Last Updated on December 15, 2025 by Ewen Finser

Stripe and Luqra both promise to move money from your shopper’s cart to your bank account with no fuss. But what about when the going gets tough? When your volume spikes, when a chargeback cluster hits, or when a bank’s risk team gets nervous? How they perform when the stakes rise can be the difference between you sleeping at night and refreshing your payouts page every fifteen minutes.

Don’t have time to read the whole thing? Here’s my takeaway in a nutshell: Stripe is the safe, default choice for low-risk e-commerce brands that want fast, self-serve setup and a big global toolkit — at the cost of being treated like a line item on a risk model. Luqra is built for e-commerce first, with more flexible underwriting, faster and more predictable payouts, and 24/7 U.S.-based support that actually picks up the phone.

If your store is simple and low-risk, Stripe will work. If you push volume, see chargeback spikes, or have ever worried about frozen funds and rolling reserves, Luqra will be the better long-term fit.

Now, let’s go into a bit more detail.

Who They Are

Stripe

Stripe is the default choice for a lot of early-stage e-commerce businesses. You sign up online, paste some keys into Shopify or WooCommerce, and you’re live. They sit in the middle as a payment facilitator, aggregating merchants under their master account, managing risk with a lot of automation, and offering a deep stack of tools: billing, subscriptions, invoicing, fraud tools, and support for more than 135 currencies.

Standard online card pricing in the U.S. sits at 2.9% + 30¢ per successful card charge, with surcharges for manually entered, international, and converted transactions.

Luqra

Luqra is a newer U.S.-based processor that combines merchant accounts with an ERP-style back end. They pitch themselves as being built for e-commerce, with meet-or-beat pricing, fast funding, near-real-time approvals, 24/7 U.S.-based support, and a strong anti-freeze message: they want you to scale freely without worrying about held funds or surprise account shutdowns.

If Stripe is the default “plug it in and go” toolkit, Luqra is closer to “payments plus back office spine” for merchants and portfolios that want more control.

Flexibility on Risk: Who They Underwrite and Who They Freeze

In my experience, when merchants talk about flexibility, they usually mean one of three things:

- Will they approve my business at all?

- Will they let me scale without daily caps and surprise reviews?

- If something spooks their risk team, will they work with me or pull the plug?

Stripe’s Risk Posture: Low-Risk by Design

Stripe frames itself as a low-risk payment processor, viewing high-risk segments as a separate category that needs tighter controls and sometimes different accounts. One Redditor puts it like this: “Stripe is a low-risk payment processor. If they decide you’re high-risk, they will close your account and hold your funds, even if you’re a legitimate business.”

From Stripe’s perspective, this makes sense. They sit in the line of fire on card networks and bank relationships, running risk at a global scale and relying on models to flag outliers. If your e-commerce business looks questionable on paper, you get treated as a risk event, not a relationship.

For low-risk brands with clean chargeback ratios, predictable volume, and mainstream products, Stripe’s approach works fine. You get fast onboarding and a wide set of tools. But if you’re in:

- Dropshipping

- Supplements or nutraceuticals

- Subscription boxes with variable quality

- High-ticket coaching or info products

You’re closer to the edge of Stripe’s risk comfort zone, and that’s where you see the bulk of the horror stories.

Luqra’s Risk Posture: E-commerce-First Underwriting

Luqra leads with a different pitch: They claim to be “the first payment processor built specifically for e-commerce,” backed by a promise of uncapped processing and scaling without merchants having to worry about held funds or account freezes.

Behind the marketing, there are a few structural differences:

- Dedicated merchant accounts, not pure aggregation

- Manual underwriting and portfolio tools, not only bots

- A broader comfort level with e-commerce patterns that would scare some facilitators

That said, Luqra is not without critics, and some anecdotal evidence suggests that their dispute fees can be inconsistent. So, like with any processor, you need to read the contract, ask about RDR and chargeback tooling, and map every fee to specific events.

A CPA’s Takeaway

- Stripe is excellent if you’re a clean, low-risk merchant with standard e-commerce flows and modest chargebacks.

- Luqra is geared for merchants who push volume, sell online-first, and do not want to feel like a rounding error in a global risk model.

Payout Speed and Cash Flow Stability

You don’t pay rent or payroll with “available balance” screenshots — you pay it with settled funds. So let’s look at how these two handle payouts once the sale clears.

Stripe Payouts: Fast… Until They’re Not

Stripe’s public docs describe payouts in simple terms:

- Funds flow from the merchant account at Stripe to your bank on a daily schedule, with built-in delays based on your region and history.

- You can enable instant payouts for an extra fee.

On paper, that looks fine. In practice, the friction shows up when risk flags fire. On Trustpilot, a recurring complaint looks like this: “They withhold my payouts at arbitrary times, useless support that just pass the buck around.” You also see long threads from merchants who have had funds held for months while Stripe reviews documents or re-scores the business.

Of course, Stripe has plenty of positive reviews as well. Many merchants praise the ease of setup and basic reliability. Some folks note that holds came from genuine compliance checks, and that support did respond and explain the steps.

From a cash flow standpoint, Stripe gives you:

- Fast, predictable payouts when your business fits their profile

- A real risk of sudden interruptions when something in your profile changes

And if you run thin cash buffers, those pauses can really sting.

Luqra Payouts: “Turbocharged Deposits” and Anti-Freeze Messaging

Luqra’s online payments page leans hard into payout speed and stability:

- “Turbocharged deposits” to “maximize your cashflow”

- “Scale freely” with no worries about account freezes or held funds

- Fast funding and uncapped processing, which are framed as core benefits for e-commerce brands

Here’s what this translates to, in my opinion:

- They want to underwrite risk up front, then keep payouts moving unless something serious breaks.

- They pitch funding speed as a competitive edge, not an afterthought.

As a CPA, that really matters to me. If you’re running paid ads, inventory cycles, and payroll off card volume, slow or inconsistent payouts turn into overdraft fees and late vendor calls.

A CPA’s Takeaway

- If your risk profile is plain vanilla, Stripe’s default daily payouts plus occasional instant payouts work well.

- If your growth is steep or your category is touchy, Luqra’s stance on fast funding and fewer freezes cannot be understated.

Support: Bots, Tickets, and Humans on the Phone

You really learn who your processor is the first time something goes sideways on a Friday afternoon.

Stripe Support: Scaled and Mixed

Stripe has global support coverage and responds to both good and bad reviews online. Docs and guides are strong. But when payouts stop, merchants don’t need a help article — they want a phone number to a human. And yet, a quick search will turn up more than a few reviews complaining of bots and automated responses.

If you have an in-house dev team and finance team that can live with ticket queues, Stripe is manageable. But if you’re a lean e-commerce team that needs a real person, the experience can feel cold and unwelcoming.

Luqra Support: 24/7 U.S.-Based Humans

Luqra leans hard into support as a differentiator:

- Promised 24/7/365 in-house, U.S.-based phone support for both online and in-person payments

- Positioning of a “dedicated problem-solver” for merchants

A CPA’s Takeaway

As someone who has quite literally spent 10 hours on hold with the IRS, the fact that Luqra is so willing to boast about their customer support really speaks to me. It shows that they take it seriously. I also like that the default contact path is a human who knows payments, not an automated ticket bot.

Pricing and Fee Structures

You cannot talk about flexibility without touching pricing. After all, the wrong structure can lock you into higher effective rates once you scale.

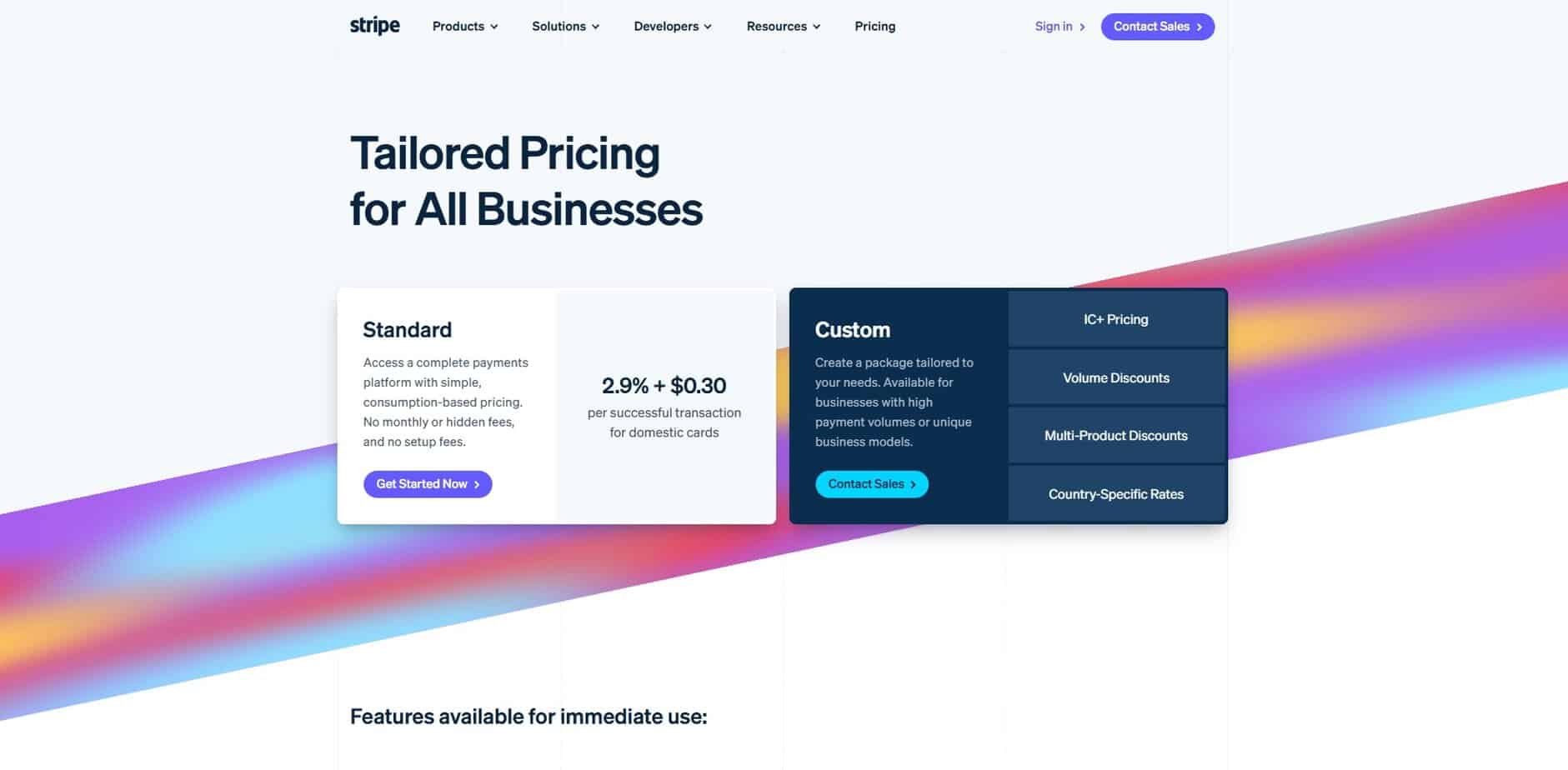

Stripe Pricing: Simple, but Not Always Cheap at Scale

Stripe’s main pitch is simple, flat pricing:

- 2.9% + 30¢ per successful card transaction for domestic online cards in the U.S.

- Extra costs for keyed, international, FX, Radar, Billing, Tax, and other add-ons

Once you factor in extra tools and cross-border volume, the costs really add up. So for an early-stage Shopify store doing modest domestic volume, flat pricing is fine. But once you push $500k–$1M+ in annual card sales, a pure flat model can cost more than an interchange-plus or negotiated program.

Luqra Pricing: Meet-or-Beat and No Increases

Luqra goes the other way:

- Meet-or-beat rates against your current provider

- Promises of no rate increases and no hidden fees

- Online e-commerce pricing that’s advertised as low as 2.3% + 20¢, with in-person starting around 2.0% + 10¢, plus cash discount options if you want to pass costs to customers

You’ll still need to get the schedule in writing and model the effective rate, but this structure is friendlier to merchants who outgrow flat pricing.

A CPA’s Takeaway

- Stripe is ideal when you need simple math and fast onboarding, and when your volume and mix match their standard model.

- Luqra shines when you have statements in hand, want a real meet-or-beat quote, and plan to drive enough volume to make a few basis points matter.

Ecosystem

This is where things get interesting and where Luqra really stands out from similar offerings.

Stripe: APIs and Global Coverage

Stripe’s ecosystem advantage is clear:

- A deep set of APIs and SDKs for custom checkouts and platforms

- Billing, invoicing, tax, fraud, and more

- Support for many local payment methods and currencies

If you’re a software company or building something bespoke on top of your payments stack, Stripe is a force to be reckoned with.

Luqra: ERP Spine for Payments

Luqra does not try to match Stripe’s API breadth. It goes in an entirely different direction altogether.

- Luqra aims to be a FinTech ERP that connects payments, underwriting, compliance, boarding, and analytics in one hub.

- They boast integrations with Shopify, BigCommerce, Authorize.net, NMI, and subscription tools like Chargebee and Recurly.

For a direct-to-consumer merchant, the more interesting piece is the reporting loop: chargebacks, disputes, fraud trends, and portfolio analytics under one roof. That helps you manage effective rates and risk costs over time.

A CPA’s Takeaway

- Stripe gives you an API-centric toolkit with many pieces you can add as you grow.

- Luqra gives you a processor + ERP spine, built more like a merchant services operation than a generic platform.

What the Reviews Say and My Two Cents as a CPA

The user review landscape on both sides looks messy — which, in all honesty, is normal in payments.

- Stripe has thousands of reviews across Trustpilot and other sites. The average rating sits in the low to mid range, with a mix of very happy users and very angry ones. Many negative reviews mention frozen funds and hard-to-reach support.

- Luqra has fewer public reviews, since they are younger and work more through direct sales channels. A bit of a mixed bag here and no clear throughline, but it’s too soon to tell.

When you read reviews through a CPA lens:

- Volume skews toward complaints. Satisfied merchants have no reason to write a review unless they’re asked.

- Risk events drive the worst stories. That is where holds, clawbacks, and fines come in. This really tends to make people angry because you’re messing with the money they feel that they have earned.

- You care about patterns, not outliers. If many people complain about the same failure mode, assume it is a real risk scenario.

Stripe’s pattern: Great when things are normal, rough when your account hits a risk flag.

Luqra’s pattern: More merchant-friendly framing on risk and support, but smaller footprint and less review volume, which means more due diligence on your side.

So, Who Should You Pick?

Let me land this with some simple profiles.

Pick Stripe if:

- Your products are plain vanilla: apparel, basic consumer goods, simple digital products.

- Your sales curve is smooth, not driven by sudden spikes or promo bursts that triple volume overnight.

- You want global coverage and many payment methods from day one.

- You have the tech- and finance-fluent staff to navigate occasional support friction and add-on tools.

Pick Luqra if:

- Your business is e-commerce-heavy with stronger swings in volume, such as dropshipping, subscription boxes, or influencer-driven brands.

- You have to worry about account freezes or rolling reserves at big facilitators.

- You want fast, predictable payouts and a team that underwrites your risk up front — and works with you as you scale.

- You value human, U.S.-based support and want one team to handle payments, disputes, and financial analytics.

By Bottom Line Advice as a CPA

If you are an e-commerce merchant making a Stripe vs. Luqra call, here’s what I’d recommend:

- Model your effective rate. Take your current Stripe statements (or projected mix), add every fee line, and calculate your all-in cost. Then ask Luqra to quote against that with their meet-or-beat guarantee in writing.

- Stress-test risk scenarios. Ask both sides what happens if your volume doubles, your chargeback ratio creeps up, or a bank flags your category. Get their answer in writing or email. Then, assume the risk team will follow that playbook when it hurts the most.

- Map payouts to your cash cycle. Look at inventory buys, payroll, ad spend, and rent. If a 30–60 day payout pause from Stripe would sink the business, you need a processor whose entire model revolves around funding speed and high-touch support.

Stripe is the default for a reason. For a large slice of merchants, it does the job.

Luqra enters the picture when you want a more merchant-centric risk posture, faster cash in the bank, and real humans on the other end of the phone when things go off the rails.