Last Updated on December 8, 2025 by Ewen Finser

So, you’re looking to upgrade your company’s financial infrastructure, but you’re not sure which tool represents the best possible investment.

The first and most important thing I’ll stress here is to make the choice in the context of your specific needs. Don’t be swayed by flashy marketing and laundry lists of semi-relevant features your teams won’t benefit from. Think about exactly what you need, and pick the tool that’s the best fit on that basis.

Melio and Ramp are both fintech solutions aimed at simplifying business finances, but they serve different primary purposes. Melio is an accounts payable (A/P) and receivable platform that helps businesses pay vendors and receive customer payments more easily, while Ramp is a corporate card and spend management platform.

I look at both in detail here and offer some insights.

The Short Version:

Melio and Ramp both do a lot to simplify business finance, but they do it in different ways. Melio is typically better suited to smaller teams with more limited requirements, while Ramp is effective all the way up to the enterprise level.

The best choice for you will depend on your specific needs (it may be the case that you need both).

What I Like About Melio

Versatility

Melio allows you to pay any business bill via ACH bank transfer, paper check, or credit card (with the vendor receiving a check or bank deposit). This means you can pay vendors who don’t accept cards by using your credit card through Melio. I think this is a particularly big plus at a time when certain payment methods are increasingly causing headaches for businesses; you don’t want to leave invoices unpaid for weeks just because your vendor doesn’t take cards. With Melio, you don’t have to.

Melio Integrations

If you already use QuickBooks or Xero, you won’t have any trouble adding Melio to the mix. Automatic bill syncing simplifies financial processes considerably, so it’s worth considering.

Melio Features

Melio has continuously focused on remaining at the cutting edge of tech development in the payments world. Its most recently released features include:

- Pay Over Time, an installment plan feature that lets eligible businesses pay vendor bills in monthly installments while the vendor gets paid up front.

- A mobile app that makes it easy to manage payments on the go.

- Automated collection of vendor W-9s and auto-generation of 1099 forms, making your life easier at tax time.

- International payments in foreign currencies.

Accounts Receivable

This is one area in which Melio is a clear winner over Ramp, as Ramp doesn’t offer an accounts receivable function. Melio allows you to send payment requests or digital invoices and receive payments via bank transfer or credit card, with funds deposited directly into your bank account. It’s a very effective way to streamline your processes in this area.

Ease of Use

If there was ever a business function requiring simplification, it’s managing invoices. Melio does a great job here.

The interface is clean and straightforward. Tasks like adding a vendor bill, scheduling a payment, or syncing with QuickBooks are guided and user-friendly. Very little training or technical know-how is required.

Pricing

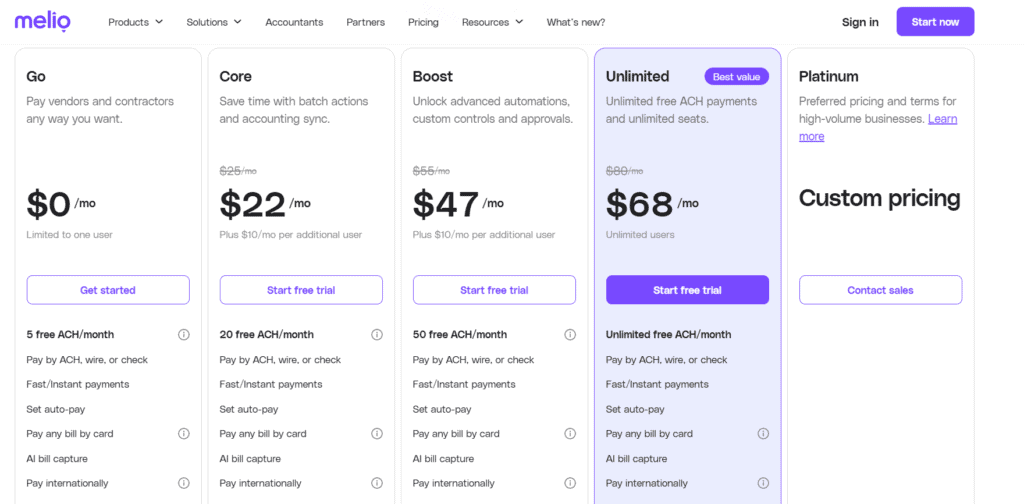

Melio’s mix of free and paid plans offers a pathway to service for businesses of all sizes. Also, because most of the company’s charges are on a per-transaction basis, you won’t be left at risk of overpaying for a model you don’t really need. Melio could be particularly cost-effective if you send a lot of ACH transfers; you get a number of these for free each month, and they only cost $0.50 per transaction after that.

Small Business Focus

If you’re a freelancer, solo attorney, boutique agency, or any owner-operated business that has to pay vendors or suppliers, Melio gives you a simple bill-pay workflow without unnecessary complexity. I’m a small business owner myself, so I appreciate any innovation that makes our lives easier. For too long, B2B tech companies have only targeted bigger organizations, so it’s refreshing to see the recent trend towards service provision to smaller outfits.

If you just need to schedule payments and maybe charge a bill to your credit card occasionally, Melio will serve you very well.

What I Dislike About Melio

Lack of Human Customer Support on Unpaid Plans

Melio’s human customer care line is only available to paid subscribers. It does offer live chat support, but only during EST business hours. This means it’s sometimes more difficult than it should be to get your issues addressed in a timely, convenient fashion.

Limited Free Version

While I think Melio’s price points are fair and generally represent value for money, I would note that the free plan is pretty limited. All but the smallest businesses will need to subscribe to Melio to get what they need.

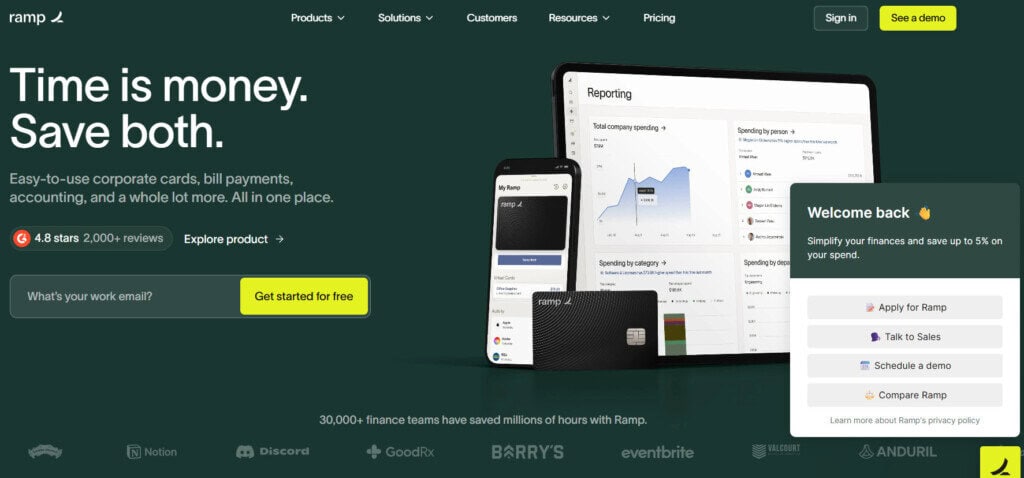

What I Like About Ramp

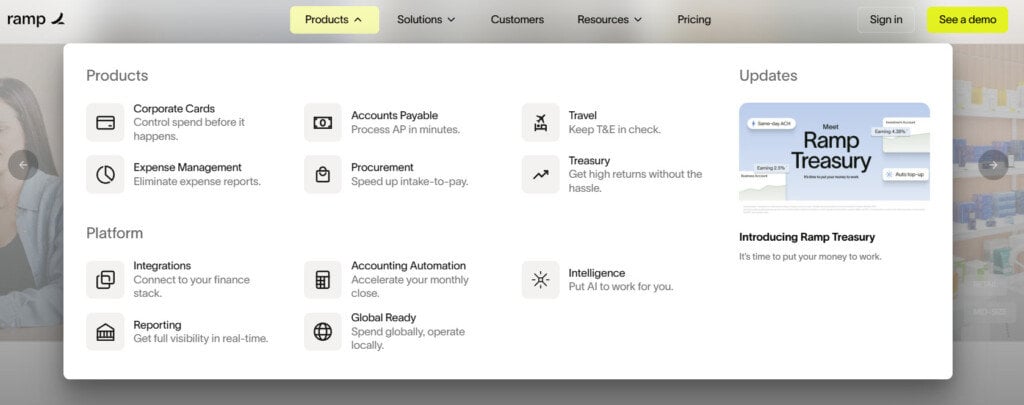

Features

Ramp is heavier on features than Melio; this can be a plus or a minus, depending on your needs.

It includes bill pay capabilities similar to Melio’s: you can pay vendor invoices by ACH transfer, paper check, or even with the Ramp card, all from the same platform. However, Ramp’s bill pay is part of a larger suite that also covers employee reimbursements, travel booking, and even a procurement module for purchase orders.

Ramp’s software allows admins to set spend limits, auto-categorize expenses, require receipt uploads, and enforce policies in real time. It effectively eliminates manual expense reporting, and that will be music to your ears if you’re familiar with that process.

Customer Support

I always like to see a human-first approach to customer care; I’ve dealt with one too many excessively chirpy chatbots in my time. Ramp shines here. While it does offer email and chat support, it also provides all users with access to over-the-phone support during business hours. If you need something serious addressed quickly, there’s no substitute for a human agent.

Ease of Use

Like Melio, Ramp is easy to use and does a good job of leveraging cloud infrastructure to make everything convenient. Also, as noted above, its customer care is excellent, so any problems that do arise are easy to address.

All-in-One Solution

Rather than piecing together an expense tool, a credit card, and an A/P tool, Ramp provides a one-stop shop. If you’re at a company where you’re currently using, say, Expensify for receipts, Bill.com for A/P, and an Amex card – Ramp can potentially replace all three with one login. This is especially useful for mid-market companies that are large enough to have significant spend, but small enough to prefer this kind of efficiency over having separate niche software for every function.

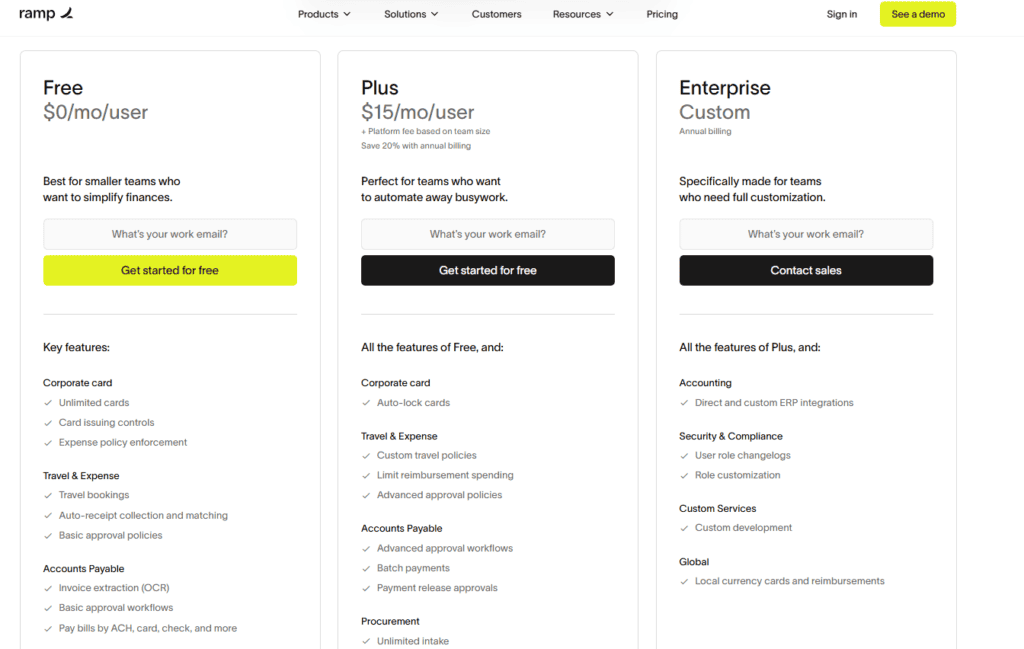

Free Core Pricing

It is free to use Ramp’s core platform. The company makes money through interchange fees from the use of its corporate card (although there are paid upgrades that may be worthwhile for you, depending on your needs). Even if you do go down the paid route, though, it’s handy to have the option to test drive the platform for free first.

What I Dislike About Ramp

Expensive ACH Payments

This is one very notable gap between Melio and Ramp; Ramp will charge you a whopping $10 to make a same-day ACH transfer. Unless you’re only dealing in very large sums, this is a significant expense.

Qualification Criteria

Ramp provides a corporate credit line, so not every small business can instantly get approved. Typically, Ramp requires your business to be a registered US corporation, LLC, LLP, or LP, and to have a minimum cash balance of $25,000 to qualify for their card. This obviously disqualifies a lot of companies. By contrast, Melio has no approval requirements beyond having a US bank account, since it’s your own money funding the payments.

Undisclosed Financing Fees

Ramp Flex allows you to finance invoices and pay the funds back over a given period. However, it’s not clear exactly how much this service will set you back until you start using it. Fees are reportedly not significant, but it still makes it more difficult to do an accurate cost-benefit analysis of the tool.

No Accounts Receivable

While Ramp excels at managing outgoing payments and expenses, it doesn’t handle accounts receivable or customer invoicing. If you need to send invoices and collect payments from customers, you’ll need a separate solution like Melio or traditional invoicing software. This limits Ramp’s appeal as a complete financial management solution for businesses that need both payable and receivable functionality.

Melio vs Ramp Pricing and Fees Comparison

The cost structures of Melio and Ramp are quite different, which can significantly impact your decision depending on your payment patterns.

Melio operates on a freemium model with transaction-based fees. ACH transfers are free for the first few payments each month, then $0.50 per transaction. Credit card payments cost 2.9% of the transaction amount. Paper checks are $1.50 each. The platform offers a premium plan at $39/month that includes additional features and higher free payment limits.

Ramp’s core platform is free, generating revenue through interchange fees from card usage (which you don’t pay directly). However, some features require paid plans starting around $15 per user per month. The expensive part comes with ACH payments – Ramp charges $10 for same-day ACH transfers, which is significantly more expensive than Melio’s approach.

For businesses making frequent ACH payments, Melio’s pricing structure typically works out much better. For companies primarily using corporate cards with occasional bill pay needs, Ramp’s model might be more cost-effective.

The Verdict

The choice between Melio and Ramp will ultimately boil down to the nature and size of your operations.

Melio is best for teams that want a focused bill payment solution, especially small businesses and those who value its straightforward approach and integration with accounting software.

Ramp is best for teams that want to centralize all spending on one platform and have the bandwidth to implement more advanced controls.

Best Choice for Small Businesses

For small businesses specifically, the decision often comes down to your primary pain points and financial situation.

Choose Melio if you’re a small business that primarily needs to streamline vendor payments and customer invoicing. It’s particularly well-suited for service-based businesses, freelancers, and small companies with straightforward financial needs. The lower barriers to entry (no credit requirements) and simple pricing make it accessible for businesses just getting started or those with limited cash flow.

Choose Ramp if you’re a growing small business with employees who need corporate cards, or if you struggle with expense tracking and approval workflows. Ramp works best for businesses that have reached the point where expense management is becoming a significant administrative burden. However, keep in mind the $25,000 cash balance requirement, which may disqualify some smaller businesses.

For many small businesses, the sweet spot might actually be starting with Melio for basic bill pay and invoicing, then adding Ramp later as employee expenses and spending control become bigger priorities. This staged approach lets you solve immediate problems without over-engineering your financial stack from day one.