- Understanding the Employee Retention Credit (ERC)

- Steps to Check ERC Refund Status

- 4. Use IRS Transcript Services

- Typical ERC Refund Processing Times

- Handling Delays and Follow-Ups

- Common Issues that Delay ERC Refunds

- Best Practices for Monitoring ERC Refund Status

- Managing Client Expectations

- When to Seek Professional Help

- You Can Do This!

Last Updated on April 22, 2025 by Ewen Finser

The Employee Retention Credit (ERC) became a vital lifeline for businesses affected by the COVID-19 pandemic, offering substantial payroll tax credits to help employers retain their workforce during challenging economic times. However, one area of concern that seems to be becoming more common for businesses and accountants alike is tracking the status of their ERC refunds.

As a licensed CPA in the state of Louisiana, it’s essential to guide my clients through understanding how to efficiently monitor their ERC refund status, so I’ve laid out the critical steps, considerations, and best practices for you to follow.

Understanding the Employee Retention Credit (ERC)

Before diving into how to check your refund status, it’s crucial to briefly revisit the basics of the ERC. The ERC, introduced as part of the CARES Act in 2020 and subsequently expanded, allows eligible employers to claim refundable credits for wages paid during the pandemic. Businesses that experienced a significant decline in gross receipts or were subject to mandatory full or partial shutdowns could benefit substantially from this credit, often to the tune of hundreds of thousands of dollars.

Steps to Check ERC Refund Status

Here is a step-by-step guide for business owners, CPAs, and other professionals to efficiently track their ERC refund:

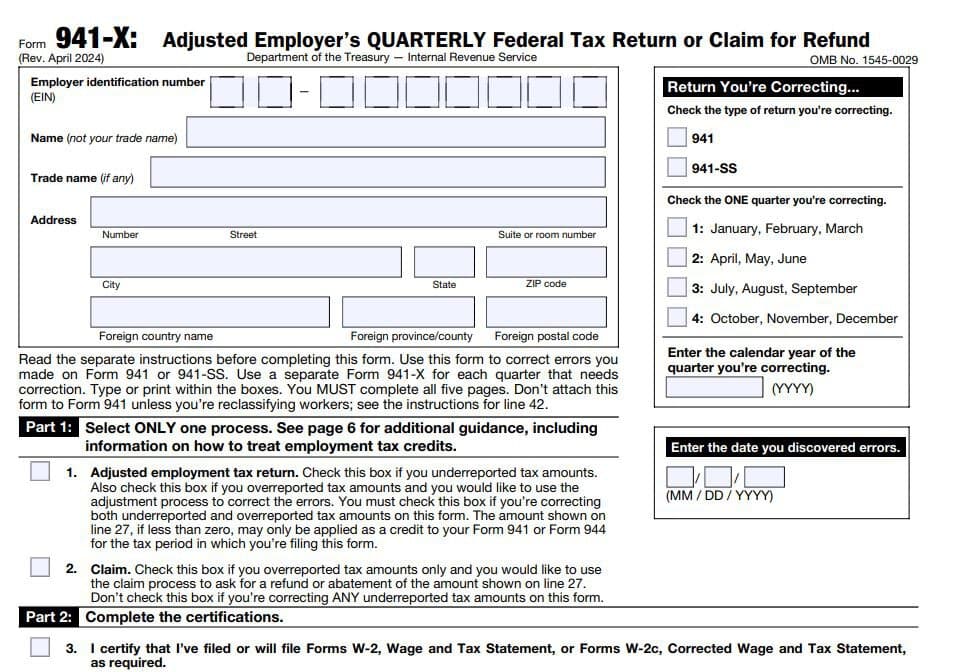

1. Confirm Submission of Forms

The first step in checking your ERC refund status is confirming that the applicable forms have been correctly filed with the IRS. The most common forms for claiming the ERC are:

- Form 941-X: Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

- Form 941: Employer’s Quarterly Federal Tax Return (if initially claiming ERC credits directly).

Ensure that forms have been correctly completed and accurately submitted, as errors or omissions will significantly delay the refund process.

2. Check Online via IRS.gov

One of the most straightforward ways to monitor your refund status is through the IRS’s online tools. However, it’s important to note that while the IRS provides “Where’s My Refund?” for individual returns, no direct equivalent currently exists specifically for ERC refunds.

Instead, you may verify that your forms were received using your IRS online account or the Electronic Federal Tax Payment System (EFTPS) if you filed electronically.

3. Call the IRS Business Helpline

To inquire specifically about the ERC refund, the IRS recommends contacting their dedicated business line:

- IRS Business and Specialty Tax Line: 800-829-4933

When calling, ensure you have critical identifying information on hand:

- Business name and Employer Identification Number (EIN).

- The quarter(s) in question.

- The specific forms submitted and submission dates.

Expect potentially long wait times due to high inquiry volumes, so plan accordingly. And when I say long wait times, I’m talking about potentially hours. And if you don’t have the above information or the Power of Attorney for the person you’re speaking on behalf of, the IRS Agent will not be able to provide you with useful information.

4. Use IRS Transcript Services

CPAs and authorized representatives with Power of Attorney (Form 2848) or Tax Information Authorization (Form 8821) may obtain IRS account transcripts. These transcripts offer detailed information about posted transactions, including the processing status of Form 941 or Form 941-X submissions.

- Online via e-Services: CPAs can use IRS e-Services to quickly retrieve account transcripts.

- Mail: If electronic access is unavailable, request transcripts using IRS Form 4506-T.

Transcripts can clarify whether the ERC claims have been processed or if additional action by the taxpayer is required. This is helpful so you don’t have to wait for the IRS to reach out to you, but instead can be proactive and send the IRS what it needs before being reached out to by the governmental agency.

Typical ERC Refund Processing Times

The IRS has acknowledged substantial processing delays due to the high volume of ERC claims submitted. Under normal conditions, processing typically takes between 3-6 months, but current wait times can extend beyond 6-12 months or more.

I’ve mentioned in previous articles and videos that the longest I’ve had a client wait for an ERC credit is 3.5 years. We filed in late 2021, and did not receive the tax credit until Feb of 2025. This is very atypical, though.

Delays can also occur due to:

- Errors on submitted forms.

- IRS requesting additional documentation or information.

- Complexity of claims involving multiple quarters and adjustments.

Handling Delays and Follow-Ups

If you experience extended delays or believe an error has occurred, take proactive steps:

- Verify the IRS has received your submission by using your EFTPS account or calling the IRS.

- Submit Form 2848 (Power of Attorney) if you haven’t already done so, allowing CPAs or other professionals to engage directly with the IRS on your behalf.

- Regularly review IRS account transcripts to identify processing updates or issues.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.

Common Issues that Delay ERC Refunds

1. Incorrect or Missing Information

One common pitfall leading to delayed refunds is submitting incomplete or inaccurate forms. Ensure that all information, including EIN, payroll data, calculation of credits, and employee counts, is meticulously verified and accurate.

2. Duplicate Claims

Businesses that mistakenly submit duplicate ERC claims for the same quarter may face substantial delays while the IRS verifies claims’ validity. Confirm that no prior claim has been submitted before filing a Form 941-X.

3. IRS Requests for Additional Documentation

Be prepared to quickly respond to IRS notices or documentation requests. Delays in responding can further prolong the processing period.

Best Practices for Monitoring ERC Refund Status

- Maintain Accurate Records: Keep detailed records of all submissions, including date-stamped copies of forms filed and documentation supporting your ERC calculations.

- Proactive Communication: Regularly update your clients or stakeholders on the refund status and anticipated timelines to manage expectations.

- Stay Informed: Regularly review IRS communications, updates, and guidance to stay ahead of potential changes or announcements impacting ERC processing times.

Managing Client Expectations

As a CPA, transparency and clear communication with your clients are paramount. Inform your clients proactively about potential delays, IRS processing timelines, and steps taken to monitor and expedite refunds. Providing realistic timelines and regular status updates helps manage expectations and maintains client confidence. While the client may certainly begin to get antsy after 12 months, there’s not much that can be done when dealing with the opaque behemoth that is the IRS.

When to Seek Professional Help

If your business’ or your client’s ERC refund is excessively delayed, or if complexities arise (such as audits, requests for extensive additional information, or significant discrepancies in refund amounts), consider consulting specialized tax professionals. Expert CPAs and tax attorneys can effectively navigate challenging situations, advocate on your behalf, and expedite resolutions. While expensive, if your business is in peril due to delayed funds, it may be worth the headache to engage in a true expert.

You Can Do This!

Tracking the status of an ERC refund may involve multiple methods, persistence, and detailed attention to IRS communication. By following structured procedures, proactively addressing potential issues, leveraging IRS resources, and utilizing technology, businesses and CPAs can efficiently manage and track ERC refund claims.

Regular, transparent communication remains vital, reinforcing trust between CPAs and their clients while ensuring compliance and timely refunds during a challenging period. With diligence and organization, CPAs can successfully navigate the ERC refund process, bringing vital financial relief to businesses during ongoing economic recovery.

Most ERC applications are stalled with traditional CPAs and accounting firms. The only firm I've found that is able to expedite and get ERC funds approved in this environment is IRSplus.