- The Quick Rundown: Overviews of Each Platform

- The Details: User Interface and Experience Comparison

- So What Platform is Best for What Business?

- The Big Stuff: Automation, Integrations, and AI

- Other Key Things to Think About: Scalability & Team Features

- What are the Costs?

- Real-World Use Cases

- Benefits for Accountants and CPAs

- Security and Compliance

- Where Each Platform Falls Shy

- Future Platform Support

- Conclusions and Recommendations: What’s Right For My Business?

- Final Thoughts

Last Updated on May 23, 2025 by Ewen Finser

In the world of accounting software, two platforms that cater to vastly different ends of the market, FreshBooks and Puzzle.io, have caught the attention of business owners, bookkeepers, and CPAs. As a CPA myself, I believe both tools are designed to simplify financial management, but they reflect two very different philosophies in approach, functionality, and audience. Read our full FreshBooks vs. Puzzle.io review for more!

The Quick Rundown: Overviews of Each Platform

FreshBooks: Simplicity First

FreshBooks was originally built with freelancers and small service-based businesses in mind. Its hallmark is simplicity: intuitive design, user-friendly interfaces, and clean navigation. It’s particularly popular among solopreneurs, creative agencies, consultants, and contractors.

FreshBooks offers essential accounting features like:

- Invoicing and estimates

- Time tracking

- Expense management

- Basic project management

- Double-entry accounting

- Mileage tracking (via mobile app)

Its main selling point is ease of use—perfect for non-accountants who want to manage their finances without dealing with intimidating general ledger entries or complex financial reports.

Puzzle.io: Built for the Accountant’s Brain

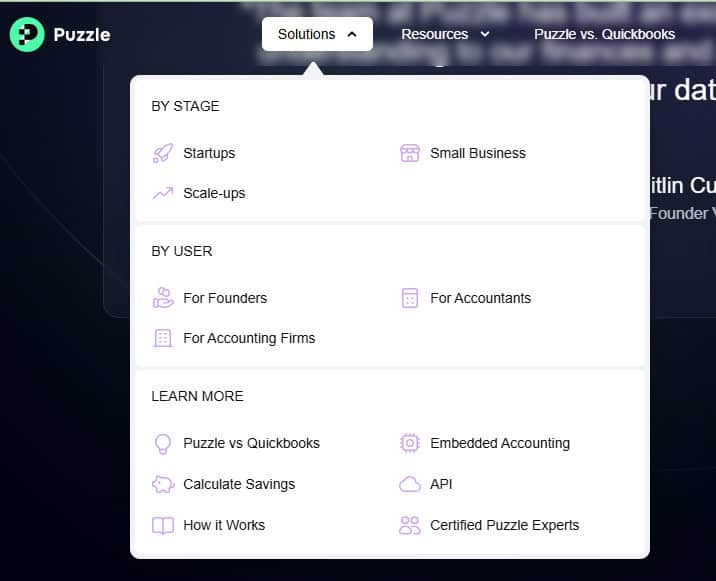

Puzzle.io, in contrast, is a new-generation accounting platform built explicitly for modern finance teams, startups, and scaling businesses. It’s particularly attractive to start up companies to Series B companies that need investor-grade reporting, accrual accounting, and audit readiness out of the box. Puzzle leans heavily into automation, AI-assisted reconciliations, and real-time financial visibility. It integrates directly with your bank accounts and corporate cards, syncing data instantly and intelligently classifying transactions.

Core Puzzle features include:

- Automated accrual accounting

- Real-time P&L, balance sheet, and cash flow visibility

- Direct integrations with Ramp, Brex, Mercury, and Gusto

- In-app audit trail and supporting documentation

- Investor-ready reporting

- Multi-entity support (coming soon)

- AI-driven categorization and error detection

In short, Puzzle is built for accountants, by accountants, but it also gives startup founders a powerful self-service financial view without relying on clunky spreadsheets.

The Details: User Interface and Experience Comparison

FreshBooks UI and Its Target Market

In my experience, FreshBooks wins major points on accessibility. It’s designed for users with little to no accounting background. The interface is clean, minimalistic, and mobile-friendly. Navigation is simplified, with large icons and dashboards that emphasize client invoicing, payments, and outstanding balances. Ya know, the typical stuff that non-accountants would be interested in because they’re running their business, not trudging through the numbers.

While this is great for ease of use, professional accountants often find FreshBooks too limited. Features like accrual accounting, advanced reporting, or multi-user audit controls are often either locked behind higher tiers or missing entirely.

Puzzle’s UI and Who It Caters To

Puzzle.io is purpose-built for teams managing complex financials. The interface is a hybrid between a modern web app and a traditional ERP dashboard. Accountants will immediately recognize the ledger-first orientation, journal entries, and clean drill-downs for every transaction. And I can not stress how much I appreciate the drill down features, it is so so helpful when deep researching aged or ambiguous transactions.

Despite being more robust, the UI remains slick and modern, especially compared to legacy systems like QuickBooks Desktop or NetSuite. For those used to tools like Carta, Ramp, or Notion, Puzzle’s design will feel familiar and contemporary.

So What Platform is Best for What Business?

In my opinion, FreshBooks is ideal for invoice-first businesses who care about getting paid quickly, managing contractors, and tracking hours. Puzzle, on the other hand, is geared toward companies preparing for scale, compliance, and financing rounds. Each platform does an excellent job of catering to its target market.

The Big Stuff: Automation, Integrations, and AI

FreshBooks

FreshBooks offers integrations with:

- Stripe

- Gusto (very limited)

- Zapier

- Shopify

- Trello

Automations tend to be simple, like auto-charging invoices or sending reminders. These are great for solo users, but don’t meet the needs of finance departments handling thousands of transactions per month.

Puzzle

Puzzle’s automation is on another level.

- Real-time sync with bank feeds

- Smart matching of receipts to transactions

- Pre-built integrations with modern fintech stacks (Ramp, Mercury, Brex)

- Native Gusto payroll sync that journals wages, taxes, and benefits

- GL posting automation based on transaction logic

- AI-led anomaly detection and error flagging

In practice, this means Puzzle reduces month-end close work dramatically. For example, you can open your dashboard and see your income statement, with support documents, fully updated—daily.

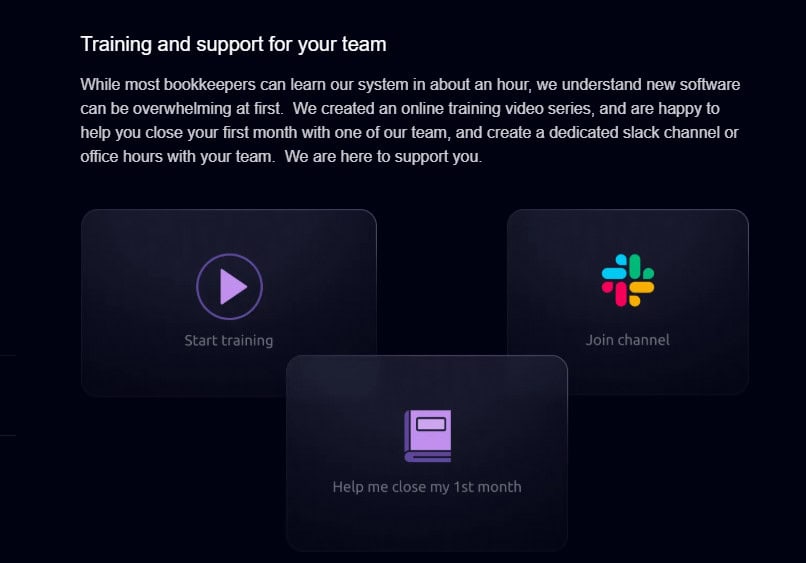

Other Key Things to Think About: Scalability & Team Features

FreshBooks

FreshBooks was built for individuals and small teams. It starts to break down when:

- You need more than 2–3 team members

- You require access controls or role-based permissions

- You need complex reporting, audit readiness, or investor communication

While the software does support “accountant access,” it’s more of a bolt-on than a real collaborative feature set.

Puzzle

Puzzle is inherently team-friendly. It supports:

- Multi-user access with roles (bookkeeper, controller, CFO, founder)

- Activity tracking and audit trail on all entries

- Collaboration workflows between external accountants and internal teams

It was designed with compliance, internal controls, and financial accuracy in mind.

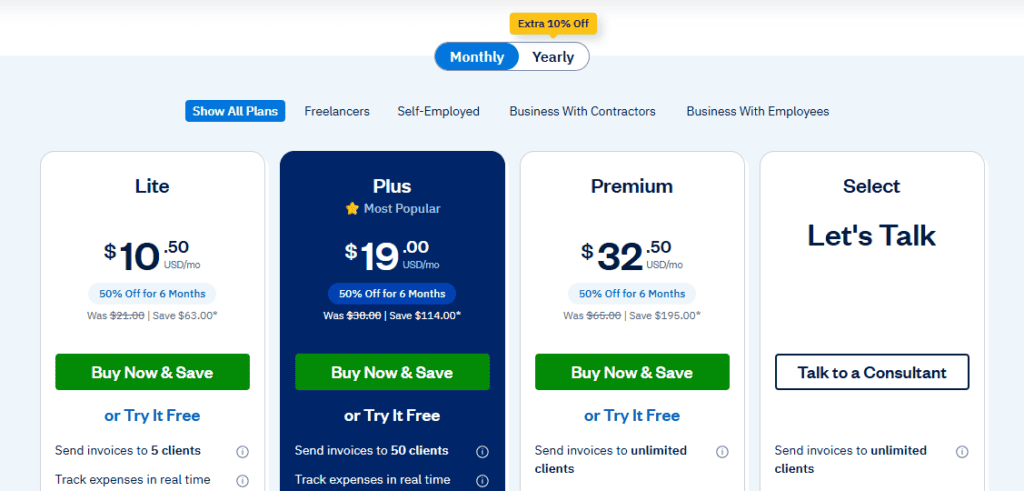

What are the Costs?

FreshBooks Pricing (as of 2025)

FreshBooks uses a tiered subscription model:

- Lite: $19/month (5 clients)

- Plus: $33/month (50 clients)

- Premium: $60/month (unlimited clients)

- Select: Custom pricing (for larger businesses)

Add-ons like additional team members or advanced payments cost more. There’s no free tier, but a 30-day free trial is available.

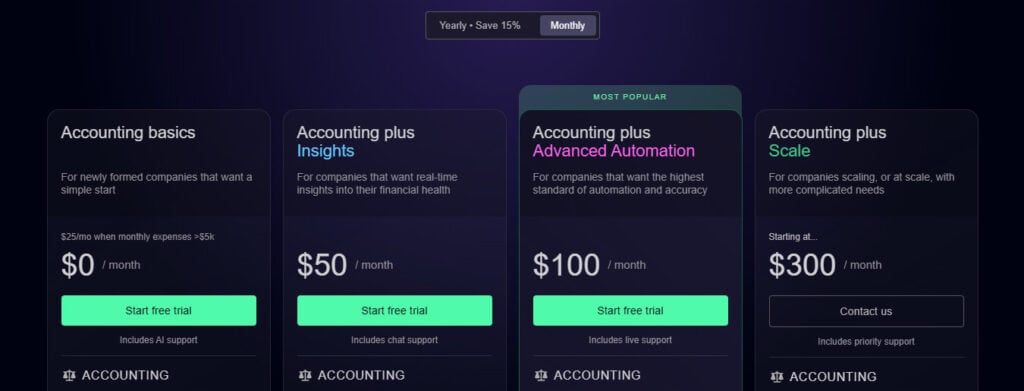

Puzzle’s Pricing

Puzzle.io offers free access for early-stage startups, which, as a cheapskate, I love. You get to try out the basic features and see if you like it. After that, they offer different pricing structures, most of which I think are reasonably priced. They’re as follows:

- Basics: $0/month, and gets you the absolute minimum

- Accounting Plus: $50/month, unlocks most automation options within Puzzle

- Advanced Automation: $100/month, unlocks the full package, and gives additional insights, as well as using AI to help close the month-end

- Custom: For larger companies with growing finance teams, offers custom solutions

This approach is perfect for tech startups or fast-growing eCommerce brands that need real-time accrual accounting but don’t want to burn cash on NetSuite, Oracle, or SAP.

Real-World Use Cases

FreshBooks: Solo Practitioners and Small Service Businesses

In my experience, FreshBooks shines when used by:

- Freelancers (designers, consultants, writers)

- Small service-based companies (plumbers, tutors, personal trainers)

- Businesses with simple bookkeeping needs and a focus on invoicing

Take, for example, a wedding photographer. They can use FreshBooks to send out proposals, track time spent editing, invoice clients, collect online payments, and handle simple expense tracking—all from one dashboard, without needing a background in accounting.

However, once that same photographer grows into a studio with 3+ employees, inventory, or complex cost allocations, FreshBooks becomes restrictive. Multi-user collaboration, custom reports, and audit support fall short quickly.

Puzzle.io: Startups and Modern Finance Teams

Puzzle.io is ideal for:

- Startups preparing for funding or audits

- SaaS companies needing deferred revenue tracking

- Founders who want investor-ready books without hiring a full controller

- Finance teams automating reconciliations and reducing close time

Let’s say you’re a SaaS company. You’re running payroll through Gusto, corporate cards through Ramp, and receiving Stripe revenue across multiple countries. Puzzle connects all of those tools, automatically performs the journal entries, and allows your external accountant to collaborate in-app. It also handles things like accruals, expense classification, and revenue mapping with zero spreadsheet exports.

Let me summarize this for you: FreshBooks helps you get paid. Puzzle helps you get funded.

Benefits for Accountants and CPAs

FreshBooks: Light-Touch Client Support

In my experience, managing clients on FreshBooks is relatively easy for very small operations. You can request access to their books, run basic financial reports, and export data for tax prep.

However, I’ve found that problems arise when:

- You need to adjust prior-year transactions

- The client wants GAAP financials

- You require full balance sheet integrity

- You’re preparing the books for a bank loan or capital raise

In these cases, FreshBooks lacks the necessary tools to function as true accounting software—it’s more of a hybrid between bookkeeping and business management.

Puzzle: An Accountant-Centric Platform

Puzzle was built to make an accountant’s job easier. It includes:

- An accountant portal with tools tailored for monthly closes

- Journal entry automation

- Full GL visibility and audit logs

- Support for deferred revenue and accruals

- Export-ready reports for tax, investor, or compliance needs

It essentially serves as an ERP-lite platform, handling complex accounting logic with startup simplicity.

Security and Compliance

FreshBooks Security

FreshBooks provides standard small-business-grade security. You’ll typically find these in other platforms like QBO or Xero – they’re essentially industry standard:

- TLS encryption

- 2FA

- GDPR compliance

- Data backups and SOC compliance via third-party infrastructure

It is secure enough for most non-regulated businesses but lacks tools for granular permission control or advanced audit readiness.

Puzzle’s Security

Puzzle takes security and compliance a bit more seriously. Some of the features baked into the platform are:

- SOC 2 Type II certification

- Detailed audit trail for all transactions and user activity

- Role-based access control for team members

- Immutable ledgers and logs for financial integrity

- Support for board and investor reporting

These features make Puzzle.io a trusted system of record, which is especially important for companies preparing for due diligence, audits, or M&A events.

Where Each Platform Falls Shy

FreshBooks Weaknesses:

- No real accrual accounting (only cash-based)

- Inferior scalability

- Weaker collaboration tools

- Limited chart of accounts flexibility

- Not audit-friendly

Puzzle.io Weaknesses:

- No native invoicing or payment processing

- Steeper learning curve if you’re not accounting-savvy

- Not ideal for brick-and-mortar or hourly-service providers

- Still growing: some enterprise features pending (e.g., inventory)

- Not a legacy software, so historical support for issues isn’t available

Future Platform Support

FreshBooks

FreshBooks continues to evolve—but slowly. Its focus remains squarely on solopreneurs and small services, which makes it unlikely to add robust features like consolidated entities, custom GL mapping, or compliance support. Its ecosystem thrives because of simplicity, not depth. I would expect iterative improvements, but not major leaps into mid-market ERP territory.

Puzzle

Puzzle is aggressively positioning itself as the AI-powered, modern ERP for startups and lean finance teams. Its roadmap includes:

- Customizable financial reporting

- Deeper integrations with tax and audit platforms

- Real-time forecasting powered by accounting data

As the accounting world moves further into continuous close and real-time finance, Puzzle is ahead of the curve—building a future where your books are never out of date.

Conclusions and Recommendations: What’s Right For My Business?

Use FreshBooks if:

- You’re a freelancer or small business without employees

- Your accounting needs are basic, and you just need to track time, send invoices, and collect payments

- You don’t need accrual accounting, investor reports, or GAAP compliance

- You want a dead-simple app to run your business without hiring a bookkeeper

Use Puzzle if:

- You run a tech-forward startup, eCommerce brand, or venture-backed company

- You need automated reconciliations, real-time dashboards, and scalable accounting infrastructure

- You work with a CPA or fractional finance team and want a shared, source-of-truth platform

- You need audit and investor-ready financials—without spending $20k/year on accounting platforms

Final Thoughts

FreshBooks and Puzzle.io are not direct competitors. They exist in different universes.

FreshBooks is a small business tool that moonlights as accounting software. Puzzle is full-blown accounting software that happens to be intuitive and beautifully designed. If FreshBooks is a bicycle, Puzzle is a truck.

So if your business is small, service-based, and focused on cash-basis simplicity, FreshBooks is a great call. But if you’re building something scalable, investor-facing, or structurally complex—and need to move fast without breaking your books—Puzzle.io is hard to beat.