Last Updated on December 4, 2023 by Ewen Finser

One of the most important decisions you must make when setting up a business is the legal entity to form it under. The United States government gives a few options depending on the business activity you wish to conduct, and all of them have their pros and cons. This step is critical as it defines how the authorities view your business and what you can and cannot do.

The most popular legal structure for small businesses is a Limited Liability Company. LLCs are structures that give owners the best of both worlds, making them suitable for anyone who does not want to lean towards the extremes. On the lower end of an LLC is a sole proprietorship or partnership, and on the higher end, a corporation.

LLCs are owned by “members,” and a time may come when one wishes to quit and move on with life. The law specifies various situations where this can happen and outlines the correct procedures to be used when removing them.

This piece will outline everything you need to know about removing a member from an LLC and explain the right way to do it.

Read on;

Overview of an LLC

An LLC is a business structure in the United States that protects its owners from personal responsibility from its debts and liabilities. This feature is shared in corporations as well. However, LLCs enjoy the best of both worlds since they have the flow-through taxation of a sole proprietorship or partnership.

The laws governing LLCs vary from state to state. Most states have no restrictions on ownership, and individuals, corporations, foreigners, foreign entities, and even other LLCs can be members of an LLC. Conditions are on banks and insurance companies.

LLCs are easy to set up, thanks to the digitization of this process. Today, you can apply to form one through the secretary of state’s website and have it approved within a few days.

LLCs have options when paying taxes. They can elect not to pay federal ones directly and have them reported through the personal tax returns of their owners. However, they can choose to be classified differently and pay them directly.

How To Form An LLC

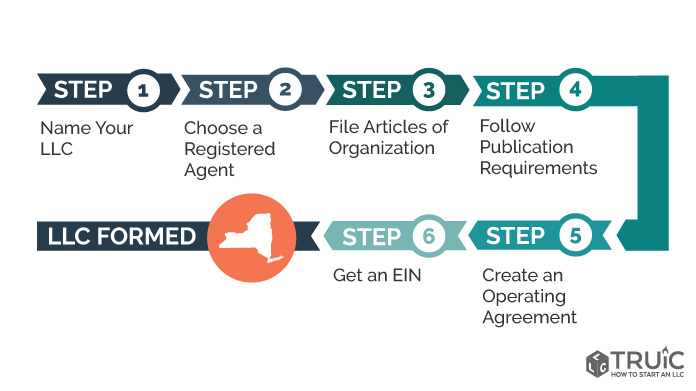

The requirements to form an LLC vary from state to state, but they are not all that different.

1. Choose a Name

The owners must pick a name the LLC will run by. The title should comply with the state’s rules which mainly indicate that it should end with the LLC tag or a variation of it. No other LLC should be using this name in that state. Owners can verify this by checking with the secretary of state’s website and see if the name is available or not. You can reserve a name for a small fee to give you time to complete the other processes that follow.

2. File Articles of Organization

This is a document that outlines all the essential information about the LLC. In most states, the document is digitized and presented as an online form that you can fill and submit. Some states refer to it as “certificate of formation” or “certificate of organization.”

Articles of organization contain the name of the LLC, name of the registered agent, details of the owners, how the LLC will be managed, and address, among others. You must pay a small fee when submitting this form, and it varies from state to state.

3. Select a Registered Agent

All LLCs must have a registered agent. This is an entity that receives legal communication from the government on behalf of the LLC. The registered agent must have a physical address in the state they are registered in. When selecting one, you have a few options, but some commercially set up entities advertise these services and let you enlist them for a small fee.

4. Create an Operating Agreement

This is not mandatory but very crucial to the smooth running of an LLC. Think of it as a constitution that defines the running principles of the LLC. It states how the LLC will be managed, the actions that follow in a conflict, how profits and losses are shared, etc. LLCs that do not have one will be subjected to the state’s standard operating agreement, which is unfavorable.

5. Tax and Regulatory Requirements

LLCs are independent entities and need to have an identity to the IRS. Therefore, you should get an IRS Employer Identification Number, even if you won’t hire any employees. An EIN is obtained by applying online on the IRS website. You will require the EIN when opening a business bank account.

Business licenses are mandatory, and they depend on what the company will do. All niches have specific business licenses, while others such as medical, financial, and consultation lines will need special ones. In addition, the state your LLC is formed in will require you to get some state-specific licenses. Before operating, ensure that you are properly registered, licensed, and permitted to do business in that state.

6. File Annual Returns

Most states require LLCs to file annual reports to them. There is a fee for this depending on the state.

How To Remove a Member from an LLC

The procedures for removing a member from an LLC are critical, especially if the management is in a dilemma. However, the members of an LLC are not allowed to vote out a member as specified by the Uniform Limited Liability Act. This act is used when an LLC does not create an operating agreement and is used in all 50 states and the district of Columbia.

Unless specified by the operating agreement, the only way members can remove another member is by writing a notice of withdrawal. The steps that ensue are;

1. Check Supporting Documents for any Clause

The first place for reference when removing a member from an LLC is the operating agreement. This document irons out any ambiguities with such situations and can give you an easy way out. It is specific for individual LLCs as members need to spell out the ground rules from the word go.

While the ULLCA does not allow for involuntary withdrawal, an operating agreement can permit it under certain circumstances. As a result, the first step to any withdrawal is to refer to this document and see the terms and conditions for withdrawal.

The operating agreement presented when forming the LLC is enforceable according to the law. When withdrawing from the LLC, whether voluntary and involuntary, a member has the right to a buyout agreement and should receive payment proportional to their ownership stake in the LLC.

2. Remove the Member According to the Rules

When the organization or operating agreement articles have a procedure for removing a member, follow the process. The document can allow for a provision to force members to withdraw if the steps are outlined clearly. In the absence of this clause, the ULLCA does not provide for a clause to remove a member forcefully.

3. Voluntary Withdrawal

A member can voluntarily withdraw from an LLC. They can initiate this process by announcing the intent in written form to the LLC.

Once the management receives the withdrawal notice, they will process it and see how to compensate the member for giving them an appropriate share of the LLC’s assets and profits before announcing the intent to leave. If the withdrawing member were responsible for the tax payments, they would have to submit a notification within 60 days to the relevant parties.

4. Member Buyout

If the operating agreement does not have a provision for involuntary withdrawal, other members can offer to buy out the one who is leaving. This is an easy way to avoid any complications with the process.

The ULLCA’s default guidelines have a provision for members who want to assign their stake to other members within the LLC, and this can be used as a loophole to give one a safe exit out of the LLC. Here, the existing members offer the withdrawing member cash equivalent of their stake in the LLC in exchange for their share, which can either be distributed to the remaining members or to one who offered the cash.

5. Forced Dissolution

In some instances, the members of an LLC can get to a stalemate and find it no longer necessary to keep on running the LLC. An example is a conflict between the members on some issues, and no one is willing to withdraw. Here, the best option is to petition the court for judicial dissolution of the LLC.

The ULLCA provides this option when the members can no longer run the business smoothly due to various conflicts. If the court of law approves judicial dissolution, the LLC is terminated. From here, the company should finalize any existing agreements as no new contracts can be entered.

Following judicial dissolution, the court assets are distributed among the members. The remaining members can form a new LLC but must use a new name and different terms. In simple terms, they must start the process of creating a new LLC from the start.

Significance of an Operating Agreement

The operating agreement is not mandatory in forming an LLC but a very crucial part. When starting a business, it’s all cozy, and everything is fine, but conflicts are inevitable, and here is where the operating agreement comes into play.

If the operating agreement explicitly outlines the procedures for removing a member from an LLC, the process will be very smooth. If it has no provision for this, and the member is stubborn, you might have to dissolve the LLC altogether. It is prudent to adopt an operating agreement for your LLC that clarifies members’ rights and obligations to the LLC and vice versa.

This document is legally binding to the LLC and members. A good one should have the following clauses;

- Member removal procedure

- Voluntary removal procedure

- Forced removal procedure

- Buyout mechanism

- Buyout terms and conditions

- Procedural delays

Having all these clauses in an operating agreement can help you address member withdrawal issues and avoid getting you in court.

Bottomline

Forming an LLC is easy but removing members can be challenging if you skimped over the operating agreement. We cannot emphasize the significance of an operating agreement, as members are often blinded by the potential of running a business and forget to address the possibility of conflicts. Ensure that you explicitly include clauses that give a provision for removing members to avoid nasty and lengthy processes that culminate in a lawsuit.