- The Bottom Line Up Front, In Chart FormComparison Table: At a Glance

- Which is easier to scale with?

- Which offers more visibility into risk and fees?

- How do they handle account stability and risk?

- The "Legacy" Problem: Why Authorize.net Feels Dated

- Which is more "E-commerce Ready"?

- Support: Bots vs. Humans

- My Verdict

Last Updated on February 10, 2026 by Ewen Finser

In my years as a CPA, I have seen the same story play out dozens of times. A business scales quickly and their revenue looks great on paper, but the back office is a disaster. It’s a tale as old as time; they are using one system for their online store, another for their gateway, a third for their merchant account, and a fourth to try and reconcile the three.

When you are small, these “data silos” are a nuisance, but they’re not a deal breaker. When you hit mid-market or enterprise volume, they are a profit leak and can be a giant pain!

Today the debate often comes down to choosing between the “old reliable” and the “modern stack.” That’s why I wanted to put Luqra vs Authorize.net toe to toe and see what makes sense, and what doesn’t. Specifically, I am looking at Authorize.net, the legacy gateway that has been a staple since the late 90s, and Luqra, a modern contender that combines payment processing with a full Financial ERP and analytics engine.

If you are trying to decide which of these will carry your business through the next five years of growth, let’s look past the marketing fluff. We’ll take a look at the data flow, the risk management, and the actual cost of operation of the platforms.

The Bottom Line Up Front, In Chart Form

Comparison Table: At a Glance

Feature | ||

Core Function | All-in-One ERP & Processing | Payment Gateway |

Monthly Fee | Often $0 (Varies by plan) | $25 |

Online Rate | Starting at 2.3% + $0.20 | 2.9% + $0.30 (All-in-One) |

Support | 24/7 U.S. Based + Success Manager | 24/7 Phone/Chat (Standard) |

Reporting | Integrated Financial ERP & Analytics | Basic Transaction Reporting |

Onboarding | Real-time / In-house Underwriting | Fast (All-in-One) or Varies (MOP) |

Chargeback Tools | Built-in Management (Often Free) | Basic Filters / Third-party needed |

Which is easier to scale with?

Scale is not just about being able to handle 10,000 transactions a minute. Any modern server can do that. From an accounting and operations perspective, scale is about how much manual work is required to manage those 10,000 transactions.

- The Authorize.net Scaling Model:

- Authorize.net is primarily a gateway. It is excellent at what it does: moving data from your website to a processor. But because it is a gateway, it is often just one piece of a larger puzzle.

- You still have to manage your relationship with your merchant acquirer (the bank) separately.

- When you scale, you are scaling your complexity.

- You have more batch reports to pull, more third-party statements to reconcile, and more points of failure in your data chain.

- The Luqra Scaling Model:

- Luqra is built on a “single pane of glass” philosophy.

- They offer a full-stack solution that includes the gateway, the processor, and a built-in Financial ERP.

- When I review a client’s books, I prefer systems where the payment data and the financial reporting live in the same house. It just makes everyone’s life more easy!

- Luqra’s ERP layer is designed to manage the entire lifecycle of a transaction—from boarding and underwriting to settlement and reporting.

- For a business that is growing, this means fewer logins and less time spent in Excel trying to figure out why your bank deposit doesn’t match your gateway’s “settled” report.

CPA Note: Scale usually breaks your reconciliation process before it breaks your website. Choosing a platform that automates the tie-out between sales and deposits is a massive “hidden” time-saver.

Which offers more visibility into risk and fees?

One of the biggest headaches for my clients is the “hidden fee” trap. You sign up for a rate that looks competitive, but by the time you add in gateway fees, batch fees, PCI compliance fees, and “statement fees,” your effective rate has jumped by 50 basis points.

- Understanding the Authorize.net Fee Structure:

- Authorize.net typically charges a $25 monthly gateway fee. Then, they add a per-transaction fee (usually around $0.10 if you have your own merchant account).

- If you use their “All-in-One” plan, you’re looking at a flat 2.9% + $0.30.

- The challenge here isn’t the price, it’s the visibility. Most platforms will put you at around 2.9%, but I prefer a clear and upfront breakdown of where costs will land.

- If you are using Authorize.net with a third-party processor, your fees are split across two different statements, making it even more confusing.

- I find this makes it incredibly difficult for a merchant to calculate their true cost of acceptance without doing manual math every month.

- Understanding the Luqra Fee Structure:

- Their online rates typically start around 2.3% + $0.20, which is already more aggressive than the standard 2.9% legacy flat rate. But The real advantage is the “Meet or Beat” guarantee.

- Because Luqra owns more of the stack (the ERP and the processing), they have more margin to play with. They can look at your current effective rate and provide a customized quote that may actually lower your overhead.

- Their analytics dashboard also gives you a real-time view of your fees. You don’t have to wait for a paper statement to see how much you paid in interchange vs. markup.

- For a CFO or a business owner, that visibility is the difference between guessing your margins and knowing them.

How do they handle account stability and risk?

In the world of high-growth e-commerce, cash flow is king. Nothing kills a business faster than a “frozen account” or a “held reserve” because an algorithm decided your sudden spike in sales looked “suspicious.”

- Authorize.net Risk Management:

- They rely on their Advanced Fraud Detection Suite (AFDS). It is a solid, rules-based system where you can set filters for IP addresses, transaction amounts, and velocity.

- However, because Authorize.net is often just the gateway, they don’t always have the final say on whether your funds get held.

- That decision often lies with the underlying merchant bank, who might not have the same context about your business that the gateway does.

- Luqra Risk Management:

- Luqra takes a more proactive, human-centric approach to risk. They perform much of their underwriting upfront.

- Their marketing claim of “zero account freezes” is bold, but it’s backed by their in-house underwriting team that reviews applications in real-time.

- Instead of relying solely on an aggressive “freeze first, ask questions later” algorithm, Luqra provides a dedicated success manager (a “problem solver”) to their merchants.

- If you have a big product launch coming up and you expect a 500% spike in volume, you can actually talk to a human being at Luqra to ensure your funds keep flowing.

The “Legacy” Problem: Why Authorize.net Feels Dated

Don’t get me wrong, Authorize.net is a workhorse. It integrates with almost everything. If you are using a niche, 15-year-old CRM, Authorize.net is probably the only gateway that will work with it.

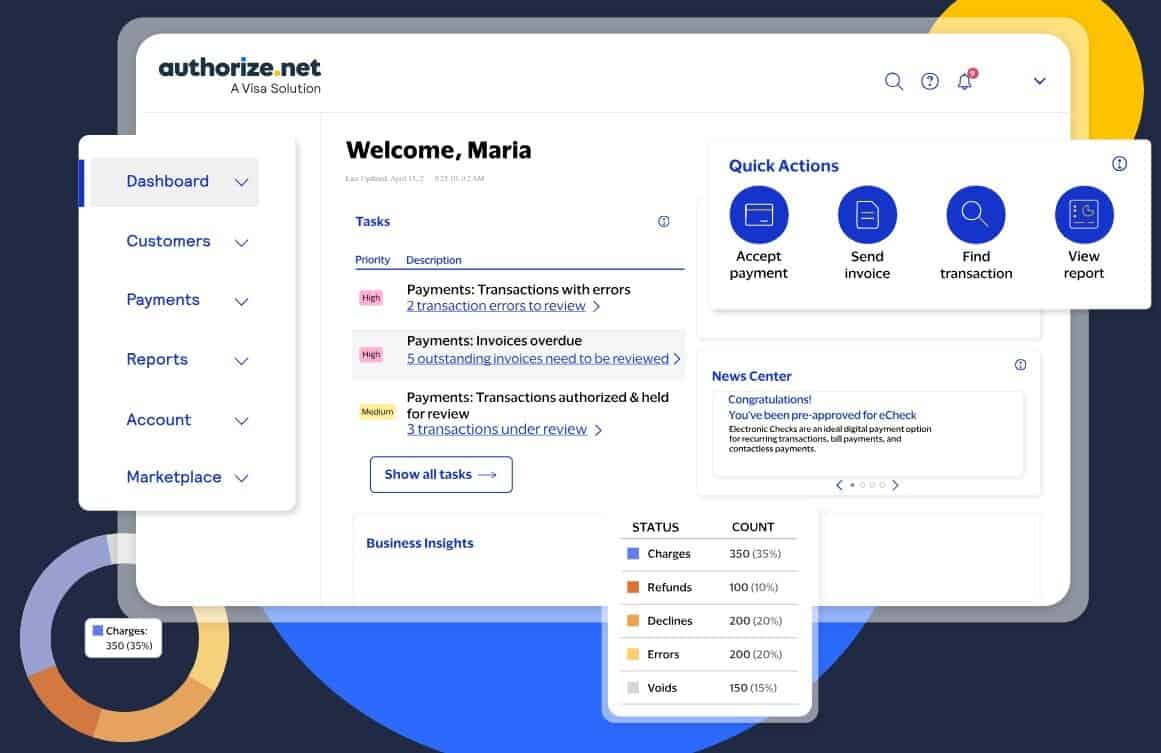

- The Authorize.net UX Experience:

- The interface and the user experience feel like they haven’t changed since 2010 and the dashboard is clunky. The reporting is also basic.

- It doesn’t “talk” to the rest of your business software without a lot of middleware or custom API work.

- Don’t discount what’s here though; just because it’s not shiny and glittery doesn’t mean the platform isn’t a superstar. It works, you’ll just need to get used to navigating it, and working around things that may need custom solutions.

- The Luqra Experience:

- I believe that Luqra’s ERP integration is the bridge that Authorize.net lacks.

- Luqra’s system manages lead management, sales funnels, and merchant onboarding all in one place. It also handles PCI reporting and TIN reporting, things that usually fall on the shoulders of the merchant or their accountant.

- By automating these compliance and operational tasks, Luqra moves the payment processor from a “necessary expense” to an “operational asset.”

Which is more “E-commerce Ready”?

Authorize.net was built for the early days of the web. It is great for a simple “Buy Now” button. It handles recurring billing (ARB) and has a “Customer Information Manager” (CIM) for storing cards.

- Authorize.net Ecommerce Capabilities:

- Authorize.net is reliable for legacy web structures, and can handle large enterprise level volume.

- It also comes with standard recurring billing features.

- The platform also offers secure card storage for repeat customers.

- Luqra Ecommerce Capabilities:

- Luqra , because it’s a newer platform, can handle the intricacies that were pushed to the web over the last 15 years.

- It integrates into your mobile app, your website, and your physical POS system without making your business look like a construction zone.

- While Authorize.net lets you set rules, Luqra uses a more modern, data-driven approach that looks at geography, IP, and behavioral patterns to block bad actors without “false positives” that annoy real customers.

Support: Bots vs. Humans

If you’ve ever had a “transaction declined” error that you couldn’t explain, you know how frustrating it is to sit on hold or talk to a chatbot.

- The Support Landscape at Authorize.net:

- Authorize.net offers 24/7 phone support, which is better than many “modern” competitors like Stripe. Like, heads and shoulders better, which I really appreciate.

- However, as they have grown and changed hands (now part of Visa/Cybersource), the support can sometimes feel a bit “big box.”

- You are a ticket number in a massive system.

- The Support Landscape at Luqra:

- Luqra makes a big deal about their U.S.-based support and their dedicated problem solvers.

- For businesses that are working with Luqra, especially those doing high volume or dealing with complex industries, having a direct line to someone who knows their business is a game-changer.

- It’s the difference between a vendor and a partner. A vendor gives you a manual; a partner helps you solve the problem.

My Verdict

If you are a tiny business that just needs a gateway to connect to an old piece of software, Authorize.net is a safe, predictable choice. It’s the “IBM” of the payment world – it’s been around forever and it’s not going anywhere.

However, if you are a growth-minded business looking to streamline your back office, reduce your manual accounting workload, and get a better handle on your actual margins, I think Luqra is the superior choice because of:

- Lower transparent rates that scale with you.

- A built-in Financial ERP that simplifies reconciliation.

- A “merchant-first” approach to risk that prevents cash flow interruptions.

From where I sit, looking at the ledger, the choice is clear. You can keep managing a dozen different tools and statements, or you can move to a single pane of glass and get back to all the other headaches that come with running a business.