Last Updated on July 15, 2025 by Ewen Finser

If you’re already busy running a business, looking for a low-cost digital payment platform probably feels like an overwhelming task—especially with so many options out there. If you’re a small U.S.-based organization or accounting firm looking to simplify your B2B transactions, Melio is a platform worth looking at. You might still be busy after signing up, but at least you won’t have to spend your morning coffee time managing invoices and vendor fees.

TL;DR: I love Melio’s simplicity and the fact they have competitive pricing for smaller businesses. I’ve been using Melio for years, but thought it was a good time to have another look at this tool. Melio offers a limited number of free ACH transfers per month, depending on your subscription plan, and they’ve added some excellent features in the last couple of years. However, if you need advanced payment platform features like comprehensive expense and invoice management or ERP integrations, you may have to look into other options.

What is Melio Payments?

Melio Payments is a free digital payments platform that only charges for ACH bank transfers and receiving transfers (ACH or check). If your business requires more advanced features, you can look into their tiered pricing plans, which provide additional capabilities.

Who should use it?

If you are looking for simple accounts payable software that you can use on both your PC and mobile, Melio is a great option for cost-conscious businesses.

It’s best for small-to-medium-sized businesses based in the U.S.

It’s also a well-priced platform for U.S.-based accounting firms.

What I look for in a solid payment platform:

- Transparent cost structures. Ideally, I look for free ACH transfers and make sure the additional fees are easy to find and read through.

- Ease of use, simplicity, and short learning curve

- Transfers and transaction speed (are same-day transfers available? What are the costs thereof?)

- Integration capabilities (most importantly with accounting software)

- Additional features like vendor management, automation, and mobile app capability

Melio’s features and services:

Melio’s features include automatic payment options, accountant access, and QuickBooks, Xero, and Amazon Business integration. Melio has a free trial available, and you can even sign up through your QuickBooks account, which is super convenient.

You can pay your bills fee-free via bank transfer and debit card, even if your vendor only accepts checks. Melio takes your online payments via bank transfer, debit card, or credit card (2.9% transaction fee) and deposits or mails a check to your vendor in your name without any delivery charges. With so many great features, I’d suggest trying out the free version to see if it offers the functionalities you’re looking for in a payment platform. Here are some of the newer and standout features I liked.

Melio’s standout features

Melio’s Mobile App

Melio has an excellent business payment app (iOS and Android), which makes it easy to track and make payments on the go. You can manage both your accounts payable and receivable in one place.

I like that you can use the app to:

- Manage your vendors, monitor payment statuses, and approve transactions.

- Amend and manage your workflows from the app by declining or approving payments.

- Easily set up reminders for transactions requiring approval to avoid delays.

Melio.me – Accept payments online.

I love the “Melio.me” feature, which allows you to accept payments online. What’s really great is that the recipient doesn’t require a Melio account to send the payment, which can be done via bank transfer (free) or a credit card (2.9% fee).

You can customize your link, share it via email, add it to your website or invoices, and get paid directly to your bank account within minutes.

Automation features

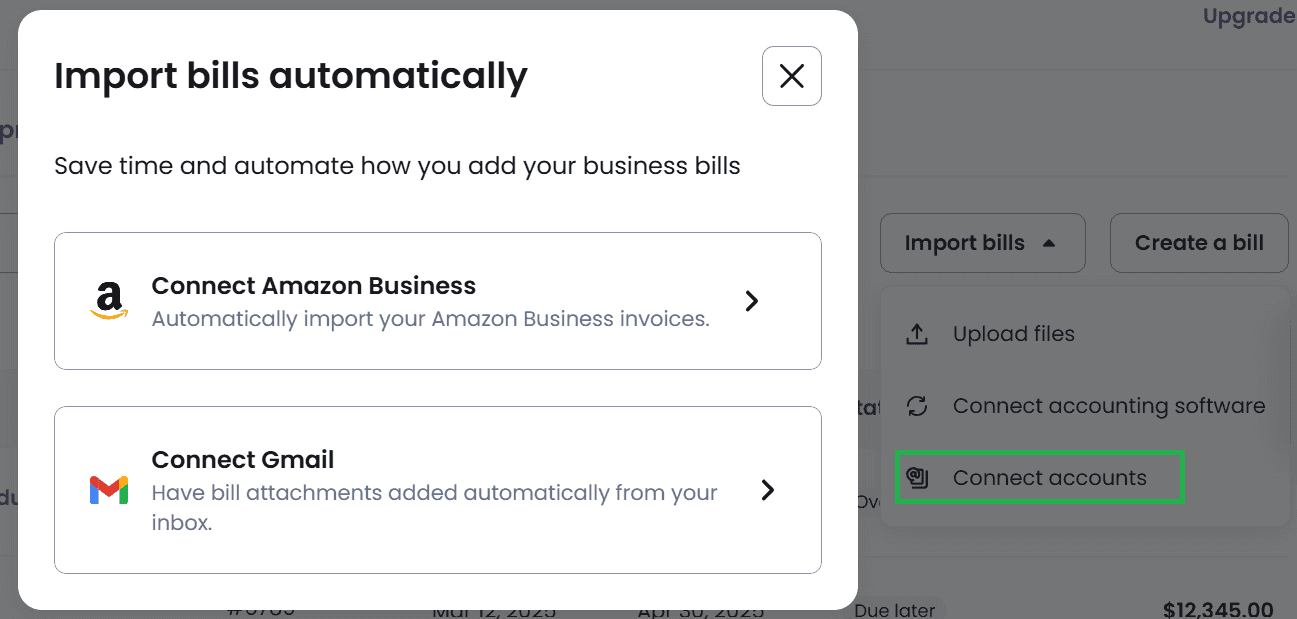

I love that Melio has recently added useful features like automated imports. You can now import your bills automatically by selecting “Connect accounts” from Gmail or Amazon Business.

Once the information has been analyzed and synced, you’ll be able to access your bills in one place, simplifying your payment processes.

Scan to capture bills.

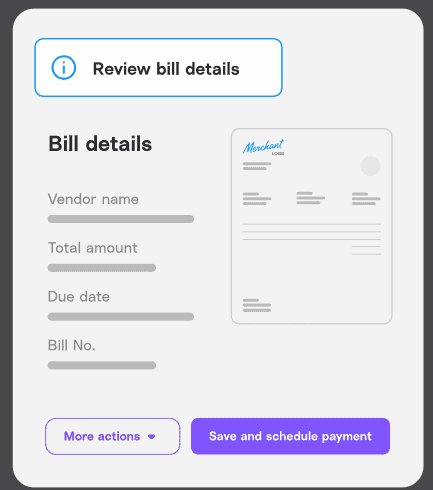

Melio has also recently added an excellent AI feature that helps you capture bills:

You can quickly add information via your phone by uploading a photo of your bills and invoices. (Alternatively, you can add the files (PDF or JPG).)

The invoices you scan or upload are automatically captured and appear in your Bills tab, including classes and locations.

Auto-add bills from your vendors

I personally love this feature! It takes the hassle out of manual data entry.

You can now easily add invoices by requesting that your vendors send invoices directly to your Melio email address. Once received, the bills will automatically appear in Melio, so you can easily schedule them for payment.

This feature also works if you forward invoices to your dedicated Pay Bills email. Melio will scan and automatically add your bills for you.

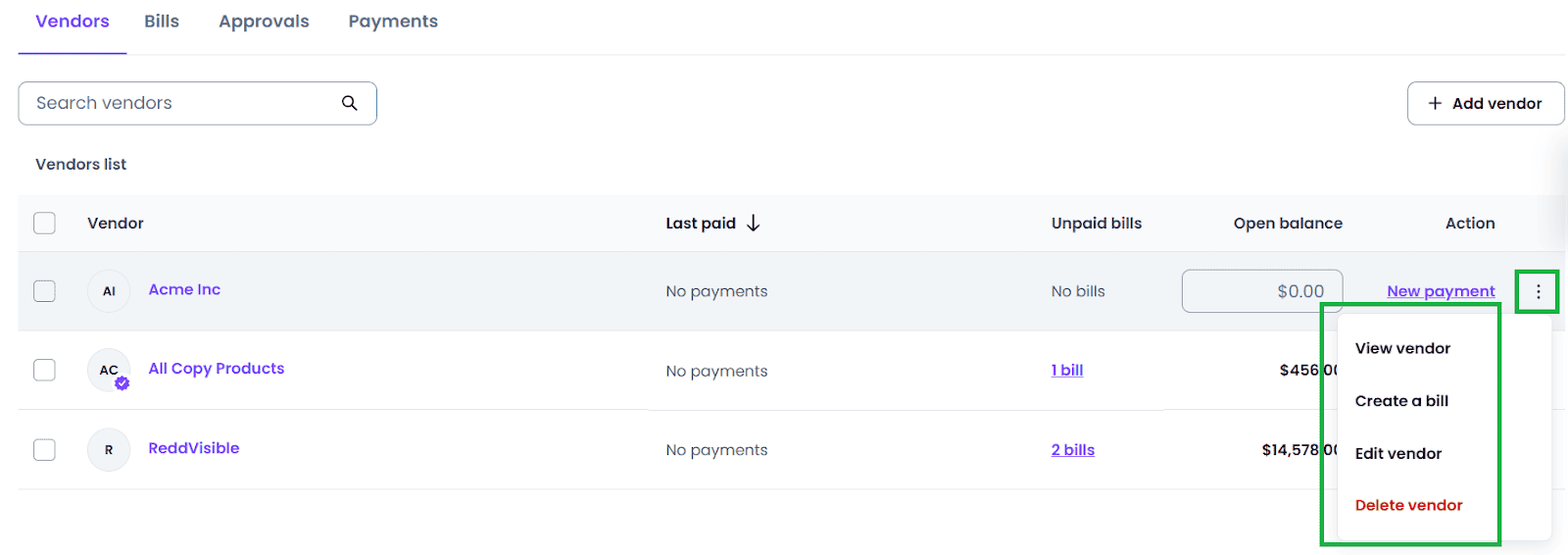

Vendor Management

This is also a newer functionality for Melio, but I was pleased to see how easy it is to manage vendors on the platform. I like tools like this that have a short learning curve and don’t require lengthy training to create, edit, manage, delete, and view vendors’ details. It also takes only a few minutes to create a new bill.

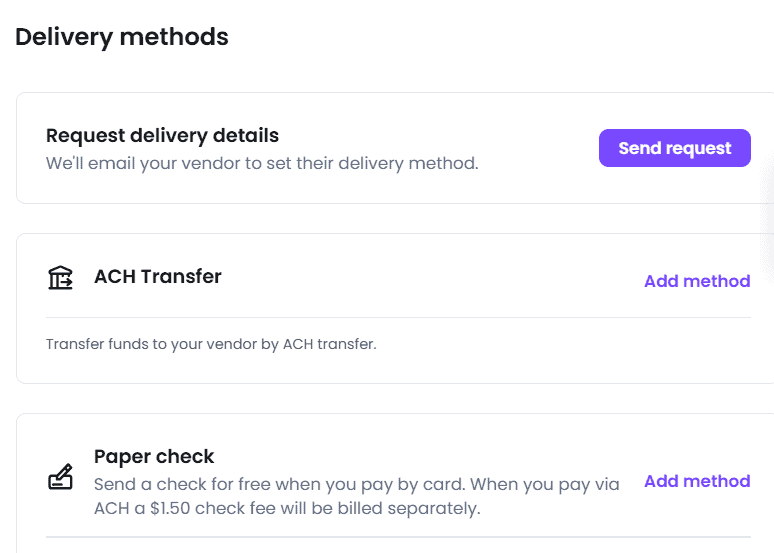

You have the ability to request delivery details if you don’t have your vendor’s details or if you aren’t sure how they want to receive payments.

This request for information can be initiated from within the app, and an email will automatically be sent to your vendor.

Payment features

Combined Payments: (for Core and Boost subscribers) If you have multiple bills from a single vendor, you can now bundle your payments so that you can send this as a single transaction. I love this option because it means a single transaction and time saved when managing payments.

Flexible Repayment Options:

Melio has launched a great option for businesses needing assistance with cashflow flexibility when it comes to repaying bills or vendors.

You can choose net 30 or up to 12 monthly installments. Plans already include a fixed fee; vendors get paid upfront in full, which won’t affect your credit score.

(Just note that this is subject to approval.)

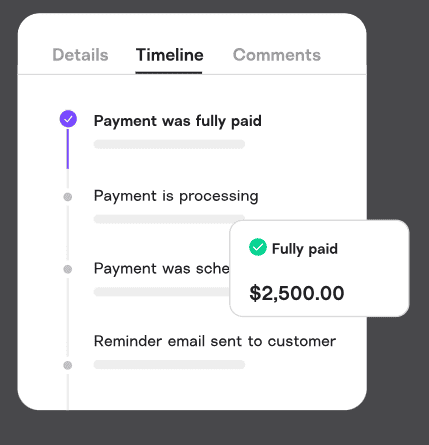

Live tracking for payments

This is another new feature on Melio that I like. If you have newer vendors, you may not know if the payment was processed and when (especially without a payment notification). On Melio, you can now access this information using the email notification link and view the estimated payment delivery from within the app.

Melio Affiliate Program:

Melio has a lucrative affiliate program that is as easy as sharing your unique link. Melio uses cookies to track your referrals. Cookies last 90 days each time the potential customer clicks on your unique URL.

Note: There are also special offers available upon request. This applies to business referrals for businesses that have high credit card payment volumes (over $500K monthly)

Melio Payments Pricing:

Melio caters to different business needs and sizes and offers three plan options.

They offer monthly or annual subscriptions (with a 25% discount on yearly subscriptions.)

Note: Credit and debit card payments are subject to a 2.9% transaction fee for all plans.

Overview and pricing:

1. Go:

Cost: Free for up to one user and includes the following:

- Send 5 free ACH transfers/month (A $0.50 fee applies to each transfer after the monthly free ACH transfers are used.)

- 10 syncs with QuickBooks Online & Xero

- Multiple payment methods: Pay by card or bank—send check, ACH, or instant transfer

- Easy bill adding: Upload, scan, or import bills

- Dedicated email for auto bill capture

- Global payments in USD or local currencies

- Recurring & partial payments

- Instant payments

- Free mobile app (iOS & Android)

- Get paid: Accept payments via custom links

2. Core:

Cost: $25/month for one user (plus $10 per month per additional user).

- Send 20 free ACH transfers/month (the same $0.50 fee applies to each transfer after the monthly free ACH transfers are used.)

- Unlimited 2-way auto-sync with QuickBooks Online & Xero

- Batch-pay multiple bills at once

- Combine payments into one transaction

- Roles, permissions, and user management

- Automated approval workflows

- W-9 collection & auto 1099 sync

- Automatic capturing of bill line items

- Priority support

3. Boost:

Cost: $55/mo for one user (plus $10 per month per additional user).

The Boost plan includes everything in Core, as well as:

- 50 free ACH transfers/month (once consumed, the same $0.50 fee as above applies)

- 2-day ACH transfer eligibility

- Advanced multi-user approval workflows

- 2-way auto-sync with QuickBooks Desktop

- Advanced bill attributes (classes & locations)

- Premium phone support

Melio also offers a Platinum Plan for power users. You will be required to fill in your business information so that Melio can create a tailored plan that suits your needs, depending on your requirements. (This is dependent on eligibility. )

Before you sign up: I would recommend looking for deals—it seems like they often offer discounts. As of right now, they’re running one for 25% off subscription fees.

Accountants Plans

For accountants, you can access all client information via the centralized dashboard, including their current payment status. The accountant plan also includes seamless syncing with Quickbooks, Xero, and Amazon Business.

I like that Melio offers a dedicated support team for its Accountant plan users. Take advantage of industry-specific support to provide your clients with professional accounts payable experience.

As a bonus, there are no subscription fees for accountants and a -30% for your clients!

Melio Integrations:

QuickBooks:

Melio has an automatic two-way sync with QuickBooks Online & QuickBooks Desktop.

The syncs include vendor details, outgoing payments, and incoming payments.

Xero

You can add your bills and invoice information, which automatically syncs in Xero and Melio.

The syncs include vendor details, outgoing payments, and incoming payments.

Amazon Business

You can import and pay your Amazon Business invoices effortlessly with Melio.

Amazon’s Pay by Invoice customers can easily connect with Amazon Business and streamline invoice payments. I like that I also have the option to pay by card, ACH bank transfer, or instantly.

Pros and Cons of Melio:

Melio Payments Pros:

- No fees

- No contracts

- Live customer support

- Advanced security features

- Tax forms

- No delivery fees

- Unlimited management

- Unlimited users

- QuickBooks, Xero, and Amazon Business integrations

- Mobile app

- Pay over time flexibility

Melio Payments Cons:

- No automated OCR data entry

- No real-time ERP sync

- No Chrome extension

- No integration with Zapier

- No built-in expense reporting

- Limited international payments support (there’s a $20 flat fee on all international payments, regardless of size.)

In summary, I really like Melio; it took only a few minutes to get the hang of the platform and set up basic information. It’s intuitive and has recently added many features, making this an excellent option for SMBs looking for a cost-effective platform. That being said, I did find that it lacks some of the advanced financial management features that would make this somewhat limited for enterprise organizations.