- My Bottom Line Up Front

- Main Differences between Taxjar vs Avalara

- What is Taxjar?

- What is Avalara?

- Taxjar - Main Features

- Avalara - Main Features

- Taxjar vs Avalara - Analytics

- Taxjar vs Avalara - Integrations

- Taxjar vs Avalara - Customer Support

- Taxjar vs Avalara - Pricing

- TaxJar

- Avalara

- Taxjar vs Avalara - Alternatives

- FAQs

- To Conclude…

Last Updated on April 22, 2023 by Ewen Finser

Unless you’re running an accounting or auditing business, filing tax returns is never fun. Yet, submitting the right amount of taxes at the right time is key for the longevity of your business.

TaxJar vs Avalara are two of the top software used by businesses across the world to automate their tax processes. I tested the capabilities of both of them, and I’m now ready to share my opinions on both platforms. So, how do TaxJar and Avalara compare? Which one should you pick for your business? Read on to see my recommendations.

My Bottom Line Up Front

Each of these platforms has its strengths and weaknesses. However, I find TaxJar to be a much more user-friendly platform, especially if you’re new to digital marketing. Setting up a TaxJar account is easy, and you have immediate access to your dashboard. TaxJar is also very transparent about its pricing model, which for me, makes it the winner in this comparison.

However, Avalara has a much more impressive user base, which means they are doing something right. It is more expensive to use and thus unfriendly to small and even medium-sized businesses.

Main Differences between Taxjar vs Avalara

The main differences between Taxjar vs Avalara are:

- TaxJar’s services are suitable even for freelancers and small businesses, whereas Avalara’s range of services is more suited for medium-sized and large businesses.

- TaxJar is optimized for sales tax filing and remittance, whereas Avalara can compute taxes like VAT, excise duty, and other categories.

- TaxJar has established pricing plans for all types of businesses, whereas Avalara requires most businesses to contact their agents for customized pricing plans.

- TaxJar’s filing options are included in the monthly pricing plans for all pricing plans, whereas Avalara’s tax filing is charged separately even in the base plan.

What is Taxjar?

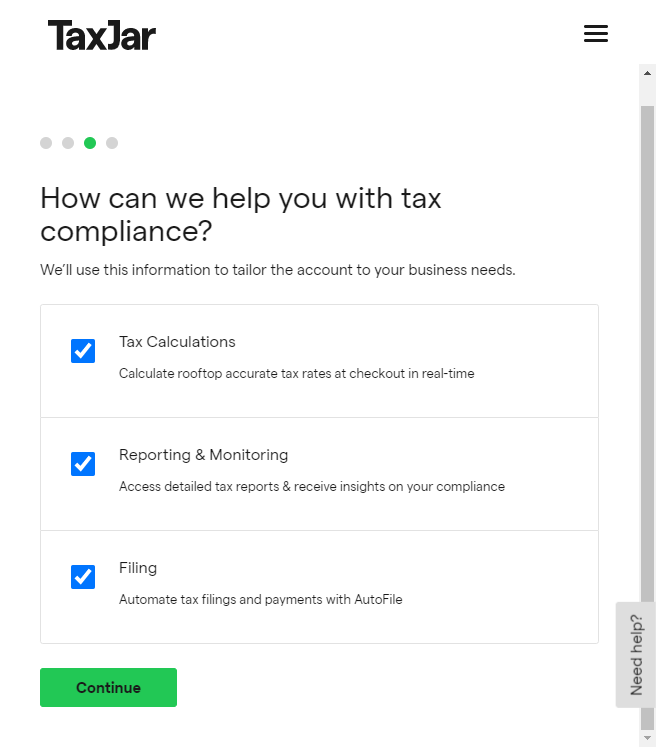

TaxJar is a software-as-a-service platform designed to calculate, track, report, and file sales tax in your online shop. The platform automates all these functions to ensure that your business is always tax compliant.

The platform functions in over 11,000 tax jurisdictions, serving thousands of small and mid-sized businesses within the US and Europe.

What is Avalara?

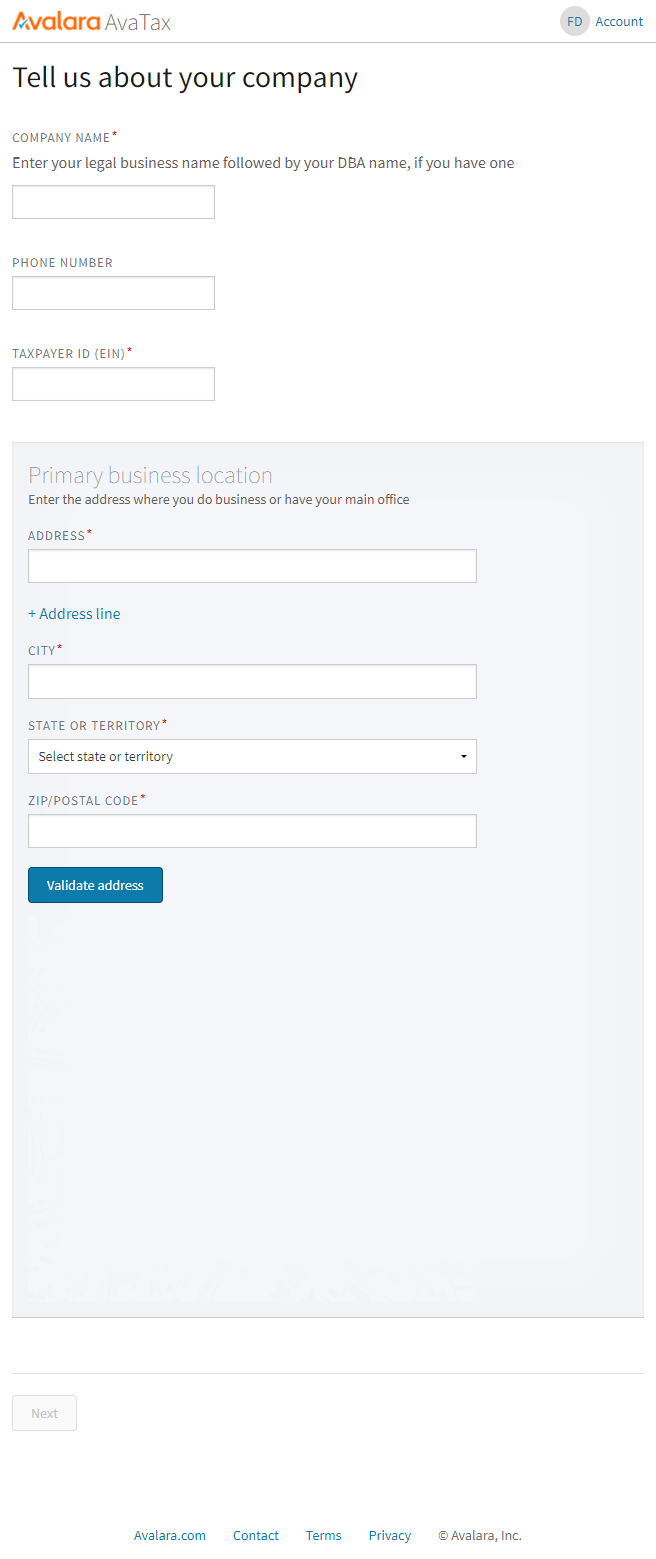

Avalara is a tax compliance software designed for small, medium, and large enterprise businesses. The platform can scale up its functionalities as your business grows to accommodate your changing needs.

Over 30,000 businesses use Avalara, including Zillow Group. The platform is functional in over 95 countries, making it useful for business owners beyond the Americas.

Taxjar – Main Features

Ease of Use

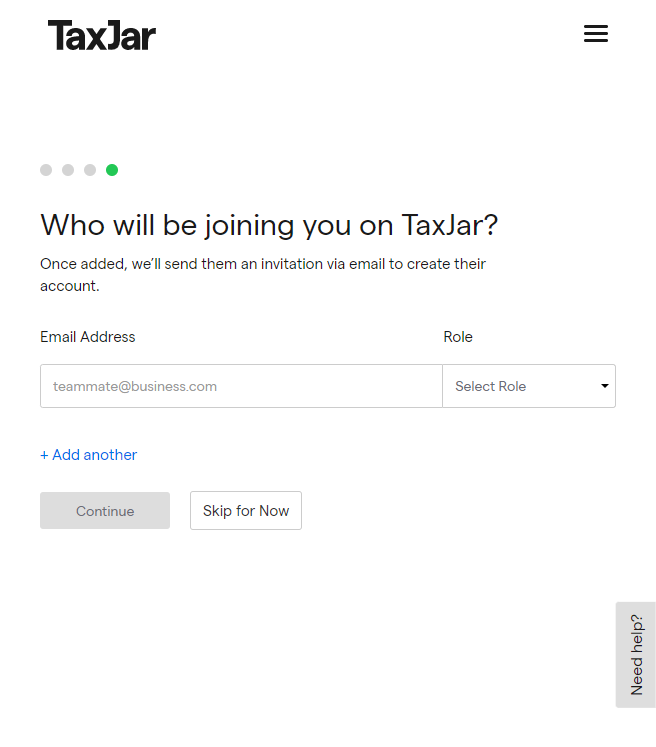

Taxjar provides a new user with prompts to help them set up their account quickly. To register an account on the platform, you will have to fill in basic information like your name, email, and password. You will then input information about your business, like the address, how many clients you have, what you need from TaxJar, and how many people will have access to the account.

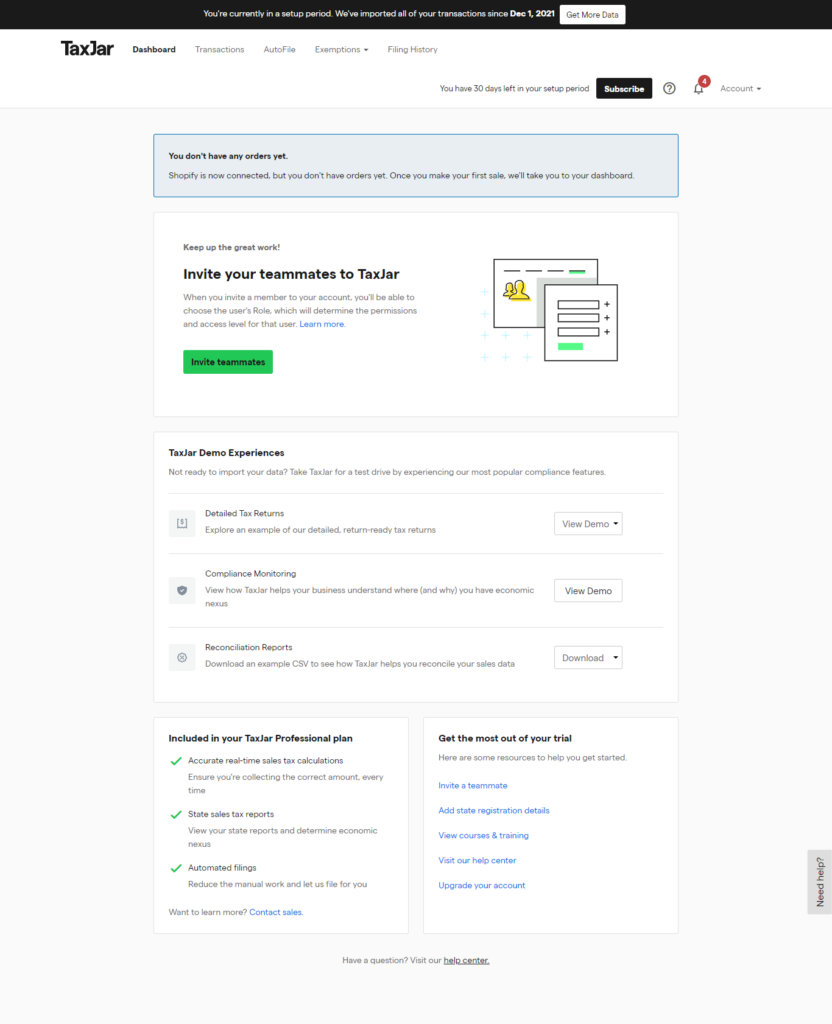

Once your account is created, you will have to connect your shop. TaxJar integrates with multiple platforms, from Amazon to Shopify to eBay to PayPal and WooCommerce. It also has an API so you can integrate it into a custom platform, and it can also be connected to the accounting software you already use in your business.

This information is needed because TaxJar needs at least 2 months’ worth of past transactions so it can calculate your tax liabilities.

Once these steps are completed, you will be led to your dashboard.

Real-Time Tax Calculations

When you run a store online, you are likely to get clients from all over the U.S., which means accurately calculating sales tax for each product in each tax jurisdiction is almost impossible.

TaxJar takes away this responsibility by accurately matching a shopper’s address to their tax jurisdiction. The tax the jurisdiction demands for a particular product is automatically added and provides the total cost the client needs to pay.

The artificial intelligence TaxJar uses also does a thorough sweep of all the products listed in your store and gives you the correct tax code for each one.

Nexus Insights

Nexus refers to the connection between a state and a business that allows taxation. While in the past, nexus was created only if a business had a physical presence, adjustments were made so that nexus is created with online businesses.

Nexus varies from jurisdiction to jurisdiction all across the US, and the rules determining it also change frequently. As a business owner, you must always be aware of the most recent regulations regarding sales tax nexus. TaxJar makes this so much easier by providing you with a dashboard where you can easily view your nexus status. You can also see when you hit the nexus thresholds for different states.

TaxJar’s nexus insights let you know when you’re close to hitting a nexus threshold so you can audit your business and see how your model can be adjusted to accommodate future sales taxes.

AutoFile

Whether you owe sales tax in one or more states, filing on time is of the utmost importance. The problem comes in when different states have different tax filing schedules, which makes it easy for you to forget your tax liabilities. TaxJar has an AutoFile feature that submits returns and remittances once they’re due. With this feature, you will never miss a due date and thus won’t be at risk of being imposed fines for lateness.

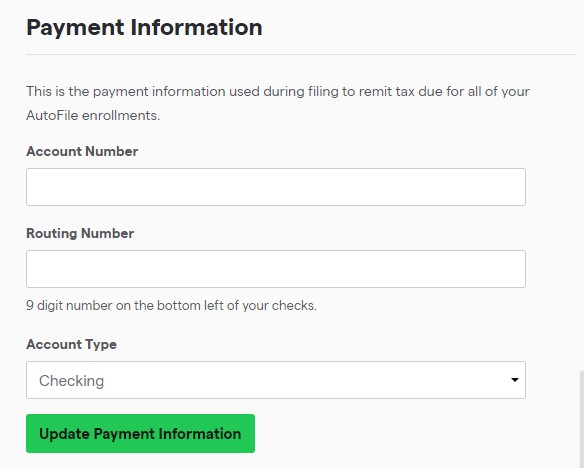

The platform even has a Filing Guarantee, reimbursing you up to 2X your subscription fee for the past year if AutoFile fails or inaccurately submits sales tax or penalties. To set up the AutoFile feature, you need to register for sales tax in the state you operate in and submit the form to TaxJar. Add your business’ bank account details so TaxJar can use it to remit all your taxes.

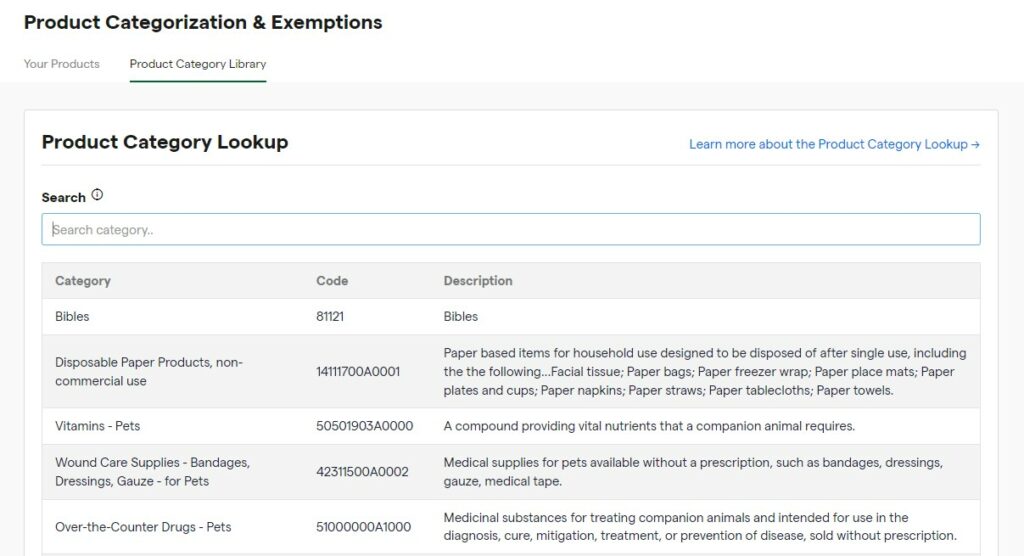

Exemptions

Among the product categories TaxJar provides includes tax-exempt product categories. You can list products like Clothing and Groceries that are subject to special tax rates or tax exemptions. You can also create a list of tax-exempt customers, for example, people making purchases for non-profit charities and religious institutions.

Users who use one of TaxJar’s supported list of platforms or the TaxJar API can categorize tax-exempt products and customers. You can access the Exemptions Tab on your TaxJar Dashboard and add information on tax-exempt customers, including their location and the exemption type they fall under.

The Products Exemption section of the platform allows you to categorize your products based on one of the hundreds of exemptions available.

Avalara – Main Features

Business Licenses

Business licenses are integral for any legal enterprise. If you are running an online shop, the process of getting the right licenses for your operations can quickly get frustrating. That’s where Avalara steps in.

By filling in a simple online questionnaire about the location and nature of your online store, the platform will let you know your obligations, e.g. personal identification information, business documentation, and license fees needed to apply for a license.

Avalara can also apply for these licenses on your behalf, and keep records so that you are reminded when you need to renew the licenses. To access this Avalara feature, you will need to fill in a simple form, upon which an agent will contact you to discuss further details.

Sales Tax Registration

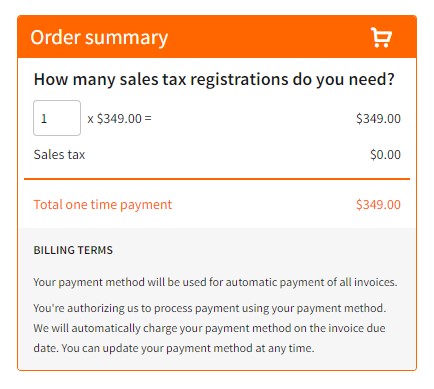

Avalara aims to be your one-stop shop for all things sales tax. Thus, the platform makes it easy for you to register for sales tax in all the jurisdictions your customers come from and where you might have sales tax obligations. You only need to fill out one form on the platform for you to be registered in multiple states. This feature is incredibly handy for US stores and should be one of the first things you set up once you sign up on Avalara.

To have Avalara register your business for sales tax in multiple jurisdictions, you will need to fill out a form and authorize payment on the platform. The form asks for card information and the name and address of the card’s owner.

You can input the number of registrations you need and the total amount will be deducted from the card once you click ‘Buy now.

Tax Rate Calculation

Avalara uses AvaTax, a cloud-based program, to automatically calculate the amount of tax levied on a product. The system uses your customer’s exact location to search and implement the latest tax laws and regulations, then adds the amount up with the product total.

This all happens quickly so you don’t need to worry that your customers will spend a lot of time at checkout even during huge sales. AvaTax can be used all across America, the UK, and Europe. It goes beyond sales tax to calculate customs and duties, VAT, GST, excise tax, Beverage Alcohol Tax, among others.

The fact that it is a cloud-based system means you can access it from anywhere and trust that you will get the right information.

Filing and Remittance

Most businesses without the capacity to run their accounting departments are often forced to outsource their tax filing and remittance to 3rd party firms. Avalara aims to save you these costs by handling these functions for you. Once you register and fill in your business information, you can access the Avalara Returns tab where you can see filing schedules for each tax jurisdiction you operate under.

Since you can connect multiple stores to Avalara, having all your tax obligations in one place makes it incredibly easy to stay on top of things. The automation capabilities that Avalara offers means you can escape the fines and penalties resulting from missing a tax deadline.

And with the platform’s scaling capabilities, you may never have to create a whole tax division once your business expands.

Certificate Management

When you run an online store, you may find that some products you sell qualify for tax exemptions, or some people who shop at your store may be tax-exempt. Such product and customer categories need certificates, and depending on the size and nature of your business, these can number well into the hundreds and thousands.

Avalara’s certificate management capabilities keep all the different certificates in one place. It makes the certificate validation process easier so customers can apply the right one when shopping. The automation feature applies the tax reduction or exemption automatically at the point of sale, which saves everyone time.

Taxjar vs Avalara – Analytics

TaxJar

TaxJar provides you with sales tax reports that update every day so you have information about your total sales and tax anytime you need it. You can easily access this information on your Reporting Dashboard, where you can see the taxes collected based on states and tax jurisdictions.

You can also download the reports into a text file for offline access and distribution to your accounting team and for filing purposes.

Avalara

Avalara provides you with reports that are updated every half-hour so you can have the most recent information at your disposal. Reports are categorized based on tax type, and there are also reports for Exemptions and Liabilities.

You can access your reports through the Transactions tab. You can also export them for offline access.

Taxjar vs Avalara – Integrations

TaxJar

You can integrate TaxJar into your business in two different ways. The first is by using the best e-commerce platform for digital products like eBay, Shopify, WooCommerce, and NetSuite. The second way is by customizing and integrating the TaxJar API into a store that is not on any of these platforms. This makes TaxJar an easy platform to use both within and outside US borders.

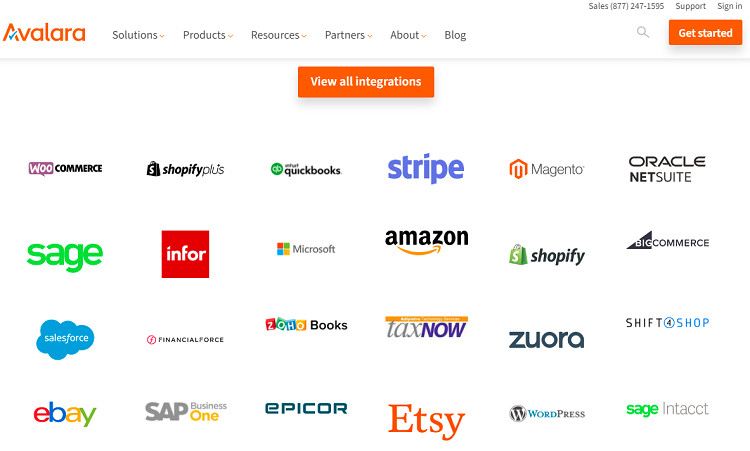

Avalara

Avalara boasts having the biggest network compared to any other tax software service. The platform has partnered with over 1,200 services and so can be easily integrated with platforms like PayPal, Xero, NetSuite, Shopify, and Etsy.

A list of all possible integrations is available so you can determine whether your platform fits. If it doesn’t, then the Avalara API gives you the power to customize the platform so that it delivers exactly what you need it to.

Taxjar vs Avalara – Customer Support

TaxJar

TaxJar offers customer support on 3 levels: first through its Knowledge Base platform where you will find hundreds of articles grouped by topic that can answer any questions you have about the platform. The second is through TaxJar Unlocked, an interactive, free platform that offers tutorials on everything from US sales tax to how to use TaxJar.

The third is through TaxJar support where you can email or speak to a customer care agent. The option of calling and speaking to customer support is, however, limited to certain paid plans.

Avalara

Avalara’s Customer Support comes in different forms. In the Help Center, you can troubleshoot your issue using the numerous blogs available. If your problem persists, then you can contact a customer care agent during business hours in U.S. Pacific Time.

Just like TaxJar, the priority you receive from the platform’s customer care depends on the plan you’re subscribed to.

Taxjar vs Avalara – Pricing

TaxJar

TaxJar offers 2 pre-built subscription plans, each with 8 tiers based on the number of orders your store processes each month. You can pay for the plans on a monthly or annual basis, with the latter costing you a bit less than the former.

The third plan, Premium, is specifically tailored to a business and requires communicating with the TaxJar team for you to get the pricing options.

Starter Plan

This plan offers you sales tax reporting and filing capabilities. Included in this plan are:

- Simple text-file imports

- Sales tax reports

- 4 free annual autofiles

- Product taxing recommendations

The following pricing tiers are available in the starter plan for monthly billing:

- Starter 200: $19

- Starter 500: $29

- Starter 1k: $49

- Starter 2.5k: $99

- Starter 5k: $149

- Starter 10k: $199

- Starter 25k: $399

- Starter 50k: $699

If you decide to go for the yearly subscription, you can expect to pay the following per tier:

- Starter 200: $205

- Starter 500: $313

- Starter 1k: $529

- Starter 2.5k: $1,069

- Starter 5k: $1,609

- Starter 10k: $2,149

- Starter 25k: $4,309

- Starter 50k: $7,549

Professional Plan

In addition to all the features in the Starter Plan, TaxJar offers the following benefits on the Pro Plan:

- TaxJar API integration

- Phone customer support for the Professional 2.5k tier and over

- Advanced CSV imports

- 12 free annual autofiles

Here’s how tiers on the Professional Plan are priced per month:

- Professional 200: $99

- Professional 500: $199

- Professional 1k: $349

- Professional 2.5k: $499

- Professional 5k: $649

- Professional 10k: $849

- Professional 25k: $1,099

- Professional 50k: $1,449

And this is the pricing for an annual subscription to the Pro Plan:

- Professional 200: $1,069

- Professional 500: $2,149

- Professional 1k: $3,769

- Professional 2.5k: $5,389

- Professional 5k: $7,009

- Professional 10k: $9,169

- Professional 25k: $11,869

- Professional 50k: $15,649

Avalara

Avalara’s pricing is calculated based on the size of your business and its scaling capabilities. This means that if you want to know what services are offered per plan, you will have to talk to an Avalara agent. If you want to explore the platform’s capabilities, you can sign up for a 60-day free trial in the Returns for Small Business plan. This gives you 5 free tax filings.

After the trial ends, the following costs apply:

- A monthly subscription fee – $19 per month.

- A filing fee – $25 for each successful tax form submitted by the platform.

Other charges on Avalara are:

- A Registration Fee – $349 for every location you want to register for tax.

- Licensing fee – $99 minimum for advice on licenses and permits.

Here are the benefit packages you can expect once you pay for plans other than the Returns for Small Business package.

Taxjar vs Avalara – Alternatives

Exemptax

Exemptax focuses on providing sales tax solutions for businesses. The platform offers you real-time tax calculations, nexus insights, and guides your customers as they use their exemption certificates.

TaxCloud

TaxCloud promises to offer you the best savings in your tax returns. The platform serves in 25 states, and its U.S-focus makes it a more appealing option for many local businesses. You can read more about it in this Top TaxJar Alternatives piece.

Vertex Inc.

When it comes to functionality, Vertex Inc. provides an almost similar feel to Avalara. With is global access and features like document management, this platform packs most of the features you want in tax software for your business.

FAQs

Question: What are the Cancellation Options for TaxJar vs Avalara?

Answer: If you’re on the 60-day free trial for Avalara, you need to provide a 30-day notice to cancel your plan. Since the Returns for Small Business plan is billed annually, you will not get a refund if you decide to cancel your subscription before the year is up.

For other plans, you cannot cancel after 60 days have elapsed so you will still have to pay any invoices that you receive. For TaxJar, you can cancel your subscription by going to the Plans & Billings tab. However, if you’re on the Professional Plan, you will need to contact customer support to finalize your cancellation. Make sure you download all your reports beforehand because you will lose access immediately after the cancellation is finalized.

Question: How Many Profiles can Access one TaxJar vs Avalara Account?

Answer: If you’re using Avalara, both CertCapture and AvaTax have the option of giving more users access to the account. In AvaTax, you can set permissions so that a user can either have full access to all aspects of the account, including multiple companies registered under it, or just one company in the account. You can also give a user read-only permissions.

TaxJar allows you 3 users on the Starter Plan and you can add their email during the account registration process.

Question: Does TaxJar or Avalara Have Mobile Apps?

Answer: No, none of the platforms has a mobile app. You can export reports to access them on the go and to share with people in your team who don’t have account access. You can find platforms with mobile apps in this Best BigCommerce Sales Tax Apps article.

To Conclude…

Depending on your business, each platform has something to offer. If your business can benefit from customized price plans and wants to use software big businesses like Zillow are using, go with Avalara. But if you’re a small business or need more transparency for budgeting purposes, go with TaxJar.

And if none of these fit your bill, see this eCommerce sales tax software guide for more options.