Last Updated on December 15, 2025 by Ewen Finser

Payments sometimes feel like plumbing: invisible and seamless when it works, but a flood of problems when it doesn’t.

Luqra wants to change that by bundling up all the messy bits into one interface that puts you in the driver’s seat — a single pane of glass that contains the payment gateway, merchant services, chargebacks, fraud rules, and even an ERP-style back office. The promise is simple: faster deposits, fewer tabs, cleaner reporting, and a support line that knows the difference between interchange and assessments.

So let’s pop the hood and see if Luqra is a real all-in-one or just another processor with a new coat of paint.

What Is Luqra?

Luqra is a U.S. fintech that combines merchant services with an ERP layer for payments operations, compliance, and analytics. The goal? Unify payment endpoints and data silos in one interface with real-time approvals, fraud and dispute handling, and transparent pricing.

- Payment processing & gateway: E-commerce and omnichannel acceptance with a gateway and fast deposits.

- Fintech ERP: A back office for sales organizations, processors, banks, and fintech partners to manage sales, merchant onboarding, compliance, underwriting, and operations all in one place.

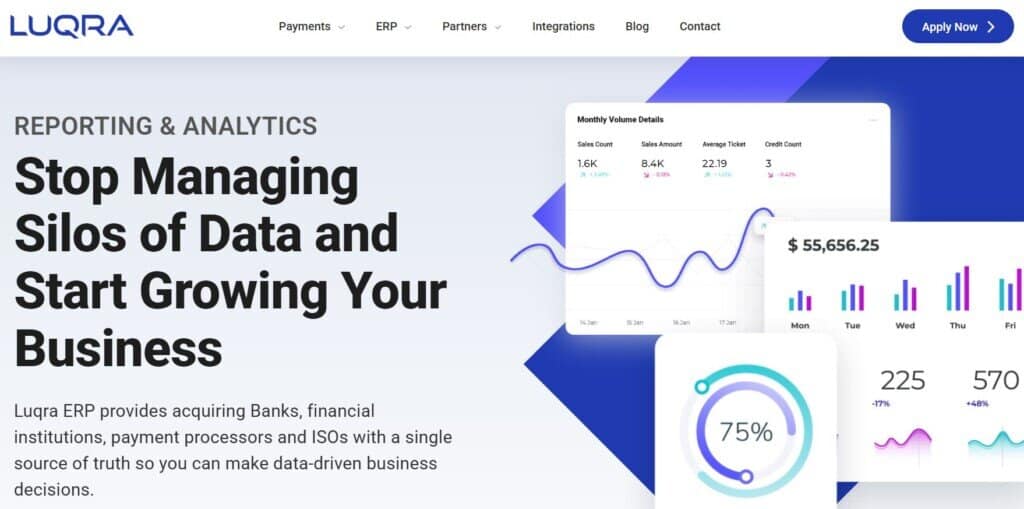

- Reporting & analytics: 360-degree analytics and integrated reporting designed for finance teams who need a single source of truth across payment data.

At a Glance: Pros and Cons

Pros

- A unified stack that includes processing, gateway, disputes, fraud, and analytics in one platform.

- Merchant-friendly posture, with fast deposits, stability messaging, and transparent pricing.

- An ISO/processor ERP that brings together end-to-end sales, underwriting, and compliance tooling for portfolio operators.

- Chargeback and ATO protections are advertised as included vs. requiring separate tools.

- Practical onboarding guidance for e-commerce readiness.

Cons

- The ecosystem and marketplace look smaller than developer-first competitors.

- Community chatter flags RDR/dispute fee questions, so make sure to do a fee audit early and frequently.

- Hardware specifics and POS fleet details are thin on public pages, so make sure to verify device support.

Features and Architecture

Payments

Luqra’s strength, in my opinion, is its online card processing. It’s made for e-commerce and SaaS, not so much the coffee truck on the corner. They do tout in-person POS as a strength, but you’ll need to verify terminal models and authorization rates, while making sure it supports things like tap-to-pay.

Note that the brand emphasizes “lightning-fast” and “turbocharged” deposits, but you’ll need to clarify same-day cutoff times, weekends, and holidays. You should also nail down ACH return handling and whether instant payout rails are offered.

Luqra also advertises free active fraud prevention and account takeover protection. However, during onboarding, make sure you ask which vendors and models they use, what signals set off flags (device, geolocation, behavioral), and how you can tune rules.

A note on disputes: “free chargeback and dispute management” suggests they shoulder tooling rather than charging per case, which is a nice plus. But depending on your needs, you should ask whether they automate Visa Compelling Evidence, Mastercom flows, and RDR integration. While doing so, confirm whether representment fees and network fees are passed through or waived.

The ERP Layer

Luqra’s ERP is something I’m particularly excited to talk about because of how powerful it is. With it, everything about your business is ready to be showcased in an array of seamless and easy-to-read charts.

The fact that it’s all in one place is just a bonus.

- Payment processing: To me, this is the core strength of Luqra. Every transaction that flows through the platform can be tagged and described in a myriad of ways so that it can be pushed to an array of reports that showcase the health of your business.

- Operations & compliance: Dealing with sensitive client data like bank accounts, addresses, and SSNs is a great reason to take security extremely seriously. Luqra does too, and they’re proud to showcase a litany of accreditations on their landing page. There are too many to list here, but a few are DDOS protection, encryption, API protections, and compliance with PCI DSS standards.

- Analytics & reporting: Luqra offers a bi-picture view of everything that goes into your business and builds out reports from that data, aiming to dissolve data silos and bring everything under one umbrella as your ERP and payment processor. Trying to compile information into a master Excel sheet from six different platforms is a thing of the past.

This “fintech ERP” positioning targets the space between traditional acquirers and developer-first gateways. If you’ve grown out of a pure gateway and now run a multi-entity portfolio, the integrated operations layer is attractive. If you’re a startup that lives in code, public docs and ecosystem gravity may matter more than an ERP-style console.

Integrations

Luqra has a comprehensive integration list, but not as comprehensive as what you may find with Stripe. However, Luqra boasts connections with 24 different platforms, including Shopify, Salesforce, Authorize.net, and WooCommerce. If your business relies on tons of connections, make sure that Luqra has what you need before you make the jump.

Performance, Scale, and Risk

Luqra claims real-time approvals and near real-time processing. That’s table stakes now, but still worth testing with edge cases like high-ticket items, cross-border transactions, prepaid BINs, and card-present fallback. If you work with higher-risk businesses that could be subject to a cash crunch (subscriptions, dropshipping, nutraceuticals), ask how they handle rolling reserves, how decisions are explained, and whether risk settings can be tuned.

Reporting and Finance Ops

Card processors win or lose in the month-end tie-out, and you can lose a ton of time getting lost in the weeds if you’re not careful.

Luqra’s pitch around integrated analytics matters if you’re tired of reconciling batches, fees, and reserves across vendors. A practical workflow I’d put to the test would be as follows:

- Daily settlement file that maps to payout batches with fee detail by category (interchange, assessments, processor markup, dispute fees).

- Dispute feed with case metadata, reason codes, evidence status, and fees.

- Invoice or statement artifact that you can attach to your month-end close package.

- GL mapping for merchant fees to hit the proper expense buckets by location or entity.

If they can schedule these into your data lake (or at least SFTP nightly), you slash manual work. Luqra’s analytics messaging suggests that this is feasible, but make sure you confirm export paths and schemas.

The Logistics

Pricing

Luqra is proud of their pricing, and I think they have good reason to be. Their public materials emphasize “transparent pricing,” “meet or beat,” and “no rate increases.”

Translation: They want to compete on interchange-plus (or a similar pass-through model) and promise price stability, with rates as low as 2.3% plus 20 cents per transaction. In my experience, I think that’s relatively fair — I’ve seen some prices go as high as 2.9%.

Implementation and Onboarding

Switching ERPs is always a headache. It costs a lot of time and money, and it’s a huge hassle. That’s perhaps why Luqra comes with an onboarding wizard and readiness checklist, and I would expect their CS team to be there to hold your hand if the going gets tough — a helpful nudge for merchants who may be hesitant to switch due to the associated unknowns.

If I was about to make the switch, I’d ask for a sandbox and implementation plan to make sure that nothing is left up to chance.

Support

Luqra advertises 24/7/365 U.S.-based support and a dedicated success manager. Make sure you get escalation paths in writing, plus SLAs for dispute inquiries, terminal swaps, and incident response. For finance teams, a named point of contact who understands your chart of accounts is gold during close week.

What Luqra Does Well

1) One Payment Application for Everything

As a CPA, I look for how fast I can reconcile cash and card batches, spot leakage, and close the month. Luqra’s ERP framing aims to bridge endpoints into one interface so that all the data I need for my job is at my fingertips in one place. That single source of truth cuts work and helps to reduce errors.

2) Merchant-Friendly Positioning for Online Sellers

While most of my clients are traditional brick-and-mortar SMBs, Luqra really looks to position itself as a powerful tool for online e-commerce platforms. They pitch faster deposits, account stability, and competitive rates that never increase.

In practice, funding speed and stability will always depend on your risk model and industry, but the attention to common e-commerce pain points like held funds, rolling reserves, and slow ACH shows that the product is trying to meet that market where it hurts.

3) Built-In Chargeback and Fraud Management

Many processors upsell fraud and dispute tools or route you to third parties. Luqra advertises active fraud prevention, account takeover protection, and chargeback/dispute management as being included. If these are truly bundled, you can simplify vendor count, which matters for lean teams. I always advise to validate services in your MSA, though.

4) ISO and Processors Coverage

If you’re an ISO, the ERP pitch is simple: end-to-end sales, quick underwriting, and compliance mean fewer custom spreadsheets and fewer systems. That’s rare from a merchant-acquirer brand and reads more like an ops platform than a simple gateway.

Where Luqra Falls Short

1) Anecdotal Evidence of Fee Issues

Anecdotal criticism from Reddit raises concerns about real-time dispute/remediation fees and alleged double-billing. Take this with a grain of salt, but it’s a good reminder to review fee tables and dispute pass-throughs before signing. Also, make sure you’re analyzing your line items to make sure no mistakes are slipping through that will cost you.

2) Limited Ecosystem

While there is an integrations page that mentions tools like Shopify, Authorize.net, Salesforce, and many others, the breadth looks smaller than Stripe/Adyen ecosystems. If you rely on dozens of off-the-shelf connectors, just make sure your stack can play well with Luqra. But I would expect that for most businesses, their ready-to-connect services should be enough.

3) Marketing Claims Need to Be in Contract

“No rate increases,” “free” tools, and “turbocharged deposits” are strong claims, so I would want caps, fee schedules, and service levels codified in the contract. Ask for specific language on pass-through network changes, reserve triggers, and dispute fee handling to avoid surprises.

Who Luqra Is For

- E-commerce brands and omnichannel sellers that want one vendor for gateway, risk, disputes, and reporting.

- ISOs, PayFacs, and portfolio operators who need sales, boarding, underwriting, and compliance in a single ERP and want portfolio analytics native to the platform.

- Finance-led teams that value settlement clarity and integrated analytics to close faster and manage fee variance.

Who Should Look Elsewhere

- Engineer-led SaaS products seeking exhaustive public APIs, SDKs, and a huge partner marketplace. If you live on webhooks and custom routing rules, press hard on documentation and sandbox depth to make sure the platform is what you expect.

- Merchants with deep third-party stacks who rely on marketplace apps and prebuilt connectors across dozens of tools.

Verdict

Luqra is a solid fit for finance-minded merchants, e-commerce operators who want service with bundled risk/dispute tools, and ISOs who need a portfolio-grade back office. The promise of no rate increases, fast funding, and integrated analytics is compelling, but treat those as clauses to capture in the MSA — not just headlines. If your team is engineering-heavy and expects Stripe-level docs and a sprawling marketplace, you may feel constrained.My take as a CPA: Short-list Luqra when you value unified ops and predictable fees, and run a structured pilot with fee audits, auth rate baselines, and end-to-end export tests. If the numbers pencil and the reporting saves you real close time, you’ll feel the win by month two.