- What is Melio Payments?

- Melio Payments History

- Melio Payments Pros

- Melio Payments Cons

- Melio Payments System Requirements

- Melio Payments Pricing

- Melio Core Features

- Melio Customer Service

- Melio Payments Security

- Alternatives To Melio: Competitors & Peers

- Velo Payments

- Tipalti

- Goby

- Paypool

- MineralTree

- Other Melio Competitors Worth Considering

- FAQs

- Final Thoughts About Melio Payments

Last Updated on February 3, 2024 by Ewen Finser

Spending hours each day managing invoices? Buried in late fees from your vendors?

Keeping your books in line shouldn’t be an after-hours endeavor. Several payment software options can automate the process so you can go back to building relationships and revenue.

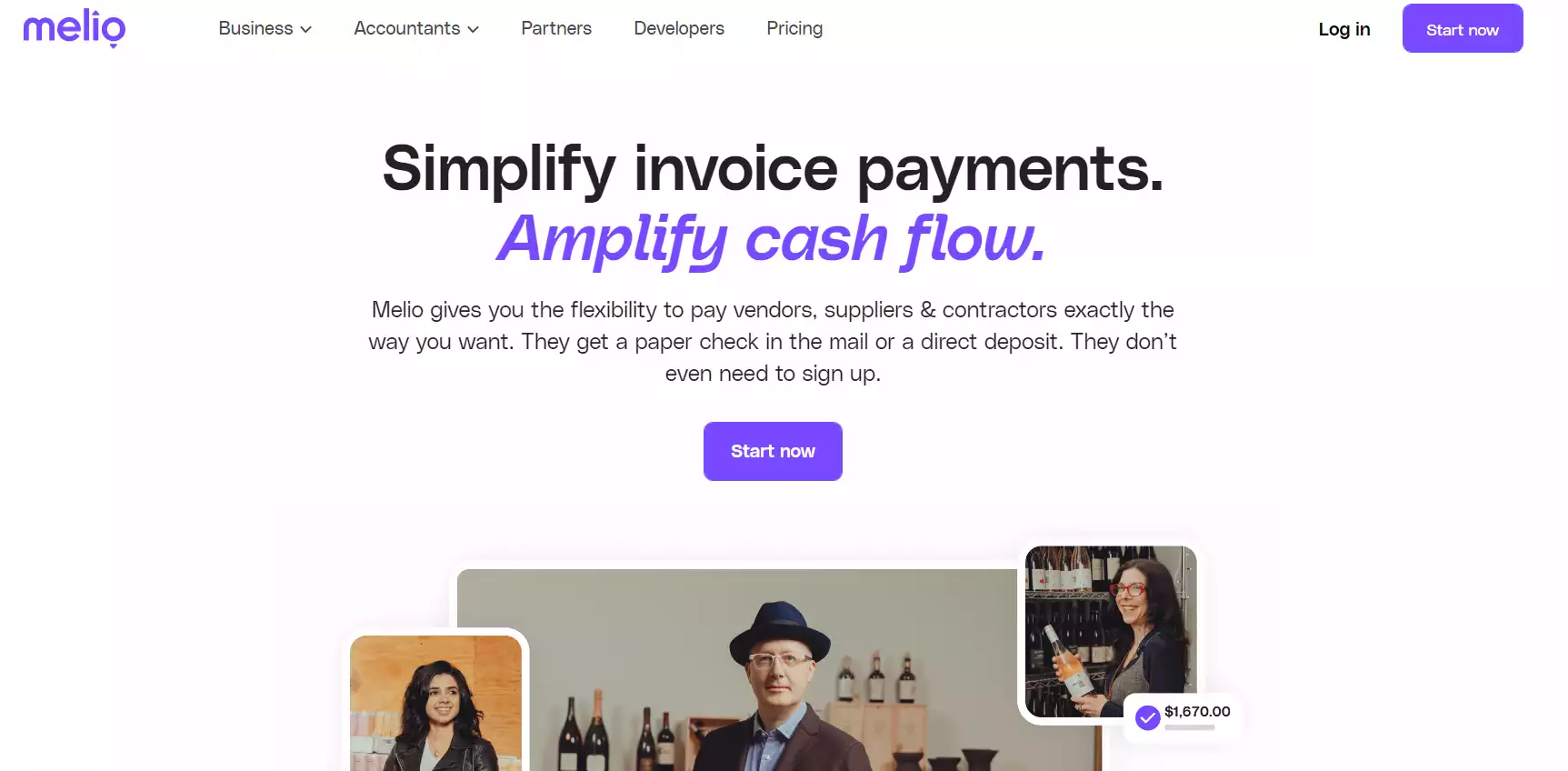

Melio Payments is free software that only charges a transaction fee when you send or receive money via credit card. Melio offers free check delivery, free bank transfers (ACH payment), unlimited companies/clients, and unlimited users.

If you are looking for a U.S.-based accounts payable solution, Melio provides a wide range of features and all with live customer support. Whether you are a business or an accountant, Melio can offer the financial organization you need to stay in the black.

TL;DR: I love how simple Melio is to use and their free ACH transfers for domestic payments (sending or receiving). I haven’t been able to ditch PayPal, Stripe, or Wise yet though, so it’s just a supplementary service for when I need to move money and save fees.

What is Melio Payments?

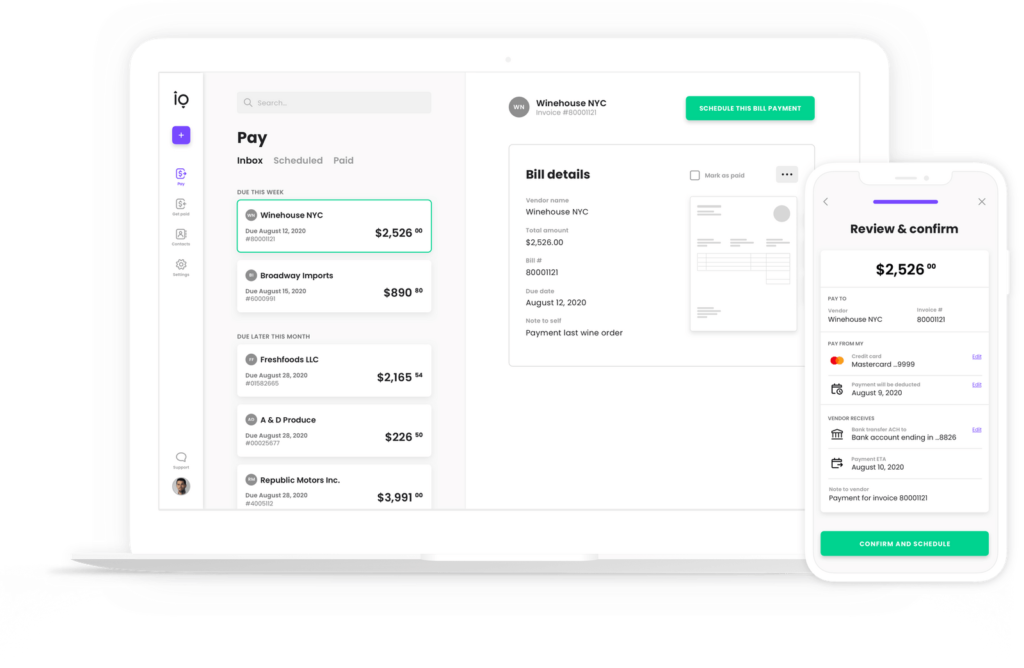

Melio is an accounts payable software available to U.S. small businesses that allow you to pay bills online.

You can pay your bills via bank transfer and through a debit card fee-free, even if your vendor only accepts checks. Melio takes your online payments via bank transfer, debit card, or credit card (2.9% transaction fee) and deposits or mails a check to your vendor in your name without any delivery charges.

If you are looking for a simple accounts payable software that you can use on both your laptop and your phone on the go, Melio can save you time and money compared to expensive accounts payable software suites.

Other features include automatic payment options, accountant access, and integration with QuickBooks. Melio has a free trial available and you can even sign up through your QuickBooks account.

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.

Melio Payments History

Melio Payments was founded by Matan Bar, Ilan Atias, and Ziv Paz. Melio’s purpose was to build an accounts payable tool that was easy to use and improve a small business’s cash flow.

The platform makes it easy to keep up with payment workflows so you can spend more time focusing on your customer relationships.

Melio Payments Pros

- No fees

- No contracts

- Live customer support

- tax forms

- No delivery fees

- Unlimited management

- Unlimited users

- QuickBooks integration

Melio Payments Cons

- No vendor management

- No automated OCR data entry

- No real-time ERP sync

- No Chrome extension

- No integration with Zapier

- No accounting automation

- No built-in expense reporting

- Limited international payments support. UPDATE: They’ve added some international support as of 2024, see this page. BUT, there’s a$20 flat fee on ALL international payments, regardless of size.

Melio Payments System Requirements

Melio is a web-based platform. You only need an Internet connection to use Melio. Whether you are in the office with a laptop or on the go with your smartphone, Melio can help keep you on top of cash flow and vendor payments.

As of April 2022, there is not a stand-alone app for Melio. However, on your smartphone go to the following URL https://app.meliopayments.com to use all of Melio’s functions when using a laptop.

Melio Payments Pricing

Melio has two account options, Melio Business and Melio Accountant. Both plans are free and offer similar features.

Melio Business Plan

No sign-up or monthly subscription fees, 2.9% credit card transaction fee

- Free to send checks

- Free bank transfer (ACH) & bank deposit

- Credit card payments (2.9% fee)

- Receiving credit card payments (2.9% fee applies for payers)

- Unlimited companies/clients AP/AR management

- Unlimited users per account

- Approval workflows

- 1099 forms

- Sync with QuickBooks Online

- Scheduled payments

- Payments tracking

- Seamless recipient updates of preferred payment method

- Live support

Melio Accountant Plan

No sign-up or monthly subscription fees, 2.9% credit card transaction fee

- Free to send checks

- Free bank transfer (ACH) & bank deposit

- Credit card payments (2.9% fee)

- Receiving credit card payments (2.9% fee applies for payers)

- Unlimited companies/clients AP/AR management

- Unlimited users per account

- Approval workflows

- 1099 forms

- Sync with QuickBooks Online

- Scheduled payments

- Payments tracking

- Seamless recipient updates of preferred payment method

- Dedicated live accountants support

Melio Core Features

Pay Vendors with a Credit Card

In business, it’s all about the cash flow. And to have more cash, you will need to pay vendors with a credit card. However, some vendors may not accept card payments as an option. Melio can step in by processing a credit card payment for you and paying your vendor via a bank transfer or paper check.

Permissions

Set up multiple payment approval workflows. Easily invite users from your company or even your accountant. Set permissions for each user so you can control the approval of transactions.

Schedule Payments

Tired of paying too late or even worse too early? Melio will help you pay on time by scheduling payments so you don’t have late fees or reduce your cash flow.

QuickBooks Integration

If you are already a QuickBooks user, you will appreciate the 2-way sync that Melio provides between your payments and your accounting.

You can even join Melio by logging in with your QuickBooks ID and password.

Melio.me

Melio.me is a quick, trackable way to accept payments online. The recipient doesn’t even need a Melio account to send you a payment. Recipients can pay with a bank transfer for free or a credit card (2.9% fee) in just a few clicks.

Accountants

Melio keeps you organized. Access all of your client accounts from a single dashboard including their current payment status and QuickBooks sync. Switch between client accounts with just a few clicks.

Melio can even send a notification to your vendors to have them enter their payment details and determine how they get paid, check or bank deposit.

Melio has a dedicated support team just for its Accountant plan users. Take advantage of industry-specific support so you can provide your clients with a professional accounts payable experience.

Melio Affiliate Program

Melio has a lucrative affiliate program that is as easy as sharing your unique link. Melio uses cookies to track your referrals. Cookies last 90 days each time the potential customer clicks on your unique URL.

You will receive $200 when a new customer sends their first payment with Melio. Payments are calculated and paid out at the end of each month via PayPal or Stripe (other methods available for non-PayPal territories). For example, if you earned a commission in February, you should expect payment by mid-March.

Melio Customer Service

Melio Payments offers live support for all of its plans. The Accountant Plan features dedicated live accountants support so you don’t have to worry about getting a general answer to your specific accounting question.

Utilize the Melio FAQ page to get your common questions answered instantly. You can also contact Melio by email or through their social media accounts (LinkedIn, Facebook, Twitter).

Melio Payments Security

Melio takes security seriously. Servers are kept in certified data centers with 24/7 monitoring. The platform uses industry-leading encryption including HTTPS and AES.

Melio is also PCI compliant. This process protects sensitive data and system tests are completed daily (manually and automatically) to help prevent fraud. Melio uses a third-party credit card processor, TabaPay. TabaPay is certified to the highest level (Level 1 PCI) which requires a yearly independent audit to keep its certification status.

The platform uses Evolve Bank & Trust so your money is never at risk and is always safely delivered to your vendor. Melio requires background checks and security training for all employees.

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.

Alternatives To Melio: Competitors & Peers

Corpay One (formally Roger)

Businesses use at least five different financial tools to run their businesses. Corpay One can simplify your accounts payable down to one easy-to-use software. It includes automated tools for invoice management, accounting, receipt collection, spending reports, payments, exports, payment reconciliation, expense approvals, vendor communication, and reimbursements.

Pros

- Vendor management

- Automated OCR data entry

- Real-time ERP sync

- Chrome extension

- Integration with Zapier

- Accounting automation

- Built-in expense reporting

Cons

- No accounts receivable

Plus Plan

$49 per month

- 39 documents/month

- Unlimited Seats

- Accounts payable

- Reimbursements

- Accounting automation

- Unlimited Workflows

- ERP sync

Pro Plan

$119 per month

Everything in Plus

- 99 documents per month

Premium Plan

$199 per month

Everything in Pro

- 169 documents per month

- One-on-one onboarding

Custom Plan (Enterprise)

Contact for pricing

Everything in Premium

- 169+ documents

- API access

Advisors Plan

$19 per client per month plus transaction fees

- Customized billing options

- Partner dashboard

- Onboarding support

Velo Payments

In 2020, Velo Payments partnered with Mastercard to provide industry-leading global payments. Velo reduces the time and manpower needed to complete accounts payable while simultaneously reducing fraud.

The platform can provide both bank and card payments and tackles the current difficulty of B2B payments.

Pros

- API access (premium plan)

- Real-time payment tracking

- SMS notifications

- 2-factor authentication

- Free tier

Cons

- Can be pricey for small business seeking Premium tier

- Payment limits

- No online support for free plan

Essential

Free, $0 per month

- Up to 100 Domestic Payments*

- 2-Factor Authentication

- Email and SMS Notifications

- Real-Time Payment Tracking

- CSV File Upload

Premium

$200 per month

- Up to 250 Domestic Payments*

- 2-Factor Authentication

- Email and SMS Notifications

- Real-Time Payment Tracking

- CSV File Upload

- Online Support (During US Business Hours)

- White-Label Notifications

- API Access

Enterprise

Contact for pricing

- Unlimited Domestic Payments*

- 2-Factor Authentication

- Email and SMS Notifications

- Real-Time Payment Tracking

- CSV File Upload

- Online Support (During US Business Hours)

- Fully White-Label Platform

- API Access

- Account Hierarchy

- 1099 Reporting (US Only)

*Domestic payments are considered US and Canada. Additional domestic payments are $1 per transaction.

Tipalti

Tipalti is an automated accounts payable software that are beneficial for companies that have multiple brands, locations, and accounting workflows.

The platform supports multiple currencies, multiple payment methods, and unlimited automated data processes. Tipalti works from small business to enterprise so you can scale without having to switch to new software.

Pros

- Easy to use supplier onboarding portal (self-serve)

- Real-time payment reconciliation

- Fraud prevention

- Tax compliance

- Support for nearly 200 countries and over 100 currencies

- Early payments (in exchange for vendor discount)

Cons

- Lacks variety in accounting features

- Cannot make changes to a paid bill

- Lacks in accepted formats to pull invoice data

- Glitches with multi-currency support

Pricing

Pricing is on a per-client basis. Contact sales for current pricing.

Goby

Goby automates the accounts payable process and is best intended for small to medium businesses. Goby can speed up the time it takes to process invoices, help you eliminate late fees, and reduce overall expenses related to AP. The platform also helps eliminate errors and validates data to find errors.

Pros

- Extracts invoice data (any format)

- Real-time error notifications

- Data validation

- Lowers late fees

- Excellent email, phone, and live support

Cons

- Data can have a lag in updating

- Reporting needs improvement

- No alerts for data disruption

Pricing

Pricing is on a per-client basis. Contact sales for current pricing.

Paypool

Paypool is an automated accounts payable software powered by the cloud. It helps streamline the entire process from collecting data to invoices to payment approval. The platform can secure an electronic paper trail and even integrate with your current accounting software.

Pros

- Approval routing

- Vendor management

- Fraud detection

- Check to print

- Mobile app

Cons

- Expensive for freelancers and entrepreneurs

- No phone or live support

Pricing

Pricing is on a per-client basis. Contact sales for current pricing.

MineralTree

MineralTree offers a payment automation and invoicing system that is cloud-based. It was created for small to medium-sized businesses and integrates with popular accounting platforms such as QuickBooks, NetSuite, Intacct, and Microsoft Dynamics GP.

MineralTree offers different user types so the software is optimized for approvers, accounting managers, and more. Accounting workflows can be automated and issue payments by ACH, check, or credit card.

Pros

- Phone and email support

- Automated workflows

- Seamless QuickBooks integration

- Fewer emails to deal with

Cons

- Expensive

- Purchase order glitches

- Software can lag

Pricing

Pricing is on a per-client basis. Contact sales for current pricing.

Other Melio Competitors Worth Considering

Here’s a few other Melio competitors that present Melio sometimes competes with on specific use cases:

- PayPal: The best known payments processor online, PayPal is accessible and widespread, particularly for international payments. However, the fees are high and account restrictions can be arbitrary. See how PayPal compares to Melio for more details.

- Stripe: Stripe is similar to PayPal in that it’s widespread, but more of a technical implementation, most commonly preferred by developers for it’s advanced API. See how Stripe compares to Melio here.

- Bill.com: Bill.com is like Melio, but with more advanced bill pay & reporting (accounts payable, accounts receivable), with some ERP-like features for vendor payment and vendor management. See how Bill.com compares directly to Melio.

- Veem: Veem shines where Melio doens’t, specifically with international payments. They have among the longer transaction fees for moving money around the world and compete with a Wise.com in this category. See how Melio compares to Veem.

- Plastiq: Plastiq is a newer payments option, ideal for mid to large size enterprises with small (but growing) accounting teams BUT not looking to deal with the fees of PayPal or complexity of Bill.com or Stripe. See how Plastiq compares to Melio.

FAQs

Question: How do I verify my business with Melio?

Answer: After completing your first payment and account preferences, you will be prompted to enter your business’s legal information. You will need to provide your legal business name, business’s legal address, Tax ID type, and number.

Sole proprietors can enter their home address as a business address and use a PO Box when sending checks to vendors. If you need to update your company information, you can easily do so through the “Company Setting” tab.

Question: Do I have to notify all of my vendors that I’m using Melio?

Answer: It is not necessary to notify all of your vendors when sending payments with Melio. They will receive their payments as usual in the form that you have chosen (ACH, paper check, etc.). Plus, vendors don’t have to sign up with Melio to get notified of upcoming payments or to receive funds.

Question: What will my vendors see when I use Melio?

Answer: Depending on how your vendor requests payment determines how they will be notified. No matter which payment option you choose, at the end of every payment process you will have the option to notify the vendor via email.

The email will consist of your business name, payment amount, payment processing method (ACH, paper check, etc.) payee, payment ETA, and invoice reference.

When choosing a paper check, expect the check to arrive at your vendor with 7 business days. The vendor will receive a paper check that lists your name and business in the upper left-hand corner, vendor name, amount, invoice number, signature on file, and Melio’s routing and account numbers.

Melio never discloses your bank account numbers since the check is paid via Melio’s account. Expect to receive an email notification that the payment has been deposited by your vendor.

Your vendor can also receive payment by ACH. When using ACH, the transaction will appear on your bank statement with your business name followed by “Melio CCD”.

Question: Can Melio schedule my vendor payments in advance?

Answer: Yes. Melio’s top priority is to keep you on track with vendors and help you manage your cash flow. Simply log on once or twice a month to batch pay all of your vendors. Easily schedule payments to arrive on a future date. You can see if you are meeting invoice due dates and select dates that match your cash flow.

Question: Does Melio support international payments?

Answer: Currently, Melio only supports payments from one US business to another US business. No payments outside the US are supported and only U.S.-based credit cards are accepted.

Final Thoughts About Melio Payments

Melio’s strengths lie in its no-cost plans that are tailored to businesses and accountants. It integrates with popular accounting software like QuickBooks so you don’t have to reinvent the wheel to improve your invoicing game.

Melio also offers unlimited management and unlimited users, a feature that not even expensive accounts payable solutions can always compete with.

Plus, you will never have to sign a contract or pay a delivery fee. The Melio payment system takes care of tax forms and provides dedicated live support (customer support).

However, Melio is not without its drawbacks. It currently doesn’t offer vendor management or automated OCR data entry, both of which may be a deal-breaker if you are a larger company.

Plus it doesn’t support multi-currencies so if you do a lot of global business you will need to look elsewhere to process payments.

Melio is built for today, while most payment processors are technical, glitchy, and dated. I use Melio in my business for straightforward invoicing. No fees, no hassle.