Last Updated on December 8, 2023 by Ewen Finser

Inventory…check. User interface…check. Domain…check.

Everything about your Shopify-based online store now looks solid and ready to roll. The stage is set and it’s almost showtime.

Just one more little thing. Yes, you’re dead right. A payment system. One that’s good enough to support your business for the long haul.

Come to think of it, facilitating remote payments has never been more important. As a matter of fact, going by information published by the US Census Bureau, online payments have now surpassed even the standard cash retail payments. In the last four years alone, the former has grown by 64%, marking a curve that’s four times as steep as the latter’s growth curve.

Well, the Bureau is not the only party that has noticed the rapid proliferation of this system of payment. Through their Global Online Consumer Report, KPMG also established that the average consumer is now conducting 19 online transactions per year.

Here are the most commonly used channels:

And you know what? All businesses are now responding proactively. Not just online stores. In the next five years, 66% of merchants believe that they will be operating completely cashless.

Now, of course, this is exceedingly beneficial to both consumers and enterprises. But all things considered, online payments come with their own set of complexities.

The biggest? We now have to rely on payment gateways to handle the payment process on the store’s behalf. Pretty much like bookies.

What is a Payment Gateway?

To be more specific, a payment gateway is a payment processing software that essentially handles the whole transactional part, and subsequently forwards the relevant financial data to your selected merchant account provider. It basically acts as the principal payment authorization system between payment portals and the corresponding processing bank.

Here’s the kicker. While this baseline fundamentally applies to all payment gateway solutions, the reality is that they actually operate under varying frameworks.

Now that alone introduces another complication, to say the least.

Thankfully, Shopify has grown to become more like a buffet of ecommerce tools. The platform now supports a wide range of payment gateways, all of which are distinctly optimized in their own special ways.

Well, I admit that I’d be the first to acquire one, hastily integrate it with my shop to get it over with. But, here’s the thing. Your final choice not only impacts your store’s transaction capability, but also overall profitability.

Each gateway solution manages transactions differently. Plus, 73% of consumers revealed that the payment system installed within a business largely determines if they will proceed to buy from that store.

Now, hang on a minute and assess that critically. You could spend a lot of time and resources building a business, conduct the subsequent marketing process quite diligently, then attract a decent following of prospects, only to lose them right at the payment stage. Just seconds away from a successful conversion. All because of an unideal payment gateway.

The average conversion rate across all ecommerce industries is 2.35%, with the highest ranked 25% managing a paltry 5.31%. The corresponding cart abandonment rate, as documented by multiple studies, averages at 69.89%.

So, of course, there’s simply no room for error here. You’re already losing prospects due to a wide range of technical reasons. Most of which are quite understandable for now. But, don’t spoil the broth further by adding an unsuitable payment gateway to the list.

Admittedly, the payment service providers, by all means, are making this even more difficult. They are essentially marketing each solution as the best when it comes to payment handling. To confuse you further, they also throw in a couple of technical terms and mix them up with guarantees, most of which, to be honest, cannot be verified right off the bat.

As a result, the selection process can be overwhelming at times. Especially if you’re a critical analyst who doesn’t evaluate solutions by popularity, but rather by their respective provisions. I’ve been there, and I know how it feels.

Fortunately for you, we’ve taken the time to comprehensively analyze and test multiple payment solutions according to their corresponding features and functionalities.

So, here’s what we’ll do. I’ll make everything much easier. By walking you through what ultimately made it to the list of the best Shopify payment gateways.

But, before we jump for the juiciest details, let’s first go through the most important consideration elements when choosing a Shopify payment gateway.

Critical Factors To Consider When Choosing Shopify Payment Gateways

1. Geographical Location

This has got to be the most ironic bit when it comes to online payment gateways. By virtue of facilitating remote transactions between consumers and ecommerce enterprises, you’d expect the payment solutions to support transactions globally.

After all, the web is quite advanced so far. Have a look at the extent of internet coverage worldwide, as of 2015.

By 2017, the number of regular internet users had surpassed 4 billion.

Now think about it this way. That’s essentially the sheer size of the prospect base on the internet. You can pretty much expand dynamically, and sell to more than half of the current human population, scattered widely at different geographical locations.

Sadly, it’s better said than done. Because the payment gateways seemingly don’t share the same enthusiasm. It turns out that they only support limited geographical locations.

To be fair, much of this has to do with complications arising from varying legislations, plus lack of uniform financial supporting structures across the globe.

But, facts are facts. Overall, the bottom line is that each payment gateway is available only in selected regions. While some are exclusive to specific countries, others have extended past the borders and established themselves as international payment gateways.

If you’re wondering, the answer is no. You don’t have to go through each solution to identify its supported territories. Thankfully, Shopify has systematically arranged them into major payment gateways, international payment gateways, and additional payment gateways by country.

To establish payment gateways supported in your area, just take a look at the applicable list. It really is that simple and straightforward.

Online stores based in the United States, for instance, have a menu of 40 seemingly appetizing major payment gateway options.

2. Business Size

One thing’s for sure. Online payments are gradually making cash payments redundant.

However, make no mistake. While cash might ultimately retire to the bank vaults for good, the financial regulations used to govern standard currency will always apply to electronic payments.

What does this mean to Shopify enterprises?

If you looked at various payment gateways keenly, you’d notice that they operate under different guidelines, applying distinct parameters when it comes to handling money. While some implement tax deductions at numerous levels, for instance, others prefer leaving that obligation to you.

We also have payment gateways that are specially optimized to handle large volume payments, and others at the opposing end of the spectrum, prioritizing on small volume transactions.

To curb online money laundering, they also come with varying limitations on the maximum amount of money you can process within a specified period of time.

Taking all this into consideration, it’s advisable to factor in your business setup and size as you evaluate the principles applicable to respective payment gateways. A micro business targeting a small geographical area, for example, can run comfortably on a payment gateway that doesn’t necessarily juggle currency exchange rates, variable taxes, and increased traffic.

Most importantly, however, do not limit your future growth capabilities. Settle on a decent payment solution that can be systematically scaled as your business expands with time.

3. Pricing Strategy

This is, by far, the biggest downside to online payments as opposed to standard cash transactions. Quite unfortunate that it costs money to accept payments online. The amount of money you make is more or less directly proportional to the corresponding loss in revenue from fees charged by payment gateways.

Some services charge fixed monthly fees. Others take their cut from every dollar you earn through their platform.

Well, at least there’s a silver lining after all. By hosting multiple possible payment gateway options, Shopify helps you benefit from increased competition. The service providers are already neck-deep in their little price wars.

That said, it’s worth noting that cheap is not always best. Conversely, expensive doesn’t translate to the best features.

That’s why you should keenly review their individual offerings in line with their respective pricing plans. You’ll have to work out your average monthly sales volume, then calculate the percentage fees charged by the payment gateways to establish if per-transaction solutions are cheaper than per-month charges.

If you’re dealing with a relatively large business, you might score a much better deal by negotiating with the service providers. The economies of scale have always favored large volume transactions.

4. Setup Time

Integrating a payment gateway to your Shopify account is as easy using the Settings option in the admin panel to go to Payment Providers, then Accept Payments, and proceed by clicking Add a Provider.

Sadly, that’s not all. While Shopify admittedly does quite a neat job of facilitating app integration, there’s also the other side of things to worry about- the final setup process from the service provider’s side.

This stage takes longer because of background checks and compliance issues. The service provider has to confirm all the business details, including legitimacy, location, credentials, and type of activities.

Now, to be fair, that might be a lot of work. Especially when you also consider the large number of applications some of these gateways deal with on a regular basis. However, a fraction of them are handling it quite well, resulting in a much-expedited setup process.

PayPal, for example, takes less than 24 hours to fire up a typical small business on Shopify, while services like Sage might force you to hold on for more than one month.

Your final choice here depends on your precise rollout schedule. If Black Friday is coming up, for example, and you urgently need everything up and running, you might need to stick with the faster options.

On the other hand, businesses with more time to spare as they perhaps work on other site elements, should be more flexible when it comes to choosing payment gateways according to setup time.

5. Fraud Prevention

Online card transactions are not convenient to only shoppers and ecommerce stores. Fraudsters are also in love with this system since it’s typically easy to capitalize on its vulnerabilities and get away with it.

Of course, we’ve seen many agencies responding by escalating their security measures. But the number of fraudulent cases is still growing at an alarmingly high rate.

Between 2013 and 2017, for example, the cost of credit card fraud increased by 26%. And get this. That data essentially covers what is thought to be the most developed country in cyber security- the U.S.

As a matter of fact, the US accounts for close to 50% of the global credit card fraud cases, despite taking up only 25% of the overall worldwide card transaction volume.

If you assumed that you were relatively safe, think again. And no, the size of your store won’t help you either. Although CNN and Fox News mostly cover cases affecting large corporations, there’s far more to the whole story.

Symantec’s Internet Security Report sampled various perpetrators and established that online card fraudsters don’t give a hoot about business size. They’ll come for your store with the same magnitude they attack established global companies.

And guess what? Shoppers are quite privy to this information too. Explains why 70% of them make decisions on transactions based on channels that are seemingly secure.

So, you want to protect your business and assure your customers of optimal protection? It’s really simple. You have to choose a payment gateway with a proven track record of effective fraud prevention. There are no two ways about this.

Pay attention to the even the smallest feature details as you analyze provisions by various payment gateways.

Top Shopify Payment Gateways

Now, over to the main dish.

Our assessment was pretty extensive, covering elements that all ecommerce businesses would consider most essential. However, since the features affect various shops differently, we chose to remain objective by not ranking them in any specific order. I leave that to you.

That said, here are the top Shopify payment gateways.

1. Shopify Payments

Think of Shopify Payments as the default payment gateway because it comes with your Shopify account. As a result, the setup process is pretty basic and doesn’t need any third-party integration. In fact, you can handle everything without coding experience.

Simply choose Shopify Payments from your account’s dashboard and enter your bank details. Pretty straightforward.

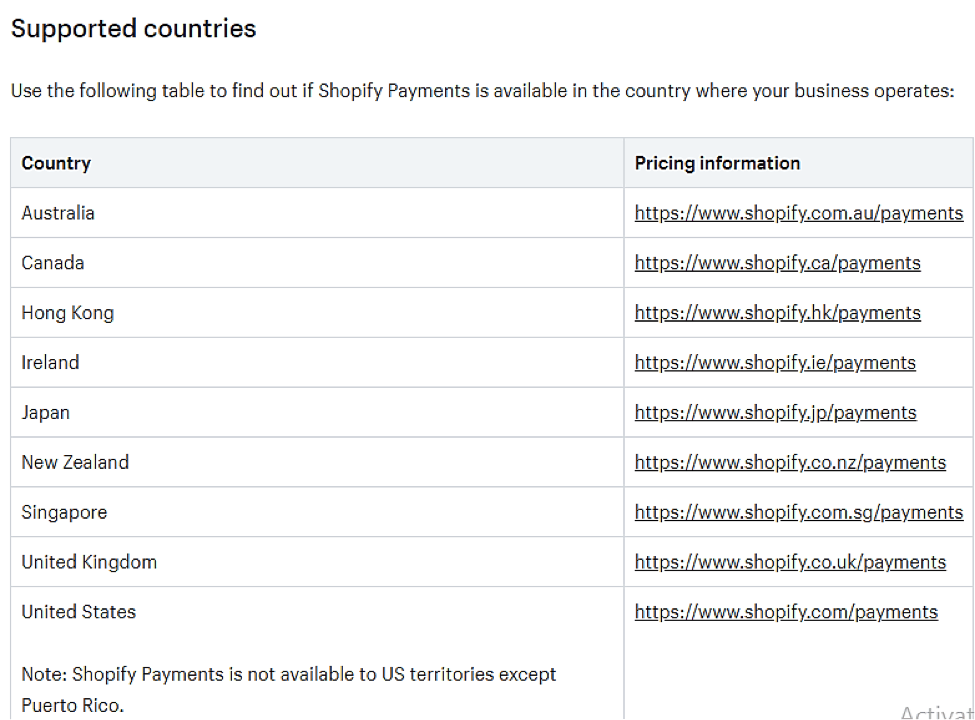

Sadly, the situation is quite different for online stores which are not based in Singapore, New Zealand, Australia, Ireland, the UK, Canada, Puerto Rico, and the US. Shopify Payments can only be leveraged by parties within those areas. Even US territories, apart from Puerto Rico, are not supported.

If you’re lucky enough to fall within that limited bracket, the first thing you’ll probably notice is waived shopping cart transactional fees. Shopify only applies these standard fees to users who are yet to subscribe to Shopify Payments. Stores using the service, on the other hand, end up paying only the card payment processing fees.

Fair enough, but how does the actual fee structure look like?

Well, it turns out that credit card rates are charged according to your overall Shopify plan.

- With Basic Shopify, Shopify Payments applies 2.9% plus $30 cents on every online transaction. In-person is slightly cheaper at just 2.7% of every transaction.

Users on Shopify get a lower rate of 2.6% plus $30 cents of each transaction conducted online. In-person transactions, on the other hand, cost 2.5% of the total amount.

- The cheapest rate is applicable to comparatively large enterprises subscribed to Advanced Shopify. They pay 2.4% plus $30 cents of each online credit transaction. The standard $30 cents, however, are waived when it comes to in-person transactions.

Pleasantly basic, to say the least. There are no extra hidden fees or monthly charges. You only pay when you make money.

The payment gateway then holds your money for a pay period that’s dependent on the country your shop operates from.

In the US, for instance, funds are remitted to the stipulated bank accounts every two business days. This wait time is double in the UK and Ireland, where Shopify Payments sends funds to user bank accounts after every four business days. New Zealand, Australia and Canada-based merchants, on the other hand, all have to wait for three business days.

Now, that’s seemingly not bad. Not bad at all. But, what do you get in return?

Apart from fraud analysis and chargeback management, Shopify Payments comes with a host of features built to optimize both online and in-person transactions.

All things considered, its primary benefit has got to be the waiving of transaction fees, which are usually charged across the board on all third-party payment gateways. Basic Shopify users typically pay the highest rates at 2.0% of every transaction, while Shopify stores are charged 1%, and 0.5% for Advanced Shopify.

Although you’ll be forced to pay the corresponding credit card rates, you’ll find them to be strategically competitive compared to other payment processing services.

Another feature you’ll possibly love is multi-vendor credit card support. In the US, for example, Shopify Payments accepts Diners Club, Discover, JCB, American Express, MasterCard, plus Visa debit and credit cards.

2. PayPal

Shopify Payments is quite popular on Shopify as the default service. We’re not challenging that. But, you have to admit that PayPal is the mother of all online payments. According to the 2016 Globe News Wire Survey, PayPal is, by far, the most renowned online payment processing service.

Such prominence, coming to think, is not just beneficial to PayPal as a global payment platform. Online stores are also enjoying the consequent consumer confidence.

69% of consumers, for example, trust PayPal at protecting their financial data. And they have every reason to, considering PayPal’s tight fraud prevention features and protocols.

Now, when it comes to Shopify, PayPal is available through two primary integrations:

- PayPal Express Checkout

- PayPal Payflow Pro

Shopify continues to encourage its users to opt for PayPal Express as opposed to Paypal Standard, which will ultimately be eliminated from Shopify. Unlike the latter, the former does not relay payment notifications to Shopify, which run the risk of getting lost.

In addition to one-click checkout button, PayPal Express provides automated order cancellations, which essentially refunds customers when orders are canceled. This saves you the trouble of logging into your PayPal account to manually process the refunds.

Tracking the individual transactions even after such automatic operations shouldn’t be hard at all, considering PayPal Express’ detailed order summary feature. You can follow up on everything through its well-organized descriptions attached to pretty much each line item.

And guess what? Setting up this PayPal system is completely free, and exempted from regular monthly charges. However, PayPal will take 2.9% plus $30 cents from every transaction. Pretty much means that the final cumulative charges could add up to deductions of (4.9%+$30c), (3.9%+$30c), or (3.4%+30c) if you factored in Shopify’s typical transaction fees.

But you know what? You can save yourself from all that by simply maintaining Shopify Payments, along with any of PayPal’s integrations within your online store. This strategy alone eliminates transaction fees from your entire store, regardless of any extra third-party integration.

Payflow Pro, on the other hand, was developed for users seeking a much more flexible option. You can configure multiple elements like page sequence, layout, language, and PCI compliance options to suit your specialized needs. It’s also possible to offer PayPal Credit on this integration, and proceed with either their default hosted pages, or your own unique PayPal button built right into your store.

Now, that’s neat. But, here’s the kicker. Payflow Pro comes at an additional cost of $99 during setup, plus a standard monthly fee of $25.

3. Worldpay

Just as its name suggests, Worldpay is another extensive online payment platform, available globally. But, make no mistake. It’s not as big as PayPal yet since it’s only available in about 120 countries.

Now, it might be lagging behind the leader, but let’s admit it. A global reach of more than 100 countries is no easy feat at all.

And the best thing about this? Well, apart from facilitating payments from multiple countries, Worldpay supports a wide range of credit cards and debit cards.

So far, your customers will be able to pay via Visa Purchasing, Visa Electron, American Express, Maestro, plus MasterCard debit and credit cards.

But that’s not all. Interestingly, Worldpay also accepts PayPal payments. As a result, it’s practically possible to accept payments from unsupported credit cards, which are alternatively accepted on PayPal.

And just like other major payment gateways, Worldpay has implemented a solid fraud detection and prevention system to protect both online stores and shoppers. It also handles data compliance logistics for you, processing sensitive card data within their servers, and then relaying the subsequent info as anonymous tokens.

Apart from uptime reliability, Worldpay is particularly known for exceptional tech support, optimized for both developers and shop owners. Reviewing your application and setting up a payment gateway should take about 24 hours. Any integration difficulties are addressed by a team of developers who actually wrote the service’s code.

If your ecommerce enterprise provides products based on subscriptions, you’ll love Worldpay for its recurring billing features. It can securely hold onto your shoppers’ details over a prolonged period of time to process recurrent payments as requested by your customers.

Since the payment gateway typically settles funds twice a week, store owners eventually receive their money about three to four days after order placement.

All things considered, Worldpay is a notable service worth checking out if you’re particularly keen on expanding your business globally. It supports 120 currencies, making it possible for foreign-based customers to conveniently pay for products and services without any difficulties.

So, what will this cost you?

Worldpay is available in two optional plans. Pay-as-you-go merchants pay a 2.75% of the transaction cost plus £0.20 on both debit and credit card payments.

You can alternatively proceed with the monthly package, which costs £19.95 per months, plus 0.75% of the transaction volume on debit cards, and 2.75% of credit card transactions.

Setting all this up shouldn’t cost you a cent. However, PCI compliance certification is only awarded after paying £29.99 per year.

4. Authorize.Net

Authorize.net has been around the block since 1996, progressively managing a decent foothold in the payment gateway space. So, far, it has expanded to Canada, Australia, Europe, the United Kingdom, and the United States.

To cut to the chase, one of the principal things you’ll notice right off the bat is the relatively high pricing structure. First of all, you’ll be required to pay $25 per month as the standard gateway fee.

Well, that should be enough to match up to other payment gateway solutions. But Authorize.net, surprisingly, proceeds beyond that to charge 2.9% plus $0.30 on each transaction.

Admittedly expensive, to say the least. At least until we come to the service’s intricate details.

Here’s the thing. There’s always that risk of chargebacks for each transaction flagged as fraudulent. Although standard payment gateways with typical fraud prevention protocols reduce the chances, it’s still possible to fall victim to friendly fraud.

A single case could lose you about $15 to $25 in chargeback fees. That’s bad enough. But, to make matters worse, credit card companies like MasterCard or Visa might start taking a keen interest in you. Then eventually cease accepting payments from your site after several chargebacks, subsequently killing your business effectively.

Now, that’s precisely where Authorize.net comes in. It might be a bit costlier for good reason, owing to its high-level fraud prevention features. Its Advanced Fraud Detection Suite (AFDS), for instance, is holistically optimized to prevent cases of fraud, consequently saving you from possible chargebacks and blacklisting.

So, in the end, Authorize.net is substantially cheaper than chargeback fees your store might be incurring with weaker payment gateways.

Bottom Line

To recap, here are the critical pointers to remember:

- As a matter of fact, going by information published by the US Census Bureau, online payments have now surpassed even the standard cash retail payments.

- In the next five years, 66% of merchants believe that they will be operating completely cashless.

- A payment gateway is a payment processing software that essentially handles the whole transactional part, and subsequently forwards the relevant financial data to your selected merchant account provider.

- Plus, 73% of consumers revealed that the payment system installed within a business largely determines if they will proceed to buy from that store.

- Each payment gateway is available only in selected regions. While some are exclusive to specific countries, others have extended past the borders and established themselves as international payment gateways.

- It’s advisable to factor in your business setup and size as you evaluate the principles applicable to respective payment gateways.

- Work out your average monthly sales volume, then calculate the percentage fees charged by the payment gateways to establish if per-transaction solutions are cheaper than per-month charges.

- While Shopify admittedly does quite a neat job at facilitating app integration, there’s also the other side of things to worry about- the final setup process from the service provider’s side.

- Between 2013 and 2017, for example, the cost of credit card fraud increased by 26%.

- The US accounts for close to 50% of the global credit card fraud cases.

- Think of Shopify Payments as the default payment gateway because it comes with your Shopify account. As a result, the setup process is pretty basic and doesn’t need any third-party integration.

- Shopify only applies standard transaction fees to users who are yet to subscribe to Shopify Payments.

- 69% of consumers, for example, trust PayPal at protecting their financial data.

- PayPal is available through two primary integrations: PayPal Express Checkout, and PayPal Payflow Pro.

- Interestingly, Worldpay also accepts PayPal payments.

- Apart from uptime reliability, Worldpay is particularly known for exceptional tech support, optimized for both developers and shop owners.

- Net Advanced Fraud Detection Suite (AFDS) is holistically optimized to prevent cases of fraud, consequently saving you from possible chargebacks and blacklisting.

All in all, your final choice depends on all the fundamental assessment factors we’ve covered. And the best thing is…you can settle for several payment gateways in one online store. So, feel free to mix them up according to your enterprise needs, and please remember to share your experience in the comments section.