Last Updated on February 4, 2026 by Ewen Finser

As a startup, you can have the best product-market fit in the world, but it won’t matter much if you run out of cash.

This is where runway comes in and runway tracking tools with it.

Runway is essentially how much time you have left. You calculate it by dividing your current cash balance by your net burn rate, which means if you have $500,000 in the bank and burn $50,000 a month, you have 10 months of runway.

It’s one of the single most critical metrics for early-stage survival, which is why it should be constantly monitored, alongside burn rate (the speed at which you spend cash) and your cash zero date (the specific calendar date when your bank account hits $0).

Manually tracking these metrics in a spreadsheet works for a while, but as expenses grow and complexity increases, it only becomes a massive headache — and all it takes is one broken formula or missed invoice to lull you into a false sense of security.

The right software automates this. I’ve helped plenty of business owners integrate different platforms into their tech stack so they can monitor the health of their business, so let’s talk about what I think works and what doesn’t.

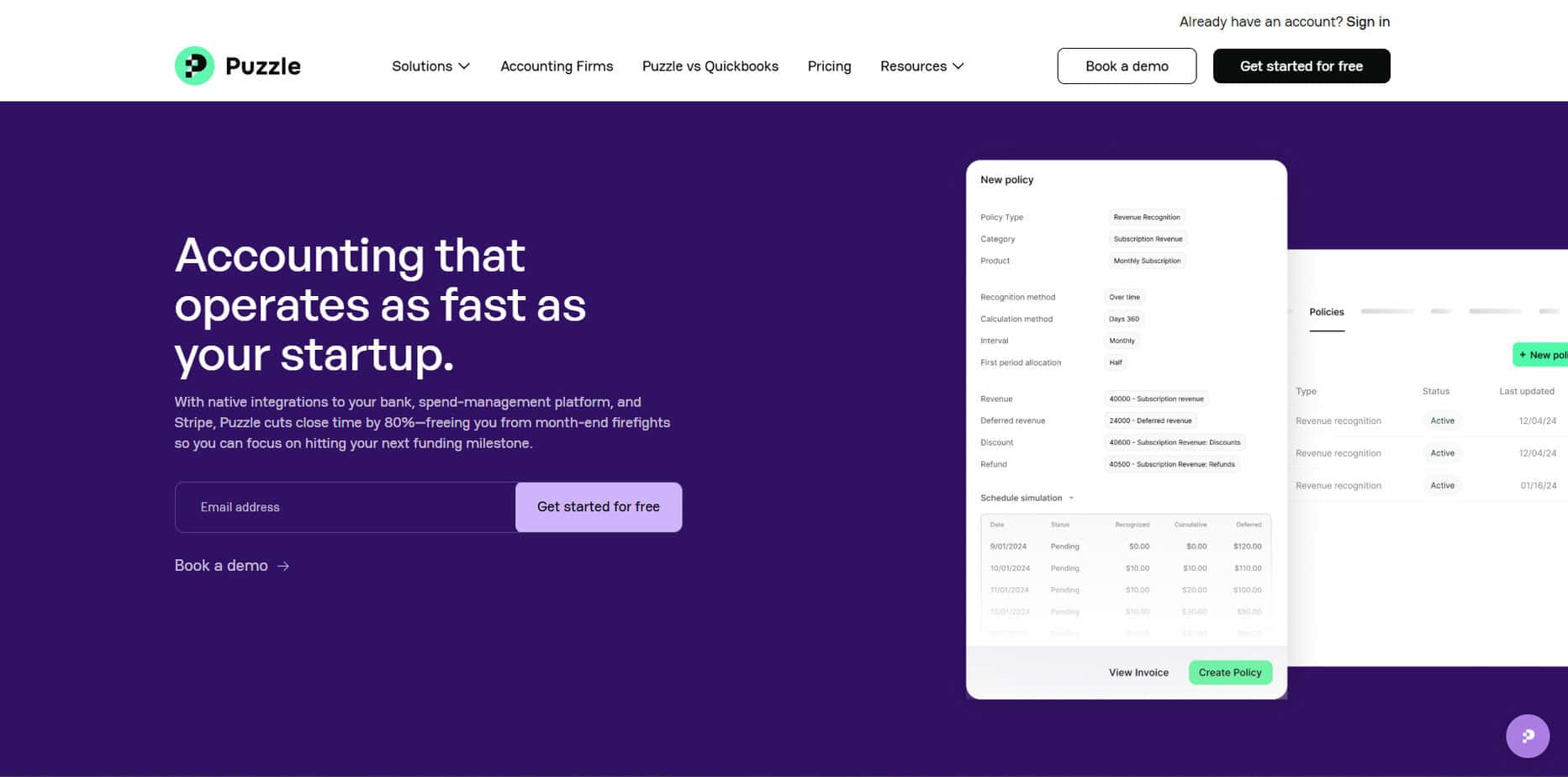

1. Puzzle

Puzzle is an accounting platform built specifically for startups. It doesn’t just measure metrics like runway and burn rate; it’s a holistic view of all the financial data founders use to make decisions, combining a general ledger with real-time insights. Rather than looking backward like most accounting software, Puzzle uses AI to categorize transactions as they happen, generating real-time metrics.

How It Works: You connect your bank accounts, credit cards, and payroll processors (like Gusto or Rippling) directly to Puzzle. The system then ingests the data and automatically prepares your financial statements, updating your runway and burn metrics instantly every time a transaction clears. You don’t need to wait for a month-end close to know how many months of cash you have left.

Pricing: Puzzle offers a tiered pricing structure that scales with your company, including a free plan, a $50/month plan, a $100/month plan, and custom solutions and pricing if you need more support.

Pros

- Real-Time Data: You see your financial position today, not what it was 30 days ago.

- Native Integration: Runway tracking is built into the accounting software. You don’t need to buy a separate tool and sync it with your books.

- Drill-Down Capability: If your burn rate spikes, you can click into the metric to see the specific transactions driving the increase.

- Startup Focus: The platform can handle startup-specific nuances like R&D tax credits and revenue recognition autonomously.

Cons

- Up-and-Comer: It has fewer years in the market compared to legacy giants like QuickBooks.

- Feature Density: The sheer amount of data available can initially overwhelm founders used to simple cash-basis reporting.

Best For: Puzzle is the ideal choice for early-to-growth stage startups (seed to Series B). It suits founders who want to eliminate manual finance work and need a single platform that encompasses all of the financial aspects of the business.

2. LivePlan

LivePlan is a business planning and forecasting tool that’s widely known for helping founders write business plans for bank loans or investor pitches. Over time, it’s evolved to include performance tracking features: sitting on top of your accounting software like QuickBooks Online or Xero, pulling in your historical data, letting you build a forecast within LivePlan, and then comparing your actual results against your plan.

How It Works: You start by building a budget and a forecast in the LivePlan dashboard. Once connected to your accounting software, it imports your actual financial results, visualizing the variance between what you planned to spend and what you actually spent.

Pricing: LivePlan’s plans are priced at $20/month and $40/month. Additional add-ons like Expert Help are available for an additional $16/month per user.

Pros

- Forecasting Strength: LivePlan excels at what-if scenarios. For example, you can easily model how hiring three new engineers affects your runway.

- Visual Reports: The dashboard creates clean, easy-to-read charts that are perfect for board meetings.

- Guidance: The software includes benchmarks that let you compare your metrics against similar companies in your industry.

Cons

- Data Lag: LivePlan relies on data from your accounting software. This means that if your books aren’t up to date, your dashboard will be inaccurate.

- Tool Sprawl: This isn’t an all-in-one tool; you must pay for both an accounting system and LivePlan.

- Maintenance: You need to constantly update your forecast to keep LivePlan’s comparisons relevant.

Best For: LivePlan is excellent for founders who need to present formal business plans to banks or traditional investors. It’s also useful for teams that want to practice disciplined budget-vs-actual analysis.

3. Pilot

Pilot is not a software in the traditional sense; it is a service that combines software with human bookkeepers. They manage your books in QuickBooks Online and provide a monthly financial report that includes your key metrics. As such, Pilot is positioned as a hands-off solution — you hand over access to your financial accounts, and their team handles the categorization and reconciliation.

How It Works: Pilot assigns a dedicated finance team to your account, using their internal software to process your transactions. At the end of each month, they send you a financial package that includes your profit & loss, balance sheet, and a summary of your key metrics.

Pricing: Pricing is based on your monthly expenses. It can start as low as $99 per month, but most businesses will end up at the $499 per month range, and things like fractional CFO services cost $5,250 per month.

Pros

- Human Oversight: You have actual accountants reviewing your books, which adds a certain layer of assurance.

- CFO Services: For an additional (hefty) fee, Pilot offers fractional CFO services to help with more complex financial modeling and fundraising strategy.

- Hands-Off: Pilot requires very little time from the founder once the integration is set up, allowing them to just focus on product.

Cons

- Delayed Insights: You cannot check your real-time burn rate in the middle of the month; you typically receive your financials 10 to 15 days after the month ends.

- Cost: Pilot is significantly more expensive than pure software solutions, and the cost only increases as your monthly expenses grow.

- Platform Dependency: You’re still using QuickBooks Online as the backend here, which carries its own legacy limitations.

Best For: Pilot is best for well-funded startups that have the budget to outsource their finance function entirely and do not require daily visibility into their numbers.

4. Mosaic

Mosaic is a strategic finance platform designed for scaling companies — a heavy-duty tool that’s meant for mature finance teams rather than early-stage founders. It aggregates data from your ERP, CRM, and HRIS to create a complete picture of your business, moving beyond simple runway tracking into complex efficiency metrics like LTV:CAC ratios, Magic Number, and headcount efficiency.

How It Works: Mosaic integrates with core systems like QuickBooks/Xero for finance, Salesforce/HubSpot for sales, and Rippling/Gusto for people data. It then maps this data into a unified model and allows finance teams to build complex models without using pesky spreadsheets.

Pricing: As an enterprise-grade solution tailored to mid-market companies, Mosaic does not publish standard pricing. Expect to sit on a sales call for an hour or two.

Pros

- Deep Analysis: You can slice your data by department, customer segment, or product line.

- SaaS Metrics: Mosaic comes pre-loaded with templates for standard SaaS metrics, making it easy to track subscription health.

- Collaboration: Different department heads can view their own budgets and forecasts within the platform.

Cons

- Complexity: The learning curve here is steep. It’s designed for finance professionals, not generalist founders.

- Implementation Time: Setting up the data mapping and integrations takes time and effort.

- Overkill for Early Stage: If you just need to know your runway and burn, Mosaic offers far more power (and complexity) than you really need.

Best For: Mosaic is best for Series B or Series C companies that have a dedicated finance hire (such as a VP of finance or a CFO). It’s the tool you graduate to when you outgrow simple spreadsheets.

5. Fathom

Fathom is a reporting and analysis app. Like LivePlan, it connects to your existing accounting system to visualize financial performance and monitor trends over time. As such, it’s popular among accounting firms that want to provide better reports to their clients, turning dry financial tables into colorful dashboards and graphs.

How It Works: Fathom syncs with your accounting ledger. You select the KPIs you want to track (such as cash flow, profitability, or growth metrics), and it will generate a dashboard that updates whenever you sync your accounting file.

Pricing: Fathom charges a monthly subscription per company file. It’s affordably priced for small businesses, and if you have just one file, it’s $53 a month. You get economies of scale based on the number of companies you’re running reports for, and you can get it as low as $12 per company.

Pros

- Visual Appeal: The reports are easy to read and professional — excellent for sending to investors who want a quick snapshot.

- Trend Analysis: Fathom excels at showing how a metric has changed over the last 6, 12, or 24 months.

- Goal Tracking: You can set targets for specific metrics (e.g., “Keep burn under $20k”), and Fathom will alert you if you miss them.

Cons

- Backward Looking: Like LivePlan, Fathom only reports on what’s already happened. It is not a real-time operational tool.

- Not a Planning Tool: While Fathom has some forecasting features, they’re not as robust as LivePlan’s or Mosaic’s.

- Sync Delays: You’re relying on the underlying accounting file being accurate here. If you put garbage in, you get garbage out.

Best For: Fathom is great for founders who want high-level, visual summaries of their financial health to share with advisors or investors. It’s also a good tool for CFOs who manage multiple entities and need to consolidate reports.

6. Startup Runway

Startup Runway is a specialized tool focused entirely on cash planning. It doesn’t try to be an accounting system or a full FP&A suite; it just helps you answer the question: “When do we run out of money?” This limited scope also means that it’s simple and accessible, often serving as a stepping stone for founders moving off of spreadsheets.

How It Works: You connect your bank feed or manually input your spending data, and Startup Runway will visualize your burn rate and project your cash zero date. It also allows you to model simple scenarios, such as “What if we raise a bridge round?” or “What if we cut marketing spend by 50%?”

Pricing: They offer a free tier for basic features, with paid plans for advanced scenario modeling and integrations.

Pros

- Simplicity: It does one thing and does it well. The interface is intuitive and requires no financial background.

- Focus: It forces you to look at cash, which is the only thing that matters in the very early days.

- Free Tier: They often offer a functional free version for early-stage startups.

Cons

- Limited Scope: It does not handle accounting, tax, or deeper financial analysis. You will still need an accounting solution.

- Manual Entry: Without deep integration into a general ledger, you may end up manually adjusting numbers to match reality.

- Lack of Detail: It is hard to drill down into the “why” behind the numbers since it doesn’t hold the transaction-level data.

Best For: Startup Runway is best for pre-revenue or very early-stage startups that need a free or low-cost way to visualize their cash flow without getting bogged down in complex accounting software.

How Do I Choose the Right Tool?

Your choice depends on your stage and your current stack.

If you’re a Series B company with a finance team, Mosaic can handle the complexity of a scaling organization. If you’re a traditional business that needs a loan, LivePlan can help you build the documents the bank requires. If you have significant funding and want to be completely hands-off, Pilot provides the service layer you’re looking for.

However, for most technology startups, from seed to Series A, Puzzle offers the most efficient path. It solves the core problem (runway tracking) by fixing the root cause: disparate financial data. By unifying your accounting and your metrics, it gives you accuracy and speed without the need for a second or third tool.