- Sovos vs Avalara - Bottom Line Up Front:

- Main Differences Between Sovos vs Avalara

- Recommended Buying Guidelines

- A Focus on Sovos

- The Main Features of Sovos

- The Pros of Using Sovos

- The Cons of Using Sovos

- A Focus on Avalara

- The Main Features of Avalara

- The Pros of Using Avalara

- The Cons of Using Avalara

- Other Alternatives to Sovos vs Avalara

- Vertex

- EXEMPTAX

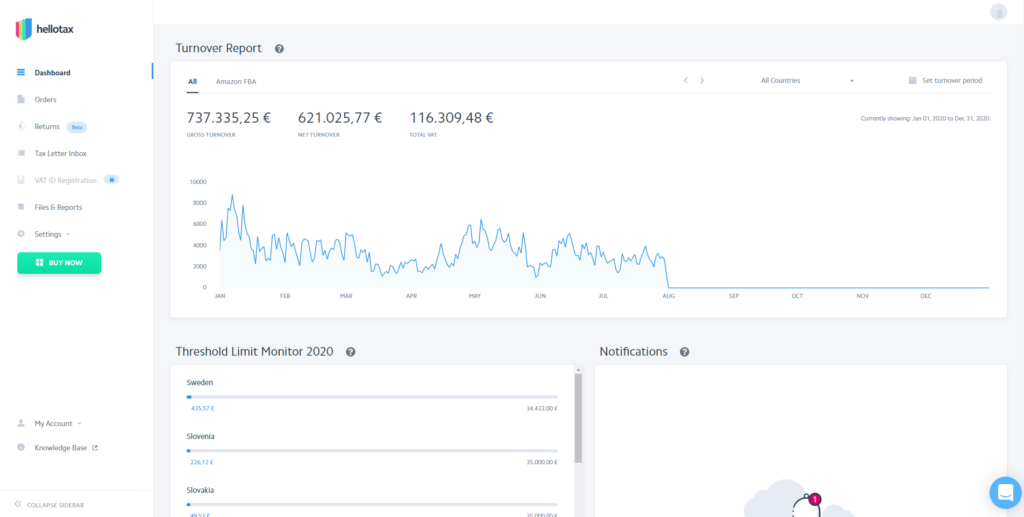

- Hellotax

- How To Ensure That You’re Using a Sales Tax Software Effectively

- FAQs

- Sovos vs Avalara - Final Thoughts

Last Updated on July 19, 2023 by Ewen Finser

As an e-commerce company grows, some businesses can find it difficult to tax their online transactions for having sales in different states. Regardless of the nature of your business, though, filling and meeting tax obligations is a tedious job. It can be challenging to keep up with sales transactions and return tax details. After all, the policies concerning tax regulations for online businesses keep on changing. The two softwares we’re discussing today, Sovos vs Avalara, can help with that.

Attaining software that helps keep up with tax regulations that regularly change isn’t just smart; it is also a means of adopting a proactive approach to help secure your business from tax penalties. A tax software comparison like Sovos vs Avalara can help you find a software that can give all the various tax rates for different states and the tax codes to be able to operate in other states lawfully.

Furthermore, businesses can be able to give proper tax returns to different jurisdictions respectively. Companies and small businesses can be guaranteed that their tax obligations are met through an automated online platform. Failure to be up to date with new tax regulations may trigger costly audits and financial penalties, something we all understandably want to avoid.

Today, I’m going to take a look into two popular sales tax software to help you determine which one is best for your business. These software’s are:

Sovos vs Avalara – Bottom Line Up Front:

This kind of software is very popular in the sales tax software industry, and both Sovos and Avalara are great products to use for meeting tax obligations. In as much as Avalara runs smoothly, though, Sovos has a competitive advantage for having a better support team that responds timely to its customers’ inquiries. The simple, easy-to-use interface also makes Sovos more user-friendly and better than Avalara.

However, if you are looking to find other alternatives to these automated sales tax software brands, here are some others that you can consider:

- Vertex (Makes complex cases easier!)

- EXEMPTAX (An affordable and user-friendly choice!)

- Hellotax (A great international option!)

Main Differences Between Sovos vs Avalara

The main differences between Sovos vs Avalara are:

- Sovos focuses on giving services to global organizations and businesses, whereas Avalara is the best for individuals and small businesses.

- Avalara allows many software integrations regarding e-commerce tools, whereas Sovos has a limited number of applications that can be integrated.

- Avalara offers a free trial plan for testing the product, whereas Sovos does not offer a free trial.

Recommended Buying Guidelines

When choosing a sales tax software, there are some details you need to consider to be able to choose the right software for your needs:

Understand the nature of your business

Every business operates uniquely internally, so identifying areas where automation is needed to improve efficiency can help give you the insights to determine which tax software is best. You’ll want to choose one that will work with the existing architecture and not replace current systems and processes.

Conduct a comprehensive assessment of existing tax software

When you better understand the needs of your business, then you’ll be able to pinpoint the specific features that are needed in the software. Evaluating various alternatives will help you choose one that is the best fit for your business.

Target market location of your business

Does the tax software cover those jurisdictions? If not, can the software be modified? These questions will help to ensure that the software chosen has up-to-date tax compliance regulations for the targeted states.

Determine the usability

Most sales tax software requires training to use its features effectively. Some have a complicated user interface, but they may offer more services and features, determining whether you may want to sacrifice extra features for a simple software design.

Consider the quality of support

Will you need interactive software that gives timely feedback? Whether you need to place inquiries via a live chat, phone call, or email, the response time may affect your productivity. Some software responds poorly to customers, for instance. Getting to know which sales tax software responds to requests promptly will impact the efficiency of your operations.

Both Sovos and Avalara meet most of these purchasing criteria. However, to determine which software best fits your business, I’ll be looking at an in-depth analysis of the specific details and features offered by both sales tax software. I’ll also weigh their pros and cons to narrow down our decision.

A Focus on Sovos

Sovos was developed to handle the digital transformation of tax and its complexities. Sovos manages to do this by integrating with governmental compliance processes. The software has also integrated with various e-commerce applications that increase its efficiency.

The Main Features of Sovos

To understand how Sovos works, here are some significant features of this software.

Provides up-to-date tax content

Sovos gives its clients a database of tax compliance regulations that allow any business to transact in any location. The feature offers accurate figures that benefit businesses in conducting the correct tax return according to different states and jurisdictions.

Automates filing taxes

An important feature that Sovos has is that it organizes your tax exemptions. Every sales transaction made is verified by the software that it does not have any errors. This feature allows one to file accurate taxes.

Sovos utilizes methods that support the Electronic Data Interchange (EDI) technology. This control of information from EDI to integration with other applications allows you to have correct tax calculations and precise tax returns.

Sovos prepares you for audit

The user interface of Sovos makes it easy to monitor different tax rates. The software prepares you by producing reports that give relevant information about all transactions made. The reports are customized according to tax jurisdictions, which means that users can check how much tax was filed for individual transactions in different states.

Data aggregation

Sovos can summarize data from different regions and sources then analyze the gathered data. This analysis includes the amount of tax filed in a state by the business. It also organizes the number of sales in different locations. In turn, business owners can be able to better distinguish which locations they can put extra focus on to achieve higher sales.

Supports integration with existing systems

Sovos allows users to connect e-commerce systems such as Enterprise Resource Planning (ERP). This allows a business to use the current systems without replacing them. Some locally used systems, such as the Point of Sale system, can be integrated with Sovos to ensure that every transaction is recorded and taxed.

The Pros of Using Sovos

- Easy collection of tax certificates. Sovos helps to collect exempted tax certificates from clients automatically. This helps to organize and present these tax exemptions to the tax department. The collection of exempted certificates saves time.

- Friendly usability. Regardless of whether you have completed the software training or not, the software’s layout makes it easy to use. Even if you don’t know how to execute a task, the comprehensive help menu assures that you can figure it out quickly.

- Easy editing of transactions. Sovos allows users to make corrections to tax after a transaction is done. For instance, if a client omits their tax exemption certificate during a transaction and later submits it, the tax charged can be edited without refunding.

- Supports crypto tax. Businesses that allow payments in the form of cryptocurrencies can be able to file their tax returns with Sovos.

The Cons of Using Sovos

- Does not offer a free trial. users have to purchase the software to get to know how it performs. This aspect could disadvantage users who are deciding on which sales tax software to settle for.

- Difficult integration. Connecting Sovos to other e-commerce sites is a long and challenging process. Also, Sovos integrates with only a few ERP systems. So if you need a robust sales tax software that integrates with many applications, Sovos will not be ideal.

- Users have to configure Sovos for use. The software requires users to input data about their products into the program to achieve accurately taxed transactions. This can be a burden to businesses with thousands of products and can take up a lot of time.

- Poor development of the software. The system’s overall performance is slow and frequently presents hiccups. However, Sovos compensates for this issue by having a fast-responding support team that ensures more efficiency in the system.

A Focus on Avalara

Avalara is a cloud-based tax compliance software that has automated the process of filing taxes for online businesses. The software supports enterprises and small businesses and delivers its services to global transactions. The software has a wide range of functionalities, and here are some of its main features to consider.

The Main Features of Avalara

- Warehouse management. Businesses with extensive inventories need to track their products during a sale and calculate tax according to where the product is going. Avalara has teamed up with leading inventory management software, such as Zoho, to help you be able to track orders and apply the correct taxing information to the sale.

- Tax management. Avalara calculates sales and applies tax to every sale made. The software automatically files taxes on behalf of its users.

- POS Invoicing. Point-of-sale systems can be integrated with Avalara to create a tax-compliant invoice in real-time. This feature makes it easy for both the client and business to distinguish how much tax is charged.

- General ledger. Avalara offers bookkeeping for financial data. Businesses can use this data to develop statistics that can influence their sales in terms of demographics.

- Comprehensive integrations. Avalara boasts of having over 700 integrations with popular accounting systems. This aspect makes Avalara versatile with how it collects information from different sources.

The Pros of Using Avalara

- Focuses on small businesses. Individuals and small enterprises receive the best service with Avalara than with other sales tax software. This is due to the software’s ability to connect with local systems such as the point-of-sale system (POS).

- Strong software. The software has been developed well enough to be fast when executing tasks. Users experience minimal system failures, making the software more efficient than its competitors.

- Certificate management. Avalara makes it easy to organize tax exemption certificates for frequent customers. The software ensures that future sales will be taxed correctly.

- Updated tax regulations. Avalara keeps itself updated on the changes often made to the tax regulations. This aspect allows businesses to have relevant and up-to-date tax filings.

The Cons of Using Avalara

- Poor support team. Avalara has a bad reputation for having poor customer service. Their responses to queries are often delayed, and most of the time, users have to solve the issue by themselves. Also, the support team is not well informed about the software.

- Unfriendly user interface. The structure design of the software makes it an unpleasant experience for new users; with this software, comprehensive training on how the software works are needed.

- Transaction editing. Avalara does not support editing of completed transactions. One has to refund the payment to update the transaction.

- Insufficient training. Avalara offers poor after-sales services. Users struggle with training since not much guidance is given by the sales team on how to use the software.

Other Alternatives to Sovos vs Avalara

While both Sovos and Avalara are great choices, they’re not the only software out there. If you’re considering other options, why not take a look at some of these brands?

Vertex

Designed for both bigger and smaller businesses, Vertex is another reliable choice for those looking for a good tax software option. Combining up-to-date tax research with state-of-the-art technology, their goal is to help improve the accuracy of your taxes and your transactions.

Pros:

- Allows for importing and exporting of data

- Can handle more complex tax cases

- Provides advance reporting options

Cons:

- Could be more user friendly

- Customer service is somewhat lacking

EXEMPTAX

For those of you looking for a cloud-based option, EXEMPTAX could be what you’re looking for. Designed to make managing your tax exemption compliance easier, they can help with the validating, renewing, collecting, and auditing process of your exemption certificates.

Pros:

- Offers fantastic customer service

- Software is surprisingly user friendly

- Affordable price point

Cons:

- Some features are not easily customizable

- Hard to set up at first

- Manual certificate uploading is pretty slow

Hellotax

As a cloud-based VAT (value-added tax) management software, Hellotax aims to make it easier for users to automate their filings and returns. With features like live data validation, improved quality control, deadline notifications, and turnover tracking, this software can be a decent choice for international sellers.

Pros:

- Handles European taxes with ease

- Extremely affordable software

- Interface is easy to learn

Cons:

- Not designed for American users

- Customer service not up to par

- Setting up can be tricky at first

How To Ensure That You’re Using a Sales Tax Software Effectively

It can be relatively challenging to shift from old conventional filing methods to an automated cloud service system to compute taxes for you. This change means the methodology of attaining accurate tax returns has to improve.

Here are some of the ways to help make sure that you get the most out of sales tax software:

- Ensure that you feed sufficient and correct transactional data to the software.

- Make it mandatory for all employees who will use the system to take the training lessons on the software.

- Push yourself to use new features found in the software that you would typically have to do manually when filing taxes. This effort could improve your productivity.

FAQs

Question: Between Sovos and Avalara, which software is better?

Answer: Both software offers relatively the same accounting services. However, despite having a poor support team, Avalara appears to have more features than Sovos.

Question: What is the main difference between Sovos and Avalara?

Answer: The main difference between Sovos and Avalara is their usability. Sovos is somewhat easier to use than Avalara.

Question: Which other apps can Sovos integrate with?

Answer: Sovos can also integrate with Salesforce sales cloud, Magento Commerce, NetSuite, and SAP HANA Cloud Platform.

Question: Who are the usual users of Avalara?

Answer: Avalara makes it easy to integrate with any existing application that can be found within a business. Because of this, small and mid-size businesses are their most typical users.

Question: Who are the usual users of Sovos?

Answer: With the limited integration with other e-commerce applications, Sovos is mainly used by global organizations and bigger enterprises.

Sovos vs Avalara – Final Thoughts

Both Sovos and Avalara offer a similar service. These two are identical in several ways, making it somewhat challenging to choose the better option. However, there are some differences in features and reliability that make both software distinguishable. If the size of your business is small, then Avalara would be a convenient option.

Sovos is preferable for larger businesses due to its fast support team and simple interface. In my opinion, for these reasons, Sovos seems to be a better alternative for having better after-sales services. Regardless of the nature of your business, though, either of the two software will help you get the job done.