Last Updated on December 23, 2025 by Ewen Finser

I’ve worked across enough affiliate verticals to say this confidently: health offers break weak affiliate software faster than almost anything else.

When I talk about “health offers,” I’m referring to supplements, telehealth lead generation, wellness subscriptions, clinics, medical devices, and regulated or insurance-adjacent leads where advertising is allowed. On paper, many of these look like standard CPL or CPA offers. In reality, they come with stricter ad policies, higher chargeback risk, and constant compliance pressure. Here’s where Affiliate Software for Health Offers come in

What makes this category different?

It’s the way conversions actually happen. Rarely is it a single click-to-purchase flow. Most health funnels involve multiple steps: a lead submission, a qualification layer, a booked consult, and sometimes an offline outcome like a call center approval or prescription verification. Those steps don’t always happen on the same day, or even in the same system.

Because of that, tracking needs to handle more than just clicks and pixels. I’ve seen teams struggle when their platform can’t reliably fire server-to-server events, deduplicate conversions, or reverse payouts when leads fail quality checks. Add geo and device restrictions, traffic caps, and policy enforcement into the mix, and small tracking gaps turn into real financial and compliance issues.

This is also where demos can be misleading. A platform can look feature-rich and still fail in daily operations, especially around link governance, fraud controls, event quality visibility, and partner enforcement.

If you’re running health offers at any meaningful scale, affiliate software isn’t just infrastructure. It’s risk management.

What Counts as Affiliate Software Here (and What Doesn’t)

When I evaluate affiliate software for health offers, I draw a clear line between tools built for performance operations and tools built mainly for partner marketing convenience.

In this context, affiliate software means affiliate tracking platforms, a.k.a. systems that handle performance tracking, attribution, partner management, payouts, and detailed reporting. These platforms are designed for CPA and CPL models, multi-event funnels, and high-volume traffic where governance and data integrity actually matter.

That’s different from partner or affiliate program SaaS, which is often optimized for e-commerce or SaaS revshare programs. Those tools are great for onboarding partners and managing contracts, but they can fall short when you need server-to-server events, offline conversion uploads, lead reversals, or granular traffic controls.

There’s also an important distinction between network platforms and brand-run affiliate software. Networks bundle tracking with distribution and advertiser access. Brand-run tools give you direct ownership of tracking logic, approvals, and data. In health, many teams use both, but the underlying software still has to be solid.

In practice, no serious health setup runs in isolation. Add-ons matter: fraud prevention, call tracking, CRM integrations, and sometimes data warehouse exports for quality analysis.

What doesn’t qualify for this category, in my experience:

- Coupon or referral plugins built for simple e-commerce

- Influencer-only platforms without real conversion plumbing

- Basic link shorteners with no attribution depth or event control

If a tool can’t support multi-step conversions, offline outcomes, and strict partner governance, it’s not affiliate software for health offers; it’s a shortcut that usually shows cracks under scale.

The Roundup: Best Affiliate Software for Health Offers

Here’s a quick overlook of how the main platforms stack up based on real-world use, not marketing promises.

| Platform | Best For | Tracking Depth | Partner Controls | Fraud Tooling | Reporting | Integrations / API | Typical Fit |

|---|---|---|---|---|---|---|---|

| Everflow | Networks + serious advertisers | High | High | Strong | Strong | Strong | CPL/CPA at scale |

| Impact | Brands with partner ecosystems | High | High | Medium | Strong | Strong | Partnerships + affiliates |

| PartnerStack | B2B SaaS-style partner ops | Medium | Medium | Low–Med | Medium | Medium | SaaS + affiliates |

| TUNE | Advertisers + networks | High | High | Medium | Strong | Strong | Custom workflows |

| Cake | Networks (legacy-friendly) | High | High | Medium | Medium | Strong | Enterprise networks |

| Affise | Performance teams | High | High | Medium | Strong | Strong | Growth + automation |

| Post Affiliate Pro | SMB affiliate programs | Medium | Medium | Low | Medium | Medium | Budget-conscious |

| Trackier | Performance marketing ops | High | High | Medium | Medium | Strong | Mobile + web mixed |

This table isn’t about declaring a universal “winner.” It’s about alignment.

If your biggest pain point is lead quality, compliance enforcement, or payout disputes, prioritize platforms with strong partner controls, fraud prevention, and event-level visibility, even if the UI feels less polished. In health offers, operational control almost always beats cosmetic convenience.

My Evaluation Framework for Health Offers

I don’t evaluate affiliate software for health offers based on feature lists or homepage claims. I evaluate it based on what breaks first under real traffic, and how fast the platform helps me fix it. Over time, I’ve narrowed this down to a set of criteria that consistently separates tools that look good from tools that hold up.

- Tracking Integrity (Non-Negotiable) – Everything starts with tracking integrity. If this fails, nothing else matters.

- Compliance & Governance Controls – Health offers live or die by governance. I want clear control over what affiliates can run, with the ability to disable creatives fast if policies change. Just as important: audit trails. When something goes wrong, I need to know exactly who changed what and when.

- Fraud Prevention & Lead Quality Tooling – I look for bot filtering, click-spam detection, and anomaly alerts that surface unusual patterns early. IP and device-level signals help, but only if they’re actionable and not just vanity metrics.

- Payout Operations – The platform needs to support CPL, CPA, revshare, and hybrid models, often within the same program. Hold periods, reversals, chargebacks, and clawbacks should be native features, not manual workarounds.

- Reporting that Actually Helps You Optimize – Good reporting isn’t about pretty charts…it’s about answers! I rely heavily on cohort analysis to see partner quality over time, not just daily spikes. SubID breakdowns and creative-level performance are mandatory for traffic optimization.

- Integrations & Extensibility – No affiliate platform operates alone. I expect robust webhooks, APIs, and export options, ideally into a data warehouse. CRM integrations (like HubSpot or Salesforce), call tracking platforms, and analytics tools need to plug in cleanly.

- Support, Reliability, and 2 a.m. Problem-Solving This is the silent differentiator. I pay attention to platform uptime, status transparency, and realistic SLA expectations. Migration support matters more than vendors admit, and documentation quality tells me how self-sufficient my team can be.

Below is my practical roundup of affiliate software that I’ve seen work in real health-offer environments, what each does well, where teams get burned, and how I’d use them.

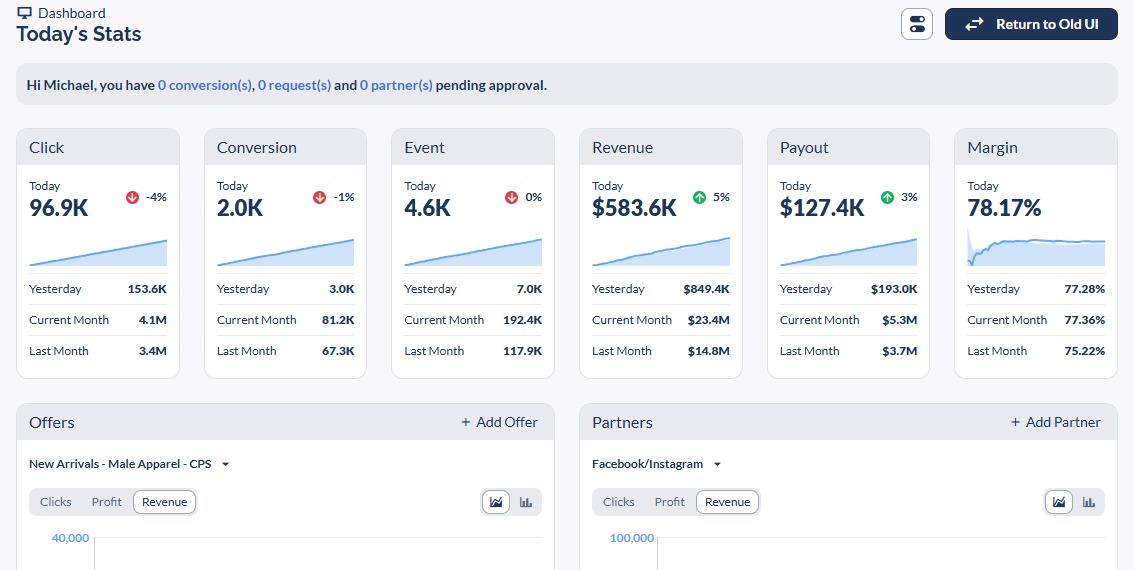

Everflow

Best for: Performance advertisers and networks running multiple health offers who need granular tracking, partner control, and clean reporting at scale.

What I like: Everflow tends to perform well where health funnels get messy. The tracking depth and event visibility make it easier to manage multi-step conversions without losing clarity. I like how clean the partner management workflows feel: approvals, caps, and offer-level controls are straightforward and don’t require workarounds. Reporting is strong enough that I can actually optimize from it, not just export data into something else. Automation also helps once volume picks up.

Watch-outs: The platform gives you tools, not guardrails. You still need disciplined internal processes for compliance reviews, creative approvals, and partner enforcement. Teams that expect software to replace operational ownership usually struggle.

Health-offer use case: Telehealth CPL offer where affiliates are paid only on qualified leads. Initial leads fire one event, validation fires a second event, and unqualified leads are suppressed or reversed automatically. Payouts are clean, disputes are easier to resolve, and reporting reflects real lead quality.

TUNE

Best for: Advertisers or networks that want control, flexibility, and the ability to build custom workflows.

What I like: TUNE is solid when you know what you’re doing. Tracking is flexible, integrations are robust, and the architecture scales well. I’ve seen it handle complex attribution and offline conversion flows reliably when implemented correctly. It’s a good option for teams that want to design their own logic instead of being boxed into defaults.

Watch-outs: Implementation choices matter a lot. Poor setup decisions can haunt you later, especially with attribution and event logic. You need a strong ops owner who understands both the platform and the business requirements.

Health-offer use case: A multi-event funnel where web leads route into a call center, and final outcomes (qualified, booked, approved) are uploaded back as offline conversions. Works well when the CRM and tracking logic are aligned from day one.

Affise

Best for: Fast-moving performance teams that live in SubIDs, automation rules, and rapid optimization cycles.

What I like: Affise shines when you’re actively managing traffic. The UI makes it easy to analyze performance at a granular level, and automation rules help reduce manual work once patterns emerge. Offer and partner management is efficient, which matters when you’re juggling volume.

Watch-outs: Fraud prevention and governance depend heavily on how the platform is configured and what add-ons you’re using. If you expect strong controls out of the box without setup, you’ll likely be disappointed.

Health-offer use case: Supplement trial offer with strict geo and device restrictions, traffic caps by partner, and aggressive SubID monitoring to identify low-quality sources early.

Cake

Best for: Established networks and enterprise operations that need mature, battle-tested workflows.

What I like: Cake has been around long enough to prove itself in network environments. It handles complex offer structures, finance workflows, and partner hierarchies reliably. For larger operations, the extensibility and familiarity across teams can be a real advantage.

Watch-outs: It can feel heavy. Without proper training and a clear naming taxonomy, teams can get overwhelmed. It’s not the most forgiving platform for disorganized setups.

Health-offer use case: A network managing multiple nutraceutical advertisers, each with different payout rules, hold periods, and approval flows. Cake handles the operational complexity well when configured correctly.

Impact

Best for: Brands managing broader partnership ecosystems that include affiliates, content partners, and influencers.

What I like: Impact is strong on the partnership side. Partner discovery, contracting, and onboarding workflows are mature, and reporting is polished. For brands that want more control over how partners represent them, this is a real strength.

Watch-outs: If you’re running pure CPA or CPL lead gen at scale, Impact can feel like more platform than you need. Some performance teams may find it less nimble for rapid traffic testing.

Health-offer use case: A wellness subscription brand working with affiliates and creators, all using approved messaging and creative libraries, with performance tracked across channels.

PartnerStack

Best for: Partner-led growth programs, especially B2B or membership-style wellness services.

What I like: PartnerStack excels at managing the partner lifecycle. Onboarding is smooth, partner portals are easy to use, and communication feels organized. It works well when partners are long-term collaborators rather than anonymous traffic sources.

Watch-outs: Pure performance marketers may miss deeper clickstream and SubID-level data. If you rely heavily on micro-optimizations, this can be limiting.

Health-offer use case: A corporate wellness platform running referral and channel partners with tiered commissions based on deal size or contract length.

Post Affiliate Pro

Best for: Smaller teams that want a straightforward, affordable affiliate program manager.

What I like: It’s accessible and does the basics reasonably well. For teams just starting an affiliate program in health, it can be a practical entry point without heavy overhead.

Watch-outs: You’ll likely need additional tools for fraud prevention, deeper attribution, and complex S2S event handling. It’s not ideal for high-volume CPL environments.

Health-offer use case: A boutique supplement brand building an ambassador and affiliate program with relatively controlled traffic sources.

Trackier

Best for: Performance ops teams running multiple channels (web and mobile) that need strong tracking and integrations.

What I like: Trackier covers a lot of ground across tracking, automation, and integrations. It’s flexible enough to support varied workflows, which is useful for mixed traffic environments.

Watch-outs: Reporting depth should be evaluated carefully. Make sure SubID granularity, event trails, and exports match how your team actually optimizes.

Health-offer use case: Lead generation with multiple buyers, suppression lists, and routing logic handled alongside external tools for quality scoring.

Honorable Mentions

Some tools don’t fit cleanly into full affiliate platform categories but are still worth mentioning.

Voluum / Binom are excellent for traffic analytics and optimization, but are not full partner management solutions. I’ve seen them work best alongside a primary affiliate platform, not as a replacement.

FirstPromoter / Rewardful are strong for SaaS-style referrals and simple revshare programs. They can work for certain wellness brands, but they’re generally too light for complex CPA or compliance-heavy health funnels.

Pricing & ROI: How I Think About Cost in This Category

I avoid comparing affiliate software purely on sticker price. In health offers, cost needs to be framed against risk reduction and operational efficiency.

Typical cost buckets include:

- Platform licensing

- Add-ons like fraud prevention, call tracking, or advanced exports

- One-time or ongoing implementation effort

The ROI doesn’t come from saving a few dollars per month. It comes from:

- Reducing invalid or fraudulent leads

- Optimizing partners faster using real quality data

- Preventing disputes with clear logs and audit trails

One quality failure, such as a bad traffic source, a compliance issue, or a payout dispute, can erase months of software savings.

My rule of thumb is simple:

If you’re spending meaningfully on paid traffic, saving a few percent on software rarely beats preventing one quality disaster.

Summing Up

Health offers push tracking, compliance, and partner governance harder than most verticals. That’s why the best affiliate software isn’t the one with the flashiest dashboard; it’s the one that stays stable when funnels get messy.

Clean S2S tracking, multi-event visibility, and reliable reversals protect your spend. Strong partner controls reduce compliance risk. Quality-focused reporting helps you scale what actually works.

If you want to find the one that works best for you, 2-3 platforms, run the demo checklist, and test everything in a sandbox using your real funnel events.

Do keep in mind that an affiliate software won’t fix a weak offer or a loose compliance strategy, but the right platform will make good decisions easier and bad decisions visible faster. After years of dealing with health funnels, complex validation flows, and high-stakes partner governance, Everflow is the pick I trust most consistently.