- The Bottom Line Up Front

- What The Platforms Are and How They Think

- The Real World on Payday: Hours to Tips to Payroll

- Compliance Controls (OT, Breaks, and Filings)

- Integrations and Ecosystems Gravity

- Who Each Platform Fits

- Deep-Dive: The Daily Workflows and Where Time Disappears or Comes Back

- Implementation & Change Management

- Edge Cases

- Performance, Mobile, and Adoption

- Limitations

- My CPA Verdict

Last Updated on January 28, 2026 by Ewen Finser

Alright y’all, today’s line up isn’t a beauty pageant; it’s a question of what makes pay day boring. And like it or not, boring is great, I absolutely LOVE boring! Not everything has to be a blockbuster, exciting, and crazy new experience. Any time you can avoid chaos, always pick boring. And that’s what we’re going to see if today’s platform comparison can do. Can the two platforms eliminate messy shift swaps, multi-rate pay, tip pools that don’t foot, and “we’ll figure it out later” conversations, and make the end of the week boring?

QuickBooks Online Payroll makes a strong case for keeping everything under the Intuit umbrella, from books, to payroll, to taxes, and even time (on Premium/Elite), which appeals to the accountant brain that loves one pane of glass. Homebase, on the other hand, comes at the same problems from the floor, not the ledger: shift-native scheduling, time clocks that understand roles and wage codes, and tip math that lands inside the timesheet before payroll ever runs. Same goal, different center of gravity.

The Bottom Line Up Front

From a CPA’s desk, the choice comes down to where your truth lives. If your operational truth is the schedule, i.e., who showed up, what job they covered, whether they took a break, then Homebase tends to deliver cleaner inputs because the frontline app is the system of record. If your truth is the GL and your team’s time data is already disciplined, QuickBooks Online Payroll (especially with QuickBooks Time bundled) gives you that tight accounting loop with guardrails and support tiers. Both can get you paid and compliant. Only one will save you from chasing tip allocations at 9 p.m. on payroll night

What The Platforms Are and How They Think

Homebase

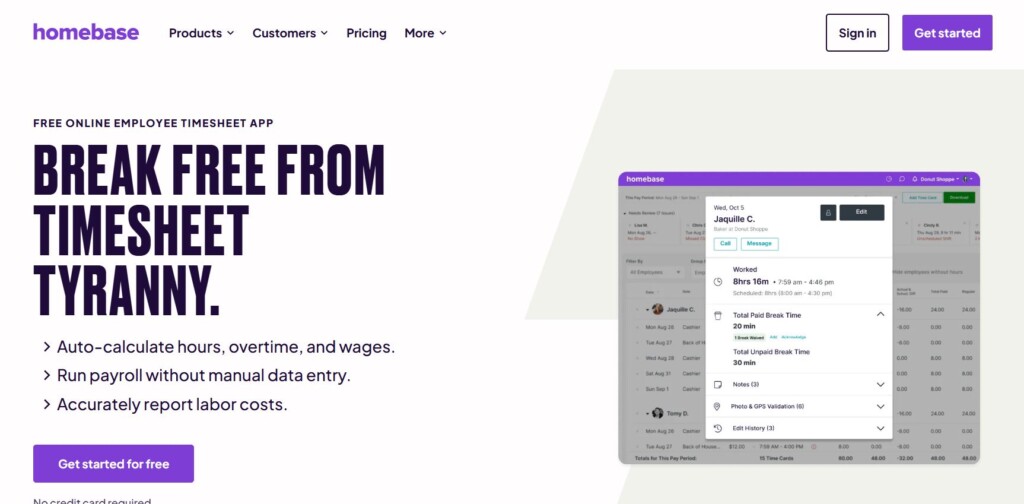

A people-ops cockpit built for hourly teams: scheduling, time clocks, labor controls, messaging, and payroll that pays W-2s and 1099s in all 50 states, with a free entry tier for small shops and a payroll add-on priced simply. The thesis: fix frontline chaos and payroll accuracy follows.

QuickBooks Online Payroll

Intuit’s payroll engine embedded in the QuickBooks ecosystem. The thesis: keep books, payroll, taxes, and (on Premium/Elite) time tracking under one roof, with tiered protections and support for complex tax scenarios especially appealing if your GL of record is QuickBooks.

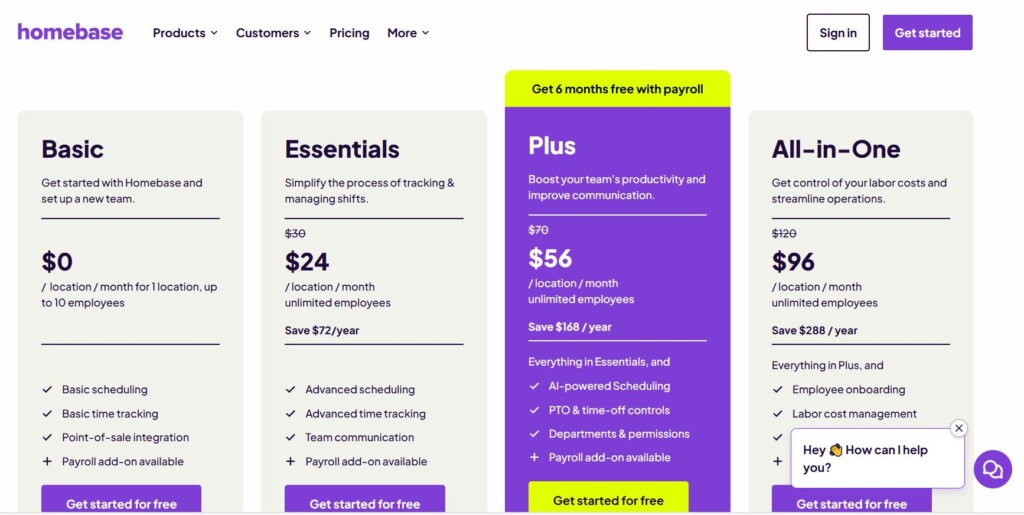

Pricing and The Gotchas You Probably Didn’t Expect

- Homebase Payroll: $39/month base + $6 per active employee. Unlimited payroll runs, W-2/1099 filings are included. You only pay for people you pay in that month. Payroll is an add-on to any Homebase plan. The Homebase Basic (free) plan is for one location up to 10 employees; paid tiers expand features and multi-location controls. There’s also a Tip Manager add-on ($25/location) that automates import and pooling.

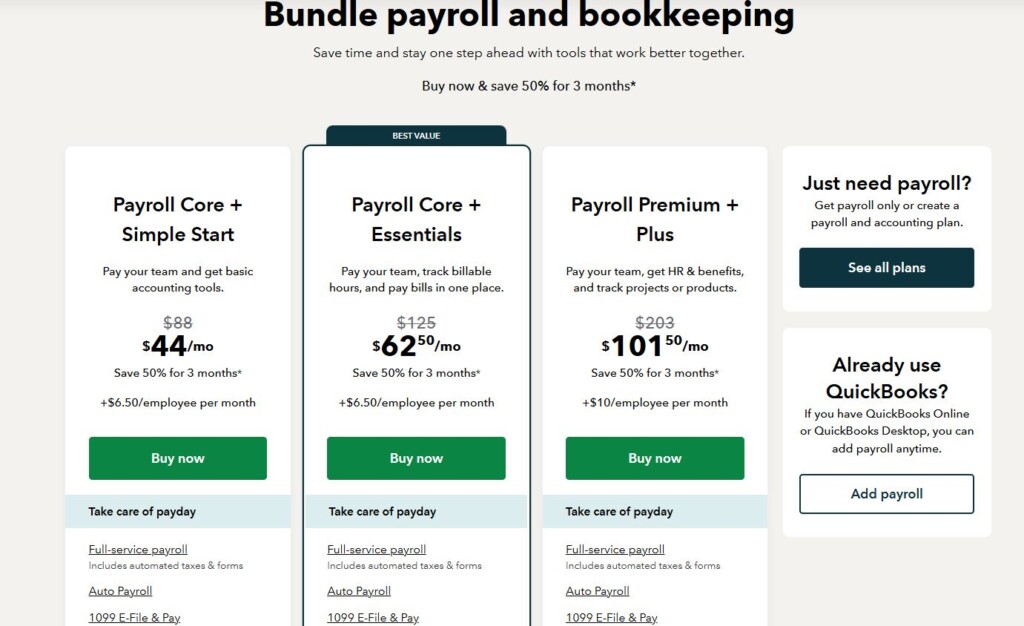

- QuickBooks Online Payroll: three payroll-only tiers: Core ($50 + $6.50/emp), Premium ($88 + $10/emp), Elite ($134 + $12/emp). There are frequent short-term promotions that can reduce price substantially for the first 3 months. Another thing to note is that Premium and Elite include QuickBooks Time. One other thing to note, Intuit is constantly raising prices, so always check current list vs. promotional pricing.

My CPA takeaway: Entry pricing is similar at small headcount. The real cost delta shows up in:

- Whether you’re buying time tracking separately or included (QBOP Premium/Elite include QuickBooks Time), and

- The amount of rework you avoid because shift/time/tip ergonomics are native in Homebase as opposed to a mangled mess of spreadsheets you’d be likely to encounter for tip allocation on QBOP.

The Real World on Payday: Hours to Tips to Payroll

Time Capture and Multi Wage Rates

Hourly teams live on split roles: barista to shift lead; server to expo; tech to on-call. Homebase’s time clock is designed for role-based clock-ins, automatic multiple wage rates, overtime, and missed-break alerts, all before timesheets hit payroll. That matters when your compliance posture hinges on capturing which job code someone worked at what rate.

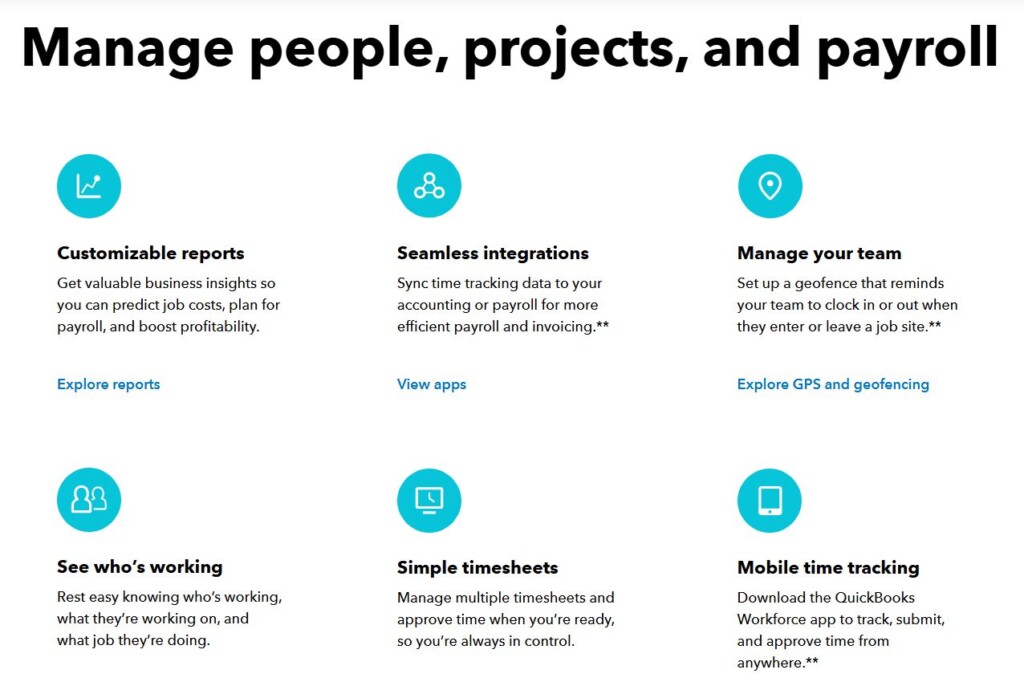

QuickBooks Time (bundled with QBOP Premium/Elite) handles granular job codes, GPS geofencing, and approvals nicely; it’s battle-tested for field service and project teams. The sticking point I see in restaurants/retail is less the tracking tech and more the shift ergonomics of who’s on, where they are, who swapped, and whether the right wage rate applied when someone hopped from FOH to BOH mid-rush. Homebase bakes that context into the schedule and timecard UX.

Tip Pooling

If you’re doing tip share by hours/points/roles (or need to import tips straight from your POS), you need the math to be boring. Homebase’s Tip Manager pulls tips from the POS, calculates the pool, and posts allocations into timesheets so they flow straight into payroll. That means fewer reclasses and, frankly, fewer tip disputes.

QBOP can certainly pay supplemental/allocated tips, but it expects tips to be correct when they arrive at payroll. In practice, that means either your POS handles it, or you reconcile tips in QuickBooks Time or a spreadsheet before payroll which is an extra surface area for errors.

Timesheet to GL Sync

Homebase pushes approved hours to QuickBooks accounting so your labor costs and payroll JE alignment can be standardized. That’s handy even if you choose Homebase Payroll, as it keeps your books tight with fewer manual mappings.

Compliance Controls (OT, Breaks, and Filings)

- Break & overtime discipline: Homebase flags missed breaks and calculates OT at the timesheet layer. In my experience, catching this before payroll is how you avoid backpay and penalty wages, especially in states with meal/rest rules. QB Time supports rules and approvals too; but I always felt that the difference is Homebase’s schedule-native approach, whereas in QBO it feels buried and like it’s an afterthought.

- Tax filing coverage: Both platforms do full-service payroll tax filings with W-2s and 1099s. Homebase explicitly supports all 50 states + DC and delivers W-2/1099 electronically (paper optional); QBOP likewise files federal/state/local where required. If you’re in a multi-state retail footprint, both are fine; the needle moves based on your time/tip complexity more than tax jurisdiction.

- Protections & support tiers: QBOP brings escalating protections (tax penalty protection, expert setup, same-day direct deposit, etc.) on Premium/Elite, plus 24/7 support on select plans. If your risk profile demands that kind of safety net, QBOP shines. Homebase keeps it straightforward: filings included, transparent fees, good support; it’s less about “insurance features” and more about preventing errors upstream.

Integrations and Ecosystems Gravity

- Accounting: QBOP’s native GL is QuickBooks, and that’s obviously an inescapable black hole. QBO is the premier accounting platform in the U.S., and it “just works” for most small businesses. If your books are in QuickBooks, payroll “just being there” is nice. That said, Homebase integrates to QuickBooks Online for hours and payroll JEs, so you can keep shifting people ops in Homebase without losing the accounting consolidation you want.

- POS & tips: Homebase’s angle is “bring your own POS” and stitch the real world together. The Tip Manager add-on makes POS to tip allocation to payroll feel first-party, regardless of which register you run. On the QuickBooks side, you’ll rely more on the POS (or a middleware like xtraCHEF) to land sales journals; while tip distribution still needs clean upstream logic to avoid manual work (those mangled spreadsheets I mentioned earlier).

- Time tracking: With QBOP Premium/Elite you get QuickBooks Time included, which is a big value if you would otherwise buy a separate tracker. If time tracking is your only frontline need and your shifts are simple, this bundling can win on TCO. If your team is heavily schedule-driven with frequent shift swaps, Homebase’s scheduler-centric workflow tends to create fewer exceptions in the first place.

Who Each Platform Fits

Pick Homebase if you…

- Run shift-based hourly teams with frequent role swaps, multi-rate pay, pooled tips, or strict break rules.

- Want the frontline app to be the source of truth (scheduling, messaging, PTO, time), so payroll inherits clean data.

- Like transparent, pay-for-who-you-pay payroll pricing and a free entry tier for small headcount (one location, up to 10 employees on Basic).

Pick QuickBooks Online Payroll if you…

- Live fully inside the QuickBooks ecosystem and want payroll tightly coupled to the GL with QuickBooks Time included (Premium/Elite).

- Value tiered protections and Intuit’s support machinery (think: penalty protection, expert setup; just be ready to pay tons of money for each!)

- Have straightforward tips or no tips, and don’t mind relying on POS/middleware to prep tip allocations pre-payroll.

Deep-Dive: The Daily Workflows and Where Time Disappears or Comes Back

1) Scheduling & Coverage Changes

- Homebase: You publish the schedule, and then employees can swap or pick up shifts in-app. Wage rates follow the role on that specific shift. Missed break alerts appear in timesheets. By payroll cutoff, your hours are already labeled with correct job codes/rates.

- QBOP + QuickBooks Time: You can mirror this with Projects/Jobs and solid manager discipline. It works, but you’re assembling the experience rather than living in a single “shift native” canvas. The more churn (no-shows, swaps), the more work will pile up.

2) Tip Pooling and Allocation

- Homebase: Pulls tips from POS, calculates pool based on hours/points/roles, writes allocations directly to timesheets → payroll. “Math lives next to the hours.”

- QBOP: Pay tips easily if the allocation is final. The allocation itself is upstream: POS or spreadsheets. Great when clean; tedious when Friday got weird. Me personally, if you’re doing anything that’s not straightforward with tips, I would steer clear of the spreadsheets and find a different method of wage compensation or try to use Homebase with a sync to QBO. Those tip allocation spreadsheets can be such a headache, it is a dread to do payroll, in my experience.

3) Multi-Location, One EIN

- Homebase: Payroll works across all locations under the same EIN (same frequency/schedule), which is common for multi-unit operators centralizing payroll. Hours and tips still start at the store level.

- QBOP: Also fine across locations; your control lives in classes/locations in QuickBooks and the job structure in QuickBooks Time. Works great with a disciplined chart and close checklist.

4) Tax Filings, Year-End

- Both: File federal/state taxes, generate W-2 and 1099 forms, and provide employee access to pay docs. Homebase makes W-2/1099 available in-app and supports paper on request. Intuit offers robust filing and resolution processes with strong support coverage, especially at upper tiers.

Implementation & Change Management

- Homebase: Import teams, set locations/roles/wage rates, connect POS if using Tip Manager, connect QuickBooks (accounting), and run a parallel pay to validate tax mapping. Payroll add-on keeps pricing simple and reduces the vendor sprawl the team touches day-to-day.

- QBOP: If you’re already on QuickBooks, setup is quick, especially on Premium/Elite with expert help. QuickBooks Time rollout is the heavier lift (training supervisors on approvals/job codes), but once the muscle memory builds, it’s solid.

Edge Cases

- Different wage rates in a single day: Homebase handles this cleanly if employees clock into the correct role at each handoff; the timesheet totals reflect multiple wages automatically. QuickBooks Time can do it via jobs/positions; just make sure managers enforce the switch.

- Retro tip corrections after payroll closes: In Homebase, I’d correct the POS day, re-pool in Tip Manager, and adjust the next payroll with a one-off earning line. In QBOP, the workflow is similar, but because allocation is upstream, you’ll likely do more manual calculation.

- 1099 volume (seasonal contractors): Both are fine. Homebase’s “pay the people you pay” model is cost-friendly when a bunch of 1099s are dormant most months. QBOP’s per-employee fee applies to active employees/contractors on that run; watch how your seasonal cadence lines up with monthly billing.

- Multi-company bookkeeping: QBOP excels when each EIN has its own QuickBooks file and you want consistent payroll JE treatment across entities. Homebase works well if the frontline ops are centralized and you’re making sure that clean hours and costs are being input into each GL.

Performance, Mobile, and Adoption

Both platforms are mobile-forward. Homebase’s mobile app centralizes schedule, time clock, team chat, PTO, pay stubs, W-2/1099 access, which really pushes adoption by your team. This is key when your team’s never going to open QuickBooks on their phone. I have Quickbooks on my phone, and even I don’t open it. However, QuickBooks’ workforce apps are mature and scalable; but adoption hinges on supervisor discipline with approvals. In shops where the schedule is the system of record, Homebase’s single-pane approach tends to win hearts (and reduce “I forgot to clock into the other job” errors).

Limitations

Homebase

- You’ll add the payroll add-on to a Homebase plan, which is just one more SKU to understand versus “payroll-only.” For pure accounting-centric shops with minimal scheduling needs, Homebase’s strengths can feel like more than you may need.

- Tip Manager is an extra add-on fee. I’m fine with that (it saves hours), but budget accordingly.

QuickBooks Online Payroll

- If your frontline lives in the schedule, QBOP can feel like three apps: scheduler (elsewhere), QuickBooks Time, and payroll, which is more seams where exceptions hide.

- Tip distribution requires clean upstream logic (say NO to tip allocation spreadsheets, together we can end the madness!). If your POS doesn’t do this well, someone is doing Excel gymnastics every week (not me, find a different accountant).

- Pricing is consistently rising; per-employee creep is real. Keep an eye on list vs promo pricing when forecasting.

My CPA Verdict

For shift-heavy, hourly operations, Homebase wins by a longshot because it treats the schedule as the truth and makes time, tips, and compliance flow through a single funnel before payroll. That’s fewer “we’ll fix it next run” IOUs. If your world revolves around QuickBooks and your time tracking needs are project/job oriented (field service, construction back office, pro services), the bundling in QBOP Premium/Elite is compelling, and you’ll appreciate Intuit’s protections and muscle.

If you asked me to implement today for a 40-person, two-location restaurant: I’d deploy Homebase with Payroll add-on and Tip Manager, and then I’d connect QuickBooks for the accounting sync, and run one parallel period. For a five-tech HVAC shop already in QuickBooks: QBOP Premium (to get QuickBooks Time) is an easy, efficient choice.

Either way, the “right” answer is the one that makes Friday boring.