- Main Differences Between Sage vs QuickBooks

- Sage vs QuickBooks: Who's QuickBooks?

- Who's Sage?

- Sage vs QuickBooks: Features

- Pricing Comparison

- Sage vs QuickBooks: Customer Support

- Sage vs QuickBooks: Pros and Cons

- Types of Businesses That Use QuickBooks

- Types of Businesses That Use Sage

- Frequently Asked Questions

- Sage vs Quickbooks - Have You Found the Right Accounting Software for You?

- Further Reading on Accounting Software and Tools

Last Updated on December 8, 2023 by Ewen Finser

In our detailed comparison, we will be comparing Sage vs Quickbooks. See how these accounting software products stack up against each other

Many challenges confront you when you become a business owner. First off, you need to secure your first-ever sales. Once you’ve achieved that (congrats!), you’ll then need to start overseeing your income and expenses.

Unfortunately, handling your finances will probably be the most complicated it’s ever been.

All too often, money has a nasty habit of getting away from us. What with tax regulations and the hustle and bustle of operating your business, it can be tough to keep a clean record of all your finances. In short, collecting everything for tax purposes becomes a right hassle.

Bottom Line Up Front Summary: For most small to mid sized businesses (less than 50 employees or less than about $1.5M in receivables), I would recommend STARTING with Quickbooks here. It’s even quite capable at the enterprise-level. Plus, EVERYONE KNOWS QUICKBBOOKS! There’s plenty of CPAs and accounting specialists to pull from. However, for large enterprises, Sage does make sense here for better analytics and customization.

Main Differences Between Sage vs QuickBooks

The main differences between Sage vs QuickBooks are:

- Sage provides solutions for larger companies and enterprises, whereas QuickBooks directs its services at small business – to medium-sized businesses

- Sage’s more advanced solutions also offer functionality for HR and inventory and stock management, whereas QuickBooks is a general accounting and financing software.

- Sage appeals to specific industries including manufacturing and nonprofits, whereas QuickBooks has a separate freelancer plan for self-employed individuals that aren’t VAT registered.

- Sage has further pricing tiers depending on how many users require access to the software, whereas QuickBooks’ pricing tiers are more transparent and scale-up to multiple user access more cheaply

- Sage lets users accept payments from clients via PayPal or their built-in online payment processing system, whereas QuickBooks doesn’t offer payment processing.

More integrations with service providors and software solutions make Quickbooks an easy pick as our preffered accounting tool here. Put simply, more CPAs use Quickbooks. It's highly customizable and has the most market share (and thought share).

Larger businesses, therefore, usually work with a bookkeeper or accountant to handle this side of their enterprise.

But, if you’re a small business sorting your own finances, or a bookkeeper wanting to streamline your accounting process, consider using an enterprise resource planning (ERP) software.

This is hands down the easiest solution.

QuickBooks and Sage software are both examples of such tools. They provide all the tools you need to help streamline your bookkeeping, accounting tasks, and overall business management tasks. They also offer a clear overview of your cash flow and available finances.

They both sound great, right?

So, if you’re trying to choose between the two, you might find this review helpful. Which is best suited to your needs? Continue reading to find out exactly that.

Let’s dive straight in!

The Similarities

- Sage and QuickBooks have both been around for over two decades and enjoy a great deal of industry experience.

- Both provide entry-level accounting and financing features at an affordable price

- Free trials are available for both tools

- The core features of both pieces of software include income and expense tracking, invoice and payment management, tracking mileage and receipts, measuring time, and visualizing cash flows.

- QuickBooks and Sage offer mobile apps where users can access most of their core functions.

Now we’ve taken a quick peek at the similarities and differences between these two pieces of software, let’s take a look at both QuickBooks and Sage in more granular detail…

Sage vs QuickBooks: Who’s QuickBooks?

QuickBooks is designed by Intuit and has been around for over two decades. Over that time, it soon became the go-to service for bookkeepers and businesses to keep their finances organized. So, if you’re looking for a tried-and-proven tool, QuickBooks has undoubtedly made the rounds through the industry. It’s used worldwide by thousands of professionals.

Overall, QuickBooks is more geared towards small to medium-sized companies and is available internationally. The company has many offices dotted across the globe. It’s used by over 29 million businesses, 80% of which are small business operations in the US.

Who’s Sage?

Sage is accounting software designed to facilitate, organize, and simplify a variety of accounting-related tasks. It, too, has been around for over 20 years and has become the third-largest accounting software on the planet.

To date, Sage is used by over 6 million people, impressive, right?

Generally, the service is superb for creating financial reports, keeping records, and overall business management. It offers a solution for companies of any size or industry.

However, the more expensive (and consequently, more advanced options) of Sage’s software differ significantly from its cheaper plans. These are customized to meet the needs of larger enterprises. But, more on that in a sec.

Sage vs QuickBooks: Features

First up, let’s look at the features Sage offers…

Sage

The Mobile Accounting App

Sage’s mobile app allows subscribers to track their income and expenses, create invoices, and access information about their business while they’re on the go.

The Sage Business Cloud

Sage’s core accounting software is cloud-based, which means you can access Sage’s dashboard from any device, from anywhere.

Handy right?

So, you don’t have to be tied to your office to track and manage expenses, create and send invoices, take care of VAT, and generate cash flow forecasts and statements.

Sage50cloud Accounts also include additional functionalities for managing inventory (inventory tracking) and payments and integrates with Office 365.

Medium-sized businesses can upgrade to Sage200 to run their entire business, including finance, sales, and accounting management, all via the same cloud access. This makes it easy to use Sage’s features from any connected device. It’s also worth noting, Sage200 also comes with payroll features.

Sage200 and 300 build on the accounting feature present in Sage 50cloud. Namely, by providing more sophisticated inventory and product management tools. Plus, the user can also manage multiple companies and currencies with Sage200 and 300.

Sage Provides an Industry-Specific Service

Sage offers a decent variety of solutions for different business sizes but also several specific industries, including:

- Manufacturing

- Discrete manufacturing

- Process manufacturing

- Wholesale distribution

- Professional services

- Education

- Nonprofits

Each of the industries listed above has the accounting requirements of their own. So, Sage aims to meet these needs by providing tailored solutions.

For example, standard accounting software often doesn’t take into consideration that nonprofits need to manage funds and gifts, engage donors, and recruit networks to support their mission.

Whereas, Sage’s nonprofit plan gives them the tools they need to do precisely that. For example, active recruitment and workforce management and engagement features that go beyond the simple accounting need satisfied by Sage People.

If you’re looking for a package that focuses on financial management, Sage offers its platform Sage Intacct. Here you’ll find features such as multi-dimensional data analysis, automated workflows, multiple currencies, and core financial dashboards.

Whereas, Sage Intacct Construction includes features for AP/AR process automation. This comes in handy for increasing workflow efficiency. That’s in addition to real-time visibility and insights over the state of your finances and continuous consolidations. This makes it much easier to track the budget of your projects.

As we’ve already said, Sage also offers an ERP software solution for manufacturers. This comes with features that help businesses track quality control across all stages of manufacturing, and can be adapted to meet compliance requirements.

This program can be used to help keep costs under control and pinpoint areas where money could be saved. Other notable features include inventory management and production scheduling.

So as you can see, when it comes to Sage’s features, it all depends on the plan you subscribe to.

Sage’s plans offer loads of industry-specific solutions, which makes them a little more complicated than other service providers.

If you’re only after basic accounting features, you can rest easy knowing that Sage’s basic accounting and Sage50cloud plans (more about these in the pricing section below) include core features such as:

- Tracking expenses and income

- Managing invoices and payments

- Generating quotes and estimates

- Managing inventories

- Connecting with your online bank

All of these features are also included in Sage’s more advanced plans.

QuickBooks

QuickBooks is also designed to suit small to medium-sized businesses. However, they also provide a plan for self-employed workers to help them handle their accounting needs. This bundle includes everything you need to manage your income, expenses, and taxes with better visibility.

More features become available as you upgrade to higher pricing tiers, allowing functionality better suited to managing a larger workforce and more complex transaction journal entries.

The features of this software include:

- Tracking project profitability. You’ll enjoy a bird’s eye view of all your projects, conveniently located in one place. QuickBooks allows you to easily track labor costs, payroll, expenses, and shows how profitable a project is going to be.

- Managing bills. You can track the status of your bills, record payments, and create recurring payments. You can also pay multiple vendors (and bills) at the same time and create checks from anywhere.

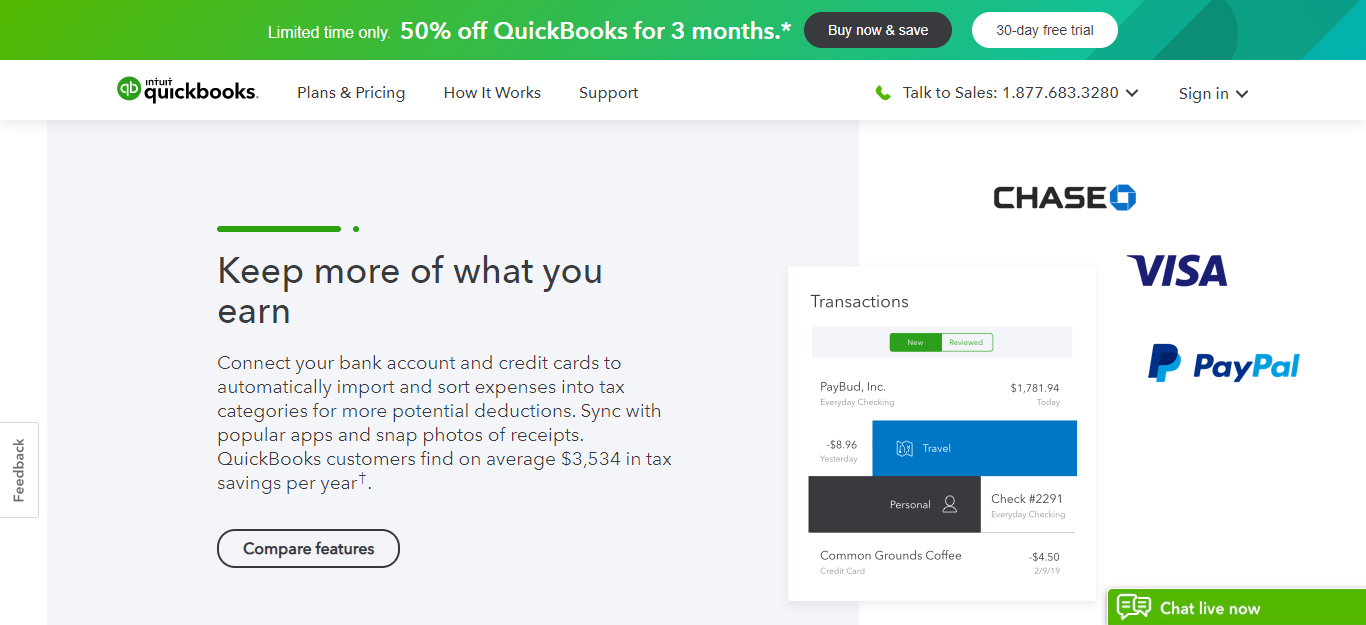

- Tracking income and expenses. You can transfer transactions from your bank account, credit cards, PayPal, and Square account, over to your QuickBooks dashboard. Just to name a few. QuickBooks can help you automatically sort transactions into tax categories.

- Categorizing and registering receipts. Snap photos of receipts and QuickBooks will automatically match them to existing expense categories.

- Managing payments and invoices. View, pay and manage invoices quickly, and send reminders to clients and customers who still owe you money.

- Managing contractors. This includes assigning vendor payments to 1099 contractors, observing who you’ve paid and when, and preparing and filing 1099 forms. You can do all this directly from QuickBooks.

- Tracking miles. QuickBooks can connect to your GPS to automatically track your miles. Easily categorize business and personal trips and get shareable reports that break down your miles driven and any potential deductions.

- Tracking employee time. Clock employee time and billable hours. You can enter them yourself or give employees protected access to enter their own hours. This is made more accessible when you integrate QuickBooks with TSheets by Quickbooks.

- Managing multiple currencies.

- Track sales and sales tax. QuickBooks can integrate with your e-commerce tools, including Shopify, to automatically calculate taxes on your invoices. You can keep sales in sync and gain an overview of the sales tax you collect and owe. QuickBooks can also integrate with a variety of CRM platforms in a similar way.

More integrations with service providors and software solutions make Quickbooks an easy pick as our preffered accounting tool here. Put simply, more CPAs use Quickbooks. It's highly customizable and has the most market share (and thought share).

There’s also the option of adding standard payroll or advanced payroll to your QuickBooks solution.

QuickBooks keeps its features simple by focusing on financial management tools for businesses and freelancers. This is partially what makes its interface so easy to use.

Self-employed individuals benefit from a more basic QuickBooks plan. This allows them to manage THEIR invoices and payments, track income and expenses, and capture and organize receipts to help with their tax returns. While limited in features, it provides all the core functionality a sole-trader needs to stay on top of their financial responsibilities.

Helpful Tutorials on QuickBooks:

Pricing Comparison

When purchasing any software for your business, you have to ensure it coincides with your budget. So, let’s explore how much both Sage and QuickBooks will set you back…

Sage Pricing

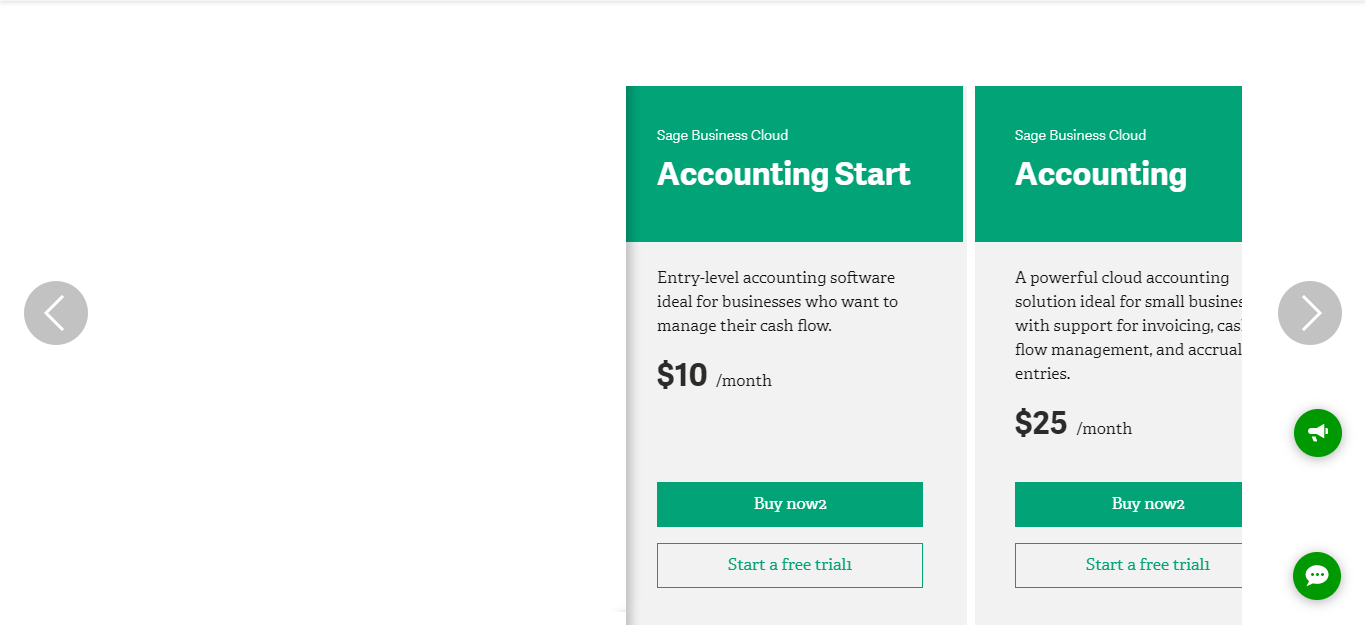

Sage Business Cloud Accounting software is available at two pricing tiers:

- Accounting Start ($10 a month): This allows you to connect your bank, track what you’re owed, and create sales invoices.

- Accounting ($25 a month): This enables you to do the above as well as act on real-time reports, generate quotes and estimates, record purchase invoices, and view cash-flow statements.

While these two packages cover more basic accounting needs, you can also purchase Sage 50cloud accounting. This is best suited for small yet well-established businesses.

Sage 50cloud accounting, offers three pricing tiers:

- Pro Accounting ($50.58 a month): You can manage expenses, pay bills, invoice customers, reconcile financials with your bank automatically, secure remote access, track and manage inventory cost jobs and integrate with Microsoft Office 365 (you can also add office for an additional $150 a year)

- Premium Accounting ($78.21 a month for one user) This offers all the above, plus you can trace transactions and access more advanced budgeting tools. Additional users cost extra. Three users can be made available at $126 a month and five users for $185.13.

- The Quantum Accounting Plan ($197.55 a month for three users): This package is ideal if you’re managing multiple companies and need to assign role-based security. It unlocks industry-specific functionality, like for construction, manufacturing, and distribution.

At an additional price, payroll functionality can be added to the software. Your quote depends on the country you live in. In the US, payroll is available as HRMS Software. If you’re interested in this service, you’ll have to contact Sage directly, as they’ll need to calculate a customized quote. Payroll pricing depends on how many employees you pay each month.

This service is terrific for simplifying payroll. It’s easy to register new employees and pay them on time based on their tracked hours and overtime each month.

Sage100cloud, Sage200 cloud, and Sage 300 cloud business management software, offers further features and tools to help you manage your business, beyond accountancy-related tasks.

They offer more ways to track sales, inventory, and manage your workers. Often, these tools work in conjunction with other software. As such, again, you’ll have to contact Sage to get a custom quote and schedule a demo to find the right solution for you. But, these services are available as monthly or annual subscriptions and start in the region of $300 a month.

QuickBooks Pricing

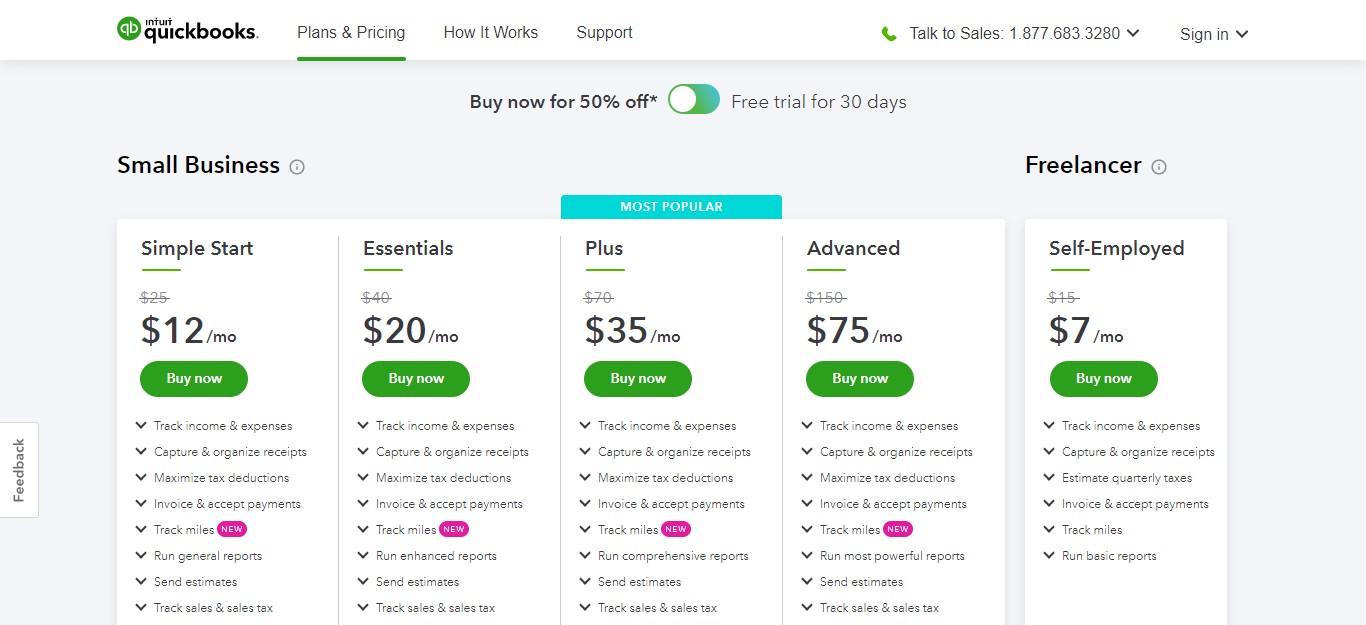

QuickBooks offers four different pricing plans and an additional self-employed plan for anyone that isn’t VAT registered. Their packages are as follows:

The Simple Start Plan for $25 a month: This comes with all the core features you need to track and manage your business’s finances. These include tracking income and expenses, maximizing tax deductions, managing invoices and payments, running reports, capturing and organizing receipts, tracking miles and sending estimates. You can also track sales and sales tax and manage 1099 contractors.

The Essentials plan for $40 a month: You’ll get everything in the previous plan, plus you can manage bills, track time, and you get access for three users.

The Plus Plan at $70 per month: This program unlocks access for five users, allows you to track project profitability and track your inventory.

The Advanced Plan for $75 a month: This entitles you to a range of additional features, including tools for managing and paying bills, viewing business analytics and insights, creating batch invoices and expenses, customizing access roles, and automating workflows.

The advanced plan also provides access for up to 25 users, and additional support in the form of a dedicated account manager. Plus, you get on-demand QuickBooks online training, and digital backups and restoration.

Freelancers who aren’t VAT-registered can get away with QuickBooks’ cheapest option – for $15 a month. This plan provides all the accounting basics, you can:

- Track income and expenses

- Capture and organize receipts

- Estimate quarterly taxes

- Invoice and accept payments

- Track miles

- Run necessary reports

Payroll Core can be added for an additional $45 a month, as well as $4 per employee. This is also upgradable to payroll premium ($75 + $8 per employee) or Payroll Elite ($125 + $10 per employee).

Sage vs QuickBooks: Customer Support

Getting to grips with new software (no matter how simple-to-use) can be daunting. That’s why customer support is so important. Let’s see how Sage and Quickbooks compare when it comes to customer care.

Sage

All Sage50 plans come with:

- Unlimited online chat support

- A knowledge resource library

- Access to an online community of peers and certified partners

- Unlimited access to North America-based phone support.

Telephone support is available from 9:00 am to 8:00 pm ET Monday-Friday. Calls may be limited to one hour or one incident.

The cheaper accounting plans have access to web-chat support and self-help documentation.

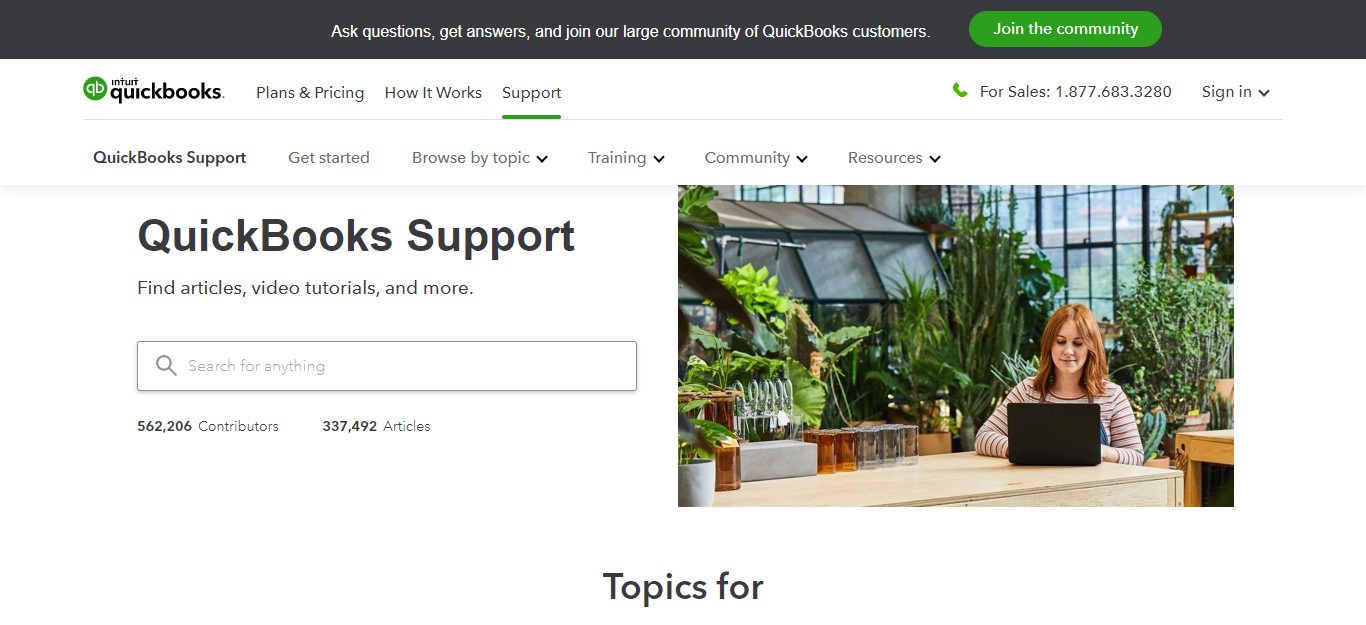

QuickBooks

All QuickBooks customers (no matter the plan they’re on) is supported with:

- Full telephone support available from 8 am – 8 pm on workdays

- An extensive library of support documents

- Tutorials, demos, and webinars for members

- Active QuickBook communities around the web

- 24/7 messaging support

Quickbooks has an extensive library of support documents. Once a member, you can contact them directly or be matched to a specialist advisor in a similar field (QuickBooks ProAdvisor). The website also provides tutorials, demos, and webinars to members, and it’s easy to find active communities of QuickBooks users across the web.

Sage vs QuickBooks: Pros and Cons

QuickBooks

First off, the advantages…

Pros:

- Quickbooks is an easy to use, affordable accounting option for small businesses

- QuickBooks gives self-employed freelancers a cheap opportunity to manage their basic accounting needs

- The price plans are transparent, and it’s easy to grant more users access to your QuickBooks account.

- QuickBooks is a popular choice for bookkeepers and accountants and can easily integrate into their client’s workflows

- There’s a 30-day free trial available

Cons:

- The software doesn’t offer functionality specific to any industry. That means, in many fields, Quickbooks will need to be used in conjunction with other software. Otherwise, there will be a massive gap in their accounting needs.

- QuickBooks doesn’t scale as effectively to larger businesses or enterprises as its competitors.

Sage Accounting Software

Again, let’s start with the perks…

Pros:

- Sage provides versatile accounting solutions for all types of businesses across multiple industries

- There are solutions including HR and team management tools

- There’s a mobile app you can download and use to manage basic expenses

- A free 30-day trial is available

Cons:

- Sage’s pricing plans are less transparent and harder to follow, as they offer several similar yet advanced products. Then they further divide their packages depending on how many users you want to register.

- Adding extra users comes at an additional price. For sage50 accounting software, more than 11 users require custom pricing over $330 per month.

- Industry-specific solutions boast a significant leap in price.

Types of Businesses That Use QuickBooks

QuickBooks tends to serve many small operations, from solopreneurs to small digital brands and brick and mortar “main street” businesses. Of course QuickBooks is expanding “up market” just like Sage (see below) is trying to expand “down market”.

Some popular categories of QuickBooks users are:

- Accounting Firms & CPA Services

- Legal Firms

- Brick & Mortar Independent Retail

- Professional Services

- Freelancers

- Self-employed

Types of Businesses That Use Sage

Sage Accounting services many mid sized enterprises and large corporate type clients. Whereas QuickBooks is far more widespread across many categories (regardless of concentrations), Sage tends to cluster more tightly around:

- Biotechnology Companies

- Publicly Traded Companies

- Construction Industry

- Franchises

- Real Estate Professional Services

- Health Technology

- Large Commercial Retail

- Nonprofits

Frequently Asked Questions

Can I get QuickBooks for free?

QuickBooks Online offers a free trial of 30 days. After the trial, you will have to pay to access the premium membership. Apart from free unlimited cloud storage, QuickBooks offers a wide range of features with its online subscription. You can download and use the desktop version of QuickBooks for free.

Does Sage have a mobile app?

Yes, there’s a mobile app you can download and use to manage basic expenses.

Will QuickBooks Online work on my Apple Mac?

Absolutely! QuickBooks Online is a full Cloud solution that can be used on any compatible browser on any computer (PC or Mac), and mobile device.

Sage vs Quickbooks – Have You Found the Right Accounting Software for You?

If you’re looking for basic accounting software to make it easier to:

- Track your income and expenses

- Manage invoices

- Stay on top of cash flow

Both QuickBooks and Sage Accounting have entry-level solutions – so, both brands have programs to suit your needs.

Where the services differ most is as they scale up to cater to more substantial and more established businesses.

Sage provides different solutions for enterprise-level companies and specific industries. However, this comes at a considerable leap in price, making it significantly more expensive than QuickBooks. As such, some of the more sophisticated features provided by Sage’s pricier plans are only warranted for larger companies. In some cases, these are most successfully used when managed by a dedicated CFO.

If you’re a smaller business and your financial needs are less specific, QuickBooks has got you and any bookkeeper you work with covered, for an affordable price. QuickBooks is also the better and cheaper option for freelancers looking to do basic income and expense management for their business.

Bottom Line Summary: For most small to mid sized businesses (less than 50 employees or less than about $1.5M in receivables), I would recommend STARTING with Quickbooks here. It’s even quite capable at the enterprise-level. Plus, EVERYONE KNOWS QUICKBBOOKS! There’s plenty of CPAs and accounting specialists to pull from. However, for large enterprises, Sage does make sense here for better analytics and customization.

It’s important to carefully evaluate your business needs as you make a decision on accounting software. Do you need specific features to support your industry? How many users would you like to register? Do you require an additional team and resource management tools? Let these answers inform your decision.

More integrations with service providors and software solutions make Quickbooks an easy pick as our preffered accounting tool here. Put simply, more CPAs use Quickbooks. It's highly customizable and has the most market share (and thought share).

Do you use either of these pieces of software? If so, we would love to hear your thoughts in the comments box below. Let’s get the conversation flowing!

Further Reading on Accounting Software and Tools

If you are still stuck deciding between Sage Accounting and Intuit QuickBooks, check out how they compare against the competition.

Compare QuickBooks vs Other Accounting & HR Tools

- QuickBooks vs Netsuite Compared

- QuickBooks vs Freshbooks Cloud Accounting

- QuickBooks vs Wave Accounting

- QuickBooks vs Bench.co Cloud Accounting & Bookkeeping

- QuickBooks vs Peachtree Bookkeeping Compared

- QuickBooks vs Bill.com Cloud Accounting

- QuickBooks vs Zoho Accounting & Project Management

- QuickBooks vs Hurdlr Compared

- QuickBooks Payroll vs Paychex Compared

- QuickBooks vs ZipBooks Compared

- QuickBooks vs Honeybook Compared

- QuickBooks vs Tally Compared

- QuickBooks vs Aplos for Nonprofits

I enjoyed reading your comparison, but still don’t know what “small to mid-size companies mean”? Does that look at the number of vendors you have? Number of Customers? Sales Dollars Annually? Employees?

I’ve clarified! It’s not a perfect science but QuickBooks tends to max capacity around 50 employees or $1-2M in receivables. At this point a more robust suite like Sage makes sense in many (but certainly not all) cases.