Last Updated on April 22, 2023 by Ewen Finser

Are you looking for a solution to make handling your business taxes easier?

Below, you’ll discover two convenient solutions for US sellers: TaxJar vs Taxify. With either of these software solutions, you’ll avoid manual audits and penalties resulting from human error in data entry. On top of that, these services will make it a breeze to deal with sales.

In the following paragraphs, you’ll discover:

- how both services can simplify handling your professional taxes;

- the key differences they bear;

- a clear answer as to which is better suited for you;

- their costs and associated fees;

- frequently asked questions and alternatives worth considering;

- and more…

The Bottom Line

TaxJar vs Taxify are both superb options for handling your sales tax. That being said, Taxify might be a little too advanced for most entrepreneurs if they are not dealing with specific needs and multiple sales channels. TaxJar also offers very, very competitive prices, and while not the sharpest sales tax software in the shed, it will get the job done well enough for most people.

Key Differences

- TaxJar has a very competitive price tag, whereas Taxify is more than twice as expensive.

- TaxJar has little customization, whereas Taxify has more personalization features.

- TaxJar does not always have the most up-to-date laws and regulations on file, whereas Taxify does.

- TaxJar offers no specific help to Amazon sellers, whereas Taxify does.

- TaxJar does not provide on-demand official forms, while Taxify does.

How To Choose The Best Sales Tax Software

There are many things to consider when selecting your favorite sales tax software.

Ease of use

Using sales tax software is a great alternative to manually filling your taxes, provided that using the tool doesn’t require more work than using a pen and a notepad. You want to make sure that the service you’re going for is easy enough to use and that you don’t waste a lot of time learning how to use it (especially if you have staff to train) and using it.

Accounting for sales tax

Here’s the main thing you want sales tax software to do: register sales tax for you. Most likely, your platform will offer some degree of sales tax collection. But only some degree. A proper sales tax software will provide you with tax information and features on another degree of relevance.

This saves time over manually reporting for every sale and reduces human errors drastically. Different software will do such a thing differently. You want to make sure that the one you’re going for does it in a relevant way to your business model.

Paying sales taxes

Some services will go the extra mile and directly submit your tax papers for you. This saves you the stress and hassle of due dates, eventual late submission of tax returns, and cryptic government forms. If this point seems valuable to you, look for software that proposes such a service.

Pricing

Rare is the service that comes in useful and free of charge. Most sales tax tools come with monthly or per-transaction subscriptions. Depending on the price tag and volume of operations you’re dealing with, you want to be mindful of the budget you’ll allocate to such tools.

Counseling and support

Because dealing with one’s taxes can be so confusing with all the different regulations in place over the States, you’ll surely find it convenient to receive appropriate counseling whenever needed. Some software lets you contact actual human tax experts who will guide you through.

Others offer a knowledge database to find answers to all your burning tax questions. Some services will have the added benefit of providing excellent tax education. It will feel overwhelming, significantly closer to deadlines, to have to deal with all the different tax regulations you might encounter, mainly if you deal with multiple sales channels over numerous states. And that comes on top of accounting for sales tax and filing returns.

TaxJar Key Features

Ease Of Use

TaxJar is a very straightforward and standard option that will most likely satisfy most users. It’s best for those operating with only a few sales channels and an excellent choice for eCommerce sellers, simply because there aren’t any crazy or niche features to see here.

The interface is simple and easy to use and understand. The service is suitable for simple cases, and there are some downsides associated with that. But for the sake of being easy to get around, TaxJar is a clear winner here. The service comes with exciting features such as auto filing, sales tax reports, automated synchronization with your eCommerce store, local and state sales tax reports (although not the most up to date), and sales tax sourcing.

Accounting For Sales Tax

As previously mentioned, data entry is straightforward with TaxJar. You’ll find automated sales tax computing, recording, and porting through its AutoFile feature. The feature gathers info from all of your marketplaces at once and uses it to calculate the exact sales tax you’ll need to pay.

We must mention that TaxJar is not the most up-to-date in terms of niche and local sales tax regulations and that other services are performing better in that regard.

Paying Sales Tax

Here again, the Autofile feature makes electronic filing of your sales tax a breeze. Either way, whether you’re filing online or offline, TaxJar got you covered. Correctly set up, the service can automatize the entire process.

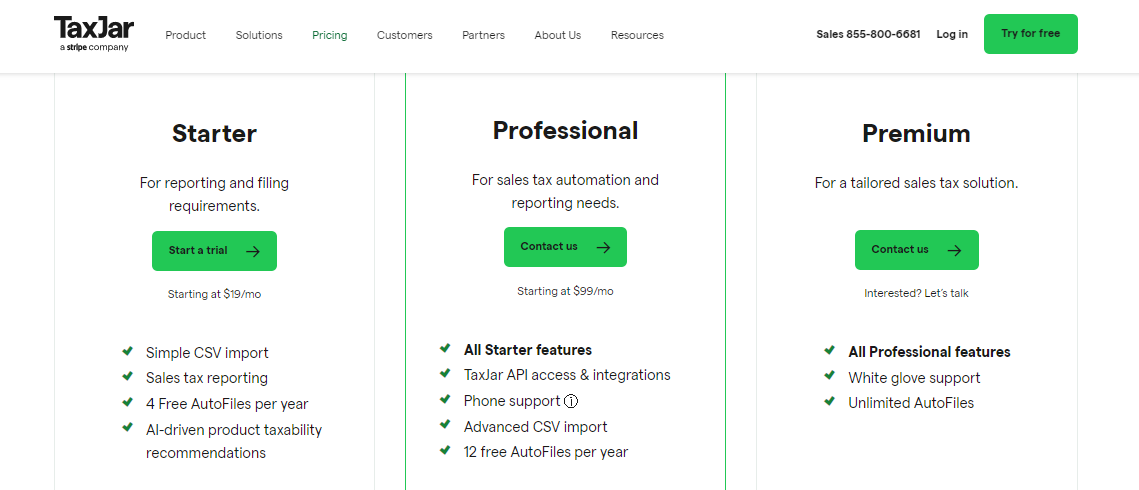

Pricing

TaxJar most likely shines through its tiny price tag. It beats most of its competition with a basic plan starting at $19 per month, while the most expensive plan sits at a still affordable $99 a month. If you’re looking for a more tailor-made solution, you can also request a personalized quote.

Counseling And Support

The information regarding laws and regulations offered by TaxJar is not the sharpest one, and you’ll have to dig a bit deeper by yourself in some niche-specific cases. For example, if the city you do business in has specific sales tax rules that are different from the state you’re in.

TaxJar support is available through live chat, email, support ticket, phone, and through a large base of online knowledge on the TaxJar website.

TaxJar Pros and Cons

Below you’ll find a rundown of the most prominent TaxJar pros and cons.

Pros

- Easy to use;

- Straightforward;

- Tiny price;

- Convenient;

- It makes dealing with sales tax a breeze.

Cons

- Not the best state sales tax registrations;

- It will feel lacklustre to those with particular sales tax management needs.

Taxify Key Features

Ease Of Use

Taxify is easy enough to use, thanks to its well-laid interface. The service appears to be a bit complicated to use, according to online reviews, and it’s not as straightforward to use as TaxJar.

On the other hand, Taxify comes with more features, more profound knowledge regarding regulations, and is generally a more complete and advanced service.

Accounting For Sales Tax

Taxify is great at keeping you up to date with current tax regulations anywhere your tax nexus may be. There offer competitive features such as relevant tax rate information, PDF filings, and payment confirmations, among many others.

Taxify allows some degree of flexibility, and this is especially useful for businesses with multiple sales channels or dealing in products and services exempt from taxes. You can edit information based on orders or edit the actual sales tax rate that is accounted for before the reports get filed. In case of discrepancies, you can directly get in there and fix those manually. On top of that, the service lets you do back filing.

Paying Sales Tax

Each state has its own rules, laws, and regulations regarding sales tax, and those might vary from one another. Cities and counties may also impose a specific sales tax and require returns. Unfortunately for you, it’s your job to make sure your business complies with everything. Fortunately for you, Taxify will help you know precisely how, where, and when to do so.

The software will also help you register with the relevant jurisdiction, as well as file and remit. It will also help simplify the various filing and payment methods.

Pricing

Taxify comes in with a steeper price; the starting plan is available at $47 per month. There is a free 30-day trial, and more advanced paid plans can be talked over a phone call with a sales rep.

Counseling And Support

Taxify gives access to its users to ready-to-print and ready-to-sign tax forms, enabling them to facilitate and streamline their tax filing and reporting obligations, which is a nice touch. Taxify goes the extra mile and does a lot to help its users. For example, the service has an eBook created solely to help Amazon sellers deal with their taxes.

Overall, Taxify proposes email, phone, live support, training, and support tickets as a way to make sure your tax problems get solved efficiently.

Taxify Pros and Cons

Below you’ll find a rundown of the most prominent TaxJar pros and cons.

Pros

- Helpful for Amazon sellers;

- Lots of customizable options;

- It simplifies the process of dealing with sales tax once correctly set up.

Cons

- A bit pricey;

- A bit complicated for some users.

Price Comparison: TaxJar vs Taxify

Overall, Taxify is a bit more expensive than TaxJar. If you’re a small to medium business looking for a simple sales tax solution and selling over only one or two channels, Taxify will probably not be worth the heftier price tag.

When comparing TaxJar and Taxify, TaxJar seems more advantageous with an entry price for the basic plan at $19 per month. On the other hand, Taxify introduces its starter plan at $47 per month, which is more than double the price of TaxJar to solve pretty much the same problem.

In the end, you’ll need to take a deep look at which specific features you need. If you do not need the more advanced features of Taxify, TaxJar is the obvious best option.

Recommended Alternatives To TaxJar And Taxify

Here are a few attractive alternatives to TaxJar and Taxify we’d recommend. Those mainly offer the same service, but with a few differences that might be more suited to your specific needs.

Avalara

Avalara is probably the most significant player here as the service has been around for a very long time. It offers a lot of information on product taxability and different rates within different jurisdictions. It also supports a selection of international fillings, including Canada and US territory islands.

The service is free up to a specific volume and offers a lot of convenient integrations with other systems. Once you start selling big, you’ll be charged per transaction as the service automatically calculates and manages taxes on every individual product on your behalf.

One big downside is that their tax system does not integrate with many eCommerce platforms like Shopify, Amazon, or BigCommerce. It definitely won’t be the best option for online sellers.

QuickBooks Online

QuickBooks Online is geared towards smaller companies. It’s a software and app that lets you manage your business’ taxes on the go. The service provides much functionality but stays easy to use in a pinch. You can control expenses, track inventory, get paid, run payroll, send invoices and manage your accounting.

It’s not only focused on handling your taxes but is more of a convenient and portable solution to keep track of your business’ treasury. Better suited for mobile entrepreneurs over huge companies. It’s a trusted service used by over 4.5 million customers so far, so you can’t go wrong with it. It comes with a free 30-day trial.

Intuit ProSeries Tax

Intuit ProSeries Tax is a web-based tax management system built to help accounting firms prepare online forms, returns, and tax filing errors through diagnostic tools.

The service is more of a tool to help accounting services make sure everything stays error-free, features tax payments, income, and expenditures tax planner, including data input assistance, missing data troubleshooting, status tracking, multi-year online documents filling, files encryption, and data import automation. Furthermore, the software provides a library of tax forms like 1040, 1041, and 1120 and allows data transfer using K-1 import.

There’s an available module to collect and organize clients’ confidential and sensitive data such as files and images. Another module allows the creation of client-specific checklists, client-specific billing options, and a wide range of other client-related analytics.

FAQs

Question: Does TaxJar have an app?

Answer: TaxJar does have a Shopify app that will integrate seamlessly with your shop. This is an excellent fit if you’re looking to handle your Shopify store’s taxes. If you’re looking for a mobile app, TaxJar does not have any, be it for Android or iOs.

Question: Does Taxify integrate with Shopify?

Answer: Taxify is an excellent opportunity to make sure you stay compliant with tax rules in all 50 states. Shopify helps you collect sales taxes, but you’re responsible for making sure you pay the exact taxes on time. Taxify integrates with your Shopify store (and most other notable eCommerce platforms) to do this for you. Taxify automatically collects your taxes and automatically files returns for you. It is elementary to connect with Shopify directly from the Taxify dashboard.

Question: How does TaxJar work?

Answer: TaxJar automatically registers your sales tax reports over all your sales channels. Once you connect your online store, the service will download its data and compile it into detailed information so you can easily file sales tax returns in the state you’re in. Furthermore, the service also works with Canadian taxes to ensure the most convenience over North America.

To Conclude

Most likely, you hate having to deal with taxes. Moving towards sales tax software will ease the pain of taxation. Those save time, are usually easy to work with, and reduce deadline and tax regulations stress. This is what is closest to hiring a real accountant, without hiring an actual accountant. TaxJar and Taxify are both excellent services in that regard, but TaxJar seems to come on top.

While Taxify is an excellent tool with many features, it’s dedicated to those with more specific needs, and the higher price tag shows. On the other hand, TaxJar will be a great first choice for most eCommerce entrepreneurs and small to medium businesses.

Some might find TaxJar lacklustre, and that’s true. It lacks deeper features and some degree of customization. But again, for most people, the features it proposes will be way more than enough, and you can hardly go wrong with its attached tiny price tag.

In short:

- If you need a more personalizable sales tax software with deeper features and can handle a lot of different sales channels at once (for a higher price), Taxify is a worthy choice.

- If you’re looking for a straightforward sales tax solution at a friendly price and you do not manage a lot of different sales channels, TaxJar is the perfect fit for you.

- NOTE: If you’re an Amazon seller, you’ll find Taxify simplifies your life in more than one aspect with lots of additional support to Amazon sellers.