Last Updated on June 1, 2023 by Ewen Finser

What is Bill.com?

Bill.com was founded by Jeremy Pyles in 2006 and is located in Palo Alto, CA. It is a cloud-based platform for small to medium-sized businesses allowing them to manage billing customers and receiving payments automatically. The software handles both accounts receivable and accounts payable functions. It helps businesses remove the tedious and redundant tasks of managing payments and following up on receivables so business owners can stay focussed on getting more sales and building customer relationships.

How it Works

Accounts Payable has many functions from receiving supplier invoices, managing cash flow, approval processes, submitting payments, to monitoring canceled cheques and audit preparations. There are a lot of tedious accounts payable tasks that are time-consuming. They can easily distract a business owner from staying focussed on obtaining new business or developing and maintaining customer relationships.

Bill.com automates the Account Payable process saving time managing this important task.

Setting up the Accounts Payable function in Bill.com is pretty straight forward.

- A digital inbox is a set-up for your vendors to send invoices to

- The invoices are automatically processed and scheduled to pay now or later

- Invoices can be uploaded and paid on a snapshot of an Invoice too

- Approvals steps can be customized before invoices are processed

- Mobile apps allow approvers to accept or reject invoices, while away from the office

- Payments can be made using ACH, cheques, virtual card, and international wire transfers

- Vendors and invoices are synced with 3rd party software

Accounts Receivable is not much different than how Accounts Payable works in Bill.com. Invoices are submitted to customers via email, automatic reminders are sent out for past-due invoices, notifications are received when payment is made, and everything is synced with 3rd party software,

When you enter Bill.com you are asked for your Username and Password.

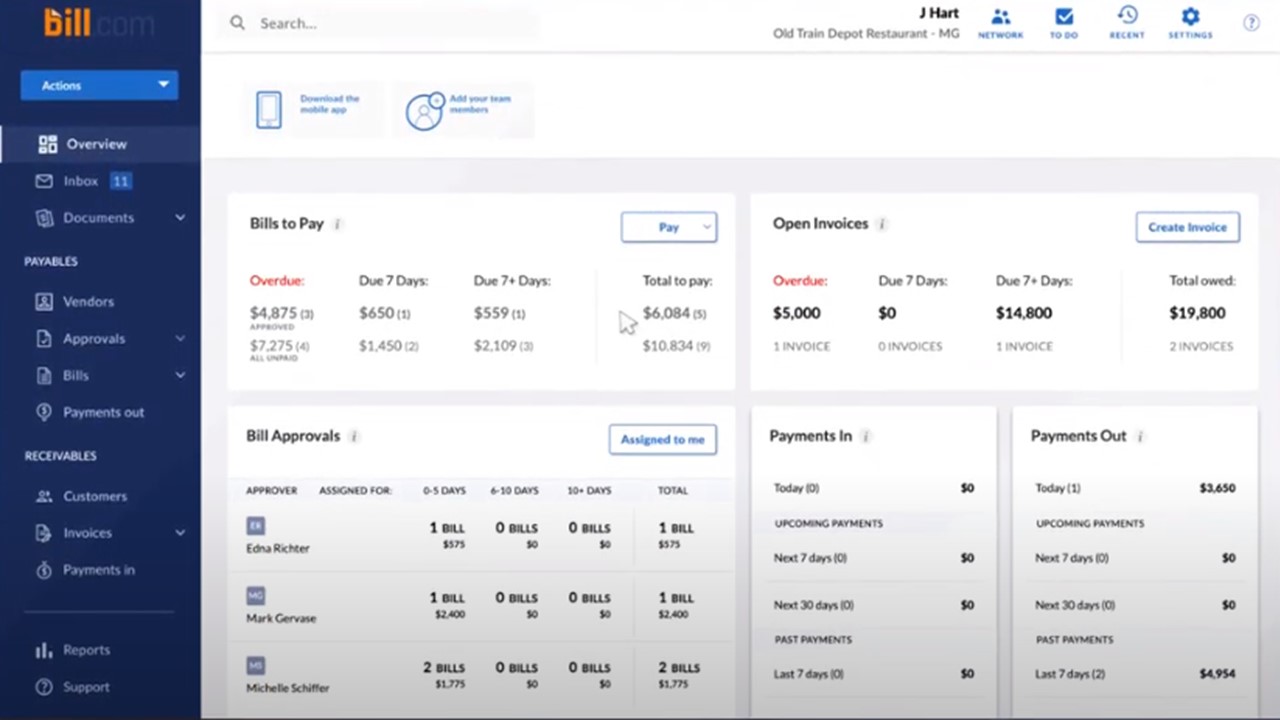

Once you log in, you are given this Overview screen. On the left is a navigation panel that consists of:

Overview

This gives you a dashboard snapshot of the accounts receivable and payable activities to-date: billing, bill approvals, open invoices, payments in, payments out

Inbox

- This is where the vendor invoices are emailed to

- Each business you interact with is given a unique email address for billing; for example [email protected]

- You can drag and drop a snapshot picture of an invoice with your mobile app too

- Alerts can notify you that a new invoice has been received in your inbox so it can be reviewed, coding to the general ledger account, approved or denied, and scheduled for payment

- Bill.com automatically syncs data every 24 hours, or you can click ‘Sync Now’ to obtain immediate updates

Documents

All your business invoices, contracts, spreadsheets, snapshots are stored here for easy access during audits, banking purposes, and tax time.

Payables Section

- Vendors

- Approvals

-

-

- Shows a summary of the invoices to be paid and the approval process

-

Bills

- Shows the bills to be paid that have been approved for payment

- Bills can be paid in batches or chosen individually

- Invoices are paid electronically, by cheque, or with a vendor direct, a single-use virtual card option

Payments Out

- Information is stored and tracked for easy retrieval during audits

- Bill.com keeps the documents, coding time stamp, approval, and cheque image once cashed by the vendor—front, back endorsement, signature, bank stamp, etc.

Receivables Section

Customers

- Customer setup with contact information

Invoices

- Invoices logged, ready for processing, approved, not approved to send

Payments in

- Customer payment status

Then a section for Reports, Support, and International Payments

- International payments can be paid to vendors in 130 countries

- Bill.com converts the currency automatically and pays the vendor in USD or their own currency, whichever is established

- Currency is shown in real-time

Bill.com automatic sync with:

- Sage Intacct

- Oracle Netsuite

- Intuit Quickbooks

- Expensify

- Tallie

- Hubdoc

- Xero

Bill.com data integration with:

- Microsoft Dynamics

- Sage

- SAP

- Fresh Books

Features Include:

- Smart Automatic Data Entry – helps by saving time with redundant manual data entry

- Smart Detection that detects duplicate entries – helps avoid human data entry error

- Cloud service – provides real-time information

- Payment Flexibility – ACH, virtual cards, and more

- Schedule & Record Bill Payments

- Email invoices and reminders

- Automated Accounts Receivable, Approval Routing Process, Accounts Payable

- Fraud Protection

- Payment Arrival Notification

- Cash-flow review & management

- Unlimited Document Storage

- Email integration

Benefits

- Increases efficiency and saves time by automating the redundant task

- Improves payment turnaround time

- Helps businesses gain more control with approved team workflow set-ups

- Syncs Data with 3rd Party Software and Mobile Devices

- Processes International Payments with various countries and various currencies

- Audit-Ready with Automatic Payment Activities

- Real-time data updates

- Trusted Security with Encrypted Data using Transport Layer Security

How Much Does Bill.com Cost?

Bill.com includes 4 Payment Package Options, designed to meet your company’s specific needs.

1. Essential Plan

- $39 per user/ month

- Includes:

- Import/ Export

- 5 standard user role & approval workflows

- Unlimited document storage

- Payment support & positive pay

- Business Payment Network

2. Team Plan

- $49 per user/ month

- Includes everything in Essentials, plus:

- Sync with 3rd Party Software: QuickBooks Pro, Premier, Online, and Xero

- Customer user roles

3. Corporate Plan

- $69 per user/ month

- Includes everything in Team, plus:

- Invoice automation and payment automation

- Discounted “ approver-only” users

- Custom approved limits

4. Enterprise Plan

- Custom

- Includes everything in Corporate, plus:

- Sync with 3rd party software: NetSuite, Intacct, and QuickBooks Enterprises

- Multi-entity/ location/ accounting files

- API access to Bill.com

- Import and Export with Microsoft Dynamics

Additional Transaction Fees are also charged, so be sure to read through their price plans accordingly to be sure there are no surprises on your end.

Bill.com provides a 30-day risk-free trial with no credit card required.

Deactivating a User or Cancelling Your Bill.com Account:

Right from Bill.com’s website: “Your Right to Cancel. You may request to deactivate a User or cancel Your Bill.com account at any time by submitting a request through Your Bill.com account or through Our customer support portal. Bill.com reserves the right to require up to 60 days’ prior notice of cancellation or User deactivation”

It is best to read thru their Terms and Conditions to understand your Rights and what Rights they exercise, before signing up to use their services.

PROS CONS

Automation for sending invoices, reminding customers on past due invoices, receiving payments, and paying suppliers |

Pricey monthly costs that increase yearly |

Instant up-dates for business managers, banking, and the accountants |

Limited customized reports |

Payment choices include ACH or manual cheques |

Customer service support is poor |

Syncs with 3rd Party Accounting Software and mobile devices |

A little slow |

Designed for small to medium-sized businesses |

Not robust for Corporations |

Social Media:

Bill.com can be found on the following Social Media platforms:

Facebook, Twitter, LinkedIn, Youtube, and Instagram

Mobile App:

Bill.com has an App for your Mobile Device allowing you to get paid online.

This APP allows you to get paid twice as fast.

It is set up to:

- Receive Payments from your customers and others and has a tracking feature to keep you informed as to when payment is expected

- Approvers can remotely approve or reject a bill before it is sent

- Various avenues of payment: ACH, international wiring, virtual card, or manual cheques

- The status screen provides a basic overview of Open Approvals and Outstanding payments

Customer Reviews:

Software Advice gives Bill.com a rating of 4.11 stars out of 5. Most customers were satisfied. Some concerns were with customer service and price.

Merchant Maverick rates Bill.com 4 out of 5 stars.

Bill.com provides an extensive resource of Video Tutorials:

Bill.com has Video Tutorials for the following:

- Accounting Preferences

- Getting Started- Approvals, InBox, Receivables, Roles & Permissions

- Settings Overview

- Setting Overview

Bank Account Setup

- Adding a bank account by manual entry and with online banking

Bill Management

- Create a bill without a document

- Creating, viewing, and deleting a bill

- Editing and existing bill

- Entering a bill with a document and entering a new bill

- Manage payment terms

Getting Paid

- I was invited to get paid by a Bill.com customer

- Comment to your vendor or customer from your existing account

Import Export

- Introduction

- Importing and Exporting Data and Best Practices

Inbox

User Management

- Clerk role, Manage Users, Payer Role, Approver Role

Webinar Recordings

- 5 ways to Pay you Vendors

- Bill Enhancements

- Create & Manage Approvals

- How to Add/ Verify your bank accounts

- How to Connect to Your vendors via the Bill.com Network

- How to Manage Documents in Bill.com

- Payment Fraud Mitigation: Business Email Compromises

- Sync 101: How to Sync like a Pro the new Bill.com

- Understanding clearing accounts

- Vendor Direct

International Payment

- Adding an International Vendor

- International payments sync with Sage Intacct, Oracle NetSuite, QuickBooks for Windows/Online, Expensify, Tallie, Hubdoc

Network

- Accept or Decline Network Invitations

- Cancel an Invitation

- Connect to a vendor via Payment Network

- Find pending invitations

- Locale Payment Network ID (PNI) for vendors & customers

- Provide PNI to connect

- Send an Invitation to a vendor with a bank account already manually added

- Send an Invitation when adding or editing a vendor

- Send an Invitation to multiple vendors at once

- Send your Inited vendor a reminder

- Track an initiation

- Vendor Advanced Search

- Verified national vendor ePayment Setup

Payment

- Paying Bills

- Payment Processing & Timing

- Payment Status

Receivables

- Overview and Functions

- Manage sub-customers

- How customers view your invoices

- Enter received payments manually

- Create Invoice

- Communication with your customers

- Send Invoices

- Set-up automatic reminders

Sync with:

- Oracle NetSuite- setting up

- QuickBooks, Online- setting up, how the sync works, sync troubleshooting

- QuickBooks Desktop – setting up

- Xero – sync basics and setting up, how to sync with Xero work, sync troubleshooting

What if I have a Question or Concern with Bill.com?

Bill.com offers a few avenues of Customer Service.

You can use their Contact Us page and mail one out of two Office locations, either their headquarters in California or their Houston Office in Texas.

Palo Alto Headquarters

1800 Embarcadero Road

Palo Alto, CA 94303

Or

Houston Office

2103 CityWest Boulevard, 12th Floor

Houston, TX 77042

Or on the same page, you can send them a brief summary of which they can respond by email or phone.

They also have a support page where you can search when entering a keyword in their search bar. If you click on the Contact Us page, a pop-up box asks you to enter additional questions for more assistance.

Does Bill.com have any Youtube channels that provide visual insights into this business platform?

Yes, you can check out this Youtube channel to see How the Bill.com Intelligent Business Payments Platform Works

This Youtube channel shows you how the Accounts Receivable section works

This Youtube channel shows you the Accounts Payable features and functions

Does Bill.com offer pricing packages for Accounting firms?

Yes, the Accounting firm pricing package is $49.00/ month. You can check it out here: Bill.com for Accountants

Frequently Asked Questions:

Answer: How tu Buy?

Answer: You can click on www.bill.com to get started. Just fill in the required information in the pop-up box that appears on the screen.

Question: Does Bill.com create double-entry if I also use QuickBooks?

Answer: No, the integration between Bill.com and QuickBooks, NetSuite, Xero, and even Intacct means that any updates in one system automatically update the other. Saving time and money managing cash flow.

Question: How does Bill.com handle security?

Answer: Bill.com is designed with security that protects your money transactions, sensitive information, and privacy by enforcing the following:

– A strong password policy

– A 2-Factor Authentication

– A secure channel for sending login data over

– Timed log out for customers if inactive for a period of time

– Communicating risks of business email compromises

– Payment protections that reduce risk from check theft Bill.com applies Positive Pay de reduce the risk of check fraud; the bank matches the check issued with the check presented for payment

– Bank account information is kept private from vendors when making digital payments

– Security software that detects intrusion and prevents unauthorized use.

– Data protection includes an additional level of encryption

– Uses Transport Layer Secuirty (TLS) to protect customer data when transmitted over the internet

– Disaster recovery protection is in place to help retreive data should something catastrophic occur

– Secure Data Center is managed by a certified data center provider

– Well trained employees undergo background checks, data security, and privacy training

– Compliance Protection with SOC 1 and 2 Type II, PCI, AMI, OFAC.

Alternatives

Plooto

Plooto is an automated software that handles Accounts Payable and Accounts Receivable functions

- They provide a 30-Day free trial

- Pricing: $25/month, no additional user fee

Comarch

Comarch automates AP and AR e-invoice processing

- No free trial

- Pricing is provided upon request

Invoicera

Invoicera automates AP and AR functions

- 15-Day free trial

- Pricing:

- Business Package $25/month; 1,000 clients

- Pro Package: $15/month; 100 clients

- Infinite Package: $149/month; unlimited clients

Conclusion

Bill.com is a user-friendly software that automatically manages all the accounts receivable and accounts payables functions, saving businesses time and effort. It contains many advantages and a few disadvantages. It can be a pricier option than their competition when you consider how many users you need to use the system. The APP is a good feature to have for when signing authorities are out of the office, and you cannot wait for them to return to pay a bill or invoice. I recommend trying their free trial out and reviewing the library of training videos they offer to see if this software suits the needs of your business.

Further read: