- The Bottom Line Up Front

- First Off, What Is a Credit Card Reconciliation?

- Why Automate It?

- The Accounting Software with The Most Robust CC Recon Module

- Step-by-Step: How to Automate Your Credit Card Recs with Puzzle

- 2. Set Up Your Accounting Ledgers

- 3. Review and Confirm Suggested Matches

- Common Mistakes I See (and How to Avoid Them)

- Who Should Use a Tool Like This?

- What About Security?

- What If You Already Have a System in Place?

- Final Thoughts

Last Updated on August 15, 2025 by Ewen Finser

I’ve been doing this a long time. I’ve reconciled accounts manually when there were no better options, and I’m talking about accounts that get over 1500 transactions a month. It took HOURS. I’ve cleaned up messes left by “automated” systems that promised more than they delivered. And I’ve had those 10 p.m. moments where I find a rogue $74 charge that breaks the whole reconciliation and makes me want to throw my laptop through a wall.

So trust me when I say this: if you’re still doing credit card reconciliations manually – or if your automation tool is causing more headaches than help – it’s time for a better approach.

For startups and small businesses, your time and resources are stretched thin. You need your books to be clean, fast, and accurate without having to babysit every transaction. That’s where automated reconciliation tools come in. And yes, I’ve given more than my fair share a go. Let’s break it down in plain English.

The Bottom Line Up Front

If you’re a startup or small business still doing manual credit card reconciliations, you’re wasting time and inviting the opportunity for errors. Automated tools like Puzzle.io, which I will be using in today’s walk-through article, make the process faster, more accurate, and less painful – without the bloat of traditional accounting systems. It’s the kind of upgrade that pays for itself in clean books and fewer headaches.

First Off, What Is a Credit Card Reconciliation?

If you’re not an accountant, you may have never even heard the term bank reconciliation. Or credit card reconciliation, for that matter. Credit card reconciliations are the process of matching transactions recorded in your accounting system (i.e., the books) to the actual charges reported by your credit card provider. The goal is to ensure everything lines up – what you think you spent is what you actually spent.

It sounds simple, but in practice, it gets messy:

- You might have dozens – or hundreds – of small charges in a month.

- Your credit card feed might import incomplete data due to syncing issues, or broken bank feed connections.

- Human error creeps in if reconciling manually.

- Refunds, duplicate charges, and vendor name inconsistencies make it even worse.

If you’re still reconciling by hand or using tools that force you to click through each transaction one at a time, you’re not alone. I’ve seen companies with $200MM+ in revenue still stuck in the accounting hellscape that is manual reconciliations.

Why Automate It?

Here’s what automation gets you:

- Speed – What used to take hours can now take minutes (maybe even SECONDS if your system is that well implemented).

- Accuracy – Eliminates human error, especially when vendor names don’t match.

- Audit Trail – Clear logs of which entries were matched and why.

- Consistency – Month-end closes don’t get delayed due to missing transactions.

- Sanity – You stop dreading reconciliation day (I used to HATE the 1st of each month, and my wife wouldn’t see me from 5 AM to like 10 PM, it was an absolute slog!)

The Accounting Software with The Most Robust CC Recon Module

I’ve worked with QuickBooks, Xero, NetSuite, and plenty of third-party plug-ins. They all have pros and cons.

But for startups, lean teams, and small businesses, I’ve found Puzzle.io hits the right balance of automation, clarity, and control without overengineering it.

Here’s why:

Feature | Puzzle | Traditional Tools |

Real-time transaction sync | · Instant updates from cards | · Can be delayed due to sync or broken connections |

Smart matching rules | · Learns patterns as you use it | · Requires manual setup and lots of trial and error |

Multi-user collaboration | · Built for teams | · Often single-user oriented |

Startup-friendly setup | · Easy onboarding | · Can require help from experienced folks |

Clear audit trail | · Always visible, exportable | · Often buried or missing |

The reason Puzzle stands out to me isn’t just the tech – it’s the design of the workflow. It feels like it was built by people who’ve actually had to do reconciliations, which I really appreciate.

Step-by-Step: How to Automate Your Credit Card Recs with Puzzle

Here’s a walkthrough for setting it up right the first time.

1. Connect Your Credit Card Account

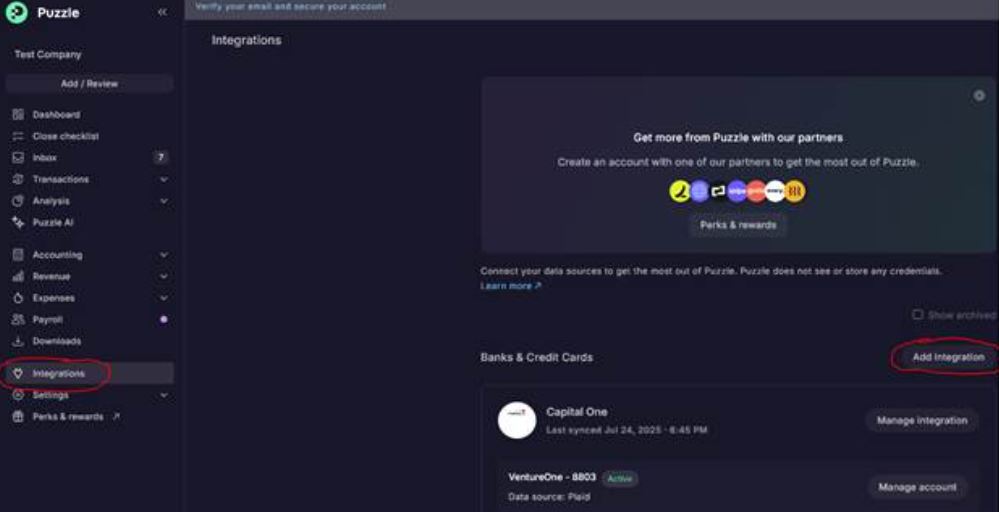

Once you create a Puzzle account, go to the “Integrations” tab and click “Add Integration.” Choose your card provider – most major U.S. banks are supported.

Puzzle uses Plaid (a secure industry standard) to sync your transactions.

Pro tip: Connect all business credit cards up front. Puzzle can handle multiple cards under one reconciliation cycle.

2. Set Up Your Accounting Ledgers

During setup, it’s wise to browse the preloaded chart of accounts to ensure it has the typical expenses your business may find itself incurring. Navigate under Accounting, select Chart of Accounts and configure the accounts to match what your business needs. For instance, I don’t believe fuel expense is a preloaded account – if your business has a fleet of vehicles, you’d want to add it now.

3. Review and Confirm Suggested Matches

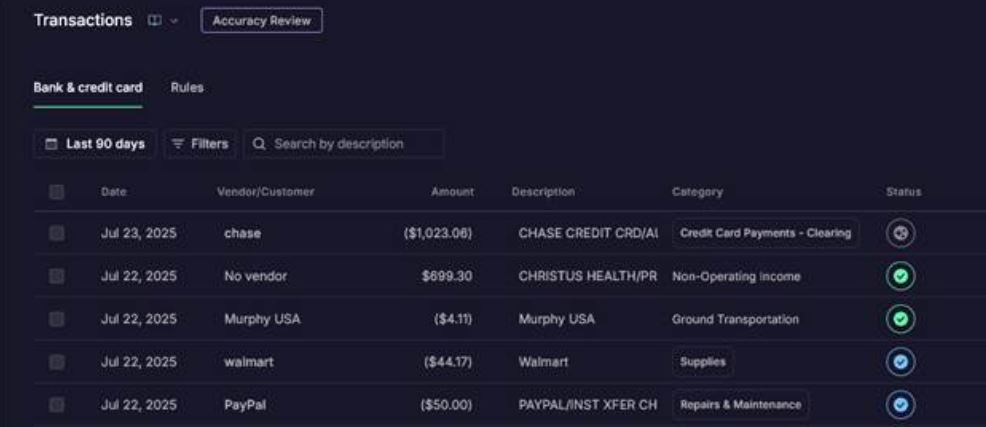

Here’s where the automation starts to shine. It’s also where many tools get messy. Puzzle’s mapping interface is clean and intuitive. Navigate back to “Transactions,” and select “Bank and Credit Cards.”

Puzzle will:

- Match imported card transactions with entries in your ledger.

- Flag items that look like duplicates or may need a second look

- Auto-categorize recurring charges (like Zoom or AWS).

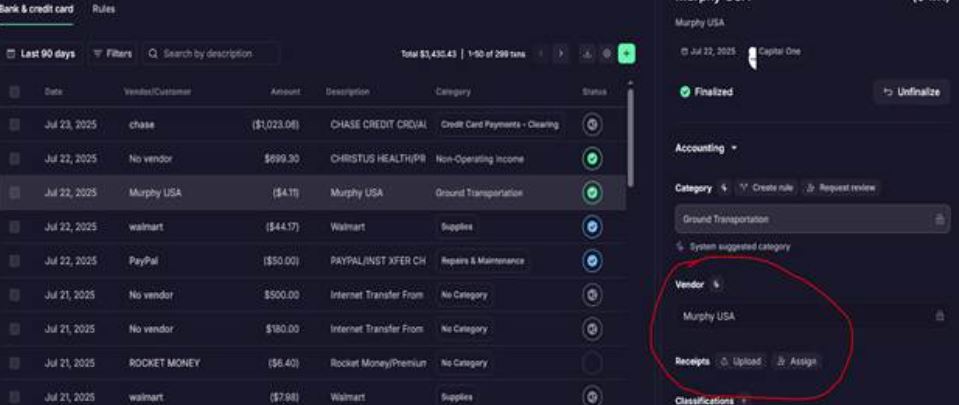

You review the suggested matches and confirm with a single click – or override if something looks off. Once something is finalized, you can mark it and it’ll turn green, if it’s something you’ve assigned as a user that needs to be finalized, it’ll be blue. Unknown and uncategorized items remain gray until you assign an expense account.

4. Add Supporting Detail or Receipts

Need to attach receipts or memos for audit purposes? Puzzle supports uploads, tagging, and internal notes. Just click on the transaction, and load it up. You can also assign team members within the transaction to have users investigate further, book it, etc.

5. Finalize and Lock the Period

Once everything matches and the balance is reconciled, you can close out the period and export a reconciliation report. This becomes part of your audit trail and can be shared with your accountant, CPA, or investors.

So What Makes Puzzle Different From the Other Tools I’ve Used?

Let me give you a quick comparison from my own experience. I’ve used traditional accounting platforms, and I’ve used bolt-on reconciliation tools that promise the moon but end up just creating more review work.

Here’s where Puzzle sets itself apart in day-to-day use:

1. It Doesn’t Over-Automate

Some platforms try to match everything automatically, even when the context is off. Puzzle uses logic – but it always shows you the reasoning. You still have control, and that’s crucial.

I’d rather double-check a suggested match than undo five bad ones later. Puzzle keeps me in the driver’s seat without slowing me down.

2. It Learns Over Time (Without Getting Sloppy)

Most reconciliation tools can remember basic matching rules. Puzzle does that too – but it gets more specific. Over time, it starts to recognize how you categorize vendors, how your GL is structured, and how your team handles specific types of spend.

I’ll give you an example. In QBO, if a client has a couple of checks that are paid to employees for Payroll and I see them in the bank feed as Check # XXXX, when I correctly mark the checks as a Wage Expense, QBO assumes everything with bank text as Check # XXXX is for Payroll. Even though it can be for anything from building maintenance to automotive repair, to COGS. It’s super frustrating, and Puzzle doesn’t typically do that.

3. It Doesn’t Require a Full ERP Setup

Puzzle was clearly built for lean teams. I’ve seen clients handle their own reconciliations in Puzzle with zero prior accounting experience. And I’ve seen growth-stage startups use it to speed up close with small finance teams.

You don’t need to build a complex ERP system to get clean reconciliations.

Common Mistakes I See (and How to Avoid Them)

Even with automation, things can go sideways if you don’t set the foundation right. Here are a few issues I’ve seen more than once:

Mistake #1: Not syncing often enough

Some platforms only pull transactions once a day. That’s fine if you reconcile monthly – but most growing teams want real-time visibility. Puzzle syncs throughout the day, which cuts down on lag and surprises.

Mistake #2: Ignoring vendor naming issues

If you’ve reconciled manually, you know the pain: a charge from “AMZN Mktplace” doesn’t match “Amazon AWS.” Even with automation, naming conventions can trip things up. In Puzzle, I recommend setting aliases for common vendors and letting the tool learn from your corrections.

Mistake #3: Treating reconciliation as a once-a-month task

This one’s big. If you wait until the end of the month to review charges, you’re behind (I’m guilty of doing this – procrastination at its finest). Reconciliation is much smoother when it’s continuous. With Puzzle, reviewing every few days is quick and painless – and it makes your close much faster.

Who Should Use a Tool Like This?

You don’t need a full-time controller to benefit from automated reconciliations. In fact, the earlier you implement automation, the better your books will look when you do bring on a controller or prepare for a raise.

Here’s who I think benefits most:

- Startups and solopreneurs – If you’re using your credit card heavily and don’t have a dedicated bookkeeper yet.

- Small finance teams – Especially those managing multiple cards, shared expenses, or recurring vendor payments.

- VC-backed companies – Clean financials matter when you’re preparing reports for investors or due diligence.

And if you’re still doing monthly reconciliations in spreadsheets? Cut it out! You’re spending time on a problem that’s already been solved.

What About Security?

This question comes up often, and rightly so. Puzzle uses bank-grade encryption and secure data syncing through Plaid. No credentials are stored on Puzzle’s servers, and read-only access means the tool can’t move money – it can only read and match data.

You can also set granular user permissions – helpful when you want a founder, ops manager, or external bookkeeper to have access without giving them full control.

What If You Already Have a System in Place?

If you’re using QuickBooks Online or Xero and you already reconcile within those tools, that’s fine. They can get the job done, but almost never as quickly as what I have found with Puzzle. I mean, I can do months of reconciling in seconds if everything lines up the way it’s supposed to, and that is just absolutely an amazing feeling!

In other words, you don’t have to rip out your current process if it works, but if you’re still using spreadsheets… well, I probably don’t need to explain the benefits again.

Final Thoughts

As a CPA, my job is to reduce risk, save time, and keep financials clean. Automated credit card reconciliation isn’t a luxury anymore – it’s absolutely necessary for operating a growing business.

There are a lot of tools out there. But in my experience, Puzzle strikes the right balance of automation, transparency, and usability. It doesn’t try to be everything. It just gets the job done, and it does it well. You don’t have to chase down every $12 charge. You don’t have to spend hours manually matching transactions. And you definitely don’t need to accept messy books as the cost of doing business.

Reconciliation should be fast, accurate, and uneventful. With the right setup, it can be.