Last Updated on December 5, 2023 by Ewen Finser

Deciding to do business is one thing, but selecting the legal structure to go with is another. All the companies today have different legal forms, and you need to understand the options available for you to select the right one for the kind of business you want to form. These different legal business structures have their good and evil, and extensive processes required to form them in different states.

In recent years, the Limited Liability Company has become a popular structure for small businesses seeking liability protection and flexibility. The specific requirements change from state to state, but the common denominator is that it can be formed in a simple process that can be completed in under a day. If you happen to be searching for a way on how to start an LLC in Colorado, here is how to do so, and all the things you will need.

What is a Limited Liability Company?

This is a business structure that borrows the advantages of a partnership and a corporation. They are known for their flexibility and flow-through taxation seen with partnerships while still holding the liability status of a corporation.

The owners are called members, and the business is legally independent of the owners in that they cannot be held liable if the company fails to pay its debts. The hybrid nature makes it a favorable option for many startups looking for a favorable structure to create their business under.

How does an LLC work?

All LLCs should hold an operating agreement that contains the rules and regulations specific to that company. It is not mandatory in Colorado, but best practices dictate that you have it. Some essential clauses in this agreement determine who will run the company, how changes in membership will be done, and how the proceeds will be distributed among other members.

The agreement should explicitly state that the entity is separate from the members. The law in Colorado allows members to seek the services of third-party professionals to manage the LLC. Still, most prefer to have one or a few members to run them since they are small businesses with limited resources.

Most changes in ownership happen if one of the members dies or leaves the firm. The agreement should address these situations to avoid any conflicts and grey areas in the future. Besides, the agreement is used as a reference when these changes are applied, and the state might force the members to dissolve and reform the LLC if some of these issues are not addressed.

Another aspect that the operating agreement should address is how to handle the profits, losses, and taxes. Most LLCs are pass-through organizations whereby the profits and losses are carried forward to the members who include them in their tax returns.

Note that even a single-member LLC needs an operating agreement to protect the owners from liability resulting from any lawsuits against the LLC.

How to form an LLC in Colorado

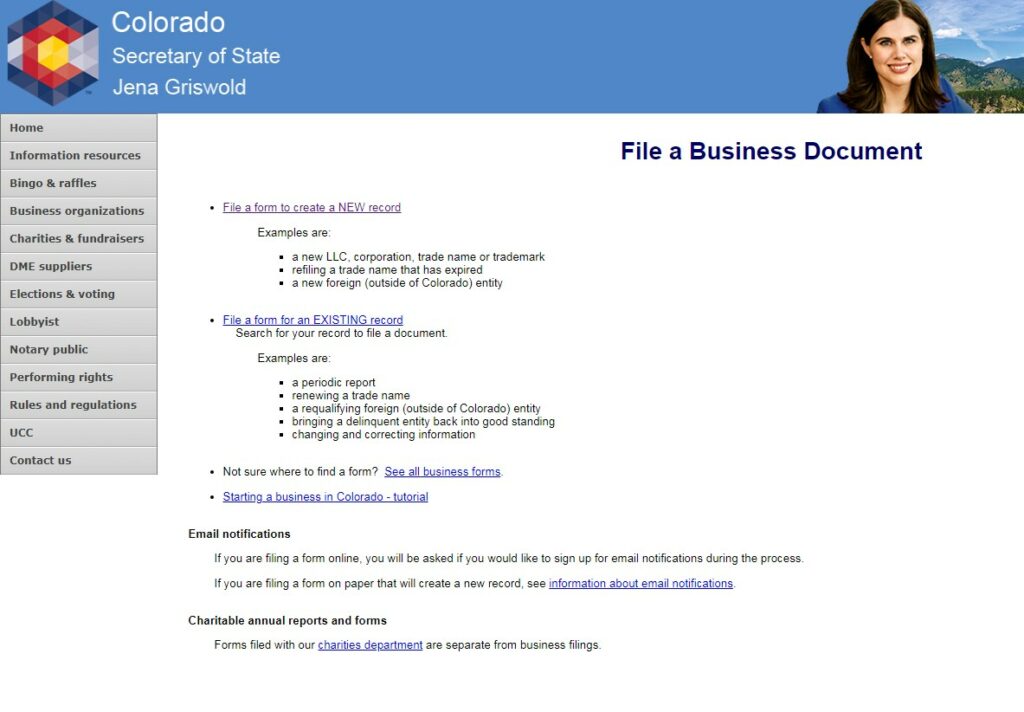

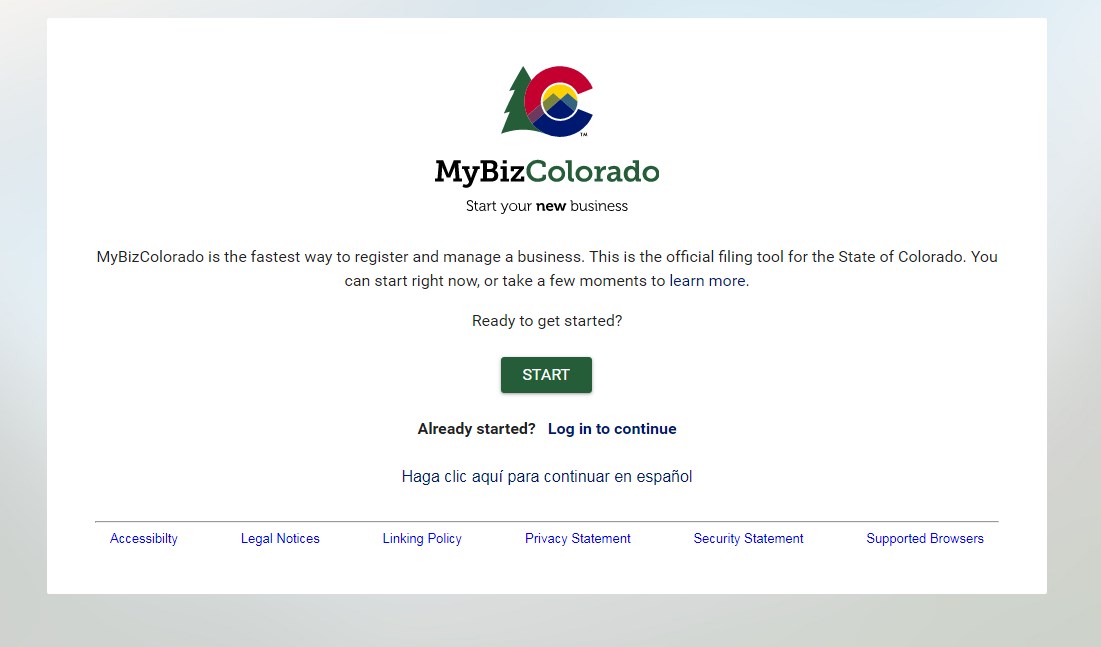

The process of forming an LLC in Colorado is very straightforward, and you can do it online. The Colorado Secretary of State has a simple online registration system that will help you to do this.

Here are the steps;

Check the availability of your preferred business name

You will need a unique name for the LLC as no two companies can have the same name in Colorado. Do not hurry over this step since a good name can help your business. The name is the face of the company, and if people can’t remember it, it can get in the way of your marketing efforts. Take your time and go through conventional business naming structures to ensure you land the right one for your LLC.

Once you get a name, go to the state’s business database to see if it is available. Do not restrict your search to Colorado, and consider checking the US Patent and Trademark Office to see if any business across the states uses that name. You might grow and expand beyond Colorado, and the last thing you want is to find another business with the same name.

Colorado laws indicate that all LLC names should have one of the following terms, Limited Liability Company, Ltd. Liability Company, Limited Liability Co., Limited, LLC, Ltd or Ltd. Liability Co. If you are still unsure about a business name, The Secretary of State allows you to reserve one for up to 120 days here.

Register the LLC

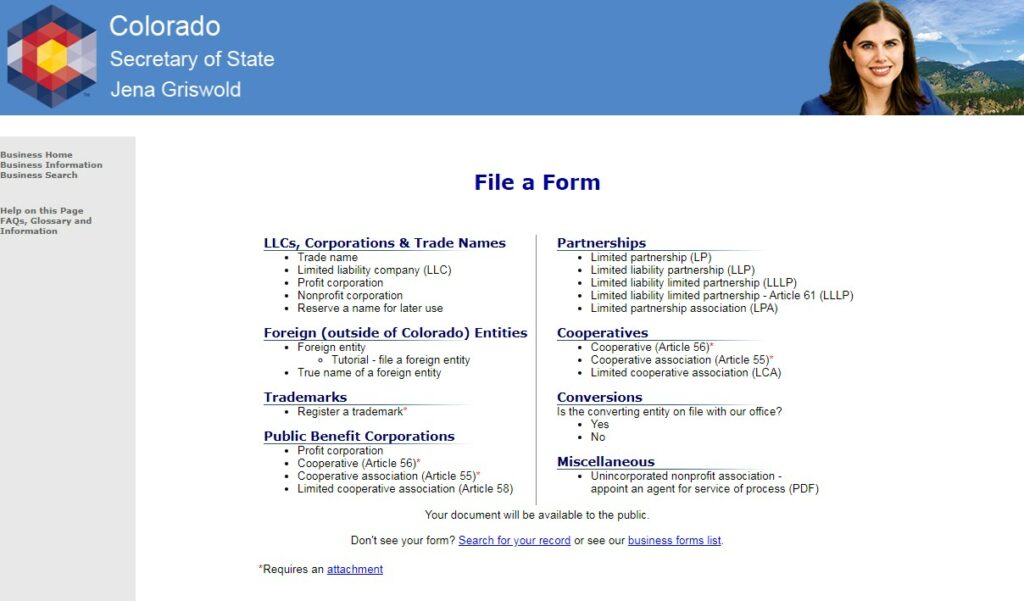

Next is to file the Articles of Organization with the Secretary of State. You will find plenty of templates online, but in Colorado, you can do it on an online form.

Some of the critical things you will need to fill in are the principal addresses which do not have to be located in Colorado. The street address should be a physical one and if you put your home address, know that it will be available online. If you do not want your privacy to be infringed, consider indicating a co-working space or getting the services of a virtual business address.

In addition, you will have to fill in the contact details of your LLC’s registered agent. This entity connects you to the Secretary of State and will receive any legal notices or subpoenas on your behalf. They must give you consent to appoint them. If you are forming a single-member LLC, the registered agent will most likely be you, but you can also appoint another business to act as your agent.

Another crucial part of this form is the legal name of the owners of the LLC. If the LLC belongs to another business entity, say a holding company, its information should be indicated explicitly.

The LLC’s management structure should be highlighted, and two standard options are the member-managed LLC or manager-managed LLC. There should be confirmation that there is at least one member of an LLC for it to be valid. The effective date of the business should be indicated, and it can be as long as 90 days in the future. An email address is essential to keep you in the loop with updates from the Secretary of State and, lastly, the name and address of the person filling the form.

After filling the form, you will be required to pay $50 for it. Always keep a copy of the confirmation page as a reference if there is a hiccup and your payment does not go through.

Secure the business record

While this is not mandatory, it is necessary to keep your record safe from any unauthorized parties making changes. Once you confirm the payment, you will receive a link to “set up Secure Business Filing’ and clock on this to create a password.

This is all it takes to register an LLC in Colorado, but you might be required to do a few more things to make it functional.

These steps include:

Apply for an Employer Identification Number

An LLC is a taxable legal entity, and you will need an EIN to identify it with the IRS. Note that every entity does not require an EIN, and if your answer is NO to all these questions, you will use your social security number instead of an EIN. In simple terms, if your LLC has multiple members and plans to hire employees, you will have to get an EIN.

Get a Bank Account

You will need to keep your personal and business finances separate by getting a dedicated bank account for your LLC. This is useful when trying to prove that the business is a separate legal entity.

Banks will need proof that the LLC is registered with the Colorado Secretary of State. They will ask you to provide an official copy of the Articles of Organization, a Certificate of Good Standing, and a copy of your EIN if applicable. The first two documents can be obtained from Colorado’s Secretary of State’s website.

Get a Wage Withholding Account

If you plan to hire employees and withhold tax from their income, the Colorado statutes require you to open a wage withholding account, which can be done online. This is particularly necessary if you are hiring W-2 employees or withholding taxes from 1099 contractors.

Opening this account will automatically create a sales tax license for your business. This is required if you are going to sell anything.

You do not have to go through the wage withholding account to get a sales tax license, as you can get it online.

File Annual Reports

LLCs in Colorado should file a periodic report with the Secretary of State annually. You can do this online, and the fee is $10. The filing period is specific for every LLC and is due within the three-month period beginning the first day of the anniversary of the date when the LLC was formed.

The Good and Bad of an LLC

Advantages of an LLC

- Few corporate formalities compared to corporations that require members to hold regular meetings and share corporate minutes.

- No restrictions on ownerships such as the number of members who can own one and the nature of owners

- LLCs can operate using the cash method of account where income is not earned until it is received

- Memberships interests can be placed in a living trust

- Active participants can deduct operating losses from their regular income

- Tax flexibility due to the pass-through feature

Disadvantages of an LLC

- In some instances, their profits might be subjected to Medicare and social security taxes

- Owners must automatically distribute profits

- Employees receive few benefits

How to Start an LLC in Colorado: FAQs

Question: Do I need an operating agreement for my Colorado LLC?

Answer: You won’t be asked anywhere to submit an operating agreement when setting up an LLC in Colorado, but it is vital to have one. It will be used as a reference if anything goes wrong and some clarification is needed. It can also protect your limited liability status, avoid any managerial issues and ensure that your LLC is run by your laws and not the state ones that can be unforgiving in some cases.

Question: Can a foreign LLC do business in Colorado?

Answer: All LLCs outside of Colorado must register with the resident Secretary of State to do business. They must appoint a registered agent based in Colorado. The fee for filing a Statement of Foreign Entity Authority is $100, and the process is done online.

Question: Can I form an LLC in Colorado that offers professional services?

Answer: Licensed professionals have to form a Professional Limited Liability Company to offer their services in Colorado. Examples are architects, accountants, dentists, and attorneys, among others. Usually, if you deliver a service that requires you to hold a state license before you can practice, you are a professional service. However, Colorado law only allows an LLC to offer one specific type of service, and all the owners must be licensed or registered to provide this professional service.

Question: Can I set up an LLC without a lawyer in Colorado?

Answer: You do not need a lawyer to register an LLC as the entire process can be completed online.

How to Start an LLC in Colorado: Bottomline

Forming an LLC in Colorado is straightforward, and with all the required information, you can do it in under an hour. However, do not rush over the process and go over the due diligence that will set your LLC up for success and avoid any issues in the future. Things such as operating agreements might not strike as crucial in the first days, but you will need them along the road.

Read More: