Last Updated on November 20, 2025 by Ewen Finser

Today, we have a cage match for you: On one side, Zeni shows up with an out-of-the-box, AI-powered finance team. On the other hand, Digits brings an AI-native ledger that wants to run your books while you sleep. Both promise clean categorization, fast closes, and dashboards that don’t need a PhD to take advantage of.

Finally, something fun to argue about in the accounting space that isn’t GAAP vs. IFRS or another ASC 606 discussion.

I’m your host for this match — someone who’s lived the 4 AM scramble with bank feeds, vendor oddities, and the “we’ll fix it later” emails. Today, I’m showing you how each platform can help you sleep in on the first day of close, all to answer a simple question: When your receipts hit, which platform turns the chaos into tidy trial balances with fewer clicks and fewer mistakes?

At a Glance

Category | Digits | Zeni |

Core model | Autonomous General Ledger | AI software with an in-house finance team |

Best for | Companies that want to run a scalable platform | Startups that want bookkeeping handled for them |

Automation approach | End-to-end AI agents for categorization, recon, AP, and reporting | AI-assisted workflows with human review and execution |

Reporting & dashboards | Real-time, dimensional reporting (dept/location/project) | Startup metrics focus (burn, runway, MRR) with standard reports |

Bank/credit card feeds | Very broad coverage; continuous sync | Solid coverage; less public focus on breadth |

AP/AR | Built-in bill pay, invoicing, approvals; recurring and inter-company (higher tiers) | Bill pay with OCR, approvals, and same-day ACH in many cases |

Multi-entity / multi-currency | Yes (higher tiers), with consolidated statements | Primarily single-entity, U.S. focus |

Service layer | Partner-friendly for accounting firms; bring your own team | “Team-in-a-box” bookkeeping, controller, and CFO support |

Scalability | Strong for high volume and complex structures | Strong for simple to moderate footprints |

Typical limitations | Newer change management; fewer bundled services | International and edge-case complexity can strain the model |

The contest between Digits and Zeni comes down to depth of AI automation, ledger architecture, and accounting-firm readiness. Zeni offers a solid, human-in-the-loop finance platform, but Digits nudges ahead with a system built from the ground up for AI-native work. If you want the future now, Digits is the better pick, though Zeni remains a compelling choice for firms comfortable with a more traditional service model.

Let’s walk through why.

About the Platforms

Zeni

Zeni is an AI-powered bookkeeping and accounting platform with a built-in finance team. They automate categorization and reconcile transactions while simultaneously providing dashboards, bill-pay, and fractional CFO services.

Key Points:

- AI categorization of transactions, OCR processing of bills/invoices.

- Real-time(ish) dashboards that show cash balance, burn rate, and runway for startups.

- Not just software — a team of finance experts who work with the platform’s AI (at certain plans/prices).

- Meant for U.S.-based venture or growth stage startups (especially SaaS/e-commerce) who want finance operations handled for them.

Digits

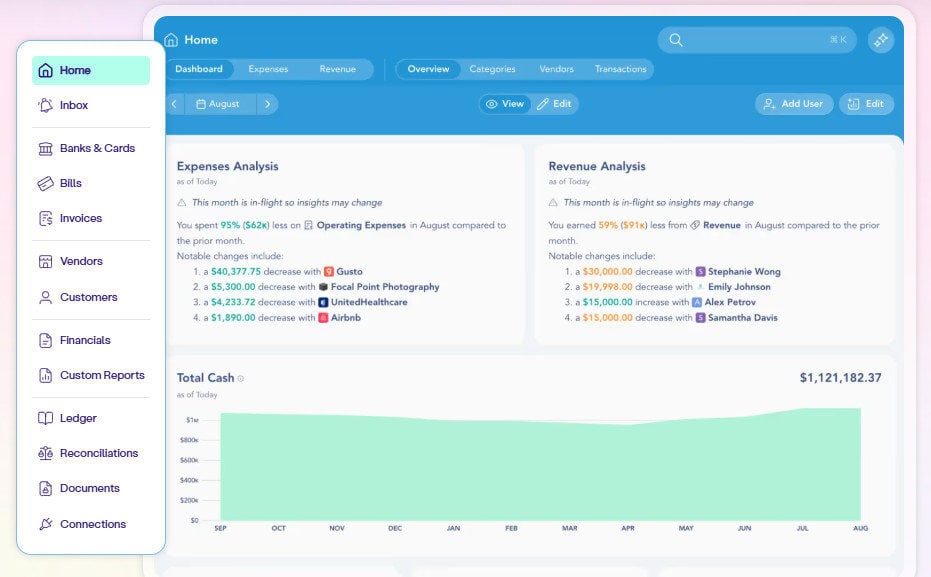

Digits takes a different tack: build a ledger and accounting platform from scratch with AI at the center. Their slogan: “accounting software for the AI era.”

Key Points:

- A proprietary Autonomous General Ledger that was designed with AI at its core (which you get access to at a much lower price than Zeni’s comparable offerings).

- Several real-time integrations with banks/cards and 24/7 categorization.

- AI agents that run entire workflows (from reconciliation, categorization, to bill pay) rather than forcing another add-on.

- Focuses on accounting firms and their clients.

Going Under the Hood

Since I’m a CPA and geek for ledger architecture, here’s what’s going on behind the scenes with these two platforms.

Digits’ Autonomous General Ledger (AGL)

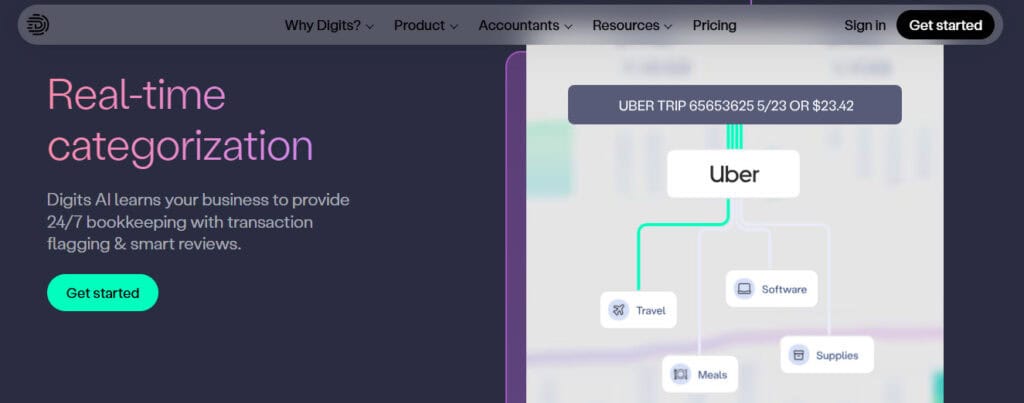

The AGL in Digits is a key differentiator. Rather than build bookkeeping modules that sit on top of a database and then retrofit AI, Digits designed the general ledger itself with AI/ML models, automation workflows, and a data model that supports auto-classification, auto-reconciliation, and auto-reporting. From day one, the system was built for AI rather than retroactively tacking it on feature-by-feature.

Key Elements Include:

- Modelled transaction flows: The system learns your patterns for things like vendor behavior, expense types, and spending patterns. This allows categorization without rules management.

- AI agents: Reduce manual entry with autonomous workflows, such as bank feed → auto-categorize → flag anomalies → prepare reconciliation entries → auto-post journal.

- Dimensional accounting baked in: Rather than bolting on “departments” or “cost centres” as extra attributes, Digits includes location/department/project at the transaction level, slicing financial statements by dimension without Excel gymnastics.

- Real-time integration: The architecture supports 12,000+ card/bank/card feeds for the near-real-time updating of ledger balances, dashboards, and drill-downs. This architecture excels in scaling for large volumes, multiple clients, or a complex finance stack.

Zeni’s Hybrid Model

Zeni takes what I’d call a platform and team approach, with an AI engine that handles high-volume work (categorization, OCR, daily feeds) while human controllers and bookkeepers oversee, catch exceptions, and ensure GAAP compliance.

Technical Details:

- AI categorization and reconciliation: Strong AI capabilities, with reviewers noting that daily close is feasible.

- Built-in bill-payment workflows: Including AI invoice capture, multi-level approvals, and ACH disbursements.

- Embedded metrics: Especially those critical to SaaS, like burn rate, runway, and MRR churn reviewed in dashboards.

This model is ideal for businesses that just want the finance ops handled and don’t care too much about building in-house automation. However, I have a hard time accepting that a third party will know your business as well as you could. I also think they may be overly relying on the AI and quickly looking over your financials when you schedule a meeting with them.

Feature Comparison

Let’s break out some of these platforms’ core areas and compare how they perform in practice.

Bookkeeping & Transaction Categorization

- Zeni: An AI engine that handles everyday categorization and reconciliation, combined with a human team to ensure GAAP-compliant books and monthly close faster than legacy systems. Zeni’s highlights here include daily reconciliations, OCR of invoices, and lite human oversight.

- Digits: The AGL architecture allows for extreme automation, with the Digits team claiming that up to 97% of transactions can be correctly categorized without human touches. Also, its “AI agents” layer means that workflows (e.g., when a vendor bill hits, categorize → reconcile → approve → pay) can be automated end-to-end with minimal human touch.

Verdict: Digits wins here because of the depth and architecture of their automation. Zeni is solid but comes with higher costs and relies more on the human + AI combo, carrying more service overhead.

Bank and Card Feed Integrations

- Zeni: Supports connection of accounts, automatic categorization, and real-time(ish) metrics. The emphasis here is more on bookkeeping + team than on ultra-broad integrations. Also, you must use Intuit’s QBO, which I thought was interesting… and not necessarily in a good way.

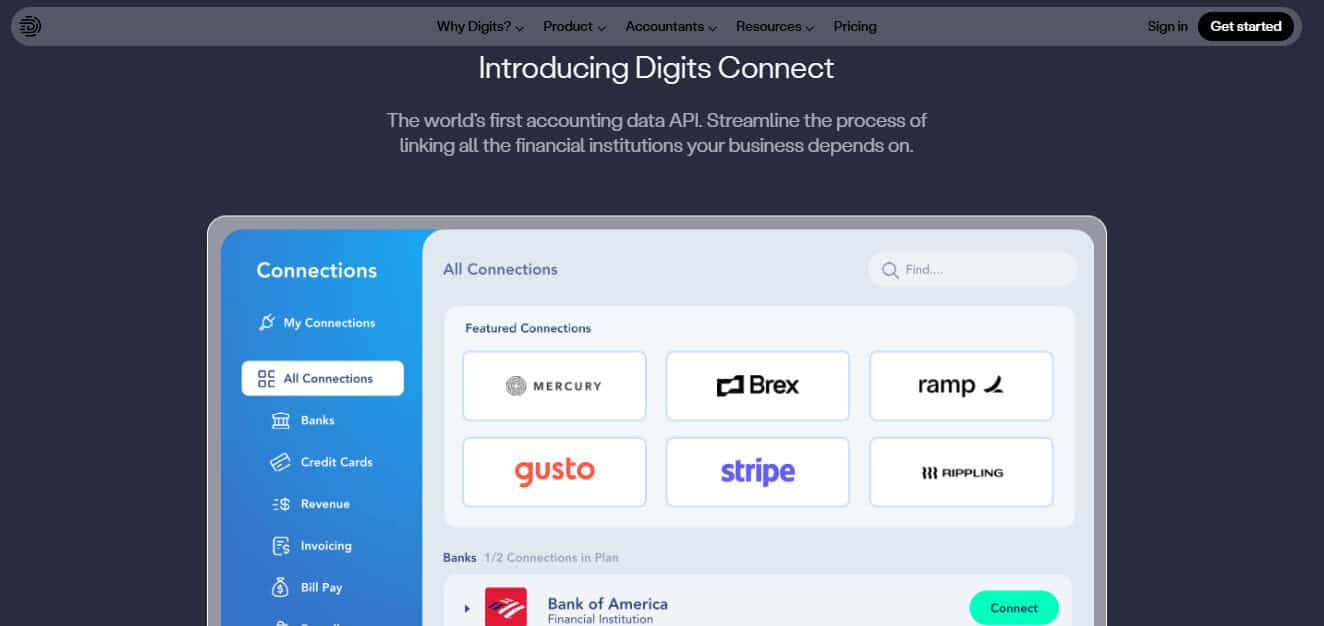

- Digits: Access to over 12,000+ cards/banks/card feeds by API and Plaid. Also supports unlimited banks/credit cards and expense accounts.

Verdict: Digits takes this category thanks to its strong edge in feed/integration depth.

Dashboards, KPIs, Reporting

- Zeni: Real-time dashboards showing burn rate, runway, key SaaS metrics (MRR, churn). There’s definitely a command center feel to the dashboard here.

- Digits: Built-in interactive management reports, live dashboards, and dimensional accounting (department/location/project tracking).

- Because Digits’ ledger is more deeply integrated than Zeni’s, you get more custom reporting, drag/drop dashboards, and investor-ready reports. I also like that you can send reports directly from the dashboard without ever leaving the application.

Verdict: Both strong, but I’m giving this one to Digits because it keeps everything under one umbrella.

Bill Pay and AP/AR

- Zeni: Includes domestic and international bill payments with AI invoice capture, multi-level approvals, and same-day ACH (in some cases).

- Digits: Built-in invoicing and bill pay (drag/drop upload, no manual data entry, approve & pay in seconds) are both available. Unlike QBO’s Bill Pay feature, there is no added cost or monthly fee to get started here.

Verdict: This one’s a tie. Digits has a smooth and intuitive workflow in their bill pay module, but Zeni is also very hands-off.

Multi-Entity and Dimensions

- Zeni: Works well for startups, especially U.S.-based, single-entity.

- Digits: Explicitly lists dimensional accounting (department, location, project) in its Core tier. You get multi-currency, multi-entity consolidated statements in the Professional tier.

Verdict: Digits has the edge if you anticipate complexity (multiple entities, projects, currencies). If you’re a simple single-entity startup, Zeni works fine.

Service Model and Human Support

- Zeni: A big part of their pitch is the finance team (bookkeeper + controller + sometimes CFO) working alongside AI. Good if you want hands-on support, and it’s less DIY.

- Digits: More platform-centric, so you build once and scale. There is customer support available, but expect to lean on in-house accountants or bookkeepers.

Verdict: If you want white-glove service, go with Zeni. If you want a scalable platform your firm or internal team can control, Digits wins.

Scalability & Performance

- If your transaction volume expands (many cards/bank feeds or multiple entities/projects), Digits’ architecture will scale better due to its ledger design and automation layers.

- If your business is fairly straightforward (one entity, standard chart of accounts, moderate volume) and you want minimal internal overhead, Zeni is more turnkey.

- Digits’ ability to auto-reconcile bank statement PDFs and truly 24/7 categorization is powerful and convincing.

- One of the most exciting characteristics of working with Digits is the fact that its real-time ledger makes near-instant reporting feasible.

Verdict: Don’t think about where your business stands today — think about where it may stand three years from now. If you expect lots of growth, international sales, etc., you need to consider how each platform will evolve as your business does.

Where They Fall Short

As much as I love to talk about the highs, it’s also important to consider the lows. No platform is perfect, after all.

Let’s look at areas to be cautious in.

Zeni

- Over-reliant on service: The human component, while helpful, may limit speed/scalability and introduce higher costs when compared to purely automated workflows. The model may suit venture-backed startups, but it may be overkill (or costly) for small businesses or accounting firms wanting more system control.

- Complexity/inflexibility: Because you’re using their ecosystem (platform + team), there’s less flexibility to plug in existing accounting stacks and customize. You also have to be based in the U.S.

- Less ledger innovation: The architecture here appears to be an overlay on traditional bookkeeping + AI, rather than a ground-up AI ledger rebuild. So limitations may emerge when you outgrow simple scenarios.

Digits

- Up-and-comer with fewer service-layer supports: Because Digits is built AI-first and platform-intensive, there may be fewer curated services available, which means a firm might need to bring their own accounting talent or partner with a firm. For businesses heavily relying on outsourced support, be prepared to handhold.

- Change management: For firms used to legacy systems like QuickBooks and Xero, migrating to a fully AI-native, agentic ledger may require new habits, a restructured chart of accounts, and staff training.

- Integrations: While Digits lists 12,000+ integrations and advanced features, some users might find certain edge cases (specific tax regimes, niche industries) less supported than they are with industry incumbents. Also, any platform that updates as frequently as Digits requires more update vigilance.

Why Digits Comes Out on Top

With all that being said, here’s why I lean toward Digits being the better pick of the two:

- Architectural advantage: Because Digits was designed from scratch for AI and automation, it has a sustainable edge. For firms that anticipate growth, complexity, or the need for automation at scale, this is important.

- Scalability & dimensionality: Features like multi-entity, multi-currency, and inter-company invoicing (which are built in at the higher tiers) make Digits more future-proof for scale.

- Firm-enabled model: If you’re a CPA firm working with multiple clients, Digits aligns with you as a partner, not just another vendor (as a CPA, I LOVE this).

- Depth of automation: The move from AI assistance to agentic AI performing entire workflows (with human review) is forward-looking; Digits is ahead of many in the accounting tech market in that respect.

However, keep in mind that Zeni is no lightweight. If you need help with fractional CFO duties or simply want more finance operations handled for you out of the box, Zeni holds substantial value as an efficient choice — especially if your complexity remains modest.

Where to Watch and Caveats

- Cost structure & tiers: Both platforms have tiered pricing. Digit’s $100 a month plan is where most folks will end up, unless enterprise solutions are needed. Zeni starts at $494 per month.

- Migration and change management: Switching ledgers or platforms always carries inherent risk. With Digits, you may need to restructure your chart of accounts and adjust workflows accordingly. With Zeni, you may be handing off certain operations entirely.

- International support: If you have global entities or regularly deal with VAT/GST and non-USD currencies, you may need to consider alternative platforms such as Xero.

- Partner enablement and firm readiness: If your firm is going to serve clients on the platform, Digits makes sense. Zeni does not offer this configurability in a way that makes sense.

Picking Digits vs. Zeni: A CPA’s Cheatsheet

In the cage match between Digits and Zeni, the victor depends heavily on your business context. If I have to pick a winner, Digits gets the belt. Its architecture, automation depth, and scalability give it a slight but meaningful advantage for forward-looking firms and accounting practices. And in my opinion, the future is leaning toward platforms built for AI, not just sprinkled with it.

However, Zeni remains a highly respectable option. If your business values simplicity and service support, Zeni may be the smarter, faster path. I’m just too much of a control freak to let others run my books.

Here’s a handy cheatsheet if you’re still unsure:

- Early-stage SaaS (U.S., single entity, lean staff): Zeni fits. You want finance ops handled, sharp dashboards/metrics, and fractional CFO help.

- Growth-stage (multi-entity, multi-currency, internal team or firm): Digits offers more control, scalability, and future-proofing.

- Accounting firm scaling many clients: Digits wins for workflow scale, automation, and a firm-partner model.

Global or complex needs: Both have limits, so verify industry specifics. Zeni’s team can handle odd cases, while Digits may need more firm infrastructure.