- The Bottom Line Up Front

- What These Platforms Are (In Plain Ole’ English)

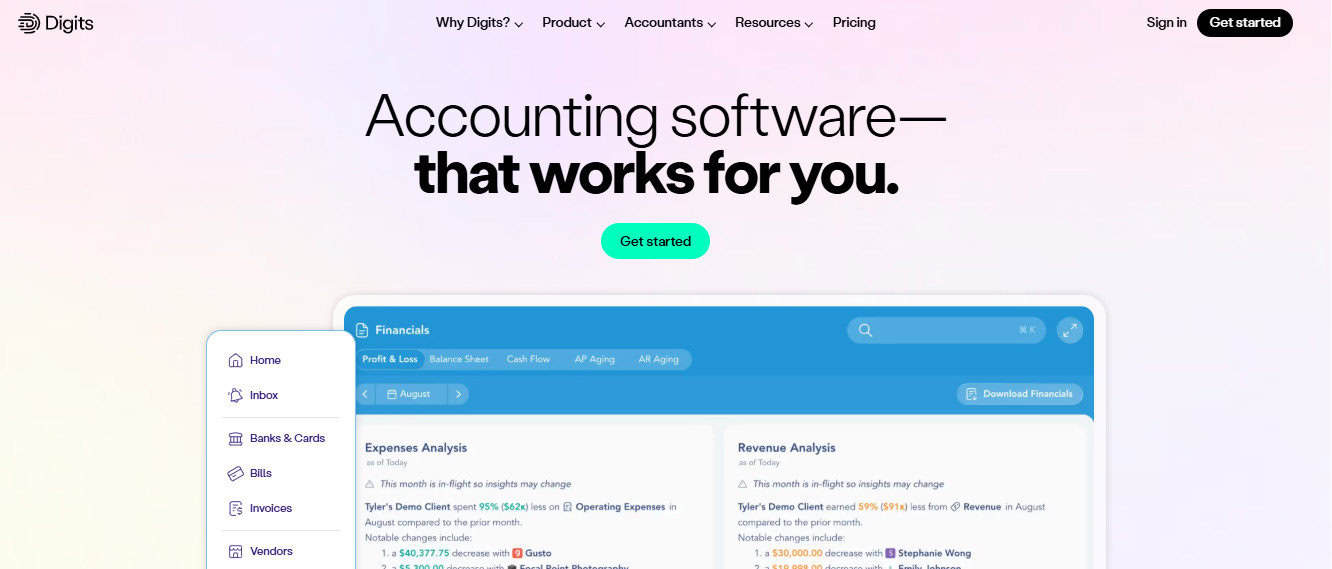

- Digits

- QuickBooks Online

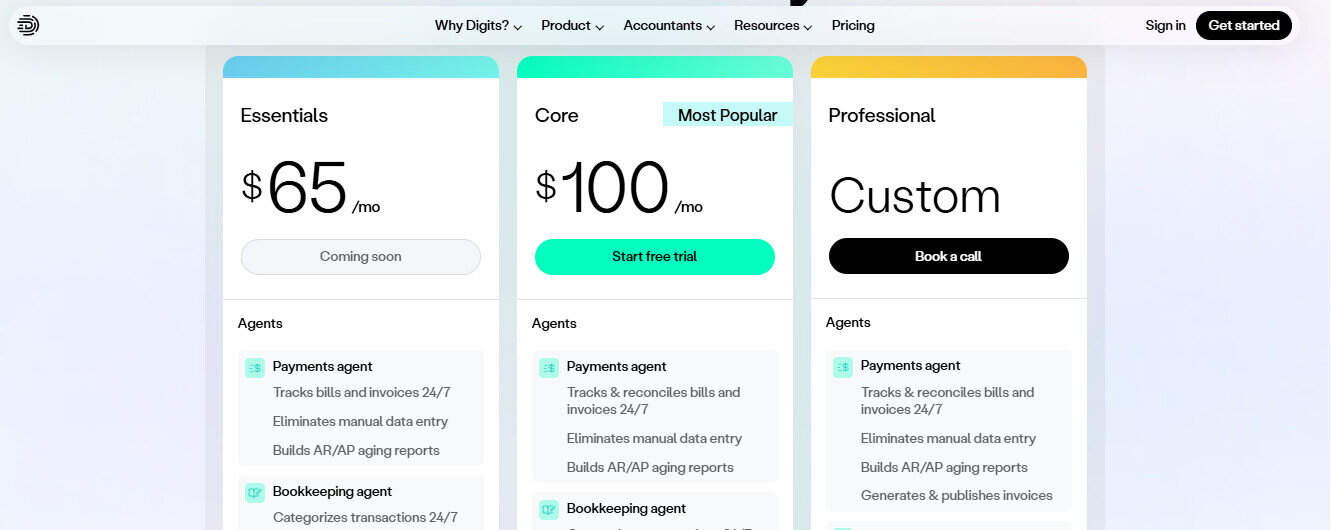

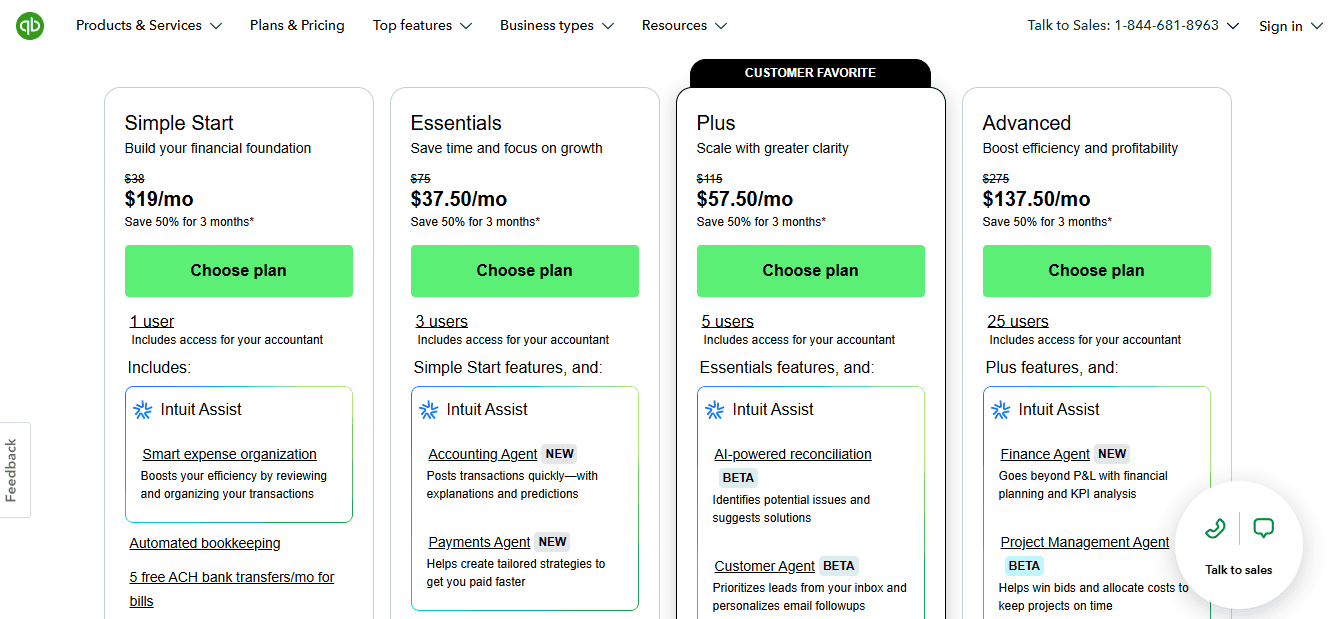

- Pricing Snapshot (and Why It Matters)

- Core Features, Side-by-Side

- QBO’s Plan Limits vs. Digit’s “Unlimited”: The Real-World Impact

- Where Each Platform Shines

- Reporting, Close, and Collaboration: Who Gets You to Answers Faster?

- A Note on Market Gravity

- Who Each Platform Would Best Serve:

- One of The Most Important Things: What About Support?

- My Final Takes

Last Updated on November 20, 2025 by Ewen Finser

Alright y’all, here’s the matchup everyone’s been waiting for: the entrenched incumbent vs. the AI-native upstart. Intuit’s QuickBooks Online is the 600 lb gorilla in the room, and is the most widely used small-business accounting platform in the U.S., and for good reason. It’s flexible, familiar, and can be configured for just about any industry.

But what if there’s a faster, smarter way to run the books and a chance to retire some of those legacy workflows? Enter Digits, a platform that flips traditional bookkeeping on its head with an AI-driven ledger, real-time insights, and built-in automation.

I’m a CPA who lives in both worlds, so let’s put them side by side and see where each one actually shines and where they fall short.

The Bottom Line Up Front

- Digits is the new, AI-native upstart: one platform with an Autonomous General Ledger that aims to do the bookkeeping for you, plus built-in invoicing, bill pay, real-time reports, collaboration, and unlimited users starting at $100/month (for now, they’re working on a cheaper option). It’s opinionated, fast, and built for owners and accountants who want automation first.

- QuickBooks Online is the entrenched incumbent: a mature ecosystem with four plans, payroll add-ons, and a sprawling app store. It’s incredibly flexible, but you’ll juggle plan limits (users, CoA, classes/locations) and often bolt on apps for inventory, advanced workflows, or vertical needs. Pricing (pre-promo) runs $38–$275/month for accounting, plus payroll per-employee fees.

If you want the freshest AI automation inside a single pane, kick the tires on Digits. If you need breadth, third-party choice, and a nationwide bench of ProAdvisors, QBO still wins. For many firms, the practical answer is both: QBO for established processes and ecosystem depth; Digits for AI-powered bookkeeping lift and modern client experience.

What These Platforms Are (In Plain Ole’ English)

Digits

Digits is an AI-native, end-to-end accounting platform built around its Autonomous General Ledger (AGL). Think continuous categorization, reconciliations, and real-time reporting, with native AI Bill Pay and invoicing. It positions itself as the “first accounting system of the AI era,” not a bolt-on.

QuickBooks Online

QBO is the SMB accounting default in the United States. It has all the normal things you’d expect to have in accounting platform, like general ledgers, invoicing, bills, projects, inventory (in higher tiers), plus a massive app marketplace, ProAdvisor network, and optional Payroll tightly tied to the books. It’s adding its own AI, but the core value is maturity + ecosystem.

Pricing Snapshot (and Why It Matters)

- Digits: Pricing starts at $100/mo, but the Digit’s team is working on a cheaper option for $65 per month. The draw, despite the initial higher price tag, is unlimited users & connections, baked-in invoicing and bill pay, and collaboration without per-seat math. If you’ve been burned by user caps, this is refreshing.

- QBO (pre-promo list, per Intuit): Simple Start $38, Essentials $75, Plus $115, Advanced $275 per month. Frequent “50% off for 3 months” promos exist, but your steady-state cost aligns with list pricing.

- QBO Payroll (add-on): Base fee $40–$134/mo depending on Core/Premium/Elite plus $6.50–$12 per employee/month. This is where TCO creeps if you’re growing headcount. And that cost per employee is no joke. I have some clients that pay over $800 per month for their QBO subscription due to the Payroll module.

- QBO price drift: Over the past few years, Intuit has raised prices materially (e.g., Advanced from $150 to $275; Plus from $70 to $115), so budget for major, periodic price bumps.

CPA take: If your muscle memory is QBO, factor plan limits and payroll per-employee into the total. If your team is cross-functional (ops, sales, finance all inside the books), Digits’ unlimited users can simplify access control costs.

Core Features, Side-by-Side

Bookkeeping & the General Ledger

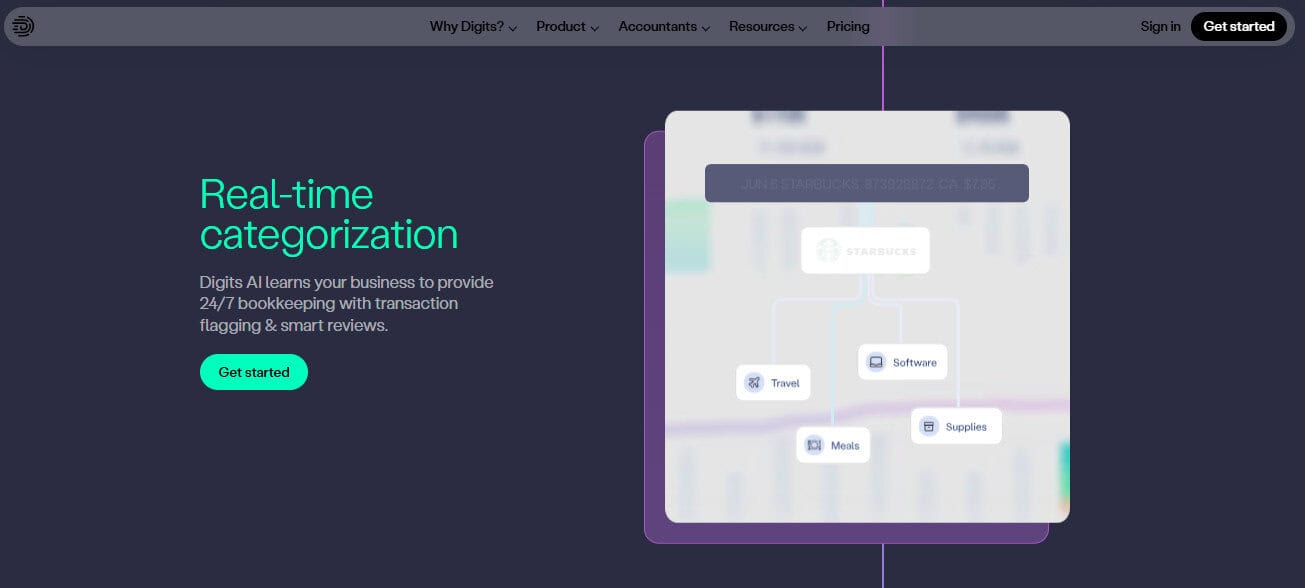

- Digits: The AGL is the headliner with AI/Machine Learning-driven categorization, reconciliations, and continuous close. The experience is designed around real-time, filterable reports and “explainability” of where numbers come from. In practice, that means fewer click-paths to get to an answer.

- QBO: Traditional GL done at scale with millions of users. It learns categories, rules can auto-apply, and Intuit’s new AI agents are starting to surface anomalies and automate repetitive work, but you still manage within plan limits and a more classic workflow.

Payables & Bill Pay

- Digits: AI Bill Pay is native and heavily automated. You can capture, approve, schedule, pay, all in one place. If you’ve chained third-party AP tools to your GL before, the single-stack feel is a win.

- QBO: Built-in bills with basic automation; 5 free ACH bill payments/mo on some plans and $0.50 thereafter (allotments vary). For robust AP (multi-step approvals, vendor portals), many firms pair QBO with specialized apps because it just isn’t robust enough.

Invoicing & AR

- Digits: As someone who spends more time than I should sending other people bills, I have to say I really enjoy the built-in invoicing and collaborations on transactions. Owners and accountants can talk inside the numbers, not over email, and you can send invoices right out of Puzzle.

- QBO: Mature invoicing, recurring invoices, payment links, and aging reports. If you want advanced AR automation (collections sequences, cash app), you’ll need another app.

Reporting & Insights

- Digits: Real-time financials: Alright, let’s get into the meat and potatoes of what makes Digits really unique. It’s P&L, Balance Sheet, Cash Flow reports, A/R & A/P aging reports all come with interactive drill-downs and “top transactions” style explainers meant for non-accountants. The goal is insight at a glance with less report-builder gymnastics. It’s absolutely phenomenal.

- QBO: On the other hand, the incumbent features a huge roster of classic reports; Advanced unlocks custom fields, Spreadsheet Sync, and workflow automation for approvals and reminders. It’s powerful, but the best stuff is gated to Advanced, which means you’ll need to shell out tons of cash to get what you want.

Inventory & Operations

- Digits: Today, Digits’ focus is core accounting, and not deep inventory/MRP. If you’re heavy on assemblies or manufacturing, confirm your requirements with their team or internally if you’re considering making the switch.

- QBO: Inventory tracking is available in Plus/Advanced FIFO. It’s basic for manufacturers; many add in other applications like Cin7/Unleashed/Fishbowl, etc., for robust ops.

Ecosystem & Experience

- Digits: It’s a newer ecosystem, and the promise is fewer add-ons because more is native. If you crave “one vendor, one UI,” that’s the draw. And I absolutely adore having everything under one umbrella.

- QBO: The app store and ProAdvisor network are the moat you can find specialists for almost any vertical, and there’s a steady drumbeat of new integrations.

QBO’s Plan Limits vs. Digit’s “Unlimited”: The Real-World Impact

QBO limits matter when you scale or migrate from a deep chart:

- Users: 1 (Simple Start), 3 (Essentials), 5 (Plus), 25 (Advanced).

- Chart of Accounts: 250 max in Simple Start/Essentials/Plus.

- Classes & Locations: 0 in lower tiers; 40 combined in Plus; unlimited in Advanced.

If you’ve got >250 accounts after a Desktop migration, you’ll be nudged to Advanced or to prune aggressively. I see that surprise cost often in construction and multi-entity setups.

Digits publishes unlimited users & connections on its pricing page, which tends to simplify collaboration across ops/finance/advisors (and avoids the “who gets a seat?” conversation).

AI: Who’s Actually Doing the Work?

- Digits: Built AI-first, the AGL is marketed to automate the bookkeeping lifecycle, not just suggest categories. In demos, you see the emphasis on real-time GL, explainable categorization, and automated AP driven by AI. If you’re chasing a “continuous close” experience, this is the bet.

- QBO: Intuit is shipping AI agents (think anomaly spotting, task automation), and the pace is picking up, but you still orchestrate within QBO’s plan scaffolding and, often, third-party apps. It’s more evolutionary than revolutionary.

The Hidden Costs (and Savings) to Model

QBO TCO usually includes the following categories:

- First, you’ll need to pay for the core platform (likely Plus or Advanced if you need inventory, classes/locations, or more users) and then you’ll need to pay for Payroll base + per-employee, and THEN you’ll need to pay for more apps (AP automation like Melio or Bill.com, inventory, reporting, field service, E-comm). Over 12–24 months, price increases have been common; so plan accordingly.

Digits TCO leans on:

- Flat platform fee (starts $100/mo) with invoicing and AI Bill Pay included, and fewer seats/apps because users are unlimited and core accounting is consolidated. Your savings show up in seat math and tool sprawl reduction.

Reality check: If you need advanced inventory, field ops, or deep verticals, QBO + best-of-breed apps still makes sense. If your pain is manual categorization, month-end drag, and email-based collaboration, Digits can reduce hours without stitching three apps together.

Where Each Platform Shines

Digits: What It Does Well

- Automation-forward bookkeeping with the AGL, which means less keystroking and faster closes.

- Single-stack experience: GL, AI Bill Pay, Invoicing, reports, and collaboration in one UI.

- I really enjoy that Digits offers unlimited users without nickel-and-diming access. It’s great for CFOs, owners, and ops leads all looking at the same source of truth.

- Modern reports designed for non-accountants (filters, “top transactions,” and quick drill

Digits: Where It Falls Short

- Ecosystem depth isn’t QBO-sized. If your stack depends on a quirky vertical app, check integration reality first.

- Inventory/manufacturing: no public claims of advanced MRP/assemblies. Heavy make-to-order shops may outgrow capabilities and want more specialized tools.

- Change management: You’re adopting a new platform, not swapping a skin on QBO. Teams accustomed to the “QuickBooks way” will need a short learning curve.

QBO: What It Does Well

- Ecosystem & expertise: App Store and ProAdvisor network are unmatched; there’s an expert (and an app) for almost anything under the sun.

- Feature breadth: Projects, time, basic inventory (Plus/Advanced), budgets, classes/locations, and Advanced tier goodies like custom fields and workflow automation.

- Payroll: Integrated W-2/1099 payroll with benefits options, widely used and understood by practitioners; pricing is predictable per employee.

QBO: Where It Falls Short

- Plan limits & upsells: Users, CoA entries, classes/locations, etc., you hit caps fast as you grow or after Desktop migrations. And this is one of my largest gripes with QBO, I feel like every time I’m turned around, I’m being nickel and dimed. It’s super frustrating!

- Tool sprawl: For robust AP, inventory/MRP, collections, or industry workflows, you’re shopping the marketplace, which adds cost and complexity.

- Price inflation: In recent years, list prices (esp. Advanced) have climbed significantly. Budget the delta.

Reporting, Close, and Collaboration: Who Gets You to Answers Faster?

- Digits emphasizes live, filterable reports with human-readable insights (e.g., standout transactions, customer trends). Comments live next to the numbers, so review cycles happen in-context. For owner-operators or busy PMs, it’s fewer clicks to clarity.

- QBO has the large report library you probably already know, and Advanced unlocks a lot (custom fields, Workflow, Spreadsheet Sync). If your controller loves Excel and templates, QBO’s Advanced can hum but many SMBs won’t unlock those benefits until they pay for Advanced.

A Note on Market Gravity

QBO’s market share and brand gravity mean contractors, bookkeepers, and CPAs will always “speak QuickBooks.” That matters for staffing and hiring. Digits is the innovator and therefore fewer resumes list it today, but the workflow gains can offset training time.

Who Each Platform Would Best Serve:

- Service businesses, sub-$5M revenue, light inventory, fast-moving ops team

- Pick Digits if your biggest pain is manual categorization and slow closes, and you want everyone in one place without seat math.

- Pick QBO if you rely on a specific app stack for things like proposals, scheduling, invoicing, collections, etc, that’s already dialed for QBO.

- Construction trades, job cost obsession, with lots of classes/locations

- As much as I hate to say it because I feel Intuit is constantly overcharging me, QBO Advanced likely wins due to limits and ecosystem depth (time, budgets, field, project reporting). But be certain to budget for the ads.

- Digits can still slot in if AI bookkeeping and collaboration are game-changers and your ops stack lives elsewhere. But for most construction-centric customers, I see QBO being the best bet.

- E-commerce/omnichannel with real inventory complexity

- QBO Plus/Advanced with a specialist inventory app (Cin7/Unleashed, etc.) is the typical architecture needed for this type of business.

- Digits could be the financial backbone if you handle inventory in your platform/3PL suite, and just need clean financials with less manual lift.

- Multi-stakeholder finance (owner, controller, FP&A, ops) across entities

- Digits shines when unlimited users and in-app collaboration reduce email churn and can accommodate large teams.

- QBO can do it, but you’ll watch the user counters and likely ladder up to Advanced.

One of The Most Important Things: What About Support?

- QBO: The ProAdvisor universe is vast; certification, training, and revenue-share programs keep practitioners active and available. If you want a local bookkeeper tomorrow, odds are they’re QBO-fluent.

- Digits: Digits is definitely an earlier-stage community, but when talking with the folks from the Digits team, I’ve been very satisfied with their prompt responses to questions. I would absolutely expect their CSRs to offer a white glove service.

My Final Takes

If you’re sick of living in the reconciliation mines, Digits delivers a qualitatively different day-to-day experience with less “how do I force this report to show what I need?” and more “the answer’s already here.” The unlimited-user model also matches how business actually runs in 2025: finance is a team sport.

If you hire from the market, QBO’s ubiquity matters. So does the app store. And if you need Advanced-level tooling, it’s a mature path, but just be sure to keep a running TCO model as you scale because those costs do add up quickly.