- TL;DR: Which One Should You Choose?

- Key Differences Between Melio and PayPal

- Melio: Features, Pros, and Cons

- PayPal: Features, Pros, and Cons

- Cost Comparison: Melio vs. PayPal

- Funds Availability and Processing Time

- Invoicing and Billing: Melio vs. PayPal

- Which One Should You Choose?

- Other Competitors to Melio and PayPal

Last Updated on July 15, 2025 by Ewen Finser

When my freelancing business started turning a steady profit, I realized I needed a reliable, web-based payment platform. Heading to the bank every week to deposit or receive payments wasn’t an option and I needed a way to just do it online.

Two of the most popular choices are Melio and PayPal. Both offer digital payment solutions, but they’re built for different needs. So, which one is the best fit for your business? Let’s take a look at their features, pricing, and key differences to help you decide.

TL;DR: Which One Should You Choose?

If your business is mostly U.S.-based and you want a straightforward invoicing and bill pay system, Melio is the best choice. There’s a free option, it’s easy to use, and has fewer fees. Those with international needs will be happy to learn Melio also supports payments to vendors in 70+ countries, though for extensive international needs, especially multi-currency transactions, PayPal might be the better fit.

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.

Key Differences Between Melio and PayPal

To make an informed decision, it’s important to understand the fundamental differences between Melio and PayPal. Here’s how they compare:

- Payment Methods: Melio allows payments via bank transfer, debit, or credit card. PayPal enables money transfers without sharing financial details.

- Global Reach: Melio supports paying vendors in 70+ countries (though transactions settle in USD), while PayPal operates in over 200 countries with multi-currency capabilities.

- Processing Time: Melio transfers take 1–3 business days, whereas PayPal provides instant access to funds, though bank transfers can take up to 4 days.

- Fees: Melio offers 5 to 20 free ACH transfers (depending on the plan you go for), which is great if you’re looking to avoid extra fees. Credit card payments come with a 2.9% fee, and international transfers have a flat $20 fee. PayPal, on the other hand, charges between 2.29% to 4.99% plus a fixed fee for domestic transactions, and adds an extra 1.5% fee for international commercial payments.

- Integrations: Melio integrates with QuickBooks and Xero, while PayPal has built-in POS (Point-of-Sale) features.

- Target Users: Melio is designed for small businesses and freelancers, while PayPal caters to businesses of all sizes.

Melio: Features, Pros, and Cons

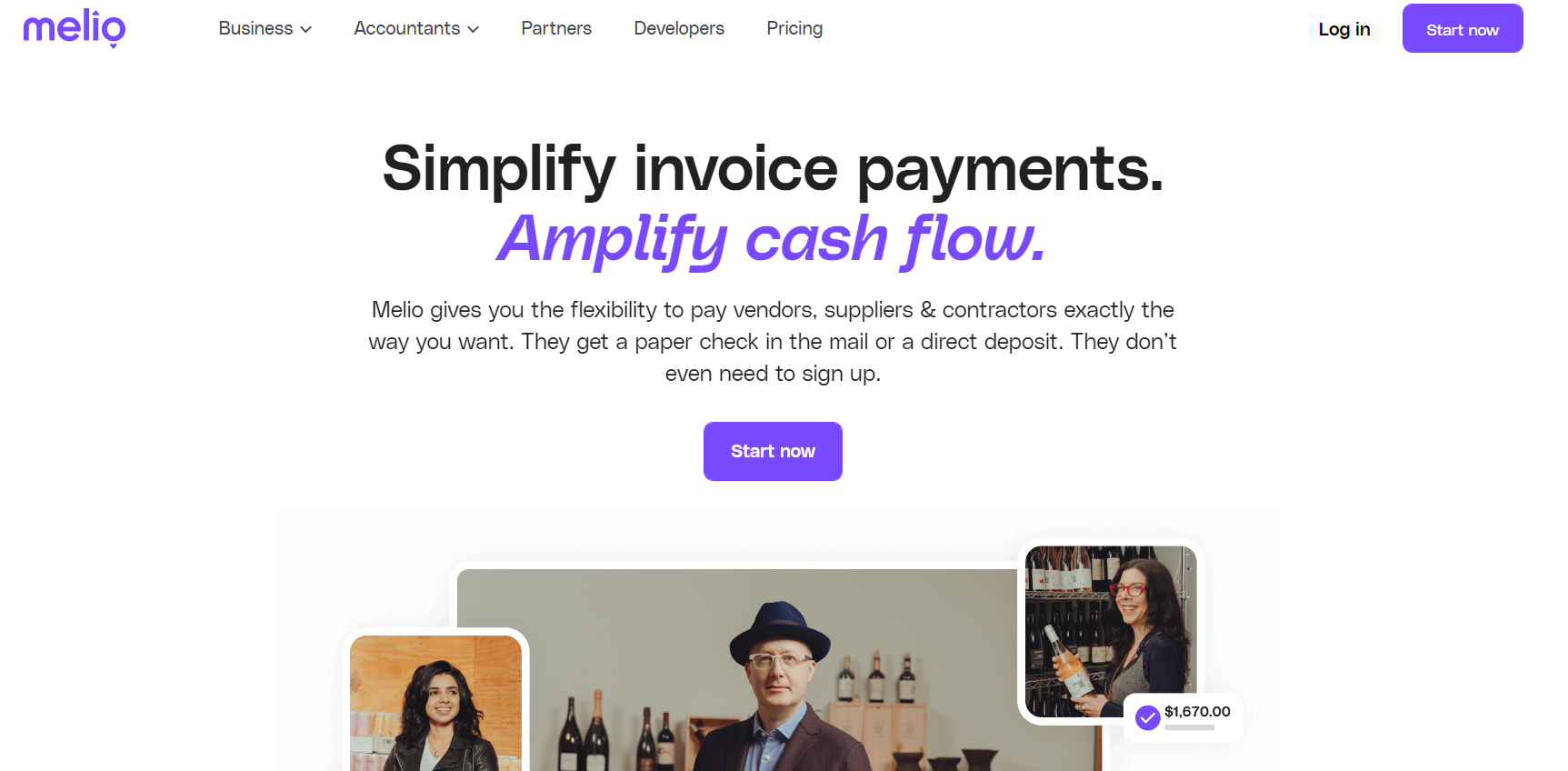

What Is Melio?

Founded in 2018, Melio is a digital accounts payable platform designed to simplify bill payments and invoicing for small businesses and freelancers. It offers multiple service tiers for independent users and accounting firms that manage multiple client payments.

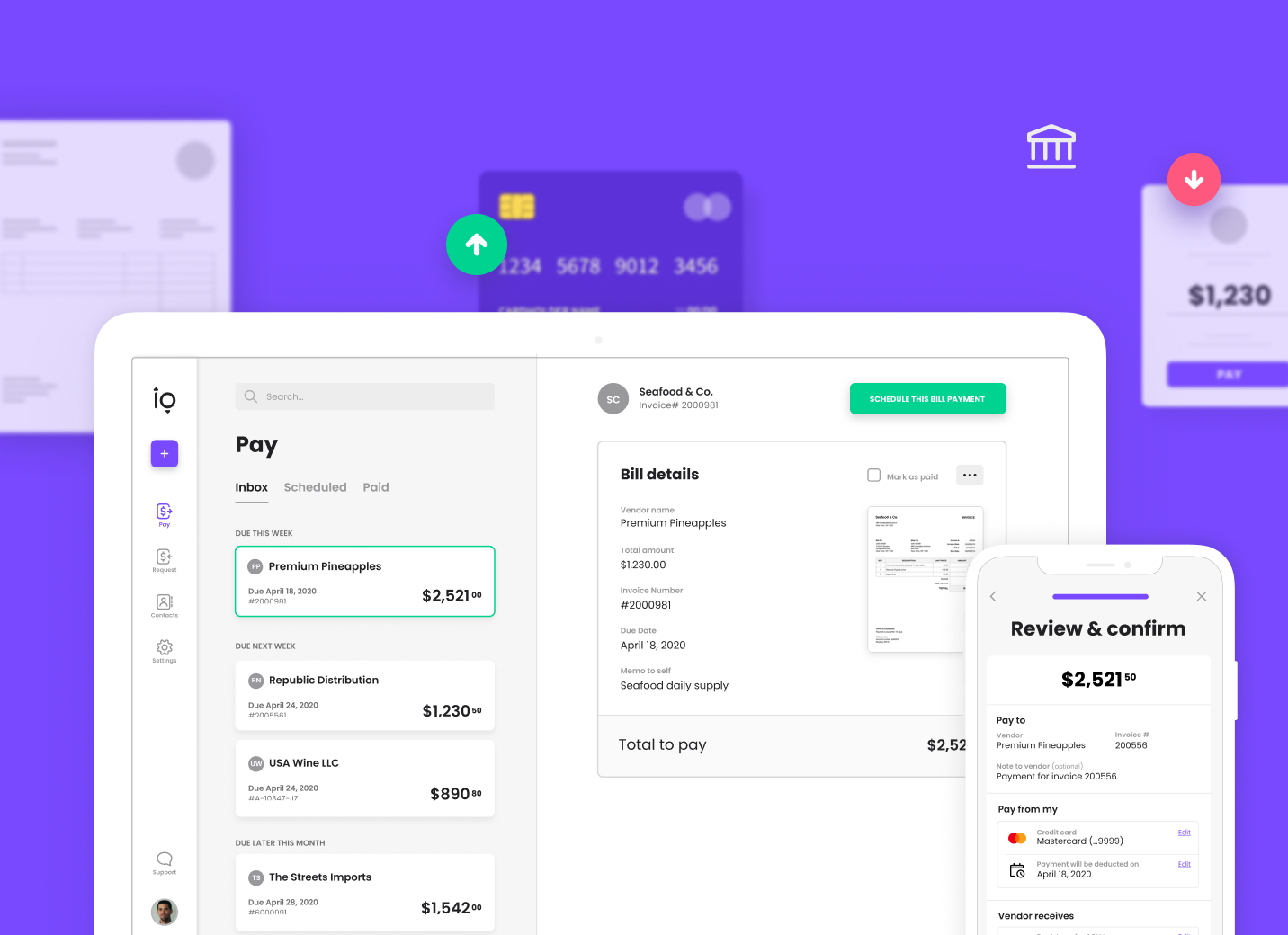

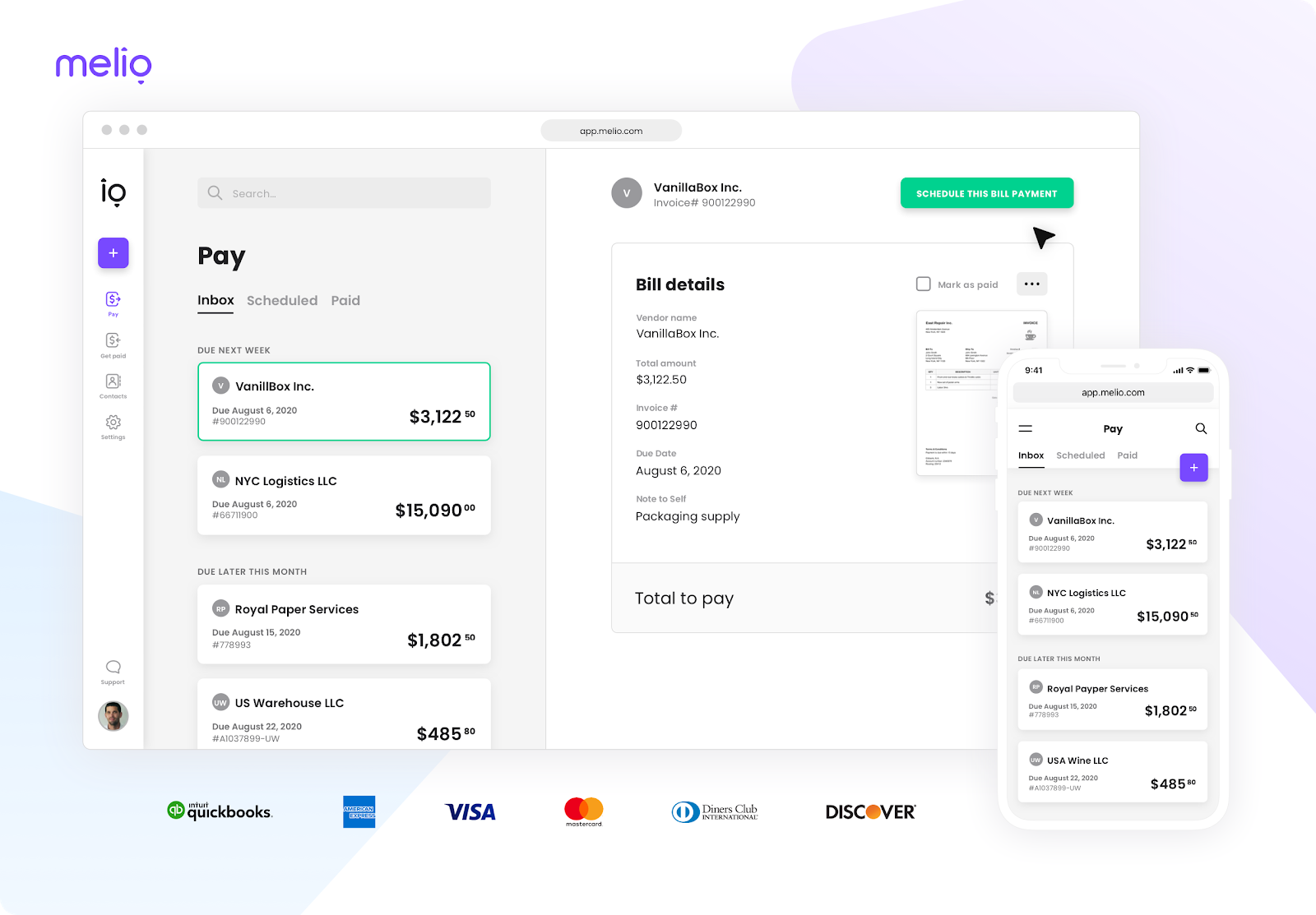

Key Features:

- Automated data sync with QuickBooks and Xero

- Payment scheduling and reminders

- Paper check payments (delivered within 7 days)

- User-friendly invoicing and reporting

- Centralized dashboard for tracking payments

- Ability to pay vendors with a credit card, even if they don’t accept cards

Why Choose Melio?

Melio streamlines invoicing and payments with no or low monthly fees (depending on your plan), making it a cost-effective solution for small businesses. It’s particularly useful for U.S.-centric businesses looking for a simple system, though it still enables vendor payments internationally.

PayPal: Features, Pros, and Cons

What Is PayPal?

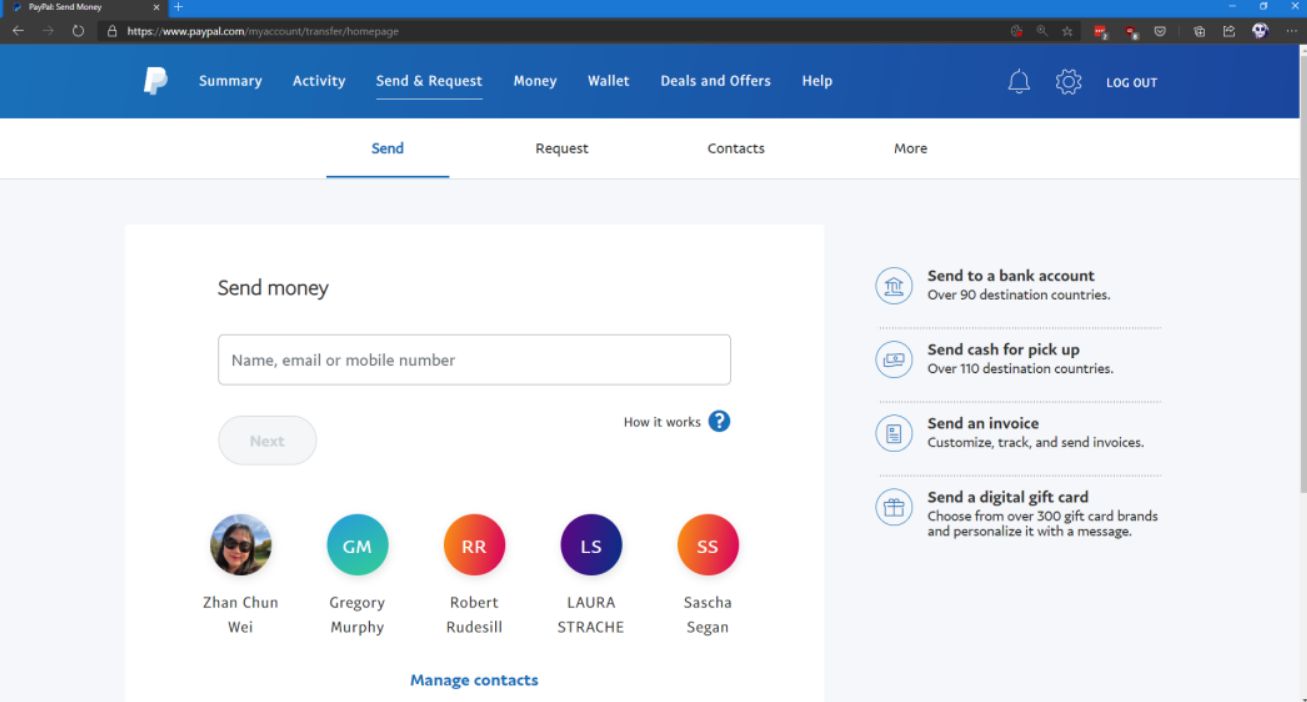

Founded in 1998, PayPal is one of the world’s most widely used digital payment platforms, with over 429 million users worldwide. Its main goal is to help businesses and individuals send and receive money safely without sharing sensitive banking information.

Key Features:

- Online invoicing and express checkout

- Mobile card reader and barcode scanning

- Inventory tracking for eCommerce businesses

- PCI compliance for secure transactions

- “Bill Me Later” feature for deferred payments

Why Choose PayPal?

PayPal is ideal for businesses with international clients, as it supports multiple currencies and allows instant access to funds. If you need to process payments globally or want the flexibility of a widely recognized payment platform, PayPal is the better choice.

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.

Cost Comparison: Melio vs. PayPal

Understanding the cost structure of each platform is crucial when deciding which one to use. Here’s a breakdown of the costs associated with Melio and PayPal:

Melio:

Plans range from free to $80/month, with custom packages also available:

Melio Plans:

Plan: | Price: | Features: |

Go | $0/month | 5 free ACH/month Pay by ACH, wire, or check Fast/Instant payments Set auto-pay Pay any bill by card AI bill capture Pay internationally |

Core | $25/month | Everything in Go, plus: 20 free ACH/month QuickBooks Online sync Xero sync Batch payments Approval workflows W-9 collection 1099 automation Dedicated bills inbox Priority chat support |

Boost | $55/month | Everything in Core, plus: 50 free ACH/month Advanced user roles Custom approval workflows Set classes & locations QuickBooks Desktop sync Premium phone support |

Unlimited | $80/month | Everything in Boost, plus: Unlimited free ACH/month Dedicated account manager White-glove onboarding |

Platinum | Custom | Customized for high-volume businesses |

PayPal:

Free for domestic purchases, but charges apply for receiving money (2.9% + $0.30 per transaction) and international transactions (an additional 1.5%).

Funds Availability and Processing Time

Feature | Melio | PayPal |

Bank Transfer Time | 1–3 business days | Instant access to PayPal funds |

Paper Check Payment | 5–7 business days | N/A |

Credit Card Payments | Next-day processing | Instant access |

Bank Account Transfer | 3–4 business days | 2–3 business days (instant transfer costs 1%) |

💡 Tip: PayPal offers an instant transfer feature, but it incurs a 1% fee (max $10 per transaction).

Invoicing and Billing: Melio vs. PayPal

Since invoicing is a key aspect of managing payments, let’s take a closer look at how Melio and PayPal compare:

Melio Invoicing

- Syncs seamlessly with QuickBooks and Xero

- Enables automated invoice payments

- Provides scheduled payments and reminders

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.

PayPal Invoicing

- Allows businesses to create and send invoices

- Includes payment tracking tools

- Supports recurring payments for subscriptions

Which One Should You Choose?

Now that we’ve examined the features, costs, and processing times of both platforms, let’s determine which one aligns best with your needs:

- Choose Melio if you’re a freelancer or small business owner looking for a free, simple, and cost-effective invoicing solution.

- Choose PayPal if you frequently send international payments or need a platform that handles multiple currencies.

Both Melio and PayPal are convenient payment platforms, but I went with Melio. The core plan offers everything I need while saving me money on fees.

Other Competitors to Melio and PayPal

Melio and PayPal aren’t the only options in the payments space. Our team has reviewed (and used) many of them over the years. Here’s the full list: