- What The Heck is Digits Anyway?

- The Bottom Line Up Front

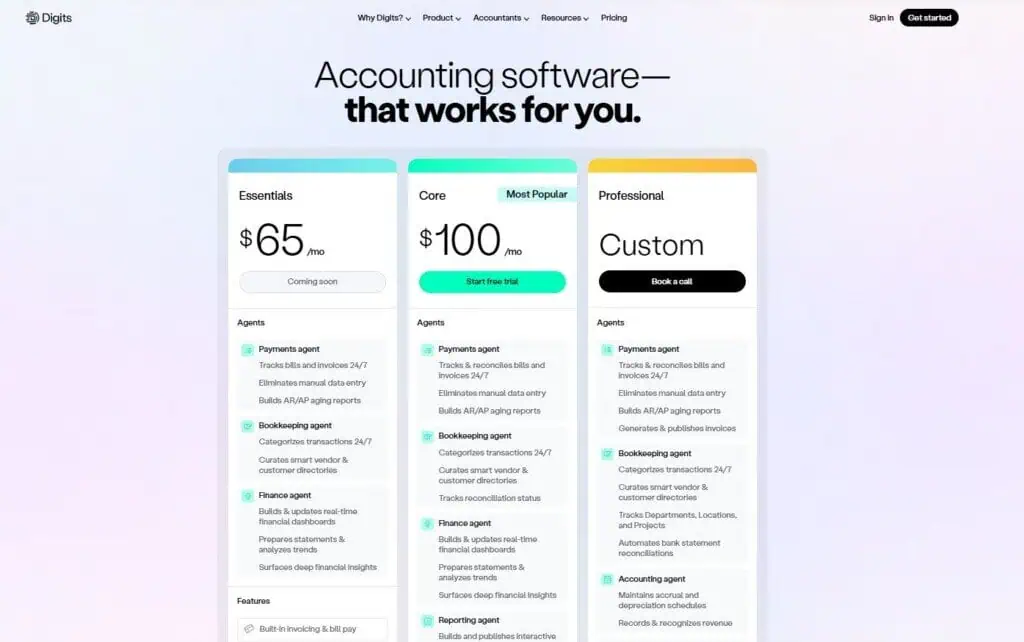

- Pricing (Clear, and Refreshingly Simple)

- What Digits Does Exceptionally Well

- 9) Pace of Product Updates

- Where Digits Falls Short (Today)

- The Daily Workflow (How It Actually Feels)

- For Accounting Firms: Why This Matters

- Migration & Integrations

- Security, Compliance, and Stakeholder Comfort

- Who’s Gonna Love Digits?

- Who Should Wait?

- The Competitive Landscape (QuickBooks, Xero, and the New Guard)

- The Product Velocity Check

- Pricing Math vs. the Status Quo

- My Take (CPA, Controller, Operator)

- Should You Switch?

- Final Word

Last Updated on December 20, 2025 by Ewen Finser

What The Heck is Digits Anyway?

Digits calls itself “accounting software for the AI era,” and unlike bolt-on “AI features” slapped onto legacy systems, the AI is the engine here. At the core is the Autonomous General Ledger (AGL going forward because that is indeed a mouthful) is purpose-built to automate categorization, reconciliations, invoicing, A/P, and reporting. As a CPA, I’ve read this many times as QBO, Xero, Sage, and others tout their AI updates, but Digits feels different. The modules just work, flawlessly, almost every time. It’s quite refreshing in my line of work.

A recent industry “First Look” series walked through how Digits rethought the usual accounting stack, from the Inbox triage, to a Category Manager that modernizes the chart of accounts, to reconciliations that emphasize flow and visibility. Reading those pieces alongside hands-on use, the takeaway is clear: this isn’t a QuickBooks or Xero skin. It’s a total redesign, and I’m all for it!

Digits also isn’t a brand-new stealth app anymore. In March 2025 it publicly launched AGL, brought Xero’s co-founder Craig Walker onto the leadership team, and positioned itself squarely against aging cloud incumbents, with pricing that starts at $100/month and a claim of models trained on $825B+ in transactions. That’s real ambition and it explains why you’re suddenly hearing about Digits in firm circles.

The Bottom Line Up Front

Digits is a genuinely new take on small-business accounting with an AI-native general ledger with real-time bookkeeping, built-in invoicing and bill pay, and interactive financials. It’s fast, sleek, and ambitious.

Pricing starts at $100/month for Core, with a coming-soon Essentials tier at $65 and a Professional plan that’s custom-priced for heavier accounting needs. ACH is $0.50 and checks are $2 via Digits Pay. U.S. entities only (for now). If you’re a startup, online-first business, or a modern firm ready to automate the grind, Digits is absolutely worth a trial. If you need deep inventory, multi-currency, or non-U.S. banking today, you’ll feel some edges.

Pricing (Clear, and Refreshingly Simple)

Digits currently lists three editions:

- Essentials is $65/month (coming soon): AI Bookkeeping + Payments + Finance agents; built-in invoicing and bill pay; unlimited connections and users.

- Core is $100/month (most popular): Everything in Essentials plus the Reporting Agent, bank statement reconciliations, secure document storage, and more.

- Professional (Custom Pricing): Adds an Accounting Agent (accruals, depreciation, revenue recognition), Departments/Locations/Projects, and open API access. This is where Digits really would flex its digital muscles.

Digits also offers a 30-day free trial. Bill Pay is included, with $0.50/ACH and $2/check network fees.

Verdict on pricing: for what you get in Core, $100/month is aggressive…in a good way. It undercuts the true cost of cobbling together several separate tools (bank rules + reporting add-ons + bill pay) and removes a lot of ops drag. The “unlimited connections & users” detail is quietly huge for multi-stakeholder teams and firms. And truth be told, most of my clients are paying over $80 per month for Intuit’s QBO with Payroll, so $100 per month seems to be around the going cost of decent software nowadays.

What Digits Does Exceptionally Well

1) AI That Does, Not Just Answers

Digits’ agentic AI works in your ledger. The Bookkeeping Agent categorizes continuously and flags low-confidence entries into your Inbox, where you review, confirm, or correct. The Agent also learns across your chart of accounts and improves with firm-level feedback loops. In practice, this means you spend more time on approvals and edge cases, not the 80% of “obvious” transactions that still eat real hours each month.

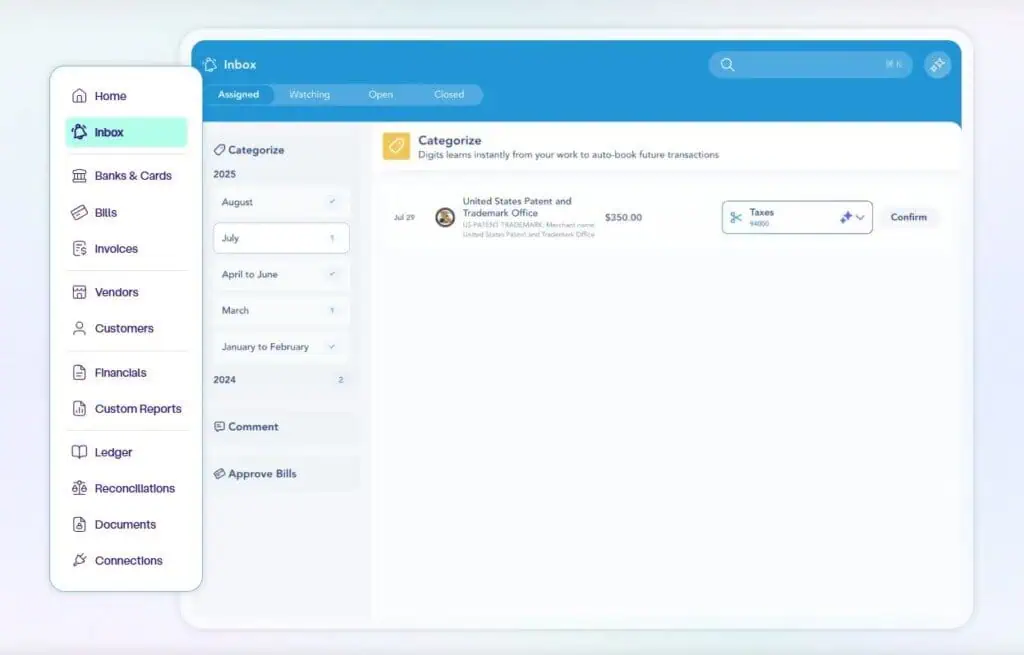

2) Inbox as Command Center

The Inbox consolidates what needs attention (uncategorized items, unmatched transactions, questions, and teamwork chatter). It sounds small; it isn’t. Anchoring the daily workflow here cuts the whiplash between banking, GL, and your task tracker. For firms, it’s also a shared queue that keeps staff aligned.

3) Category Manager > Old-School Chart of Accounts

Digits reframes the Chart of Accounts into a Category Manager that’s easier to standardize, import, and structure (with parent/child layers). It’s more forgiving for non-accountants and less brittle for firms standardizing dozens of clients across many different industries.

4) Reconciliations That Don’t Fight You

The reconciliation views emphasize status, history, and bulk actions. When your data sources are connected (banks, cards, payroll, etc.), reconciliations feel like the end of a continuous process and not the monthly slog it’s traditionally been.

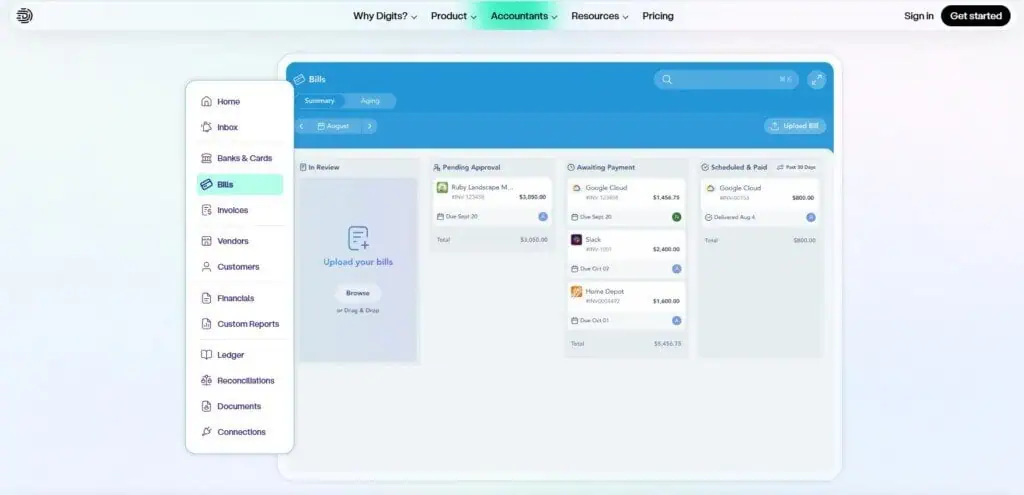

5) Bill Pay and Invoicing: Built-In, Sleek, and Modern

Upload or drag-and-drop a bill; Digits OCRs and populates it, supports approval flows, and pays via ACH or check (and auto-reconciles). Invoicing is similarly quick: generate, customize, send, track viewed/overdue/paid, and automate follow-ups. These workflows don’t feel bolted-on; they feel native. Fees are clear and modest.

6) Interactive Financials and Reporting Agent

Financial statements are real-time, filterable, and presentable with executive summaries you can quickly assemble. For the first time in a while, I didn’t feel the need to export to Excel just to understand the numbers though you still can for board decks and bankers.

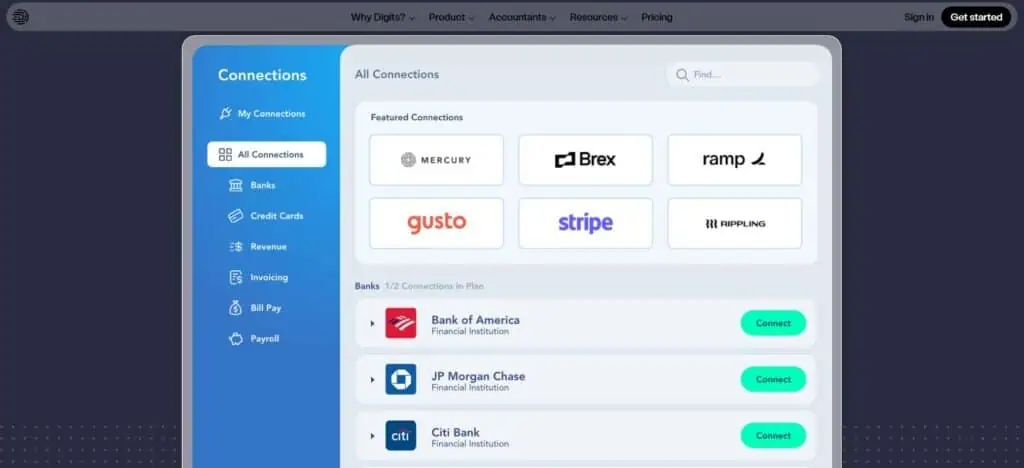

7) Integrations that Match the Modern Stack

Digits connects directly to fintech mainstays like Gusto, Mercury, Ramp, Stripe, BILL—plus thousands of institutions via Plaid. You can migrate from QuickBooks Online, set a cutover date, and keep working. For payroll, the Gusto integration brings real-time views and categorized payroll flows. It’s the stack many of my clients already run, so it’s nothing to get them connected.

8) Security & Compliance

SOC 2 Type II, tokenized connections, TLS in transit, encryption at rest…the right boxes are checked in plain English, not just a shield icon in the footer. For clients who ask the security questionnaire every single time, this matters.

9) Pace of Product Updates

The changelog shows frequent, practical improvements (mobile dashboards, better filtering, download original bill documents, keyboard shortcut manager, multi-dashboard home). That shipping cadence is a strong leading indicator for long-term viability.

Where Digits Falls Short (Today)

- U.S.-Only, USD-Only

Digits is currently limited to U.S. entities with U.S. bank connections and USD. If you run multi-currency or operate outside the U.S., that’s a hard stop for now (you can still import CSVs, but you lose the primary advantage: live, automated feeds). - Ecosystem Maturity

The app ecosystem, training resources, and “every-third-party-has-a-plugin” gravity around QuickBooks/Xero won’t appear overnight. Digits is building partner programs and certifications at blazing speed, but if you rely on niche add-ons, verify your must-haves. - Muscle Memory & Change Management

If your team has years of QuickBooks reflexes (and muscle memory for monthly rituals), the Digits way (Inbox first, agent handoffs, real-time everything) takes a beat to internalize. That’s not a bug; it’s the price of a different model that will save you countless hours in the long run.

The Daily Workflow (How It Actually Feels)

- Connect the stack (banks, cards, Gusto, Stripe). Within minutes, the ledger starts to populate and categorize. Vendor/customer directories build themselves. The Inbox immediately shows a small pile of transactions flagged for review, not 300; a manageable handful.

- Inbox triage replaces a lot of “banking tab dwells.” I confirm obvious entries, drop a comment on a contractor reimbursement that needs receipt backup, and tag the owner for a one-line answer, all from inside the system.

- Bill pay is a drag-drop + quick approve and not a separate system with a separate login. Approvals feel crisp, and the fee schedule is predictable.

- Invoicing, especially for service businesses feels fast. Client sees, pays, and the ledger stays in sync. No swivel-chairing between tools.

- Reconciliations turn into finishing moves. Because the feeds and AI have been working all along, month-end is a tidy review rather than a reconstruction.

- Financials & reporting: I’m then able to ship a clean, branded package with a short executive summary. If leadership wants to slice by vendor or dig into a weird trend, it’s interactive first; export second.

The point: Digits reclaims hours by moving the work upstream and continuously, so month-end is a confirmation ceremony, not an excavation.

For Accounting Firms: Why This Matters

Digits is courting firms with a partner program, firm dashboards, user roles, exclusive plans, and a certification path to help navigate the software. The direction is obvious: equip CAS teams to run more clients with fewer keystrokes, while standardizing quality. If you’re reshoring or rebuilding your close process around AI, this is the right time to pilot a few clients and build playbooks.

A recent Partner Program update in Digit’s Changelog even introduced a “Ledger Only” plan for tax-only/year-end clients, keeping feeds live and reconciliations current without the full bells-and-whistles experience. That’s tailor-made for firms who just need clients’ books to be EOY-ready without getting trapped in the monthly “send us the statements” loop.

Migration & Integrations

Migration from QuickBooks Online is a guided flow: connect QBO, choose your cutover date (e.g., 12/31 if you want a clean new year), and bring over history, COA, vendors, customers, and key financials. From there, Digits becomes the system of record. If your bank isn’t supported or you’re outside the U.S., you can still import CSVs, but again, you lose real-time magic.

On the live-ops side, out-of-the-box integrations with Gusto, Ramp, Mercury, Stripe, BILL, and thousands of bank connections via Plaid mean most modern stacks connect in minutes. Ramp’s integration highlights real-time sync and dimension mapping; Gusto’s details emphasize automated categorization of payroll to appropriate accounts. These aren’t exotic one-offs; they’re the everyday rails startups already use.

Security, Compliance, and Stakeholder Comfort

In finance, perception of safety often matters as much as the controls themselves. Digits publishes plain-English explanations of tokenized access, TLS, encryption at rest, and SOC 2 Type II compliance. It’s the screenshot I want when a bank underwriter or investor asks “so… what is this new ledger you’re using?”

Who’s Gonna Love Digits?

- Startups & SaaS: Subscriptions, card-heavy spend, payroll through Gusto, revenue via Stripe…this is Digits’ home turf in my opinion.

- Digital Agencies & Professional Services: Invoicing + A/P + real-time reporting = fewer “how are we doing?” emails and faster decisions.

- Multi-entity operators (U.S.): Unlimited connections/users remove weird seat math, and Category Manager helps standardize across entities.

- Firms with a modern CAS practice: Inbox queues, agent workflows, and Partner/Academy tracks line up with the direction most CAS leaders are heading.

Who Should Wait?

In my opinion, manufacturers with complex inventory, global/multi-currency shops, and anyone whose must-have integration isn’t available yet. You can still use Digits in a hybrid setup, but you won’t realize its full value until live feeds and the AI have more to chew on.

The Competitive Landscape (QuickBooks, Xero, and the New Guard)

QuickBooks Online and Xero are mature, battle-tested ecosystems with breadth and depth, and decades of accumulated workflows across millions of users. But that maturity comes with baggage: slow month-end closes, rules, and reports that aren’t truly “live.” Digits’ bet is that AI-native automation + opinionated workflows will flip the default: live books by default, approvals and exceptions on rails, and management reports that are always current.

It’s not just different UI; it’s a different operating model. This is the same shift we saw when cloud accounting replaced desktop: once the data was live, behaviors changed. If Digits can keep shipping at its current pace while expanding international/multi-currency and deepening vertical hooks, the “AI ledger” category will harden around it.

The Product Velocity Check

I always look at changelogs because they tell you whether a team ships what pros ask for. Over the last six weeks, Digits added mobile dashboards, smarter filtering across Ledger/Bank/Vendor/Customer/Recon views, a keyboard shortcut manager, multi-dashboard Home, and the simple but delightful “download original document from any Bill.” These aren’t vanity features; they shave seconds off common flows or reduce context switches. That’s the right kind of velocity.

Pricing Math vs. the Status Quo

Here’s the real-world calculus I run with clients:

- QuickBooks/Xero + bank feeds + some rule logic + bill pay add-on + reporting add-on + time lost to monthly cleanup ≠ $100s/month. It’s much more, once you count staff hours.

- Digits Core at $100/month consolidates the core stack and pushes work upstream. Add the predictable ACH/check fees and you’ve still simplified both cost and operational risk.

If you’re a firm, the “unlimited users” piece means you stop rationing seats and start structuring teams by process, not license constraints which is a quiet but material win.

My Take (CPA, Controller, Operator)

I went in skeptical. Every platform these days seems to have a gimmick. The market has been loud on “AI for accounting,” and a lot of it is garnish. Digits, in contrast, made me do less work to get to a clean close. The AI agents aren’t a sideshow; they’re orchestrated into the ledger itself. The Inbox minimized Slack pings. The Category Manager cut down on COA drift. Recons didn’t fight me. Reporting felt “live” enough that I didn’t immediately reach for a spreadsheet.

Is it perfect? No. The U.S.-only constraint, multi-currency gap, and ecosystem maturity are real. If you’re exporting containers in six currencies, keep your expectations in check. But if you’re the archetypal SaaS, agency, or services shop with a modern fintech stack, Digits is the first GL in a long time that earns a migration.

Should You Switch?

- You should try Digits if: you’re U.S.-based, run a modern stack (Gusto/Ramp/Stripe/Mercury/BILL), and want month-end to feel like a quick inspection, not a dig. Start on Core, connect everything, and give the Inbox two weeks to learn.

- You should wait if: you need multi-currency now, rely on deep manufacturing inventory, or operate primarily on non-U.S. rails. Put it on your radar and check the changelog quarterly.

Final Word

As someone who lives in the trenches of job costing, cash flow, and “why is this still unreconciled,” I judge software on whether it buys back my time and my team’s focus. Digits does. It’s the first small-business ledger in years that doesn’t feel like we’re teaching 2005 how to be 2025. If your books live inside a modern fintech stack and you’re U.S.-based, this is the one to pilot next.