Last Updated on December 8, 2023 by Ewen Finser

Whether you’re a solopreneur or heading up a small team managing an online store, there are plenty of things to do, and all too often, not enough hours in the day.

This is especially true when tax-related tasks start to overwhelm you, and you don’t have the budget for an accountant to handle them.

If you can relate, tax filing is one job busy ecommerce sellers can take off their list.

So, what is the answer?

By outsourcing it to a tool like TaxJar.

If that sounds good to you, continue reading because we’ve taken a look at this service and reviewed its relevance, features, and pricing in this article.

We have lots to cover, so let’s not hang around and dive right in!

Taxjar Review: Sales Tax Can Consume Too Much Time

When you sell taxable products, tax returns are a timeconsuming effort. For instance, if you’ve been selling things like clothing, furniture, electronics, etc., for a while, you’re likely aware of how complicated this process can be.

Sales tax is filed more frequently than income tax and isn’t regulated at a federal level. This means you need to take the time and effort to research the specific regulations imposed in the state you’re operating in.

So, why’s sales tax so complicated? Here are a few reasons:

- Depending on your state, companies need to base their sales tax on where the item was shipped from. Or, where the product is shipped to.

- Each state assigns different filing frequencies for sales tax – this could be annually, semi-annually, quarterly, monthly, etc.

- Individual states assign their own due dates for these filings

- Larger businesses may have to file sales tax in several states if their ‘sales tax nexus’ in a state is significant enough to warrant this.

- The sales tax businesses charge customers needs breaking down into specific amounts when remitting tax back to the state. This can be confusing and time consuming to understand.

- Missing a due date for filing sales tax can result in penalty fees as high as $50 in some states (even if your business has no sales tax to remit)!

- Most e-commerce platforms help businesses calculate the amount of sales tax they need to collect (sales tax collection), but won’t file sale tax on their behalf. So, sometimes confusion surfaces here as to who’s responsible for what.

As you can see, calculating sales tax is far from simple. These are just a few of the issues businesses face while handling this area of their business. So, it’s no wonder entrepreneurs across the country are trying to find a solution.

Taxjar Review: So, How Can TaxJar Help?

In short, TaxJar helps entrepreneurs streamline their sales tax processes and provides businesses with easy-to-access education on the topic.

The tool takes the arduous task of handling sales tax and transforms it into an automated and painless workflow. Namely, by helping you to file your taxes correctly and on time for the right states.

Needless to say, this saves you a lot of time. So, you and your employees can focus on more important things – like growing your business.

The tool is trusted by over 20,000 enterprises and is widely regarded as a leading solution for busy e-commerce sellers. In fact, companies such as Eventbrite, Coca Cola, and Microsoft utilize this service.

These organizations know how to do business. Period. So, what does that say about TaxJar? Well, they’re probably onto something good by adding this to their automation arsenal.

Taxjar Review: Features and Services

Now let’s look at the nitty-gritty of what Tax Jar has to offer…

Filing Capabilities

TaxJar lets users manage their sales tax filings in one of two ways:

- Manually

- Through AutoFile

If you choose to manage sales tax manually, you can connect all your sales platforms with TaxJar. Then, when the time comes to file sales tax returns, TaxJar instructs you on how to do that. It can also provide all the info you need to complete filings for each state’s e-file website. However, when you submit your sales tax returns manually, it’s your business’ responsibility to file them on time and meet all the relevant criteria.

But, if you choose to file your sales tax return using TaxJar’s AutoFile service, there’s no need to manually submit any paper or online forms. Instead, TaxJar sends the filings on behalf of your business.

The main advantage here is clear: You no longer have to worry about due dates, filing returns at multiple times, or submitting late returns.

That’s a lot less to bother with (phew!)

AutoFile is available for all US States and but there’s an additional fee to use this feature as it isn’t included in the monthly TaxJar plan. This is because businesses only use AutoFile when it’s time to submit their tax return, which occurs at different times during the year.

The AutoFile fee, when the service becomes relevant, is $25.

To enroll for AutoFile, you simply click a button under the name of your state inside of your TaxJar dashboard. This only becomes available when the submission window for that state opens.

Multi-Channel Selling

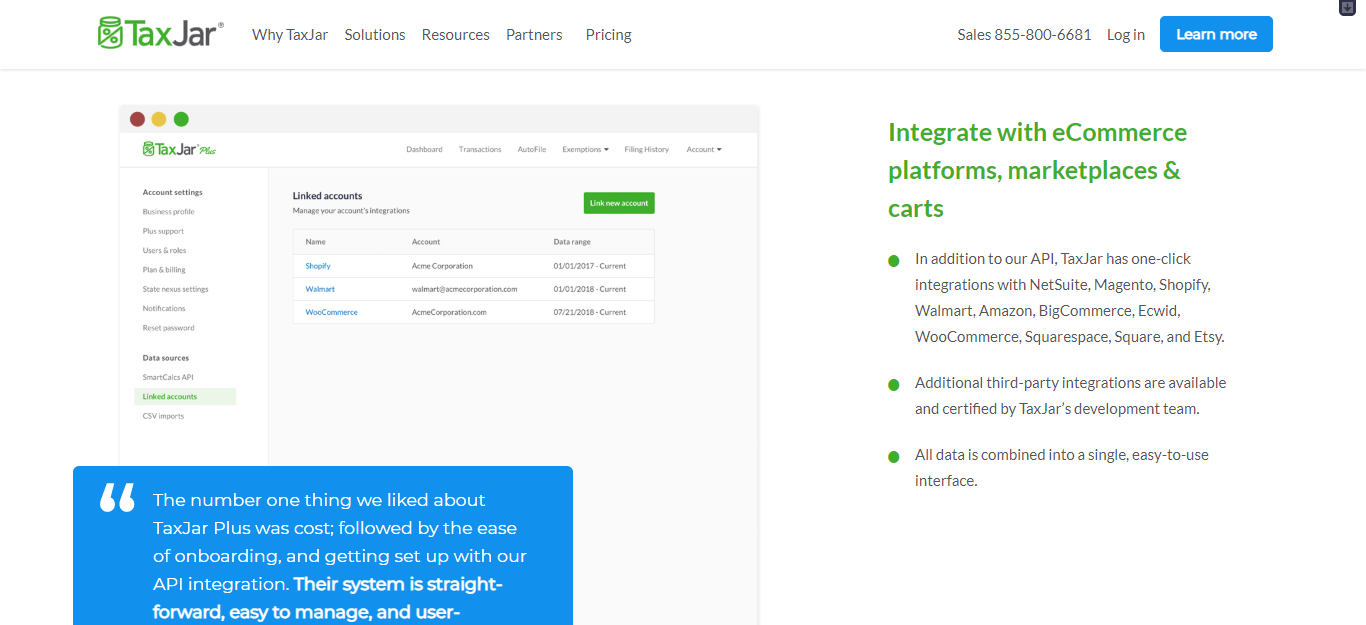

If you sell via multiple sales channels, TaxJar is a great solution for keeping everything organized and straightforward. The tool is able to compile sales data from various channels and display key metrics from one accessible dashboard. So, gone are the days where you had to painstakingly crunch numbers and transfer sales data to a single platform.

Instead, with TaxJar, you just integrate your sales platforms, and they’ll manage the data for your sales tax returns.

E-commerce platforms TaxJar integrates with, include:

- Shopify

- BigCommerce

- Magento

- Amazon Seller

- eBay

- WooCommerce

- Etsy

TaxJar Work with Your CPA

If you’re already working with a certified personal accountant (CPA), TaxJar still remains a valuable asset. Many of TaxJar’s customers work with CPAs. In fact, their services can make your CPA’s work easier by streamlining all your sales data into one location and taking care of tax submission.

Understanding Your Sales Tax

One of the main benefits of using TaxJar is that it makes taxes easier to understand.

How?

Well, TaxJar provides loads of resources to help businesses understand their sales tax, whether you’re filing manually or using TaxJar’s AutoFile service.

Knowledge is power. So, with this info at your disposal, you’ll be in a better position to make the best tax-related decisions for your business.

For your convenience, we’ve listed some of TaxJar’s most useful resources. In our opinion, these are certainly worth checking out:

- Their blog

- Their sales tax webinars

- The sales tax calculator

- The ‘Getting Started’ guides.

TaxJar also provides excellent visibility over your sales tax across several states and does a wonderful job of breaking down the different criteria each state demands.

From your TaxJar account dashboard, you can click on any state to see more info and receive a breakdown of your gross sales for the current filing period.

That’s in addition to seeing how much sales tax you’ve already collected as well as an overview of your past data. Needless to say, this comes in handy for identifying and observing trends in your business’s development.

Supported Languages

TaxJar supports English, German, and Spanish.

Integrations

Besides the popular sales channels we’ve already listed, TaxJar also integrates with different single payment processor and recurring payments options, including Square, Paypal, and Stripe.

Taxjar Review: Customer Service and Reviews

TaxJar’s customer service is highly rated, which is something the company is very proud of. They’re available by phone on their toll-free number or via email, with a promised response time of 24 hours (at the very most).

From a quick hunt around the internet, we see customer reviews commonly praise the software’s ease of use. Especially when it comes to checking sales tax and the specific states a business needs to file in.

Many also comment on how easy TaxJar makes filing tax returns and calculating sale tax without an accountant. For many users, this saves lots of time and money for an otherwise impossible task.

The software is also praised by CPAs for providing affordability, efficiency, and education alongside excellent customer service.

Not bad, right?

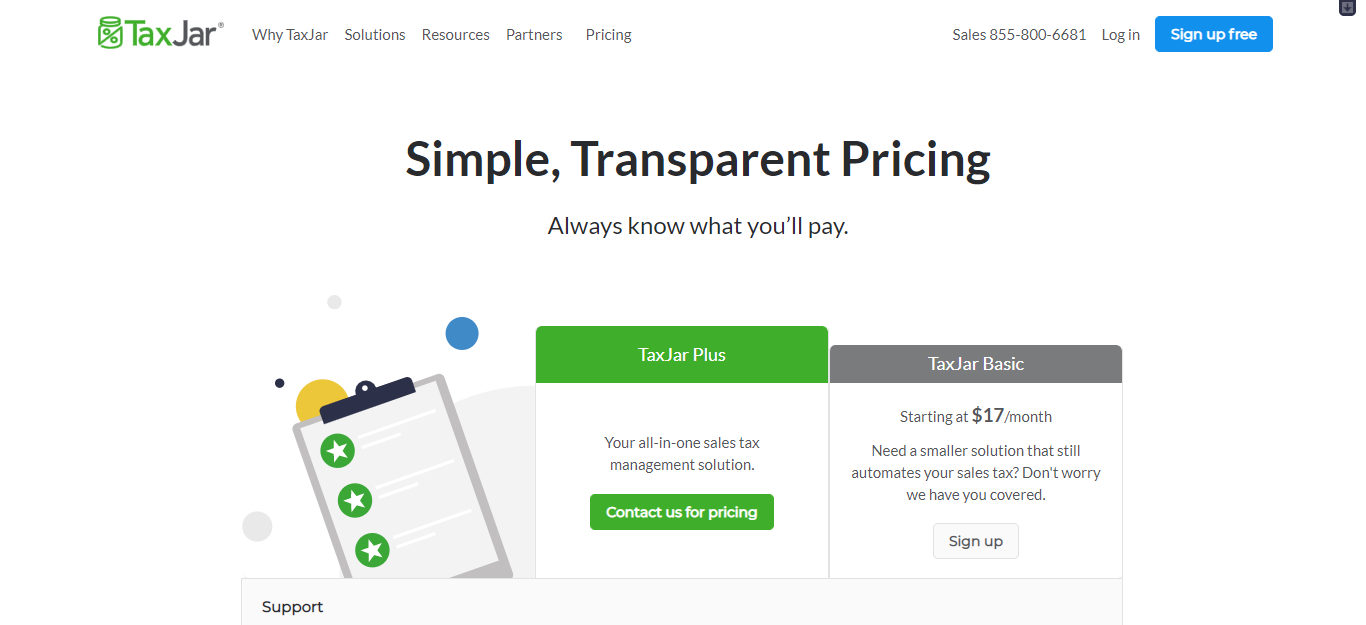

Taxjar Pricing

Basic TaxJar starts at $17 a month. This solution is aimed at smaller businesses and helps them automate the sales tax process without overstacking on features.

It includes email support (with a real human, not a bot), jurisdiction-level tax reporting, one-click eCommerce website integrations, and multi-channel ecommerce platform data aggregation.

For a custom price, TaxJar offers its Plus Plan. This includes prioritized email support, 24/7 phone support, dedicated account management, and API onboarding. You can also register multiple users on your account so that your team can access TaxJar, and assign them specific roles. That’s as well as access to real-time tax calculations, simple XLS report exporting, and advanced ERP integrations such as Netsuite and Microsoft Dynamics NAV. Furthermore, this plan unlocks technical features such as a guaranteed 99.99% uptime, address validation, and the developer sandbox.

To receive a quote for this plan, you need to contact TaxJar directly, as they tailor these plans to meet the specific needs of your business.

And as we’ve already said, auto-filing is available to monthly subscribers at $25 per filing. But, for annual subscribers, it’s $20.

Bulk discounts are also possible:

- Ten auto files: $18.75 each

- 50 auto files: $17.50

- 100 auto files: $16.25

You can also cover 45 states, assuming monthly filing, with the unlimited AutoFile Service. This works out as $9.25 per filing or $5,000 in total.

If you’re not convinced TaxJar is the right solution for you, they offer a 30-day free trial. Make the most out of this to see if these features meet your needs.

For current pricing, visit TaxJar’s pricing section on their website.

Taxjar Review: Pros and Cons

Let’s start on the brighter side by listing TaxJar’s most notable perks…

TaxJar’s Pros

- TaxJar’s AutoFile service ensures you file on time, every time, in all the necessary states.

- AutoFile is available in all US states

- TaxJar provides an easy to use dashboard that helps you understand your sales tax and calculates your returns for you

- Excellent customer service

- There’s a 30-day free trial available

- TaxJar’s website offers numerous educational tools to help you better understand their services (and sales tax in general)

- Multi-channel integrations allow you to combine all sales tax data into one place

TaxJar’s Cons

- AutoFilling is sold on a pay-per-filing basis, which can quickly become an expensive additional cost

- The software is still evolving and doesn’t always get local legislations 100% right

- TaxJar only supports sales tax filings for US customers

- The current pricing plans lack some transparency and require customers with more advanced needs to get in touch

Frequently Asked Questions

How much does TaxJar cost?

Basic Annual subscriptions start at $17 per month. Basic Monthly subscriptions start at $19 per month. Also offered are TaxJar Plus subscriptions with Premium support and features.

Does TaxJar work with Shopify?

All it takes is a single click to link up TaxJar to your Shopify account. Then it will automatically import your transactions. You only need to do this step once! Your Shopify account is now synced with TaxJar and will update on a daily basis.

Does TaxJar work with eBay?

TaxJar syncs up with your PayPal account and automatically pulls the information it needs. You don’t need to upload or download anything. eBay only allows sellers to collect one sales tax rate per state.

Should You Be Using TaxJar?

Calculating and filing sales tax is a task anyone would happily avoid, and with TaxJar, you can do so. This is an excellent tool for small and larger businesses alike, with flexible pricing options, sales tax management features, and automatic filing.

To summarize, TaxJar is a great tool if you need to file sales tax returns across multiple states for tax compliance, from numerous sales channels (marketplace settings) and want to streamline this process.

If that sounds like you, this service might save you lots of time and help you keep on track with all your submission dates and requirements. It’s also super useful if you sell in a state with notoriously complicated tax legislation such as South Carolina, Washington, or Texas.

However, if you only need to file sales taxes in a state with simple regulations, you might find after trying this process once or twice, you can do it quite quickly on your own. In this case, TaxJar might be an unnecessary tool for you once you learn how to file sales tax yourself. This is also true if you’re only using one sales channel where your sales are easily overseeable.

So, after reading this review, do you think you’ll start using TaxJar? Or, have you got any experience with this software? Either way, let us know in the comments box below. We would love to hear from you. Speak soon!

Further reading: