- My Bottom Line Up Front

- Main Differences Between Sovos vs Vertex

- What Is Sovos?

- What Is Vertex?

- Sovos - Main Features

- Vertex - Main Features

- Sovos vs Vertex - Analytics

- Sovos vs Vertex - Integrations

- Sovos vs Vertex - Customer Support

- Sovos vs Vertex - Pricing

- Sovos vs Vertex - Alternatives

- FAQs

- Conclusion

Last Updated on April 22, 2023 by Ewen Finser

If you’re looking for a tax compliance solution, you may be wondering whether Sovos vs Vertex is the right choice for your business. Both platforms offer a range of features and benefits, and I made a side-by-side comparison to see which one is best. So if you’re looking for an e-commerce sales tax software guide, read on for my Sovos vs Vertex opinion.

My Bottom Line Up Front

I recommend Sovos for any business looking for a comprehensive tax compliance solution. It offers a complete suite of products that helps you manage your tax data in real-time.

However, if you’re only looking for tax technology to support your compliance processes, especially if you run a small business, I think Vertex is a good option. The platform has more native integrations, which makes using it a lot easier.

Main Differences Between Sovos vs Vertex

The main differences between Sovos and Vertex are:

- Sovos is a cloud-based solution, whereas Vertex is a software-as-a-service platform.

- Sovos provides a complete end-to-end solution for tax compliance, whereas Vertex focuses on providing the technology to support tax compliance.

- Sovos offers products for tax determination, reporting, and payment, whereas Vertex offers products for tax compliance, calculation, and filing.

What Is Sovos?

Sovos is a cloud-based tax compliance platform that offers real-time visibility into your tax data. The platform includes products for tax determination, reporting, and payment. Sovos also offers compliance services, such as audit defense and risk management.

Sovos integrates with ERP systems and accounting software, making it easy to get started with and use. It prides itself in serving half of the Fortune 500 companies, so you know your business is in good hands.

What Is Vertex?

Vertex is a tax compliance platform that helps businesses manage and comply with tax regulations. It offers a suite of products that includes Tax Compliance, Tax Calculation, and Tax Filing. The company was founded in 1978, and the platform is used by more than 10,000 businesses across the world.

Sovos – Main Features

Ease of Use

Sovos offers a straightforward sign-up process. You can create an account and start using the platform in minutes.

To start, I filled out a simple form with my personal and company details.

The signup process is fast, and Sovos has a user-friendly interface, making it easy to navigate and find the information you need.

End-to-End Tax Solutions

Sovos offers a comprehensive end-to-end solution for tax compliance using its Taxify software. This is a cloud-based solution, which makes it accessible from any device or computer with an internet connection. The platform provides real-time visibility into your tax data. This gives you the ability to make quick decisions and take action when needed. It also helps you stay compliant with tax regulations.

I liked that Sovos easily integrates with a lot of ERP and accounting systems, so you don’t need to install any software or hardware. This makes getting started with Sovos quick and easy.

Sales & Use Tax

The platform applies the latest regulations from over 12,000 tax jurisdictions across the U.S. and Canada, so your business stays compliant with its sales & use tax obligations.

Whether you run an online store or a physical one, Sovos will ensure your business is tax compliant. It tracks each transaction, charging the right amount of tax for each with no noticeable delays. This is useful for e-commerce stores.

The platform maintains all the exemption certificates, so you and your customers are not exploited. It also assists in correctly filing taxes collected from each tax jurisdiction, removing the manual work from the process.

Value Added Tax

The Sovos platform uses your sales data to determine all the jurisdictions you have reached VAT nexus. It also provides real-time visibility into your VAT data and helps you manage your VAT compliance processes. Sovos has helped thousands of businesses transition to the new EU VAT laws. Once you start to use the system, you will get real-time information on any updates to VAT regulations, realigning the systems to reflect any changes.

The platform also assists in correctly filing VAT taxes collected from each tax jurisdiction. The automation process ensures you hit all the tax remittance deadlines and avoid costly fines.

Shipping Compliance

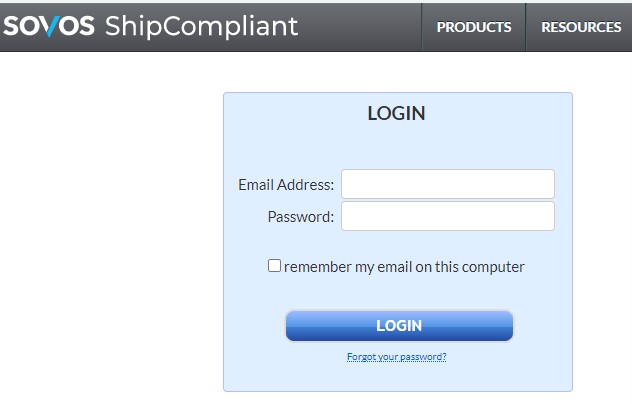

Sovos is also a great solution for shipping compliance. Its ShipCompliant software serves distributors, retailers, and importers alike. It helps businesses that transport products across all state and country borders meet all their tax obligations.

ShipCompliant provides an all-in-one solution to shipping taxes, including an efficient 3-tier reporting system for alcohol companies. ShipCompliant can be integrated with most e-commerce platforms, POS systems, and carrier platforms.

With ShipCompliant, you are guaranteed real-time data on taxes as your products travel across different jurisdictions. Tax compliance is made easy, helping you collect and remit the right amount of taxes at each turn. ShipCompliant also has a dashboard that can be easily accessed through a simple login process. Sale and tax reports are kept up-to-date and automatically filed to relevant agencies before the deadlines.

Automated Workflows

The Sovos platform includes integrated workflows to help you manage your tax compliance processes. This makes it easy to get started and keeps everything organized in one place. The workflows are customizable, so you can tailor them to fit the specific needs of your business. You can also set up alerts and notifications to ensure you never miss a deadline or an important update.

Audit Defense

In addition to the software, Sovos also provides compliance services such as audit defense. This is done through accurate recording of tax data, which is used to help businesses manage their tax risks.

The Sovos compliance team can help you with audit defense. Experts will work with you to create accurate records and documentation. They will also help you prepare for the audit so you can be confident and present your case in the best light possible.

Risk Management

Risk management is another key service that Sovos offers. The platform can help you identify and manage any tax risks your business may face. The Sovos compliance team will work with you to create a tailored risk management plan.

I liked that Sovos has a risk management portal that provides real-time information on any tax risks that may affect your business. Here, risk experts can keep track of potential risks and find ways to avoid or mitigate them.

Document Management

Sovos offers a document management system to help you keep track of all your tax-related documentation. This system is secure and easy to use, making it a great way to keep everything organized. The document management system can be accessed through the Sovos platform or the ShipCompliant software. It helps you store and manage all your relevant tax documentation in one place.

You can also track who has accessed the documents and when. This helps keep all information secure and make the tax compliance process transparent and error-free.

Vertex – Main Features

Ease of Use

The Vertex platform is designed to be easy to use, even for those who are not familiar with tax compliance. The software is intuitive and easy to navigate, so you can get up and running quickly.

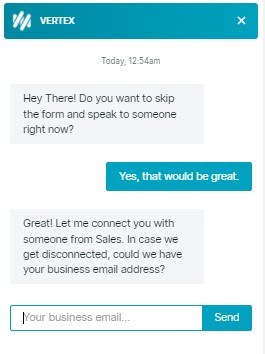

To get a Vertex account, I had to fill out a form with details about my business.

The platform also provides the option of speaking to a tax agent who will help anyone interested in the services decide if the platform is a good fit for their business.

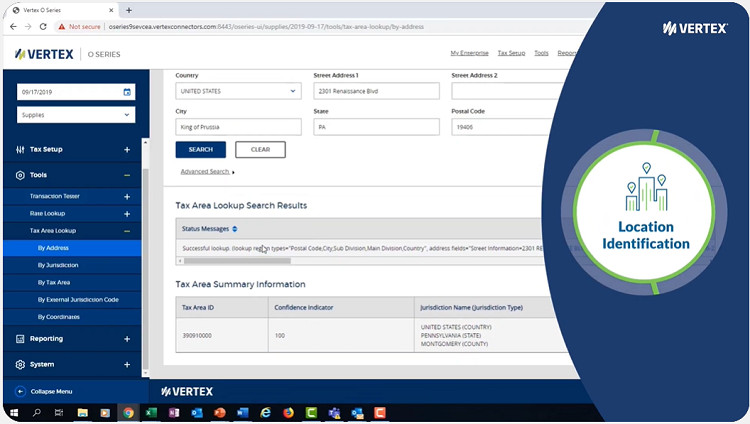

Tax Determination

Vertex provides a comprehensive tax determination solution for businesses using its Taxamo software. The software can determine the correct tax treatment for any product or transaction. The Vertex tax determination engine is constantly updated with the latest tax rates and regulations. This ensures you always have accurate information on hand.

The software can also handle multi-jurisdictional taxation. Taxamo can determine the correct tax treatment for any product or transaction, no matter how complex.

Tax Calculation

Vertex provides a powerful tax calculation engine for your business’ indirect taxes. The platform provides a multi-jurisdictional calculation solution that can handle any tax scenario. Its specialties include VAT, Sales & Use tax, Consumer Use tax, Lease Tax, and Payroll Tax. The software can combine data from multiple sources to determine the correct tax treatment for a product or transaction.

Vertex’s global tax coverage means you can rely on the software to calculate taxes beyond U.S borders. The platform is successfully used by businesses in over 70 countries, including those that transact beyond their home borders.

The tax calculation engine maintains a database with millions of tax rules covering close to 20,000 jurisdictions. The rules are constantly updated, so you always have accurate information at hand for the exact locations your business transacts in.

Vertex’s Edge computing makes it possible to calculate taxes as transactions happen. This means you can trust the system to compute the right amount of tax at the point of sale, even if your business has a complex pricing model.

Audit Support

Vertex also offers a comprehensive suite of Tax Information Reporting (TIR) solutions. The software can help you comply with all the tax information reporting requirements. The transaction and tax reports Vertex offers assist your business through the entire audit process. The software has been designed to help you quickly and easily respond to auditor requests.

You can also use Vertex’s data extraction capabilities to create ad-hoc reports for auditors.

Tax Remittance

Vertex’s compliance solutions are designed to help you automate your tax-related processes. This makes it easier for you to stay compliant and helps reduce the risk of errors. The platform’s features include a tax calendar, which helps you track filing deadlines and due dates. The software can also generate customized reports to help you track your compliance progress.

Vertex offers an e-filing solution that makes it easy to submit your tax returns electronically. The software can populate your returns with data from your Vertex account, making the process quick and easy.

Document Management

Vertex has a Certificate Center that helps you keep track of your tax exemption certificates. The software can also help you manage your W-9 forms and 1099s. The platform can provide real-time alerts when certificates or forms are about to expire. You can use the Certificates Center to automatically apply for and renew expired certificates.

Customers can create and upload exemption certificates to the Center. This creates an audit-ready database that you can easily access at any stage of the process.

Sovos vs Vertex – Analytics

Sovos

Sovos provides a customer dashboard that offers insights into your tax compliance. The software uses data analytics to help you identify risks and opportunities. The Sovos Customer Dashboard gives you visibility into your tax compliance status. It uses data analytics to help you identify risks and opportunities.

The dashboard provides insights into your business’ tax profile, compliance activity, and payments data. You can use the dashboard to spot trends and develop strategies for improving your tax compliance.

Vertex

Vertex provides a reporting solution that helps you track your tax-related data. The software can populate your reports with data from your Vertex account, making the process quick and easy.

The solution offers pre-built and customizable reports, so you can get the information you need in the format you want.

You can use the reporting solution to monitor your compliance progress and track your tax payments. The software also helps you identify audit risks and opportunities.

The Vertex Reporting Solution is a valuable tool for any business that wants to optimize its tax compliance.

Sovos vs Vertex – Integrations

Sovos

Sovos integrates with several leading ERP and accounting systems to automate your tax-related processes. Data can be easily transferred between the integrated platforms and helps reduce the risk of tax errors.

Native integrations are possible with SAP, NetSuite, and Magento. The Sovos Simple Connect API is customizable and provides a better fit for platforms that do not have native integration to the software.

Vertex

Vertex integrates with many of the leading ERP, point of sale, e-commerce, and procurement platforms.

The platform has pre-built integrations with ERP systems like SAP and Oracle, e-commerce platforms like Magento and BigCommerce, and the Intuit financial system. You can find a full list of Vertex integration partners here.

Sovos vs Vertex – Customer Support

Sovos

Sovos offers customer support via phone, email, and live chat. The type of solution offered depends on the kind of solution you get from the platform. Users can reach direct phone support in over 11 countries. Contacting the team during working hours will ensure you get faster support. I used the email option to get more information about the platform’s pricing model.

If the team is offline, you can either leave a message or fill out a form so an agent from the relevant department will contact you when they’re back online. The Sovos Portal lets users directly create cases for support and track them as Sovos agents offer support. This solution is better for users of the platform and ensures your case is dealt with more effectively.

The platform also has a Knowledge Center that you can use to find answers to your questions. I explored the various case studies and webinars designed to help users optimize the software’s functionality.

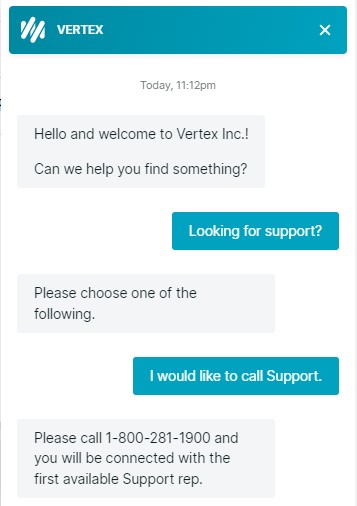

Vertex

Vertex offers various levels of customer support. A toll-free number is available for anyone interested in the company’s services. I used it to talk to an agent about the platform’s functionalities. The platform’s users can use their Vertex Community account to start cases that customer agents will deal with directly.

You can also access the platform’s knowledge base with hundreds of articles written by experts to see if you can solve any problems on your own.

Sovos vs Vertex – Pricing

Sovos

Sovos offers a subscription-based pricing model. The software is priced based on the number of entities you have under tax compliance. Coupled with this, you’re able to get a discount if you prepay for a longer-term. Sovos also offers a la carte services, so you can pay for what your company uses instead of the full range of Sovos services.

Pricing is customized for your business depending on the size and number of functions. As such, Sovos does not publicize its pricing plans.

Vertex

Vertex also offers a subscription-based pricing model. The type of services and thus amount you are charged depends on the size of your business.

The following services are tailored towards large or enterprise businesses:

- Vertex Indirect Tax O Series

- Vertex O Series Edge

- Vertex VAT Compliance

Small and medium-sized businesses can pay for the following services:

- Indirect Tax O Series

- Taxamo Assure

- Exemption Certificate Manager

- PDF Returns

- Sales & Use Tax Returns Outsourcing

Sovos vs Vertex – Alternatives

Avalara

Avalara is a cloud-based platform that helps businesses of all sizes with tax compliance. The software offers several features, such as tax automation via electronic filing, invoicing, and exemption certificate management. You can see how the platform holds up when Sovos vs. Avalara and Avalara vs. Vertex are compared.

TaxJar

TaxJar is a sales tax automation platform that offers integrations with popular eCommerce platforms, accounting software, and shopping carts. The platform serves small businesses, including freelancers.

TaxJar vs Taxify Compared shows you how the platform fares against Sovos.

Bench.co

Bench.co is an all-in-one bookkeeping service designed to automate all accounting aspects for small and medium-sized businesses. The platform also offers tax compliance and tax advisory services.

You can see how it compares to the platforms reviewed in this article in this Bench.co vs Pilot tax service comparison.

FAQs

Question: How do I cancel my Sovos or Vertex account?

Answer: Canceling your Sovos or Vertex account is easy. You can either call the company’s customer service or send an email to the support team.

Canceling an account will result in the termination of all services and support. All data will be deleted, and you will not be able to access your account.

Canceling an account may also result in a financial penalty in that you will not be refunded the subscription cost for the duration of the subscription period.

Question: Can all employees have Sovos and Vertex access?

Answer: Yes, all employees can have Sovos and Vertex access. You will need to create an account for each employee and assign them roles and permissions.

Question: What do I do if I cannot find my specific country in the list of Sovos and Vertex areas of operation?

Answer: If your country is not listed on Sovos’ website, you can email or call the customer service team for the country closest to you. You can do this even without a Sovos or Vertex account, so you can see if these platforms’ services extend to your area.

Conclusion

Both Sovos and Vertex offer comprehensive solutions for businesses of all sizes when it comes to tax compliance. Sovos is an excellent choice for businesses that need a simple, all-in-one solution. I would recommend it for big businesses and those that carry out frequent cross-border transactions.

Vertex is a good choice for businesses that need software that can be integrated with their current systems. The fact that it has solutions for small businesses makes it a winner in my eyes.