- The Strategic Shift: From Velocity to Veracity

- Why "Real-Time" is No Longer Enough

- Key Decision Points for CFOs

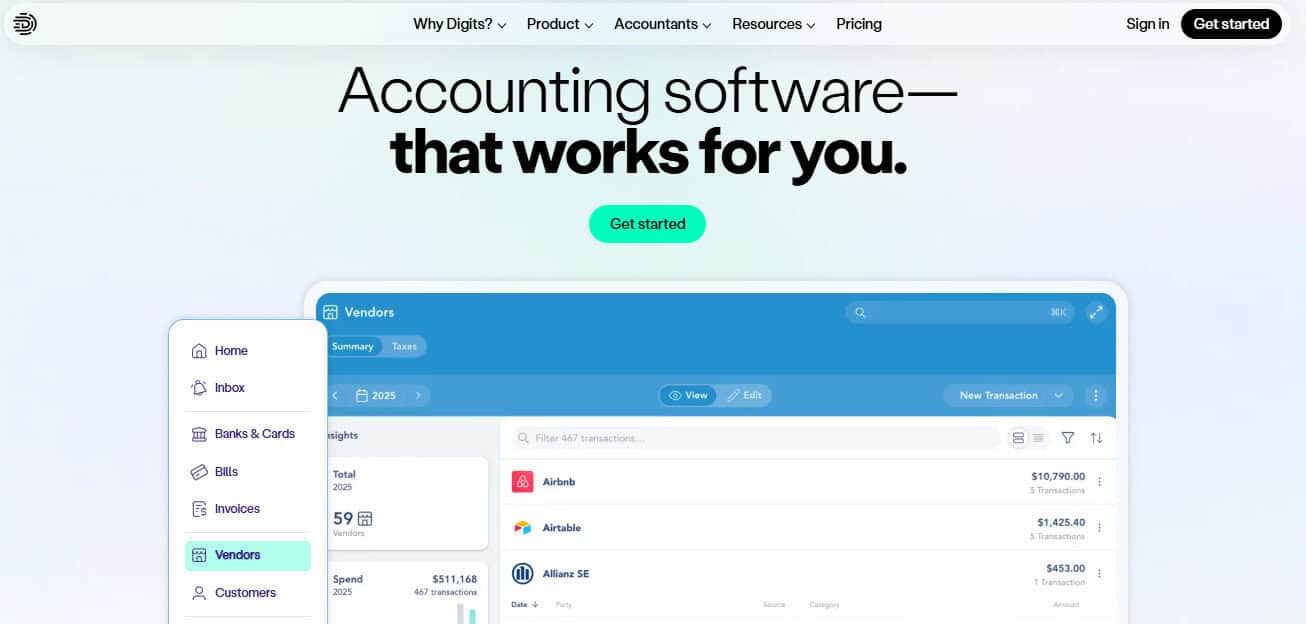

- 1. Digits: The AI-Native Agentic General Ledger (AGL)

- 2. BlackLine: The Enterprise Standard for Governance

- 3. FloQast: The Controller’s Best Friend

- 4. Trintech (Adra): The High-Volume Specialist

- 5. Cube: The Bridge Between Accounting and Strategy

- Outliers: Why Picking The Right Software Is So Important

- Conclusion: Selecting for the Future

Last Updated on February 12, 2026 by Ewen Finser

Let’s immediately cut to the chase. Trust is the only currency that matters in a boardroom. If you can’t trust your numbers, then what are you doing in front of the people you probably owe a ton of money to?

For a CFO, the speed of a month-end close is a vanity metric if the resulting numbers are shaky or inaccurate. When you stand before the board or prepare a forecast that dictates next year’s headcount, you aren’t just looking for “fast” data; you are looking for “verified” data.

As a CPA, I’ve tried out tons of software for tons of different use cases, with recon software being no exception. I want to talk about some of the big players that CFOs may use in 2026, focusing on data integrity, auditability, and the transition from manual “ticking and tying” to AI-verified financials. But before we get into the Best Financial Reconciliation Tools for CFOs, here are some points to consider:

The Strategic Shift: From Velocity to Veracity

Most legacy reconciliation tools sell “speed.” They promise to shave two days off your close. But for a modern CFO, the pain point isn’t just the duration of the close, it’s the lingering doubt. Did the intercompany eliminations catch every edge case? Does the cash on the balance sheet actually match the bank’s PDF, or just the digital feed?

I think nowadays, strategic reconciliation is now about Decision Integrity. It’s the difference between saying “The books are closed” and “The numbers are right.”

Why “Real-Time” is No Longer Enough

In 2026, real-time data is a baseline requirement, not a feature. You should be able to reconcile thousands of transactions in a single day with a robust enough system. The true challenge is anomaly management. A real-time feed that contains a duplicate entry or an incorrectly categorized SaaS subscription simply provides “real-time errors.” CFOs now need to prioritize platforms that offer tools that don’t just stream data, but audit it against source documents (like PDFs and receipts) the moment the transaction occurs.

Key Decision Points for CFOs

When selecting a tool, your criteria should shift from “user interface” to “trust architecture.”

- Verification Method: Does the tool rely on “rules” which can break or AI, which can learn.

- Data Lineage: Can you click a cell in your board deck and see the original bank statement PDF?

- Exception Intelligence: Does it just flag a mismatch, or does it explain why (e.g., a timing difference vs. a missing wire)?

- ERP Integration: How deeply does it live within your general ledger?

The Bottom Line Up Front, In Chart Form

Tool | Primary Audience | Core Strength | Verification Tech | Board-Ready Features |

Digits | High-growth Startups & Mid-Market | Real-time integrity & AI-native AGL | Agentic AI (PDF-to-Ledger) | Live dashboards & automated variance analysis |

BlackLine | Large Enterprise (Global 2000) | Complex global consolidation | Rules-based workflows | Deep audit trails & SOC compliance |

FloQast | Mid-Market Finance Teams | Close process management | Folder-linked checklist | Flux analysis & team accountability |

Trintech (Adra) | Mid-Market to Enterprise | High-volume transaction matching | Logic-based matching | Exception trend reporting |

Cube | FP&A-focused Teams | Spreadsheet-native reconciliation | AI-powered mapping | Scenario planning & “What-if” analysis |

Let’s jump in and see what platforms I think at least deserve to be considered.

1. Digits: The AI-Native Agentic General Ledger (AGL)

In my opinion, Digits has fundamentally changed the reconciliation motif. While other tools act as a “layer” on top of your accounting software, Digits is an AI-native platform that introduces the Agentic General Ledger. It’s not a tool for reconciliation, it’s the entire accounting software and life cycle in one place.

Why CFOs Trust the Numbers

The “Digits Difference” lies in its ability to reconcile against reality, not just digital mirrors. Most tools reconcile your Ledger against a Bank Feed. If the feed is missing a transaction, the tool won’t know. Digits allows you to drag and drop an actual Bank Statement PDF.

The AI reads the PDF, compares it to the Ledger, and flags anomalies. This creates a “Three-Way Match” (Feed vs. PDF vs. Ledger) that provides a level of certainty previously impossible without manual human audits. Honestly, I don’t even know what else to say other than that the first time I saw it, I was super impressed.

Beyond Simple Matching: Dimensional Intelligence

Digits goes further by offering Dimensional Accounting. It doesn’t just match a $5,000 payment; it automatically attributes it to the correct Department, Location, and Project. For a CFO, this means when you see a spike in “Marketing Spend” in your board deck, you can drill down instantly to see which specific campaign drove the cost, verified by the underlying invoice.

Key Features for Decision Support:

- Ask Digits: A natural language AI hub where CFOs can ask, “Why is our burn rate up 10% this month?” and get a verified answer based on reconciled data.

- Auto-Booking (95% Rate): By automating the vast majority of transactions, the finance team shifts from “data entry” to “quality control.”

- Live Dashboards: These aren’t static reports; they are living views of your P&L and Balance Sheet that update as soon as a reconciliation is verified.

2. BlackLine: The Enterprise Standard for Governance

For a CFO at a public company with 50 entities across 12 currencies, trust comes from standardization. BlackLine is the heavy hitter in the space, and is well known and used by many mid-sized and large businesses. It isn’t a “quick install,” but it provides a rigid framework that auditors love.

Why CFOs Trust the Numbers

BlackLine’s strength is its “Modern Accounting” playbook. It moves the close from a “big bang” event at the end of the month to a continuous process.

- Internal Controls: It enforces a strict separation of duties and approval hierarchies.

- Global Visibility: A CFO can see the real-time status of every reconciliation across the entire global organization.

Solving the Intercompany Crisis

In my personal experience, intercompany mismatches are a leading cause of audit friction and what often gets management into trouble. BlackLine’s Intercompany Hub centralizes these transactions, automating eliminations and currency conversions. This ensures that when you consolidate your global books, the “Net” actually equals zero, eliminating the “mystery variances” that plague enterprise board meetings.

Advanced Audit Readiness:

- Task Management: Every step of the close is documented with a timestamped audit trail.

- SmartClose: Automates the recording of journal entries directly into the ERP, ensuring the GL and the reconciliation tool are never out of sync.

3. FloQast: The Controller’s Best Friend

FloQast was built by accountants, for accountants. Its motif is “Centralization.” It doesn’t try to replace your ERP; it organizes the chaos surrounding it. Like BlackLine, this software is well known in mid size and larger firms, so I can handle a wide array of businesses of any size.

Why CFOs Trust the Numbers

Trust in FloQast comes from process transparency. Many CFOs fear the “black box” of their team’s spreadsheets. FloQast brings those spreadsheets into a governed environment.

- Excel Integration: It lets teams keep their complex Excel workpapers but links them directly to the GL. If a number changes in the GL, FloQast alerts the team that the reconciliation is now “out of balance.”

- Flux Analysis: It simplifies the “Why did this move?” question. By automating variance analysis, it helps CFOs explain fluctuations to the board with confidence.

Enhancing Team Accountability

FloQast offers a Close Management Dashboard that shows exactly which reconciliations are pending and who is responsible. For a CFO, this visibility reduces the “last-minute panic” on Day 5 of the close. If a high-risk account (like Revenue or Payroll) hasn’t been reconciled, the system flags it early, preventing a surprise revision right before a board meeting.

Key Compliance Benefits:

- FloQast Ops: Extends the close process into broader business operations, ensuring that non-financial data (like headcount) is also verified.

- AutoRec: Uses AI to match transactions across bank statements and the GL, focusing human effort only on the exceptions.

4. Trintech (Adra): The High-Volume Specialist

If your business handles millions of small transactions (like e-commerce, retail, or high-volume SaaS), your risk isn’t a single $1M error; it’s ten thousand $100 errors. Trintech’s Adra suite is designed for this specific type of data integrity.

Why CFOs Trust the Numbers

Adra’s strength is its High-Volume Transaction Matching. It can process millions of rows of data across multiple sources—POS systems, merchant gateways, and bank accounts—to find the “needle in the haystack.” I’d like to see your Excel sheet try to do that without imploding.

- Advanced Logic: It uses sophisticated “Many-to-One” or “Many-to-Many” matching rules that go beyond simple dollar-amount comparisons.

- Exception Prioritization: It doesn’t just give you a list of 500 errors; it ranks them by financial risk. I really like this because if there’s a dozen one dollar transactions, or one $50,000 error, it’s evident where your focus should be.

Bridging the Mid-Market Gap

While Trintech’s “Cadency” platform serves the Fortune 500, the Adra Suite is specifically tuned for mid-market CFOs who need enterprise-grade reconciliation without the 12-month implementation timeline. It provides “Quick Wins” by automating the most friction-heavy accounts (Cash and Credit Cards) within weeks.

Visibility for Decision Makers:

- Adra Balancer: Automates balance sheet reconciliations, ensuring every account is justified by supporting documentation. I feel like most reconciliation tools focus on cash, so it’s nice that the rest of the balance sheet is being considered with this tool.

- Adra Analytics: Provides heatmaps of where errors are occurring most frequently, allowing the CFO to fix root-cause operational issues.

5. Cube: The Bridge Between Accounting and Strategy

Cube is unique because it sits at the intersection of Reconciliation and FP&A. For a CFO, trust is often tested during forecasting. If your starting point (the actuals) is wrong, your forecast is a work of fiction.

Why CFOs Trust the Numbers

Cube acts as a Single Source of Truth by pulling data from your GL, HRIS, and CRM into one multidimensional database.

- Spreadsheet Native: It keeps the flexibility of Excel but adds a database layer that prevents “broken formula” errors.

- Intelligent Mapping: It uses AI to convert plain-language mapping rules into structured hierarchies, ensuring that a change in your account structure doesn’t break your board reports.

Narrative-Driven Finance

One of Cube’s standout 2026 features is its AI Analyst. Instead of just looking at a spreadsheet of reconciled numbers, a CFO can ask Cube to “Write a summary of our Q3 variance compared to the board-approved budget.” The AI analyzes the reconciled actuals and generates the narrative, ensuring the story told to the board is grounded in verified data.

Strategic Planning Features:

- Scenario Modeling: Quickly run “What-if” scenarios (e.g., “What if we miss our revenue target by 5%?”) using the same verified data used for reconciliation.

- Bi-directional Sync: Push adjustments from your planning model back into your reporting environment seamlessly.

Outliers: Why Picking The Right Software Is So Important

In 2026, I think CFOs are increasingly responsible for data governance. A reconciliation error isn’t just an accounting mistake; it could be a sign compromise or vendor fraud. Let me paint a picture of why an Excel Sheet or Bank Feed is no longer a method that is okay on its own.

Tools like Digits now incorporate “Anomaly Detection” that looks for patterns of fraud. such as a vendor changing their bank details or a duplicate invoice with a slightly different name. By reconciling in real-time and using AI to “watch” the ledger, the CFO acts as the final line of defense against financial attacks or fraud.

If you’re using Quickbook’s bank feed to do your reconciliations, you’re not going to receive that same level of service. That’s why using an AI Centric platform or a specialized tool is becoming increasingly important.

Conclusion: Selecting for the Future

The “Best” tool depends on your scale and objectives, but the goal remains the same: Absolute certainty.

- If you are a fast-growing startup or mid-market firm, Digits offers the most modern, AI-native path to verified financials.

- If you are a complex global enterprise, BlackLine provides the necessary governance.

- If you need to organize a messy close without leaving Excel, FloQast is your best bet.

The right tool doesn’t just save you time; it saves your reputation. When the board asks, “Can we trust these forecasts?” you want to be able to answer with a definitive, data-backed “Yes.”