- Top Bill.com Alternatives to Consider

- 1. QuickBooks - Best complete bookkeeping and accounting system

- 2. Wise - Best for international payments and bill pay

- 3. Melio Payments - Best for lightweight B2B online payments

- 4. Oracle NetSuite ERP - Best upmarket enterprise platform

- Other Bill.com Alternatives

- Try before you buy any of the Bill.com alternatives

- FAQs

- Conclusion: Bill.com Competitors and Alternatives

Last Updated on July 1, 2025 by Ewen Finser

Bill.com is a great cloud-based software for accounts receivable and accounts payable purposes, but it can be costly, and its features are limited.

There are multiple alternatives that offer Accounts Payable and Accounts Receivable features at various price points, so if you are looking for alternative software options that provide more than A/R and A/P functionalities, then take a look at the list of Bill.com alternatives below.

Top Bill.com Alternatives to Consider

There are a LOT of alternatives to choose from, so I’ve summarized some key options depending on your use case for online payment methods and business payments solutions:

- QuickBooks – Best complete bookkeeping and accounting system

- Wise (formerly Transferwise) – Best for international payments and bill pay

- Melio Payments – Best for lightweight B2B online payments

- Oracle NetSuite ERP – Best upmarket enterprise platform

1. QuickBooks – Best complete bookkeeping and accounting system

QuickBooks is an excellent alternative to Bill.com if you’re looking for online accounting software for your business. You can manage everything from income, expenses, bookkeeping, payments, paying bills, and more.

It automatically imports and categorizes bank transactions, simplifies reconciliation, and provides robust tools for managing accounts payable and receivable. Features like recurring transactions, auto-matching payments to invoices, and customizable chart of accounts reduce manual work and improve accuracy. It also supports multi-currency, sales tax tracking, and detailed audit trails, making it suitable for both domestic and international operations. Overall, QuickBooks combines automation with flexibility to ensure accurate, efficient, and compliant bookkeeping.

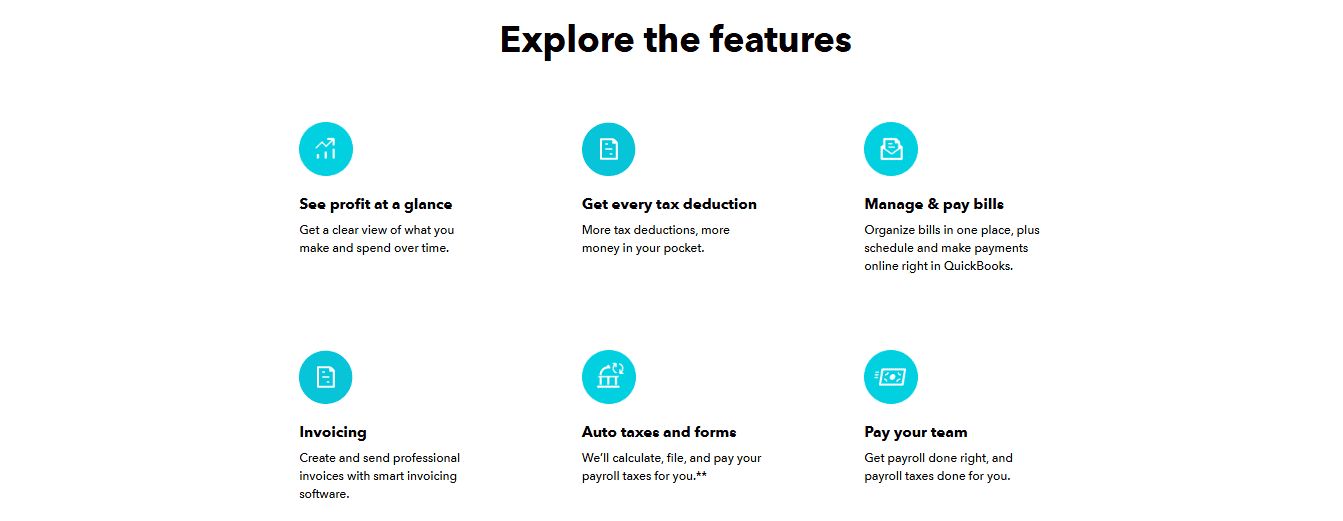

Here are some of the top features I like:

- Invoicing – QuickBooks offers free templates to create personalized invoices for your business. You can then conveniently add billable hours to your invoice and get paid online with ease.

- Payment collection and automation – Once payments are made, QuickBooks also automatches your payments so that you can save time when reconciling your books. It categorizes and imports all payments and bank transactions in one place, helping you simplify your accounts payable and receivable.

- Built-in time tracking app – I like that QuickBooks has an integrated time tracking app within its platform that allows your team to capture hours, manage time off, and coordinate schedules easily, all from within the app.

- Real-time inventory management – QuickBooks allows you to track inventory changes in real time and receive notifications when you reach low levels so that you can proactively manage your inventory to avoid stock shortages.

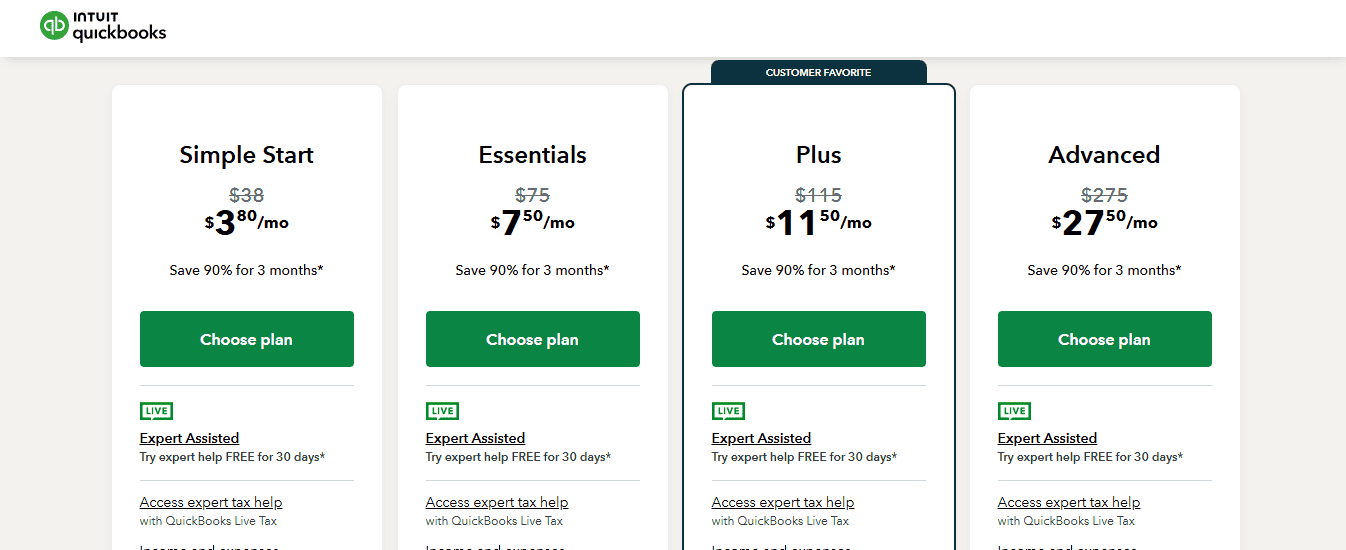

Pricing plans:

QuickBooks offers pricing plans on three tiers, which is great for businesses that need flexible pricing options to cater to growing business needs.

All plans include basic features such as income & expenses, banking, bookkeeping automation, invoice and payments, tax deductions, and more, with advanced tiers offering more in-depth service offerings for larger organizations.

Simple: $35/month

Essentials: $65/month

Plus: $99/month

Advanced: $235/month

QuickBooks also offers a free 30-day trial.

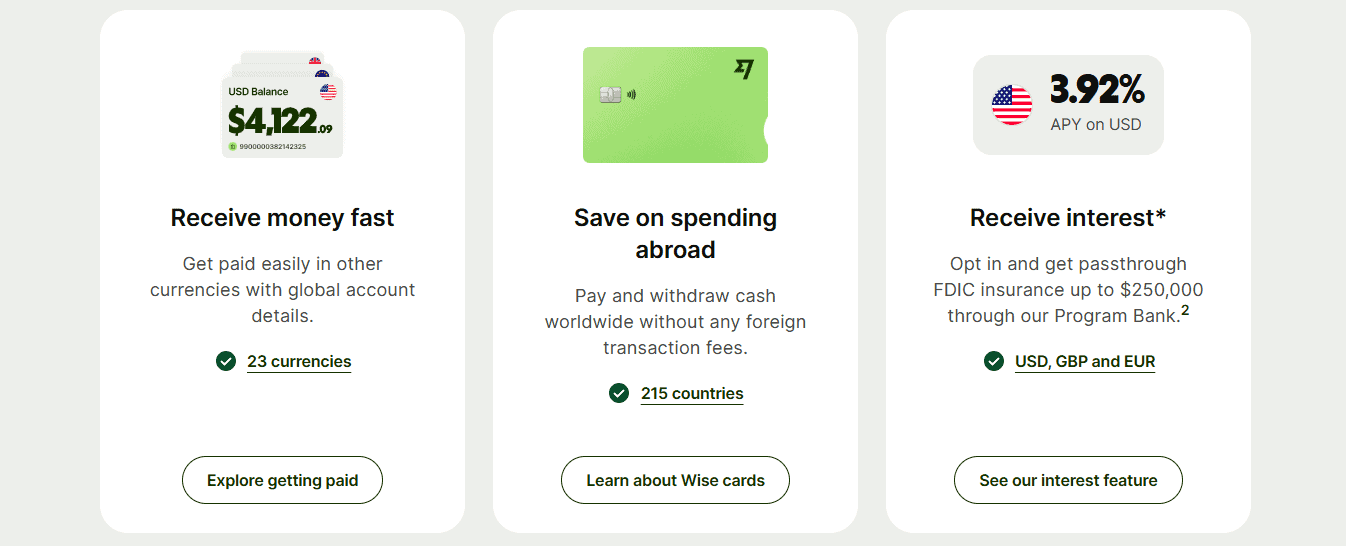

2. Wise – Best for international payments and bill pay

Wise (previously known as Transferwise) has fast become one of the most popular payment platforms for businesses that need to make payments in multiple currencies.

They have a great, easy-to-use mobile app and cost-effective fees for both payment senders and receivers.

Here are some of the top features I like:

- Fee Transparency – Unlike many other platforms, the fee structure is transparent and straightforward, so it’s easy to calculate exact costs when it comes to making payments in over 70 currencies globally. There are no hidden fees, and I like that there are no exchange rate markups.

- International debit card – This is one of the really great features of Wise. They have the option to make use of an international debit card once the account is set up. With a global debit card, customers or users can save on high banking fees and currency conversions and avoid needing to carry vast amounts of cash when travelling.

- Digital card – You can now also make use of the Wise digital card (once-off fee applies) so that you can make use of the digital card for transactions globally. This is ideal for travellers or businesses that may require an added level of security.

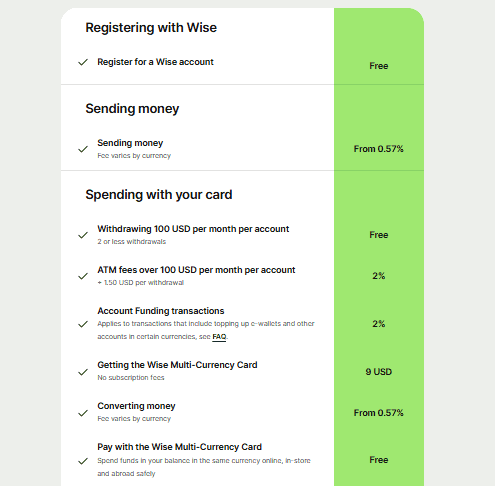

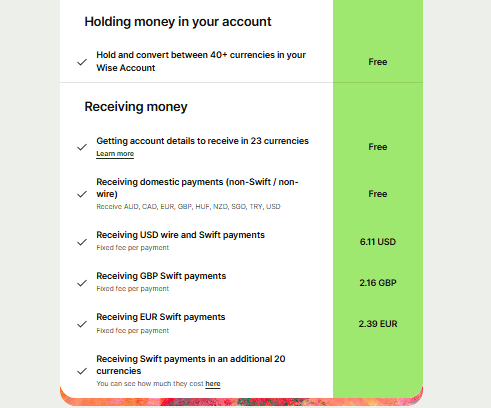

Pricing and fees:

Wise is free to set up and is entirely online, making it ideal for global recipients.

Sending money: Fees start at 0.57% but vary depending on currency.

Receiving money: Depending on the country, but it ranges from no cost to $ 6 per payment. (fixed fee).

Holding money in your account: Free

3. Melio Payments – Best for lightweight B2B online payments

Melio is one of the most cost-effective and easy-to-use payment platforms I’ve used.

It’s simple to set up, making this an ideal option for less technical teams that require a solution that is fast to implement. They have a great mobile app, making it easy to manage expenses, bills, and receive payments on the go.

Here are some of the top features I like:

- Accept payments online – You can make use of Melio’s service, which allows you to create an invoice and send the payment request to the recipient. A significant value-add is that the recipient will not even require a Melio account in order to make the payment, and they can choose which method is best for them. This includes via credit card or bank transfer (free).

- Automation and OCR – You can easily connect and import accounts from Amazon and Gmail using Melio’s automation features! This is a great time saver when needing to import historic bills manually.

OCR is another great feature I really liked. You easily use the Melip mobile app to scan and upload bills on the go. This is ideal if you need a quick way to scan information like invoices or expenses. You can also use the upload feature for PDF or JPG formats if preferred. - Live tracking for payments – As a new business with new clients, you may feel uneasy initially about vendor payments. I love that Melio allows you to track payment statuses from scheduling to full payment. You can even send payment reminders from within the app if your payment is late.

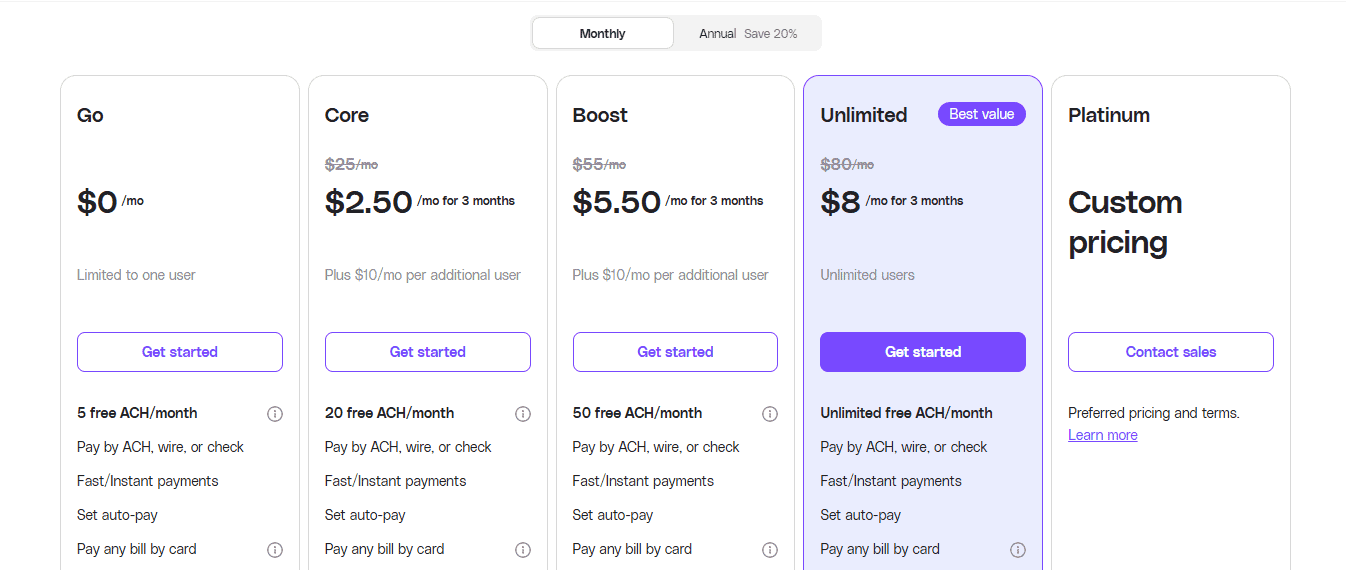

Overview and pricing plans:

All plans include a set number of free ACH transfers per month. There is a small fee that applies to each transfer after the free transfers have been consumed. Melio has three tiers, including a free plan.

- Go: Cost: Free for up to one user.

- Core: Cost: $25/month for one user (plus $10 per month per additional user).

- Boost: Cost: $55/mo for one user (plus $10 per month per additional user).

In addition to the above, you can expect to factor in the following fees:

- 2.9% for credit card transactions

- $20 fee for international transactions

- $1.50 for mailed checks

4. Oracle NetSuite ERP – Best upmarket enterprise platform

If your business needs a more substantial service offering, Oracle NetSuite may be a better solution. NetSuite’s products include accounting software that helps you manage accounts payable and receivable, tax management, and other accounting functionalities. On top of the accounting features, it offers ERP, CRM, payroll, performance management, analytics, resource management, project management, and more, which makes this a full-service tool. It can be pretty costly compared to other platforms, so it’s best suited for larger organizations with complex requirements.

Here are some of the top features I like:

- Scalability and customization – Oracle NetSuite has advanced customization options, which are ideal if you have diverse business needs. I like that you don’t require advanced IT skills to set up the platform in a way that best suits your needs,

- Automation – Oracle NetSuite SuiteFlow is a great feature to enhance efficiencies by helping you create customized workflows that can automate both simple and complex work tasks and notifications. This is another feature that can be set up by business users and doesn’t require advanced technical capabilities.

- Intelligent billing – Oracle’s SuiteBilling feature is an excellent tool for organizations like SaaS or other service-based businesses that need to track usage-based, milestone, or subscription-based billing. You can set up automated billing for recurring subscriptions and manage the changes to subscriptions easily, saving you time, as this removes the manual overhead of needing to monitor and track this manually.

Other Bill.com Alternatives

Here’s a list of alternatives that offer more than just the basic accounting functionalities of AR and AP that you may want to consider for your organization.

Software Provider | Key features | Pricing | Free Trial |

Payroll, GL, A/R, A/P, job costing, inventory, bill payment, credit card & banking | Available upon request | Demo available | |

Accounting software powered by Salesforce, Bill Customers, Pay Vendors, GL, Financial Reporting, and more | Available upon request | Demo available | |

Accounts Receivable software. Cash Flow, automated cash posting, digital invoicing & payment, credit & collection, trade credit software, B2B payments | Available upon request | Demo available | |

Financial Management Software. Reporting, consolidation, business intelligence, approval workflows, and more. | Starts at around $300 per month. (£199 per month) | Demo available | |

A/R, A/P, Bank Reconciliation, Fixed Assets, GL, and Payroll | Available upon request | Demo available | |

Society Management Software. Managing maintenance requests, Making Payments of Property Dues, Maintaining Accounts History, to Managing Tenants’ Data, Apartment Management App | Essential Package – Free; ERP and Gatekeeper Package costs available upon request | No | |

A double-entry accounting system, complete with AR, AP, GL, and more | Free | Free version | |

Platform for payments automation for all tax types. S Supports all different types of payments and document management | Available upon request | Demo available | |

Global payments, embedded payments, invoicing, and billing. | Custom pricing available upon request | No | |

Invoicing, accounting, profit & loss, expense management, and more. | Free and paid plans | Free Trial | |

Billing, receivables, collections, credit granting, portfolio, and revenue management | Available upon request | Demo available | |

Invoicing, payments, expenses, vendors, proposal creation, time tracking, projects, and kanban | Free option available. Paid plans range from $120 – $240 per annum. | Free trial | |

Invoicing, Online Payments, Financial Statements, Time, Expense, Mileage & Tracking. | Free Plan available. Paid plans range from $9.99 – $29.99 /month. | Free Trial | |

Online Invoicing, Payments, AR, AP, Expense Management, Forecasting, and more | Free plan available. Paid plans range from $19 – $149/month | Free Trail | |

Invoicing, data analytics, tax management and compliance, automated and recurring billing, and more. | Available upon request | No | |

Budget & bill reminder for personal finance, an app for Android & iOS with a complimentary web App | $3.50 for a 90-day subscription or $10.99 for the annual subscription. | No | |

Billing, Payments, Subscription Management, Tax Compliance, CRM, Email Campaigns, Help Desk, Authentication | $47 – $127/month with a custom pricing plan available. | Free trial available. | |

Bill management and payment solutions. Tracks payments and due dates. Sends reminders, invoices, account balances, and monthly expenses. | Custom pricing available upon request. | No | |

Accounting automation tool. Automates bookkeeping for online sales, subscriptions, and services, and more. | $65-$275/month with a custom pricing plan available upon request. | Free Trial & Demo Available | |

Pay bills, accept payments, claim expenses, bank reconciliations, track projects, and more | $25-$75/month | Free trial | |

Accounting, Billing, Expenses, Reports | Free plan. Paid plans range from $15-$35/month. Custom pricing for accounting firms available upon request. | Free plan available | |

Quotes, invoicing, expense management, time tracking, payment reminders, reporting, and more. | Free plan available with paid plans ranging from $29-$69/month, with custom pricing plan available. | Free version | |

Accounting in Salesforce CRM | Available upon request | Free trial |

Try before you buy any of the Bill.com alternatives

It’s always best to try out free versions before committing to a paid subscription plan.

Here are some things to keep in mind when trying out a potential alternative software.

- Ease of use – This is critical to ensure user adoption is high and that you don’t require extensive training, especially for non-technical users.

- Specific feature sets – Make sure that the alternative solutions meet your requirements based on any shortcomings of your existing solution.

- Pricing plans – make sure that the pricing plans are affordable for your organization and that you can scale as your company grows.

- Integration capabilities – Consider solutions that are able to integrate with other software systems, such as different accounting software or CRMs that you may use.

FAQs

Question: Why use Accounting Software?

Answer: Accounting Software can help improve time, efficiency, and labor costs because of its automation features, error proofing, and reporting capabilities. Not to mention the automatic accumulation of data for meeting taxation reporting and audit preparations. Every entry, transaction, and accounting history is at your fingertips.

Question: What should I look for and ask about when searching for an Accounting Software Package?

Answer:

Ease of use is imperative. Look for tools with a short learning curve, but also those that have all the basic features included in the standard plan. I’d also recommend looking into platforms that have scalability and flexibility when it comes to both pricing and features. This means you can scale up (and down) as your business requirements change.

Question: What is cloud-based accounting software?

Answer: Cloud-based accounting software means that the platform or service is hosted on a remote server and stores your accounting information in the cloud instead of a physical location, which can be more accessible, secure, and a better solution long-term.

Conclusion: Bill.com Competitors and Alternatives

Carefully defining your business requirements is critical to deciding which tool will be the best option for your organization. If you don’t need all the bells and whistles, then avoid complex, enterprise-level platforms that have ERP and other extensive features. Instead, select a more cost-effective and straightforward solution that may be a better fit for your users and business needs.

If you’re still undecided, I would recommend trying out those that offer a free trial to get a good idea of the look, feel, ease of use, and functionalities.

Having cloud-based software at your fingertips is a great way to manage your business, no matter where you are, so you may want to consider whether it’s flexible to see if it can accommodate this request affordably.

Further Reading on Bill Payment, Billing, and Payment Processing Accounting System: