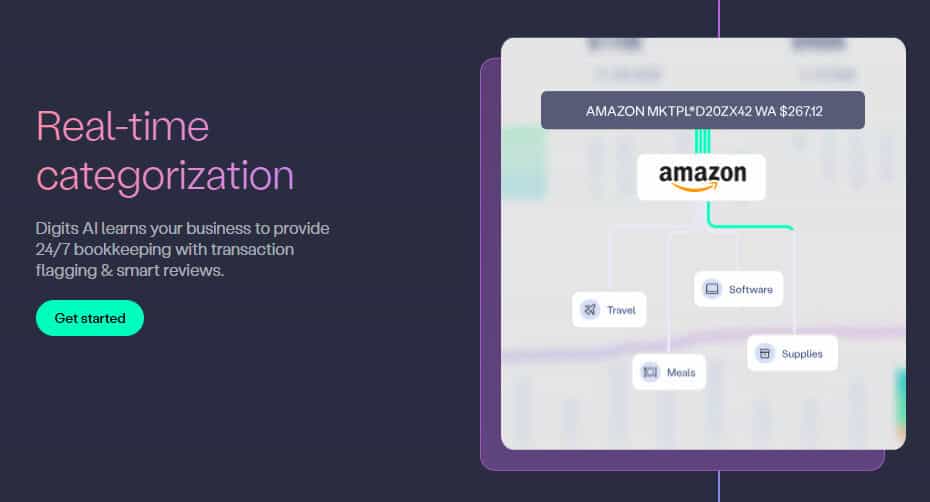

- What Digits Is: An AI-Native Ledger, Not Just a Pretty Wrapper

- What Fincent Is: A Full-Service Bookkeeping and Tax Shop with Software on Top

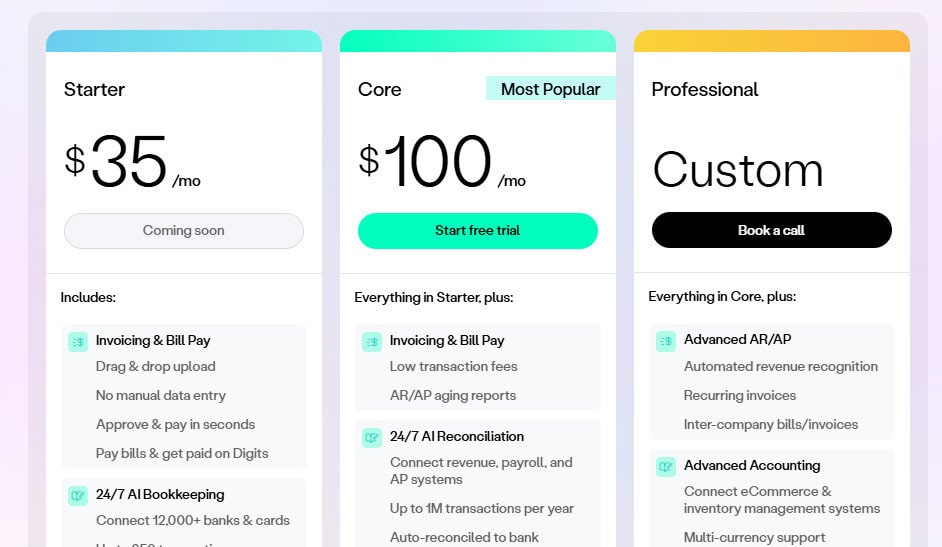

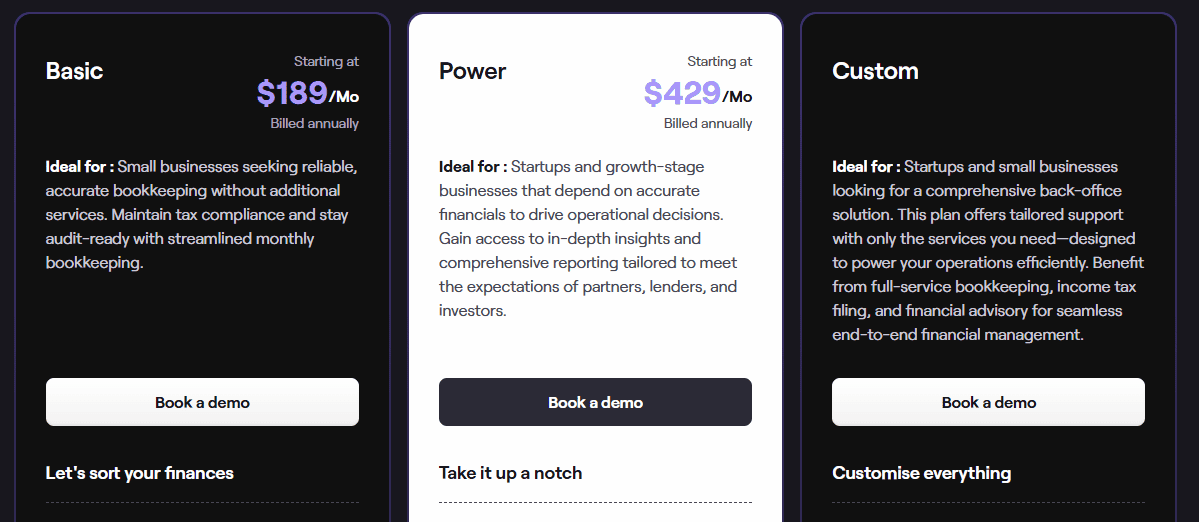

- Pricing

- Digits

- Fincent

- Workflow Breakdown: Your Day-to-Day Use

- Daily Bookkeeping and Reconciliations

- Bill Pay and Vendor Management

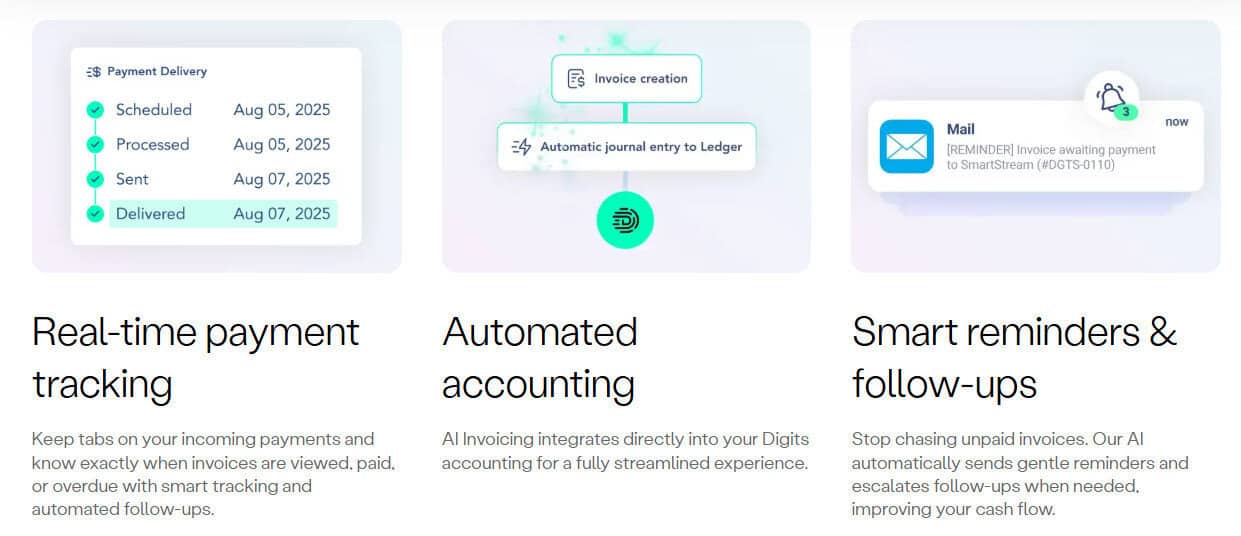

- Invoicing, AR, and Getting Paid

- Reporting, FP&A, and Decision Support

- Who Each Platform Is Best For

- Other Considerations and Trade-Offs

- A Quick Look at the Highs and Lows

- The Verdict

Last Updated on November 23, 2025 by Ewen Finser

Digits and Fincent both sit somewhere between DIY and old-school, outsourced bookkeeping. They both pitch AI and promise clean books and clear dashboards. They both want to be your one-stop shop… but under the hood, they make some very different bets on how the work gets done, who’s in the driver’s seat, and what your actual workflow looks like day-to-day.

In short, both get the job done, but depending on your company and management style, one will make more sense than the other. If you want an AI-first general ledger that puts you in the driver’s seat, with dimensional reporting, live dashboards, and tight control of your books, Digits is the sharper tool. If you want a modern bookkeeping firm with a slick portal and a team of humans who push your books across the finish line for you, Fincent is the safe pick.

Now, let’s jump in and really pick these platforms apart.

What Digits Is: An AI-Native Ledger, Not Just a Pretty Wrapper

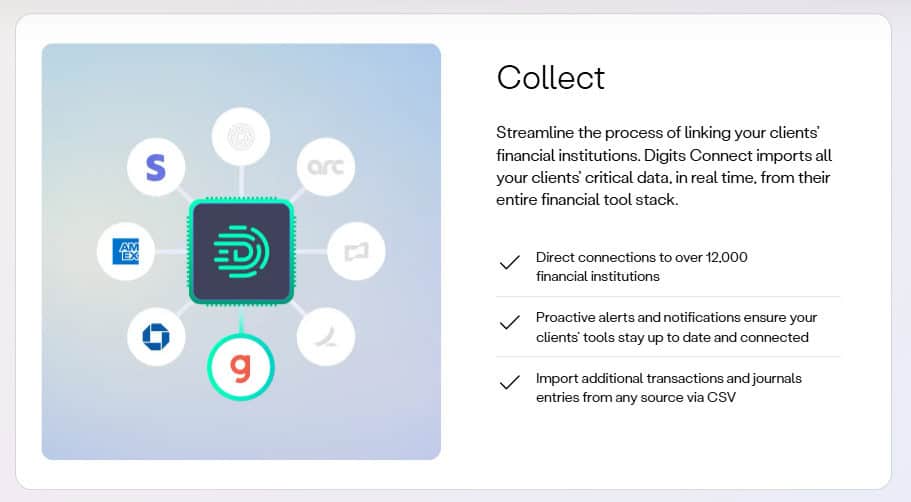

Digits is an Autonomous General Ledger that uses AI agents to run workflows: bookkeeping, bill pay, financials/reporting, and deeper “close the books” work on higher tiers. You’re not just bolting it onto QuickBooks; this is the system of record. And with an AI/ML-driven core that ingests bank feeds, cards, invoices, and bills, it becomes a database of your full financial history so that agents can search patterns and context in real time.

In practice, this means:

- Classification and matching: The AI handles the boring 95% of transaction coding, including vendor pattern recognition, split entries, and recurring patterns. This means you’re only reviewing edge cases and not grinding through a pile of uncategorized charges.

- End-to-end workflows: Bill capture, approvals, payments, and posting all live in one place with AI bill pay. Invoicing is also native, with auto-filled customer details, terms, and status tracking.

- Live dashboards: You’re not exporting to Excel to see runway, burn, or revenue. Management reports are interactive, drillable, and tied directly to the ledger.

Where It Shines

From my standpoint, as a CPA who’s spent a ton of time in the weeds, some of my favorite things about the platform are:

- Real GL: Digits is built to be the primary ledger, which matters for audit trails, dimensional reporting, and clean handoff to tax or FP&A tools. All reports tie back to data directly in the GL.

- Agentic workflows: Its bookkeeping agents don’t just suggest categorizations; they actually run full workflows and then flag exceptions, saving you time and letting you focus on the tricky side of things.

- Reporting that feels like FP&A Lite: You get live KPIs (runway, burn, MRR-style metrics) without having to model everything in spreadsheets first.

- Partner-friendly: Digits takes accounting firms and internal finance teams seriously, with a road-map and partner programs aimed at letting pros run multiple entities in one place.

Where It Stumbles

Digits does have its shortcomings, however, including:

- New ecosystem: Compared to QuickBooks/Xero, the Digits ecosystem is still young, and you’re betting on their roadmap for deep payroll, tax, and niche integrations.

- Change management: Moving your GL into a new AI-native system is not a casual switch. And if your current accountants are allergic to new tools, the transition can be a little rough.

- Tax and compliance: Digits automates the accounting side, but full tax prep and compliance still rely on humans and partner firms.

These shortcomings are definitely surmountable, especially if your in-house team is capable, so Digits is still a safe bet.

What Fincent Is: A Full-Service Bookkeeping and Tax Shop with Software on Top

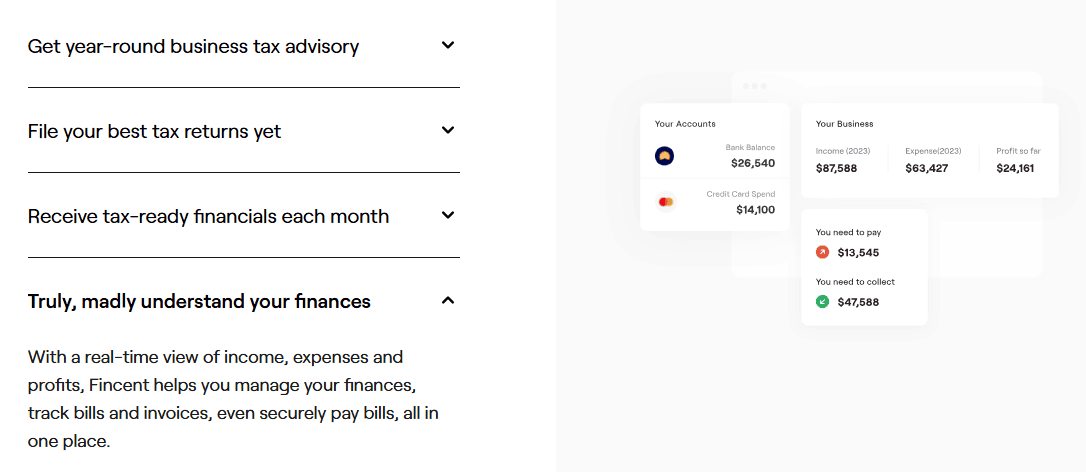

Fincent is not trying to be your autonomous GL; it’s a modern bookkeeping/tax firm that wraps your books, tax prep, and some advisory in a clean app. It also provides a portal with Headsup dashboards, a timeline of transactions, a hub for documents, and data-driven insights via Fincent Intelligence. And if you ever decide to leave, your data is exportable through a backup QuickBooks account.

Here’s how this plays out in practice:

- Hands off financials: A dedicated bookkeeping team learns your business and closes your books month after month.

- Real-time reporting on business health: Proactive check-ins on cash, margins, and tax deadlines, ensuring you and the Fincent team always have a pulse on how your business is performing.

- A third-party team: Fincent owns the day-to-day accounting and tax prep, using software for speed and humans for judgment to keep you tax-ready year-round.

To me, Fincent is for the folks who need to maintain clarity while they focus on their core offerings and are not yet ready to bring finance in-house.

Where It Shines:

From the practical side:

- Hands-off bookkeeping: If you’re a founder with zero appetite for accounting, Fincent behaves like an outsourced finance department for the basics.

- Strong service component: One of Fincent’s key highlights is responsive human bookkeepers and accountants, with real people on email, phone, and Zoom.

- All-in on tax: Fincent offers tax prep and filing, including federal/state, franchise taxes, and even R&D credit support and strategic tax planning at higher service levels.

Where It Stumbles

While Fincent offers a unique business proposition, you still need to consider the following:

- Higher starting point: Public info pegs Fincent’s base pricing in the high hundreds per month. You’ll see numbers around $179/month at the low end, but unless you’re running a very minimal set-up, I would budget for more.

- No free trial: You can book a demo, but there’s no self-serve free trial like a typical SaaS app.

- Less AI-deep, more service-heavy: There is automation under the hood, but the value prop here is definitely on the outsourced books, not an autonomous GL.

For lean, product-led teams that want to grow an internal finance function, this can feel like the wrong center of gravity.

Pricing

From their websites (and a few third-party reviews), you can expect the following:

Digits

- Core: Starts around $100/month for small businesses and startups. I’d expect most folks to land here based on the feature list.

- Starter: Coming soon at $35 a month, so you can get your feet wet and see if Digits is for you.

- Custom: Allows you to leverage the full power of Digits, but you’ll need to book a call to get a quote.

Fincent

- Basic: Starts at $229 a month, but I’d expect this to be fitting for very few businesses. Expect costs to creep up as you grow.

- Power: Starts at $499 a month, and I would expect most businesses to land here. It’s pricey, but that’s the cost of having someone else deal with your bookkeeping headaches.

- Custom: Book a call for pricing, but I’d expect this to cost around $1,000 a month.

- À la carte: You can also get individual packages like tax prep for $125 a month, project costing for $150, and invoicing assistance for a custom price.

Cost Takeaways

- Digits is less costly with a deeper array of offerings — you just have to do it all yourself.

- For tax + bookkeeping + support rolled into one monthly check, Fincent can be fine with the caveat that you’re stepping into an agency-style pricing model, not a pure software bill.

Workflow Breakdown: Your Day-to-Day Use

Let’s walk through a few key workflows and see how the two compare from the controller’s chair.

Daily Bookkeeping and Reconciliations

Digits

- Bank feeds and cards stream into the Autonomous General Ledger.

- AI agents categorize, match, and propose entries, handling routine stuff and flagging exceptions.

- You (or your team) review the flagged items, which teaches Digits for the next time, and lock accounting periods.

For a high-volume environment (SaaS with Stripe, agencies with lots of cards, e-commerce), this is a huge lift, as the system scales without adding humans linearly.

Fincent

- You connect your accounts, and Fincent’s team and software ingest the data.

- Their bookkeepers do the categorization and reconciliations, using tools like the Timeline view and Fincent Intelligence for context.

- You get updated financials and highlights, but the daily grind lives with them.

For a low-volume, steady business (local agency, small professional service shop), this can be lovely. You log in, check, and move on.

Bill Pay and Vendor Management

Digits

- Bills are captured from sources like PDFs and emails, auto-read, and turned into structured payables.

- You can set approval rules, schedule payments, and push them through without leaving the platform.

- Posting to the GL happens automatically when the payment clears.

This is close to what I expect from a modern AP tool: minimal manual data entry, direct tie-in to the ledger, and a clear audit trail.

Fincent

- Fincent offers vendor payment services, but you’ll need to pay extra for a higher-tier or custom bundle.

- You’ll likely interact by approving payments or reviewing open bills in their portal, but a lot of the grunt work happens on their side.

Again, you’re trading dynamic control for “please just handle it.”

Invoicing, AR, and Getting Paid

Digits

- Native invoicing is directly tied into the platform; AI helps generate invoices, pull in customer data, and track open/overdue invoices.

- The system can send reminders and escalate follow-ups automatically.

Fincent

- Fincent supports invoicing and payments management, with project tracking and e-commerce billing as add-ons.

- A human on their side may help with creating and chasing invoices, depending on your package.

Reporting, FP&A, and Decision Support

Digits

- You get live financial dashboards with drill-downs, dimensional reporting, and KPIs like burn and runway.

- The agents sit over your database, so they can answer intent-heavy queries like “why did OpEx jump in August?” with transaction-level context.

For startups, agencies, and venture-backed companies that care about board decks and scenario planning, this is closer to what you’d expect from a modern finance stack.

Fincent

- Its Headsup dashboard gives you a snapshot of bank balances, key metrics, and recent activity.

- You can view tax-ready reports, P&L, your balance sheet, and some financial health metrics.

It’s more like a financial package with some insights attached than a lightweight FP&A engine.

Who Each Platform Is Best For

Digits

- You’re a SaaS startup, agency, or tech-forward SMB that wants an AI-first ledger and is willing to be an early adopter.

- You have an internal finance person or firm partner who likes running the numbers and needs strong reporting and automation.

- You’re sick of duct-taping point solutions on top of an aging GL, and you want a single AI-native accounting platform that feels modern and end-to-end.

Fincent

- You’re a small business owner who wants bookkeeping + tax + some advisory done for you with a predictable monthly bill.

- You care more about having a responsive human team than pushing the frontier of AI in your books.

- You’re ok with QuickBooks in the background, as long as someone else keeps it clean and the portal looks good.

Other Considerations and Trade-Offs

From a CPA’s standpoint, here’s where I’d keep my eyes open during demos:

- Data ownership and portability

- Verify export options (full transaction history, trial balance, custom dimensions) in case you ever need to leave. It’s nice to have that option, should you need it.

- Fincent runs a backup QuickBooks file for you, which is great for portability, but make sure it’s synced and know what level of detail you’ll have prior to migrating.

- Audit trail and controls

- In Digits, dig into how approvals, period locks, and user roles work, given that it’s AI agents that are posting entries.

- In Fincent, ask how changes are logged when humans touch your books, and how you’ll see who did what, when.

- Tax coverage

- Digits focuses on the accounting stack, so you’ll need to handle that in-house or have a CPA or tax firm ready to do the heavy lifting.

- Fincent bakes in tax prep, filing, and planning as part of core and add-on services, which is very handy if you don’t have a tax CPA yet.

- Scalability

- Digits should scale better on transaction volume and entities without adding a linear stack of human bookkeepers. You may need to upgrade from the Core tier to Custom if your business grows to need niche solutions, so budget extra dollars.

- Fincent scales by adding more human capacity. That’s fine, but it’s a different cost curve, and you should also expect to see price increases as you require additional team members.

A Quick Look at the Highs and Lows

For the folks who skimmed the article, I’ve thought about you. As an accountant, I love charts, and if you’re short on time and can’t read the whole article, you can still get the highs and lows

Factor | Digits | Fincent |

Core model | AI-first general ledger and workflows | Modern bookkeeping + tax service with its own portal |

Who owns the books | Your in-house finance team, powered by AI agents | Fincent’s bookkeeping and tax team |

Best for | Startups, agencies, and SMBs building a finance function | Owners who want bookkeeping + tax handled for them |

Automation depth | Deep: autonomous GL, bill pay, invoicing, live dashboards | Moderate: automation under the hood, human-led workflows |

Reporting | Real-time, drillable, FP&A-style dashboards | Clean financial packages and health snapshots |

Tax services | Via your own CPA or partner firms | Built-in tax prep, filing, and planning in many plans |

Pricing pattern | SaaS-style monthly software plans, free trial tier | Service-style monthly bundles, higher starting price point |

The Verdict

If you strip away the marketing:

- Digits is an AI-native accounting platform that wants to be the modern replacement for your GL and back-office workflows. It’s best if you want control, automation depth, and serious reporting in one place — and if you’re comfortable steering the ship.

- Fincent is a modern bookkeeping and tax firm with good software. It’s best if you want a single vendor to own the books and taxes, and you’re okay paying more for that hands-off experience.

As a CPA, I’d say that Digits comes out ahead for most startup and tech-leaning SMB use cases, especially when you have even a part-time controller or a finance-savvy founder. You get more leverage out of the same spend, and your finance stack looks like it belongs in this decade.

However, Fincent still has a clear lane for owners who want to stay out of the books entirely and treat accounting like one more service subscription next to legal and payroll.