- The Bottom Line Up Front

- Why SMBs Are Tire Kicking Other Platforms

- So What Should Everyone Be Looking For Instead?

- 1) Homebase: Best for Hourly Teams That Want Fewer Tabs

- 2) Gusto: Best All-Around Experience for Small Businesses

- 3) RUN Powered by ADP: Best for Compliance Depth and Scale

- 4) Paychex Flex: Best for Hands-On Owners Who Want a Human on Speed Dial

- 5) Square Payroll: Best for Restaurants, Shops, and Contractor-Heavy Teams

- 6) Rippling: Best for Companies That Want HR, IT, and Finance in One Place

- How to Choose Your Quickbooks Payroll Alternative

- The Gotchas That I Often See Overlooked

- Verdicts By Use Case

- A Final Word on “Value” vs. “Price”

Last Updated on February 27, 2026 by Ewen Finser

I’m sure the book keepers and SMB owners that are present in my nook of the internet today share a similar view as me on this. Payroll shouldn’t feel like defusing a bomb with oven mitts, but here we are on Thursday afternoon, three coffees deep, entering timesheets, tips, and surprises while Quickbooks freezes up. If you’re running an hourly team, you don’t need to be a masochist to run payroll, you just need a stack that keeps schedules, punches, and taxes singing off the same sheet. And let me tell you, there are tools that cut down on reclasses, stop the spreadsheet sprawl, and get you from shift to paycheck without the existential dread that you get every Thursday morning.

The Bottom Line Up Front

If you’re feeling boxed in by QuickBooks Payroll’s recent price bumps and tier creep, there’s no shortage of credible replacements. For hourly teams, Homebase is the most balanced “do it without baby-sitting it” option in my opinion because scheduling, timekeeping, and tip handling live right next to payroll. It isn’t flashy; it just reduces the places you can make mistakes. For shops that want a broader HR bench, Gusto and Rippling are strong, while ADP and Paychex are the classic compliance tanks. Restaurants and contractor-heavy crews will feel right at home with Square Payroll. Below, I’ll break down who fits where, with nuts-and-bolts details you can use to make a decision without a demo call.

Why SMBs Are Tire Kicking Other Platforms

It’s no secret that QuickBooks has nudged payroll pricing multiple times, including changes to per-employee rates across Core, Premium, and Elite. Core sits at a $50 base with $6.50 per employee; Premium at $88 plus $10 per employee; Elite at $134 plus $12 per employee, with one state included on Core and Premium and more included at Elite. Those nickels and dimes add up fast for high-turnover hourly shops, where active headcount fluctuates and multi-state filings are common.

So What Should Everyone Be Looking For Instead?

From a controller’s desk, the win condition isn’t “more features,” it’s fewer places to mis-key, fewer timesheets to sanitize, fewer Monday morning conversations, and fewer amended filings. That means:

- Native time & attendance with audit trails and clean imports to gross pay.

- Tip management that doesn’t require spreadsheets.

- Strong multistate tax handling and auto-filings that actually run on time.

- Reasonable, predictable pricing that doesn’t whiplash as you grow.

- Tight accounting integrations so payroll entries don’t turn into Frankenstein journals (been there, done that, and absolutely would not recommend!)

With that frame, here are the six strongest QuickBooks Payroll alternatives and where each shines.

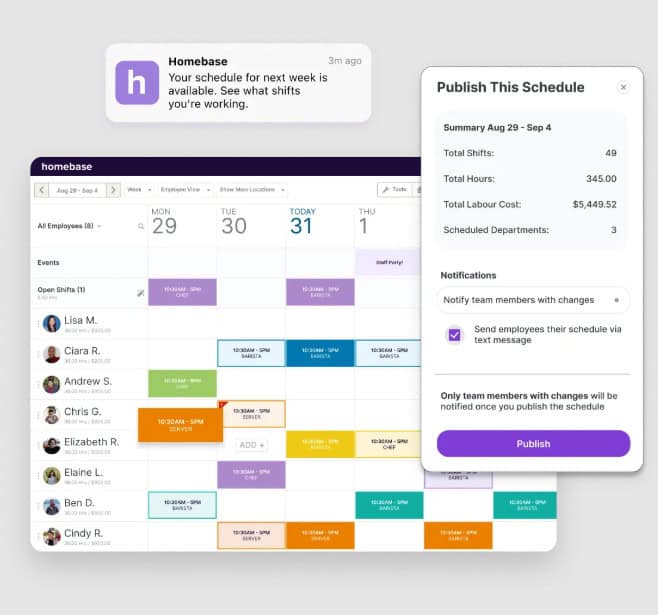

1) Homebase: Best for Hourly Teams That Want Fewer Tabs

What it is: Homebase combines scheduling, time tracking, team messaging, tip pooling tools, and full-service payroll into one workflow designed for hourly staff. No heroics needed to go from a schedule to a payroll run.

Why it works: The fewer bridges between timecards and paycheck, the fewer opportunities for garbage to get in. With Homebase, you’re pulling time directly from the same ecosystem you used to schedule shifts, collect punches, approve time-off, and manage tips. Practically, that means cleaner gross pay, fewer retro fixes, and lower labor variance. If you’ve ever spent Friday scrubbing timesheets, you know the value here.

The Technical Details That Matter:

- Full-service payroll with automated tax calculation, filing, and payment, unlimited runs, W-2s/1099s, direct deposit, and reports.

- Scheduling + timesheets are first-class citizens, not afterthoughts; the handoff into payroll is native.

- Tip management flows into payroll to reduce manual entries.

Pricing: Homebase Payroll is currently $39 per month base + $6 per active employee. That’s straightforward and usually pencils well for restaurants, retail, and services that run a lot of hourly staff.

Where It May Be a Little Short:

If you want deeper HR stack elements like custom performance frameworks, complex PEO-style benefits orchestration, you may need to tack on a supplementary platform. Homebase will feel intentionally focused rather than sprawling. It optimizes for hourly operations first and broader HR second.

Bottom line: If your pain is messy timesheets, shift differentials, and tips, and you want a single pane that naturally feeds payroll, this is the calmest water in a choppy ocean of administrative headaches.

2) Gusto: Best All-Around Experience for Small Businesses

What it is: Gusto is a very popular full-service payroll and HR suite with excellent UX, automated filings, benefits administration, and a deep integration catalog. It’s the platform I can hand to a non-finance owner without worrying they’ll click the wrong thing.

Why it works: Gusto’s workflows are intuitive, and it consistently executes the boring parts: taxes, W-2/1099 handling, new hire reports, etc. Accounting integrations, including Xero and others are mature and well-documented.

Technical Details:

- Full-service multistate payroll with automated filings.

- Time tracking and HR features available on higher tiers; large integration ecosystem.

- Accounting integrations are native, with a clean sync to Xero and other GLs.

Pricing snapshot: As of 2025, Gusto’s Simple plan lists $49 per month + $6 per person; Plus is $80 + $12 per person; Premium is quote-based, so get ready to spend a bit more if your enterprise is niche and complicated. There’s also contractor-only pricing. Costs have climbed versus 2023, so do your per-employee math.

Where It May Be a Little Short

Heavy hourly operations sometimes need tighter, native scheduling and tip pooling than Gusto’s bundle, unless you add and maintain extra apps (which is exactly what we’re trying to prevent). Also note support access tiers and business-hour limitations unless you’re on higher plans.

Bottom line: If you want an approachable, well-rounded suite and can live with add-ons for advanced workforce needs, Gusto is a safe, reliable choice.

3) RUN Powered by ADP: Best for Compliance Depth and Scale

What it is: ADP RUN is the small-business front door to the ADP ecosystem. You’re buying payroll that’s been battle-tested across industries with serious compliance chops and a wide network of benefits and ancillary services.

Why it works: When you need to trust filings in multiple jurisdictions, manage garnishments and fringe cases, or scale quickly, ADP’s rails are steady. RUN ties into a broad set of accounting and POS tools and can expand as you add headcount and complexity.

Technical Details:

- Multiple RUN packages with increasing HR services layered in (just be ready to pay for additional scope!).

- Integrations with accounting, time, and POS systems; 50-state compliance focus.

Pricing snapshot: ADP does not publish standard list pricing for RUN, which is much to my dismay. You’ll get a quote after talking with a sales team member. That can be good for negotiation and bundling, but it makes apples-to-apples comparisons harder.

Where It May Be a Little Short

You’ll likely navigate a sales process and custom pricing that may creep as you add services. The platform is powerful, but it’s not the simplest interface in this lineup for owner-operators who just want to run payroll by breakfast.

Bottom line: If your top worry is “don’t let us screw up compliance,” and you want vendor longevity with room to grow, RUN holds up.

4) Paychex Flex: Best for Hands-On Owners Who Want a Human on Speed Dial

What it is: Paychex Flex is a full-service payroll and HR platform that often wins on service model and sturdy compliance. Think of it as a modernized take on the classic bureau, now with solid cloud software.

Why it works: Paychex is very comfortable with real-world scenarios like multiple pay frequencies, special deductions, retirement plan integrations and it possesses strong support. It’s a good fit when you want both software and a human willing to own the edge cases.

Technical Details:

- Full-service payroll with multistate filings, garnishments, and HR add-ons.

- Extras like time-off management and benefits administration.

Pricing snapshot: Paychex pricing is often quote-based, but third-party guides put Flex Select around $39 per month + $5 per employee as a reference point. Treat that as directional until you receive a formal quote.

Where It May Be a Little Short

Interface polish is better than it used to be but can feel dated next to newer suites. I have also personally found that the interface can lag a bit if you have 25+ employees your entering checks for. Also, add-on stacking means your monthly costs can drift upward unless you keep a close eye on scope.

Bottom line: If you respect a service-heavy partner who will help wrangle the trickier payroll edges, Paychex is dependable.

5) Square Payroll: Best for Restaurants, Shops, and Contractor-Heavy Teams

What it is: Square Payroll slots directly into the Square ecosystem. If you’re already using Square POS and Team Management, Payroll becomes a natural extension, importing timecards and tips with minimal friction.

Why it works: The timecard and tip import is a lifesaver for retail and hospitality. You get fewer manual adjustments, cleaner pay runs, and a straightforward UI your manager can drive without a manual.

Technical Details:

- Timecard and tip import straight from Square POS or the Team App.

- W-2 and 1099 support, automatic tax filings, and standard direct deposit.

Pricing snapshot: Square publishes $35 per month base + $6 per person for full-service payroll; contractor-only is $6 per person with no base fee. Clean and predictable, which is always a plus in my book.

Where It May Be a Little Short

If your accounting stack lives outside the Square universe, integrations and reporting depth may feel thinner than HR-first suites. For complex multistate orgs, you’ll want to test the edge cases before committing.

Bottom line: If your register is Square, and your needs are relatively straight forward, consider using Square Payroll.

6) Rippling: Best for Companies That Want HR, IT, and Finance in One Place

What it is: Rippling is a unified platform for HR, IT, and finance. Payroll, device management, identity, spend, and more all live under one impressive application. Rather than stitching six vendors, you can centralize the employee system of record and automate the glue work.

Why it works: The magic trick is automation across that shared spine. Hire an employee, give ‘em a laptop, set permissions, enroll benefits, and add them to payroll without jumping through three admin apps. For startups and growing SMEs, that’s real overhead reclaimed.

Technical Details:

- Modular: buy only what you need; core HR, payroll, time, IT, spend.

- Automation: onboarding workflows that cut across departments.

Pricing snapshot: Rippling uses modular, quote-based pricing; you won’t get a static list price. Plan to run a discovery call and map modules to budget.

Where It May Be a Little Short

If you just need payroll and basic time, Rippling can be more platform than you bargained for. Budget discipline is key when modules pile up.

Bottom line: If you want one operating system for people, devices, and spend, Rippling is the most ambitious option in this list.

How to Choose Your Quickbooks Payroll Alternative

If your week dies due to dirty timecards: Prioritize a system with native scheduling and time tracking that flows straight into payroll. That’s Homebase in a nutshell; Square also does this well if your POS is Square, but be ready to field edge cases.

If you want the friendliest owner experience: Gusto’s UX and documentation shorten the learning curve, with rock-solid automation for filings.

If compliance paranoia keeps you up: ADP and Paychex remain the steady picks, particularly if you have edge cases, garnishments, or a fast-changing multistate footprint.

If your stack spans beyond HR: Rippling consolidates HR, IT, and finance automation, which saves time and reduces login sprawl, especially after funding rounds or seasonal ramp-ups.

If your register is your source of truth: Square Payroll is the obvious win, thanks to direct timecard and tip ingestion.

The Gotchas That I Often See Overlooked

- Dirty data in, dirty checks out. No payroll software can rescue a sloppy time discipline. If you’re migrating, lock down your shift rules, job codes, and PTO categories first. Platforms that own scheduling and time reduce these risks by design.

- Per-employee creep is real. Even small per-head increases, plus multi-state surcharges, can swing TCO in ways owners miss. QuickBooks’ newer per-employee rates are a good illustration; in my opinion, running a twelve-month scenario before switching is a great way to see what things will cost.

- Accounting integration quality matters more than marketing logos. “Integrates with X” can mean anything from proper dimension-level mapping to a CSV. Gusto’s accounting connections are solid; Homebase’s native time-to-payroll flow reduces the number of sync points; Square keeps time and tip data inside its own garden. Test with a sandbox and confirm the exact journal format.

- Restaurants and pooled tips require intentional setup. If you’re managing credit card tips, cash tips, and declared tips, choose a platform that treats tip handling as first-class, not a spreadsheet afterthought. Homebase and Square both recognize this daily reality.

Verdicts By Use Case

- Hourly retail, service, restaurants with multiple roles and tips: Homebase first, Square Payroll second if you’re already on Square POS.

- General small business needing easy wins and clean UX: Gusto.

- Multi-state compliance, growth, and benefits at scale: ADP RUN or Paychex Flex.

- Modern companies that want to unify HR, IT, and finance workflows: Rippling.

A Final Word on “Value” vs. “Price”

In my opinion, price tags are the easy part. Value is measured in corrections avoided, time you didn’t spend cleaning data, and filings you never had to think about. Hourly teams, especially in restaurants and services, live or die by what happens between the posted schedule and gross pay. That’s why Homebase gets my top nod because the operational stack is built around hourly life with payroll as the natural conclusion. It’s less glamorous than AI-everything pitches, but it’s the difference between payroll that hums and payroll that hijacks your Thursday.