Last Updated on October 21, 2025 by Ewen Finser

So, you’ve decided to sell your business, but you’re not sure how exactly to do it.

The good news is that there are plenty of buy-and-sell platforms out there that can make life easier in this regard. The bad news is that it can be difficult to pick the most appropriate one for your needs.

There are significant differences between these service providers in terms of their price points, industry specializations, level of service, and features. If you want to get the best possible sale for your asset, you’ll need to consider these options at length.

Flippa and Acquire are two of the biggest business platforms in this space. I’ve looked at both in detail here and discussed some alternatives as well.

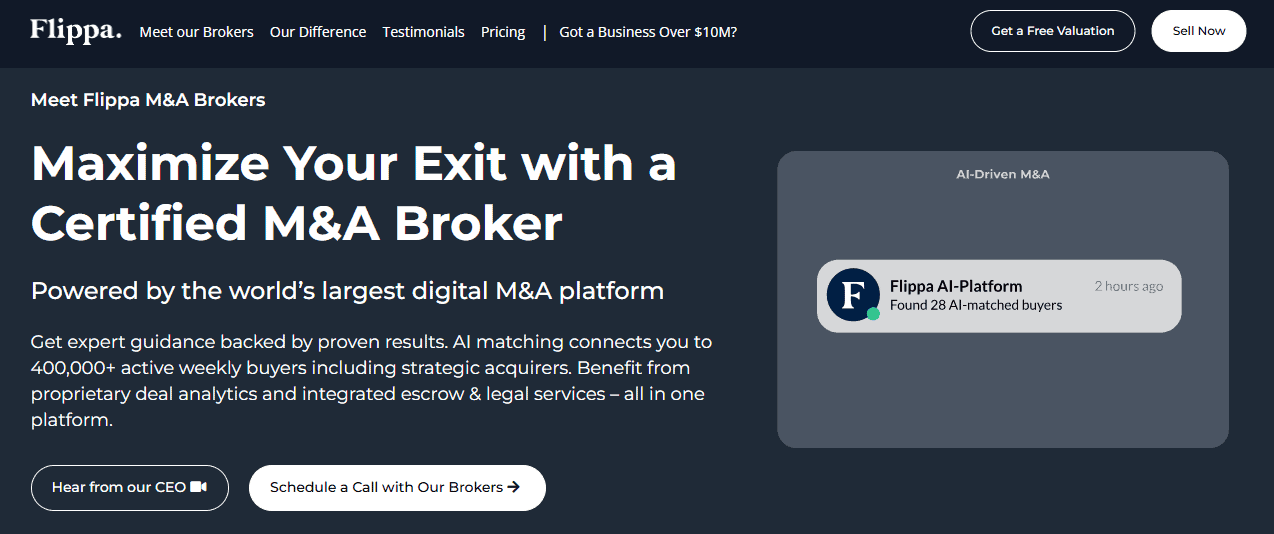

Flippa: Overview

Flippa is one of the OG marketplaces for buying and selling websites and online businesses. It was launched in 2009 and has since grown into a huge platform with millions of users.

The process here is largely self-serve; you create a listing, set an asking price or auction, and field inquiries or bids. Flippa also offers an optional brokerage service for high-end listings: if your business has at least a six-figure asking price, you can choose to pay extra for access to a broker.

The real draw of Flippa is the sheer number of potential buyers to which it provides access. When you list on the platform, you’re showing your company to millions of people who might take it off your hands.

However, as I’ll explain in more detail below, this is a double-edged sword.

Acquire.com: Overview

Founded in 2020, Acquire.com is a newer entrant to the market that has quickly made a name for itself by focusing on startups and SaaS businesses. Previously called MicroAcquire, it now has about 500,000 registered users (founders and investors) and has facilitated over 2,000 deals totaling around $500 million in value.

Acquire’s higher average deal size hints at its typical focus; it doesn’t deal with as many cheaper companies as Flippa (although it does cater to the four- and five-figure segment of the market).

Flippa vs. Acquire

Price

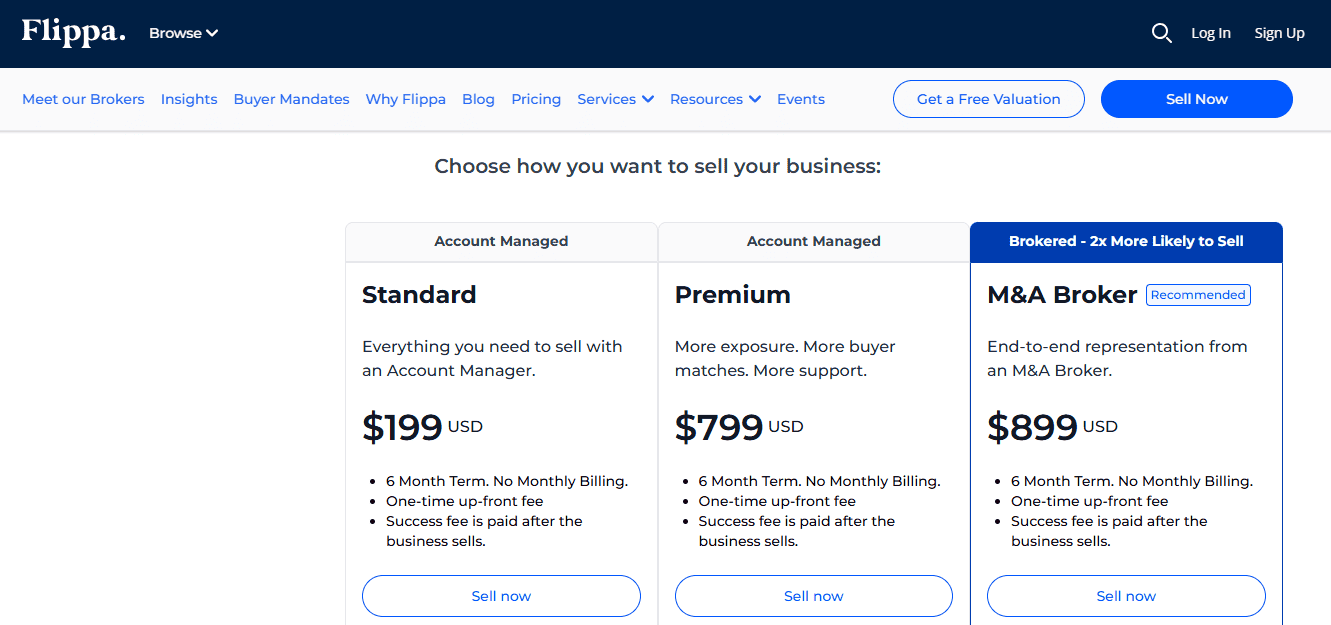

Flippa and Acquire both charge listing and success fees, but their structures and total costs differ significantly depending on deal size.

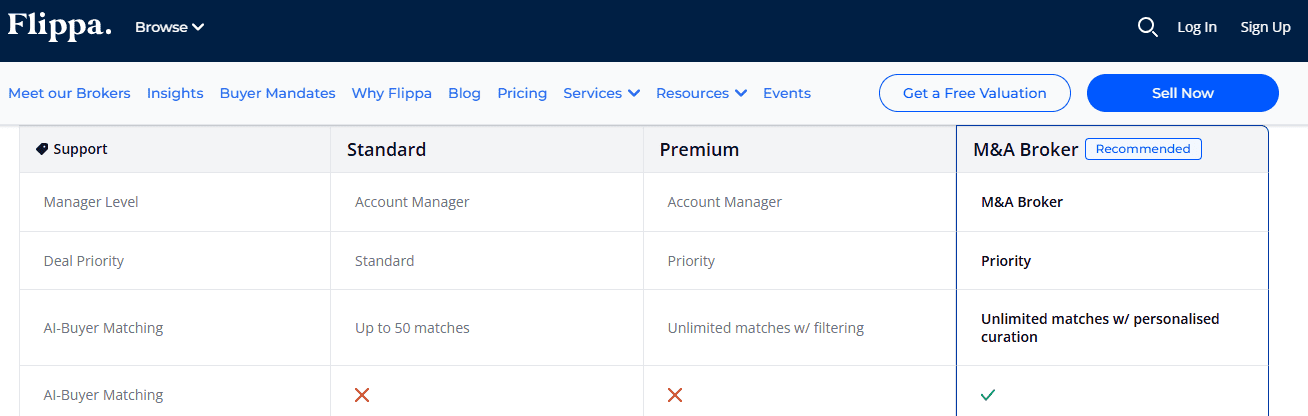

On Flippa’s basic tier, you’ll pay a listing fee of $199 for smaller listings (this will keep your listing up for six months). The Standard package will set you back $799 for a six-month spell; here, you’ll get additional support, features, and exposure. The M&A service above will set you back $899.

When your business sells, Flippa charges a success fee of about 10% for smaller deals; success fees for deals over $500k are on a sliding scale. If you use the premium brokered service, the commission can reach around 7%.

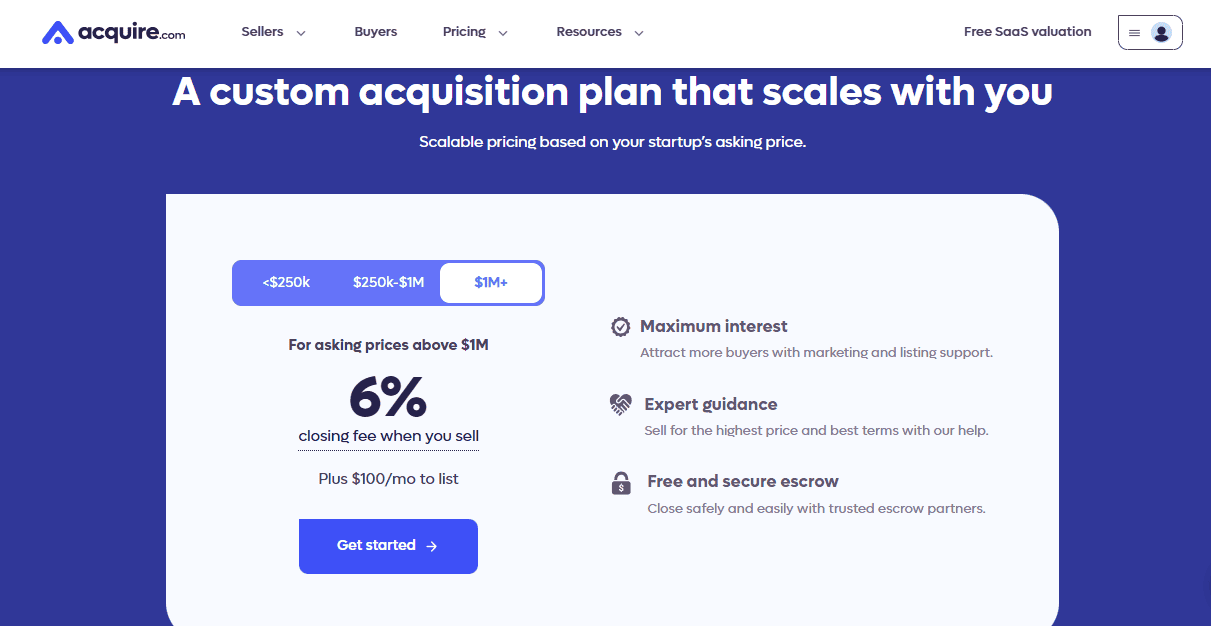

Acquire.com, on the other hand, keeps pricing simpler and generally lower. You’ll pay a monthly listing fee between $25 and $100 (depending on business size) and a success fee of 6–8% when you sell. Acquire doesn’t charge extra for marketing boosts or escrow; those are included. On a $1mn sale, you might save $10k–$15k in fees compared with Flippa’s higher-tier packages.

Winner: Acquire’s lower, transparent fees make it the more cost-effective choice, especially for mid- to high-six-figure sales.

Reach

Flippa is the largest online business marketplace in the world, with over 3 million registered users. This sheer volume means your listing will likely get attention quickly, whether you’re looking for $500 or $500k. The tradeoff is that buyer quality varies, and that a smaller listing must compete with thousands of others just like it.

Acquire prioritizes curation much more. It has about 500,000 registered users, but many are serious startup and SaaS investors rather than casual browsers. When you list on Acquire, most inquiries will come from people with a solid understanding of your industry and business model.

Winner: If your goal is maximum visibility, Flippa’s reach is unmatched in the industry. If you’d prefer a smaller but higher-quality audience, though, Acquire wins.

Level of Service

Flippa is largely a self-service platform. You write your own listing, respond to inquiries yourself, and handle negotiations alone (for the most part). Support is available, but unless you pay for their top-tier brokered plan, you’re on your own for most of the process.

Acquire offers more built-in guidance. You can sync financial data automatically from Stripe or QuickBooks, use standardized templates for LOIs and purchase agreements, and access free escrow and customer success support. While Acquire doesn’t broker deals fully, its team helps streamline things and keeps both sides moving toward closing.

Winner: Acquire provides a higher-touch experience and smoother workflow without the need to pay broker-level fees. It’s the clear winner here.

Vetting

Flippa allows pretty much anyone to list, which is both a strength and a weakness.

You’ll find incredible deals next to listings that are questionable or outright misleading. Although Flippa now verifies Google Analytics and revenue data, buyer due diligence still falls heavily on the seller.

Acquire takes vetting more seriously. Buyers must sign NDAs to access full listings, and, for larger deals, only verified premium members can contact sellers. Acquire can also confirm connected revenue metrics automatically, cutting down on the number of scams and inflated claims you might see otherwise.

Winner: This is an easy one, as Flippa’s vetting is practically nonexistent. Acquire’s verification process and gated access mean higher trust and fewer time-wasters for serious sellers.

Extra Features

Flippa offers a few handy add-ons — integrated Escrow.com payments, optional broker assistance, and paid upgrades like homepage features or boosted listings. For many small sellers, those extras help drive visibility.

However, Acquire builds more functionality directly into the experience. The free escrow service, NDA gating, and data integrations are all part of the base product, and this all amounts to a more comprehensive feature set than what’s available from Flippa, particularly on the respective base tiers.

Winner: Acquire delivers more built-in value, especially for startup and SaaS sales.

Privacy

On Flippa, listings are public by default. Anyone browsing the marketplace can see your title, description, financials, and screenshots. You can keep your domain name hidden, but with enough detail, it’s often easy for savvy users to figure out which business is being sold. That openness helps generate more leads, but it also means less confidentiality.

Acquire.com handles privacy much more tightly. When you list, your business information stays locked behind an NDA—buyers must request access and sign before seeing details like your name, domain, or financials. You approve each buyer manually, which helps keep things discreet. Acquire also verifies buyers’ identities and funds before allowing them into higher-value listings, giving you added control over who sees what. This process might slow things down (sometimes considerably, at least compared to Flippa), but for many founders, the tradeoff is worth it.

Winner: Acquire.com is built around confidential, controlled communication; Flippa, well, isn’t.

Overall

While I’ve given Acquire the nod in most categories, I do think Flippa is the best option for some sales. If you’re looking to turn over a low-value company quickly, Flippa is the place for you. However, if you want a platform that will give you a better feature set and a higher-touch service for less money, I’d go with Acquire.com.

(I should note that “low-value” is a somewhat relative term; it can describe very different price points, depending on your net worth as a seller.)

Other Alternatives

This article wouldn’t be complete if I didn’t explore some alternatives, as there are plenty of other great companies that can help you to sell your business. I’ve looked at two of the best below.

Quiet Light

Quiet Light is a boutique brokerage that specializes in mid-to-large online business sales. In contrast with DIY marketplaces like Flippa, Quiet Light offers a very hands-on, personalized service; you get an expert advisor (broker) who manages your sale process from valuation through closing.

Quiet Light focuses on profitable businesses (generally in the $250k to $10mn+ valuation range) across e-commerce, SaaS, content sites, Amazon FBA, and other online niches.

Pros of Quiet Light

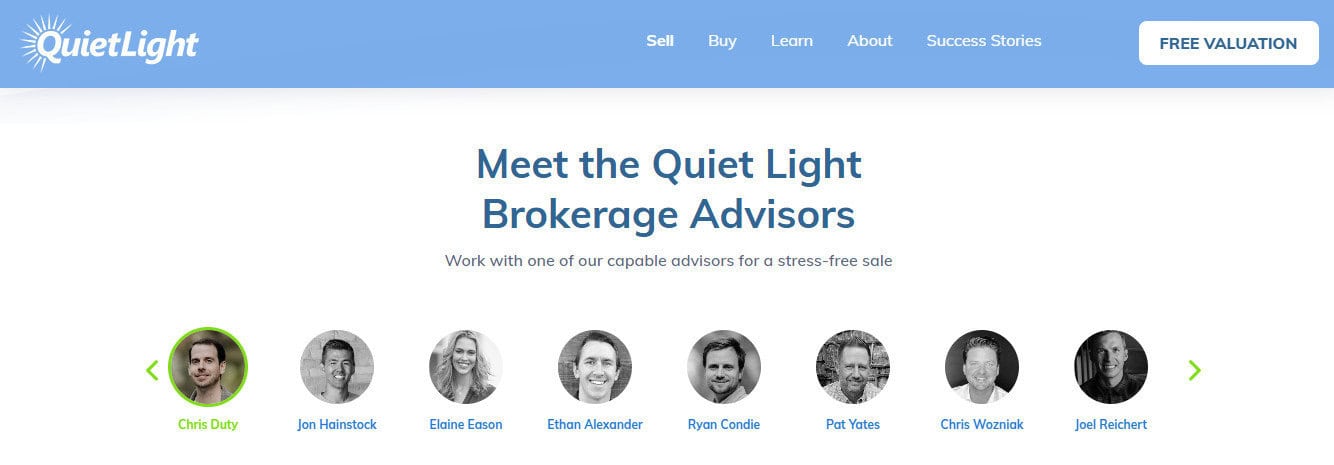

- Hands-on expert guidance: Quiet Light effectively “quarterbacks” the entire process, so you’re not left to figure anything out alone. You’ll get help with valuation, preparing the listing, buyer negotiations, due diligence, and closing. As a seller, this is invaluable, especially if it’s your first time selling a company.

- Strong buyer network: Quiet Light has a large database of vetted buyers (including private equity firms, high-net-worth individuals, etc.) This means faster sales and sometimes multiple offers.

- Favorable commission structure: Quiet Light’s fees are very reasonable by market standards. The most you’ll need to pay in commission is 10%, and this scales down for larger deals; a lot of brokers charge a flat 15%. Plus, no upfront fees; you only pay when your sale goes through.

- Dedicated, experienced brokers: When you work with Quiet Light, you’ll have a dedicated broker throughout the process; not every firm offers this. Plus, all of Quiet Light’s agents have either bought or sold a company themselves, so you know your broker will have plenty of experience.

Cons of Quiet Light

- Not suitable for very small sales: Quiet Light doesn’t publicly state a minimum valuation it will work with, but in practice, it lists few businesses with asking prices under $100k.

- Longer process: Selling through Quiet Light can take a bit longer in some cases. The prep work (valuation, creating the prospectus, vetting buyers) means that sales can often take between 3-5 months to close.

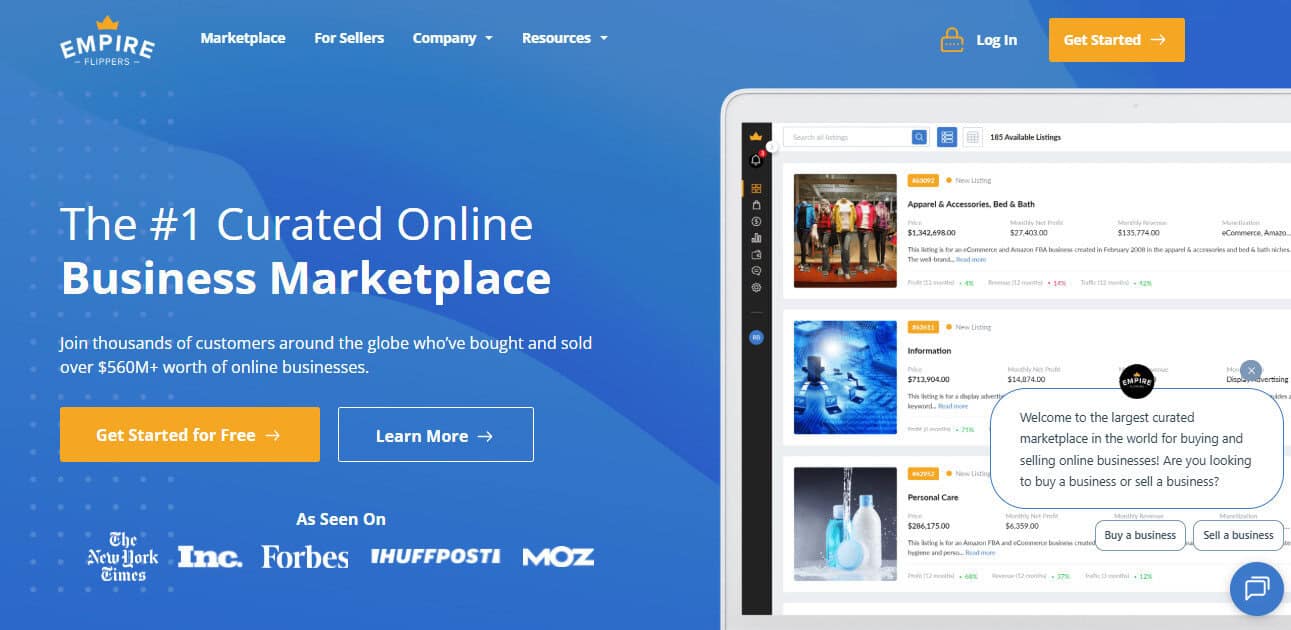

Empire Flippers

If Flippa is the flea market and Quiet Light is the boutique advisory, Empire Flippers is something in between; think of it as a curated marketplace with broker-level vetting and support.

Founded in 2011, EF grew from a small startup to a top platform for buying/selling online businesses, surpassing $100mn in total deal value a few years ago. The platform tends to specialize in content websites, Amazon FBA businesses, and e-commerce stores, though you’ll see all types of online businesses on offer there.

Pros of Empire Flippers

- High-quality listings: Empire Flippers is known for its rigorous vetting. If you list on EF, buyers are likely to take you more seriously automatically (compared to a listing on, say, Flippa).

- Large and engaged buyer base: EF has a big audience of serious buyers (tens of thousands of active investors), and it markets listings via newsletter and buyer alerts. This can get you a lot of eyes and competing offers quickly.

- Smooth process: Although it’s a marketplace, EF provides a certain level of broker-like support. It will create your prospectus, handle buyer screening (including requiring deposits), facilitate Q&A, and assist in negotiations and paperwork.

Cons of Empire Flippers

- Higher fees: Empire Flippers’ 15% base commission on successful sales is on the high side in absolute terms. It does offer a sliding scale for larger deals (the marginal commission goes down once you get above $700k), but you’ll still be paying a solid chunk. This is very difficult to justify, in my view, given the significantly more cost-effective options out there.

- Strict requirements: EF won’t accept every business. If your site is too new, too small, or doesn’t meet its criteria, Empire will likely turn you away.

- Public listings: Empire Flippers posts listings (anonymized, but with some detail) on their site for all registered users to see. While the URL and company name are masked, it’s often relatively easy to work out what business a given listing might refer to. If privacy is a big concern for you, this is a problem.

Choosing the Right Platform for Your Sale

Don’t make the mistake of thinking that every M&A broker or market platform is the same thing. There are big differences between them, and these differences can translate into four- or five-figure sums for you as a seller. It’s crucial that you do your due diligence before signing on the dotted line.