- Bottom Line Up Front:

- Why Online Notarization Matters for Professionals

- OneNotary at a Glance

- Comparing OneNotary to Other Platforms

- A Real Example of OneNotary Saving My Bacon

- Let’s Talk About The Pros and Cons

- Security and Compliance: I Can’t Understate The Importance of This

- Workflow Integration for Professionals

- How OneNotary Stacks Up Against Competitors

- Where OneNotary Could Improve

- The Bigger Picture: Online Notarization and the Future of Professional Services

- Case Studies from My Practice

- State Regulations and Acceptance

- The Cost-Benefit Equation

- My Balanced Verdict

- Looking Ahead

Last Updated on August 25, 2025 by Ewen Finser

As a CPA, paperwork is part of my daily life. Like at this point, I am REALLY good at pushing paper, and that’s good because it pays my bills. Tax filings, financial statements, loan documents, you name it, I’ve probably seen it. However, occasionally I run across documents that need to be notarized, and that’s not always convenient when my book keeper, who holds her notary, is out of office. Finding a notary, making an appointment, driving across town, is such a colossal waste of time.

That’s why I started exploring online notarization services. I wanted something that could save me time while still meeting all legal and compliance requirements. After testing a couple platforms, OneNotary stood out. It’s not the only option available, but in my experience, it strikes the best balance between convenience, security, and professionalism. Today, I’ll share how OneNotary compares to other services I’ve tried, what worked well, and a few areas where I think each platform could improve.

Bottom Line Up Front:

As a CPA who handles notarized documents regularly, I’ve tried several notarization platforms. They all save time compared to the old in-person model, but OneNotary stands out for its ease of use, on-demand availability, and strong compliance features. While competitors like Notarize, DocuSign Notary, and NotaryCam each have strengths, OneNotary has proven to be the most reliable and client-friendly option in my practice, making it my go-to recommendation.

Why Online Notarization Matters for Professionals

As a CPA, time is my most valuable resource and biggest enemy. Every hour I save on logistics is an hour I can spend with clients, reviewing numbers, or digging into tax strategy. The shift toward remote work and digital services has changed client expectations, too; many now expect quick, paperless solutions (which I’ll HAPPILY offer; I don’t even own a printer in my home office).

Online notarization checks those boxes. Instead of driving to a bank or UPS store, I can upload documents, verify my identity, and connect with a licensed notary on my laptop. The session is recorded, and the notarized document is immediately available for download. For professionals managing multiple clients, this efficiency is hard to beat.

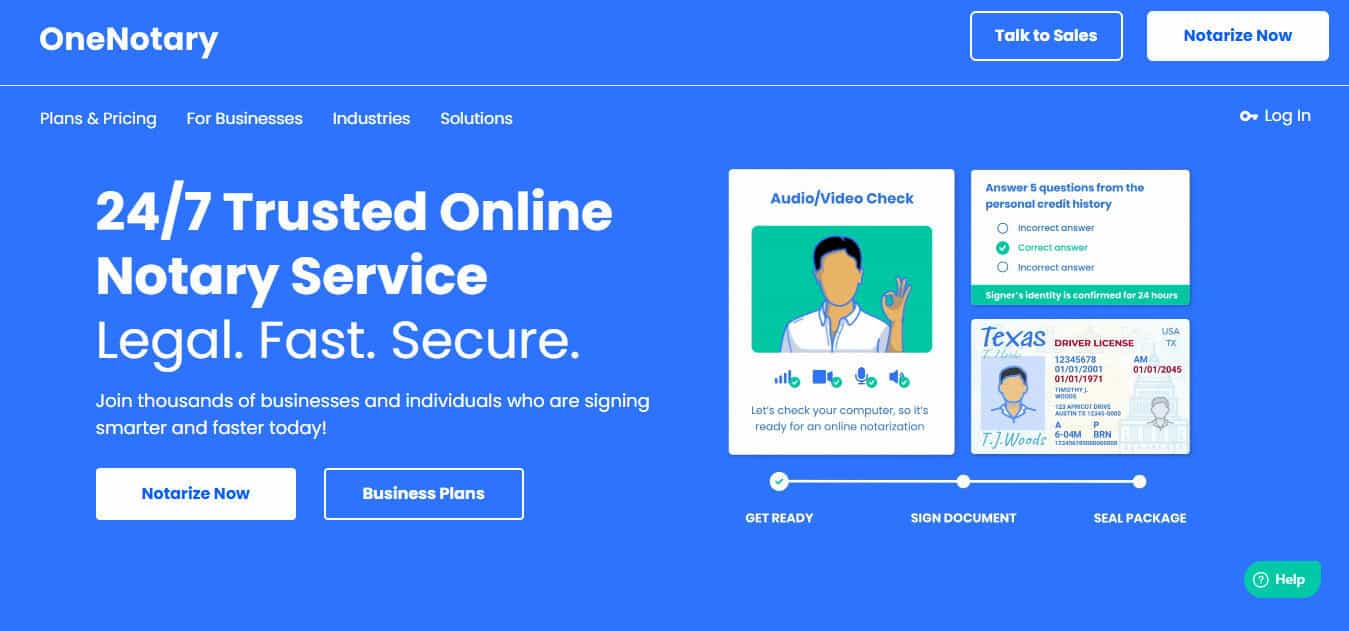

OneNotary at a Glance

Here’s what I found most useful about OneNotary:

- Ease of Use – The interface is clean, and even clients who aren’t tech-savvy have no trouble navigating it. It’s literally a couple of mouse clicks to get your docs notarized.

- Availability – Notaries are available on demand, often within minutes, so I don’t have to plan days ahead. Typically, I connect within mere seconds, let alone minutes.

- Security & Compliance – All sessions are encrypted and recorded, which helps me maintain a clear audit trail for sensitive financial documents.

- Client-Friendly – I’ve referred clients who live out of state or overseas, and they’ve been able to complete notarizations without issue.

Comparing OneNotary to Other Platforms

I tested several online notarization services before settling on OneNotary. Each has its merits, but here’s how they stack up in the areas that matter most to me as a CPA:

1. Pricing

- OneNotary – Transparent pricing, no hidden fees, straightforward for single notarizations. I also feel that it’s valuably priced and is affordable.

- Notarize – Competitive, but can get expensive for bulk usage or frequent signings.

- DocuSign Notary – Usually bundled with larger corporate contracts, less appealing for small firms or individual professionals.

2. What About the User Experience?

- OneNotary – Streamlined and intuitive, clients often complete their notarization without asking me for help.

- NotaryCam – Functional, but the interface feels dated compared to others.

- Notarize – Polished platform, but onboarding can be confusing for first-time users.

3. Availability of Notaries

- OneNotary – On-demand, with super short wait times. The last time I used it, I was connected in seconds.

- NotaryCam – Availability depends on scheduling; not always ideal for urgent needs.

- Notarize – Generally reliable, but peak hours sometimes mean delays.

A Real Example of OneNotary Saving My Bacon

One of my clients, a small business owner, needed documents notarized for a loan application to help grow their business; they really needed access to these funds urgently. Normally, this would involve taking time away from the bank to track down a notary. Instead, we used OneNotary, and within 15 minutes, the documents were notarized, signed, and ready to upload to the lender.

From my perspective, the value isn’t just convenience, it’s the ability to keep client projects moving without interruption. That’s why I keep going back.

Let’s Talk About The Pros and Cons

No service is perfect, and I think it’s important to give a balanced view. Here’s how I’d summarize OneNotary compared to others:

Pros of OneNotary:

- Easy-to-use interface for both professionals and clients

- Reliable on-demand access to notaries

- Strong compliance and record-keeping for audit trails

- Works well for cross-border or out-of-state notarizations

Cons of OneNotary:

- Limited integrations with other professional software (e.g., accounting platforms)

- Slightly higher cost than DIY notarization at a local bank, though the time savings often outweigh the difference

- It can take a couple of minutes to enter all the necessary documentation into the system to verify who you are.

When I weigh these factors, the benefits clearly outpace the drawbacks.

Security and Compliance: I Can’t Understate The Importance of This

In accounting, I deal with sensitive client data every day; it’s just part of my life. Social Security numbers, bank statements, tax returns. If there’s one thing I can’t compromise on, it’s security. Online notarization introduces a digital element that some people are skeptical about, but in practice, I’ve found OneNotary takes compliance even more seriously than I do.

A few points worth noting:

- Encrypted Sessions – Every online notarization through OneNotary is encrypted, which means client information is protected end-to-end.

- Identity Verification – Before the session begins, the system runs identity checks that are often more robust than what you’d get in person. Clients upload their ID and answer knowledge-based questions.

- Recorded Sessions – The entire signing is recorded and stored securely. From a CPA’s perspective, this is gold for audit trails. If I ever need to confirm a detail later, the session log provides proof.

- Legal Recognition – OneNotary’s notarizations are valid under state laws and the federal ESIGN Act, which means they hold up in the same way as traditional notarizations.

Not all competitors are equally strong in this area. Some rely on lighter ID checks or don’t make recorded sessions easily accessible, which can create headaches if documentation is questioned later. For me, this extra assurance makes OneNotary worth the small premium.

Workflow Integration for Professionals

One of the biggest challenges for CPAs is keeping tools connected. We’re already juggling tax software, cloud storage, client portals, emails, spreadsheets, etc. While OneNotary doesn’t yet integrate directly into popular accounting suites, I’ve found it easy enough to build into my workflow.

Here’s how I usually use it:

- Client needs a notarized form – Could be an IRS power of attorney, loan application, or affidavit.

- I upload the document to OneNotary – Share the link with my client.

- The client completes the notarization – I often sit in on the session if they want help, though most clients don’t need me.

- I store the notarized document – Downloaded copy goes into my secure client folder.

That process takes a fraction of the time compared to coordinating in-person notaries. While DocuSign Notary offers tighter integration with its e-sign tools, I’ve found its pricing and setup geared more toward enterprise users. OneNotary is a better fit for small to mid-sized practices like mine.

How OneNotary Stacks Up Against Competitors

Let’s break it down side by side. There are many online notary services out there, and I’ve tried a bunch of ‘em, and I don’t think any review would be complete without considering competitors.

OneNotary vs. Notarize

- Ease of Use: OneNotary is simpler for clients who aren’t tech-savvy. Notarize has more features but can feel overwhelming.

- Price: Comparable, though bulk use favors Notarize. For one-off notarizations, OneNotary feels more straightforward.

- Availability: Both offer 24/7 access, though I’ve personally experienced shorter wait times on OneNotary.

OneNotary vs. NotaryCam

- Ease of Scheduling: OneNotary lets me connect almost instantly. NotaryCam often requires booking ahead.

- Platform Feel: OneNotary looks modern and clean. NotaryCam feels like it hasn’t been updated in a while.

- Client Feedback: My clients who tried both preferred OneNotary for ease of use.

OneNotary vs. DocuSign Notary

- Integration: DocuSign wins here, especially for firms already using DocuSign heavily.

- Price: DocuSign Notary is usually bundled with larger contracts, which isn’t ideal for small firms.

- Flexibility: OneNotary doesn’t require an enterprise setup, which makes it easier to adopt.

Where OneNotary Could Improve

In my opinion, we should always consider the good with the bad. As much as I like the platform, there are a few areas where I’d love to see growth:

- Accounting Software Integration – If OneNotary built direct links into tax software or client portals, it would cut steps out of my workflow.

- Mobile Experience – While it works fine on mobile browsers, a dedicated app with push notifications would make the process even smoother for clients.

None of these are dealbreakers, but they’re worth pointing out.

The Bigger Picture: Online Notarization and the Future of Professional Services

When I think about where the industry is heading, I see online notarization as more than just a convenience; I think it’s part of a broader shift. Clients want services delivered digitally, whether that’s signing documents, filing taxes, or meeting by video call.

For CPAs and other professionals, using platforms like OneNotary isn’t just about efficiency; it’s about meeting client expectations. The days of asking someone to leave work early to drive across town for a notary stamp are over.

I’ve noticed clients are often surprised at how easy it is. After their first online notarization, they usually say, “Why didn’t we do this before?” That’s the same reaction people had when e-signatures first became mainstream. Now, it seems that’s almost the only way people sign things nowadays.

Case Studies from My Practice

I find that abstract comparisons don’t always capture the real value of a tool. So let me share a few examples of how OneNotary has helped me and my clients in practice.

Case 1: The IRS Form 2848 (Power of Attorney)

Every tax season, I file Form 2848 so I can speak to the IRS on behalf of clients. Traditionally, clients had to print it out, drive to a notary, and then mail or fax it back. One year, my client was out of state. Instead of delaying weeks, we used OneNotary. Within 20 minutes, the form was notarized, signed, and submitted electronically to the IRS. That saved both of us time and stress and let me handle her issues right away.

Case 2: A Small Business Loan

Another client, a restaurant owner, was applying for financing. The bank required several notarized documents on a tight, unexpected timeline (don’t you hate it when financing has something pop up at the last moment?). Instead of leaving his busy kitchen during peak hours, we uploaded the forms through OneNotary on his phone during a break. In less than half an hour, he had everything notarized. The loan went through, and he didn’t miss a beat while at work.

State Regulations and Acceptance

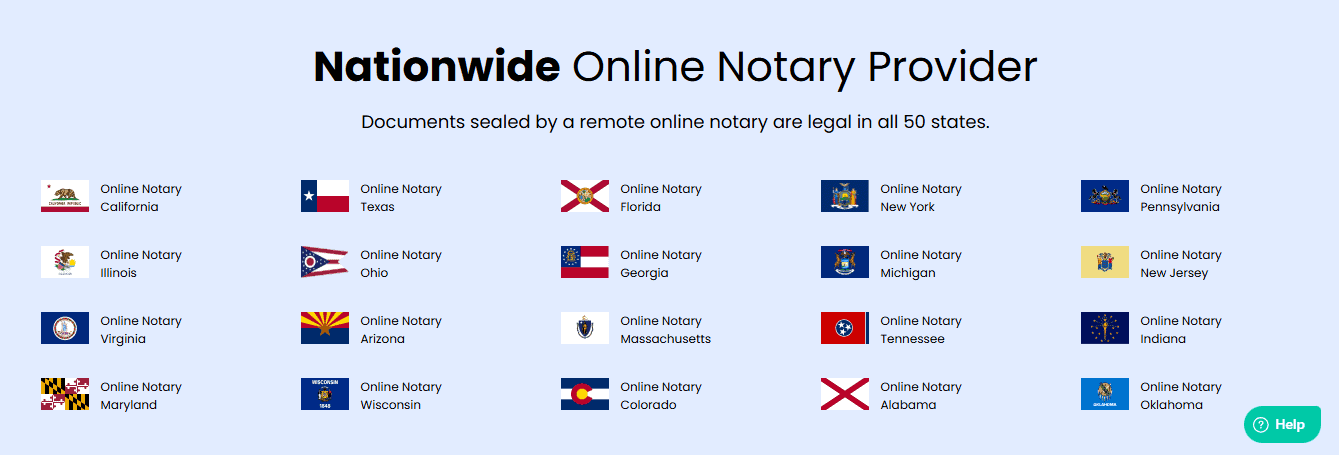

One of the first questions I had when I started looking into online notarization was: “Is this even legal everywhere?” The answer is nuanced, but here’s the simplified breakdown:

- Widespread Adoption – Most states now recognize Remote Online Notarization (RON). Many passed laws during the pandemic to allow it permanently.

- Cross-State Validity – Even if your state doesn’t have its own RON law, notarizations done by a notary in a RON-authorized state are usually valid across the country, thanks to interstate recognition rules. This was one of my key concerns the first time I used it, but I’ve never had anyone bat an eye when turning in an out of state notary.

- International Acceptance – This is trickier. For example, some countries still require “wet-ink” notarizations. But for U.S.-based transactions, I’ve never had a problem with OneNotary documents being accepted.

Compared to competitors, OneNotary makes this easier by clearly listing which types of documents are eligible. Some services leave this vague, which can cause confusion.

The Cost-Benefit Equation

Now let’s talk about money. I’m an accountant, and I can’t help it.

- Direct Cost – A typical notarization on OneNotary runs about the same as what I’d pay at a UPS store or local notary. Sometimes it’s a few dollars more, but not by much. Factor in gas and mileage, and it’s usually not even close.

- Indirect Savings – The real savings come from time. If I save myself (or a client) an hour of driving and waiting, that’s worth far more than the $25 or so fee difference. For professionals billing hourly, the math is even clearer.

- Client Perception – Clients notice when you save them time. Offering an online solution makes me look more efficient and tech-forward, which has its own value in client relationships.

When I add up those factors, an online notary service pays for itself quickly.

My Balanced Verdict

If I had to rank the platforms I’ve tried, I’d say:

- OneNotary – Best overall balance of ease, availability, and compliance. My top recommendation for most professionals.

- Notarize – Strong platform with advanced features, better for larger firms or frequent bulk users.

- DocuSign Notary – Great for enterprises already locked into DocuSign, but less flexible for small practices.

- NotaryCam – Functional, but less polished and more scheduling-dependent.

Looking Ahead

I expect online notarization to become the default within the next decade. Just like we no longer think twice about e-signatures, people will eventually stop questioning whether a digital notary is “real.” It already meets the legal requirements, and once people try it, they rarely want to go back.

As a CPA, I plan to keep using OneNotary not only for my practice but also as a recommendation for clients. It has smoothed out bottlenecks in tax prep, loan processing, and legal planning.

That’s not to say it’s the only option out there, but in my experience, it’s the one that consistently delivers the least friction.