- At a Glance

- 1. Melio: The Modern Standard for Growth

- 2. BILL: The Reliable Workhorse

- 3. Ramp: The Card-First Contender

- 4. Tipalti: The Global Scale Solution

- 5. Stampli: The Collaboration Expert

- 6. Airbase: The All-in-One Spend Suite

- How to Choose the Best AP Tool for Automation: The CPA’s Perspective

- One Other Important Note: The ERP Sync

- The Bottom Line

Last Updated on January 14, 2026 by Ewen Finser

In 2026, accounts payable is no longer a manual back-office chore. If you still have a team member keying in invoice dates and amounts by hand, you’re just burning money.

The industry has already shifted toward automated systems, and they work extremely well. These tools don’t just scan documents; they understand context, flag discrepancies, and route approvals without human prompts.

The goal? A system that captures data accurately, syncs with your ledger instantly, and pays vendors on your terms.

Your task, then, becomes finding the right automated solution for your needs. I’ve spent years looking at financial workflows as a CPA, and I’ve seen how the wrong software just becomes a tax on your time and effort, while the right software can turn a chaotic AP department into a well-oiled machine.

With that in mind, let’s jump in and go over what I think are the six best accounts payable automation platforms in 2026.

At a Glance

Melio | BILL | Ramp | Tipalti | Stampli | Airbase | |

Primary Focus | Business cash flow | Vendor Network | Card spend | Global compliance | Collaboration | Spend control |

Best For | Growing businesses | Mid-market | Card-heavy teams | International | Complex approvals | Large teams |

OCR Quality | Excellent | High | Excellent | High | High | High |

Setup Time | Minutes | Days | Hours | Weeks | Days | Weeks |

Cost | Low/transaction | Per user/transaction | Subscription | High base fee | Per invoice | High subscription |

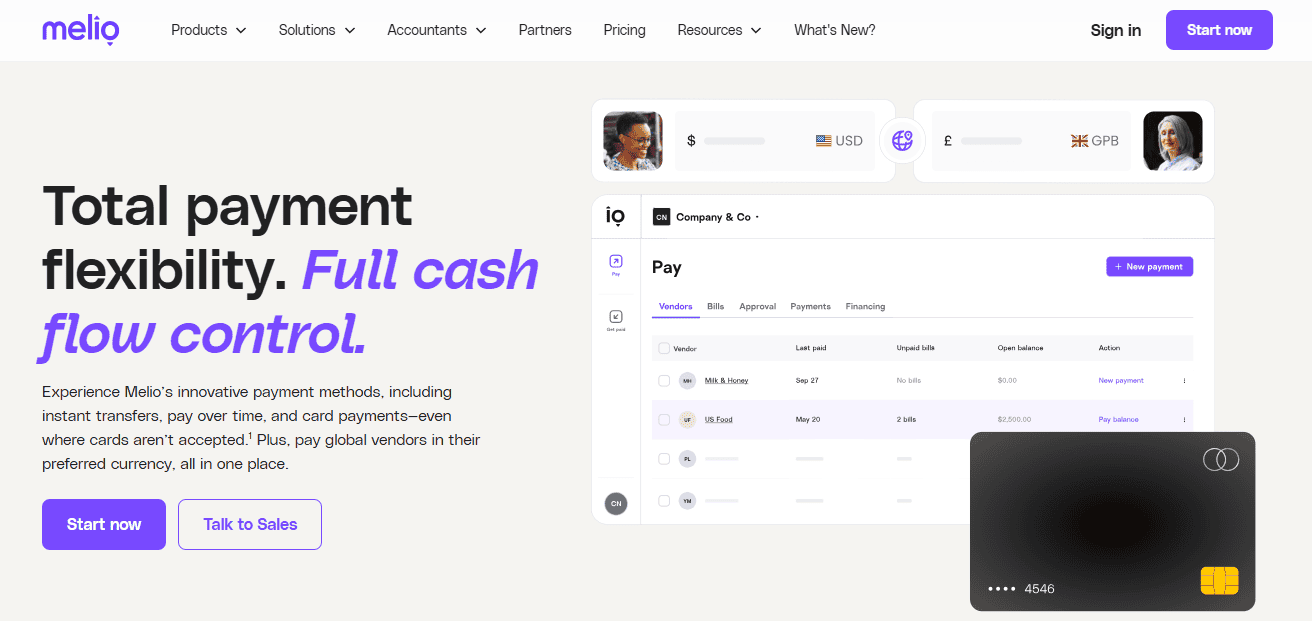

1. Melio: The Modern Standard for Growth

Melio has emerged as one of the most practical choices for businesses that need sophisticated automation without the enterprise headache. It strikes a balance that’s hard to find elsewhere.

The automation here is invisible: When you upload an invoice, the OCR works in the background to extract the data.

The real magic is in the payment flexibility.

Melio allows you to pay any vendor by ACH, check, or even credit card — even if that vendor doesn’t take cards as a payment method. This means you can pay with your card to earn rewards and keep your cash in your bank account longer, while Melio sends an ACH or a paper check to the vendor.

Its syncing capabilities with QuickBooks and Xero are also quite seamless. When you pay a bill in Melio, it’s automatically marked as “paid” in your accounting software. No manual reconciliation needed.

Where It Wins

- Cost-Effectiveness: Melio offers a free version for basic ACH transfers; you only pay for expedited services or credit card transactions.

- User Experience: It’s an intuitive platform that won’t have you reaching for a manual.

- Cash Flow Management: The ability to use a credit card for “non-card” bills is a powerful tool for managing working capital, especially if you’re in a pinch and between large payouts.

- Approval Workflows: Team roles allow you to invite your accountant or your office manager and give them specific permissions.

Where It Falls Short

Melio is not for global enterprises with 5,000 employees, and it doesn’t have the mass payment capabilities of something like Tipalti. However, for the vast majority of small- to mid-market businesses, it provides exactly what is needed.

2. BILL: The Reliable Workhorse

BILL (formerly Bill.com) is a staple in the market that’s built its reputation on a vast vendor network. If you pay a vendor, there’s a high chance they’re already in the BILL system. This makes the initial setup and payment delivery very fast.

For automation, BILL uses an AI engine called BILL Intelligence. When an invoice hits your dedicated BILL inbox, the system reads it using OCR and identifies the vendor, amount, and due date. It then suggests the account coding based on your past behavior.

The approval workflows are a core strength here, and you can set rules based on the dollar amount or the department. For example, any bill over $5,000 might require a CFO signature, while smaller utility bills skip straight to payment.

Where It Wins

- Network Effect: The sheer number of vendors already on the platform reduces the need to collect bank details manually.

- Integration: It syncs deeply with QuickBooks, Xero, and Sage Intacct, and the data flow is reliable.

- Combined AR/AP: If you want to manage money coming in and money going out in one place, BILL is a strong contender.

Where It Falls Short

The interface can feel heavy here. Because BILL has added so many features over the years (like spend management and international wires), the dashboard is a bit cluttered. Pricing has also become more complex; you pay per user and per transaction, which can add up if you have a high volume of small invoices.

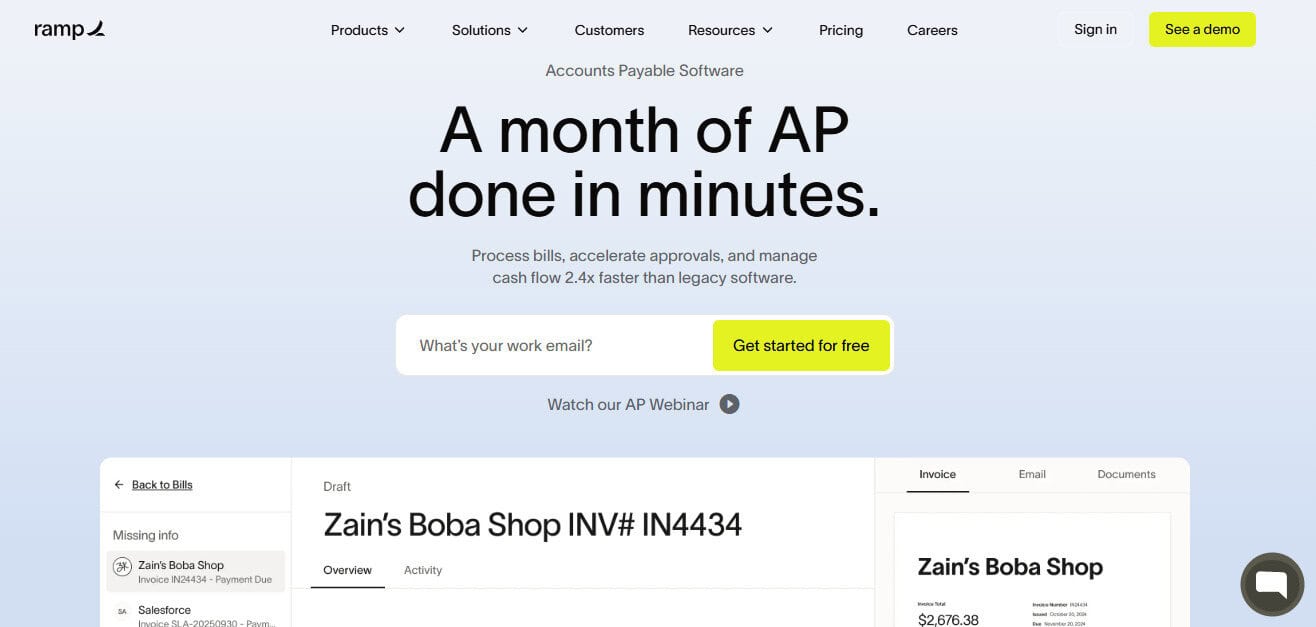

3. Ramp: The Card-First Contender

Ramp started as a corporate card company, but they’ve moved aggressively into AP automation over the years. In 2026, it’s a popular choice for teams that want to consolidate their credit card spend and their bill payments into a single feed.

The platform’s AP agents are autonomous scripts that monitor your invoices. So if a vendor sends a bill that’s 10% higher than last month, the agent flags it. I think it’s great that their system doesn’t wait for you to find the discrepancy; it brings the error to you.

Ramp also excels at line-item extraction. Many tools only read the total amount, but Ramp reads every individual item on the invoice. If you need to code different items to different departments, it does this automatically using historical data.

Where It Wins

- Speed: Ramp’s OCR is arguably the fastest in the industry.

- Cash Back: Because they’re a card company, they often find ways to pay vendors via virtual cards, which earns you rebates.

- Simplicity: The user interface is clean. It feels like modern software, not a legacy accounting tool.

Where It Falls Short

Ramp is less effective if you don’t use their corporate card program. The bill pay features are powerful here, but they’re designed to work in tandem with the Ramp card ecosystem. If your company relies heavily on manual checks or complex international wires that require specific documentation, Ramp might feel a bit light on the traditional banking side.

4. Tipalti: The Global Scale Solution

If your business operates in multiple countries or manages a massive network of freelancers, Tipalti was made for you. It’s built for complexity, and while other tools focus on the payments part of the process, Tipalti focuses on the compliance part.

Where it automates best is the onboarding of vendors. Instead of your team chasing W-9 forms or bank details, the vendor enters this data into a self-service portal. The system then validates the tax IDs and checks the vendor against global blacklist databases to prevent fraud.

For payments, Tipalti handles currency conversion and local tax laws automatically. If you’re paying a contractor in Spain and a supplier in Vietnam, the system calculates the correct exchange rates and makes sure the payment meets local regulations.

Where It Wins

- Global Reach: Tipalti supports over 120 currencies and nearly 200 countries.

- Tax Compliance: It practically eliminates the stress of 1099 and 1042-S reporting.

- Mass Payments: It’s the best tool for companies that need to send thousands of payments at once.

Where It Falls Short

Tipalti is really, really expensive; it’s not designed for a small business with ten employees. The implementation process is also long, and it can take months to fully integrate Tipalti with a complex ERP like NetSuite. If you are looking for a plug-and-play solution, this is not it.

5. Stampli: The Collaboration Expert

Stampli takes a different approach to automation. They believe the biggest bottleneck in AP is not the data entry, but the communication. If an invoice arrives and the department head has questions, most systems force that conversation into email or Slack — but Stampli puts the conversation inside the invoice.

It uses an AI assistant named Billy, which learns your unique accounting logic and identifies which manager needs to approve which bill. It looks at the history of the vendor and the conversation surrounding past invoices to route the bill correctly.

Stampli also offers three-way matching out of the box, which compares the invoice to the purchase order and the receiving report. If the numbers don’t match perfectly, it stops the process and alerts the buyer.

Where It Wins

- User Adoption: Managers who hate accounting software usually find Stampli easy to use.

- Audit Trails: Every comment and every change is logged, which makes year-end audits much easier for your CPA.

- ERP Agility: It integrates with over 70 different ERPs, including niche industry software.

Where It Falls Short

The payment side of Stampli is not as robust as its invoice management side. While they do offer Stampli Direct Pay, many users still find themselves using a separate bank portal or a tool like Melio or BILL to actually move the money.

6. Airbase: The All-in-One Spend Suite

Airbase is designed for spend management. They want to handle every dollar that leaves your company, whether it is a travel expense, a software subscription, or a traditional vendor bill.

They accomplish this by focusing on intake-to-pay, and the automation starts before the invoice even exists: An employee submits a purchase request, and, once approved, the system generates a virtual card or a purchase order. When the invoice arrives, Airbase automatically matches it to the pre-approved request, eliminating the surprise bills that often plague finance departments.

Where It Wins

- Control: Airbase offers the tightest controls over company spending.

- Consolidation: It replaces three or four different tools (expense reports, AP, procurement, and corporate cards).

- Real-Time Visibility: You see exactly how much budget is left in a department the moment a purchase is requested.

Where It Falls Short

The complexity of the system can be overwhelming here. If you only need to pay a few bills a month, Airbase is overkill. It also requires a significant amount of configuration to get the intake workflows just right.

How to Choose the Best AP Tool for Automation: The CPA’s Perspective

When I advise clients on AP automation, I look at three variables: volume, complexity, and control.

- Volume: If you have 500+ invoices a month, you need a tool with agentic AI like Ramp or Stampli. If you have 20 to a few hundred, you need something fast and cheap like Melio.

- Complexity: Do you have five locations? Do you pay in ten currencies? If yes, Tipalti is your only real choice. If your business is primarily domestic, stick to a simpler tool.

- Control: Who touches the money? If you want every employee to follow a strict “request first” policy, look at Airbase. If you trust your team but want a final look before the cash leaves the account, Melio’s approval flows are perfect.

One Other Important Note: The ERP Sync

The most common mistake I see is choosing a tool that doesn’t talk to your accounting software. If the data doesn’t flow back and forth perfectly, you’re just moving the manual work from paying to reconciling.

In 2026, these integrations should be set-it-and-forget-it.

The Bottom Line

Accounts payable automation is no longer a luxury. It’s a requirement for any business that wants to scale.

If you’re a large, global corporation, Tipalti will keep the regulators off your back. If you’re a tech-forward company where everyone has a corporate card, Ramp will give you the data you crave.

But if you’re like most of the folks I work with — business owners who want to save time, keep their vendors happy, and manage their cash flow with precision — Melio is the most balanced solution. It offers the power of a professional AP department with the simplicity of a consumer app.

Stop wasting time on data entry. Choose a platform, sync it to your ledger, and get back to growing your business.