Last Updated on April 22, 2023 by Ewen Finser

In Quickbooks, bad debt is what happens when a customer owes you money that you can’t collect. If you know you’re not going to get paid, you can sometimes write off this debt as a deduction (if your business uses accrual method accounting).

Writing off bad debt in Quickbooks will keep your income up-to-date. If you have an uncollectible customer invoice, it means you will be overstating the number of customer invoices, and you may end up paying more in tax than you should be. You may be able to claim this back in later years if you don’t manage to write it off right away, but that can be a more complex process.

It’s important to go through this process rather than just deleting the invoice. When it comes to record-keeping for the IRS, you need to be as transparent as possible. You’ll also need to show that you took all reasonable steps to retrieve payments from customers or clients.

Luckily, you can write off bad debt in Quickbooks. It’s pretty easy to do, although it does involve a few steps. Make sure that you take the time to follow each step correctly, as you’ll need to go through it in the correct order.

6 Steps to Writing off Bad Debt in Quickbooks

Here are the steps you need to follow to write off bad debt in Quickbooks:

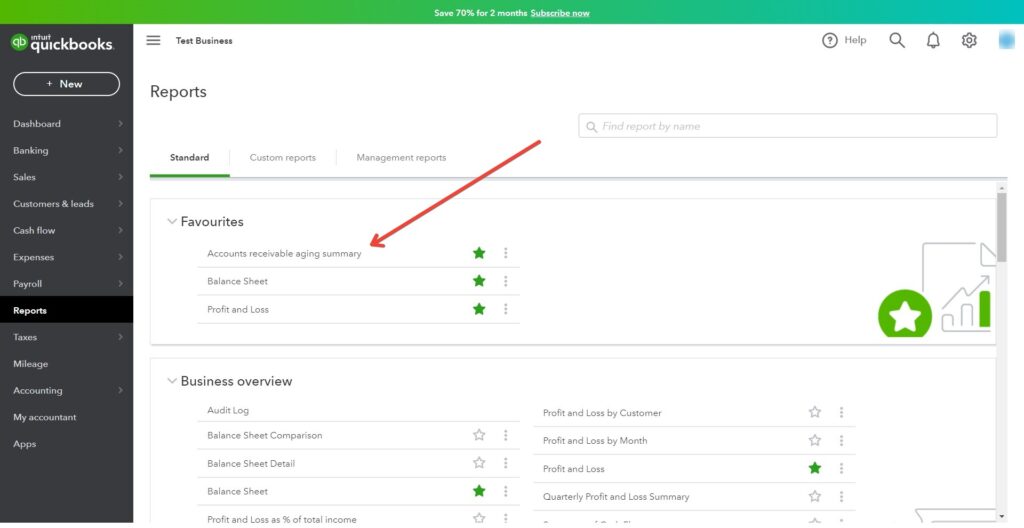

1. Run an Ageing Accounts Receivable Report

You can do this by going to Reports, then clicking on ‘Accounts Receivable Ageing Detail report.’ This should show invoices or receivables that can be considered as bad debt.

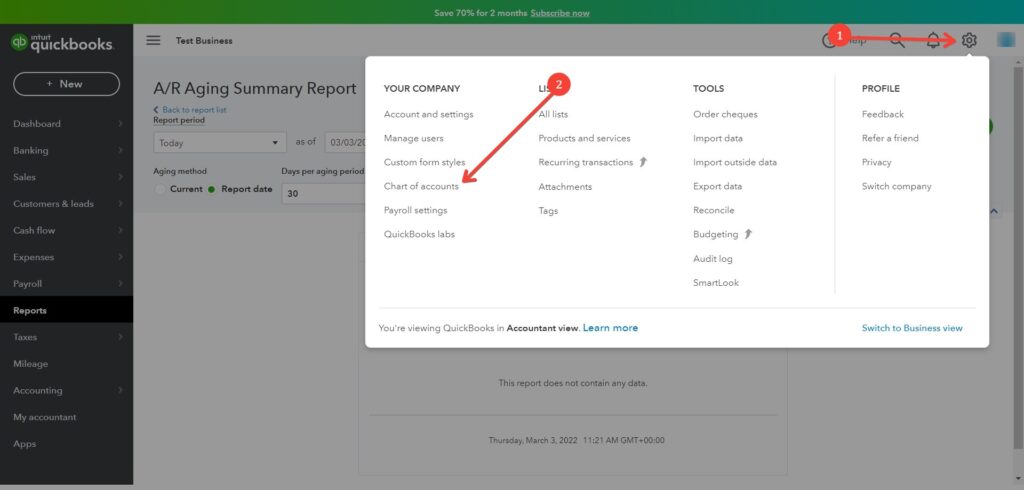

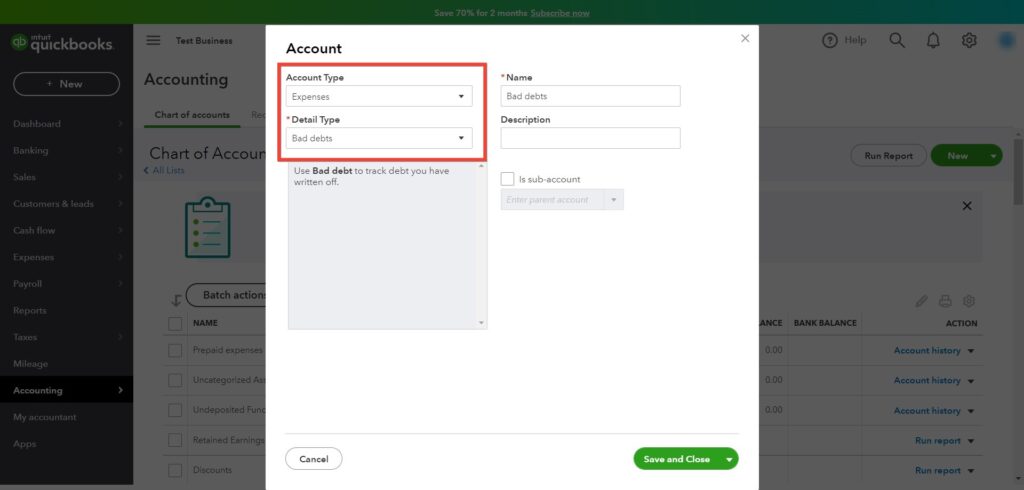

2. Create a Bad Debts Expense Account

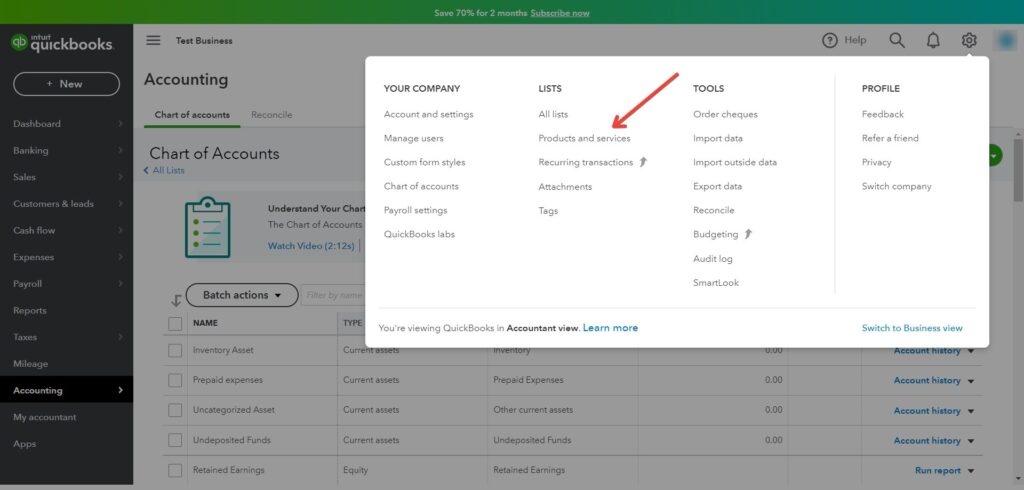

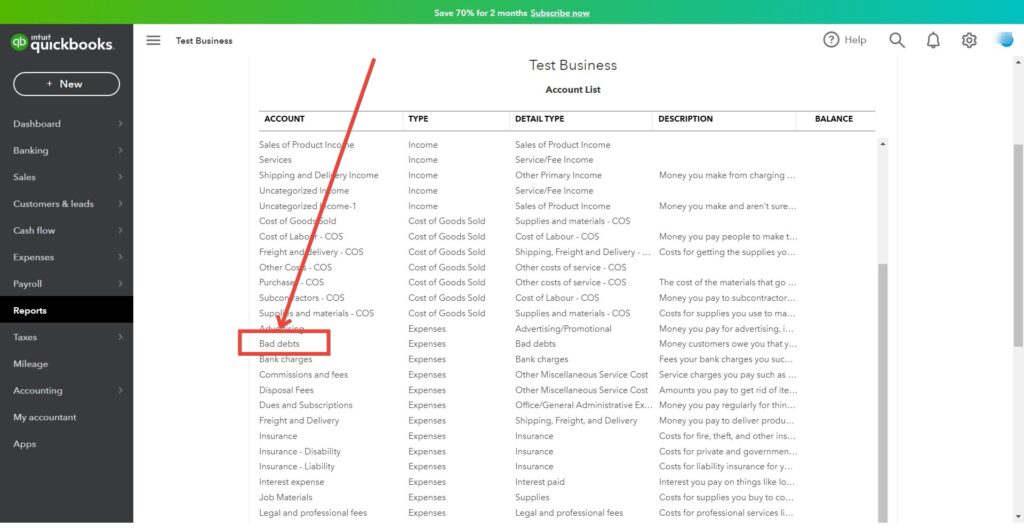

Once this is done, you should create an expense account for the bad debts. Click ‘settings,’ then ‘Chart of accounts’:

Once this is done, click ‘new’ to create a new account. Choose to create an ‘Expenses’ account.

Select ‘Save and Close’ to complete this step.

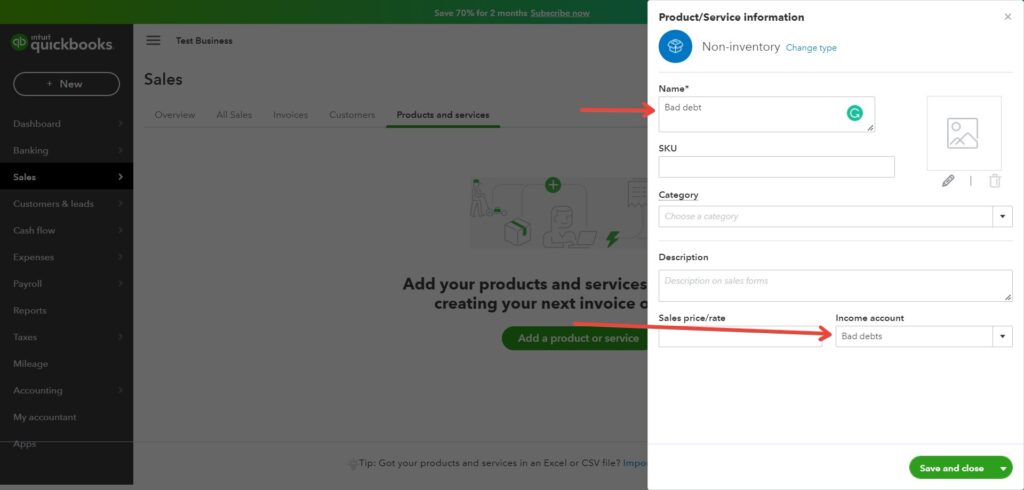

3. Create a Bad Debt Item

You’ll have to create a non-inventory item, to act as a placeholder for the bad debt item. You can go to ‘Settings,’ then click ‘Products and Services’ to get started.

Select ‘New’, then ‘Non-Inventory’. Make sure to give it the name ‘Bad debts’ so you’ll remember it later. Then click ‘Bad debts’ in the Income Account box. Then click ‘Save and Close.’

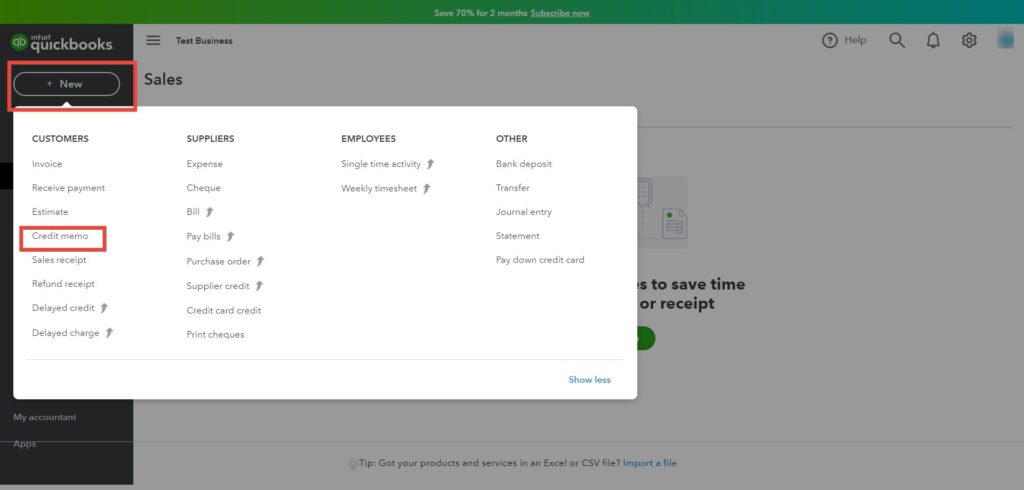

4. Create a Credit Memo for the Bad Debt

Select ‘+New’, then ‘Credit Memo’.

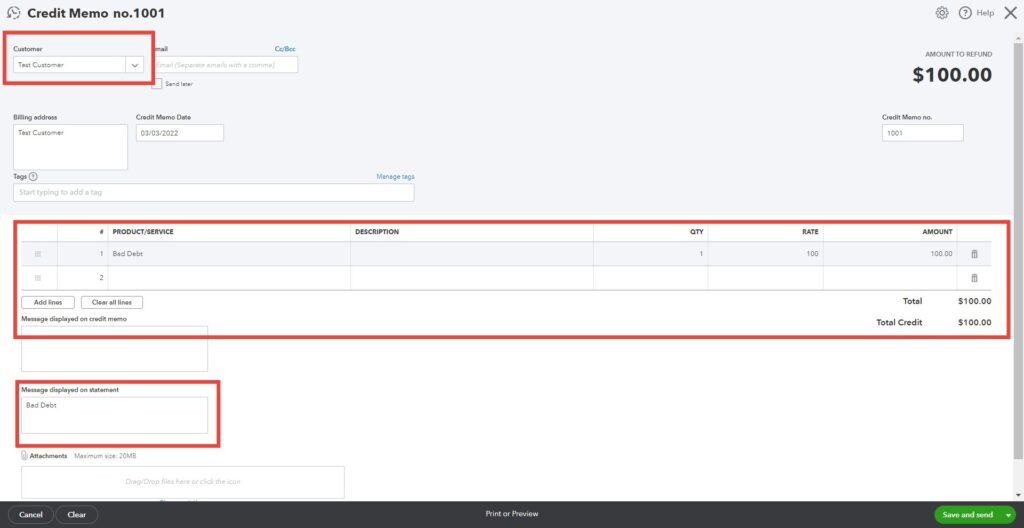

Select the following options:

- The applicable customer from the drop-down menu

- ‘Bad debts’ in the Product/Service section

- Enter the amount you want to write off in the ‘Amount’ column

- Enter ‘Bad Debt’ in the ‘Message Displayed’ box

After that, you can select ‘Save and Close.’

5. Apply the Credit Memo to the Invoice

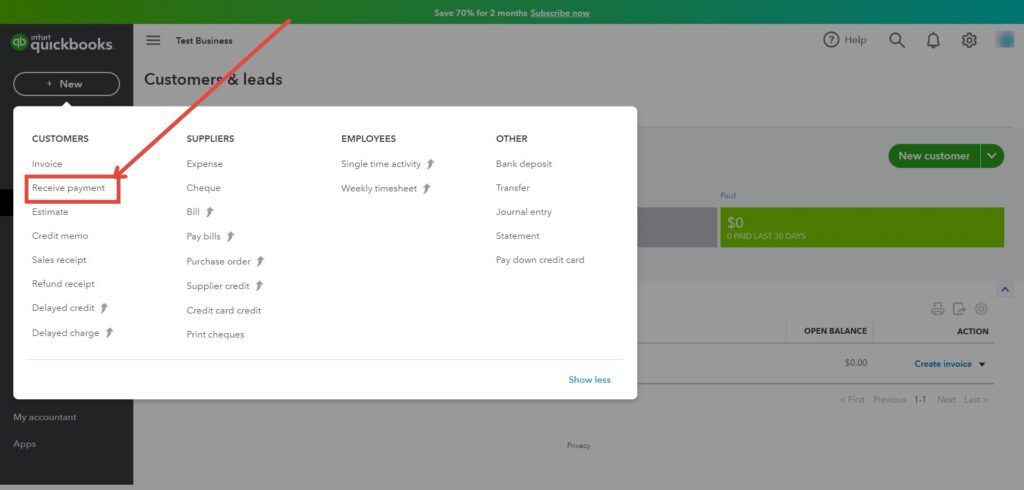

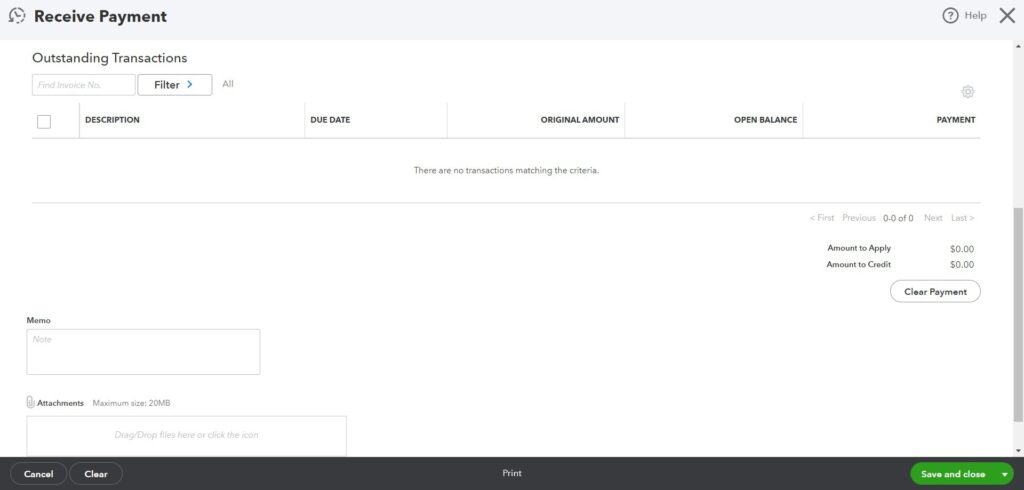

Select ‘+New’ again, then under ‘Customers,’ then choose ‘Receive Payment.’

Choose the appropriate customer, then select the invoice from the ‘Outstanding Transactions’ section. Then from the Credits section, select the credit note. Then press ‘Save and Close.’

You’ll be able to see the uncollectible debt on your Profit and Loss report under the ‘Bad Debts’ expense account.

6. Run a Bad Debts Report

Then you can run an Account QuickReport. This should flag up your bad debts. First, click ‘Settings,’ then ‘Chart of Accounts’ again, then in the ‘Action’ column, click ‘Run Report.’

And that’s it! While it does take a few different steps, it’s actually pretty quick to write off bad debt in Quickbooks.

FAQs

Question: Is Quickbooks Easy to Use?

Answer: We think that Quickbooks is pretty easy to use. While some things (like the process of writing off bad debt) can sound tricky, it’s actually fairly intuitive to use, and there are plenty of resources out there to help you to figure out how to use it. Plus, it has a good knowledge base with lots of information if you’re new.

Question: Is There a Quickbooks Mobile App?

Answer: Yes, there is a Quickbooks app for both iOS and Android.

Question: Who is Quickbooks Best Suited For?

Answer: Quickbooks is suited for both freelancers and small businesses.

Question: Can I Write off a Partially Paid Invoice?

Answer: If a customer only pays part of an invoice, for whatever reason, Quickbooks has a way to deal with this: you can read their step-by-step walkthrough here. Firstly, it’s important to record the amount they have paid:

• Click the Plus icon

• Choose ‘Receive Payment’

• Enter the customer name

• Check the correct invoice

• Enter the payment amount

• Click save and close

Once you’ve done that, it’s easier to identify partially paid invoices. Then you can follow the steps on the Quickbook support center to write them off.

To Sum Up …

Hopefully, this will help you to write off those annoying unpaid invoices in Quickbooks to help keep your income up-to-date! It’s a pretty easy process once you’ve got used to navigating around the platform.