- Main Differences Between Gusto vs ADP

- Gusto vs ADP Similarities

- What is Gusto?

- What is ADP?

- Gusto vs ADP: The Main Features of Gusto

- The Main Features of ADP

- Gusto vs ADP Pricing

- Gusto vs ADP Support

- Gusto vs ADP - Pros and Cons

- Frequently Asked Questions

- Gusto vs ADP - Which One is Best?

- Gusto and ADP Payment & HR Software Competitors

Last Updated on April 24, 2023 by Ewen Finser

Your business is starting to hit its stride and you are exhausted spending another late night manually entering payroll.

Fortunately, there are full-service payroll software options that can take this burden off your plate. You might even save money after you account for all the time you will save researching compliance, benefits, and adding new team members.

Gusto payroll and ADP are both full-service payroll solutions (payroll service) that offer additional bells and whistles. While Gusto is built for small businesses, ADP can grow with your business serving 1,000+ employees.

Which one should you choose? Check out our in-depth comparison to see which payroll solution is right for your business.

Bottom Line Up Front Summary: For transparent pricing, employee-focused features, and turn-key usability, Gusto is our top pick for small digital businesses. That said, if you are looking for a very customized payroll solution, are a mid to large size company, or have a growing international footprint, it’s a safe bet going with ADP full service payroll here.

Main Differences Between Gusto vs ADP

The main differences between Gusto vs ADP are:

- Gusto offers employee payroll advances, whereas ADP does not.

- Gusto provides transparent pricing, whereas ADP requires a consultation for custom pricing.

- ADP offers HR outsourcing, whereas ADP does not.

- ADP provides a mobile app, Gusto is only available on desktop (mobile-friendly website).

Easier to use, cheaper, and much more scalable than the competition. Gusto WORKS better, particularly for small to mid-sized companies. We went with Gusto for our business and are incredibly happy with the support and integrations with our other accounting tools.

Gusto vs ADP Similarities

- Employee self-onboarding

- New hire reporting

- Direct deposit

- Contractors and freelancers payroll support

- Online pay stubs

- Tax compliant

- Access to HR experts

- Time-tracking

- Health benefits

- Retirement investment options

- Management tools

- Seamless third-party integration

Easier to use, cheaper, and much more scalable than the competition. Gusto WORKS better, particularly for small to mid-sized companies. We went with Gusto for our business and are incredibly happy with the support and integrations with our other accounting tools.

What is Gusto?

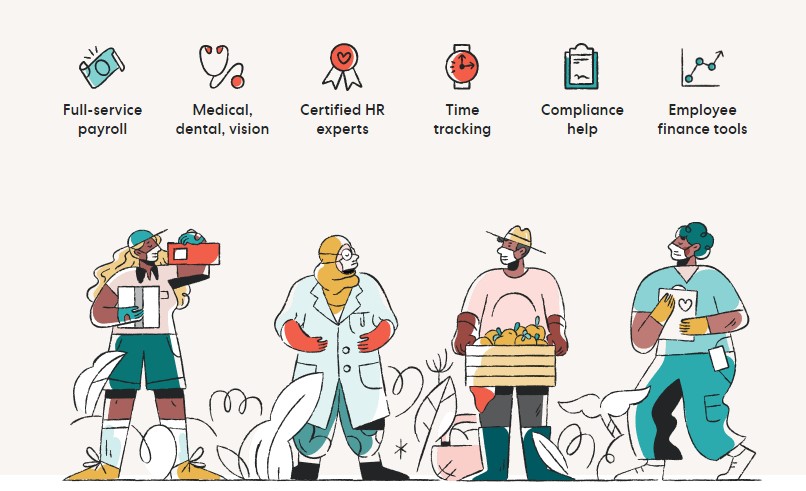

Gusto is a comprehensive payroll software solution that combines online payroll with employee onboarding and benefits, pay advances, and investment opportunities.

Users appreciate its transparent pricing, intuitive user interface, and unique features like Gusto Cashout™ which helps employees access money early directly from their next paycheck.

What is ADP?

ADP provides payroll provider and HR services for any size business. Its professional software helps companies automate day to day tasks, meet compliance, tax regulations, and employee records.

ADP’s HRIS solutions seamlessly connect with your existing HR, payroll, and financial applications and apps in the ADP Marketplace. The recommended software is divided into three categories Under 49 Employees, 50-999 Employees, and 1,000+ Employees.

Under 49 Employees

- RUN Powered by ADP® (ZipRecruiter integration)

- ADP TotalSource® (Fortune 500®-caliber employee benefits)

- ADP® Comprehensive Services (HR team support)

- ADP Streamline® (global payroll)

- WorkMarket® an ADP® company (freelancers/contractors management)

- Compass® Powered by ADP® (customized coaching)

- ADP® Mobile Solutions (mobile payroll app)

- Wisely® by ADP (employee pay card program)

50-999 Employees

- Above, plus,

- ADP Workforce Now® ( ADP Workforce comes with analytics)

- ADP SmartCompliance® (human capital management (HCM) integration)

- ADP® Celergo (global payroll)

- StandOut® Powered by ADP® (employee engagement)

- ADP® DataCloud (HR reporting)

1,000+ Employees

- Above, plus,

- ADP® Comprehensive Outsourcing Services (outsourcing for payroll, HR, talent, etc.)

- ADP Vantage HCM® (U.S.-based multinational businesses)

- ADP Enterprise HR® (comprehensive HCM)

- ADP® Global Payroll

- ADP GlobalView® Payroll

ADP is a excellent option if you've outgrown the small digital players, have physical (in-person) employees, or need to pay international payroll.

Gusto vs ADP: The Main Features of Gusto

Full-service Payroll Service

Deciphering online payroll services can eat up a lot of time. Gusto runs payroll in just a few clicks and even has an automatic option. Easily pay employees and contractors either hourly or salary. Gusto takes care of payroll tax forms and filings. It even supports paying workers in different states.

Gusto payroll integrates with popular accounting software including Xero, QuickBooks, QuickBooks Online (in lieu of Quickbooks Payroll add-on), Clover, TSheets accouting software, and many more.

If you want to learn more about Gusto, and similar services, check our detailed review on Zenefits vs Gusto, SurePayroll vs Gusto, Gusto vs Justworks, Gusto vs Square Payroll, or even Gusto vs Paychex payroll software just to compare other payroll service options…

Employee Benefits

Gusto is more than just payroll software. It also integrates health insurance, life insurances, and financial investments. Have you switched to Gusto for payroll but have other benefits somewhere else? Gusto can help you transfer services so you can take advantage of multiple services all in one place.

Gusto does not charge any fees to be an administrator for your health insurance needs. You only pay toward the premiums, which is a standard cost across the board.

- Medical, dental, and vision insurance

- Health savings accounts

- Flexible savings accounts

- 401(k) retirement plans

- Commuter benefits

- 529 college savings plans

- Life and disability insurance

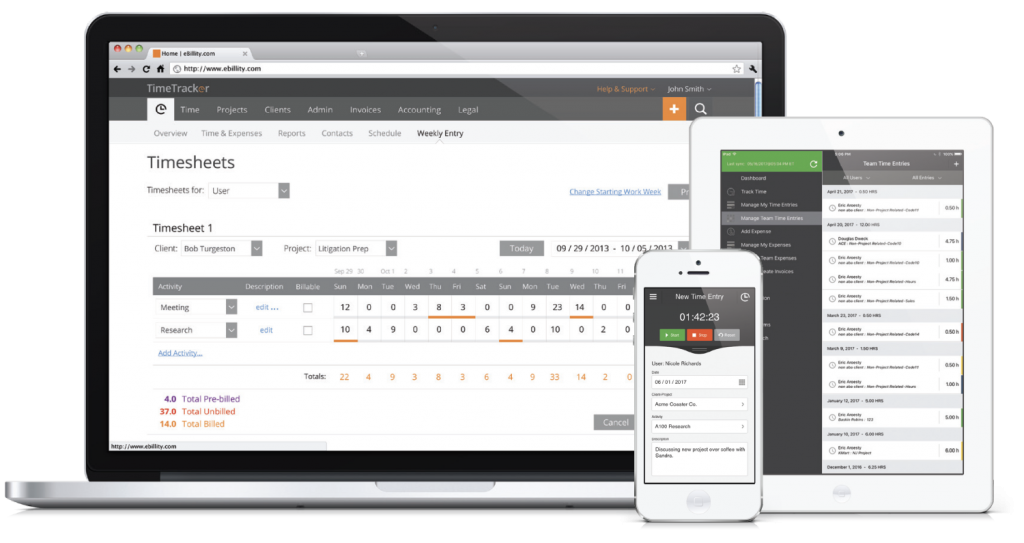

Gusto Time Tracking

Have hourly workers? Gusto helps you stay in compliance by tracking employees’ lunches, breaks, and overtime.

Compliance Help

All employee tax forms (payroll tax) are stored online for easy access. Gusto takes care of local tax laws so you don’t have to worry about tax law changes. However, users warn that some tax changes can be delayed in taking effect in Gusto, so be aware that Gusto isn’t full-proof.

Gusto helps you with compliance regulations for the following agencies ACA, ERISA, Dept. of Labor, IRS, HIPAA, COBRA.

Gusto Employee Onboarding

Trying to add the best talent to your team? Use Gusto to send personalized offer letters that your prospects can’t refuse.

Gusto allows your employees to onboard themselves to the online payroll service. Employees can enter personal and banking information to minimize errors. Plus, no onboarding paperwork for you.

Employees can also access pay stubs, benefits packages, and request paid time off (PTO). Each employee file houses key employee records all in one place so you don’t have to go searching for important documents.

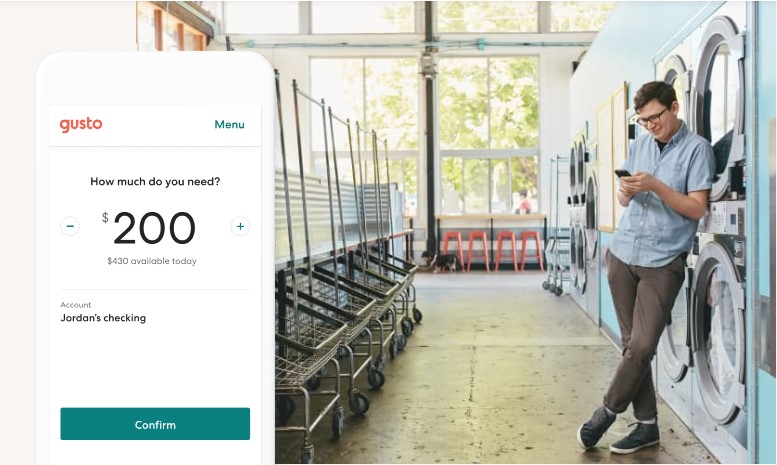

Gusto Cashout™

Gusto Cashout is a benefit that all of your employees will appreciate. It allows the employee to borrow money in between paydays for an unexpected expense.

With a few clicks, the employee can choose a custom amount and money is in their account in as little as one business day. Once the next payday rolls around, the amount is automatically deducted from their current paycheck. There are no setup fees or interest charges for the service.

Best of all, this service is also free for employers. Limits on borrowing based on the employees’ estimated earnings, protect the employee from incurring too much debt.

Gusto Cashout doesn’t affect your books or payroll.

To be eligible for Gusto Cashout, the W2 employee must be 18+ and currently paid through direct deposit. Currently, Gusto Cashout is available in all states except AZ, MA, ME, WV, IL, NV, NH, NJ, ND, OR, PA, VT. Other requirements may apply.

Gusto is currently working on a savings option that would funnel money from your paycheck directly into a personal savings account.

Employee Surveys

Gusto can collect anonymous surveys from your employees so you are in the know when an issue arises or improvements can be made to HR processes.

Easier to use, cheaper, and much more scalable than the competition. Gusto WORKS better, particularly for small to mid-sized companies. We went with Gusto for our business and are incredibly happy with the support and integrations with our other accounting tools.

The Main Features of ADP

Full-service Payroll Processing

Whether you have 1 or 1,000+ employees, ADP payroll can provide full-service payroll in just a few clicks. When you sign up for midsized to enterprise payroll (50-1,000+ employees), you will benefit from employee data syncing, integration with ADP’s HR, talent, time tracking, and benefits.

ADP payroll also offers direct deposit and mobile payroll options. This gives employees quick access to regular pay stubs, benefits, attendance, and time-off requests on the go.

Employee Benefits

Even small business owners have the option of providing retirement and group health insurance to their employees. ADP retirement plans include 401(k), Simple IRA, or SEP-IRA plans to help your employees invest in their future.

Health benefits from Automatic Data Processing Insurance Agency, Inc.’s (ADPIA®), an affiliate of ADP, LLC, will walk you through payroll integration and deductions. Great for businesses with up to 150 employees seeking enrollment.

Business insurance is also available for workers’ comp and general liability. Easily integrate your premium payments through ADP’s Pay-by-Pay® Premium Payment Program. It is important to note to use ADP’s Pay-by-Pay® Premium Payment Program you must participate in workers’ compensation insurance through ADPIA with carriers who use ADP RUN payroll services.

ADP Time Tracking

Tired of manually time tracking your employees? ADP’s automated solution tracks your employees’ attendance and hours worked by having your workers clock in and out using a computer, mobile device, or time clock.

You can even create and edit your employees’ schedules online. Easily track when your workers need a day off so you can integrate with your online schedule. Plus, this data auto flows into your ADP payroll software so the adjusted payment is processed correctly.

ADP Manager Dashboard

Use the manager dashboard to see who is currently working, if anyone was late, and if any decisions need to be made regarding efficient staffing. See hours worked and stay on top of any overtime costs.

Plus, you can run reports for supervisors and approve timecard changes to prevent delays in payroll.

Compliance Help

ADP offers compliance help for federal, state, and local regulations. Taxes are automatically calculated for you.

ADP Employee Onboarding

Need to onboard a new employee or update an employee’s position within the company? ADP makes this process as simple as filling out an online form.

ADP Talent Management

Finding the best candidates for the position can take a lot of time out of your schedule. Let ADP work for you by helping create attention-grabbing job posts that will generate top-level candidates, hiring tools, and self-service onboarding that will make adding to your team a breeze.

Leader tools include personalized employee career development including identifying employee strengths and getting them up to speed on company culture. Plus, custom training, and competitive compensation for new hires and promotions.

Gusto vs ADP Pricing

Gusto Pricing

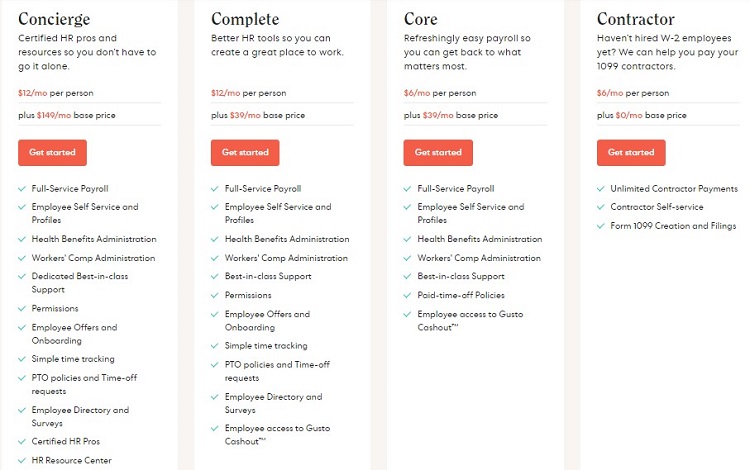

Gusto is very transparent with its pricing compared to ADP. You can see all the features it provides with clear monthly costs per employee. There are four main monthly subscriptions, Contractor, Core, Complete, and Concierge.

Contractor Plan

Haven’t hired W-2 employees yet? We can help you pay your 1099 contractors.

$0/mo base price plus $6/mo per person

- Unlimited Contractor Payments

- Contractor Self-service

- Form 1099 Creation and Filings

Core Plan

Refreshingly easy payroll so you can get back to what matters most.

$19/mo base price, plus $6/mo per person

- Full-Service Payroll

- Employee Self Service and Profiles

- Health Benefits Administration

- Workers’ Comp Administration

- Best-in-class Support

- Paid-time-off Policies

- Employee access to Gusto Cashout™

Complete Plan

Better HR tools so you can create a great place to work.

$39/mo base price, plus $12/mo per person

- Full-Service Payroll

- Employee Self Service and Profiles

- Health Benefits Administration

- Workers’ Comp Administration

- Best-in-class Support

- Permissions

- Employee Offers and Onboarding

- Simple time tracking

- PTO policies and Time-off requests

- Employee Directory and Surveys

- Employee access to Gusto Cashout™

Concierge Plan

Certified HR pros and resources so you don’t have to go it alone.

$149/mo base price, plus $12/mo per person

- Full-Service Payroll

- Employee Self Service and Profiles

- Health Benefits Administration

- Workers’ Comp Administration

- Dedicated Best-in-class Support

- Admin permissions

- Employee Offers and Onboarding

- Simple time tracking

- PTO policies and Time-off requests

- Employee Directory and Surveys

- Certified HR Pros

- HR Resource Center

- Employee access to Gusto Cashout™

Gusto doesn’t require a long-term contract.

ADP Pricing

ADP pricing is based on what services you need and how many employees you want to add. Pricing is not published and quoted based on your needs. Basic plans start at $10 per employee, per month, featured plans can cost over $20 per employee, per month (or whatever pay period you use).

A typical small business of 10-15 employees would cost around the $160 mark, with possible start-up fees ($25), and a yearly fee for processing any payroll taxes.

Since ADP pricing can vary greatly, its best to speak with an ADP rep to see what they can offer for your current budget.

Gusto vs ADP Support

Gusto Support and Customer Service

Gusto has an extensive FAQ help section for common questions.

If you would like to contact them, you must log-in to your account. Once logged in, you can choose from the following two main categories, “my account” (forms) and “other” (personal account details and health insurance).

Gusto’s team includes certified payroll professionals, licensed insurance brokers, and certified HR specialists. They are available via email, phone, and chat.

ADP Support and Customer Service

ADP has a toll-free automated customer support line (1-844-227-5237) that is available 24/7. You can also access support services through an individual employee or a company administrator portal on the website. Need chat support? ADP offers that too.

If you are looking for superior customer service, ADP wins in this category.

Gusto vs ADP – Pros and Cons

Gusto Pros

- Time tracking

- Easy to use even for tech-challenged

- Online access to paystubs

- Can be set up by the average business owner

- Removes the need for an outside accounting firm (or accounting software)

- Employee feedback service

- 401K capability

- Ability to schedule vacation time, PTO, raises, bonuses

- Tax compliant, integration with Turbo Tax

- Automatic reminders for scheduled tasks (i.e. payroll, benefits, etc.)

- Multiple subscription plans

- Employee self-onboarding

- Can handle contractors and freelancers

- Supports off-cycle payroll

- Workers’ compensation

- Accessible from a mobile device

- Supports payroll in all 50 states

Gusto Cons

- Support issues with 941 misfilings

- Generic customer support

- Confusing insurance process

- Import mapping for complex payroll

- Does not support employees working in two states

- Payday lending

- Employee withholdings are better entered by an experienced bookkeeper

- No direct integration with Quickbooks

- 401K option is clunky

- More expensive for smaller companies

- Benefit features only available in 26 states

- Not for large businesses

ADP Pros

- Customizable pricing, choose only the features you need

- Comprehensive feature set for payroll, HR, benefits

- Can scale as your business grows

- Video tutorials and online training for advanced use

- Mobile-friendly

- Online pay stubs

- Finger punch system for employee hours

- Compliant for payroll and filing taxes

ADP Cons

- Customer service is lacking when an issue comes up

- Data reports lack detail

- Accessing previous years’ data is difficult

- Lower package tiers lack access to features like performance management and recruiting manager

- Pricing is different with each customer (not transparent)

- A fee every time you process payroll

- Most HR features are additional

- Some integrations are not optimized

Frequently Asked Questions

Gusto builds payroll and benefits in-house so everything stays in sync. Generally is tailored to larger businesses, and features such as payroll and benefits are add-ons—not core to their platform. They also charge extra fees per employee for these additional services.

More advanced plans cost around $23 per employee, per month. On average, you can expect to pay around $160 per month for 10 to 15 employees. You may also have start-up fees (typically around $25, though these are often waived) and yearly fees for processing taxes.

Gusto Cashout lets employees get money between paydays based on estimated wages. It’s a simple way for employees to cover expenses when savings aren’t enough, and funds are automatically paid back from the employee’s paycheck.

Gusto vs ADP – Which One is Best?

If you run a small business, Gusto is the clear winner compared to ADP. Gusto is easier to learn, offers complex features without an extra cost (like employee tax processing and unlimited payrolls that ADP charges extra for), and provides quick, comprehensive reporting.

In fact, Gusto IS the payroll software our company uses and my top pick for the best payroll software for most digital businesses.

Easier to use, cheaper, and much more scalable than the competition. Gusto WORKS better, particularly for small to mid-sized companies. We went with Gusto for our business and are incredibly happy with the support and integrations with our other accounting tools.

On the other hand, ADP is more suited for larger businesses that need a customized payroll and HR solution. ADP provides users with a broader range of payroll software solutions which may be better suited for advanced users. ADP also offers a 24-hour toll-free support line so you won’t have to wait to solve any issues.

Bottom Line Summary: For transparent pricing, employee-focused features, and turn-key usability, Gusto is our top pick for small business and ADP is the better option for large enterprises, in-person workforces, and cross-border payments.

Gusto and ADP Payment & HR Software Competitors

If you aren’t set on either of these options yet, consider how they both contrast directly with top human resources competitors below:

ADP Alternative HR Platforms Compared

- How to Find the Best Payment Processor for Your Online Business

- Zenefits vs ADP – Which HR Service is Best for Your Business?

- Paychex vs ADP: Which is Better to Use?

- ADP vs Trinet Compared

- ADP vs Paycom Payroll Features Compared

- ADP vs Workday HCM HR Support

- ADP vs Insperity Comparison

Gusto Alternative HR Platforms Compared

- Zenefits vs Gusto: Which HR Service is Better?

- SurePayroll vs Gusto: Which Payroll Service is Best?

- Gusto vs Paychex: Which Should You Choose?

- Gusto vs Justworks: Which Payroll and HR Tool is Best?

- Square Payroll vs Gusto: Which Is the Better Payroll Platform?

- Gusto vs Bamboo HR Compared

The part where you said Gusto is much more scalable, being a company that has an average client size of 13 employees is ridiculous to say the least. ADP is a much more scalable system with multiple offerings depending on your company size that are built to scale with your company through every phase of growth. As a business owner who has used both, your opinion here is totally counter intuitive to my experience.

ADP is also a lot more complex whereas Gusto is focused on the solopreneur > SMB > mid-sized company market. ADP is great once you have at least one HR person internally as a sort of sys admin, in my experience.