- The Bottom Line, Up Front

- What Matters Most for an RON

- 1) Onboarding and Setup

- 2) Signer Experience

- 3) Compliance, ID Verification, and the Audit Trail

- 4) Templates, Packets, and Repeat Work

- 5) Team Management and Permissions

- 6) Scheduling, Reminders, and Client Communication

- 7) Pricing And Total Costs

- A Couple Other Items to Consider When Picking OneNotary or Blue Notary

- The Bottom Line

Last Updated on October 13, 2025 by Ewen Finser

What up, number crunchers and SMB owners? I’ve run a CPA for a while now and see how “small” workflow choices ripple into real costs like lost time chasing signatures, rescans because a seal isn’t clear, or a client who gives up halfway through identity checks. Remote Online Notarization (RON) solves a lot of that, so long as the platform you choose fits the way you actually work.

When my bookkeeper, who has her notary, is OOO and I need quick notarization for something urgent, I’ll usually use an RON. It saves me from driving, as well as standing in line (time is money, after all). Remote Online Notaries all follow a similar recipe, but there are some key differences. I have found that I enjoy using both OneNotary and BlueNotary for routine CPA work: engagement letters, IRS Form 2848 (Power of Attorney), bank forms, real-estate packages, and client affidavits. Both work well, but there are some key differences.

The Bottom Line, Up Front

I’m interested in three things: reliability, client experience, and how cleanly the tool plugs into a busy firm. Both platforms are capable. If you want the quick take: you’ll be fine with either, and the right pick depends on your mix of use cases and team structure. In my work, OneNotary edges out BlueNotary by a nose because it reduces friction for my clients and stays out of the way of my staff. That advantage is slight but steady, and steady wins inside a firm.

What Matters Most for an RON

When I evaluate tools, I use the same short list every time:

- Onboarding and setup: Can my staff get productive without tons of training?

- Signer experience: Will a busy client or a 75-year-old landlord finish the session without calling me?

- Compliance and audit trail: Will this hold up if a bank or an IRS agent wants to look under the hood?

- Templates and repeat work: Do recurring forms take minutes or seconds?

- Team management: Can I route work, control permissions, and keep visibility without bottlenecks?

- Scheduling ease: Are clients and staff going to be able to actually attend the sessions, or will they get lost in the fray?

- Pricing: What do I actually pay when I map the pricing to my pattern of notarizations? Is it spiky during tax season, quiet in summer?

1) Onboarding and Setup

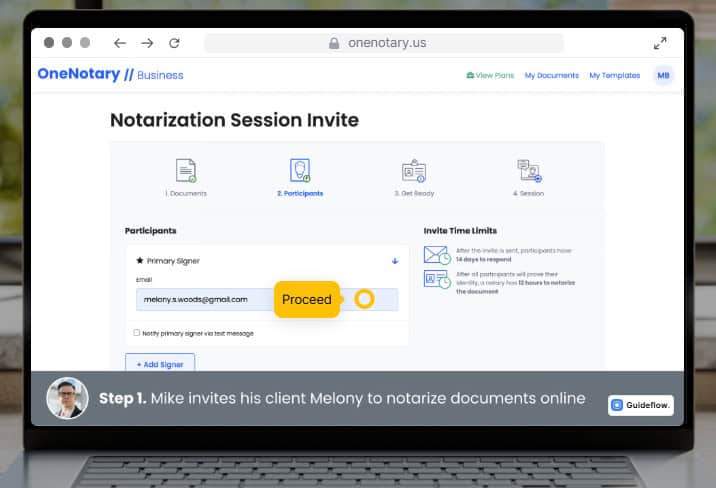

OneNotary

Set up with OneNotary is tough to beat. It is so user-friendly. The steps make sense in the order they appear: account (if you want – you can also sign in as a guest), KBA/ID requirements, stamp upload, default meeting settings, and basic notification preferences. The dashboard is dead simple. When I added staff, the invite and role assignment were clear, and she could schedule a test session in under 10 minutes. Little things help: immediate sample template, the “send test to yourself” nudge, and a clean first-use flow.

BlueNotary

Also straightforward, with a modern interface and quick sign-up. BlueNotary has a strong “marketplace” identity from the notary’s perspective, which is useful if you plan to hire third-party notaries on demand. If you’re a firm with your own notaries, that marketplace focus matters less, but it doesn’t get in your way. I still had to comb through a few more settings to land on the exact defaults I wanted.

Verdict: Both are easy. OneNotary felt a touch more “business-account first,” which cut a few minutes during setup.

2) Signer Experience

Alright, ladies and gents, this is the hill I’ll die on. If I send a link to a time-pressed client, I need them to complete the session without hand-holding. The same can be said for Grandma, I need things to get done without me needing to babysit.

OneNotary

The signer flow is linear and calm. The page explains what’s next without jargon: consent, ID check, meeting, done. The video room layout is familiar. There’s no awkward controls or crowded sidebars. Uploading documents mid-session works without the client second-guessing what they just did. I’ve noticed fewer “I can’t get my camera to work” calls, and when they do happen, the troubleshooting path is simple. For older clients or those with older laptops, the process still tends to succeed on the first try.

BlueNotary

Also smooth, with clear instructions and a polished interface. BlueNotary leans slightly more into options during the experience. That can help power users, but it can also add decisions for clients who want the shortest possible path.

Verdict: Both deliver a good signer experience without the headaches that may be encountered by tech-challenged users.

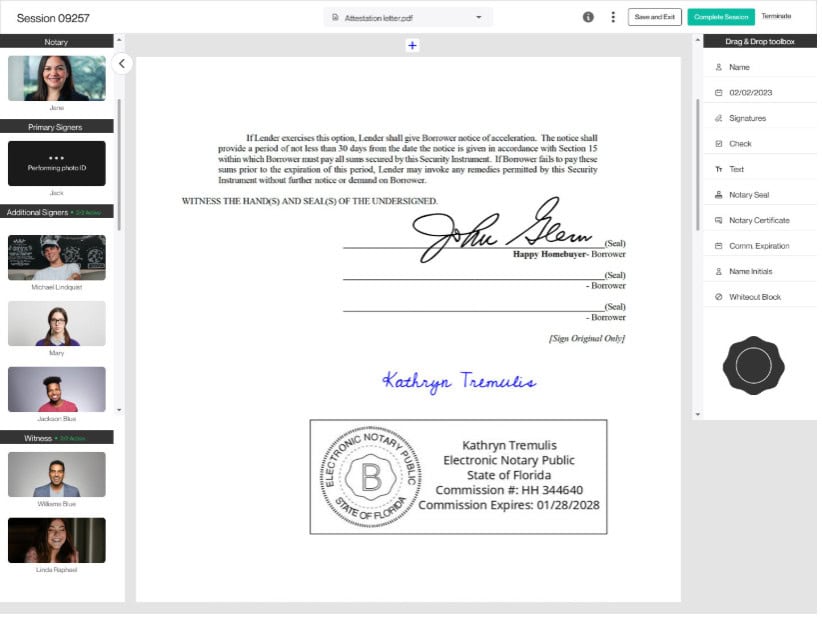

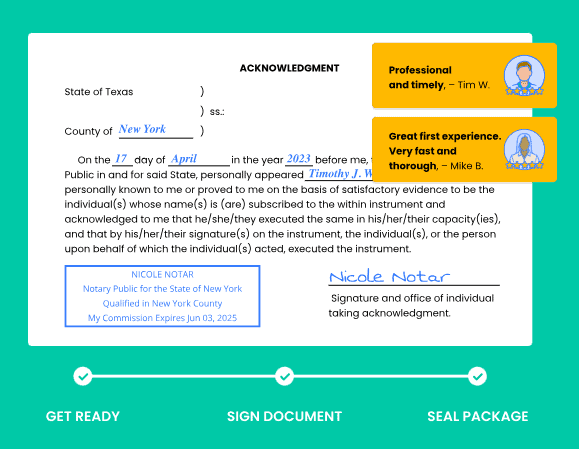

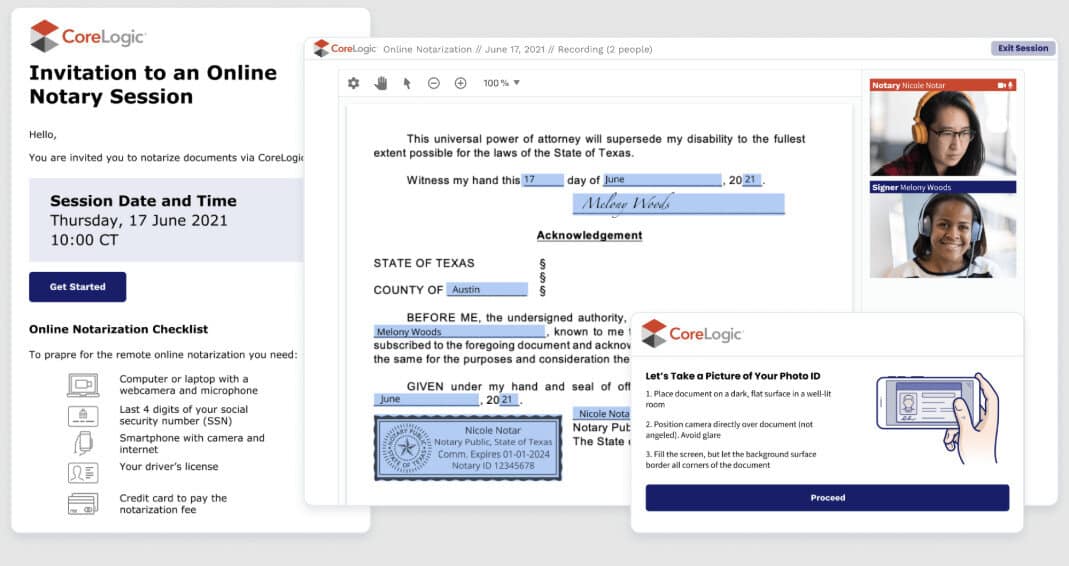

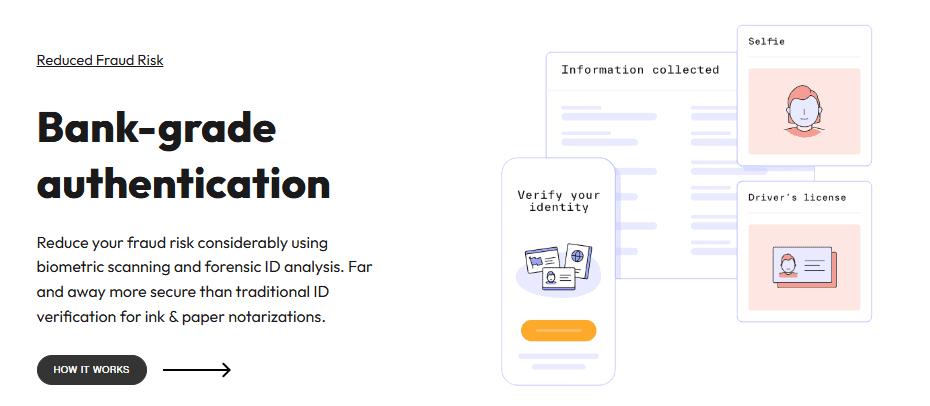

3) Compliance, ID Verification, and the Audit Trail

You want KBA (knowledge-based authentication), credential analysis, secure storage, and an audit trail that’s complete enough for a bank to accept without a back-and-forth. You also want consistent application of state RON rules.

OneNotary

It checks the boxes: KBA and credential checks, recording, detailed logs, and a final package that matches what banks and title companies expect. I have handed over OneNotary audit trails to lenders without having to annotate them. For multi-document sessions with interim updates, the record stays clear.

BlueNotary

Also checks the boxes. It produces the records that institutions expect. I’ve had zero issues with document acceptance using BlueNotary.

Verdict: Both tie on core compliance. If you do a lot of work in banks and real estate, both are fit for purpose. OneNotary’s packet layout lands a bit cleaner for my eyes, which matters when I have to review a lot of sessions, but that’s subjective.

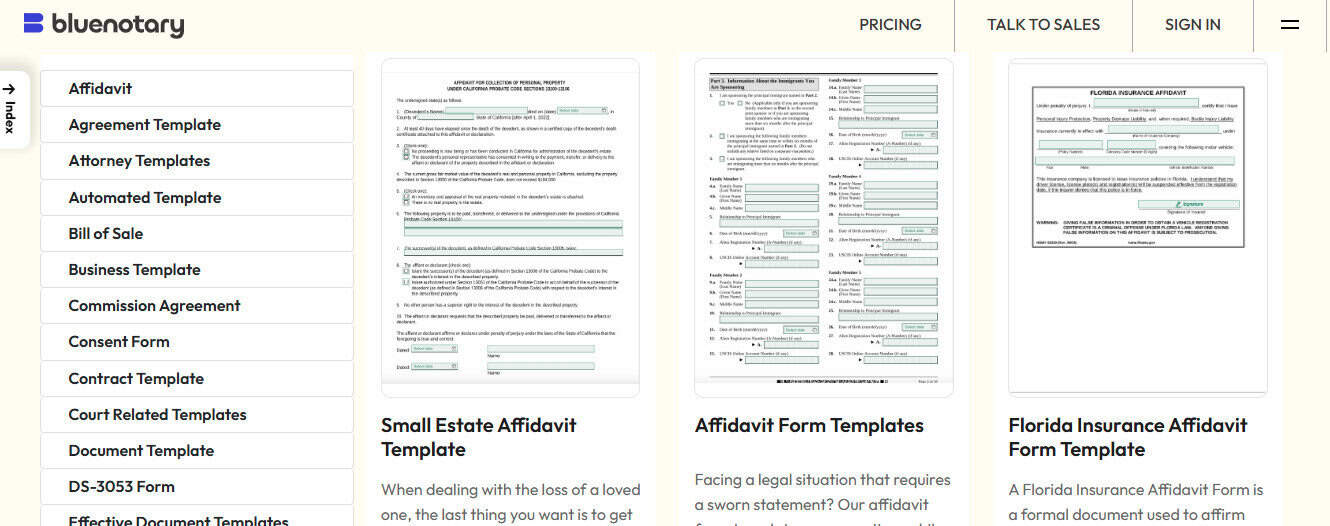

4) Templates, Packets, and Repeat Work

CPA firms live on repetition. Engagement letters, POAs, affidavits, bank form families, recurring attestations, etc. We do them over and over and over again.

OneNotary

Template creation is fast and easy! I can build packets with placeholders, initials, and required fields and drop them into a workflow in seconds. The template picker is dead simple, so staff don’t hunt for the right version. If I need to fork a template for a one-time change, I can duplicate, tweak, and go. Pre-session preparation is minimal, which is good when a client calls at 4:45 p.m. and needs a POA notarized before they’ll talk to the IRS with me.

BlueNotary

Also supports templates and reusable packets. The builder is capable, and once a team member learns it, they move fast. I have seen slightly more clicks to get to a “ready-to-send” state, depending on the template complexity.

Verdict: Both handle repeat work well. OneNotary feels quicker to “good enough” for standard CPA forms, which matters to me.

5) Team Management and Permissions

When I’m working with a Remote Online Notary service, I need to control who can schedule, host, and view sessions. I also need line-of-sight into what’s completed and what’s stuck.

OneNotary

Roles make sense: admins, notaries, and support staff. Visibility is broad but not intrusive. I can reassign sessions if someone is out sick. The activity view reads like a ledger in that it’s a fact pattern of what happened and when. That resonates with how accounting teams operate.

BlueNotary

Similar controls, with strong support for adding external notaries from their marketplace if your in-house notary is unavailable. That’s a genuine strength for shops that don’t want to maintain multiple commissioned notaries on staff, but doesn’t apply for most use cases in my opinion.

Verdict: If you want redundancy via a marketplace, BlueNotary has an edge. If you already keep a commissioned notary (or two) on payroll, OneNotary’s internal team view is cleaner.

6) Scheduling, Reminders, and Client Communication

Missed sessions and email ping-pong waste my time, and I don’t appreciate doing it.

OneNotary

Scheduling is integrated. I can offer a couple of times, send a single link, and let the client lock in. Reminders go out without me thinking about them. If we need to switch to an on-demand session, it’s a small change, not a new process.

BlueNotary

Also supports scheduling and on-demand sessions. The reminder system works, and clients receive what they need. In my usage, OneNotary produced fewer “where is my link?” emails, though both are solid.

Verdict: They both do what they’re supposed to do. In terms of scheduling, it’s a tie.

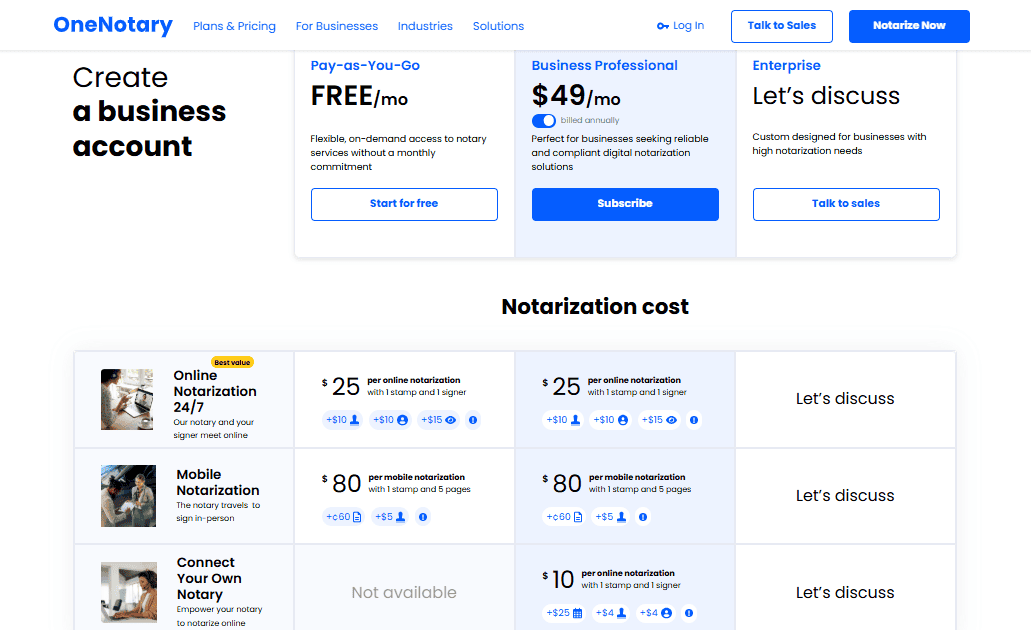

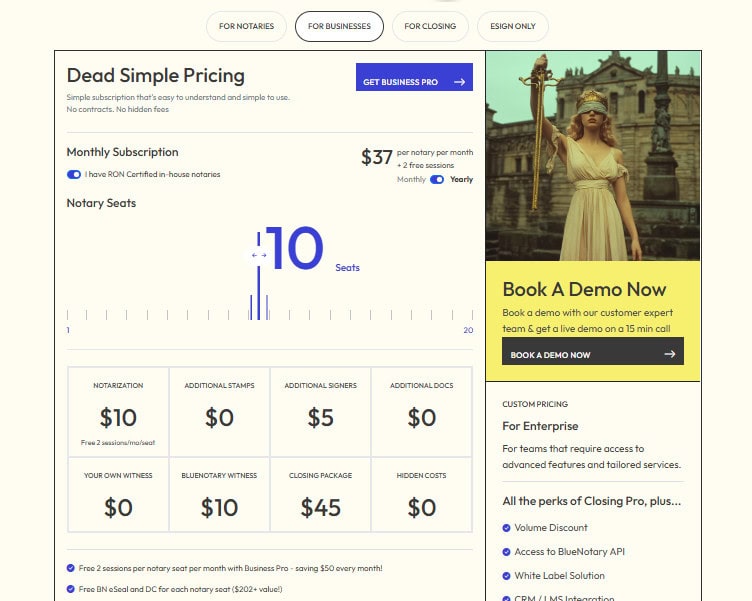

7) Pricing And Total Costs

I care less about list prices than I do about the shape of costs as my demand moves. CPA firms see highs and lows of course: year-end audits, busy-season POAs, real-estate closings, and then quiet stretches.

OneNotary

The pricing model fits “spiky but predictable.” You can keep a modest base and add volume as needed. For me, the total cost has lined up closely with actual use, without paying for capacity I didn’t touch. When I map costs over a fiscal year, the area under the curve is fair.

BlueNotary

Also competitive, sometimes with attractive options if you expect high sustained volume or want access to their on-demand notary marketplace. If you’re a solo practice that only notarizes once in a blue moon, shop both and run the math on your past twelve months.

Verdict: Both are reasonable; your answer depends on pattern. My mix favored OneNotary’s structure.

A Couple Other Items to Consider When Picking OneNotary or Blue Notary

What Happens When “It Breaks”

No platform is perfect. You measure a vendor by how they respond when the wheels come off. I’ve used contractors for things, and eventually, everyone is going to mess up here and there. What’s important is how quickly the trainwreck can be corrected and how the contractors respond to these types of things.

OneNotary

I’ve gotten quick, direct answers. The tone is practical and less scripted, more focused on the fix. I had one client with a corporate firewall. Support sent a clean workaround and followed up after the session to confirm it stuck.

BlueNotary

Responsive and friendly as well! They know their product and will walk you through a path that works. If you lean on their marketplace, support is good at coordinating moving parts.

Verdict: Both are strong.

A Big Ticket Item (Not Applicable to Me): Integrations

I don’t need deep APIs for notarization. My business just isn’t set up that way, and I’m not looking to integrate into complicated plug-ins. I don’t even have an IT Guy on staff. But that doesn’t apply to everyone reading this article. If you’re considering an RON, export should be painless, naming to be consistent, and storage to be trustworthy.

OneNotary

From what I’ve researched, imports and exports are simple. The naming convention is predictable, which helps when you auto-file into a DMS or a client folder structure. Large packets behave well. I’ve yet to see a corrupted export.

BlueNotary

Similar story. I’ve seen one or two larger video recordings take longer to surface for download, which didn’t block the work but did slow my “file it and forget it” habit.

Verdict: One Notary is superior for being able to handle APIs, Integrations, and larger files more quickly and easily.

The Client Types You Need to Consider

Let’s talk about some of the hoops I’ve had to jump through in the past.

- Elderly landlord in another state: He uses older hardware and gets nervous with pop-ups. OneNotary got him through on the first attempt. With BlueNotary, I coached him for a minute on camera permissions; then it was fine. That’s not a condemnation; it shows how tiny UX differences matter.

- Real-estate closing packet: Lots of initials, multiple signers, and a large PDF. Both handled it. OneNotary rendered the navigation a bit cleaner for the signer, which lowered coaching time.

- After-hours signer: Client pinged me at 8:30 p.m. Both platforms can support that. BlueNotary’s marketplace is handy if your in-house notary is unavailable at odd hours.

Limitations To Know About For Each Platform

No RON platform fixes a client’s broken webcam or a company’s overzealous firewall. If you support a lot of remote signers, maintain a short “prep email” that includes:

- A link to test camera and mic

- A note about using Chrome/Edge and allowing permissions

- A tip to sit near a window or lamp

- A reminder to have a government ID ready

Both OneNotary and BlueNotary work better when you control what you can.

How I Would Choose For Your Needs

Here’s a simple decision path should you be considering either option.

- List your top five notarization use cases (e.g., POAs, bank forms, real-estate packets, affidavits, engagement letters).

- Note signer profiles: age, tech comfort level, device types, and how often they sign on mobile vs. desktop.

- Map your volume pattern: Take a look at your use cases over the last few weeks or months

- Assign weight to friction cost (rework, staff coaching time) vs. subscription cost.

- Run a pilot in parallel for two weeks. Send half your sessions through one platform and half through the other. Consider things like completion time, reschedules, support tickets, and back-office acceptance questions.

If you don’t have time for a pilot, default to the platform that best matches your signer profile.

The Bottom Line

Both OneNotary and BlueNotary are capable, compliant, and widely accepted. If your firm values lowest friction for a wide range of signers and a lean dashboard that helps staff move fast, OneNotary has the edge. If your operation depends on on-demand marketplace access to notaries at odd hours or in peak periods, BlueNotary might fit better.

In my practice, where we prioritize simple signer journeys, quick templates, and quiet reliability, I use OneNotary as the default and keep BlueNotary in the toolkit for cases where the marketplace is useful. That balance has cut reschedules, reduced hand-holding, and kept my staff focused on client work instead of playing IT help desk.

Pick the tool that reduces friction for your mix of clients and documents. If you do that, you’ll feel the gains every week in the form of fewer interruptions, faster turnaround, and cleaner files. That’s what a good RON platform should deliver.