- The Bottom Line Up Front

- Digits vs Wave Accounting: Quick Comparison

- What Each Platform Is and Isn’t

- Pricing Snapshot

- Bank Feeds, Reconciliations, and the Ins and Outs of the Day to Day

- AR, Invoicing, and Payments

- AP, Bills, and Approvals

- Payroll

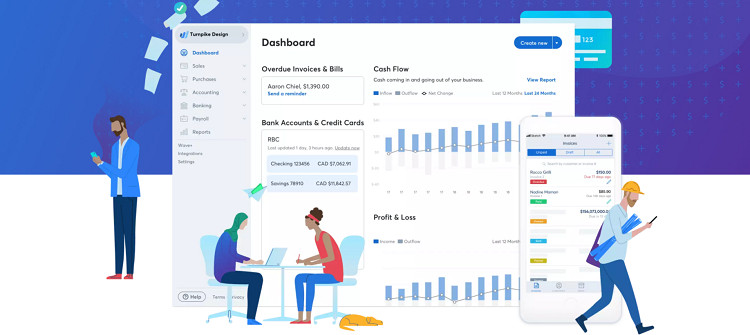

- Reporting and Dashboards

- Automation, AI, and Who Does What

- Inventory, Projects, and Growth Down the Line

- Integrations, API, and Thirty Party Hookups

- Security & Compliance

- Mobile Experience

- Community and Support

- Realistic Scenarios for a Bit of Self Reflection

- Where They Fall Short

- The CPA’s Take

- Verdict

- My Recommendations:

Last Updated on October 23, 2025 by Ewen Finser

Alright y’all, let’s put two very different philosophies under the same light: Digits (AI-native, “autonomous GL” energy) vs Wave Accounting (the freemium crowd-pleaser for soloists and micro-teams). Both claim they’ll save you hours. Both can get your books into fighting shape. But they were built for different jobs and that’s totally acceptable. But today’s comparison is going to be like comparing apples to oranges, and I’m totally here for it.

The Bottom Line Up Front

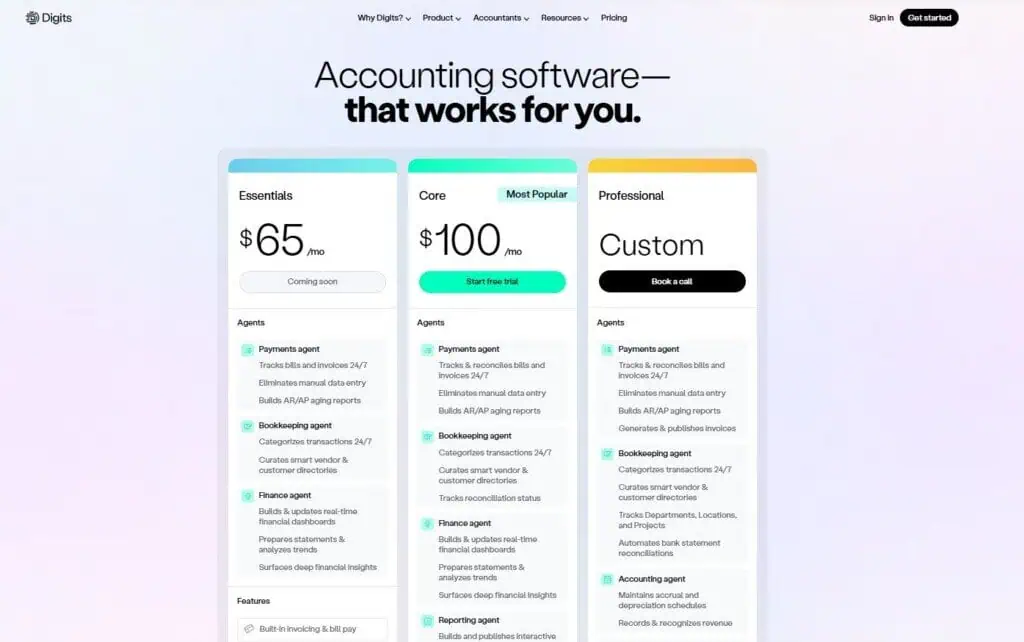

- Digits is best for founders and accountants who want live, AI-assisted books, automated categorization, interactive reporting, and end-to-end workflows (invoices, bill pay, dashboards) without duct-taping half a dozen apps. It’s not free, but it replaces a surprising amount of manual effort. Pricing starts at $100/month for the Core plan and scales up, with an Essentials tier below that and custom plans for firms.

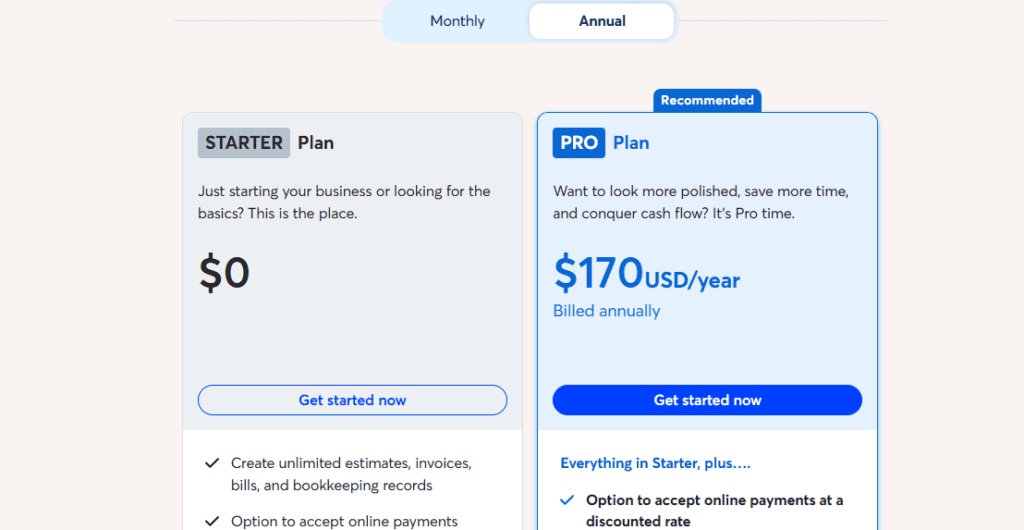

- Wave is the friendliest free on-ramp for freelancers and very small businesses. You can invoice, accept payments, reconcile basics, and keep compliant books. But you’ll hit ceilings: limited inventory/project accounting, fewer automations, and a reliance on paid add-ons (e.g., payroll) that only fully cover the U.S. and Canada and have state-by-state nuances. Wave’s Starter tier is $0; Pro runs about $190/year billed annually, and payments are per-transaction.

If you’re optimizing for time saved, auditability, and visibility, Digits edges out Wave because the “Autonomous General Ledger” and agents continuously work while you sleep. If you’re optimizing for cost and you’re a single-owner service business with straightforward needs, Wave remains tough to beat.

Digits vs Wave Accounting: Quick Comparison

Digits | Wave | |

Best For | Growing businesses, accountants, and finance teams who want AI-driven, automated books. | Freelancers and small service-based businesses looking for a free, easy accounting tool. |

Core Features | AI-powered bookkeeping, bill pay, invoicing, AR/AP automation, real-time dashboards, and open API integrations. | Invoicing, basic bookkeeping, payment processing, simple reports, and receipt scanning. |

Automation & AI | “Autonomous General Ledger” auto-books ~93% of transactions and maintains continuous reconciliations. | Basic automations (recurring invoices, rules, and OCR receipts). Manual categorization for complex data. |

Reporting & Insights | Interactive dashboards and live financial reports with drill-down and KPI views. | Standard reports like P&L and balance sheet—ideal for tax prep and small business tracking. |

Accounts Payable / Receivable | Full workflows for bills, approvals, and payments built in. | Basic bill tracking; advanced AP/AR requires upgrades or external tools. |

Payroll | Integrates with Gusto, ADP, and others (not built-in). | Optional add-on for U.S. and Canada; features vary by state/province. |

Integrations | 10k+ financial connections, open API, strong multi-entity support. | Limited integrations; best for standalone use. |

Pricing | Starts at $100/month (Core plan); firm and Essentials tiers available. | Free Starter plan; Pro around $190/year billed annually; pay-as-you-go for payments/payroll. |

Ideal Use Case | Teams that want automated books, real-time insights, and fewer manual reconciliations. | Solo operators who prioritize affordability and simplicity over automation |

What Each Platform Is and Isn’t

Digits

Digits is an AI-native accounting platform built around an Autonomous General Ledger (AGL). Instead of just recording what happened, the system learns your chart, auto-books the vast majority of inbound transactions, and queues the rest for human review. It layers in agents for Bookkeeping, Payments (AP/AR), Finance (dashboards/KPIs), and Reporting. The point isn’t to “replace your accountant,” it’s to eliminate low-value clicks so your human team focuses on exceptions and analysis.

Wave

Wave is small-business accounting with a freemium core: invoicing, basic bookkeeping, bank feeds, and a simple mobile app. It shines when you want to send professional invoices, accept cards, and keep ledgers reconciled without paying a monthly license fee. Paid layers include Pro (annual) and Pay-as-you-go Payments, plus Payroll that primarily supports U.S./Canada with limits. It’s intentionally simple; that’s the draw and the trade-off.

Pricing Snapshot

- Digits: Pricing for Core starts at $100/month and an Essentials tier below that is currently being worked on, with custom options for firms. Plans bundle agents (Bookkeeping, Payments, Finance, Reporting), real-time dashboards, invoicing, bill pay, doc storage, open API access, and unlimited connections/users.

- Wave: Starter is free for the core accounting and invoicing; online Payments charge standard card costs; Pro is about $190/year (USD) billed annually. Payroll is an add-on with U.S./Canada availability and different service levels by state.

And as always, pricing changes so always confirm the exact inclusions before you migrate.

Bank Feeds, Reconciliations, and the Ins and Outs of the Day to Day

- Digits connects to thousands of financial institutions and runs 24/7 categorization. The Bookkeeping Agent maintains reconciliation status and automatically books things to the correct customer / vendor. In practice, that means fewer uncategorized transactions, fewer stale reconciliations, and a faster month-close.

- Wave handles core bank feeds and reconciliation well for basics, with an approachable UI and clear flow from bank feed, categorize, and reconcile. It’s perfectly adequate for a low-volume service shop. However, at scale or with messy data (multiple entities, heavy AP/AR), the manual touch points add up quick.

AR, Invoicing, and Payments

- Digits includes invoicing, AR aging, and payments workflows inside the platform. The Payments Agent tracks invoices/bills and builds AR/AP aging continuously. For teams tired of spreadsheet aging reports and PDF shuffling, this is where time gets clawed back.

- Wave is beloved for its invoicing. You get clean templates, recurring billing, deposit requests, and a straightforward payments add-on with transparent rates. For solo service pros or micro-SMBs, Wave’s AR pipeline is exactly the right level of complexity. Just remember: the “free” model monetizes via payment processing and paid tiers, so advanced AR workflows will push you into Pro or peripheral tools.

AP, Bills, and Approvals

- Digits offers bill capture, approval routing, and bill pay as a first-class workflow. You just drag, drop, approve, and pay, keeping vendor data tidy and linking documents to entries. If you’ve been living inside an email inbox and a separate bill-pay app, consolidating this saves real hours per week. I also love that everything can be done in house, without the need for a 3rd party like Melio.

- Wave: you can create and track bills and mark them paid, but full AP automation (multi-step approvals, bulk pay runs, vendor portals) is not the core mandate. For many freelancers and tiny shops, that’s fine; for construction, agencies, or inventory-heavy shops with 50+ vendors less so.

Payroll

- Digits today is not trying to be your payroll tax engine. Many teams will keep Gusto, ADP, or Rippling for payroll while Digits handles GL, AR/AP, and reporting. This allows for a clean separation of duties and a best-of-breed stance. (That’s common in modern stacks, and I actually prefer it.)

- Wave Payroll supports U.S. and Canada, with tax-service coverage limited to certain U.S. states and different pricing/automation depending on where you operate. If your compliance footprint matches the supported regions, it’s a smooth add-on; if you hire across tricky states, you may outgrow it quickly.

Reporting and Dashboards

- Digits is built around interactive financials and customizable dashboards. It offers real-time P&L, balance sheet, cash flow, runway/burn, drill-down, and narrative insights. The Finance/Reporting Agents help to prepare management packs and executive summaries, turning the month-end deck into a rolling, living artifact. For CFOs and controllers, this is not just nicer charts; it’s the elimination of “update the deck” work.

- Wave provides the standard set: P&L, balance sheet, sales tax reports, customer/vendor statements. It covers what an owner-operator needs for quarterly chats with a CPA, but it won’t replace a live board dashboard or FP&A view.

Automation, AI, and Who Does What

- Digits leans fully into AI agents on top of the AGL, claiming to automatically book ~93% of inbound transactions and outperform generic LLM baselines. From a practitioner’s perspective, what matters isn’t the press release, it’s that fewer transactions linger uncategorized and fewer reconciliations stall. In back-to-back monthly closes, that compounds.

- Wave has helpful quality-of-life automations like recurring invoices, basic rules, and a decent mobile receipt scan with OCR (Pro or add-on). It’s not the same category as autonomous workflows, and that’s fine; Wave’s user is optimizing for simplicity (and price), not AI-first accounting.

Inventory, Projects, and Growth Down the Line

- In my opinion, Digits is comfortable with departmental/location tags, vendor/customer directories, and complex GLs. You can use it for just about any SMB. If you’re a multi-entity or multi-department shop and want to avoid spreadsheet purgatory, the tagging plus live reporting is a material upgrade.

- On the other hand, Wave does not offer stock/inventory tracking, project accounting, or advanced budgeting/forecasting. If you sell goods at scale, bill by project phase, or run tight budgets, you’ll bolt on outside tools or eventually move upmarket (Xero/QBO/ERP).

Integrations, API, and Thirty Party Hookups

- Digits emphasizes a Connect API platform with 10k–12k+ real-time financial connections, plus open API access on higher plans. If your world is multiple banks, cards, and fintech tools, keeping those pipes stable is half the battle. Digits treats that like first-party infrastructure.

- Wave plays nicely with the essentials and has a developer API, but the ecosystem isn’t trying to be an app store. Again, for the Starter/Pro audience, that’s perfectly acceptable, but if you’re automating across multiple systems, you’ll prefer more open plumbing.

Security & Compliance

Both vendors take security seriously; this is high stakes if you (or your clients) data is at risk.

- Digits is SOC 2 Type II compliant and positions security as a core posture (encryption in transit/at rest, hardened infra). For accountants under engagement letters and data-processor clauses, that’s the checkbox you want.

- Wave follows industry best practices; as with any free-to-paid platform, review your own risk tolerance and data governance (especially if you’re handling client funds or PII across regions). Official pages focus more on features than a security whitepaper front-and-center, so if you’re in a regulated niche, ask for documentation before onboarding.

Mobile Experience

- Digits takes a “work anywhere” stance but focuses its marketing on live dashboards and browser-first experiences (which means you’ll be sitting at the desk to take full advantage of the platform). If you’re running a finance team, that’s fine; the heavy lifting happens on desktop with shared reports and approvals.

- Wave offers a mobile app with receipt scanning (OCR) and on-the-go invoicing. If you’re a tradesperson or solo creative collecting receipts all day, this is legitimately useful.

Community and Support

- Digits sells into accountants and finance teams, with a services layer available (bookkeeping up through CFO services) if you want to “just hand this off.” That’s not a must, but it’s there and it’s useful for busy founders who need GL analysis, not another to-do list.

- Wave keeps costs low, which can mean leaner support depending on your tier. Several third-party reviews note limited advanced features and mixed support experiences; bear that in mind if you’re operating with deadlines (sales tax, lender packages, funding due diligence).

Realistic Scenarios for a Bit of Self Reflection

Choose Digits if…

- You want books that update themselves overnight with minimal hand-holding, and you value exception-only review.

- You present to a board or lenders and need interactive financials

- Your AP/AR volume is real (20–100+ active vendors/customers), and you’re done shuffling PDFs and spreadsheets for approvals and aging.

- You run multi-entity, departmental, or project-like tagging and you’re allergic to “export to CSV, pivot in Excel, repeat.”

- You want to standardize a firm’s client base on a single, AI-assisted workflow with clear human-in-the-loop checkpoints.

Choose Wave if…

- You’re a solo or micro-SMB with a handful of clients and minimal AP.

- You care most about sending invoices, collecting payments, and keeping a clean P&L for tax time without adding a monthly subscription.

- You’re in the U.S. or Canada and your payroll footprint is covered by Wave’s regional support.

- You’re fine with manual touches and don’t need inventory/project accounting or FP&A-style reporting yet.

Where They Fall Short

Not every platform is perfect, and I won’t ever pitch one as so. Be aware of some of these “gotchas!”

Digits – What to Watch out For

- If you need a payroll tax engine under the same roof, you’ll still run a separate payroll app (not a big deal for most teams, but it’s a consideration).

- AI-assisted platforms still require controls and review. I can never stress this enough, no platform is set and forget. You’ll go faster, not “hands-off forever.”

Wave – Lookout for These Shortcomings

- Feature ceilings: no native inventory, limited project accounting, and basic budgeting. A lot of businesses will outgrow these pretty quickly.

- Payroll coverage nuances (U.S./Canada only; state-by-state automation differences). If you hire beyond easy states, expect friction.

- Support can be lean versus paid competitors, which matters when you’re up against a filing deadline.

The CPA’s Take

From a control-framework standpoint, Digits’ agent design shifts the workload from “data entry & reconciliations” to “review & approvals.” That changes staffing math. A junior can clear exceptions while a senior focuses on analysis and client advisory. If you’re running a multi-client CAS practice, the throughput gains are real.

With Wave, I love it as a starter ledger. I really do, it’s super simple and therefore super attractive! I set plenty of freelancers up on Wave when budget is the binding constraint. But I also coach them on the likely migration mileposts: adding AP approvals, needing real project profitability, or running departmental reporting. Those are the moments you either bolt on tools (and lose the simplicity) or step up to a platform with deeper automation and structure.

Verdict

If we’re scoring this like a judge, Digits comes out on top for teams who value automation, speed to insight, and clean close cycles. It reduces clicks you shouldn’t be paying humans to do, and the reporting layer is actually enjoyable to use (not something I say lightly).

Wave still deserves its reputation as the best “I need legit books without a subscription” option for the smallest shops. It’s polished where it needs to be (invoices/payments), and the trade-offs are honest. Many businesses could absolutely start here.

My Recommendations:

- Solo to very small service businesses with simple AP and no inventory should consider Wave today, re-evaluate when you add headcount, inventory, or multi-entity complexity.

- Growing SMBs, multi-entity environments, agencies, or accounting firms that want live books, agent-driven workflows, and board-ready reporting should use Digits.

That’s not boosterism; it’s just matching the tool to the job. And for the jobs that demand time savings, exception-only review, and real-time FP&A-lite visibility, Digits’ architecture delivers a quieter close and fewer late-night reconciliations.