- The Bottom Line Up Front

- What These Platforms Are

- So What’s All This Going To Cost You?

- Data Ingestion and Bank Feeds

- AI, Automation, and the Close

- Revenue Recognition and Payments

- Accounts Payable, Cards, and Spend

- Payroll and People Data

- Inventory, Projects, and Operational Modules

- Reporting and Metrics

- Ecosystem and Integrations

- Security and Compliance (Don’t Downplay This Section!)

- Onboarding and Migration

- Where Each Falls Short

- Let’s Talk Where Each Would Shine In Real Life Scenarios

- How I’d Decide Which Platform Makes Sense For My Business

- My Verdict Between Puzzle and Zoho

- Final Word

Last Updated on December 4, 2025 by Ewen Finser

Have you ever woken up at 4:30 AM on the 1st business day of the month absolutely dreading the next 14 hours because you know you have to reconcile 64 bank accounts? Well, I have, and let me tell you it’s something I wouldn’t wish upon anyone. If you’re like me, you already know the “best” accounting platform isn’t the one with the longest feature list, it’s the one that quickly puts busywork to bed and keeps your numbers current. There are plenty of systems out there that can do that, but today we’re going to focus specifically on two.

Zoho Books is a proven generalist with deep operational modules and a sprawling ecosystem. It’s deep and diverse, and can handle more than just accounting. On the other hand, Puzzle.io is the AI-first upstart that wants your close to feel like a push-button operation, not a week-long marathon. Same category, same end goal, but with radically different philosophies.

As a CPA that lives in the weeds, I don’t care about marketing, but am instead obsessed with operational reality: bank data fidelity, revenue pipelines, bill pay hand-offs, payroll sync, variance flags, and how fast you can get from raw transactions to board-ready numbers. Let’s run this toe-to-toe comparison the way controllers do in the wild.

The Bottom Line Up Front

- Choose Puzzle if you’re a tech-forward small business that wants an AI-assisted, real-time accounting core with strong startup metrics, modern integrations, and to close faster with fewer keystrokes. Puzzle is SOC 2 compliant, leans hard into controllable AI, and emphasizes agents that draft categorizations and reconcile revenue while you supervise exceptions.

- Choose Zoho Books if you’re a price-sensitive small business that needs classic accounting breadth with inventory, projects, purchase approvals, and the wider Zoho ecosystem. You’ll get tiered plans with invoice and bill limits that scale, plus a lot of knobs to configure workflows.

Either way, you can run a real company on both. But if we’re splitting hairs on speed to truth, Puzzle edges it for AI-assisted throughput and founder-grade reporting, while Zoho Books wins on mature operational modules.

What These Platforms Are

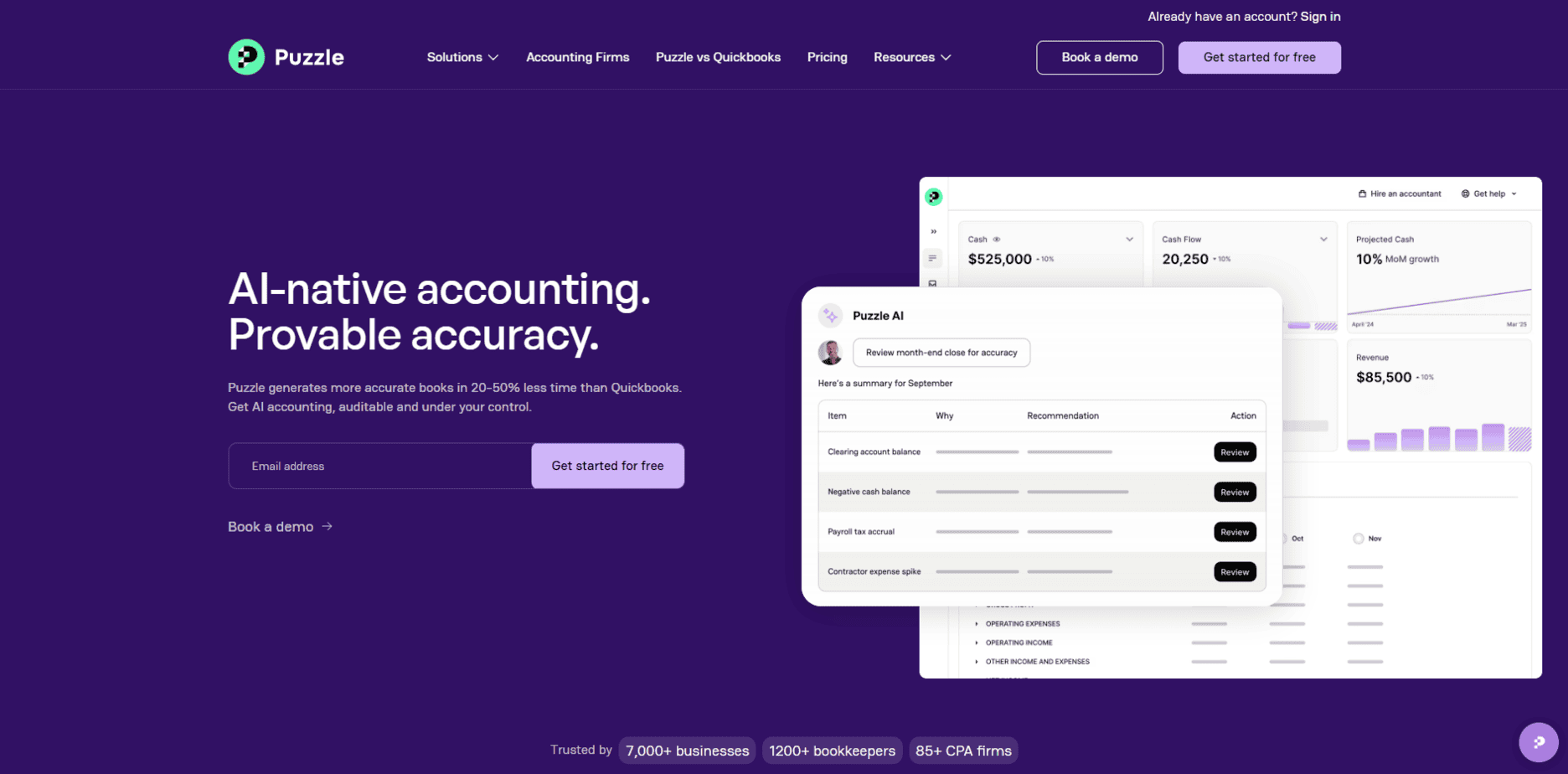

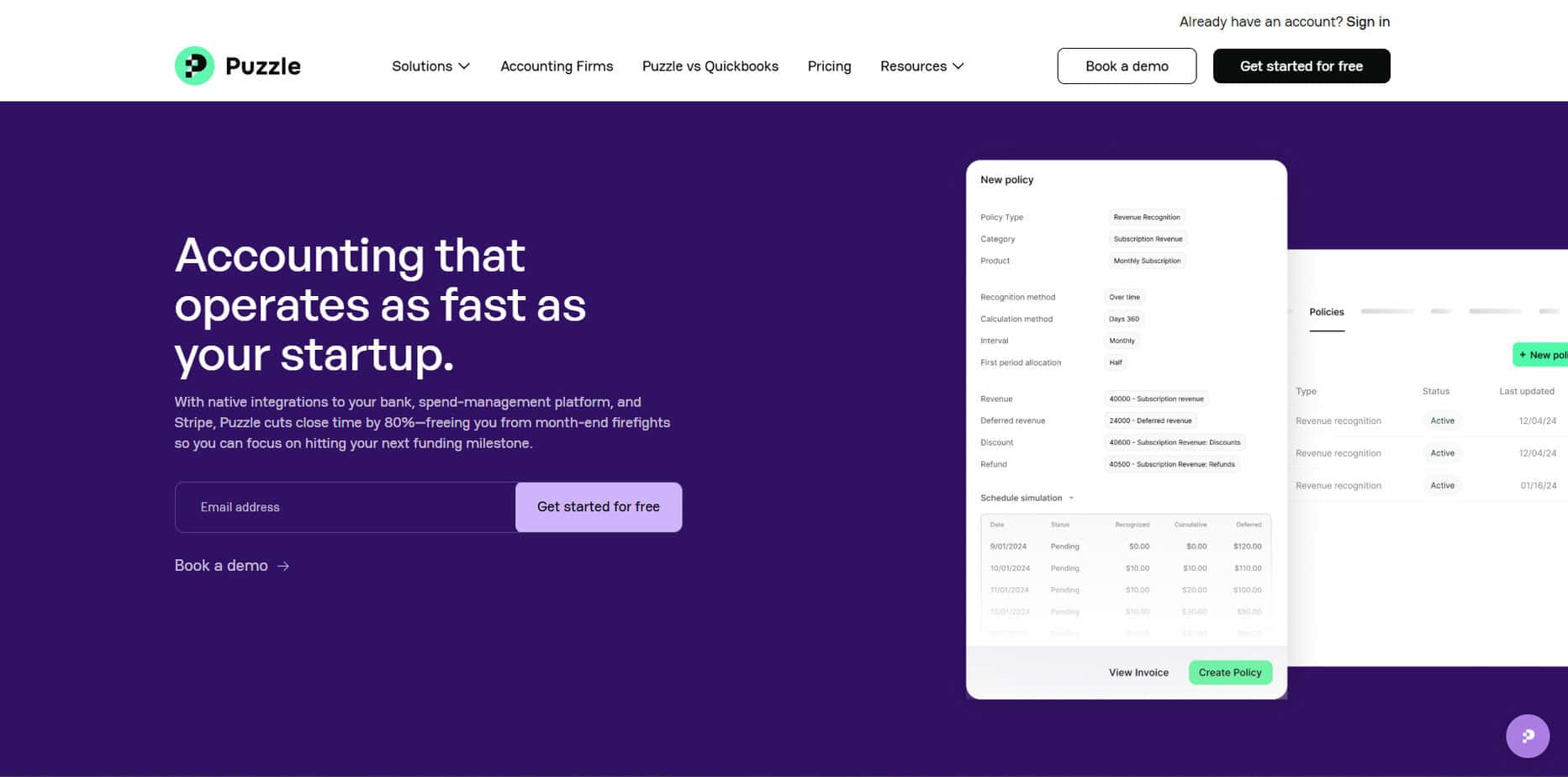

Puzzle.io is a modern accounting system built around real-time data ingestion and controllable AI. The system drafts most categorizations and reconciles revenue from processors like Stripe, while you review exceptions. This, in my opinion, is where serious time savings unfold because you’re looking at exceptions, and not the day to day monotony. I would describe Puzzle as a faster path to accurate financials, with important startup metrics like ARR, burn, and runway built right next to the GL. It’s positioned squarely at startups and firms that want to compress close and reduce manual bookkeeping.

Zoho Books on the other hand is a full-stack small-business accounting suite from Zoho’s broader platform, known for an approachable UI, per-tier invoice and expense limits, inventory and project features, and a deep set of automations. It’s the classic generalist tool that plugs into Zoho CRM, Zoho Inventory, and third-party payments, with aggressive pricing across multiple plans.

So What’s All This Going To Cost You?

- Zoho Books runs from a Free plan up to Ultimate, with annual invoices and expense limits per tier: Free and Standard cap at 1,000 and 5,000 invoices a year respectively; Professional at 10,000; Premium at 25,000; Elite and Ultimate at 100,000. Bills/expenses scale similarly by tier. It’s budget-friendly, but those hard caps matter if you scale or if your business is invoice-heavy.

- Puzzle offers tiered software priced for with Basics being free, so you can take Puzzle for a spin and see if you love it. They also offer plans at $50 a month for Plus and $100 a month for Advanced Automation. There’s also a premium plan for enterprises that starts at $300 if you really need all of Puzzle’s might. Puzzle emphasizes AI bookkeeping, tax packages from the Basic plan, and partnerships for bookkeeping services if you want a done-for-you route.

If you’re a founder with high transaction velocity and you despise spreadsheet summersaults, the billable “limits math” in Zoho Books is a real consideration. If you’re cost-sensitive and steady-state, Zoho’s tiers are tough to beat.

Data Ingestion and Bank Feeds

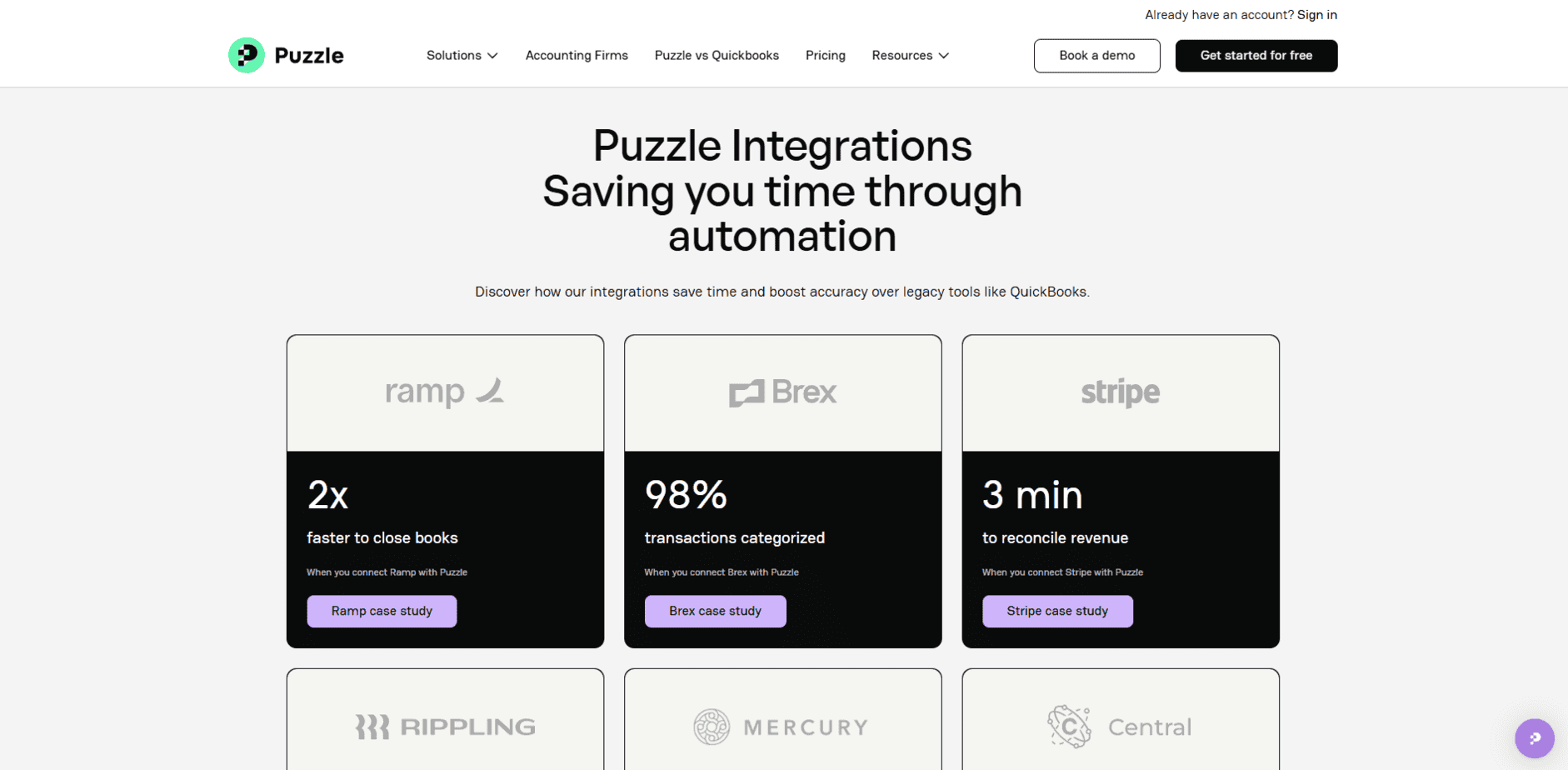

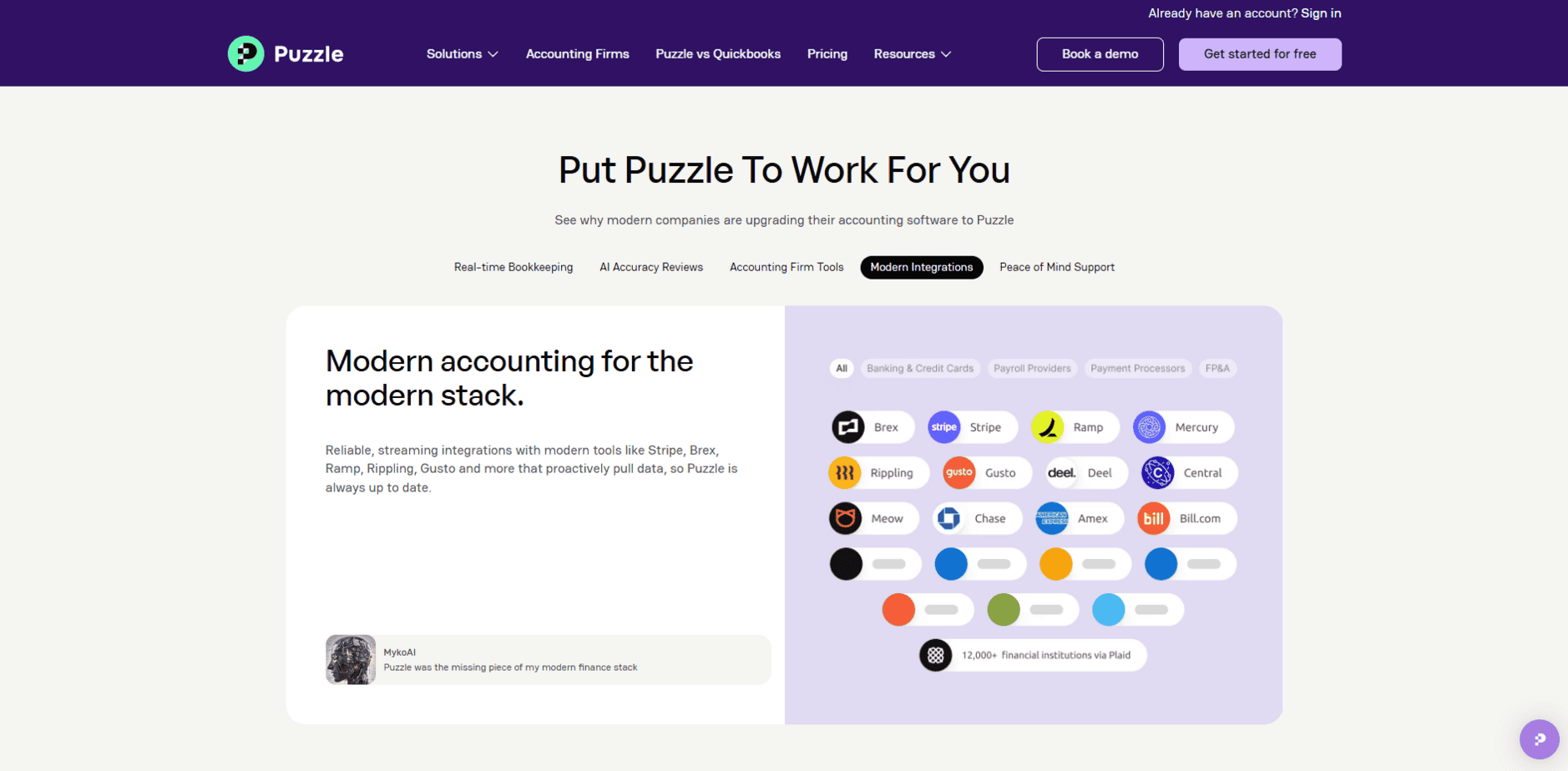

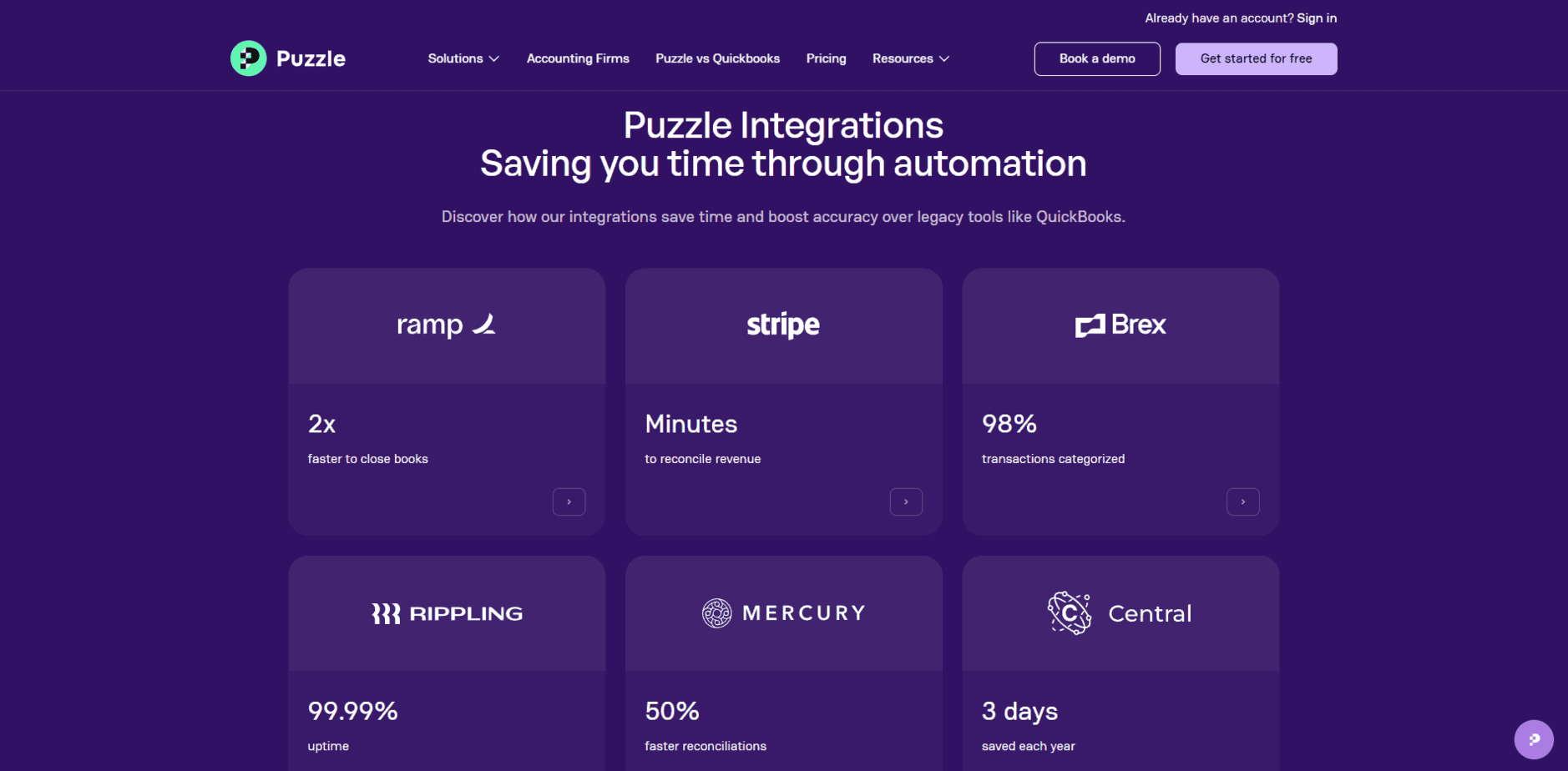

- Puzzle integrates with modern banks, cards, payroll, spend tools, and processors. Some of their premier connections include Ramp, Brex, Stripe, Mercury, Gusto, Rippling, Bill.com, and more. The pitch is less flipping between applications and more categorization drafted by AI.

- Zoho Books supports automatic bank feeds and reconciliations and plays well with mainstream payment gateways and commerce tools. It’s a known quantity for small businesses doing standard AR/AP.

My Take as a CPA: Both connect to what you need, but Puzzle’s posture is “feed it all and let AI draft the work; you approve.” Zoho’s posture is “connect it, configure it, and run the playbook you already know.”

AI, Automation, and the Close

In my experience, this is where the philosophies really diverge.

- Puzzle’s claim: the system “learns your business,” drafting up the vast majority of categorizations and handles a big chunk of bookkeeping, while also showcasing real time metrics. You supervise exceptions to preserve control (this is super important, never let your AI bookkeeper have full control of the reins).

- Industry context: Many of the newer platforms are leaning heavily into the AI agents to help speed up close, continuously book transactions, and keep up to date metrics. I think this is ultimately where the industry is headed, and Puzzle leans heavily into this mindset.

- Zoho Books: automation is present through workflows, approvals, recurring transactions, and rules. It’s robust, but the design DNA is traditional: configure workflows rather than let an AI draft the bookkeeping then ask you to bless exceptions.

My read as a CPA: If your north star is a zero-drama close, Puzzle’s approach is compelling.

Revenue Recognition and Payments

- Puzzle focuses heavily on startup revenue sources like Stripe, promising near-instant reconciliation pipelines for payment data so you don’t spend a day squaring deposits and fees.

- Zoho Books handles standard invoicing, payment links, and integrations with gateways like PayPal and Stripe, with solid reporting. For recurring revenue SaaS nuance, you’ll often need additional specialized tools or build automations.

If your business runs through Stripe or modern processors, Puzzle’s prebuilt pipelines reduce “mystery cash” and fee reconciliation friction.

Accounts Payable, Cards, and Spend

- Puzzle integrates tightly with modern card/spend platforms such as Ramp and Brex, bringing in receipts, memos, and merchant data that their AI can classify with precision. That means fewer clean ups, and less time wasted trying to chase things down.

- Zoho Books gives you bills, approvals, vendor management, and purchase orders in its higher tiers, plus connections to payment rails. Great for classic AP desk life and formal approval chains.

If you live on corporate cards and want your GL to reflect reality without chasing cardholders, Puzzle’s spend integrations are seamless. However, if you’re already a part of Zoho’s ecosystem and using their spend management platforms, it’s tough to beat.

Payroll and People Data

- Puzzle lists integrations with providers like Gusto and Rippling, aiming for automated sync of payroll journals so you aren’t reclassing wages mid-month. You’ll need a third party payroll solution if you’re using Puzzle, but their integrations ensure that payroll isn’t a chore.

- Zoho Books supports payroll-related forms and filings in certain locales and integrates across Zoho’s own HR stack and third parties. It’s very workable; and the depth depends on your region and provider.

If you’re already on a modern payroll stack, both can play ball with either application.

Inventory, Projects, and Operational Modules

Here’s where Zoho shines in my opinion. You get inventory tracking, project time/costing, vendor management, purchase orders, and approvals depending on the plan. If you’re running light distribution, bill-of-materials-lite, or you need formal approvals baked into the accounting app itself, the Zoho footprint is robust.

Puzzle isn’t trying to be your inventory MRP, and it never claimed to be. Its roadmap and positioning are about speed to financial truth for startups: real-time reporting, startup KPIs, and AI-assisted bookkeeping rather than an all-in-one operational suite.

Translation to non accountant speak: construction, retail, and inventory-heavy SMBs will feel right at home in Zoho Books’ modules. SaaS and services teams that care more about fast, clean financials than POs and stock will vibe with Puzzle.

Reporting and Metrics

- Puzzle leans into founder-grade dashboards out of the box: ARR, burn, runway, and real-time financial statements you can trust sooner. That’s fundraising-friendly and removes the “we’ll finalize next week” conversation.

- Zoho Books offers customizable reports, basic analytics, and more advanced dashboards (at higher priced tiers) through the Zoho ecosystem. It’s perfectly capable for standard SMB reporting and can expand with Zoho Analytics.

If your investors ask for KPIs every other Tuesday, Puzzle cuts the gap between “booked” and “board-ready” nicely. If you’re not public and issue financials quarterly, Zoho would be able to field your needs.

Ecosystem and Integrations

- Puzzle: modern finance stack integrations by default (Ramp, Brex, Stripe, Mercury, Gusto, Rippling, Deel, Bill.com, Runway, Causal, and more). The strategy is to meet startups where they already are.

- Zoho Books: a massive first-party ecosystem across CRM, inventory, HR, analytics, and service desk. If you want a single vendor across front and back office, Zoho is a powerhouse.

Security and Compliance (Don’t Downplay This Section!)

- Puzzle: SOC 2 compliant, and is built on modern cloud tooling with a publicly discussed security posture. I like that they’re open and transparent about it, because to me it shows they make security a priority.

- Zoho Books: enterprise-grade security as part of the Zoho family; compliant with key requirements such as MTD in the UK and various regional requirements.

Onboarding and Migration

- Puzzle advertises quick setup, automated migration from QuickBooks, and a focus on getting to real-time fast. That reduces the window where your team is half in one system and half in another.

- Zoho Books onboarding is guided and polished; you’ll spend more time deciding which modules to enable and how strict your approvals should be. The learning curve is mild, but the configuration surface is broad.

Where Each Falls Short

Puzzle:

- Less of a one-stop operational suite. If you need native inventory, multi-warehouse, or heavy project job costing with approvals inside the accounting app, you’ll look to adjacent tools. Puzzle’s bet is that your finance stack is best-of-breed and the GL is the smart hub.

- Depending on your volume and needs, confirm pricing and scope before committing; AI-assisted systems can save time, but you still want the model to reflect your accounting policies precisely.

Zoho Books

- Invoice and expense limits per tier can become a tax on growth if you scale. If you blow past 10,000 or 25,000 invoices annually, you’re negotiating plans or jumping to Elite/Ultimate.

- Traditional automations are powerful, but they don’t feel like an AI drafting engine. If your goal is to compress the close via exception-only review, you’ll work harder to get there.

Let’s Talk Where Each Would Shine In Real Life Scenarios

SaaS startup on Stripe with Ramp cards and Gusto payroll

- Puzzle path: You’d connect Stripe, Ramp, bank, and payroll. Revenue intake drafts fast, card transactions arrive with strong merchant context, and payroll lands with the right splits. ARR/burn/runway are clickable. You review exceptions and lock the month without heroics.

- Zoho Path: Connect bank feeds, Stripe gateway, and set up items and automations. It works. You’ll likely use more rules and recurring entries and lean on the Zoho ecosystem for analytics.

Light wholesale with POs, receipts, and stock levels

- Zoho path: Turn on inventory, POs, vendor management, approvals. Keep a clean chain from purchase request to bill to stock on hand inside the same suite.

- Puzzle path: Stay lean in the GL and connect to a dedicated inventory tool if needed. Puzzle’s value is financial truth and close speed, not stocking every shelf natively.

My Litmus Tests as a CPA

- Variance Surfacing: Puzzle’s AI posture favors early exception surfacing; Zoho’s rules catch a lot, but you’ll architect more of them yourself.

- Close Cadence: Puzzle markets faster closes via automation and real-time pipelines. Zoho can be fast with discipline, but it’s not the same “agents draft, humans approve” mentality. You’ll need to create rules and lookout for exceptions.

- Stakeholder Readiness: Puzzle’s startup-metric tiles mean your CEO stops asking for “quick ARR math.” Zoho Books can present strong reports, and the ecosystem can go deep, but it takes more configuration.

How I’d Decide Which Platform Makes Sense For My Business

- Map your data gravity. If 80 percent of your transactions originate in Stripe, Ramp, Gusto, and a modern bank API, Puzzle’s ingestion and AI posture will net you more time.

- List the operational must-haves. If you truly need inventory, POs, approvals, and project modules native to the accounting suite, Zoho Books takes the lead.

- Check your volume. If you’re flirting with five-figure invoice counts, run Zoho’s tier math so you don’t hit caps mid-year.

- Security box-check. If SOC 2 matters to your board or enterprise customers, Puzzle has the badge and posture in plain sight.

My Verdict Between Puzzle and Zoho

If you’re a modern startup or services firm that wants numbers you can trust now and you appreciate a system that drafts the boring bits so you can focus on exceptions, Puzzle is the better strategic bet. The SOC 2 stance, the integrations with the new-school finance stack, and the founder-grade reporting line up with how high-tempo teams actually work.

If you’re running an operationally complex SMB that values inventory, projects, approvals, and the comfort of a broad suite, Zoho Books is a fantastic, economical toolkit, just keep an eye on those per-tier transaction limits as you scale.

Between two good options, my CPA take is simple: pick the one that minimizes key-strokes between “money moved” and “truth recorded.” On that axis, Puzzle edges it.

Final Word

Both systems can deliver clean books. Zoho Books gives you breadth and an ecosystem that can swallow your back-office whole, at a price point that’s hard to argue with. Puzzle gives you speed to truth with AI-assisted workflows, real-time financials, and investor-friendly metrics that make operating cadences smoother.

For the founders and controllers who measure their week by “how many times did I have to touch that transaction,” Puzzle is my favorite not by a mile, but by the margin that matters at month-end.