- The Short Answer:

- My Top Picks for the Best Bill Payment Services

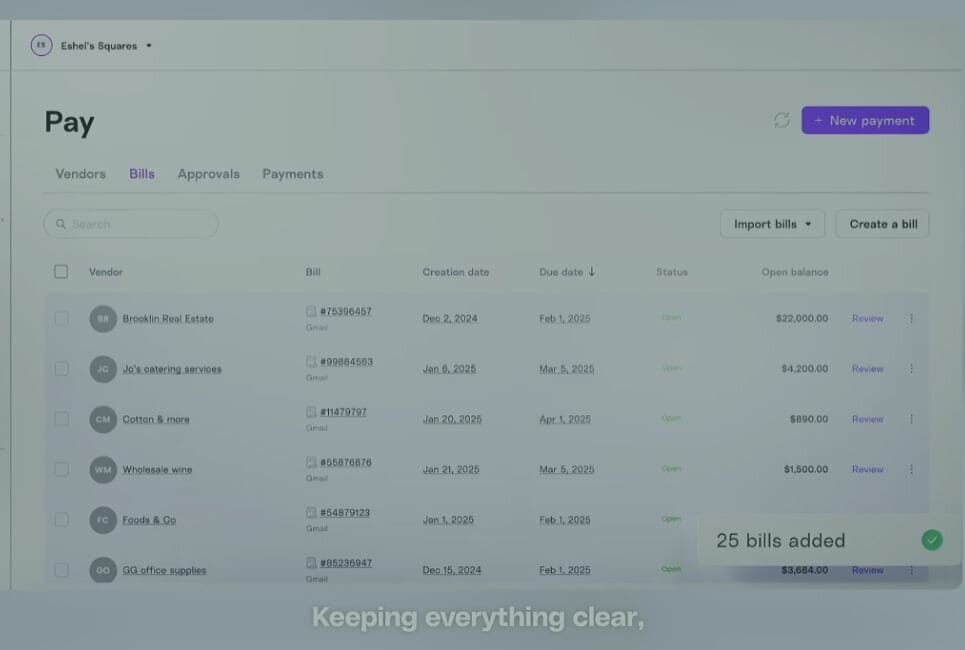

- 1. Melio: The Standout Option for Simplicity and Flexibility

- 2. Bill.com: Robust Solution for Larger Businesses

- 3. QuickBooks Online Bill Pay: A Solution for QuickBooks Users

- 4. Veem: Ideal for International Business Payments

- Choosing the Right Bill Payment Service for Your Business

- What Do I Need To Consider to Make The Right Choice For My Business?

Last Updated on June 3, 2025 by Ewen Finser

What even is a digital bill payment service? Businesses are more like people than most realize, in that they need to pay their bills just like us regular folks. Just like bad things happen if we don’t pay our rent on time, bad things happen to a business when it doesn’t pay its obligations. But businesses have way, WAY more bills than a typical household, so how does the average small business owner juggle it all?

As a business owner or financial manager, the efficiency, security, and reliability of your bill payment solutions significantly impacts your bottom line. With multiple invoices, vendor payments, and employee reimbursements, manual processes can quickly become overwhelming. In my line of work as a CPA, I’ve seen tens of thousands of dollars “slip through the cracks” due to poor expense management. That’s where digital bill payment services step in.

The Short Answer:

Melio is the top choice for businesses seeking simplicity, affordability, and intuitive usability, and it is particularly suited to SMBs. Bill.com excels for larger organizations needing advanced automation and detailed reporting. QuickBooks Online Bill Pay is ideal for businesses already in the QuickBooks ecosystem seeking a seamless integration. Veem is best for companies making frequent international transactions, offering competitive exchange rates.

My Top Picks for the Best Bill Payment Services

Melio has quickly risen to prominence as one of the best bill payment services on the market, especially for small and medium-sized businesses. Founded in 2018, Melio simplifies the process of paying bills by combining an intuitive interface with robust payment capabilities, positioning itself perfectly between functionality and ease of use.

User-Friendly Interface and Accessibility

Compared to other dashboards I’ve used in the past, Melio distinguishes itself with an exceptionally straightforward and user-friendly interface. It is designed to accommodate business owners who prefer minimal hassle and ones that need intuitive navigation. You don’t need extensive accounting knowledge or financial expertise to leverage its full potential, making it an excellent choice for businesses of all types. I have yet to run across a business that was so niche or unique that Melio couldn’t help meet its needs.

Payment Flexibility

Melio offers great payment flexibility, allowing users to pay vendors through bank transfers (ACH), credit cards, or checks. That’s great and all as that’s typical for most bill management systems, but what makes this so attractive and unique is that Melio does not charge any fees when issuing payments through ACH. This is especially beneficial for businesses looking to maximize cash flow management or earn rewards by utilizing business credit cards. Melio also allows users to schedule payments in advance, helping businesses to better manage their working capital.

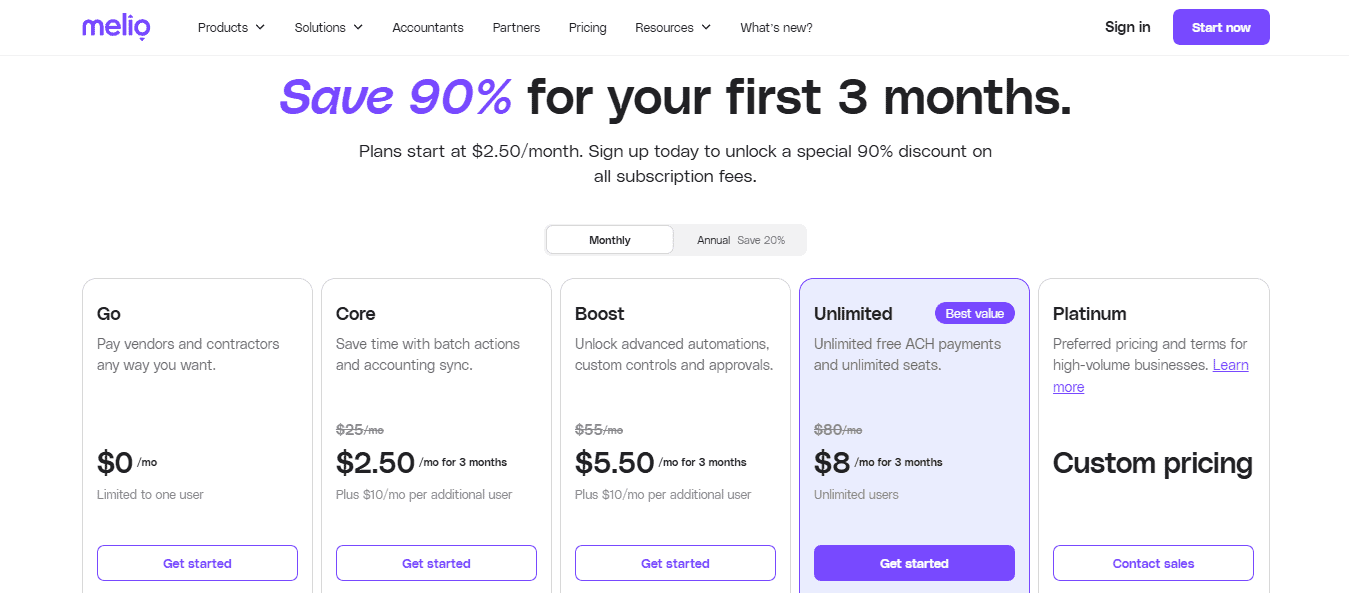

Zero Sign-Up Fees

Another mark in favor of Melio is the absence of signup fees, subscription costs, or hidden charges. Businesses can start using Melio immediately without upfront expenses, making it attractive to startups and SMBs watching their bottom lines closely. Many of the other bigger players on this list can’t make this claim, which is why I wanted to specifically note it as some of these subscription-esque services can really start to add up if you’re not watching the costs closely.

Integration Capabilities

Melio integrates smoothly with popular accounting software like QuickBooks and Xero. Seamless integrations such as these reduces manual data entry, significantly cutting down administrative overhead, minimizing errors, and providing businesses a clearer view of their financial health. It also brings great joy to accountants like me when we’re hunting for discrepancies and know that we don’t have to worry about double checking the expense side of the business because there’s no room for human error.

Who are the Ideal Users of Melio

Melio is especially suitable for:

- Small businesses looking for an affordable, straightforward bill payment service.

- Businesses aiming to optimize their cash flow by leveraging credit cards for vendor payments.

- Companies already using cloud based accounting softwares and looking to integrate a bill pay solution effortlessly (not all softwares are able to integrate, but many are).

2. Bill.com: Robust Solution for Larger Businesses

Bill.com is arguably the most recognized name among business bill payment services. Trusted by large enterprises, accounting firms, and growing businesses alike, Bill.com boasts advanced features designed to handle complex billing processes with ease.

Advanced Workflow Automation

Bill.com’s primary strength is its advanced workflow automation capabilities. This feature dramatically reduces time spent on manual payment processes, minimizing errors and delays. The platform automates the capture of bills, approvals, scheduling, and payments, allowing businesses to scale without the burden of increased administrative costs. And let me tell you, as someone who has had extensive history with Bill.com with some clients, Bill doesn’t miss. I’ve never seen a mistake or hiccup, even when paying over $100M a year in outgoing bills.

Detailed Reporting and Analytics

Bill.com also offers detailed reporting and analytics to help businesses better understand and optimize their financial operations. Users can quickly track payments, view detailed transaction histories, and gain deeper insights into cash flow using a somewhat intuitive dashboard. I never really cared for the dashboard and preferred to comb through my data in Excel, but it is available if a business owner should opt to use it.

Multi-User Access and Role-Based Controls

To me, this is a big one. If your business is large, and has multiple folks on your AP Team, Bill is tough to beat. This platform excels when it comes to complex financial teams as Bill.com provides robust multi-user access and role-based permission controls. This functionality ensures sensitive financial tasks and data remain secure and accessible only to authorized team members.

Integration and Pricing

Similar to Melio, Bill.com integrates with major accounting platforms like QuickBooks, Xero, and Oracle NetSuite. It does this at relatively low cost, but Bill.com’s pricing model is subscription-based, typically starting with an affordable entry-level plan. It then scales upward depending on features, payment volume, and user count. While slightly pricier compared to Melio, Bill.com’s extensive feature set makes it a compelling choice for growing businesses requiring sophisticated financial workflows.

Who Are The Ideal Users of Bill.com

Bill.com is particularly effective for:

- Medium to large enterprises with complex billing and accounts payable processes.

- Businesses that require extensive financial controls and detailed reporting.

- Companies that seek robust integration capabilities and automated workflow systems.

3. QuickBooks Online Bill Pay: A Solution for QuickBooks Users

I don’t know how, but every time I write an article that involves something accounting related, Intuit’s Quickbooks always finds a way to weasel into a mention. Not that that’s a bad thing, it just goes to show how ubiquitous their softwares are, and their payment solutions are no different. QuickBooks Online Bill Pay is built directly into the popular QuickBooks accounting platform, providing a seamless, fully integrated bill payment experience tailored specifically for existing QuickBooks users.

Direct Integration and Ease of Use

QuickBooks Online Bill Pay integrates natively within the QuickBooks Online environment, eliminating any need for external software synchronization. Users can easily manage, schedule, and track payments directly through their QuickBooks dashboard without ever leaving the Intuit ecosystem.

Automated Bill Capture and Categorization

One standout feature is QuickBooks’ ability to automate bill capture and categorization. I’ve used this tens of thousands of times at this point, and for the most part it does a good job, especially considering that OCR (optical character recognition) software by itself is often much pricier than the costs of a QBO subscription. You just scan or snap a pic of the bill, and QBO populates the rest. Additionally, you can have vendors send invoices directly to QuickBooks for automated processing, streamlining expense management significantly.

Simplified Payment Processing

Payments can be processed via ACH, or, the business owner or book keeper can print physical checks and slip them into an envelope (conveniently provided by Intuit) and mail them to their vendors. This simplicity significantly reduces administrative overhead, ensuring accurate vendor payments.

Who Are The Ideal Users of QuickBooks Bill Pay

It goes without saying, but QuickBooks Online Bill Pay is ideal for:

- Businesses already using QuickBooks Online and seeking a straightforward bill payment solution without additional software integrations.

4. Veem: Ideal for International Business Payments

This one is niche, but I felt it necessary to call out because there are so many different businesses out there sourcing international goods and services. Veem stands out distinctly from many competitors by focusing heavily on international transactions. If your business frequently engages with global vendors or has an international presence, Veem’s strengths in cross-border payments make it a noteworthy solution.

Specialized International Payment Support

One of Veem’s strongest advantages is its specialized infrastructure for international payments. Veem seamlessly supports transactions in over 100 countries, providing competitive foreign exchange rates and transparent transaction fees. By streamlining and simplifying cross-border payments, Veem saves businesses considerable time and money compared to traditional banking methods.

Transparent Pricing and Low Fees

Veem employs a transparent fee structure, clearly outlining transaction costs without hidden charges. Typically, ACH transactions within the U.S. are free, while international payments incur competitive and transparent rates, often much lower than traditional wire transfers. This transparency helps businesses accurately forecast expenses and optimize cash flow, even with fluctuating exchange rates.

Integrations and Automation

Veem integrates effectively with popular accounting software platforms like QuickBooks, Xero, and NetSuite, allowing automated synchronization of payment data. The platform also includes automation of invoices and payment reminders, significantly reducing administrative overhead and enhancing efficiency in managing international transactions.

User-Friendly Dashboard

Veem’s dashboard provides real-time transaction tracking, payment status updates, and detailed reporting. Businesses can efficiently track all international payments, vendor histories, and pending transactions, enabling accurate budgeting and improved vendor relationships. This is especially useful if you’re planning to make a payment in 30 days, but the exchange rate is constantly fluctuating – you can forecast what that bill should actually be based on historical data.

Ideal Users of Veem

Veem is particularly advantageous for:

- Businesses with frequent international transactions.

- Companies looking for competitive exchange rates and transparent international fees.

- Businesses desiring a secure, intuitive platform for global payment management.

Choosing the Right Bill Payment Service for Your Business

As a CPA that often finds himself with his eyes glazed over trying not to fall asleep at his desk while having 24 open Excel sheets staring back at him, I personally understand that selecting a bill payment provider is not the sexiest thing a business owner could be doing. But it could arguably be one of the most important. Selecting the right bill payment service depends on your business’s size, operational complexity, budget, and specific financial needs. Each of the four platforms outlined here—Melio, Bill.com, QuickBooks Bill Pay, and Veem—offers unique advantages tailored to distinct business contexts.

A Summary of The Options

- Melio: Perfect for SMBs looking for simplicity, affordability, and seamless integration with accounting software. It’s the ideal entry-level and straightforward solution.

- Bill.com: Best suited for mid-sized to large enterprises requiring advanced automation, detailed reporting, and robust financial controls.

- QuickBooks Online Bill Pay: Optimal for businesses already heavily invested in QuickBooks’ ecosystem, wanting simplicity without additional integrations.

- Veem: Excellent for businesses engaging in regular international transactions needing competitive exchange rates, transparent pricing, and enhanced security.

What Do I Need To Consider to Make The Right Choice For My Business?

Managing business finances efficiently requires leveraging technology solutions designed explicitly for bill payments. Moving away from manual, error-prone processes and embracing automated bill management services provides tons of benefits, including improved accuracy, increased efficiency, better cash flow visibility, and reduced administrative overhead.

Ultimately, in my opinion, Melio stands out due to its simplicity, accessibility, and affordability, which is especially beneficial to small businesses. However, businesses with larger-scale requirements, international operations, or complex workflows may find greater benefits in Bill.com, Veem, or QuickBooks Bill Pay, each catering specifically to different niches and needs.

When choosing your ideal bill payment solution, consider your existing financial software ecosystem, your transaction volumes, team structure, and specific operational requirements. With the right information leading you to pick the correct provider, you’ll streamline your processes, save time, reduce errors, and ultimately enhance your business’s financial health and operational efficiency.