Last Updated on November 4, 2025 by Ewen Finser

It’s more important than ever before for accountants to have a clean bill pay workflow that moves money, reconciles perfectly every time, and doesn’t light their cash flow on fire. Wise and Melio are two excellent, popular choices, so it’ll be a tough comparison that will likely come down to what best fits your specific needs.

Here’s my take as a CPA who uses these kinds of platforms every day.

At a Glance

Category | Wise (Business) | Melio |

Best for | Global or contractor-heavy teams needing multi-currency accounts, strong FX, and batch/API payouts | U.S.-centric SMBs that live in QuickBooks/Xero and need clean AP/AR with approvals |

Core focus | Multi-currency accounts, cross-border transfers, batch and programmatic payouts | Domestic bill pay + light AR (payment links, surcharge controls) |

Outbound payments | Domestic and cross-border bank transfers, hold/send in multiple currencies, and batch payouts | ACH, mailed checks, card-to-vendor (vendor can still receive ACH/check), international payouts |

Inbound payments | Local receiving details in multiple currencies | Branded payment links for ACH and card; optional surcharge to the payer |

International support | Full multi-currency lifecycle: receive, hold, convert, and pay out across currencies | Simple, pragmatic international sends; not multi-currency native |

FX handling | Mid-market FX with transparent fees; preview and convert balances | N/A for most domestic flows; basic for international |

Approvals & roles | Solid user permissions; deeper approval logic often handled in app stack or via API | Purpose-built AP approvals, user roles, and an accountant dashboard |

Vendor onboarding | Standard bank details collection, and not focused on 1099/W-9 workflows | Pay vendors that “don’t take cards” by charging your card and delivering ACH/check; request W-9s |

1099/W-9 workflow | Handled upstream in the accounting or payroll stack | Built-in W-9 requests; 1099 exports/integrations |

Speed | Corridor-dependent speeds, fast local rails where available, and batch timing controls | Same-day ACH, instant options to vendor bank/debit (eligibility applies), and overnight checks |

Batch payments | Robust CSV batch (hundreds to thousands); strong operational fit for marketplaces/agencies | Batch pay runs inside the app; accountant multi-client workflows |

API | Full-featured payouts and accounts API with webhooks; developer-friendly | Primarily an application-first AP/AR tool; limited developer surface |

Accounting integrations | Xero bills and recon flows; QuickBooks mark-paid/matching support | Deep QuickBooks Online (Desktop support on certain plans); Xero support |

Document capture | Needs to lean on an accounting system or API for bill intake | Email-in/OCR, file upload, vendor doc storage; Amazon Business fetch |

Reconciliation | Updates bills/invoices paid status, and multi-currency reconciliation via accounting suite | Two-way sync of bills and payments, attachments back to the GL, and clean fee mapping |

Cards & cash-flow | Spend via debit; focus is on treasury and FX rather than card-to-vendor bridging | Pay vendors by card even if they don’t accept cards; optional surcharge to your customers on AR |

Pricing | No monthly fee for a core account in many regions; there are per-transfer and FX fees, and a one-time business setup fee may apply | App-style pricing with clear domestic ACH/check economics; optional speed fees |

Wise vs. Melio: A Deep Dive

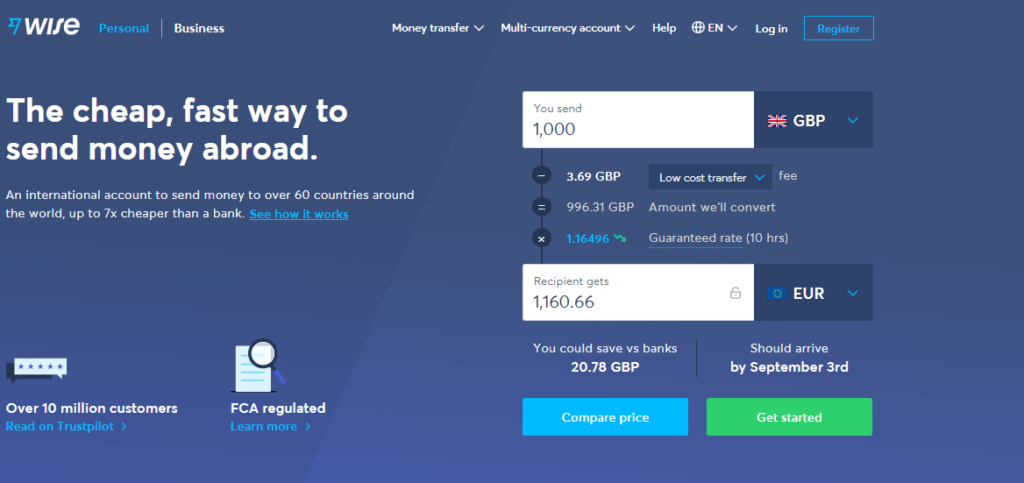

Wise is a multi-currency account and payouts infrastructure that’s more than capable of executing single or batch payments (up to 1,000 at once), settling invoices, and running global payroll or contractor payouts. It supports bill pay, especially when connected to Xero/QBO, but its superpower is cross-border, multi-currency operations with developer-grade automation.

Melio is an AP/AR system for B2B flows: scan a bill, route approvals, pay via ACH, card, or paper check, and keep your GL synced. It also flips to AR with branded payment links so your customers can pay you by bank or card — and you can choose who eats the card fee. My favorite part is that it feels like it’s built for accountants (roles, approvals, W-9 collection, 1099 sync).

Fees & Payment Methods

Wise

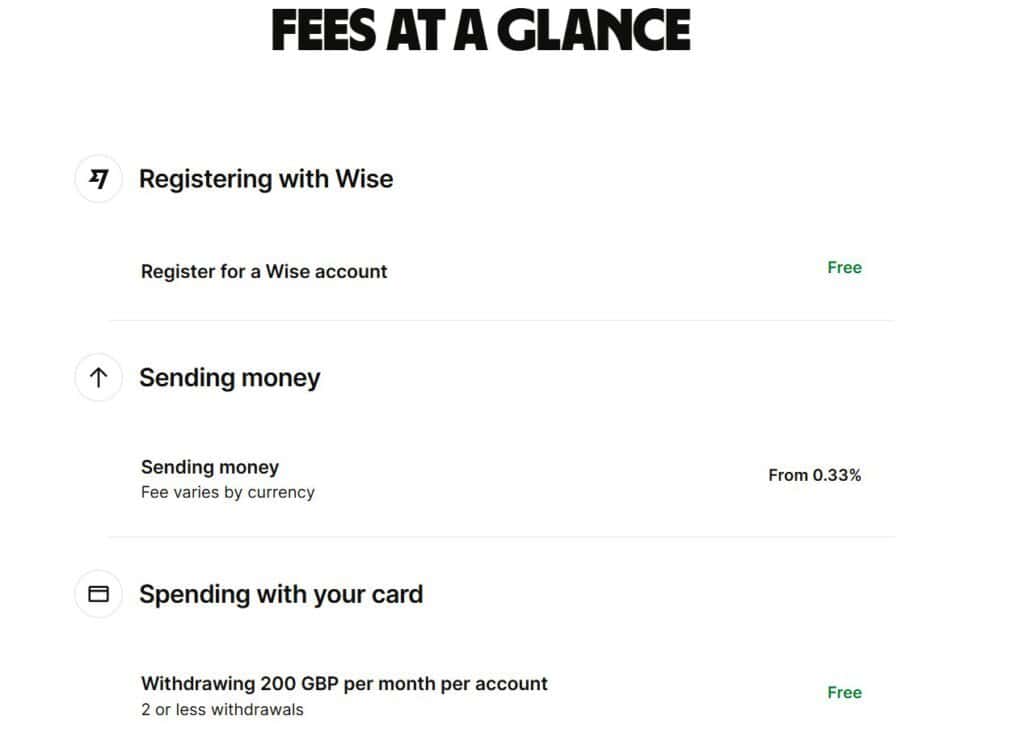

- Account setup (Business): A $31 one-time fee.

- Transfers/FX: Variable, transparent transfer fee; FX at mid-market + fee.

- Receive money in local details: Usually free locally; wires may have small inbound fees depending on currency.

- Batch payouts (up to 1,000): Included and a massive time saver for contractor or marketplace disbursements.

Melio

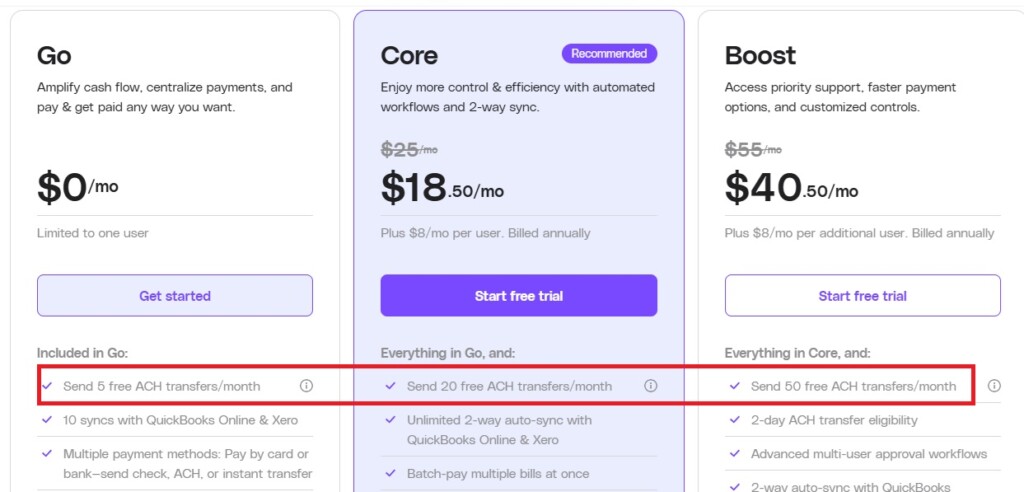

- ACH: Free on all tiers, with paid tiers unlocking higher or unlimited free ACH counts. Same-day ACH is typically 1% capped at $30.

- Card to vendor: 2.9%. You can pass this to the payer on AR or absorb it strategically.

- Paper checks: A small fee of $1.50; overnight or fast checks cost extra.

- International: Flat $20 (typically USD to vendor).

This CPA’s take: For domestic-heavy AP, Melio’s free/flat structure on ACH plus the ability to float on cards (at 2.9%) can’t be beat. Once you’re crossing borders or juggling balances across currencies, Wise’s fee model is often cheaper all-in than a bank, and the batch/API rails are a real operational unlock.

QuickBooks & Xero Integrations

Wise

- QuickBooks: Can mark bills/invoices paid in QuickBooks when paid via Wise, matching by recipient, amount, and reference.

- Xero: Native Bills sync — import unpaid Xero bills to Wise and pay from there.

Melio

- QuickBooks: Bidirectional sync of vendors, bills, payments, and customer invoices.

- Xero: Listed support and two-way sync positioning on paid tiers. (Melio’s public materials emphasize QBO the most, but Xero support is present.)

This CPA’s take: If your day is 60% reconciling QBO and chasing W-9s, Melio feels like home. If your day is 60% moving funds programmatically to 200 freelancers in 20 currencies, Wise will feel better.

Payment Methods and Speeds

Wise

Bank payouts domestically and cross-border, multi-currency balances, local receiving details in major currencies, and batch or API execution. For global supply chains, this translates to fewer hops, fewer surprise wire fees, and faster crediting on the other side.

Melio

Bank (ACH), card-to-vendor (with the vendor still receiving ACH or check), and paper check. Same-day ACH, instant transfers to the vendor’s bank or debit, and overnight checks are available when needed. This is a lifesaver when a supplier needs funds today.

This CPA’s take: Melio’s “pay by card even if the vendor doesn’t take cards” capability remains a superpower because it smooths AP timing without forcing supplier onboarding. Wise’s “pay one or 1,000 invoices” batch tool is a relief valve for ops teams that export CSVs like it’s a religion.

Approvals and Roles

Wise

With Wise, permissions exist at the account level, and you can get very far with API keys and internal controls. However, the out-of-the-box approval ergonomics are less “AP suite” and more “banking platform with good guardrails.”

Melio

Melio has granular roles and approval workflows, which I really enjoy for mid-sized businesses. It also has user management and firm dashboards tailored for accountants managing multiple clients. This matters when you need a clean segregation of duties (requester, approver, and payer).

This CPA’s take: If your governance model is click-first and code-later, Melio’s structure will feel more natural.

Reconciliation & Close

Wise

Wise pushes payment status and can mark bills/invoices as paid in QBO. It also syncs with Xero’s Bills, which is useful when the treasury function is centralized and accounting needs to see the truth in near real time.

Melio

Melio posts clean payment objects back to QBO/Xero, maps vendor credits, and keeps invoice images attached, which reduces questions long after you’ve forgotten what you’ve paid for. The AR side mirrors this with customer payments and fees so you don’t lose time trying to figure out things that don’t tie or match.

This CPA’s take: I’m torn here. What I will say is that I consistently feel good at the end of each month with both of these platforms.

Other Factors

- Approvals & roles: Melio has purpose-built flows and accountant dashboards. Wise has user controls and tokens, but deep approvals often shift to your internal SOPs or custom tooling.

- Intake & capture: Wise leans on your accounting suite for bill workflows or your API build. Melio pulls invoices from email and Amazon Business, OCRs, and anchors images to payment objects.

- 1099/W-9: Wise doesn’t try to be your 1099 tool, so expect to solve this upstream. Melio lets you request W-9s at scale and sync Tax1099, which is an excellent feature for U.S. companies.

- Speed: Melio supports same-day ACH, instant transfers, and overnight checks. Wise’s speed story varies by corridor and funding method, but cross-border ETAs are among the best in class.

- Batch & API: Wise is the clear winner for programmatic payouts. Melio offers partner/embedded routes but is primarily a best-in-class AP/AR application.

- International: Melio keeps it simple with a $20 flat fee. Wise is purpose-built for multi-currency receipts and sends with local account details.

Notable Strengths & Weaknesses

Wise

Strengths

- Multi-currency everything: Hold, convert at mid-market, receive locally, and pay out globally and at scale. Batching up to 1,000 transactions and API make ops teams smile.

- Transparent FX and corridor-specific pricing: Definitely beats the bank experience.

Weaknesses

- Domestic controls/approvals: Feels less “AP suite” and more “banking platform + add-ons,” unless you invest in process and API-level automation. Xero’s bill pay flow with Wise is solid; QBO is improving, but it’s not as deep as Melio’s two-way sync story.

Melio

Strengths

- The flow: Bills go through intake → approvals → ACH/check/card with a clean GL sync.

- Options to pay: Card-to-vendor (you float; vendor gets ACH/check), same-day ACH, and instant options when speed matters.

- Accountant features: Batch pay, roles, approvals, W-9/1099 tooling are all available within the platform.

Weaknesses

- International: Simple and flat-fee, but doesn’t have as broad-reaching international support as Wise.

My Verdict

For the typical U.S. SMB where you need tight approvals, simple ACH/check/card flexibility, and clean QuickBooks/Xero sync, go with Melio. The instant and same-day rails are a genuine Friday-afternoon lifesaver, and the W-9/1099 workflow means fewer January migraines. Melio takes the win.

For global, API-driven payouts and multi-currency cash management, Wise remains the best-in-class. If you’re paying 200 contractors across 18 countries, don’t force it — go Wise and automate ruthlessly.

Here are a couple of quick scenarios to give you a better idea:

Scenario 1: U.S. Construction Subcontractor Stack

You live in QuickBooks, you cut 80–120 vendor payments a month, half of your subs still want checks, and Thursday afternoon “can you pay me today?” texts are a thing.

Melio is my pick because it can intake bills by email, route approvers, pay via ACH/check, and flip to same-day ACH or overnight check when a lien waiver is on the line. Keep the 2.9% card option in your pocket for cash-flow smoothing, but use it only as needed.

Scenario 2: Remote-first Agency with International Contractors

You carry balances in USD/EUR/GBP, and you want to settle 60-200 payouts twice a month with tight FX.

Wise wins because you can stage the batch, preview FX at mid-market, and push up 1,000-line payout files if needed. Pipe statuses back to Xero/QBO so finance isn’t DMing ops for payment receipts.

The Takeaway

Melio is the better all-around AP/AR cockpit for U.S. businesses. It does an excellent job of working with companies that live inside QuickBooks or Xero and want card-to-check flexibility, simple approvals, and predictable domestic fees. However, Wise is the better choice when your payables and receivables routinely cross borders, touch multiple currencies, or you want to wire up an API-driven payout engine.