Last Updated on April 22, 2025 by Ewen Finser

Did COVID-19 affect your ability to conduct business as normal?

If you’re an employer who would answer “yes” to this question (and, realistically, most employers are), it may benefit you to learn more about the soon-to-be-consigned-to-the-dustbin-of-history Employee Retention Credit (ERC).

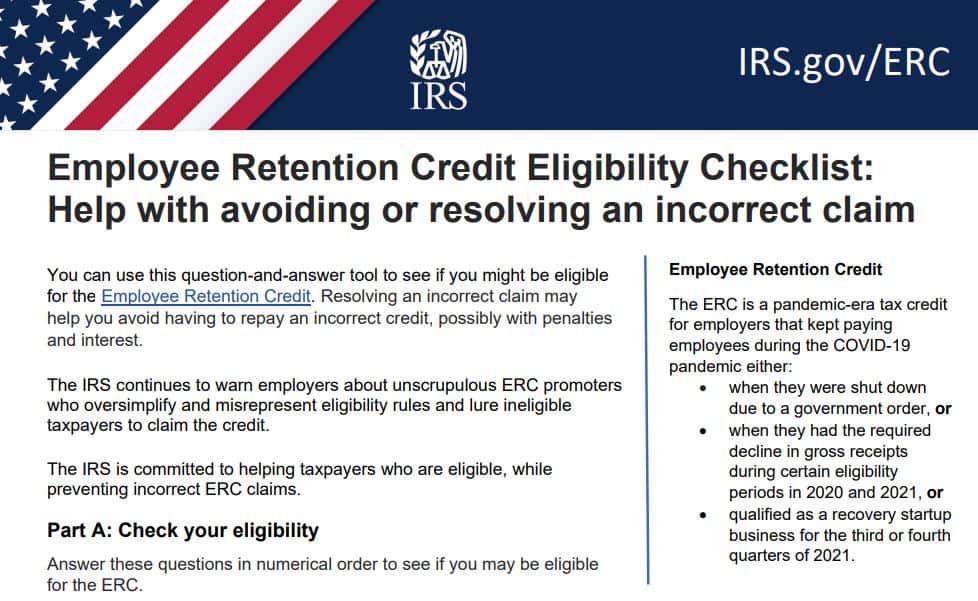

The ERC will essentially refund a certain amount of the money you paid your employees during the pandemic (if you’re eligible to benefit from it). However, the deadline for applications is April 15, 2025. Also, untangling the eligibility requirements for the scheme is extremely difficult, and the IRS has openly stated that it’s cracking down hard on companies that seek credits they’re not entitled to.

With all that in mind, I’ve put this guide together to help you figure out if ERC might be an option for your business, and to tease out the potential complications you may face.

What Is the ERC?

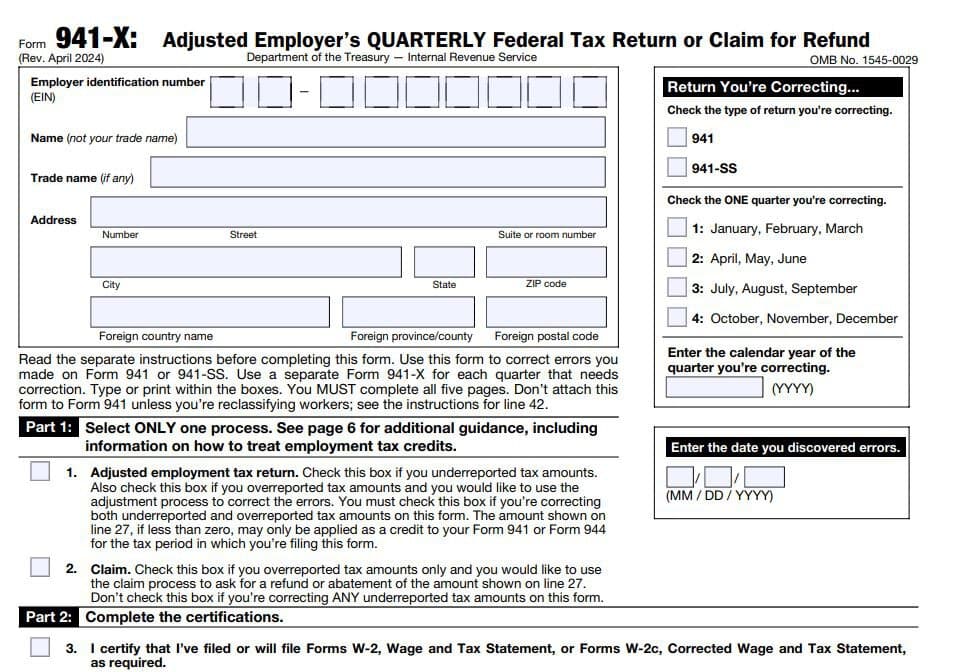

The Employee Retention Credit (ERC) is a refundable payroll tax credit introduced under the CARES Act in 2020. It was created to reward businesses that kept employees on payroll despite economic disruptions caused by COVID-19.

How It Works

The ERC allows eligible businesses to claim up to $26,000 per employee, spread across 2020 and 2021. The breakdown looks like this:

- In 2020, businesses could claim 50% of up to $10,000 in wages per employee, amounting to a $5,000 maximum credit per employee.

- In 2021, businesses could claim 70% of up to $10,000 in wages per quarter, amounting to a maximum of $21,000 per employee.

This isn’t limited to salaries and wages (as typically defined). You may also be entitled to recover health benefits paid to your employees, as well as wages you paid while your workers were furloughed.

Let’s say you own a restaurant (or any other business with pandemic-related losses), and you had 15 employees throughout 2021. If you satisfy ERC requirements in all three eligible quarters, you could receive:

- $10,000 in wages per employee per quarter.

- Multiplied by 70%, that works out at $7,000 per employee per quarter.

- This is equal to the $21,000 per employee that you can make from the scheme for 2021. Anything in excess of this would not be recoverable.

- 15 employees x $21,000 = $315,000 total ERC benefit.

Sounds worthwhile, doesn’t it?

Who Can Benefit From the ERC?

There are few limits to the types of companies that can benefit from ERC; as long as your operations were affected by the pandemic, you’re in with a shot. The impact your business suffered doesn’t need to be a complete shutdown of operations. Say you run a professional services business and your management of client relationships was hindered by your inability to have in-person meetings; you might still qualify.

Of course, you shouldn’t just assume this will be the case. As previously noted, IRS agents have been coming down hard on companies submitting inappropriate ERC claims. Do your due diligence before filing; you have been warned.

While companies of all sizes are eligible to benefit from ERC, there are different rules for bigger organizations. If you have more than 500 employees, you can only claim relief in relation to wages paid to employees who were out of work because of pandemic-related issues. For smaller companies, wages are potentially recoverable whether employees were on the job or not.

You should note that the filing deadline for claims related to employment expenses incurred in 2020 passed in April of last year. It’s no longer possible to recover an ERC benefit for wages, salaries, or other benefits paid in 2020.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Challenges Associated With Filing Claims

I won’t sugarcoat it; filing for ERC benefits is not easy, or risk-free. There are a number of potential pitfalls to be mindful of, including:

- Incorrect wage calculations: The definition of “qualifying wages” can be difficult to fully wrap your head around, especially when you’re dealing with a large workforce that experienced different levels of pandemic-related disruption. Unfortunately, the IRS has little sympathy for employers faced with this problem; miscalculations will be costly. You could also underestimate your potential eligibility and end up leaving money on the table.

- PPP overlap: It’s possible to benefit from an ERC claim even if you’ve previously received relief under the Paycheck Protection Program (PPP). However, you cannot claim ERC benefits in relation to wages you used to qualify for PPP loan forgiveness.

- Filing mistakes: You file for ERC relief via your Form 941. While this might sound more straightforward than completing a distinct application process, it can still be tricky.

- Audit risk: The IRS has flagged ERC filings as an area of high fraud risk, and is scrutinizing all claims. If you’re not careful, you could easily end up on the receiving end of an audit notice. Even if your ERC filing was accurate and honest, this is a headache no business wants to have to deal with.

For this reason, I’d suggest looking at third-party service providers who can assess your eligibility and take care of the filing process on your behalf. I’ve looked at some options in the next section.

ERC Service Providers

IRSPlus

IRSPlus is, in my view, the best option for the largest number of businesses. Its agents have experience across a broad number of industries, it offers a money-back guarantee and coverage for any filing mistakes, it has a reputation for getting applications done quickly, and it typically costs 25-30% less than its competitors. It does have less experience with larger companies than some other service providers in the space; however, if I were running a small or medium business, I’d go with IRSPlus.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Omega Accounting Solutions

Omega’s biggest selling point is its bridge loan offering; if you avail of this and you’re an existing client of the firm, you could have money in your account in as little as 10 days. However, while its pricing structure isn’t entirely clear, it’s likely you could get a similar service for a better deal elsewhere.

Bottom Line Concepts

Bottom Line has a rich pedigree in the large-cap space; it has worked with a large number of Fortune 500 companies across industries. If this is the kind of service you’re looking for, I’d recommend scheduling a consultation with Bottom Line.

How Long Does It Take to Receive ERC Funds?

The IRS is currently dealing with a massive backlog of claims. In October 2024, the agency reported that it had 1.2 million claims to catch up on, and that some claimants had been waiting over a year for their money at that point. So, I can’t give you a straight answer to this question, but I can tell you not to rely on ERC money to meet any immediate expenses. You could be waiting a while.

Should You Submit an ERC Claim?

The ERC could give your balance sheet a huge boost in 2025, but you need to understand what’s involved in the filing process before you submit your claim.

A mistake could end up being very costly. Unless you’re comfortable with the hoops the IRS will make you jump through to get your money, I’d recommend letting a third party handle the process for you.

Most offer free consultations (like IRSplus), so it’s probably worth your while talking to someone about it.