- What is a CRM?

- The Main Benefits of Using the Proper CRM that Suits Your Insurance Business

- How to Choose and Use the Right CRM Software for Your Insurance Agency

- Insurance Agent Challenges

- Improve ROI with a CRM

- How Does a CRM Work?

- The Best CRMs for Insurance Agents

- Velocify

- Radius

- Salesforce

- Pipedrive

- Zoho CRM

- Freshworks

- Honorable Mentions

- FAQ

- Final Thoughts

Last Updated on June 1, 2023 by Ewen Finser

As competition in the insurance market increases, you need to ensure you’re managing your clients and potential clients well. Growing your business requires a variety of different tools that can help you keep on top of things. Communication is the key to just about every successful business, so you need a CRM, or client relationship management too.

This simplifies how you manage your work process. You can keep up to date on several clients and multiple tasks at the same time. A CRM will allow you to call clients, schedule appointments, and close deals. It streamlines everything for you so you don’t miss anything. The insurance market is a very competitive one.

Therefore, insurance companies and agents must do their best to maintain themselves on top of their game. Capturing and nurturing prospects are two essential factors, especially if an insurer finds itself on the growth path. The way to achieving that goal is through effective communication. High-quality communication can only be done through the best CRM an insurance company can afford.

CRMs will also simplify the way you manage your work process. The following options are some of the best CRMs on the market for insurance agents. These systems will help you keep all your contacts organized. CRM stands for customer relationship management and there are many software alternatives out there regarding this concept.

What is a CRM?

A client relationship management tool helps you build and maintain lasting relationships with your customers. It can help retention and automate tasks that aren’t worth spending too much time on. A CRM can capture leads, manage your workflow, track activities, prioritize tasks, and so much more.

These tools are designed for companies, insurance agents, and other professionals who need help facilitating an effective workflow. It will help you convert prospects into customers and be your best friend when growing and maintaining a successful business. Some of you might already know what CRMs are and the way they work. But, I am also talking to those of you who’re new in this industry and are still figuring things out.

First of all, you should know that a CRM is a program that helps you create long-lasting and fruitful relationships with your customers as well as increase client retention. A CRM system will help you take care and organize numerous things such as activity tracking, workflow management, lead capturing, etc.

Insurance CRMs are specially created to serve both insurance agents and insurance companies. It enables them to gain more prospects and then convert those prospects into actual clients. CRMs are automated data processes that can meet a lot of requests as well as inquiries. A CRM will certainly help your business stand out and make an impact. Basically, with this software, you will see the following information and do these types of actions:

- Browsing leads details, including contact information;

- Storing leads in the form of accessible data that leads to a much more convenient follow-up;

- Knowing where one lead is currently positioned in the larger and more complex consumer buying cycle.

The Main Benefits of Using the Proper CRM that Suits Your Insurance Business

- A good CRM will help you create better relationships with your clients and prospects which further leads to increased customer satisfaction;

- It helps you better understand what your clients need and what they want from your services;

- These programs allow to improved market segmentation;

- Many CRM users have noticed that their customer retention was boosted;

- It enables speedier and more fruitful communication;

- CRMs protect your clients’ data and keep their information private.

How to Choose and Use the Right CRM Software for Your Insurance Agency

- Opt for that CRM that meets the needs of your company;

- Find and nurture prospects seamlessly. Do it all the time, even during your travels;

- Opt for a CRM with numerous functionalities; one that will help you increase your conversion rates;

- An effective CRM should feature automated lead allocation;

- Great CRMs let your business develop without making you spend a lot of money on sales and marketing. Choose an option that’s both affordable and scalable;

- Make sure that the CRM you’re about to purchase has customizable features;

- The CRM’s customer support should be quick and effective;

- With an excellent client relationship program, you will be able to sell on the go using mobile apps, keep track of all your business activities, find cross-sell and upsell opportunities, and develop the trust of your clients.

Insurance Agent Challenges

As an insurance agent, there are a number of challenges that a CRM can help to alleviate. You’ll tackle a wide variety of issues every day, so you need something that can help you solve them.

Close competition

It’s not all that rare that you receive a message from a client, and by the time you’re able to respond, they’ve already moved on to the competitor. It may have been 24 hours or less that you made them wait, but when they’re ready to pounce, they’re not going to wait that long. If there’s any delay in your response at all, they’re gone, because they have plenty of other options that are the same or better than you.

It sounds harsh, but there’s no shortage of insurance agents in your area alone. It’s not the fault of the insurance agent, but you will still have to go the extra mile to ensure that your tasks are completed on time so your business can reach its full potential. A CRM can help you maximize your workflow so you can stay on top of these tasks.

Fragmented sales process

You can always store your data in a spreadsheet or document, but this sort of fragmented data can’t aggregate your information all in one place. You don’t get a complete view of your clients or your process by doing it this way, which means you can’t analyze gaps in your current system. With a lot of information at your disposal and no way to keep it organized, you quickly lose touch with clients, find it difficult to get new ones, and you’re more prone to errors. These manual processes take too long and in the long term, they’re going to harm your business.

Inefficient workflow

Inefficient workflows are a major drawback for a lot of companies. Handling tasks manually takes up way too much time and results in low productivity. Keeping up with client communication becomes nearly impossible when you’re processing new policies, renewals, and follow-ups without any help.

Difficult lead generation

Clients tend to gravitate toward companies that have a solution they need. If the client is navigating several stages and the process to find out what you’re about seems difficult to them, they’ll abandon it faster than you realize.

Their interest in what you have to offer will ebb faster the more difficult it is. People prefer to opt for anything that’s less hassle while providing more value. Generating leads and converting them into customers requires a very quick implementation strategy.

Lack of retention

It’s discouraging not being able to retain customers, but it’s up to you to fix that. CRMs can support your entire process and help you work through inefficiencies in your current process so you can build a better one.

Improve ROI with a CRM

Overcoming these common challenges is much easier when you have the right CRM for you. Large and small businesses alike use CRMs to automate their processes, stay on top of important tasks, and improve communication. Studies show that CRM systems can increase revenue and improve productivity in a variety of ways.

They can also reduce the cost of labor and drastically improve your customer relationships, increasing satisfaction and retention. While investing in a CRM is good, investing in the right CRM for you is even better. You need data organization and client management, but your specific business may have additional, more specific needs that you need to identify.

Capturing prospects

At the very beginning of your sales funnel, you need to be capturing prospective clients so you can begin to develop a relationship. A CRM can even help you boost conversion rates by up to 300%. You need to be able to attract and convert nearly every client that crosses your path, and an intuitive system can simplify this process and make it easier on you.

Affordable and scalable

The hope is always that your business will grow beyond your wildest dreams. However, if your CRM helps you get there and then can’t keep up, it’s practically useless. An effective CRM will allow you to grow, continue to be effective at every stage, and still be affordable.

Customization and features

Go through the features and add-ons of the CRM and make sure that it includes everything you need at the price you can afford. You offer different policies than other agents, so you need to make sure you can customize the CRM to your needs. Customizing the features and interface will make it easier for you to use.

Collaborate

If you have a team, you need to work together in the space. A team inbox can help you communicate more effectively with clients, but it will also allow you to assign tasks, keep track of activities, and provide a seamless experience for your office and the client.

Mobile capability

These days, it’s more common to work outside of the office than it used to be. You need to make sure you can use your CRM from everywhere, which likely means having an app on your phone or portable device.

Upselling and cross selling

A good CRM won’t let you miss an opportunity. It will identify areas in which you can upsell or cross sell a client on an opportunity you think they need. It can increase revenue and boost growth.

Policy management

As insurance policies change, you need to be able to update them with ease. A CRM can help you ensure you don’t miss a policy, a customer, a clause, or a term. When you do make changes, you can notify the customer accordingly.

Develop trust

When you implement the use of a smart CRM, you automate processes that speak for themselves. Your clients are more likely to trust your process when they aren’t privy to gaps in the process. As long as you’re keeping your clients happy, they’re less likely to think of switching.

How Does a CRM Work?

Insurance agents have a multitude of options when it comes to CRMs. Not all CRMs are the same so, some of their functions or features may vary. Still, I was able to extract their most common functions that you will find with any program you choose to use.

a. Reports

These will help you know the number of leads your agency has sold the previous month, those leads that are moving from one disposition to the next, and the leads that just became more qualified. You must track these important metrics to know the areas that need improvement. You should run a new and updated report every week or month to see if your sales process is effective.

b. Calendar and Tasks Notifications

An effective CRM won’t just be collecting contact information but it will also send you regular appointment reminders and other notifications. This way, you can rest assured you are on the right track with your business efforts. This function is a very important one and all CRM must have it.

c. Email and Auto-responders

This is a rather complex CRM function because it comes with email capabilities. Through it, insurance agents will be able to contact their leads without even leaving the CRM program. It is a great functionality that promotes time efficiency. Auto-responders are part of the email capabilities and through them, you can schedule automated messages that will be sent to your leads based on specific conditions.

d. Commissions Tracking

More advanced CRM programs come with commission tracking which helps you track all your commissions. You can do that by assigning certain plans, premiums, or companies to a lead’s file. So, it helps with your tax liabilities. Besides that, this function is also useful when you want to discover the companies that haven’t paid commissions yet.

e. Lead Dispositions

You will soon discover that not all leads are committed to purchasing or signing the deal as soon as you ask them. This occurs because not all leads are totally honest when they say they’re not interested to purchase what you’re selling. Labeling the leads in their buying cycle will help you see the leads that are worth prioritizing and following upon.

f. Lead Routing for Agencies

This functionality isn’t as important for individual insurance agents as it is for insurance companies. From small to large insurance agencies, all these firms need lead routing because it helps them channel their leads’ flow.

g. Document Attachments

Document attachments represent a secondary functionality that might not be as essential as task reminders. However, it enables you to attach specific files to an individual case which will later help the agents keep track of personal correspondences, rate increases, and policy updates.

h. Dialing or Calling Out

These two features are normally built-in and they promote time efficiency. Agents can contact their leads and clients through the CRM program without being required to use their mobile phones. This will also help agencies save a lot of money by not needing second software such as a dialing program.

i. Workflows

This is one of the most recent features of insurance CRMs. Workflows allow insurance agents to save time by automating some of their activities based on the disposition of their leads. One example could be an introductory email that is sent to all the new leads that are included in your database.

j. Sync with Outlook and/or Google

If you ask me, this is one of the most useful features that a CRM can have. Perhaps you only want to use a certain email provider. This CRM functionality will allow you to sync the CRM program with that specific email provider. This way, you won’t have to keep switching between two different programs.

The Best CRMs for Insurance Agents

When evaluating CRM software, there are several things you should look for, including price, contact management, phone dialers and call management, policy management, workflow automation, reporting tools, system integrations, customization, and customer satisfaction.

Now, we are finally ready to move on to our main subject: the best CRMs for insurance agents. Below, I have detailed what I think are some of the most efficient and popular CRM programs that could help insurance agents and insurance companies to improve their business. You may even have additional criteria you want to make sure is included. These are the best insurance CRMs on the market.

Velocify

Pros

- It has numerous useful features and an intuitive interface;

- Many users consider Velocify a highly reliable CRM platform that’s also easy to access and use;

- The platform is useful for agencies because it keeps the employees organized and the client database updated;

- You can download customized reports to create specific documents.

Cons

- A few users complained about the fact that the interface could benefit from some updates and adjustments, saying it is a bit outdated;

- Some users consider the price for leads to be a tad high;

- It could have better dialing software.

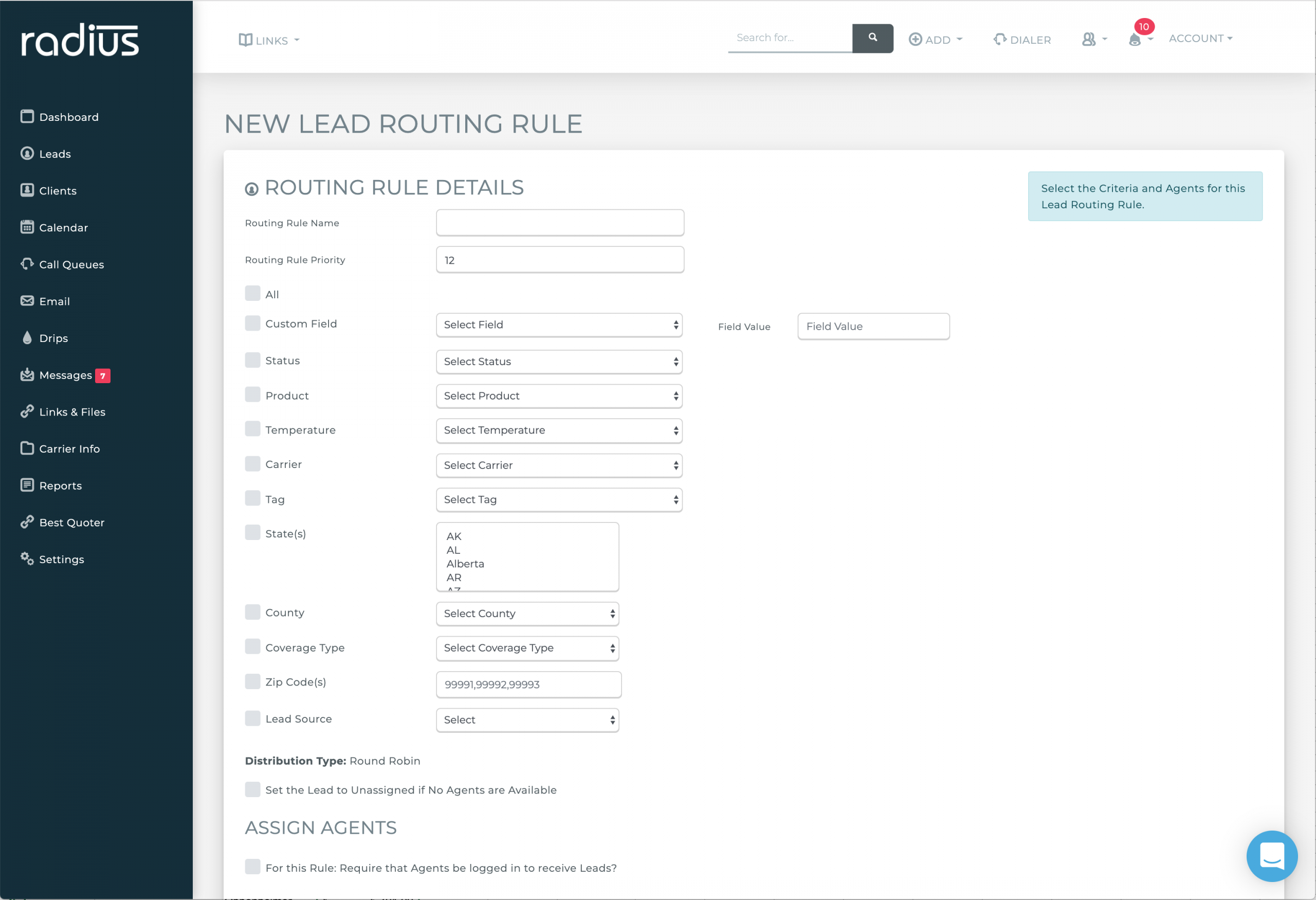

Radius

This is a cloud-based CRM solution that suits all insurance companies, regardless of their size. Radius provides clever marketing and sales strategies and functionalities like data sourcing, data management, lead scoring, and predictive intelligence. It comes with so many great features such as audience intelligence, outbound monitoring, and more.

Pros

- It has many interesting features such as marketing automation through automated workflows and email marketing;

- It will help you automate your sales through functions like lead distribution rules and quote engines;

- With this software, you will find high-quality and fruitful leads in a short period of time.

Cons

- Radius doesn’t offer leads from all over the globe. Your team will have to work if you want to expand your reach to many important hubs of the industry across the planet;

- The company’s customer service could be improved to send quicker replies.

Salesforce

Salesforce is another popular CRM that would definitely suit an insurance agency or an individual insurance agent. This platform provides a wide range of useful tools but some of them can be a tad tricky to use, especially if you haven’t worked with this kind of software before.

Pros

- Salesforce comes with many helpful and effective features that will help you boost your leads database;

- This program is complex so it can also manage large and complex businesses;

- Its lead management tools will help you create in-depth reports;

- With Salesforce, you will be able to track your agency’s social media initiatives.

Cons

- Salesforce might be too complex for some users who aren’t accustomed to this type of program;

- Some say that this program is too expensive for its value.

Pipedrive

Pipedrive is a viable CRM for your insurance company. Besides being a customer relationship management tool, Pipedrive also functions as an account-management solution. It will assist you with the whole sales process and marketing initiatives.

Pros

- Pipedrive is an intuitive platform with a user-friendly interface that’s great for beginners;

- Its workflow is deal-driven;

- It comes with great mobile apps as well as email and call synchronizations;

- It has many integrations and automation that will allow you to easily track everything.

Cons

- Pipedrive lacks social media tracking;

- It is quite pricey when you consider its limited functionality;

- This service doesn’t allow you to separate your new leads list from the contacts list.

Zoho CRM

Zoho is a very prolific CRM with an excellent product development strategy. Their team is always updating and improving Zoho’s functionalities. Moreover, they are constantly introducing new applications to make the service more useful and more effective for all the platform’s users. The Zoho CRM offers incredible custom forms.

There’s a free plan with some basic features that includes 3 users, but paid plans range in price so you can subscribe to the one that’s most affordable for you. Zoho is a CRM platform that seems to always receive at least four stars on review sites.

It isn’t perfect but it has many advantages. It’s a full-featured CRM that has plenty of built-in functionality and a constantly expanding menu of integrations, web form builders, document storage, and contact management.

There’s a phone dialer and call logging with every plan and web lead capture forms. If you need the ability to create your own forms and communicate better with your prospects, this is the best way to do it. There’s complete document control, social media engagement, deal management, and so much more. However, there’s no built-in module to handle renewals, there’s no self-service customer portal, and you can’t do any lead scoring.

Pros

- It allows numerous integrations with both Zoho programs and other independent software;

- Zoho can be easily used in insurance and many other industries due to its extensive customization features;

- This platform comes with very good email marketing tools;

- Users can extract comprehensive reports from Zoho.

Cons

- You can access the workflow automation feature only if you subscribe to Zoho’s Professional Plan;

- Some users have said that the program’s voice assistant might not be up to standard;

- The customer support is quite limited.

Freshworks

If you’re looking for the next generation of CRM platforms, Freshworks might be the answer. It delivers personalized experiences and offers many useful sales and marketing tools. This CRM is powered by artificial intelligence. It allows marketing specialists and sales teams to understand their customers’ needs and insights.

Formerly Freshsales, this CRM recently rebranded and upped their offering. They have a free forever plan, 24/7 support, live chat, and mobile apps.

The Freshsales CRM features flexible lead and opportunity tracking and contact management. You can customize both to your agency’s needs. Lead scoring is available on all plans, there’s a built-in phone dialer, and email tracking is included on all paid plans.

This is a great, inexpensive solution for business who need to manage their contacts and deal flow. The platform is user friendly and incredibly customizable. There are web-to-lead forms, deal tracking, and much more. What you’ll miss are pricing books, issuing quotes, and sending invoices.

Pros

- With this program, your CRM initiatives, as well as the entire CRM process, will be simplified in numerous ways;

- Its artificial intelligence assistant is proactive;

- This platform comes with great workflow automation capabilities;

- There are several built-in communication channels.

Cons

- If you’re a member of the Free plan, you won’t have access to reports;

- The lack of lead generation tools is definitely a disadvantage;

- Some users say that they had a hard time trying to decide which plan might suit them the best.

Honorable Mentions

insure.io

This CRM is arguably the best overall insurance CRM. It offers four paid plans, so it will grow with you and as you can afford it. Its focus is serving individual insurance agents as well as large agencies. It offers the ability to view contact and policy information at a glance to simplify your entire process.

It also features e-applications and e-signatures so you can reduce the physical paperwork in your office. Every plan they offer includes social media integrations on all plans, making social media management for your business easy. You can also click to call or text message as a basic feature on every plan.

Unfortunately, there’s no free version and it’s specifically built for life insurance, so if you offer other types of insurance, it may not be a good fit. Marketing is only available on the most expensive plan, making it difficult to promote smaller agencies.

Radiusbob

Radiusbob is a great CRM option for commission and overrides. It’s slightly more expensive than Insure.io and they charge per user, which makes it less accessible to some. However, it offers a VoIP and call center that can help a larger team manage client support.

With Radiusbob, you can have unlimited leads and clients, making it an ideal solution for increased growth. Enjoy click to call and auto preview dialer along with tracking errors and omissions and managing commissions and overrides.

There are also a wide variety of third-party integrations, so if you’re currently using other systems, you’ll experience a smoother transition. Integrations include Ninja Quoter, HealthPlanOne, Benepath, Outlook, and Gmail. Some downsides include the lack of a free version, no email tracking, and it doesn’t offer specific e-signature capabilities. While the tool is good for predictive marketing, their customer service team is unresponsive at times.

Less Annoying CRM

This cleverly named CRM is great for organizing policies, which is something every insurance agent needs. The straightforward pricing makes it easy to understand how much you’ll pay, even as you grow. You can track insurance policy applications, track renewal dates, and store group plan details seamlessly. It offers unlimited customizable fields and free customer support. You can easily track new prospects, applications, and existing policies.

This is a great solution if you need a simple user interface and a low entry price point. You don’t have to sift through which tier to use. All features are available all the time, and you pay per user. The streamlined organization ensures that nothing falls through the cracks. Downsides include a lack of email integrations, no built-in calling feature, and no workflow automation.

HubSpot CRM

If your agency needs help converting website traffic, this is the best way to do it. Even better, there’s a plan that’s free forever. However, if you need advanced features like sales, paid marketing, and service hubs, it can get quite pricey. HubSpot can help you manage your pipeline with ease and convert website traffic more quickly than you could without a system in place.

There’s email tracking, live chat for your prospects and customers, and lead capture from website activity. You’ll also get scheduling tools, a built-in phone dialer, email templates, and contact management. It’s one of the more comprehensive tools on the market. What it doesn’t include are advanced reporting features. You’re also limited to tracking 200 emails per month on the free plan.

FAQ

If you’re looking for a CRM for your agency, there are a lot to choose from. You need the one that works best for you, but it can be tough to sift through the options.

Question: Why Do Insurance Companies Need a CRM Program?

Answer: It is a highly competitive market and everyone is fighting to gain as many clients as possible. So, if you automate most of your client relationship processes, your company will have a lot to gain. It’s also useful for those businesses that have fragmented sales processes. A good CRM will make your workflow more efficient and simplify lead generation.

Question: What Are the Main CRM Strategies in the Insurance Sector?

Answer: You can use your CRM to increase profits and lower costs by: • Transforming your sales force and make sure it is adapted to your clients’ needs; • Automate mobile sales and make your services readily available; • Monitor your social media presence.

Question: How Can You Get Clients as an Insurance Agent?

Answer:

• Find your niche – know the industry’s risks and gain a competitive advantage over the other insurance agencies. • Earn referrals and develop the appropriate policies for your prospects;

• Try networking in your community – attend trade shows, charity events, and local fairs. Make sure your reputation is bulletproof;

• Prospect every single day – generate leads, call business owners, read the local paper, etc.;

• Collaborate with other professionals such as accountants, real estate agents, and financial planners.

Question: What is the best CRM for small businesses?

Answer: Some insurance agents run small businesses and are in need of CRMs that fit their model. Two of the best are HubSpot and Insightly. They are dynamic, but simple, and can help you increase your productivity in their own ways. Look into the features and pricing to see which will work best for you.

Question: What is the simplest CRM?

Answer: Often, it takes time to set up and customize a CRM. It needs to be simple so it doesn’t take you away from your business. The simplest CRMs on the market includ Zoho, Nimble, Hatchbuck, Insightly, and Bullhorn. However, they’re not all built for insurance agents, so make sure they have the features you need before subscribing.

Question: Does Google have a CRM product?

Answer: Google does not currently have a CRM tool as part of the Workspace platform. However, there are quite a few CRM software options that integrate easily with Gmail to track conversations as well as with Docs and Sheets so you can manage your document tracking.

Final Thoughts

Whether you have an insurance agency or you’re an independent insurance agent, working with the proper CRM program will help you keep track of all your leads. This is essential for any insurance business. I truly hope that today’s article has given you many helpful insights.

Every insurance agent can benefit from the use of an intuitive and flexible CRM. This list includes some of the best, with the most logical option being Insure.io. However, there are other CRMs that have free trials, more robust features, and other tools you may need.

Having a solution to your problem is beneficial to your business and your clients. It’s critical that you evaluate each CRM and find the one that meets your needs.

Now, you know what to look for when searching for the right CRM for your business and you also know some of the best players on the market.