- The Bottom Line Up Front

- Pricing & Packaging and the “Gotchas”

- Bank Feeds & Reconciliations

- AP/AR, Invoicing, and Payments

- Reporting, Analytics, and “Board-Ready” Financials

- Projects, Inventory, and Operational Accounting

- Ecosystem & Integrations

- Payroll (US Focused)

- Security & Compliance

- Geography & Compliance Scope

- Month-End Close & Who Actually Does All the Work?

- Where Each Platform Could Use Improvement

- Technical Details that CPAs and Accountants Care About

- A Couple of Examples of Who Should Use What

- A Couple of Other Things to Chew On

- Final Verdict (With My CPA Hat On)

- My Recommendation:

Last Updated on October 23, 2025 by Ewen Finser

waiting for! We’ve got a new guy on the block who has a bone to pick with the legacy accounting platforms, and from what I’ve seen of the platform, Digits means business.

Digits is not an overlay or a dashboard bolted onto somebody else’s ledger, it is the ledger, and it runs under a litany of buttery smooth reports and AI machine learning. Digits calls it the Autonomous General Ledger: ML handles classification, matching, doc extraction, and variance flags while humans review the exceptions. Agents, such as the Bookkeeping, Payments, Finance, Reporting, and (on Professional) Accounting, run continuously and surface items for sign-off. Everything lives in one place (banks/cards, bills, invoices, vendors/customers, the GL, interactive financials), cutting browser tabs, CSVs, and costly additional apps.

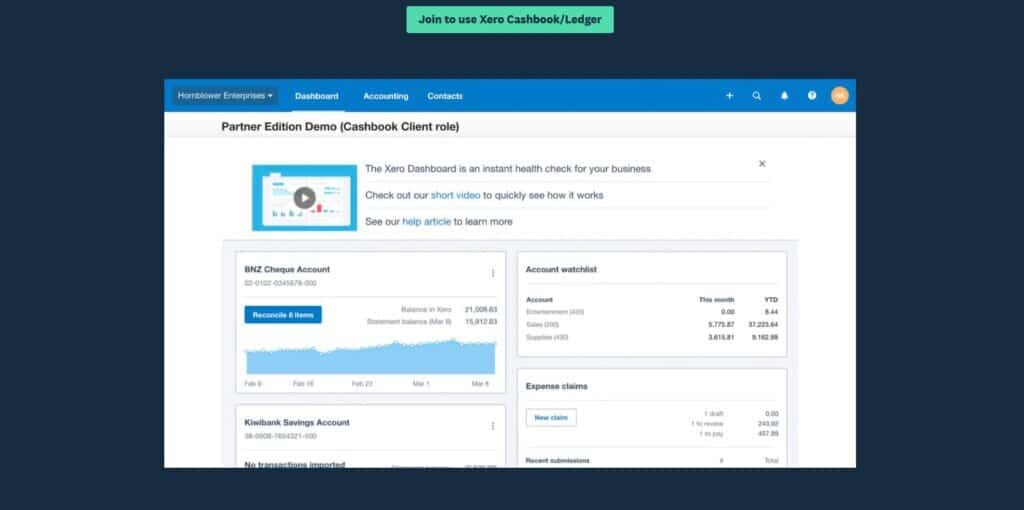

Xero takes the opposite path: it is a mature, global SMB accounting suite built around stellar bank recs, then expanded to invoices, bills, Hubdoc expense capture, projects, short-term cash analytics, and a marketplace that’s effectively an app store. Its unlimited users across plans is a gift for accountants and multi-stakeholder teams. In the U.S., payroll runs via Gusto and is now embedded as “Xero Payroll powered by Gusto.”

Let’s see how they stack up.

The Bottom Line Up Front

If your finance stack lives in the U.S. and you’re sick of gluing together bill pay, invoicing, or reporting tools, Digits feels like a time machine from the future: an AI-native ledger that categorizes continuously, drafts management narratives, and automates the close with its agents. If you need international reach, a gigantic marketplace, and long-proven workflows (especially for accountants running dozens of client files), Xero remains a brutally effective, globally mature platform with serious U.S. momentum now that it has acquired Melio for embedded AP/AR.

Pricing & Packaging and the “Gotchas”

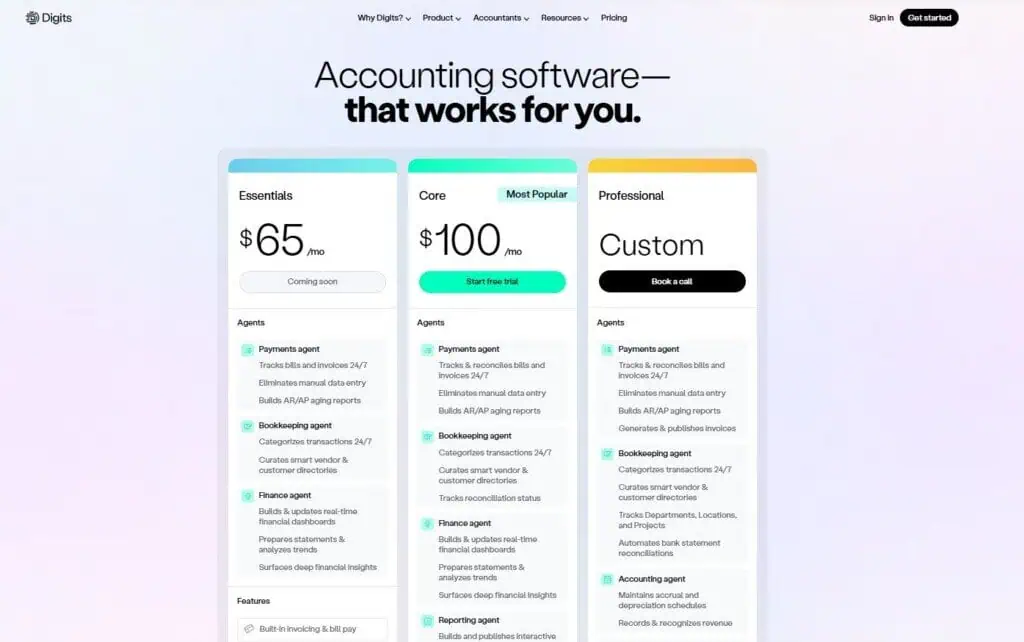

Digits Pricing (Simple, with “Agents” Baked in)

- Essentials – $65/mo (coming soon): Payments, Bookkeeping, Finance agents; built-in invoicing & bill pay; unlimited users & connections.

- Core – $100/mo (most popular): Adds Reporting agent, statement reconciliations, secure docs. This is where most businesses would see themselves, unless they’re running complicated and niche businesses.

- Professional – Custom: Adds Accounting agent (accruals, depreciation, revenue recognition), projects/departments tagging, open API.

The Hidden Edge: The “agents” approach collapses what you’d otherwise buy as separate add-ons (bill pay, reporting/BI, close management) into the base subscription. That’s rare in legacy stacks, and ultimately saves you dough.

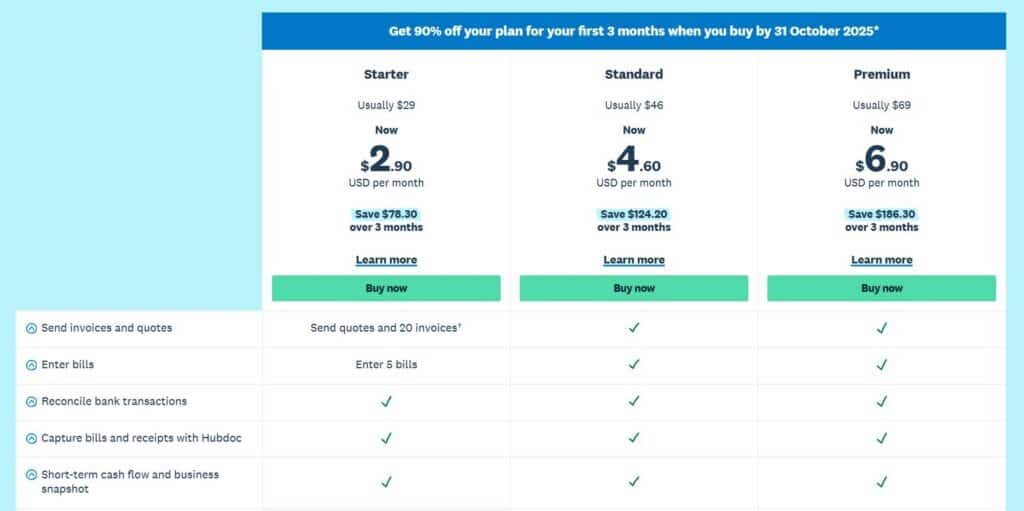

Xero Pricing (Straightforward Base Plans + Ecosystem)

- US Early/Growing/Established model; Early caps at 20 invoices/5 bills; unlimited users across plans. Promotions rotate (e.g., 90% off for 3 months until Oct 31, 2025). Expect additional costs for advanced analytics, inventory extensions, and third-party apps

The Hidden Cost: Xero’s value compounds with its app store but many mid-market workflows (advanced reporting, consolidation, complex inventory, approvals) land in paid add-ons like ApprovalMax, Fathom, Spotlight, or consolidation tools. Budget that in.

Bank Feeds & Reconciliations

- Digits: Positions itself as a continuously ingesting engine + 24/7 AI categorization with quality checks and automated bank statement reconciliations (Core+). The goal is fewer manual rules and less “bank rec day dread.”

- Xero: Bank recs are a longtime strength of Xero. ML-powered predictions assist coding when rules/matching don’t hit; this has been a multi-year investment that surfaces in faster bank rec for high-volume accounts.

A Reality Check: If your books are noisy (marketplaces, multiple cards, reimbursements), both will help but Xero’s ML is proven at scale; however Digits’ promise is that native agents plus a modern ledger cut the back-and-forth even further. If you reconcile from statements each month, Digits’ statement reconciliation on Core+ is a game-changer for closing.

AP/AR, Invoicing, and Payments

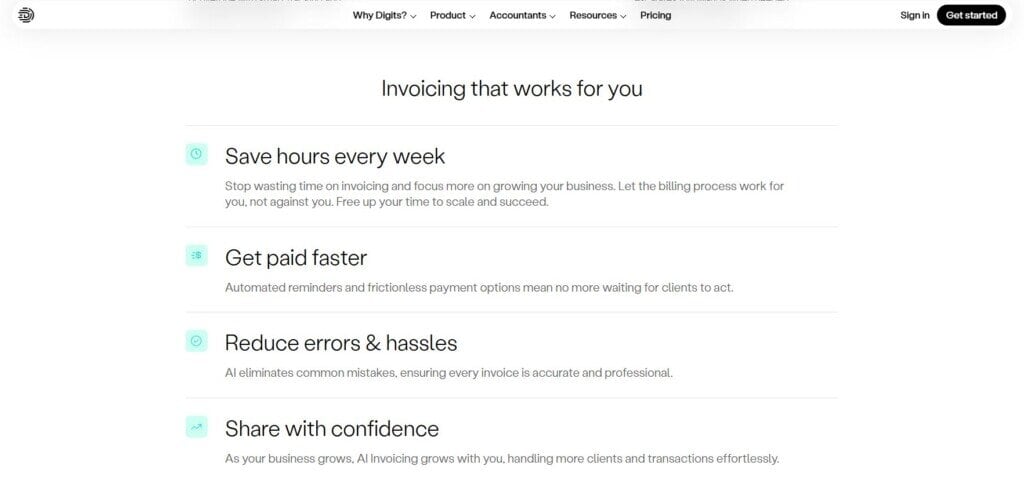

- Digits: AI Bill Pay is dead simple; it’s drag, drop, and pay. Digit’s also boasts AI Invoicing, standard AR/AP reports, and payment tracking are first-class modules included in plan tiers. It’s very “single pane” for both AP and AR.

- Xero: Possesses a mature invoicing/bills module with tight ecosystem payments (Stripe, Square, etc.). And big news as of Oct 2025, Xero acquired Melio to deepen native AP/AR in the US so you can expect a much richer “payments-inside-Xero” story as this integrates.

Decision Hinge: If you want out-of-the-box AP/AR automation without shopping the app store, Digits is appealing. If you love choice or require Melio-grade rails inside a broad accounting system Xero’s trajectory is compelling.

Reporting, Analytics, and “Board-Ready” Financials

- Digits: Interactive management reports and dashboards are core, with a Reporting agent (Core+) that drafts/annotates executive summaries. The Finance agent builds real-time KPI dashboards (burn, runway, revenue). It’s designed for founders and CFOs who want the reasons around the numbers, not just PDFs.

- Xero: Solid standard financials; Analytics Plus gives short-term cash flow and business snapshot forecasting. For deeper packages (driver-based plans, cohorts, consolidations), most businesses are going to use a separate application, but I really enjoy exporting to Excel and doing my pivots there

Projects, Inventory, and Operational Accounting

- Xero Projects can do “light job costing” which is great for time/expenses and basic profitability. It’s not built for heavy construction or manufacturing without add-ons in my opinion. Tracking categories help, but there are limits (e.g., only two active tracking categories). Many contractors graduate to specialized tools or change accounting ERPs entirely.

- Xero Inventory suits simple inventory stock; sophisticated multi-channel inventory often goes to app-store solutions, or once again requires a platform migration to something a bit more robust, like Sage Intacct.

- Digits markets Projects/Departments/Locations tagging on the Professional tier and has an Accounting agent that maintains accruals/depreciation. The agent recognizes revenue and is useful for SaaS deferrals and fixed-asset hygiene. If you need deep operational inventory or complex WIP, you’ll still want a vertical tool, same as with Xero.

Ecosystem & Integrations

- Digits claims a “Connect API Platform” with 12,000+ real-time integrations and showcases native connections to apps like Ramp, Amex, Stripe, Mercury, Gusto, and major banks via Plaid. Digits is strong for modern finance stacks, but the third-party app catalog isn’t as public or wide as Xero’s.

- Xero: A huge app store (1,000+ apps), curated collections, popularity lists, and annual global app awards. If you want à la carte best-of-breed tooling (approvals, collections, BI, POS, inventory), Xero’s marketplace is still the gold standard.

Payroll (US Focused)

- Digits: Doesn’t market native payroll. It integrates with providers such as Gusto so that Payroll is pushed directly to the platform. I have found that this is the case with many platforms, and have used ADP, Paychex, etc.

- Xero: US payroll is delivered via Gusto and is deeply embedded with single sign-on, a Gusto tab inside Xero, and automatic syncs. Xero is currently rolling out “Xero Payroll powered by Gusto” as a direct, in-product experience.

Security & Compliance

- Digits: SOC 2 Type II, “envelope encryption” per-secret, TLS everywhere, tokenized financial data access. The security write-up is exceptionally detailed for such a young platform, which shows me the Digit’s team takes security very seriously.

- Xero: Also SOC 2 audited and enterprise-grade security, with battle-tested operational controls across a global customer base. (As a general claim; Xero maintains robust security standards commensurate with scale. For pay-run data in the US, your payroll records live in Gusto and sync to Xero.)

Geography & Compliance Scope

- Digits is US-only right now (by its own FAQ). If you have foreign subsidiaries or VAT/GST obligations abroad, that’s a constraint to consider.

- Xero: Global footprint, localized features for many countries (e-invoicing frameworks, tax workflows, etc.). If you’re operating outside the US, Xero’s maturity shows up fast.

Month-End Close & Who Actually Does All the Work?

- Digits’ Close Automation and its agents aim to reduce the human steps: statement reconciliations, variance surfacing, report drafting, and executive summaries are handled by the platform, with “human-in-the-loop” review as needed. For small finance teams (or CAS firms), this feels like a force multiplier.

- Xero’s month-end is the classic toolset: great bank rec, cash coding, and standard reports. Plus gives short-term cash forecasts; the rest (close checklists, consolidation, narrative packs) typically come from apps or an excel spreadsheet.

Where Each Platform Could Use Improvement

Digit’s Current Gaps and Shortcomings

- US-only: Currently, there is no native multi-country support (tax/VAT, localization). If you have overseas entities now or soon, that’s a problem.

- Ecosystem maturity: While Digits lists boasts tons of connections, its public app marketplace isn’t as wide as Xero’s. If you rely on niche industry tools, validate integrations first.

Xero’s Limits and What to Plan Around

- Entry-plan caps: Early limits 20 invoices & 5 bills; many businesses outgrow this in month one. Budget for Growing/Established.

- Consolidations need an app: No native multi-entity consolidation; common to use an external application.

- Projects/Inventory depth: Usable but lightweight versus construction/manufacturing needs; complex job costing often requires specialized add-ons (or new ERPs entirely if you’re large in construction or contracts).

Technical Details that CPAs and Accountants Care About

- Ledger & Automation

- Digits AGL is something that I love, and just can’t get enough of it. As a CPA, I love when platforms emphasize AI-driven bookkeeping, reconciliation automation, and the things that put hours back into my day, saving me time and my clients money.

- Xero Ledger: decades of design iterations around bank rec and cash coding; ML predictions assist bank rec coding; Analytics Plus extends options for things like cash forecasting. I typically don’t use those though, and do my own cash forecasting in Excel.

- AP Approvals and Audit Trails

- Digits: AI Bill Pay and approvals in-platform; you can secure and store documents within the platform; collaboration and commenting are native.

- Xero: baseline approval flows exist, but mid-market shops often add applications like ApprovalMax for multi-step approvals and audit trails at scale.

- Users & Access

- Digits: Unlimited users on all tiers; collaborative commenting baked in.

- Xero: Unlimited users across plans (rare among SMB suites). Granular roles are decent; firms often add practice tools for workflow.

- AP/AR Rails

- Digits: First-party AI Bill Pay and AI Invoicing.

- Xero: Historically third-party rails (Stripe/Square); Melio acquisition signals deeper native payments. I think this is something to watch.

- Payroll

- Digits: Integrate with your choice; Gusto plugs and plays well.

- Xero (US): Gusto embedded; Xero Payroll powered by Gusto beta indicates a tighter, single-login experience.

A Couple of Examples of Who Should Use What

- Venture-backed SaaS / tech SMBs (US)

Digits wins hands down due to its automated classifications, revenue recognition on professional, real-time reports, interactive board packs, and fewer apps to wrangle. Accountants can “manage the machine” and review rather than grind. - Multi-entity, multi-country groups

Xero wins today due to global reach and a mature consolidation ecosystem (Fathom/Drivetrain/Konsolidator). Digits is US-only for now. - Trades, Construction, Field Services

The edge goes to Xero with a stack of vertical apps. Xero Projects is light, but the app store fills gaps (approvals, PO management, job costing). Digits’ tagging plus Accounting agent helps on the GL side, but you’ll still want a specialized operational system if you want to be GAAP compliant with your construction clients. - In-House Finance Teams That Are Working to Modernize Close

Digits Core and Professional statement recs, reporting agent, and close automation save hours, especially for lean teams or CAS firms standardizing across clients. I personally believe they’ve got Xero beat if you’re looking to modernize. - Price-Sensitive Solo Shops

Xero early is cheap but capped; while Digits essentials at $65 (coming soon) includes bill pay, invoicing, and unlimited users. If you’re sending more than a handful of invoices, Xero’s caps will push you up quickly. Meanwhile, Digits’ value is that those modules are included even at entry level. Run the math based on your invoice volume.

A Couple of Other Things to Chew On

- Xero is buying Melio (announced June 2025) to bring modern AP/AR deeply into the core product, and that’s especially relevant to US customers. If Xero executes well, AP/AR inside Xero will look less “add-on” and more “native.” That blurs one of Digits’ current advantages.

- Digits’ product velocity (Finance/Reporting/Accounting agents; AGL; AI Bill Pay/Invoice) has accelerated, with active marketing to CPA firms and a partner program. Expect more “close automation” features to show up natively versus via marketplace. Also, keep an eye on their change log as they seem to be consistent with pushing out updates.

Final Verdict (With My CPA Hat On)

If your goal is time back and you operate primarily in the US, Digits is the least amount of friction to a modern, automated close. The agents model absorbs what would otherwise be a small constellation of third-party tools. You’ll ship interactive, narrative-ready financials without living in Excel and PDF exporters. However, if you plan to expand internationally or need a very specific vertical integration, validate those connections up front, and know that multi-entity consolidation will still require outside tooling.

If you want breadth, locality, and ecosystem gravity, you can’t go wrong with Xero. It’s a proven ledger for SMBs, with ML-assisted bank rec, unlimited users, and a thriving marketplace. The Gusto embedding gives a strong payroll story for US shops, and the Melio acquisition suggests Xero will feel more “all-in-one” over the next 12–18 months, especially around AP/AR. You’ll likely still bolt on analytics and consolidation to make it sing, but the paths are well-worn.

My Recommendation:

- US Startup or tech CFO or CAS firm? Start with Digits Core. If you outgrow it, you’ll outgrow into Professional, not into a tool zoo.

Global SMB or multi-entity group? Start with Xero Growing/Established, then add consolidation/BI as needed. Keep an eye on the Melio integration roadmap.