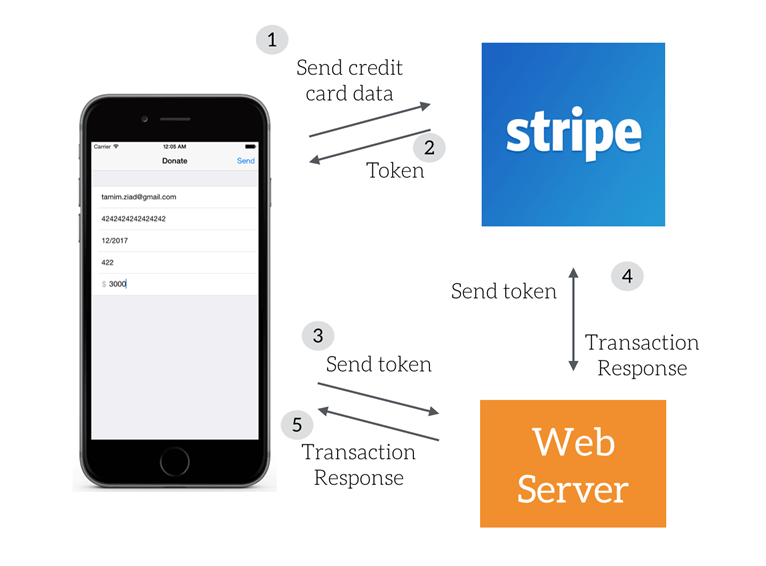

Here is a quick, basic outline of how it works:

- You use an app to collect payment information like credit card numbers, expiration dates, etc.

- This information is sent via a form to the Stripe backend by calling its API.

- If the payment is verified, Stripe sends you a token meaning the payment will clear.

- Your app will now send the token to your private server to complete the transaction.

- After the server code implements the charging process, the web application sends the token to Stripe to complete the transaction.

- The server side sends a response back to the app with the transaction result.

AppCoda, a leading tutorial site for app developers, created this image to illustrate the flow of information when using Stripe to process transactions:

The actual transaction or transaction fee doesn’t occur online via a website or mobile device as it appears; rather it is processed using a private server to ensure the utmost security.

How Much Does Stripe Cost?

- Monthly Fee: $0

- In-Person Transactions: 2.7% + $0.05

- Card-Not-Present Transactions: 3.4% + $0.30

- Online Transactions: 3.4% + $0.30

There are no hidden costs with Stripe: no setup, monthly, validation, refund, chargeback, card storage, or failed transaction fees. You simply pay per transaction and the money is transferred into your bank account on a 2-day rolling basis (however full transfers can take up to 7 or more business days). There is no merchant account required.

For owners processing ACH payments and Bitcoin payments, there is a 0.8%+ $5 cap.

What Does Stripe Accept?

Stripe accepts all major credit cards, works with over 100 currencies and Bitcoin, and local payment instruments like Alipay. Payment services are also accepted like AmEx Express, Checkout, Android Pay, and Apple Pay.

Five Best Features of Stripe that are included:

- Provides the opportunity to take on-site payments giving you complete control over the checkout process.

- It features integrated mobile payments for iOS and Android, checkout and recurring billing options, and the ability to add promotional codes and discounts.

- There are no setup costs or monthly fees.

- Money is transferred into your bank account quickly, usually within two days, with no merchant accounts or manual withdrawals required.

- Many online reviewers rave about Stripe’s outstanding customer service experience.

Other features included with Stripe:

- Subscriptions: all businesses can use Stripe’s subscriptions engine to build and manage recurrent billing.

- Relay: Customers can purchase your products through other mobile apps like Twitter with Relay at no extra cost.

- Connect: Connect is a complete platform for running a marketplace for getting sellers paid, including support for ID verification, international sellers, and tax reporting. This is included up to 0.5%.

Conclusion: Stripe is a great option for owners that want an affordable, one of the best, easy-to-use gateway services that doesn’t require a merchant account.

AUTHORIZE.NET

Authorize.Net is a leading payment gateway provider, allowing businesses the ability to accept both credit cards and electronic checks on their ecommerce website. The money from these transactions is automatically deposited into a merchant bank account, which Authorize Net requires.

Authorize.Net has been providing payment processing services since 1996, and their website claims their solutions are designed to save time and money for small-to-medium-sized businesses. Based on online reviews, Authorize.Net is known for its dependability and is widely considered the industry standard currently serving over 440,000 merchant customers.

While Authorize.Net will accept international transactions from customers worldwide, to be an Authorize.Net customer your business must be based in the United States, Canada, United Kingdom, Europe or Australia.

How Authorize.Net Works

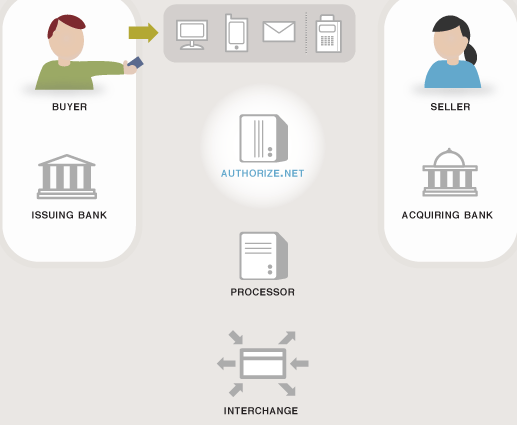

This image on their website helps explain their process:

- The customer provides his credit card information.

- net takes this information on behalf of the merchant.

- The information is sent via a secure connection to the processor.

- The merchant bank’s processor submits the transaction to the credit card processing network.

- The credit card network routes the transaction to the bank that issued the card to the customer.

- The transaction outcome is relayed from the bank to the credit card network back to the merchant bank’s processor; which then relays that information to Authorize.Net.

- Net stores and sends that transaction information to the merchant.

- The merchant provides the goods or services.

- The issuing bank sends the funds to the credit card network which then passes it to the merchant’s bank account.

- This money is called ‘settlement’ and appears in the merchant’s primary bank account within 2-4 days.

I know that is a lot to follow, but just imagine trying to run an online business without the help of a payment gateway. You would be on the phone trying to process transactions all day long!

How much does Authorize.Net cost?

- Monthly Fee: $25 (for both plans)

- Payment Gateway-Only Plan: Per-Transaction Fee: $0.10; Daily Batch Fee: $0.10

- All-in-One Plan: Per-Transaction Fee: 2.9% + $0.30

This cost includes their Advanced Fraud Detection Suite, Customer Information Manager, Automated Recurring Billing, and a Sync for QuickBooks. According to online reviewers, these added features are the reason why they are willing to pay a monthly subscription fee.

Authorize.Net also offers eCheck.Net which is a fully integrated electronic check payment method for an additional 0.75% per transaction.

Aside from this pricing, Authorize.Net promises no extra fees like an annual renewal or cancellation fee. On their website, they claim their mission is to “keep it simple by eliminating unanticipated “gotcha” fees and long-term contracts.”

What does Authorize.Net accept?

Authorize.Net accepts all major credit card payments including:

Five Best Features of Authorize.net that are included:

- Features a quick-sync with QuickBooks to help make accounting for your business easier.

- Supports recurring payments from customers and features a Customer Information Manager that can tokenize and store customers’ information on secure servers.

- Transactions occur on site giving owners the control they want over the checkout process.

- Automated recurrent billing helps manage subscriptions services.

- The Advanced Fraud Detection Suite adds another level of security to your data.

Other features included with Authorize.Net:

- They offer a Transaction Details API to retrieve the details of processed transactions for reporting and reconciliation.

- A free Authorize.Net Verified Merchant Seal is available for use on your website to add credibility to your checkout process.

- Net offers free, award-winning support including online chat, eTicket system, web form email, phone, and an online support center.

- Free Authorize.Net mPOS mobile application to accept payments on the go and the ability to create multiple user accounts with varying restrictions.

Conclusion: Authorize.Net is ideal for established businesses looking to expand their market and upgrade their image. It isn’t the cheapest online payment gateway option available due to its monthly subscription fee, merchant e-solutions account requirement and start-up cost; but many reviewers claim the customer support, solid security, and easy-to-use interface is worth the investment.

Have you decided whether Stripe or Authorize.Net is the one for you? Great! If not, here’s the promised cheat sheet to help you decide:

Features |

Stripe |

|

Merchant Account Required |

Yes |

|

Set-up Fee |

$0 |

$49 |

PCI compliance / PCI compliant |

Yes |

Yes |

On-site Transactions |

Yes |

Yes |

Subscriptions/Recurrent Billing |

Yes |

Yes |

Settlement Period |

2-7 days |

1-7 days |

Cost per transaction |

2.9% + .30/trans |

2.9%+.30/trans |

Subscription Cost Per Month |

$0 |

$25/month |

Multi-Currency |

Yes |

Yes |

Advanced Fraud Detection |

No |

Yes |

Sync for QuickBooks |

No |

Yes |

Recurring Billing |

Yes |

Yes |

Sales Reporting |

Yes |

Yes |

Customer Information Mgmt. |

No |

Yes |

Third Party Integration |

Yes |

Yes |

Total Integrations |

250+ |

125+ |

Alternatives to Stripe and Authorize.net

If neither Stripe nor Authorize.net seems like the perfect fit for your business, consider these alternatives:

- PayPal: A well-known payment service provider, PayPal offers digital wallets, online payment gateways, and payment processing. It’s simple to use and familiar to millions of consumers.

- Square: Square is a popular “full-stack” payment services provider, focusing more on brick-and-mortar transactions.

- Merchant Account: If you prefer greater control over payments, a merchant account provides independence from payment service providers.

Or, check out these direct comparisons our team has written on a wide array of Stripe alternatives:

- Stripe vs Recurly Compared

- Stripe vs PayPal Compared

- Stripe vs WePay Compared

- Stripe vs Bill.com Compared

- Stripe vs Adyen Compared

- Stripe vs Moolah Compared

- Stripe vs Shopify Payments Compared

- Stripe vs Authorize.net Compared

- Stripe vs Melio Compared

- Stripe vs Marqeta Compared

- Stripe vs Plaid Compared

- Stripe vs Braintree Compared

- Stripe vs Chargebee Compared

- Stripe vs WooCommerce Payments Compared

- Stripe vs Stax Payments Compared

Further Reading on Payment Processors & Payment Providers

- Best WooCommerce Payment Gateways

- Best Payment Gateways for Shopify

- Best Payment Gateways for BigCommerce