Last Updated on November 5, 2025 by Ewen Finser

Let’s be honest: “Melio vs. Zelle” sounds like a heavyweight boxing match between two guys with last names that come from a country that may not exist anymore. But the reality is so much worse, and instead of watching two dudes duke it out for the title belt, today we’ll instead be comparing two different AP/AR platforms.

Luckily for you, I know how to make this matchup just as interesting as a Tyson v. Paul Netflix Special. In one corner, we have an AP cockpit with rails, roles, and receipts; and in the other, we have a slick money slingshot for people you already trust. I’m putting both tools in the ring and stress-testing them the way a controller actually works: messy invoices, rigid close dates, and zero appetite for reclasses. Both move money, but only one helps you run payables like a grown-up.

The Bottom Line Up Front

- Use Zelle when you already know and trust the counterparty, need funds there within minutes, and don’t require approvals, audit trails, or accounting integrations. Limits and potential fees vary by bank; there’s no purchase protection, and it’s U.S. domestic only.

- Use Melio when you need an actual AP system: vendor onboarding, roles and approvals, scheduled payments, pay-by-ACH/check/wire/card, international payout options, and a sync with QuickBooks/Xero. Fees are transparent; free ACH is available on many plans, card is typically 2.9 percent, and specialty rails like rush checks/wires have clear add-ons.

What Each Platform Is and Isn’t

Zelle: A Bank Rail Inside Your Existing Account

Zelle lives inside participating bank apps to transfer money directly between U.S. bank accounts. It’s fast and convenient when both sides are enrolled. But it is intentionally scoped for known, trusted parties and does not include purchase protection. There’s no standalone AP module, no bill object, no approvals, and no native accounting sync. Limits and any business-use fees are set by your bank. That means Zelle behaves differently at Bank A than at Bank B, and per-transaction caps can throttle higher-ticket vendor payments.

Melio: A Purpose-Built AP System for Accountants

Melio is an AP / AR platform through and through: collect bills, route approvals, choose a rail (ACH, check, wire, even pay by card), schedule disbursements, and synchronize entries to your GL. It integrates with QuickBooks Online, QuickBooks Desktop, and Xero, which means vendor, bill, and payment data flows into your books without retyping. Melio also supports international payouts with published fees and can let you pay by business credit card even when a vendor only accepts bank deposits, which extends float and can earn rewards.

The In the Weeds Breakdown

1) Speed and Reliability

- Zelle: When both parties are enrolled, transfers often complete within minutes. That speed is the main draw. The trade-off is finality and risk allocation: once sent, you cannot reverse a payment, and there is no purchase protection for authorized transactions. For business accounts, Reg E protections differ. This is why banks repeatedly warn to use Zelle only with people you know and trust.

- Melio: Standard ACH is predictable for scheduled vendor runs; you can also use same-day ACH and wires where timing matters, or instant payout options on the receiving side. Speed is configurable by rail, not a single on/off switch. You’re operating in an AP system with bill-level context and an audit trail, which, as a CPA, is something I absolutely expect from my software and clients.

Verdict: Zelle is the fastest for trusted one-offs. Melio gives you controlled speed inside a process.

2) Limits and Caps

- Zelle: Daily and monthly caps are bank-specific. A large bank may permit a small business customer to send up to roughly five figures per day; others set MUCH tighter caps (maybe just $500 a day). Incoming funds can be uncapped at some institutions, but the sender’s bank limit still rules the transaction. These variable caps are a ceiling for paying larger vendors or progress draws.

- Melio: You choose the rail that fits the amount. High-value wires, same-day ACH, and checks exist specifically to avoid arbitrary app caps.

Verdict: Melio scales with invoice size; Zelle’s bank-by-bank caps can create friction on higher-ticket bills.

3) Fees and Transparency

- Zelle: Zelle itself doesn’t charge standard transfer fees, but your bank may for business use (in very rare cases, in my experience), and several banks now disclose business Zelle pricing or vary it by account type. You have to check your particular bank’s schedule of fees and limits.

- Melio: Transparent, published fee grid. Domestic ACH is free on many plans; card payments are typically 2.9 percent; check, rush check, wires, instant, and same-day ACH have posted amounts. International fees are published and predictable. This matters for budgeting the cost of payments versus rewards/float.

Verdict: Zelle may be free, but the variability lives at the bank. Melio’s pricing is centralized and forecastable.

4) Accounting Integration and Reconciliation

- Zelle: No native bill object, no line-level coding, no approvals, no sync. From an accounting standpoint, it’s a black box, and I detest that. You’ll be doing manual coding in your accounting system and tying outgoing Zelle transfers to vendors by memo discipline. Fine for a few transactions a month, but ridiculous at scale.

- Melio: Sync with QuickBooks Online/Desktop and Xero. Vendors, bills, and payments map over automatically. Approvals and audit trails reduce the Monday morning “what was this for?” routine. For controllers, this is the difference between a payment app and an AP subsystem.

Verdict: Melio, decisively, for reconciliations that don’t eat headcount.

5) Controls, Approvals, and Roles

- Zelle: It’s a send-money feature. You can limit access to the bank app, but there are no per-bill approvals, no dual control for a specific vendor payout, and no granular role-based permissions inside Zelle itself. Banks can add security steps, but that’s not the same as a workflow.

- Melio: Built-in approval workflows, user roles, and scheduling across a payable run. This is what separates operational AP from ad hoc payments.

Verdict: If you need separation of duties, Melio is the fit.

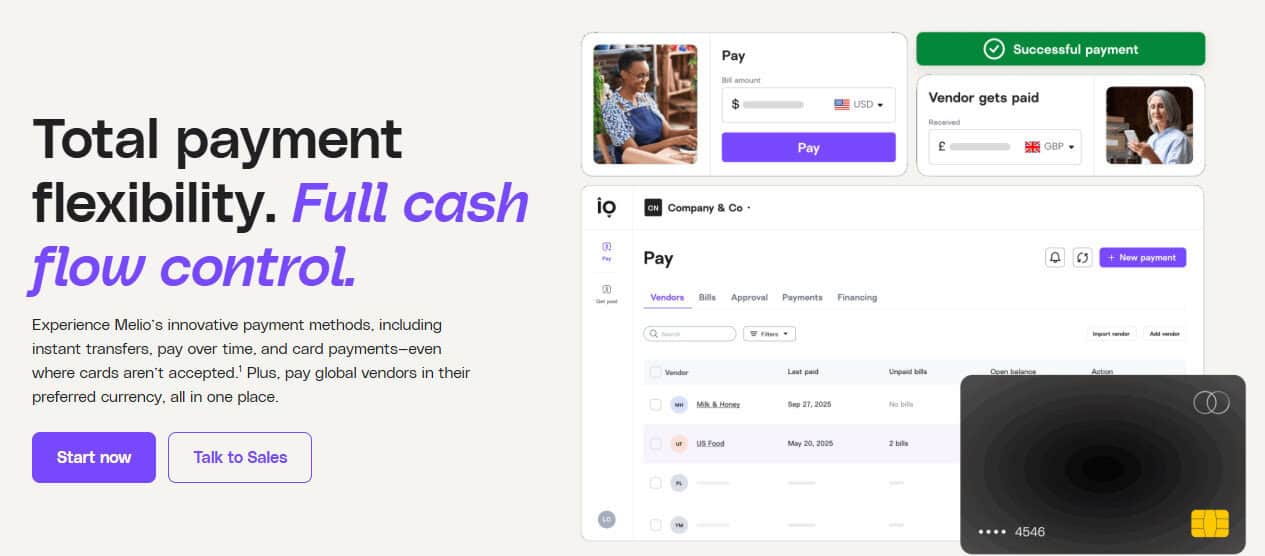

6) Payment Rails and the Vendor Experience

- Zelle: U.S. domestic bank-to-bank only, which I think is pretty limiting. Both sides need to be eligible and enrolled. You can request money, and some banks support QR codes, but your vendor must be able to accept Zelle. International and card-funded options are off the table.

- Melio: Pay by ACH, check, wire, same-day options, and most crucially, in my opinion, you can fund by card even if the vendor only takes bank deposits. That lets you keep standard terms with the vendor while you manage float and rewards on your side. Vendors don’t have to sign up to get paid by check or bank.

Verdict: Melio is vendor-agnostic. Zelle requires the vendor to be in the club. And I have found the club to be pretty small.

7) International payments

- Zelle: Domestic only. No cross-border. Forget about it.

- Melio: Supports paying international vendors from the same dashboard, with options for USD or supported local currencies, and a posted fee schedule. If you’re paying suppliers abroad or contractors outside the U.S., this is non-negotiable.

Verdict: This heavyweight boxing match is getting ugly because Melio hasn’t missed yet.

8) Risk, Fraud, and Recourse (This is a Big Deal!)

- Zelle: Banks and Zelle repeatedly caution to use it only with people you know and trust, and there’s no purchase protection for authorized payments. High-profile scrutiny has led some banks to add friction for risky-looking transfers, and public enforcement actions have raised awareness of scam risk. It’s fast, but you’re carrying risk. I’ve accidentally sent someone $800 mistakenly, personally, and had to beg a stranger to give me my funds back. It was a nightmare.

- Melio: You’re not bypassing your AP process. Bills, approvals, audit trails, and accounting sync reduce internal error risk. You still need standard financial controls, but the platform design assumes business-grade workflows.

Verdict: For transactional speed with trusted parties, Zelle is fine. For business process risk, Melio’s design is the safer posture.

What’s the Price?

- Zelle: Typically, no fee from Zelle itself; your bank may charge for business usage. Limits and fees vary by institution, so two firms on different banks will have different economics and caps. You’ll need to check your specific bank’s disclosures.

- Melio: Posted fees by payment method. Domestic ACH is free on many plans; card funding is usually 2.9 percent; checks after any free allotment are a small per-item fee; wires and rush options have listed fees; international payments have a clear published schedule. If you’re using a business card strategically for float or rewards, you can model the spread between points earned and the 2.9 percent fee.

When Would I Need to Use Either In The Real World?

Paying a one-off local subcontractor today

- Zelle: If you know and trust them, they’re enrolled, and the amount fits your bank’s caps, the money can land in minutes. You’ll manually record it in your GL. Risk is on you if there’s a dispute.

- Melio: Schedule same-day ACH or a check. Code it to the right job cost center, keep approvals and audit intact. Vendor doesn’t need to join anything.

Routine monthly vendor runs across ten suppliers

- Zelle: You’re assembling a spreadsheet and firing individual transfers from the bank, then reconciling by hand. No approvals per bill. This is beginning to sound like a headache isn’t it? It’s why I always steer my clients away from Zelle, Venmo, CashApp, etc.

- Melio: Upload or sync bills, route approvals, choose rails per vendor, schedule for cash-flow timing, and sync back to books on payment.

Paying a designer in Canada and a manufacturer in the U.K.

- Zelle: Not possible.

- Melio: Pay internationally from the same dashboard, with USD or supported local currencies and posted fees.

Preserving cash and stretching float during a tight month

- Zelle: Bank-to-bank only; no card float.

- Melio: Fund by card while the vendor receives ACH, check, or wire. You pay your statement later and potentially capture rewards. This is one of those practical cash-management levers SMBs actually use.

Important Implementation Details to Consider

- Vendor onboarding: With Zelle, onboarding is the vendor’s bank enrollment status. With Melio, you maintain a vendor master with payment prefs and tax details; you can pay even if the vendor never creates an account because Melio can issue checks and wires.

- Audit trail: Zelle provides bank confirmations, not bill-level histories. Melio logs the bill, approval steps, payer, date, and rail. It’s great, and it’s important because external auditors may have questions at a later date.

- Separation of duties: Bank credentials alone are a blunt instrument. Melio allows roles so an AP clerk can prepare, a manager can approve, and only authorized users can release funds.

- Bank independence: Zelle behavior is bank-specific. Melio is bank-agnostic on payables, functioning consistently regardless of where you bank, and can route payments via multiple rails.

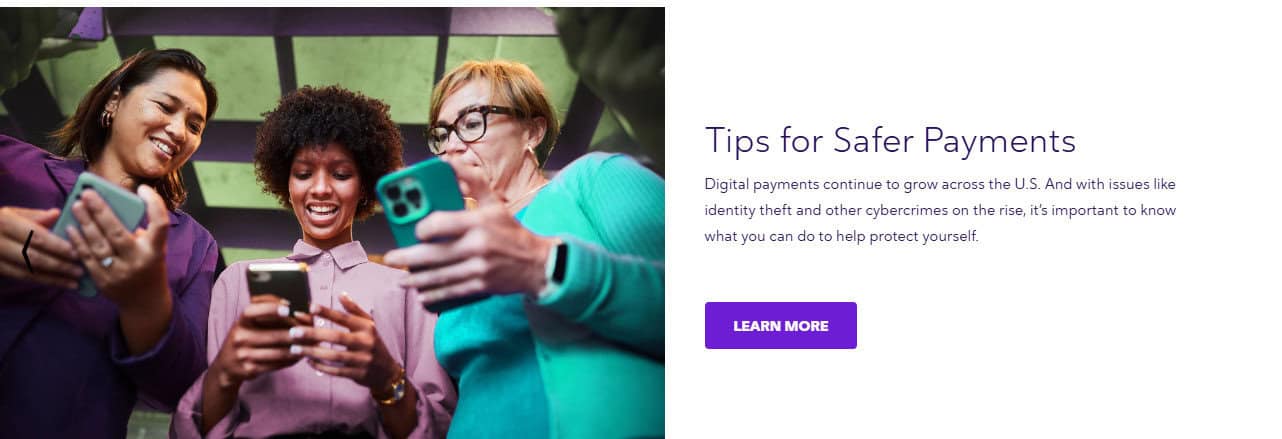

Security And Policies

Zelle’s speed and inability to undue sent payments have drawn regulatory and media scrutiny around scams and authorized-but-problematic payments. This has prompted some big banks to add new friction and rules on risky traffic. The official language across multiple banks reiterates that Zelle is for friends, family, and others you know and trust, and explicitly notes the absence of purchase protection for authorized payments. That’s not a defect so much as a design choice, but it’s a mismatch when teams try to use Zelle like a merchant solution or an AP system.

Melio’s security posture is the standard SaaS AP model: permissions, approvals, and audit. You can still make bad decisions, but the platform is built to lower the odds and document who did what, when.

An Example of Pricing Math

- Card-funded Melio payment: 2.9 percent fee. On a 10,000 dollar payment, the cost is 290 dollars. If your rewards are worth ~2 percent back and the float is strategically valuable for two to six weeks, that can be net-positive depending on cash-flow pressure and card bonus structure. ACH is free on many Melio plans, so default to ACH unless timing, rewards, or vendor constraints justify card.

- Zelle transfer: Often zero fee from Zelle itself; your bank may charge a business fee. The hard limit is the bank cap, and the lack of controls and sync. If you run fifty vendor payments a month, the hidden cost is not a per-item fee; it’s staff time reconciling and the risks of loose approvals.

Where Each Falls Short

Zelle limitations

- No purchase protection for authorized payments; recommended only for trusted parties.

- No line-item coding, approvals, or accounting integration.

- Domestic only; limits and any fees vary by bank.

- Hard to scale beyond a handful of trusted counterparties without process risk.

Melio limitations

- Card funding costs 2.9 percent; rush and specialty rails carry explicit fees.

- You’re adopting a system, not just sending money, so there’s setup and process discipline.

- International has fee schedules and supported currency lists to review before sending.

The Final Call

Man, so much for this being a head-to-head match. I basically just put a 600 lb gorilla in the ring and had it square up against a kitten. Poor Zelle has its place, just not in the business world, because from an accountant’s standpoint, it’s just not the right tool for the job.

If you’re a sole proprietor paying a familiar vendor every few weeks in small amounts, Zelle is fine. The moment you have outgrown that, you’ve outgrown a bank feature, and you need an AP layer. That is Melio’s lane. The platform lets you keep vendors happy in their preferred rails, keep me happy with reconciliations and approvals, and keep owners happy with cash-flow timing and visibility. That’s why Melio earns the belt for most business payables, while Zelle got KO’d in the first round.