- The 5 Best BigCommerce Payment Gateways | No. One: PayPal

- The Advantages and Disadvantages of Setting Up a PayPal account for business

- The Five Best BigCommerce Payment Gateways | No. Two: Stripe

- The Pros and Cons of having a Stripe Account

- The Five Best BigCommerce Payment Gateway | No. Three: Square

- The Pros and Cons of using Square's payment system

- The Five Best BigCommerce Payment Gateway | No. Four: Authorize.net

- Pros and Cons of choosing Authorize.net

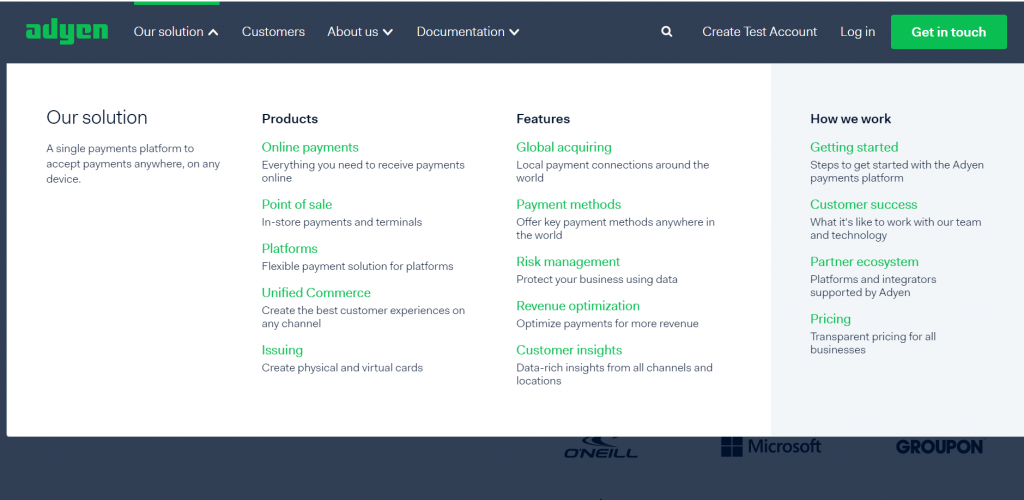

- The Five Best BigCommerce Payment Gateway | No. Five: Adyen

- Adyen | Pros and Cons of One of the Best BigCommerce Payment Gateways

- Frequently Asked Questions Regarding the Best BigCommerce Payment Gateways

- The Five Best Bigcommerce Payment Gateways | Buying Decision

Last Updated on June 1, 2023 by Ewen Finser

Are you looking for the best payment gateways to integrate with BigCommerce? Well, then you’ve come to the right place because in this article we’re giving you the five best BigCommerce payment gateway providers.

If you’re wondering why you should stick around then take a moment to consider:

- The damage payment fraud could do to your business.

- How much a high rate of credit/debit card fraud could damage your brand equity.

- The time it’ll take to rebrand and rebuild your broken brand image.

- How detrimental negative customer reviews via social media could be to you inbound marketing pursuits.

- Why all of these things combined will deflate your percentage market share.

Seamlessly list, optimize, advertise, sell and fulfill products across 100+ channels. All the capabilities of enterprise ecommerce—without the cost or complexity.

Do I have your attention yet?

Anyway, avoiding payment fraud is a lot easier when you’ve got a shortlist of reputable payment aggregators and processors offering gateway services. And it just so happens that this post offers exactly that.

So if you’re looking to deliver an amazing, valuable service to your customers – keep reading!

The 5 Best BigCommerce Payment Gateways | No. One: PayPal

Paypal is a payment aggregator with a gateway offering: PayFlow. BigCommerce itself offers a native integration with PayPal (powered by Braintree) to vendors in over 45 different countries. Vendors who make use of this native integration could potentially benefit from reduced fees on credit card transactions.

But Bigcommerce partnership with PayPal is fruitful to varying degrees depending, of course, on the plan you choose. You see, BigCommerce’s pricing is tiered. Its “Standard” or cheapest option has a transaction charge of 2.9% + $.30, whereas its most expensive plan costs roughly 2.2% + $.30 depending on other variables.

Bear in mind too that this is a negotiated rate subject to terms and conditions. So it doesn’t apply at checkout immediately. There is an application process of roughly two weeks by the time all steps are completed. Here’s a link to BigCommerce explanation of its partnership with PayPal. Please view the footnotes at the end of the page to see what I’m talking about.

PayPal is the default gateway for vendors based in the US.

The Advantages and Disadvantages of Setting Up a PayPal account for business

Advantages

- Out of the box integration.

- Convenient, popular payment method for customers.

- A reputable, secure payment gateway provider.

- PayPal operates in 190+ markets worldwide.

- The ability to accept payments in 20+ currencies making international commerce more straightforward.

- PayPal lets you set up a personal account alongside as well as a business account.

- Invoicing is quick and easy using PayPal’s free templates, a wide variety of payment options and an integrated system to manage invoice payment data.

- PayPal is available to a limited extent in over 200 countries and regions.

Disadvantages

- PayPal has, in the past, been involved in an email or “phishing” scam which left a lot of people feeling upset.

- PayPal charges you to receive money.

- Account-holders have been frozen out of their accounts, so those people lost their money.

- Chargebacks are expensive with PayPal and can take a long time – over 75 days to be precise.

- It can sometimes take a while for your money to clear and arrive in your bank account.

- Support is available 24/7 via PayPal’s customer service help centre but many people are reporting online that PayPal’s reps are less than responsive.

- Harsh currency conversion rates.

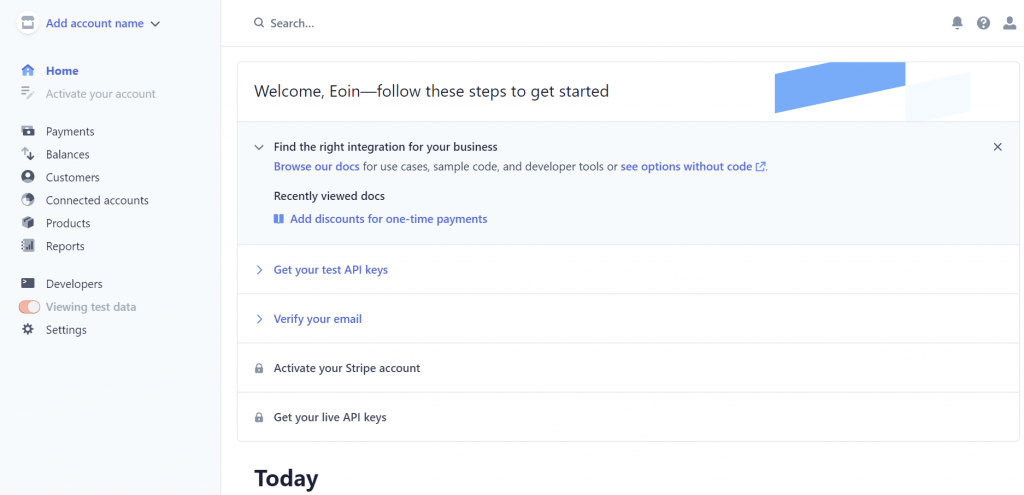

The Five Best BigCommerce Payment Gateways | No. Two: Stripe

Stripe is a popular competitor vs PayPal. Stripe specializes in providing online payment processing for internet businesses. For anyone who’s been stung by PayPal, Stripe tends to be a popular alternative.

And it’s popularity isn’t surprising when you consider large firms like booking.com, Deliveroo, and Xero all avail of its services. That being said, Stripe isn’t as well known as PayPal which may hamper business with some prospects.

Nevertheless, for eCommerce store owners and developers alike Stripe tends to be a great option. Powerful and reliable APIs are available to users that are easy to use and customize so that payment functionality is swiftly integrated.

Stripe’s API documentation, out of the box eCommerce shopping cart integrations (WooCommerce, Shopify, etc.), and variety of programming languages makes it an extremely useful, versatile payment gateway provider.

Stripe is a popular and widely used payment gateway service with over 13,000 API requests per second. According to Stripe.com, over 90% of the US population has used Stripe to complete a purchase although they’re probably not aware of that fact. So, although Stripe may be relatively unheard of within many consumer segments it’s clearly a popular choice of those holding the market shares.

The Pros and Cons of having a Stripe Account

Pros

- Versatile payment options and a wide range of currencies available for use. In fact, there are over 135 options at the disposal of Stripe users.

- Stripe is available in 42 countries globally.

- Quick set up times.

- Competitive processing fees compared to industry standards.

- Stripe chargeback protection guards businesses against online fraud.

- Ability to stay onsite when making a payment can be reassuring to some customers.

- Designed with developers in mind.

- Exceptionally well suited to larger firms with high monthly earnings.

- Subscription billing available.

- Once-click checkout.

- Processing fees are much lower for European cardholders (1.4% + $.30), which is an advantage for those doing business on the continent.

Cons

- Slow payment processing times (slower than PayPal)

- The process of resolving a Stripe dispute can occasionally take some time.

- International card purchases are debited by an extra one percent.

- There’s a lot of information that may or may not confuse some users.

- Stripe doesn’t have an affiliate program so you can’t gain fiscally through referrals.

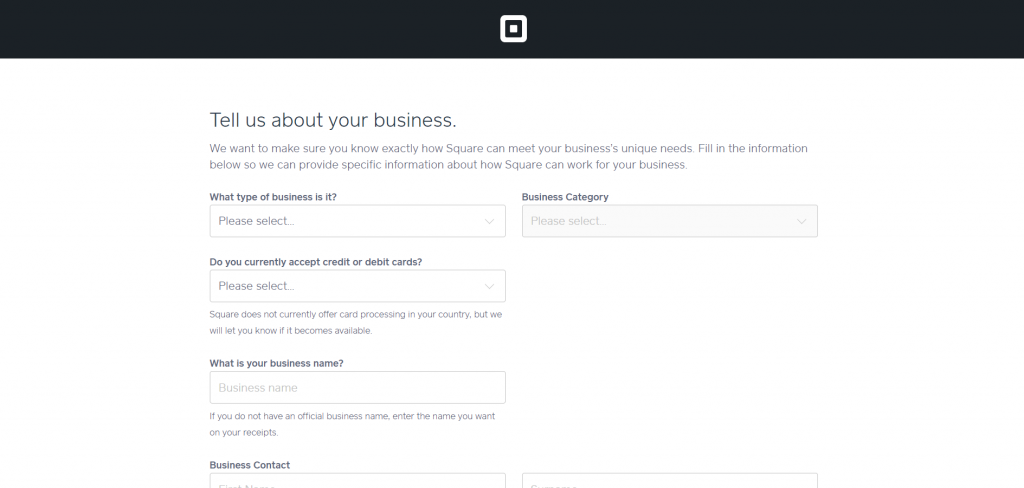

The Five Best BigCommerce Payment Gateway | No. Three: Square

Square is a payment system that provides gateway services. It acts in the payment aggregator mould similar to competitors PayPal and Stripe.

Square markets itself as an excellent option for anyone selling in-person (using POS hardware) as well as online through its eCommerce range. So, when you’re searching online make sure you’re viewing square payments to receive the correct information regarding its gateway services.

Square’s security is a plus due to its PCI compliance and end to end encryption. Although Square’s greatest strength lies in its ease of use as well as its simplicity.

For those wondering, Square is a separate company from Squarespace. The two platforms can be integrated.

The Pros and Cons of using Square’s payment system

Pros

- Square’s flat rate makes it a great option for low volume merchants. For example, startups and small businesses.

- Easy to set up and quick to access.

- Solid POS options for selling in person.

- Instant deposits for a fee.

- The contactless card reader is helpful for door-to-door and market sales reps.

- Square offers online store building functionality that goes well with checkout for those building eCommerce websites.

- Simple invoicing.

Cons

- Square’s flat rates can make it a more expensive option for high volume vendors.

- Customer service isn’t ideal with numerous reports complaining about having to pay to call Square’s customer support team.

- Limited time to submit proof of payment documentation.

- The card reader can sometimes malfunction.

- Square’s processing fees are high for non-profits, but still better than many of its competitors.

- Multi-currency selling unavailable.

- Not 3d secure.

- Cannot store credit card information.

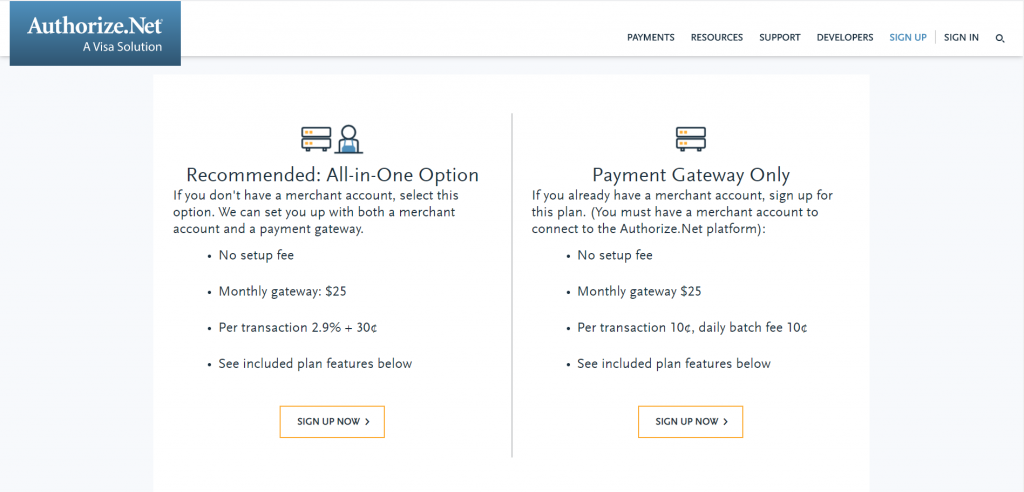

The Five Best BigCommerce Payment Gateway | No. Four: Authorize.net

Authorize.net is an online solution offering gateway services. Merchants can set up an account that can then be used to accept card payments, contactless payments as well as e-checks. Other payment types include signature debit cards and other digital payment methods.

Authorize.net’s security features are reassuring. The gateway extension offers fraud protection in the form of Velocity filters, SAQ-A level PCI compliance, IP filters and more. It’s widely regarded as a reputable, secure payment processor despite having some security breaches in the past.

Also, vendors based in the United States, United Kingdom, Canada, Europe, or Australia can accept international payments. Support is available to all license holders on a 24/7 basis via telephone and documentation available through the all-in-one payment platform’s support center.

Pros and Cons of choosing Authorize.net

The Pros of using Authorize.net:

- No hidden fees and, overall, reasonably priced considering its performance against its competitors and other alternatives. Authorize.net’s pricing is certainly competitive.

- Secure to a fault – literally.

- A mobile option allowing for access to transaction data anywhere around the globe.

- A good option for billing and building account reports.

- Connecting Merchant accounts is straightforward enough using Authorize.net’s API.

- Authorize.net’s support center appears to provide satisfactory customer service, overall.

- Its PCI compliance is a major boost for websites that currently are not.

- Solid sandbox environment conducive to testing.

- USB cards can be read using the AuthNet virtual terminal.

Cons

- Security features cannot be adjusted optimally using security settings. Certain fraud transactions cannot be blocked without enabling features that also prevent genuine transactions. Which is reported to be problematic when it comes to satisfying customers.

- Website design is poor from a developmental standpoint.

- Some pages are overly cluttered, particularly the administration page that makes managing customer transaction unnecessarily difficult.

- High setup fees.

- Authorize.net was established in 1996, as such many developers have reported that its API is clunky and outdated.

- Difficult to use due to its UI being far from the right side of the “industry standard”.

The Five Best BigCommerce Payment Gateway | No. Five: Adyen

Our fifth and final payment gateway is Adyen. The benefit of choosing Adyen is that it lets you accept payments remotely. So whether you’re selling online or through a brick and mortar store it’s a solid option. But be warned – it’s considered more of an Enterprise-grade solution. So might be too pricey for some vendors.

Anyway, Adyen’s stock is synonymous with big-name brands such as Uber, Booking.com, and Spotify. So, it’s certainly a reputable company.

Adyen is also a popular Bigcommerce alternative vs Stripe and Paypal. Adyen offers all the same core features such as 3d secure funding, control panel funds capture, refunds, multi-currency selling, ability to store credit cards, option to embed checkouts, and is also available in a host of countries scattered globally.

The ability to gain data insights via financial reporting is an advantage of Adyen’s offering. It’ll help you get a better read on your customer analytics and therefore give you an edge over your competitors.

Adyen | Pros and Cons of One of the Best BigCommerce Payment Gateways

Pros

- Offers all the core features you’ll find in well-known payment processing solutions such as Stripe and PayPal.

- Generally easy to use.

- Setup isn’t overly difficult.

- Ability to sell from anywhere in the world.

- Improves transaction and billing speeds.

- Customizable fraud protection.

- Reliable and secure platform.

- Developer documentation.

- Payment methods.

- Accounting.

- Excellent visibility of customer transactions.

- Straightforward refund process.

Cons

- Slightly more difficult to use than PayPal and Stripe during rare instances.

- The interface is somewhat lacking in terms of design.

- API is somewhat lacking.

- An enterprise-grade solution that’s not best suited to low volume sellers.

- Fraud scoring is somewhat unclear – requires too much clicking and hovering within a user’s profile to extract basic information.

- Even when you’re gateway isn’t in use you’re still being charged, which isn’t ideal if you’re someone who doesn’t make a lot of sales. Being charged in a per-transaction manner would be better for low volume sellers.

Frequently Asked Questions Regarding the Best BigCommerce Payment Gateways

Which Payment Gateway is Best (With Examples)?

It’s difficult to say definitively what payment gateway is best. But, the ones listed above are strong options. For example, Adyen is a great option for enterprises looking for gateway services. While Square is great for low volume sellers looking to bundle eCommerce store building functionality with a gateway provider. If you’re looking for a well-rounded provider then PayPal is a must. Ultimately, the best payment gateway is the one that best fits your business needs.

What a Payment Gateway is using an Example?

A payment gateway is a technology that enables payment processing for different business types ranging from eCommerce stores to brick and mortar retailers. Think of a payment gateway as the middle man between you and your customers tasked with approving or declining a transaction. An excellent real-life example of a middle man is an estate agent. In a nutshell, a payment gateway provides you with the technology you need to sell your offerings to your customers – in exchange for a percentage of the profits, of course.

Payment Processor vs Payment Gateway?

Payment processors are the software needed to hold and complete a transaction. Whereas a payment gateway communicates whether the transaction has been accepted or rejected. Processors tend to offer gateway services.

PayPal vs Stripe – Which is Better?

PayPal and Stripe are both extremely well matched. Depending on your needs, you may be better off with either option. People tend to trust PayPal more, however, because it’s been around for longer. So some customers may be hesitant to set up a Stripe account. That being said many people have been stung using PayPal, so the same logic could be applied to choosing its eCommerce platform over PayPal. They offer all the same core features needed to offer robust payment gateway functionality, so you’ll need to look deeper into both platforms to find which one suits you best.

Who uses Adyen?

Adyen is used by 7,000+ firms worldwide. Some massive names include Spotify and Uber.

The Five Best Bigcommerce Payment Gateways | Buying Decision

Your buying decision should ultimately depend upon your business-specific needs. That being said, I can tell you that low volume vendors should give strong consideration to Square. Although it does lack key features.

For anyone looking for solutions more in the mid-market range, PayPal and Stripe are excellent choices. At the Enterprise level, Adyen is a fantastic option. Meanwhile, Authorize.net offers most of the core processing features you’ll need while also being a secure, reputable payment solution.

So, base your buying decision on the features you need, support, and pricing. These are all different facets of each gateway so go through an onboarding phase and perform some research to see what you like best.

Seamlessly list, optimize, advertise, sell and fulfill products across 100+ channels. All the capabilities of enterprise ecommerce—without the cost or complexity.

Further read: