- The Bottom Line, Up Front:

- My Perspective as a CPA

- What Both Get Right

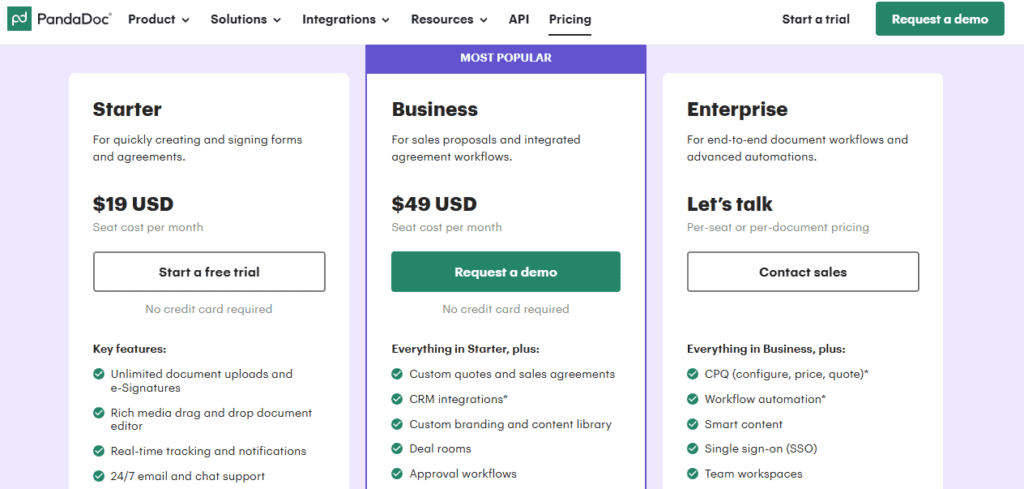

- Pricing Transparency and Costs

- Witnesses and the Real World

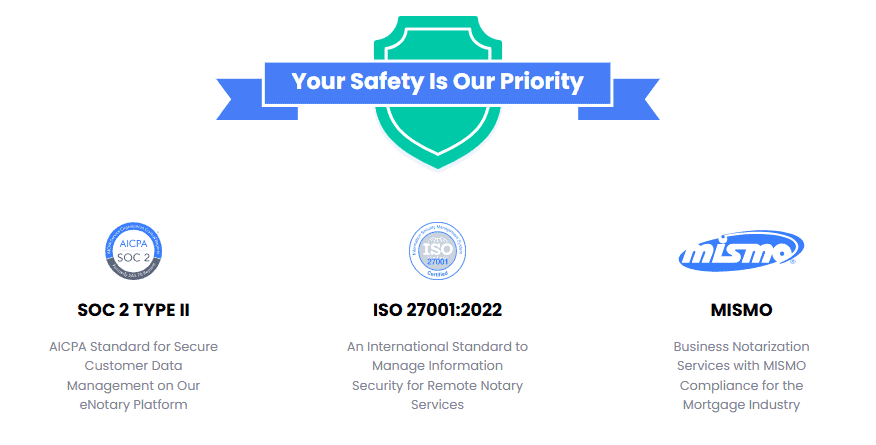

- Compliance, Certs, and Vendor Risk Profiles

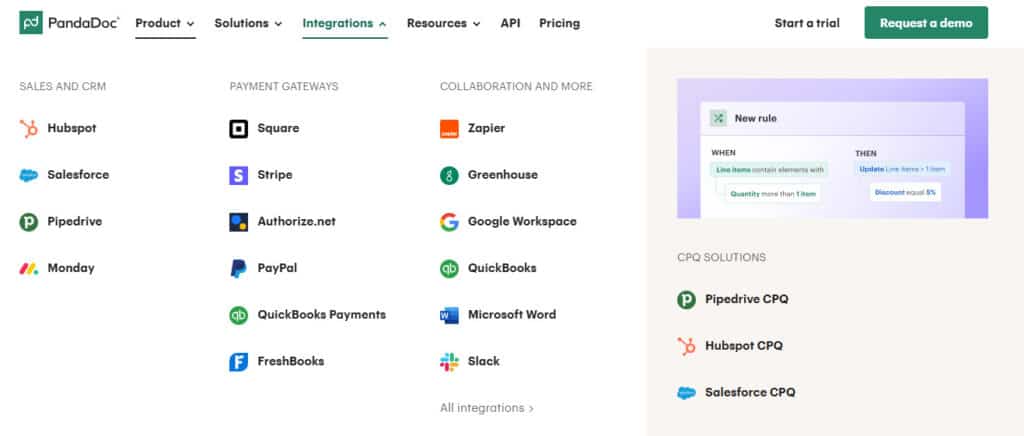

- Integrations and Dev Options

- Industry-Specific Call Outs

- Availability and Support

- Practical Constraints to Think About

- A Couple of Real Work Scenarios I’ve Handled

- Decisions Decisions Decisions

- My Verdict:

Last Updated on October 1, 2025 by Ewen Finser

If you’re like me (and every other accountant that walks the earth), you probably don’t like change. If things aren’t broken, they don’t need to be fixed. Normally, I’d wholeheartedly agree with that sentiment, and luckily, I don’t run the world, otherwise we’d never have discovered fire, and we’d still be living in huts. Luckily, there are people out there who are rocking the boat, and they’re finding better ways to do things. One of those things is the hundred-year-old process of notarizing documents. Normally, you’d have to find someone with a state-issued stamp and then give them your documents and a wad of cash. Not so anymore, now you can do it all ONLINE, which blew me away earlier this year when I first came across these options.

Normally, notarizations aren’t an issue for my small CPA firm. My bookkeeper has her notary, but sometimes she’s out of office, since she’s part-time. Sometimes, I’m in a pinch and I need something notarized timely, and that’s how I came across RONs (Remote Online Notary services). There are dozens of platforms, and I’ve tried a bunch of ‘em. However, today we’re going to cover two of the heavy hitters that I’ve tried out, PandaDoc and OneNotary.

The Bottom Line, Up Front:

Both platforms can handle remote online notarization (RON) well. If your team already builds, edits, and routes documents in PandaDoc, adding PandaDoc Notary can keep everything in one place and meets mortgage-industry MISMO requirements. If you want clear, predictable per-notarization pricing, on-demand witnesses, mobile notary coverage, a “signer pays” option, and a quick path to implementation, OneNotary edges it.

My Perspective as a CPA

I’m using an appeal to authority here. I manage finance, risk, and operations work where notarizations are routine: real estate closings, lien releases, contractor affidavits, I-9s, and estate documents for clients. I care about a couple things:

- Compliance: ID verification, audit trails, and retention that align with state law and my vendor-risk file.

- Total cost: Not only license fees, but also how costs scale with signers, KBA checks, and witnesses.

- Workflow fit: Can staff use our own notaries? Can I push signing costs to the signer? Will it plug into my stack?

With that frame, here’s how OneNotary and PandaDoc Notary compare.

What Both Get Right

Legality and the RON basics. Each platform supports state-approved RON sessions with an audio-video meeting, notarial seal, and a tamper-evident output. PandaDoc Notary says its platform is “state-approved” and records sessions with a robust journal and audit trail. OneNotary describes the same core model and emphasizes continuous auditability. Truth be told, all RONs at this point in the game can be used in all 50 states, but do your due diligence if you’re working with international docs and notaries outside of the United States.

Identity proofing. Both use multi-step identity checks. PandaDoc Notary describes “two-point identification” (KBA plus live credential analysis). OneNotary publishes a three-step flow (KBA, credential analysis, and notary verification) and clarifies that KBA requires a U.S. address and SSN history.

Retention and audit trail. RON sessions must be recorded and retained; many states require 10-year retention. OneNotary’s policy and help content reflect that window. PandaDoc Notary explains e-journals and session recording in its knowledge base. For my file, either satisfies the baseline, but I still capture the exact clause in the MSA/SOW.

Multi-signer support. Both support multiple signers in one session; PandaDoc states multi-signer capability, and OneNotary covers adding signers and witnesses in its help docs. However, for both, expect that to add to the cost of the platform.

Pricing Transparency and Costs

One of my favorite topics to discuss with business owners is what things cost. Everything has a trade-off, and you want to make sure what you’re spending money on offers significant value. Otherwise, it’s better to keep those dollars in your pocket.

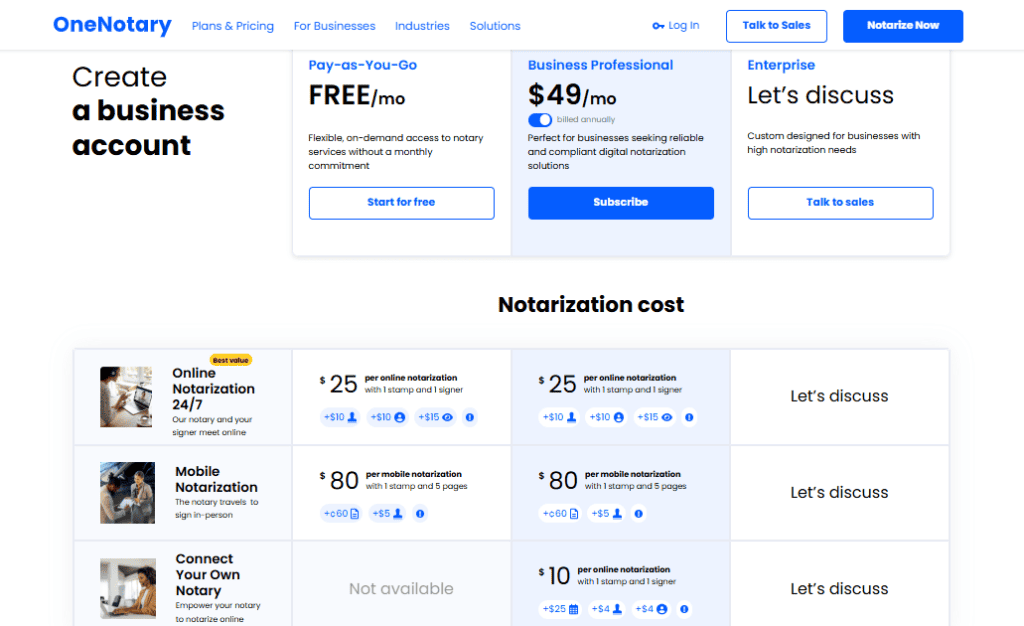

OneNotary publishes simple retail pricing: online notarizations start at $25; mobile notarizations start at $80. For businesses, the plans offer “signer pays” (you can shift the fee to the signer), unlimited storage on business tiers, and REST API access. The business plan costs $49 per month, and I think you receive a fair bit of services for the price you’ll pay.

PandaDoc Notary funnels you to “book a demo” for pricing. PandaDoc’s core e-signature product has public seat pricing, but Notary is a feature for Business (paid add-on) and Enterprise plans (wow, that was a technical answer on how much something costs!). In practice, you’ll model cost around your seat licenses plus a Notary add-on and usage. If your team already runs PandaDoc for proposals and contracts, the bundle may still pencil out. Truth be told, I did not appreciate how confusing their pricing model was when I was trying to onboard myself. Essentially, it’ll be a cost per month per user for the subscription, anywhere from $50 to $90, and then a one-time fee per notarization depending on the volume of transactions.

Identity-check spend. With PandaDoc’s broader product, KBA attempts are billed in addition to the notarization. That gives you a knob to control risk and cost, though the exact billing under the Notary add-on may differ by plan. OneNotary’s KBA attempts are baked into the costs of their service ($25 per notarization).

Bottom line on cost: OneNotary’s transparent pricing structure DEFINITELY wins out here, even though PandaDoc is an add to a business suite of softwares. If you’re pushing a massive amount of volume and are already a part of Panda’s ecosystem, it may be worth it, but you’d have to talk to a sales representative to find out.

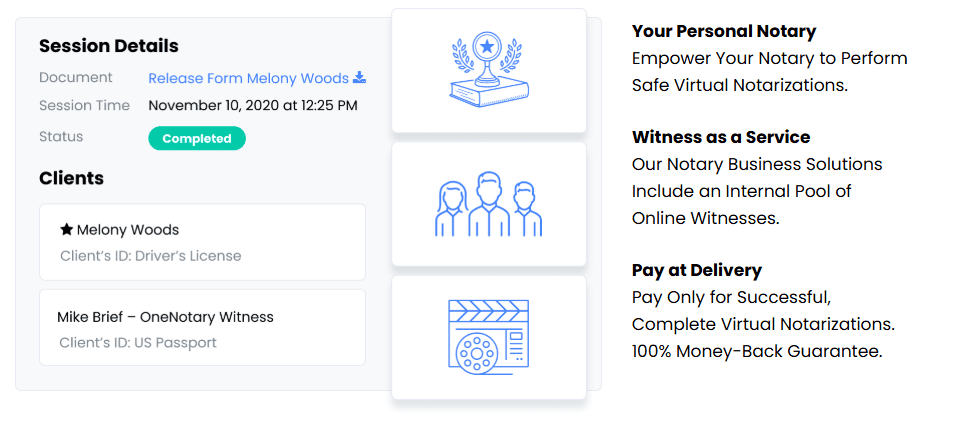

Witnesses and the Real World

Many documents need one or two witnesses. Lining them up is the part that causes delays. With RONs, that’s typically a thing of the past.

OneNotary offers witness-as-a-service from an internal pool. I can add a witness from within the session setup and proceed. Their guide also notes you can invite up to six participants (signers + witnesses) to one session, which covers most estate and healthcare forms.

PandaDoc Notary supports inviting participants and provides guidance on witness rules, but it does not advertise a built-in paid witness pool on its site the way OneNotary does. When I was giving their platform a test run, the documents I was notarizing did not need witnesses, so I can’t say how easy it would be to utilize them in that regard. In my workflows, that means we either supply the witnesses or pre-coordinate third-party help.

Compliance, Certs, and Vendor Risk Profiles

PandaDoc Notary states MISMO certification and SOC 2 Type 2 compliance helpful for lenders and title firms who gate vendors on MISMO.

OneNotary publishes SOC 2 Type II and ISO/IEC 27001:2022 on its site and links to its SOC 2 Type II report. It also markets MISMO compliance for mortgage workflows. For non-mortgage use or where the bank’s checklist focuses on SOC/ISO, this is strong.

My rule: Both are plenty sufficient in my experience for just about any document you’ll run across. Attach the current SOC report cover page, confirm who stores the video, where it’s hosted, and the retention period. I then document it in our MSA/SOW.

Integrations and Dev Options

PandaDoc lives in a very broad document stack (templates, forms, payments, CRM integrations like Salesforce and HubSpot). If your sales or HR teams already live there, Notary becomes a natural extension.

OneNotary publishes a REST API and calls out legal-centric integrations like Clio, which matters for law firms that run matters and billing there. If your primary need is notarization and you don’t need a full document-creation suite, OneNotary’s narrower scope can be a plus.

Industry-Specific Call Outs

Mortgage and real estate. If your lender or title partner requires MISMO-certified platforms, PandaDoc Notary checks that box on its site. OneNotary markets MISMO compliance; confirm the exact certification level your documents typically require before selecting your software provider of choice. Either way, confirm eNote and eVault workflows if you close at scale.

Automotive and mail centers. OneNotary highlights use cases for auto (titles, POAs) and USPS PS-1583 mail forms, which come up for business clients and registered agents. That packaged content helps staff pick the right template and avoid rework.

HR onboarding (I-9). OneNotary also advertises remote Form I-9 support with E-Verify integration. That is helpful if you hire outside your home office and want one vendor for both notarizations and I-9 verifications.

Availability and Support

OneNotary markets 24/7 professional notary service and transparent retail pricing, which suits after-hours needs. As a CPA, this is important to me because I may find myself working at 9PM at night during the busy season. Those extended hours are definitely a leg up. PandaDoc also features notaries on demand, a full knowledge base, and 24/7 email/chat support through the broader PandaDoc platform, which is useful if your team already engages their support.

Practical Constraints to Think About

U.S. identity data. KBA often requires a U.S. address and a credit-based history; OneNotary’s help center spells this out. For non-U.S. signers, plan for alternatives such as credible witnesses (if your state allows) or rely on credential analysis where permissible. PandaDoc notes it can support U.S. citizens abroad in many cases, subject to state law.

Retention ownership. Your notaries must maintain access to journals and recordings even if you change vendors or end a seat license. Both platforms do this without any additional headaches or asks, but it’s still wise to document journal/recording access, and lock it in by contract with named retention and export rights.

Witness logistics. OneNotary’s witness pool reduces scramble on estate and healthcare documents. If you go with PandaDoc Notary, decide whether staff will supply witnesses or you’ll maintain a separate service.

A Couple of Real Work Scenarios I’ve Handled

A contractor’s lien release. A subcontractor needed a notarized lien release to fund a draw that needed to be submitted by the 25th of the month. It was almost EOD on the 25th, and we NEEDED to get the lien waiver notarized quickly in order to hit the deadline. We used an on-demand notary and had a signed, sealed waiver with an audit trail in under 30 minutes. OneNotary’s 24/7 access really came in handy as the sub needed those funds desperately keep working capital in a spot that was manageable.

A lender’s closing stack. For lender clients with rigid checklists, PandaDoc Notary’s MISMO position and the ability to keep creation → eSign → notarize in one system reduced pain points and helped us pass the vendor-security review with errors and revisions.

Estate plan with witnesses. We scheduled a session that needed two witnesses. OneNotary’s witness-as-a-service meant no scrambling, and we closed the file in one call.

Decisions Decisions Decisions

If you’re still having trouble picking an RON that makes sense, here’s a couple things to consider:

- If you already live in PandDocs for proposals, quotes, HR packets, and you want one system of record for creation, eSign, and notarization…you should definitely lean toward PandaDoc Notary because it integrates with your existing templates and workflows.

- If you want published per-session pricing, a “signer pays” toggle, quick adoption, and baked-in witnesses, you should lean OneNotary. They have transparent pricing, and their business plans would work in almost all use cases.

- Mortgage or title work with strict vendor lists: Confirm MISMO status your partners require; PandaDoc Notary advertises certification; OneNotary markets MISMO-aligned workflows, but you’ll want to verify the exact requirements before inking any contracts.

- Law firm stack: If you run Clio, OneNotary’s listed integration is handy. If your firm already drafts and routes inside PandaDoc, its ecosystem wins.

- Frequent off-hours and ad-hoc signers: OneNotary’s 24/7 notary marketplace and per-notarization price swing the pendulum in favor of OneNotary.

My Verdict:

As a CPA, I need both compliance and speed. PandaDoc Notary shines when you want a single document system from drafting through notarization, especially in lending and title, where MISMO certification reduces friction with counterparties. The add-on model also suits firms that already pay for PandaDoc seats and want fewer vendors to manage. But in my opinion, it only makes sense if you’re already in the Panda ecosystem.

OneNotary wins on clarity and flexibility: transparent per-notarization pricing, a “signer pays” option, witness-as-a-service, mobile notary coverage, and quick identity-proofing scripts your staff can follow. The SOC 2 Type II and ISO 27001 checks key risk boxes, and the API options lets you automate invites and callbacks without buying a full document-creation suite. For most small and mid-size use cases, I see such as contractor affidavits, POAs, corporate resolutions, and I-9s, OneNotary comes out ahead on ease and cost control.

That said, both are safe choices. Your best pick comes down to whether notarization is part of a larger PandaDoc workflow or a stand-alone service you want to scale on demand.